A global multi-currency virtual business account in Singapore

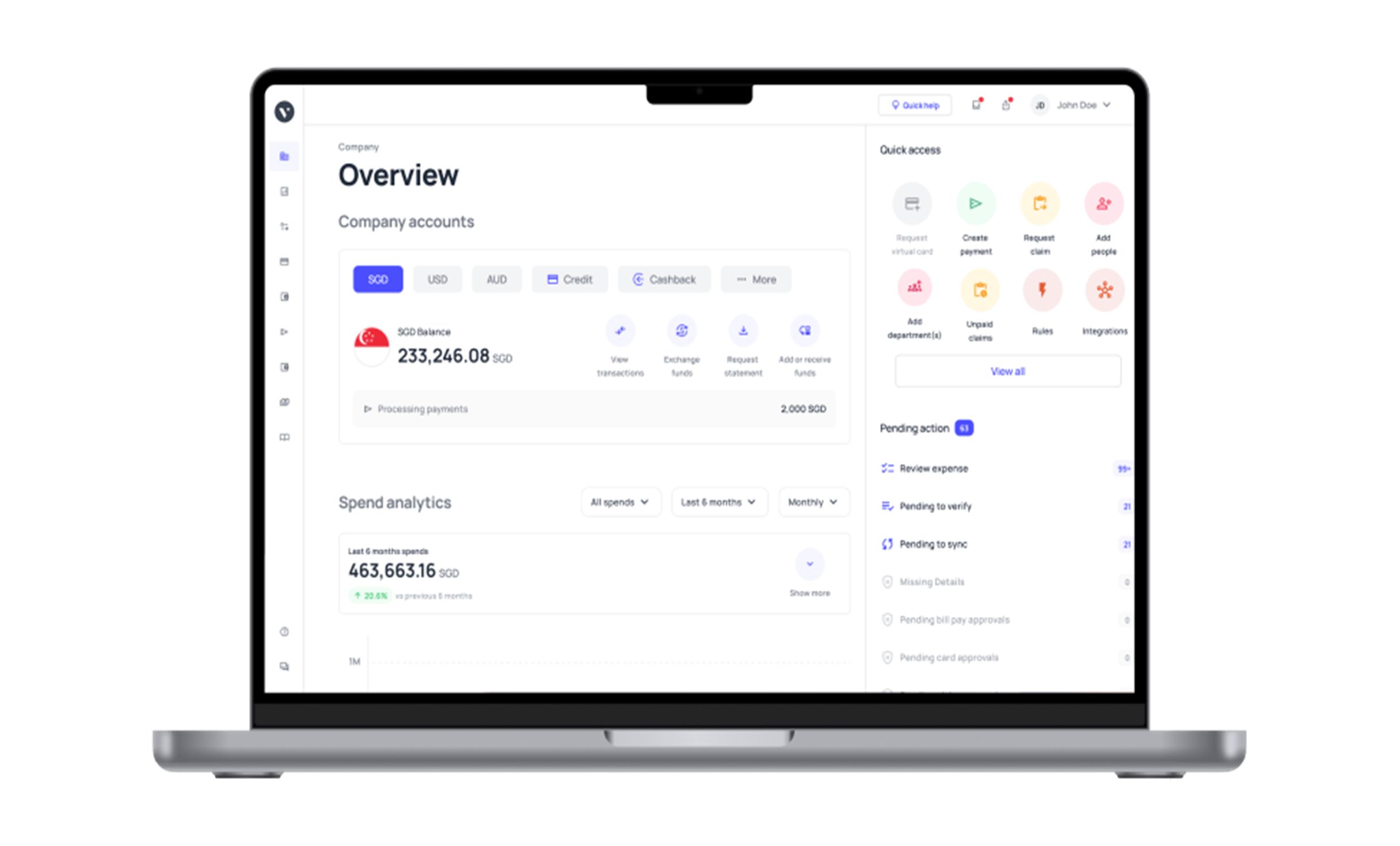

With a single multi-currency account, Singapore businesses can eliminate the need for multiple bank accounts. Pay vendors in any corner of the world. Volopay’s multi-currency business account streamlines deposits, payments, and expense tracking, with no minimums, low fees, and no upper limits.

