The best virtual prepaid and debit card in Singapore for businesses

Virtual prepaid cards are the best way to efficiently manage your company’s payments. Volopay has the best virtual card Singapore has to offer, enabling you to make online payments and control SaaS spending.

Create and assign a Volopay virtual card to your employees. Give them financial autonomy and the flexibility to make corporate purchases without having to use their personal finances.

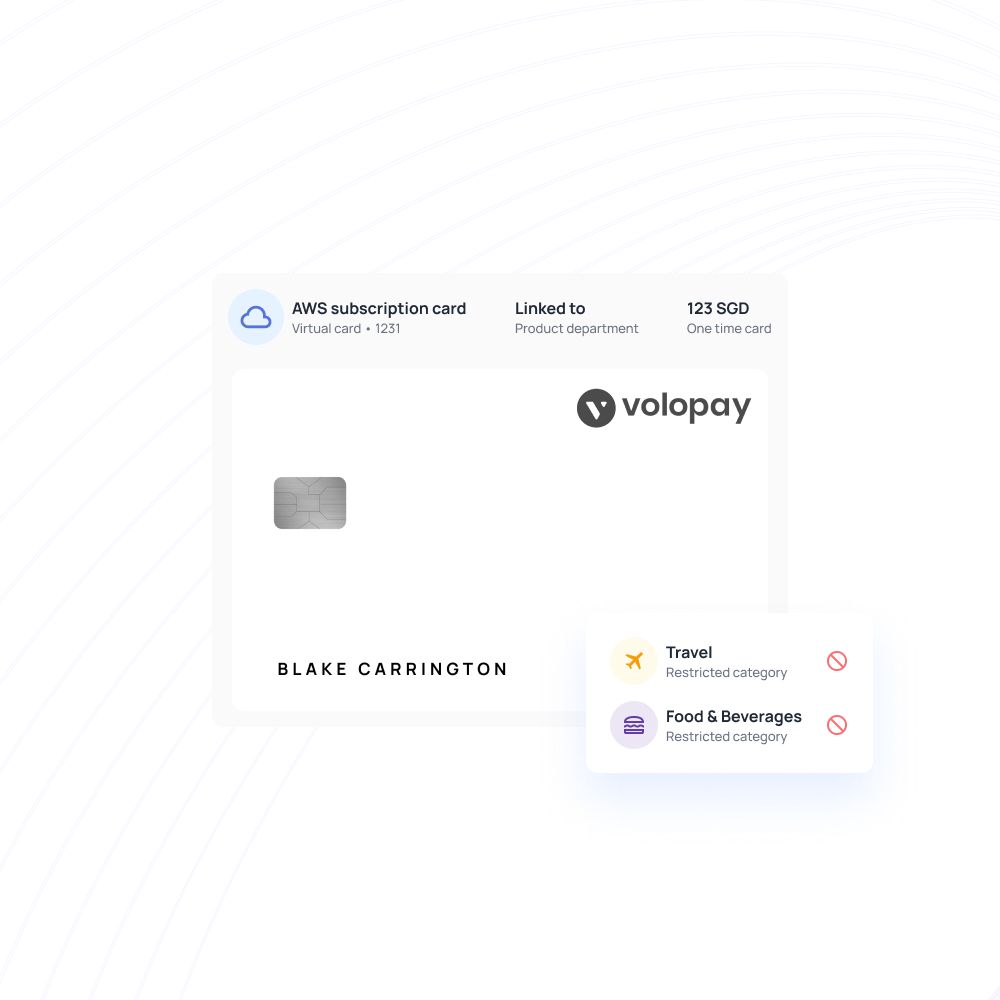

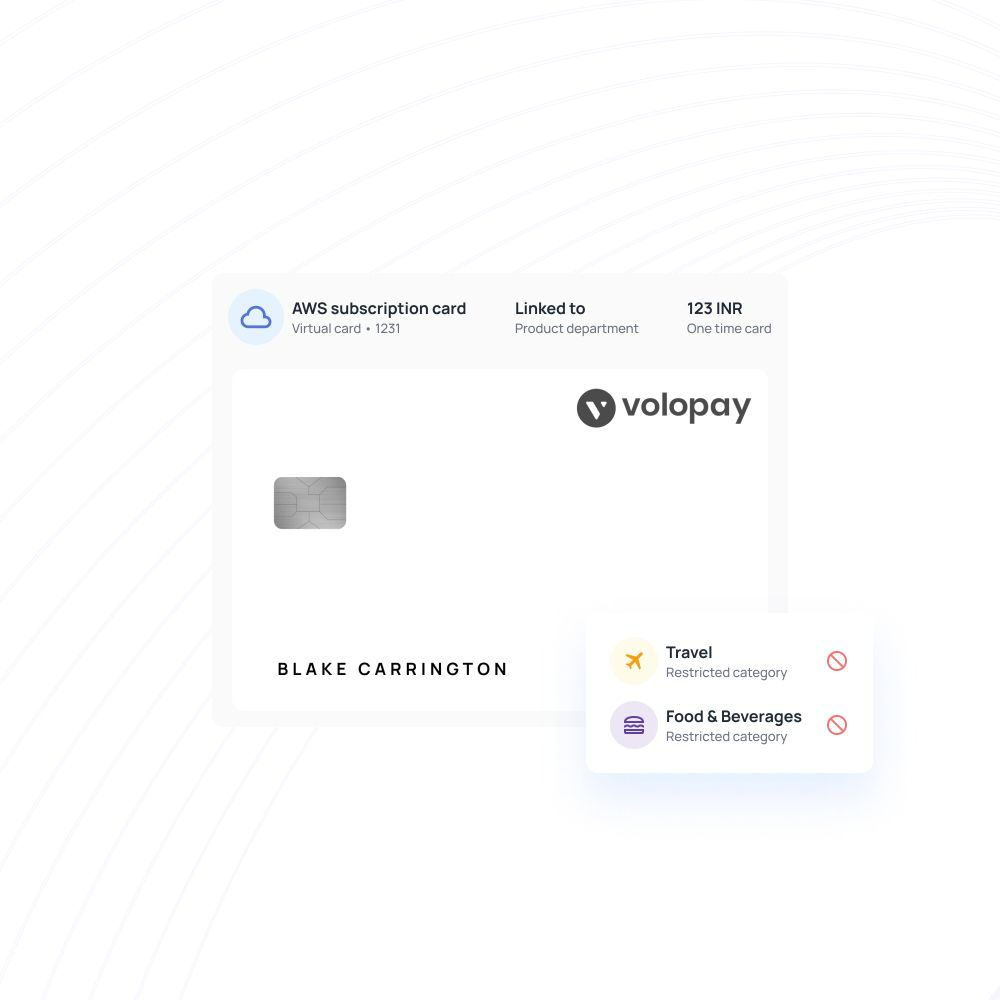

Virtual card for subscriptions

Create multiple business virtual cards for subscription management to keep your SaaS payments under control and ensure that no numerous or obsolete subscriptions get in the way of money management.

Make one-time or recurring payment card, or assign a card specific to a vendor to keep track of budgets and payouts for each SaaS billing.

Online payments are now safe and secure

Our virtual prepaid card in Singapore is governed by the Monetary Authority of Singapore. They are issued by VISA and have the same encryption and security as any other bank-grade credit card. Because you can create an endless number of virtual cards, you won't have to share cards or worry about data leaks.

Since a virtual card is not tied to your company's bank account, there is no risk of hacking. Keep your cards organized and separated, load or freeze as needed, and keep everything in one location for peace of mind.

