Streamline international money transfers and remittances

With Volopay's super-fast international payments, paying foreign vendors and remittances around the world has never been easier. By consolidating all foreign wire transfers on a single platform, you may streamline your accounts payable process.

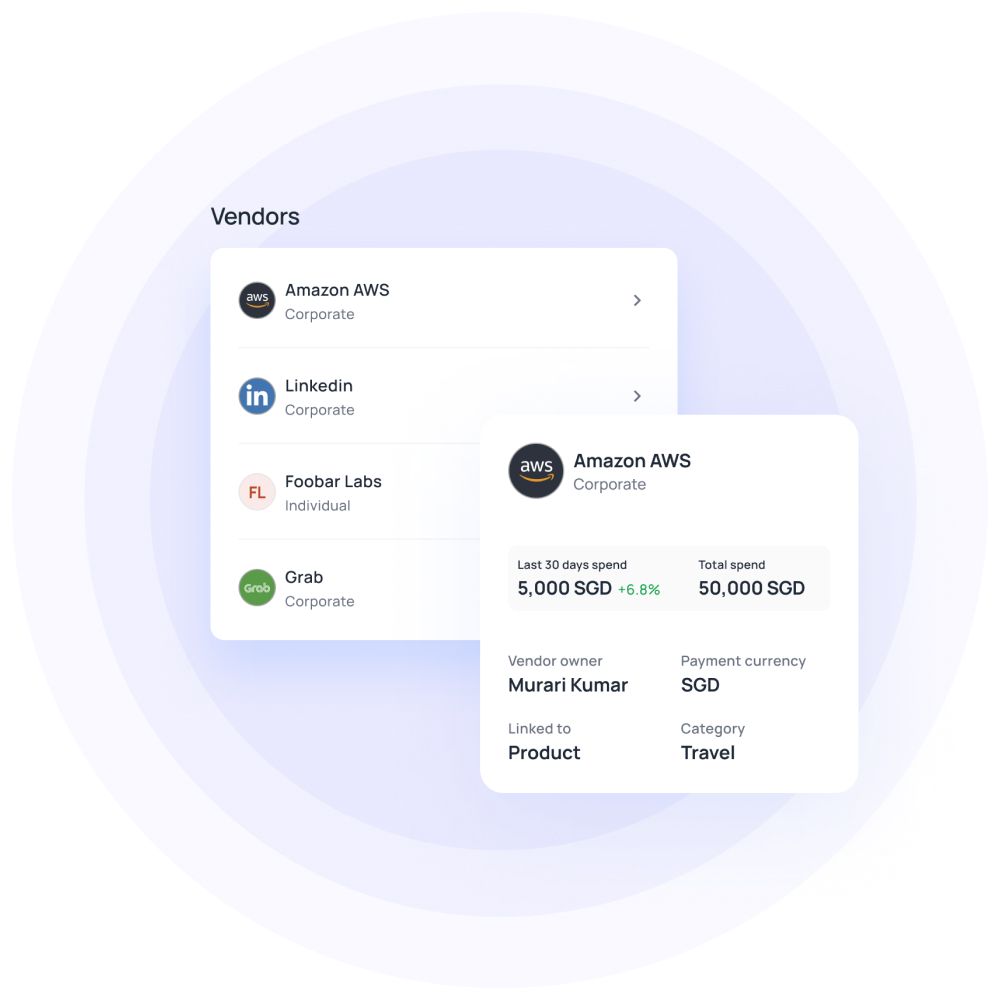

Efficient international vendor payout

Are you tired of waiting a week for your vendor to confirm a single international wire transfer? It's never been easier to pay overseas sellers, thanks to Volopay.