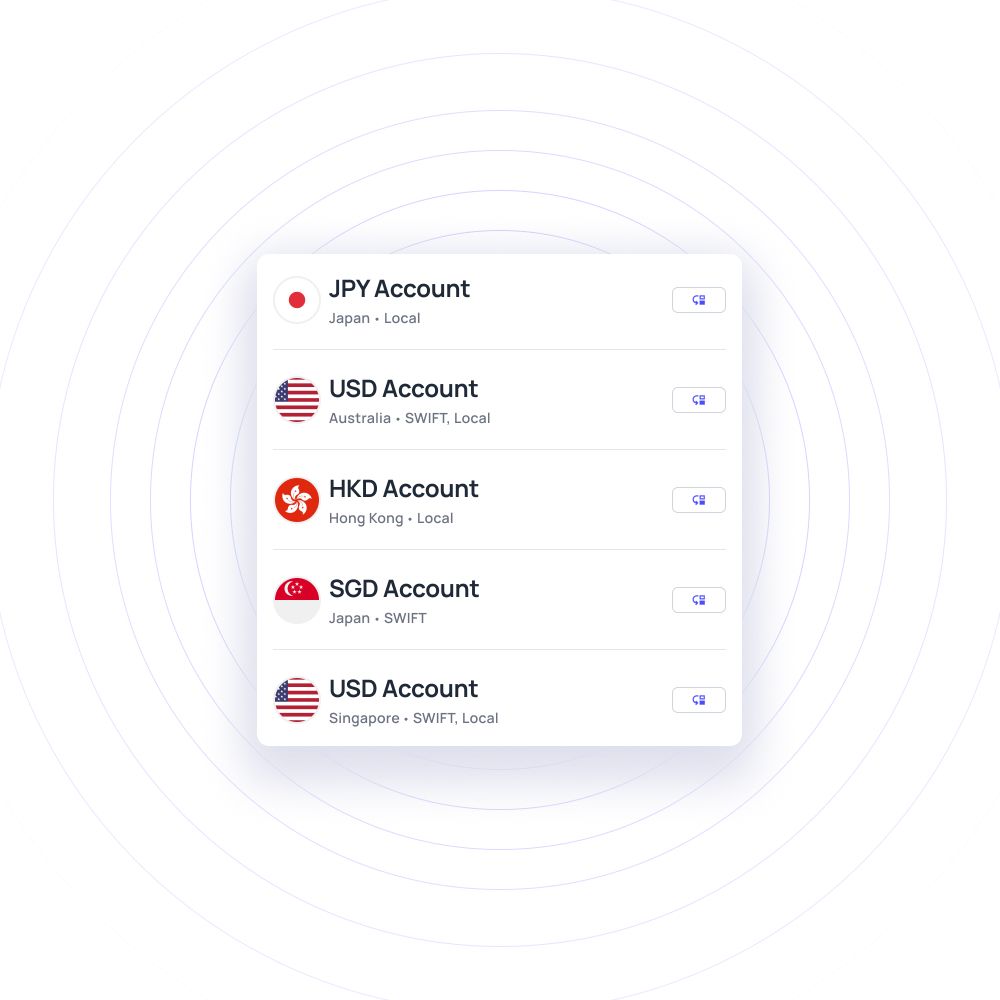

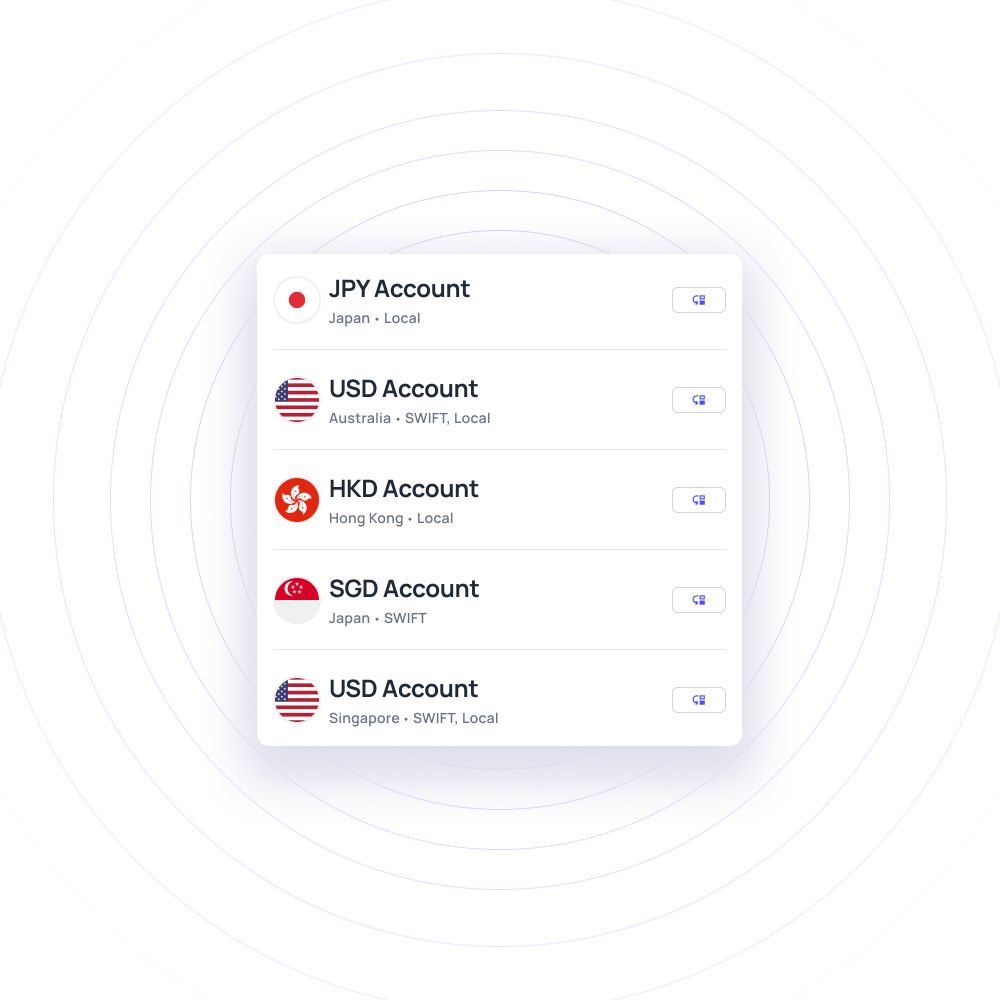

Global multi-currency business accounts

Volopay's global multi-currency account enables you to store funds in various currencies, simplifying international payments and circumventing the hefty exchange fees common on other platforms. In contrast to traditional banks, this method offers a cost-efficient approach to vendor payments abroad.