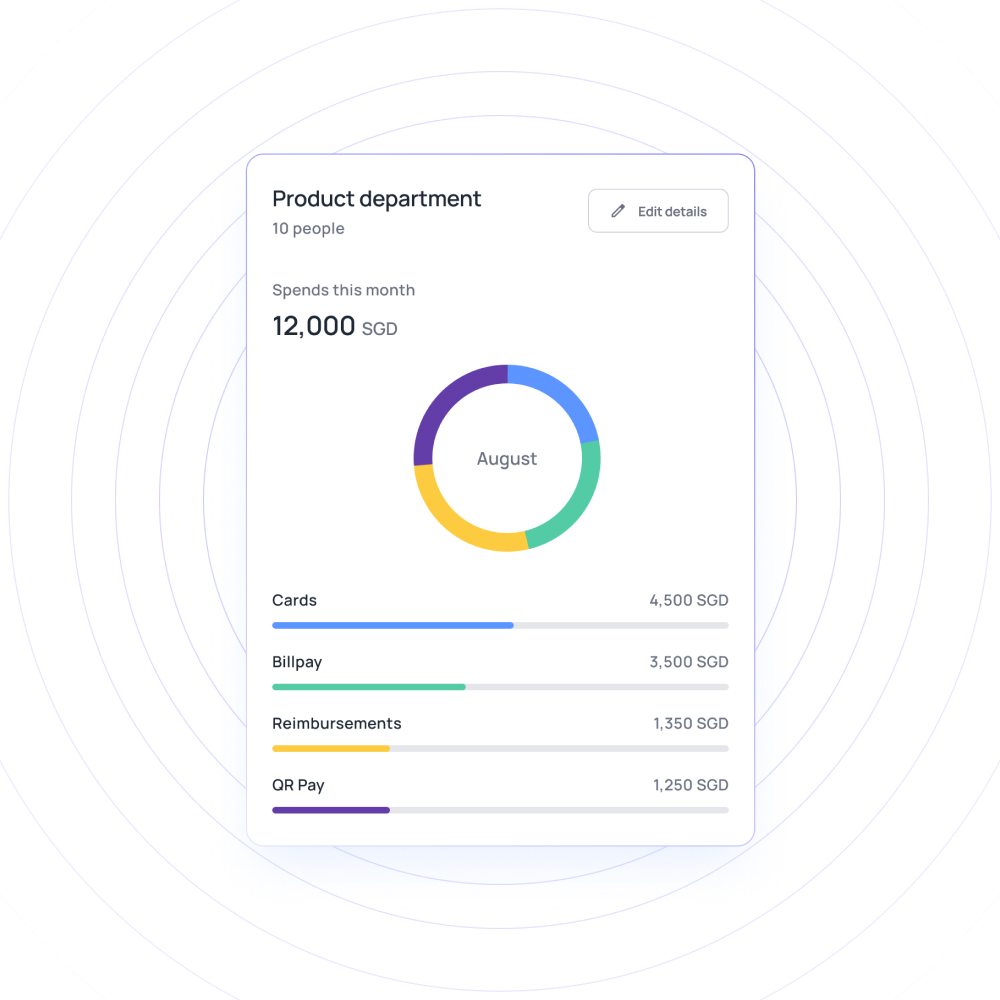

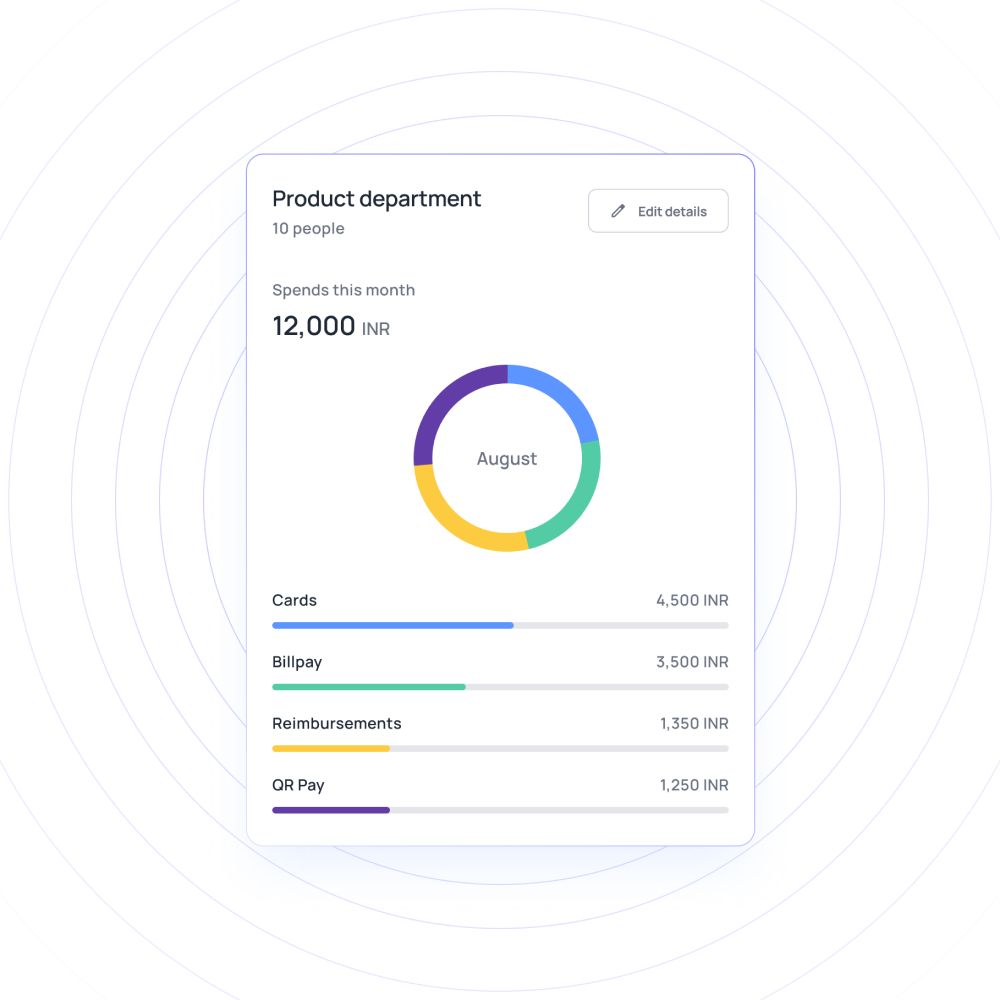

Business-wide spend visibility

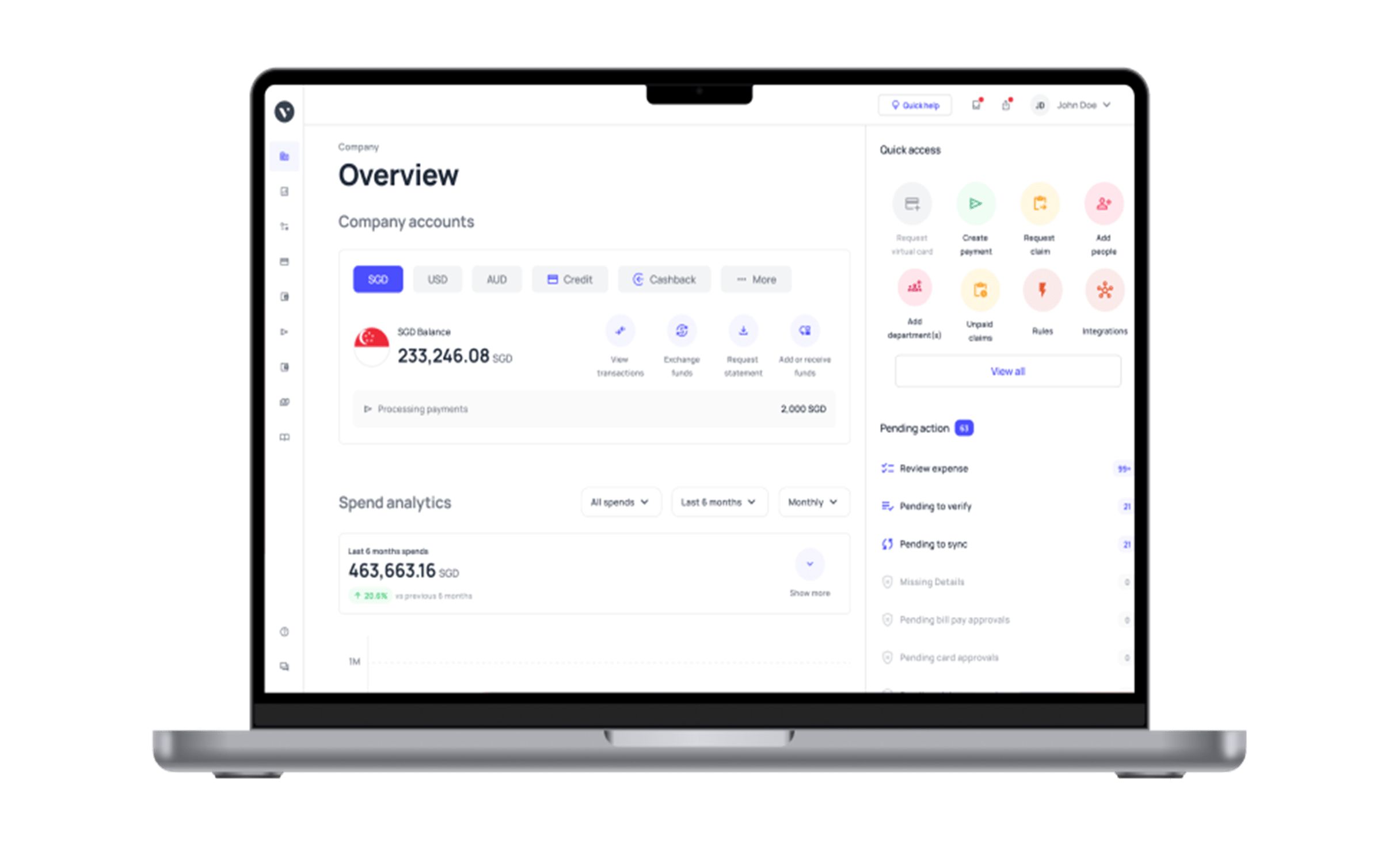

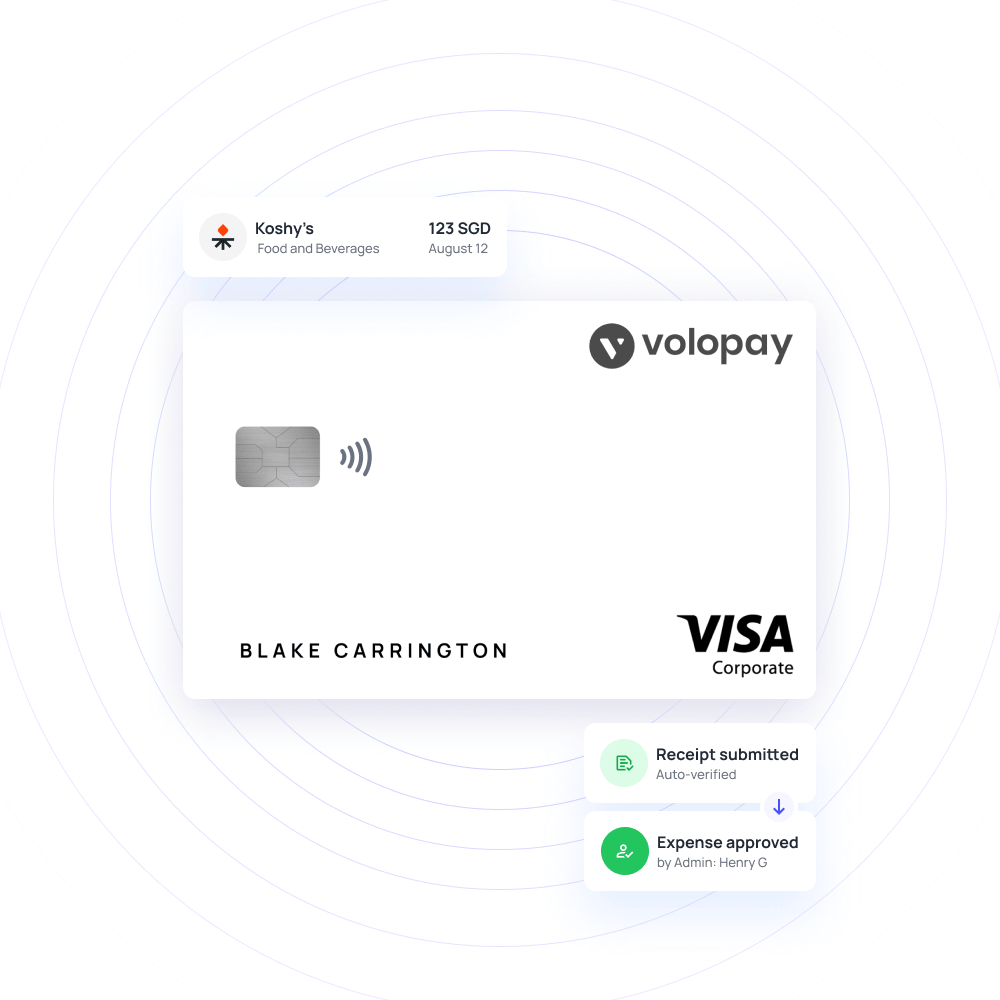

Our business virtual prepaid card is linked to your Volopay account, so any transactions or expenses made using them are updated instantly. Every swipe, every transaction, is captured in real-time.

There's no risk of losing data, and you'll always know every dollar that leaves the company. Keep a track of your spend metrics any time and from anywhere.

Perfect virtual card solution for your business!