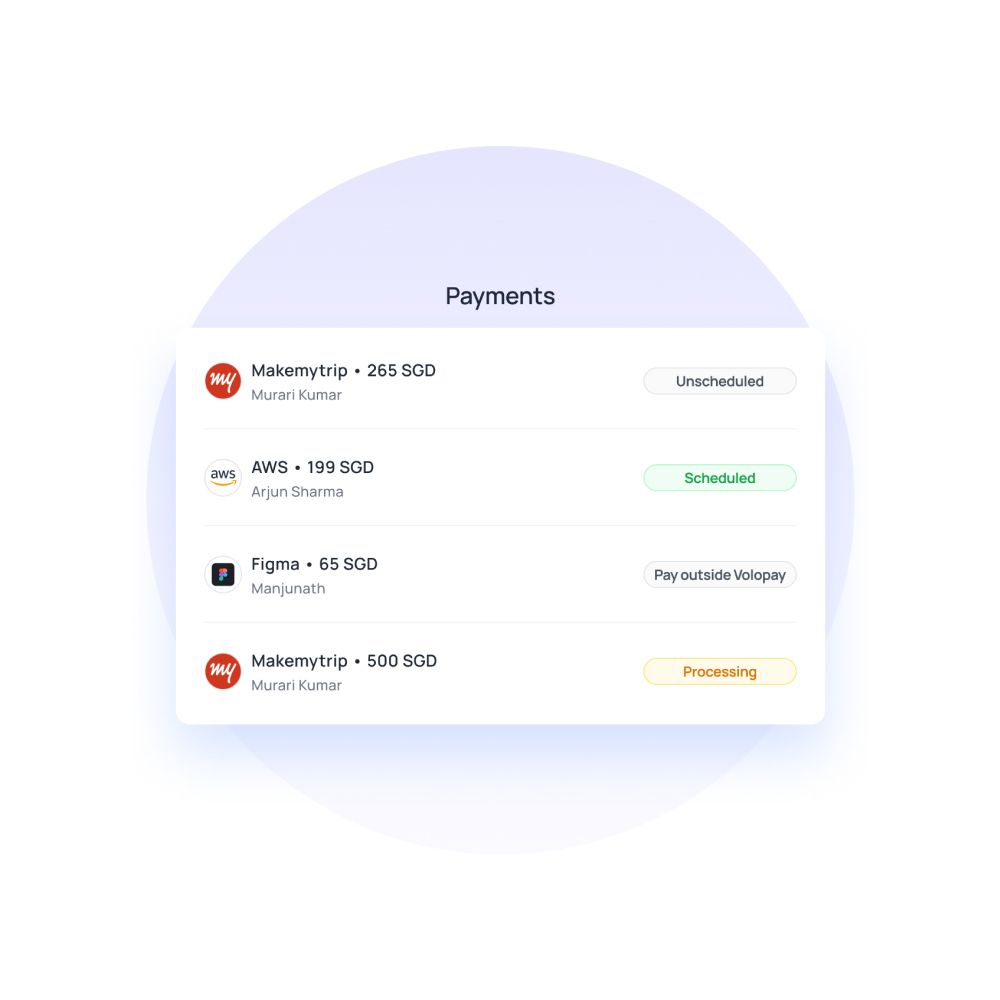

Payments made using Volopay, unlike most bank transfers, appear in your vendor's account within a few days. From a single dashboard, you can manage all of your vendors in more than 180+ countries. Track and schedule foreign payouts via SWIFT or non-SWIFT to avoid hefty FX fees.