With a global multi-currency account, Singapore entities can make effortless international transactions. Take advantage of custom user roles so that all user actions are recorded in the activity tab for user insights and reference purposes.

Locally transfer money with ease

With a Volopay business account, conducting local payments within Singapore becomes effortlessly smooth. Streamlined transactions foster operational efficiency, while the platform's dashboard provides real-time visibility into all your payment activities.

Transfer money domestically as vendor payouts or salary compensation to employees. Make unlimited local payments with our multi-currency account that facilitates secure business payments.

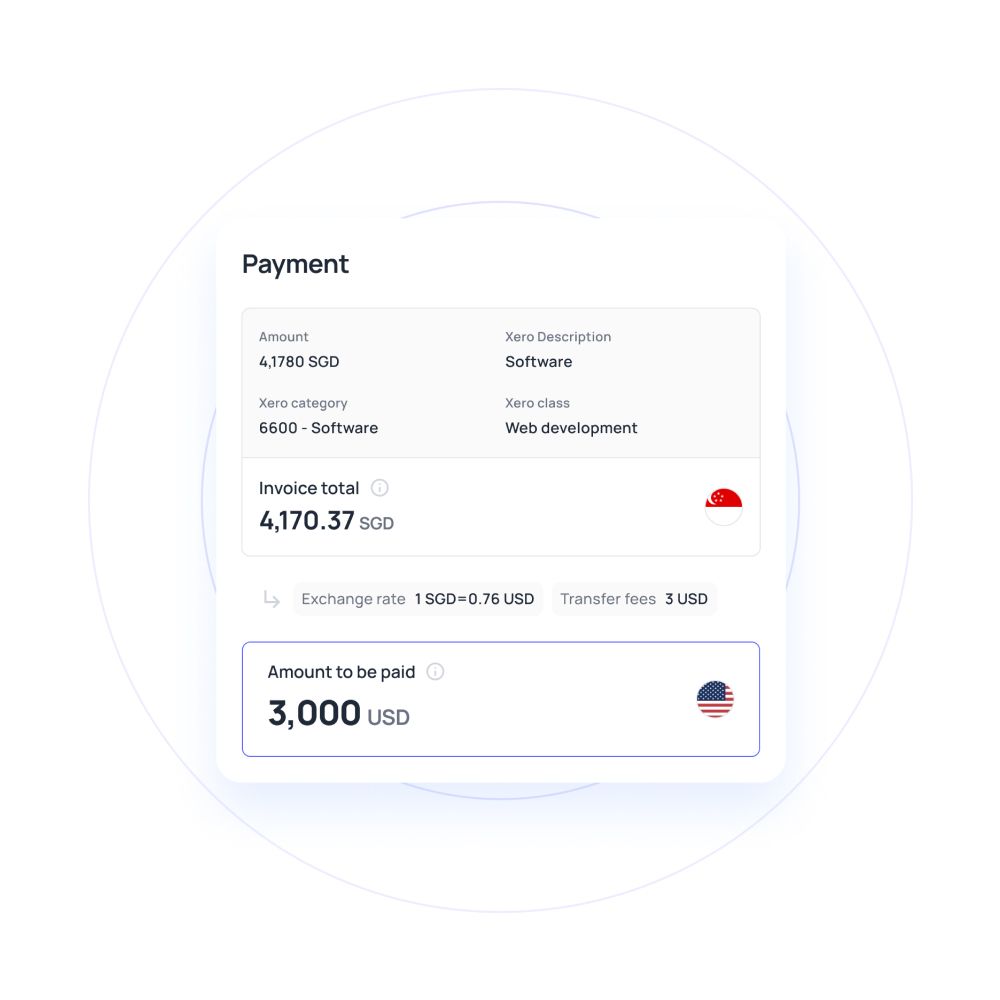

Payments without borders

Facilitating payments to vendors or employees overseas is as straightforward as any domestic transaction with our business account. Enjoy discounted FX rates when funding your multi-currency wallets, centralize all your payments, and gain the capability to transfer funds to over 180 countries.

We reconcile your diverse international payment methods on one unified platform for quicker accounting, too.