Set and enforce spend limits

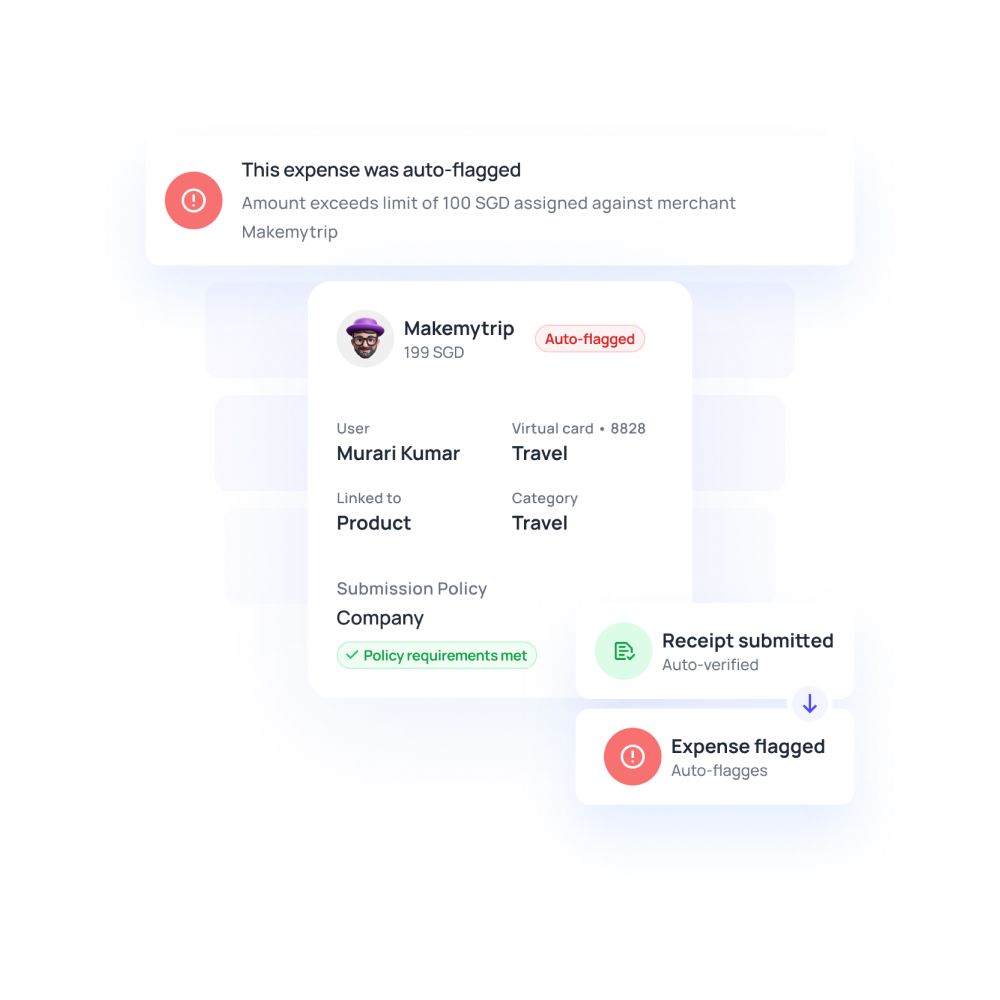

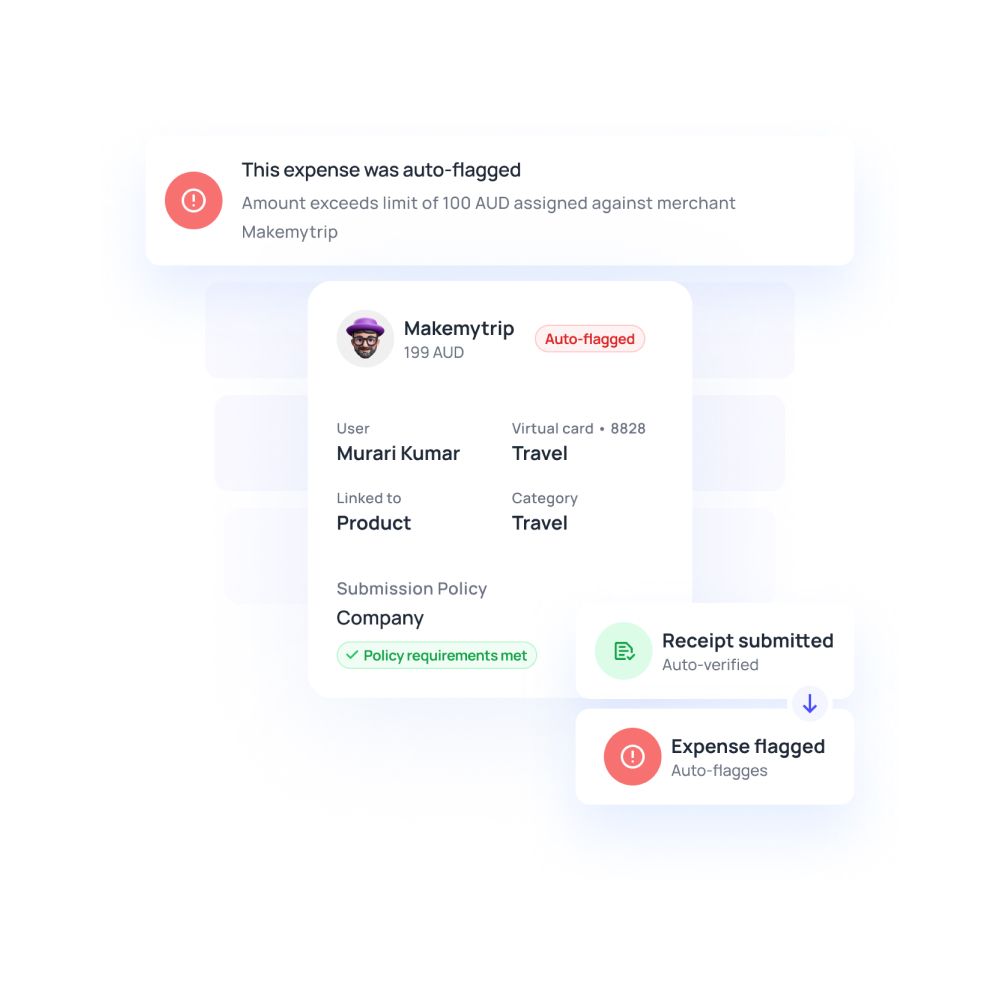

Set specific spending restrictions, allowing you to keep track of how each card is utilized. By default, company spending policies are applied, which will auto-decline any transactions that exceed a particular limit or if they’re made for a blocked merchant.

Cards can be assigned a set budget and recurring reload frequency (or even be set for one-time use!). Your business virtual cards are smart and reliable.