Lowest FX charges ever

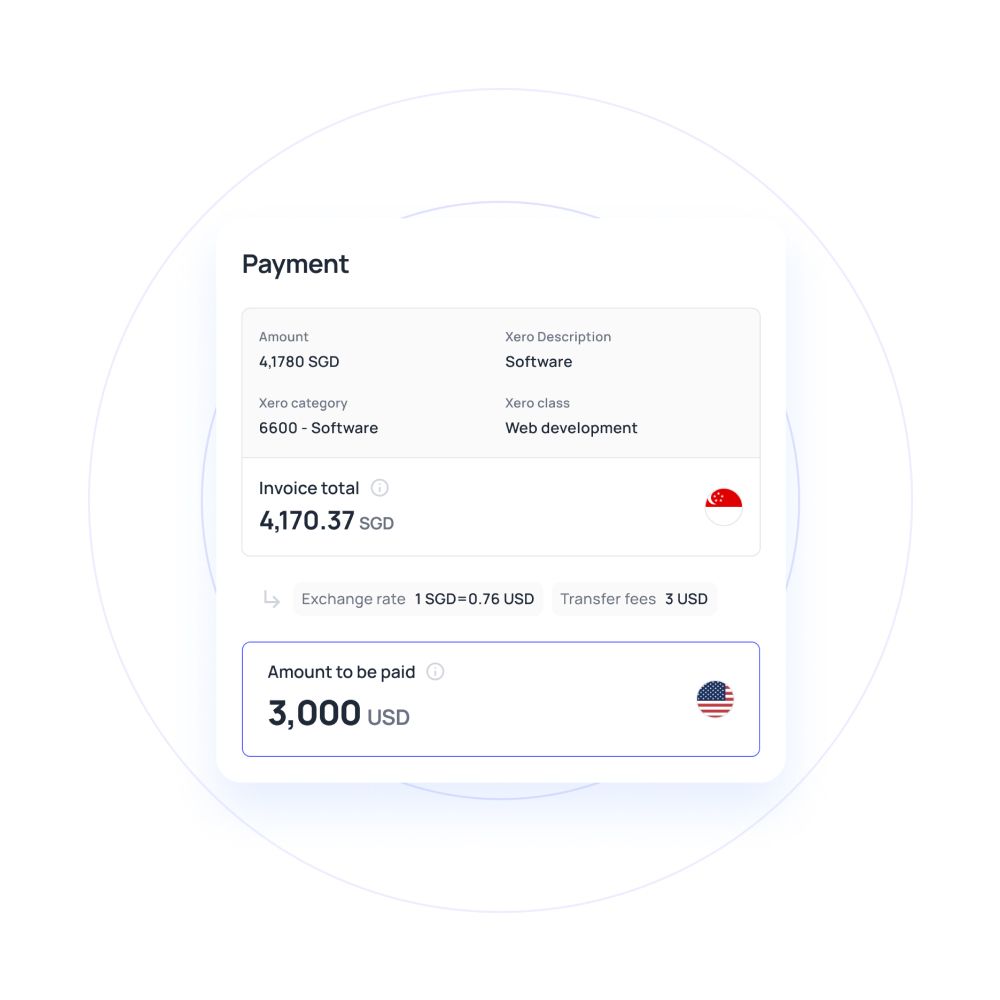

Expanding your vendor or team base abroad may sound appealing, but paying large FX fees is a nightmare! For all international money transactions, Volopay offers super-low interchange fees compared to regular banks.

Enjoy the benefits of the lowest exchange rates on every expense you make on our platform, whether it's paying overseas suppliers or transferring remittances to employees.

Track international wire transfers in real-time

Gone are the days when you had to wonder if your international money transfers were successful. Volopay's live dashboard allows you to pay, monitor, and track all of your foreign payouts.

Get real-time notifications on the status of your transactions and never miss an invoice or receipt again. Get complete visibility into all of your international payments.