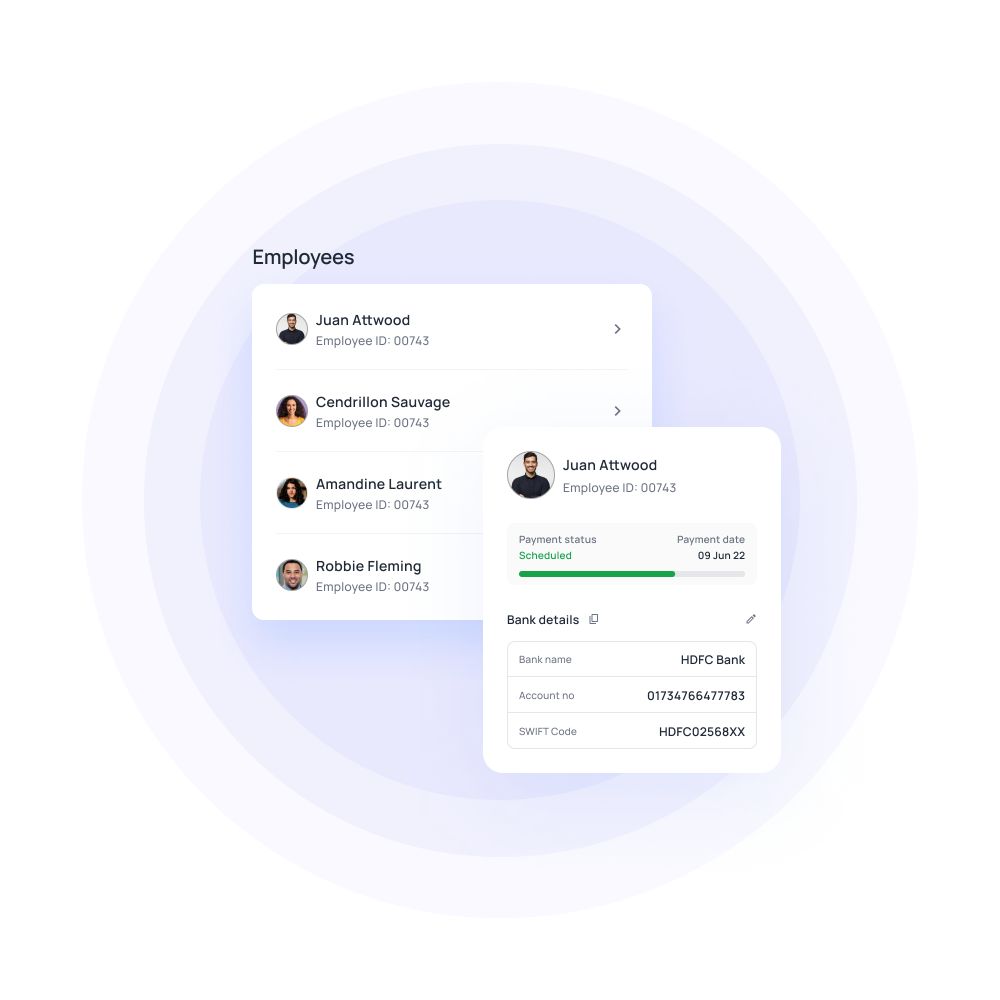

Efficient payroll management

Accelerate local employee payments and simplify international payroll without incurring extra transfer fees. Payroll management functionalities such as tax calculations, automated payment scheduling, and bulk payroll processing ensure timely salary disbursements for every employee.

Want to switch to Volopay from your traditional business bank account?

Hassle-free reimbursements

Volopay's system simplifies the reimbursement process for organizations, whether it's for local or international expenses, by allowing reimbursements to be made in the currency of the incurred expense.

Finance teams can establish automation to ensure claims adhere to company policy before proceeding with bulk reimbursements.

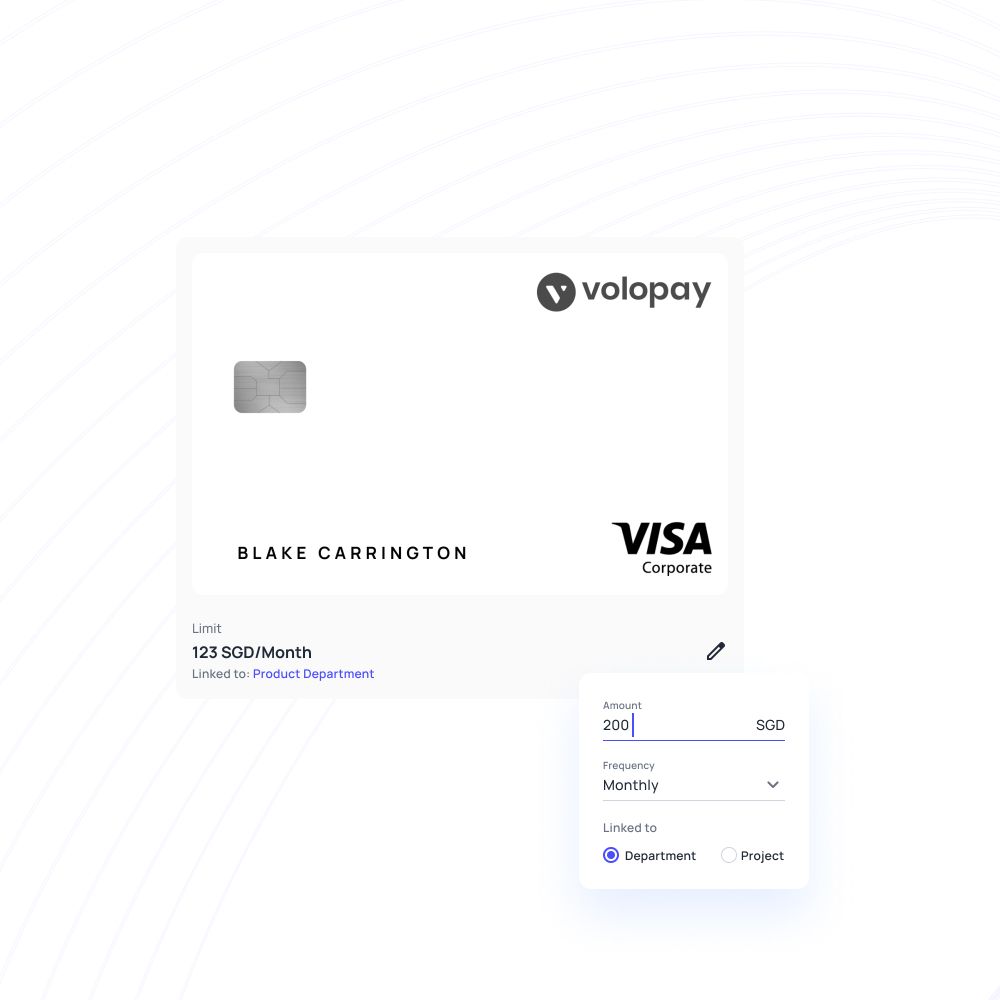

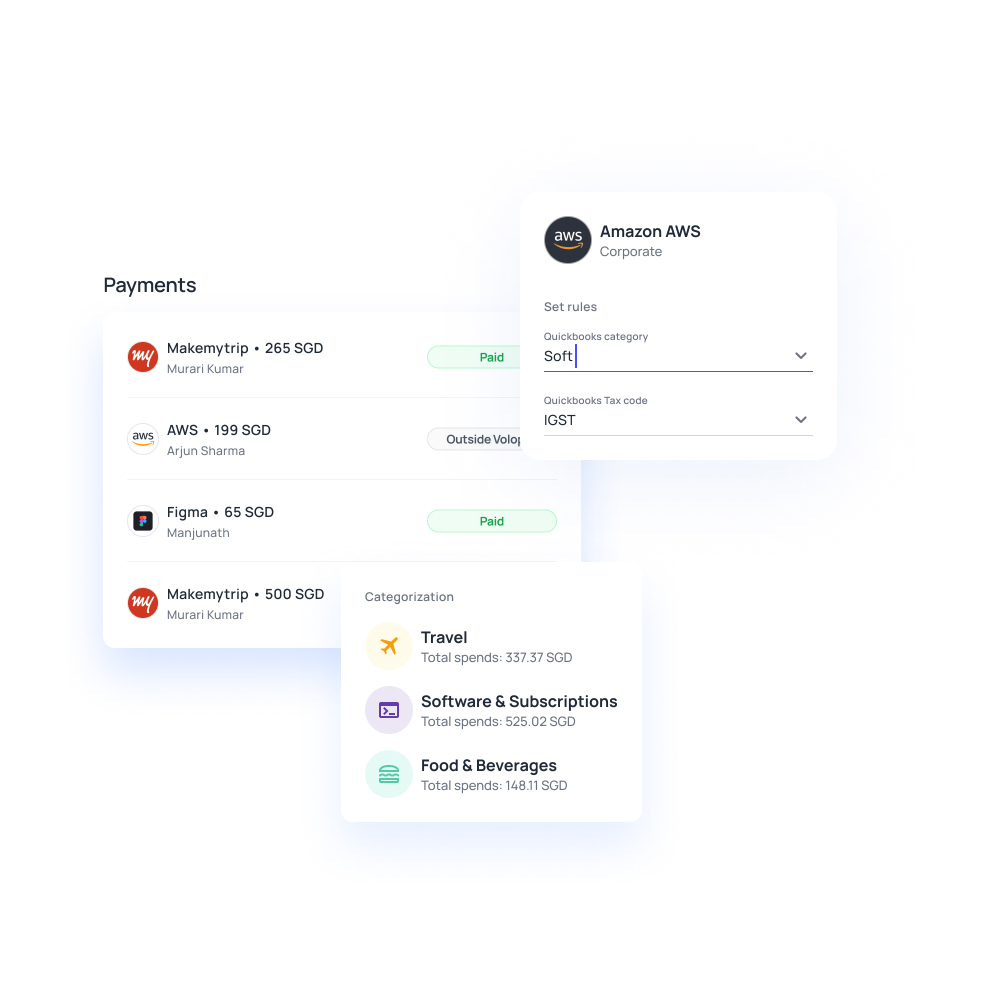

Corporate cards for expense management

With Volopay's business account, the best multi-currency account, Singapore businesses gain access to corporate cards tailored for expense management, which can be assigned to individual employees. These cards can be funded with designated currencies based on your business account, enabling payments in local currency to circumvent FX charges.

Manage subscriptions with unlimited virtual cards, and issue physical cards for making payments on the go.