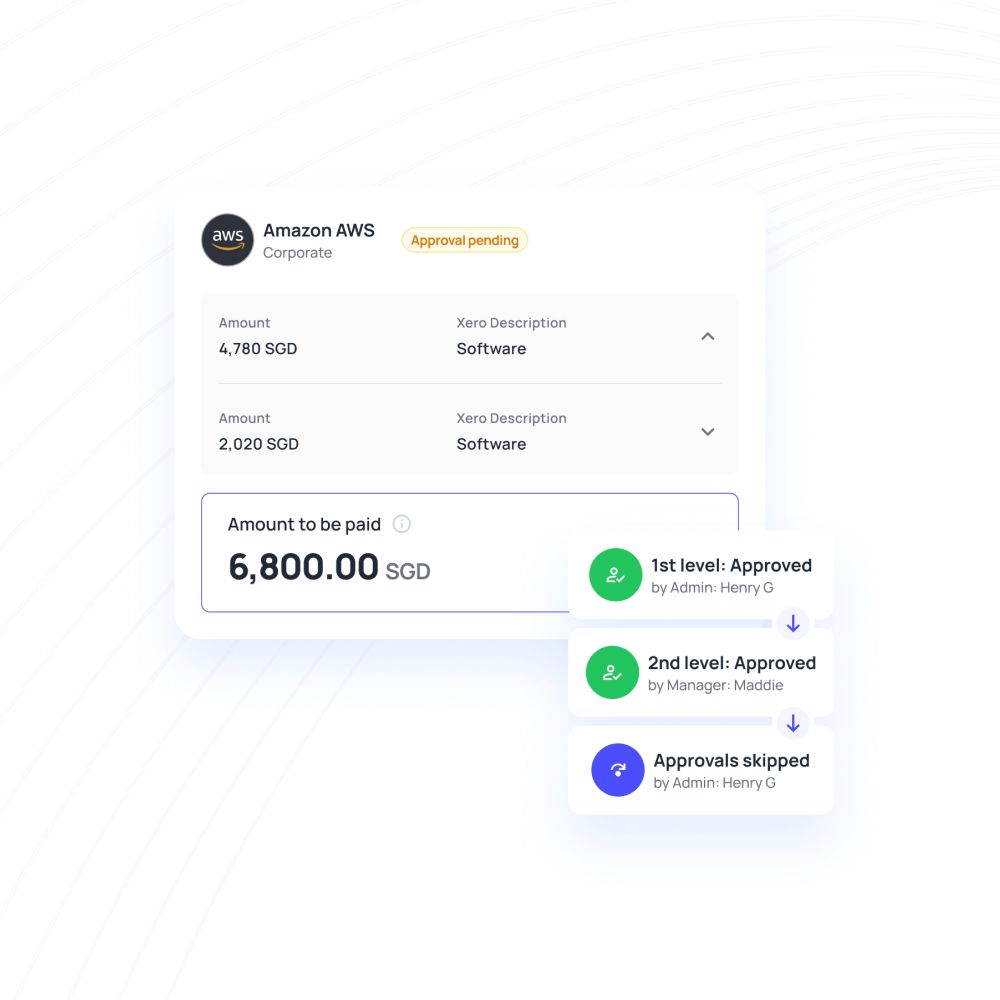

Advanced multi-level approvals

All international money transfers should be compliant with policy. With unique corporate expense regulations and enforceable policies, you can increase openness and accountability.

Create a multi-level approval system on Volopay, so that no payment goes unchecked. As needed, enforce compliance with built-in policies, merchant blocking, and spending limits.

Efficient international vendor payout

It's never been easier to pay overseas sellers. From a single dashboard, you can manage all of your vendors in more than 180+ countries. Track and schedule foreign payouts via SWIFT or non-SWIFT to avoid hefty FX fees.

Send and receive money

Pay your vendors across 180+ countries with SWIFT and NON-SWIFT payment options at the lowest rates. Track all transactions on the platform, and approve payments on the go. Sync your account with the accounting software of your choice for automated reconciliation.