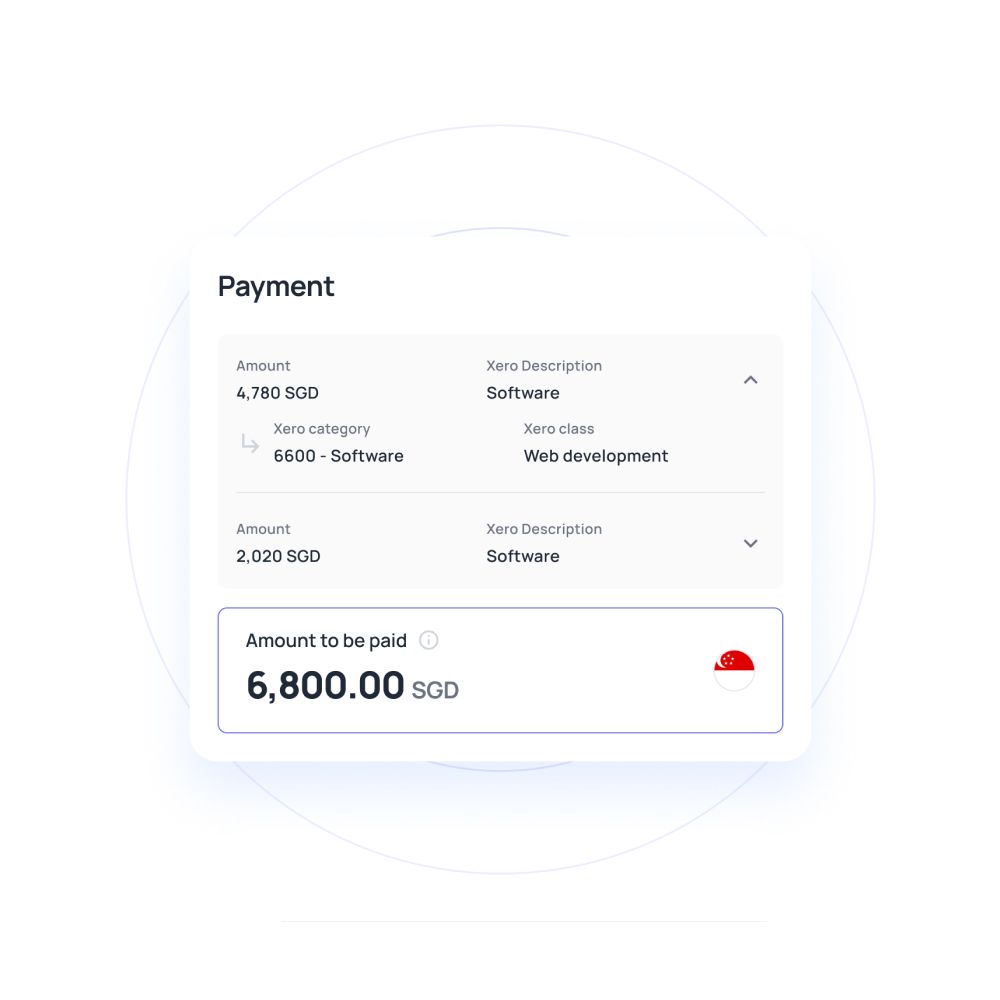

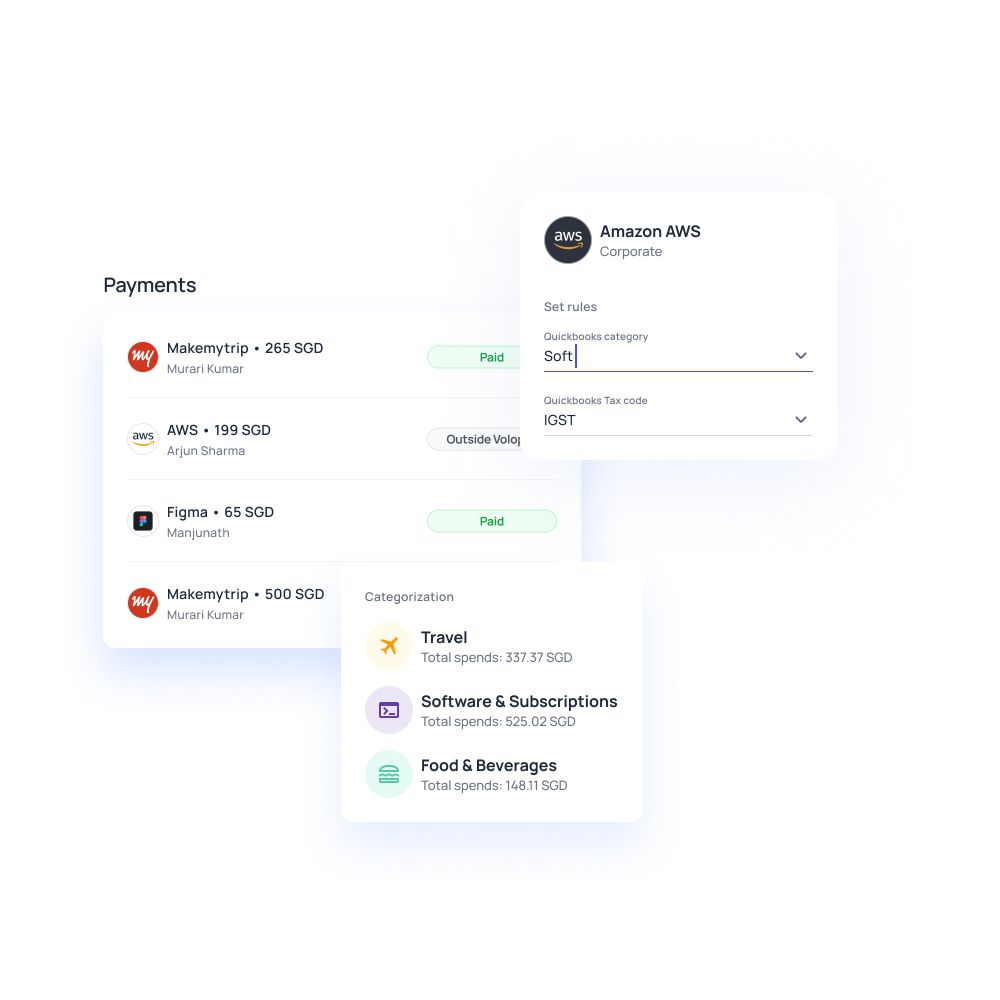

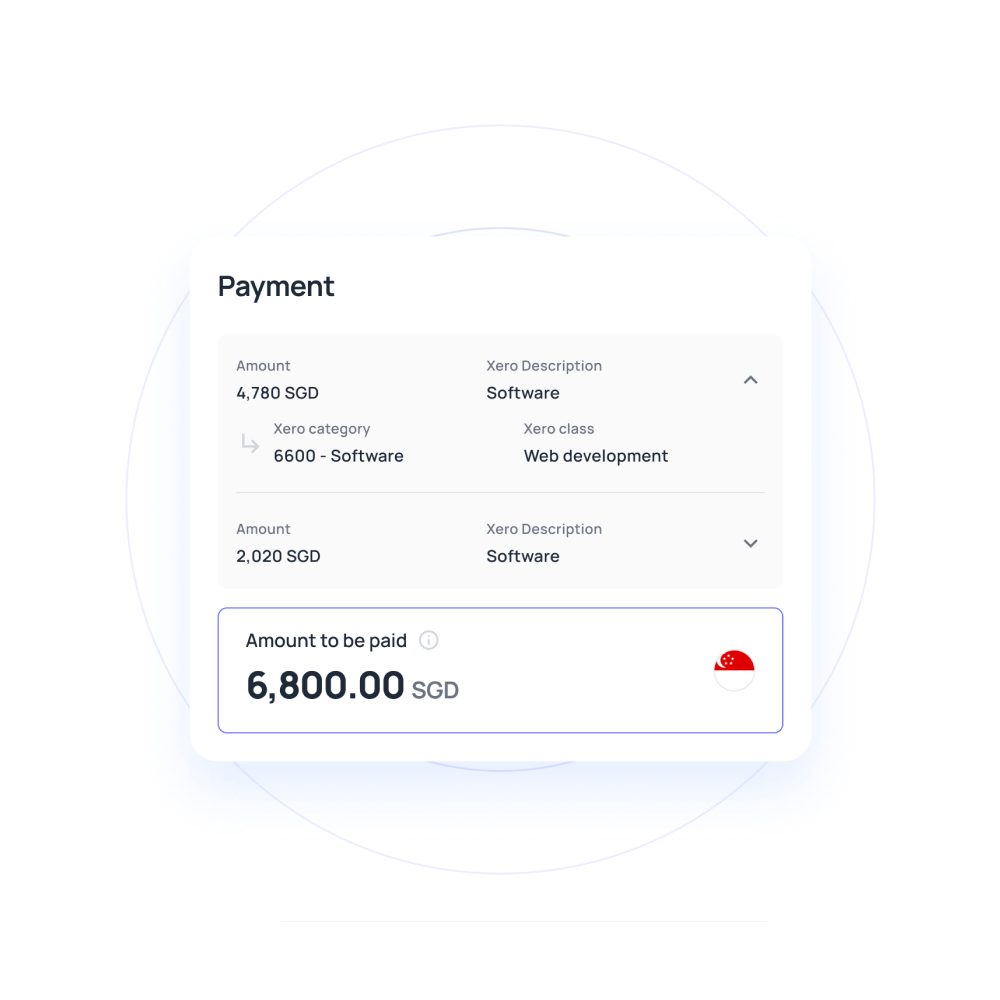

Streamline your AP process and accounting

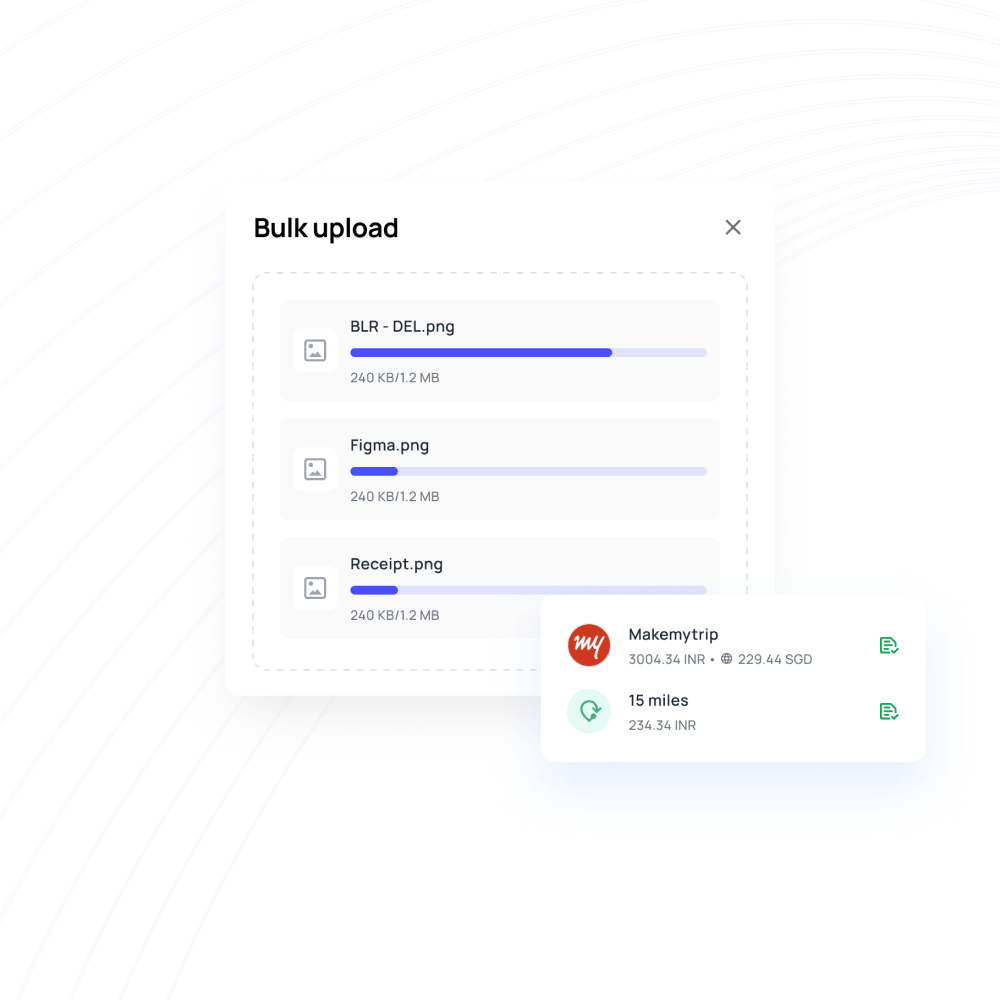

Never miss out on a single receipt with Volopay’s streamlined multi-currency account payable process. Consolidate all your invoices onto a unified platform. Set up automatic one-time or recurring payments and efficiently manage your vendors – all from a single business account.

Syncing payments from Volopay with your accounting system is seamless, guaranteeing consistency of data across all platforms. Regardless of the currency used for payments within Volopay, automated synchronization schedules can be configured to maintain up-to-date company records.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Volopay Vs. Traditional business bank account

Wondering how Volopay stacks up against a traditional business bank account? We've broken down the key differences in features, flexibility, and efficiency in the table below to help you decide what's best for your business.

Volopay vs traditional business bank account

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our business account

Volopay is an all-in-one financial control center for modern businesses, integrating a smart business account, multi-level approvals, corporate cards, expense management, reimbursements, and accounting automation.

Domestic money transfers

You do not need two different bank accounts to pay vendors and manage salaries. Volopay lets you transfer money for vendor payouts, salary compensation, and reimbursement from a single dashboard. We facilitate domestic payments at no extra cost or hidden charges.

International money transfers

Make money transfers around the world – settle invoices and payroll using our multi currency business account. Unify payment platforms and manage expenses at the lowest FX charges imaginable.

Global business account

Become a global entrepreneur with Volopay’s robust multi currency account. Hold money in major global currencies and save up on exorbitant FX fees traditional banks usually charge. Replace multiple bank account setups with a unified platform for all your multi currency expenditures.

Accounting automation

Close your books 10x times faster than any other company with Volopay’s streamlined accounting automation. Swiftly integrate with leading accounting software and update your books in real-time. Every single card swipe and approved expense gets automatically recorded, making manual data entry obsolete.

Accounts payable

Submit, process, and track bill payments, vendor invoices, and receipts all through our unified platform. Collate necessary documentation for faster reconciliation and a smooth auditing process. Promote transparency in your accounts payable workflow with Volopay.

Explore more about business accounts

Multi currency bank account in Singapore helps you store money in local currencies and save huge on forex charges with lots of other benefits.

Opening a business bank account is not as difficult as it appears. Know how to get a business bank account in Singapore easily.

Discover what a virtual business bank account is, how it works, and its benefits for modern businesses.

Bring Volopay to your business

Open an account now

FAQs on business account

Book a demo with Volopay to open your business account. Our team will demonstrate how our cutting-edge products and features may be effortlessly integrated into your current business processes in real time. For KYB purposes, you will need to provide paperwork such as an ACRA document, an ID, and the POA of your company's assigned POC. We'll create an admin account for the POC designated by your firm once your account has been authenticated. Your account is now operational.

Read Guide to opening business bank account in Singapore to know more.

With Volopay, your money is always safe. DBS, Singapore, holds your funds in a trust account. Volopay never uses customer cash for its own operations, and they are always kept separate to ensure that your money is always safe and accessible when you need it. Even employee information is kept safe because all data is encrypted.

Unlike a standard business account, Volopay allows you to:

1. Maintain various currencies in your account.

2. You can load money to unlimited virtual cards.

3. Sync data to your accounting tools automatically.