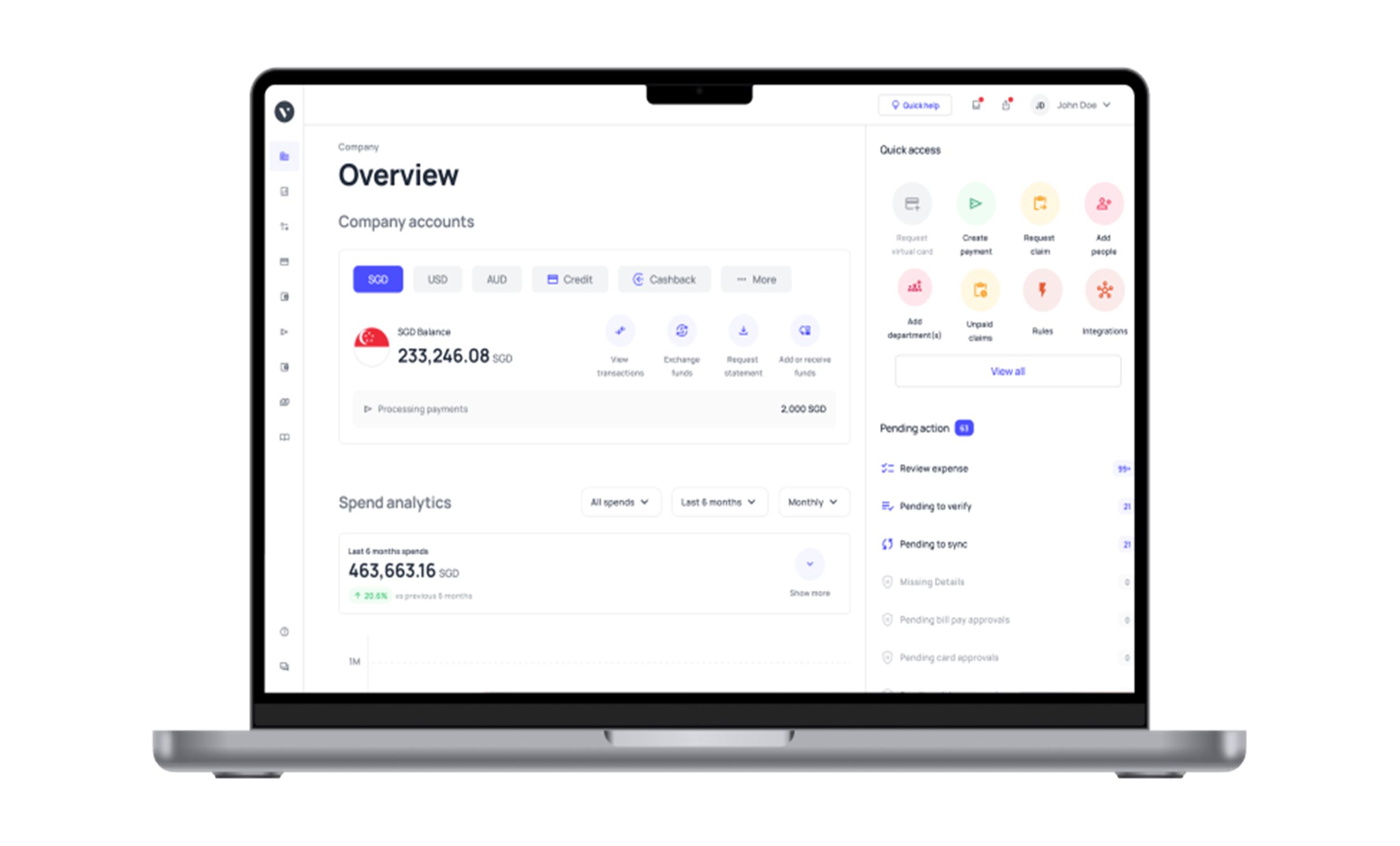

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

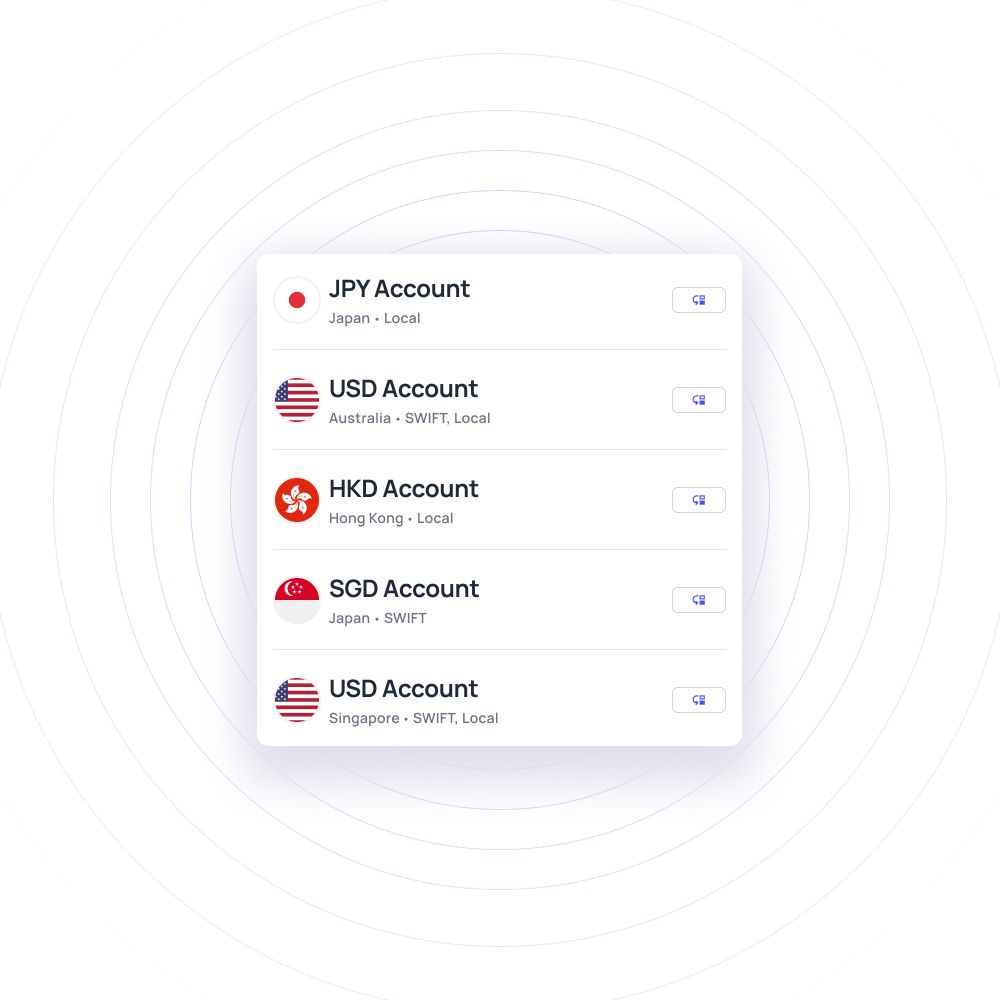

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Consistently rated at the top

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our international money transfers

With a clever, simplified, and scalable expense management software on your side, you can go global. Volopay is a superior platform that combines the power of corporate cards, bill payments, approval workflows, employee reimbursements, and automatic accounting connections.

Domestic money transfers

Transfer money locally in a jiffy. Volopay makes it easy to pay local businesses and teams with no hidden fees. From a single dashboard, you can keep track of all of your business spending. Pay only what you owe thanks to a multi-level clearance process that makes verification easier and faster. Volopay allows you to manage all of your local merchants from a single platform.

Global business account

Using our global multi-currency business accounts, manage cross-border B2B payments across 130+ countries. Maintain a balance in all major currencies. Issue corporate cards to employees all over the world, and keep track of their spending through a centralised, user-friendly dashboard.

Vendor payouts

With Volopay, you can streamline vendor management and pay them on time. Using non-SWIFT or SWIFT payment channels, pay local or international businesses. Never pay late fees again with our Bill Pay function, which allows you to create, schedule, and automate payments. When you choose early payment, Volopay will automatically present discount possibilities to your vendors.