4. Instead of an end-of-month statement, get transactional information in real time.

5. Save money by paying a cost that is far lower than that of a business bank account.

6. Avoid having to keep a minimum balance or paying high transaction fees.

7. Make domestic transfers in a flash.

8. Transfer money internationally faster than using wire transfers and at low remittance and FX rates.

The primary benefit of a business account is being able to separate your business transactions from personal usage. Additionally, virtual business accounts come with dedicated features such as corporate cards, expense management tools, real-time tracking, spend controls, and automated accounting that streamline company wide financial management, and are accessible digitally.

Yes, you certainly can! Because the SWIFT network involves funds flowing from bank to bank, each bank charges for holding the money, wire transfers can be costly. With a Volopay account, the process is expedited and the fees are significantly reduced. Furthermore, unlike higher conversion rates offered by banks, our FX rates are competitive.

There are numerous questions business owners have before opening a business bank account: “Which bank account is best for business? What are the requirements to qualify as a business account? How much would it cost?” and more.

However, to open a business bank account you must have all the needed legal documents and they must be immediately accessible before proceeding with your application. These include ID documents, PoA documents, and other KYB documents (requirements differ for different providers).

You can sign up for a demo to understand what documentation you need to onboard with Volopay.

To open a business bank account in Singapore, you must have a company. This means your business must have director(s) and authorized signatories, who essentially need to be present to sign the paperwork of the account opening. There might be some rare exceptions as well.

It usually takes up to 4 weeks to open a business account. The process begins as soon as your application form and the required documents are received and to avoid any delays make sure that the directs and the authorized signatories are physically present for signatures.