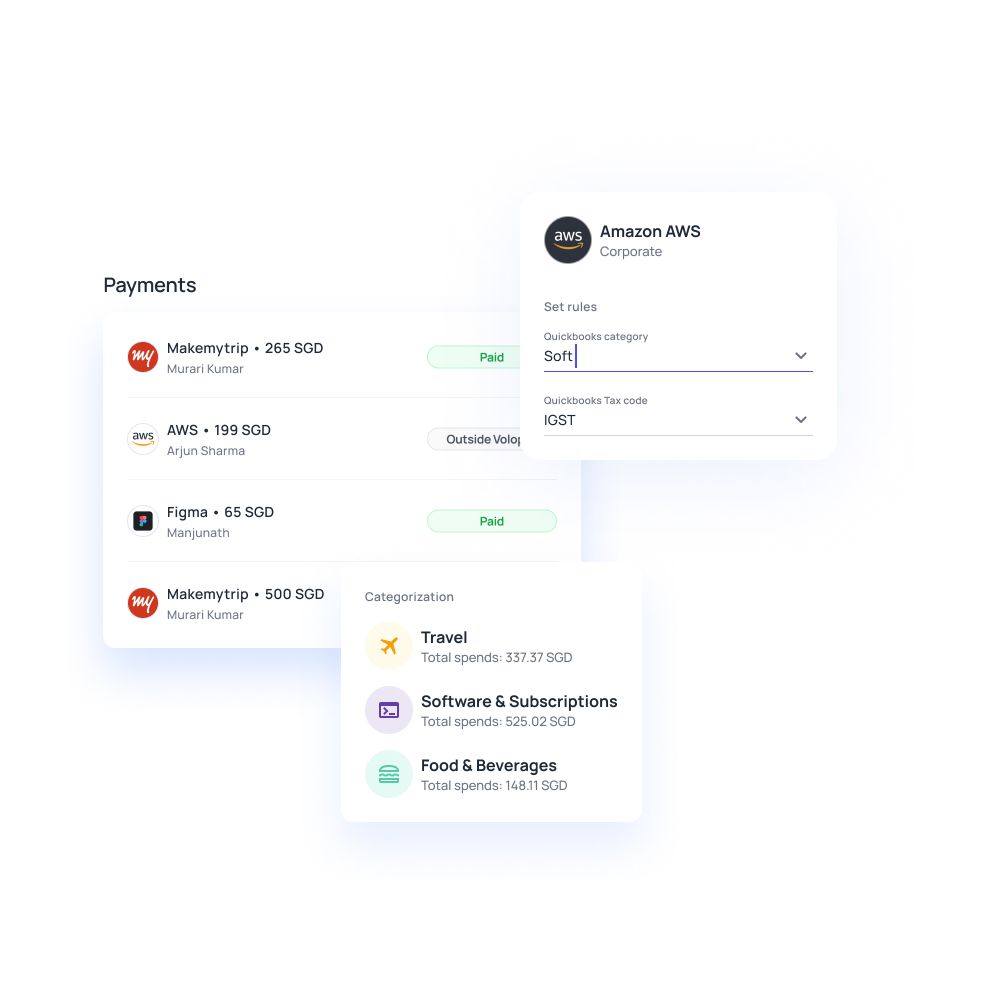

Accounting automation

The best accounting software in the world meets Volopay's top-notch integrations. Connect to Xero, Quickbooks, NetSuite, and more with ease. With our one-click sync tool, you may export expenditures right away. For a streamlined expenditure reporting experience, set accounting triggers, custom mapping fields, and import expense categories from your accounting software.

Bring Volopay to your business

Get started now

FAQs on international money transfer

Other wire transfer companies take several days to complete payments; Volopay takes less than half that time. Traditional financial institutions and wire transfer providers charge much higher exchange rates than we do.

Volopay offers better foreign exchange rates than any regular bank. Our foreign exchange margins are much lower than those of banks and other international wire transfer companies, saving you hundreds of dollars each year. Book a demo with us today to discover more about our most competitive exchange rates!

Volopay is a safe and secure international payment expense management solution. To secure your overall money, you can relocate a portion of your company's assets to an e-wallet that works as an escrow account. We don't have access to or control over the monies in your e-wallet. For added security, our VISA-powered corporate cards do not have direct access to your e-wallet. They can only be filled with monies from their authorised budget, ensuring that your e-wallet funds are secure.

International business money transfer can be done either directly through banks or you can use a spend management or third party platforms. The difference between business money transfers made through a bank and a financial management or third party platform majorly lies in the remittance charges and exchange rates.

International business money transfer limits aren't exactly a law, but every financial institution has its own number set. In Singapore, the transfer limit varies from SGD 200,000 (USD 144 000) daily to all countries to SGD 10,000 (USD 7 000).

This depends on the country laws and the rules of the financial institutions. Some may offer smooth transfers up to $10000 or more.