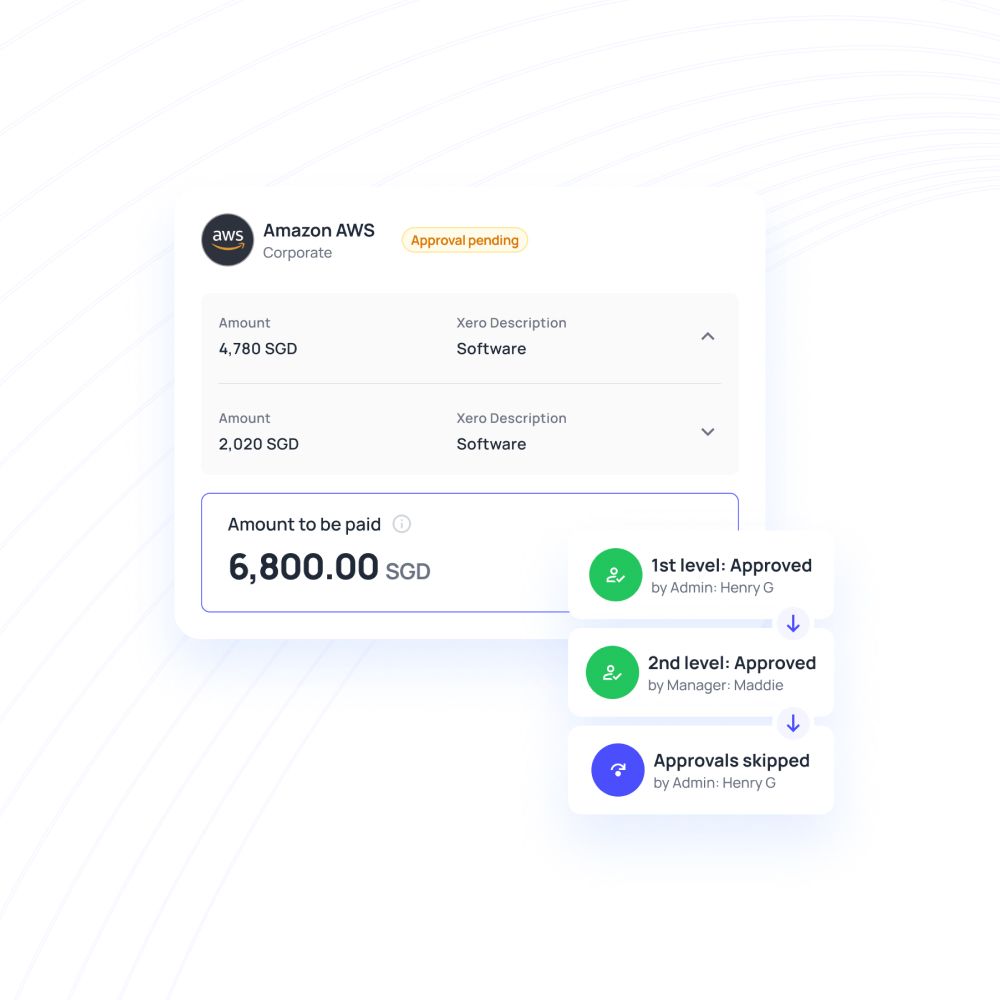

Multi-level approval workflow

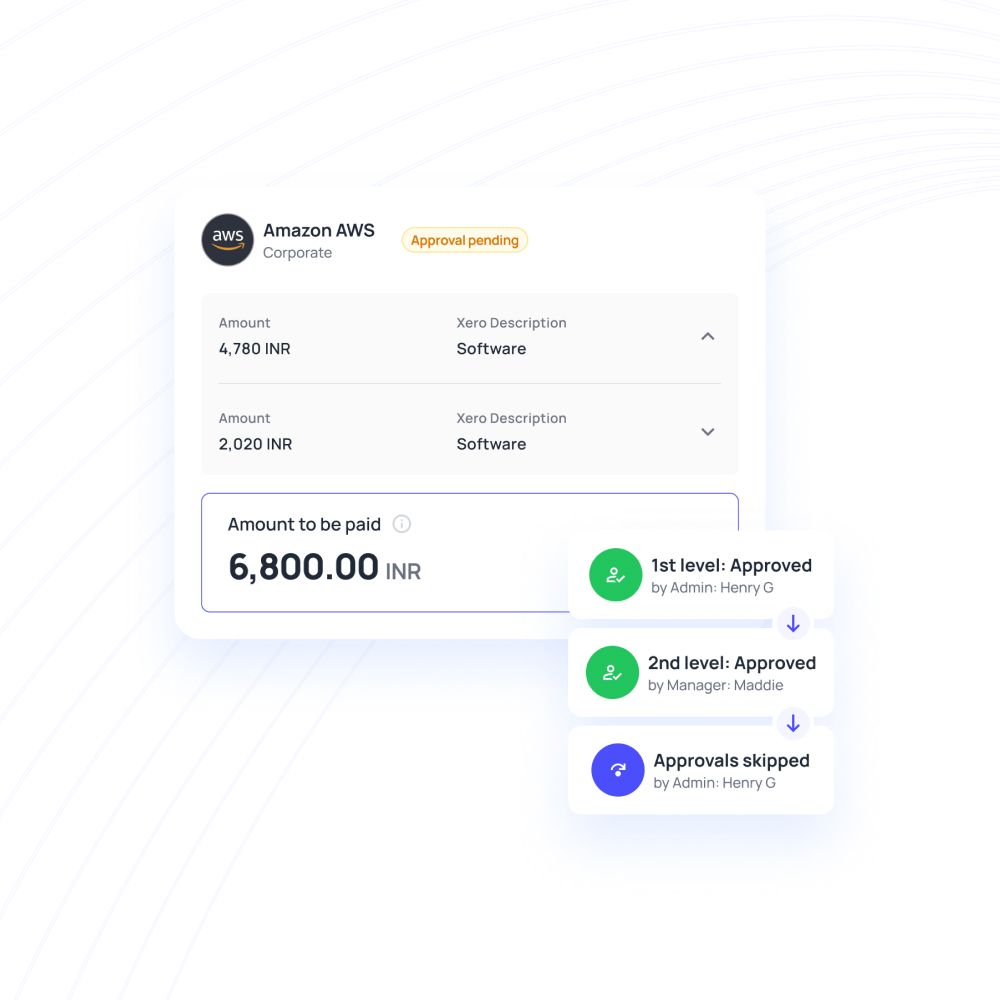

You can create up to five levels of approvers for fund requests and checking of expenses. This is a one-time configuration, after which push alerts and fast payouts ensure that everything runs well.

Expense flagging rules can also be set up so that non-compliant transactions on virtual prepaid cards are automatically refused, saving time and effort for approvers.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

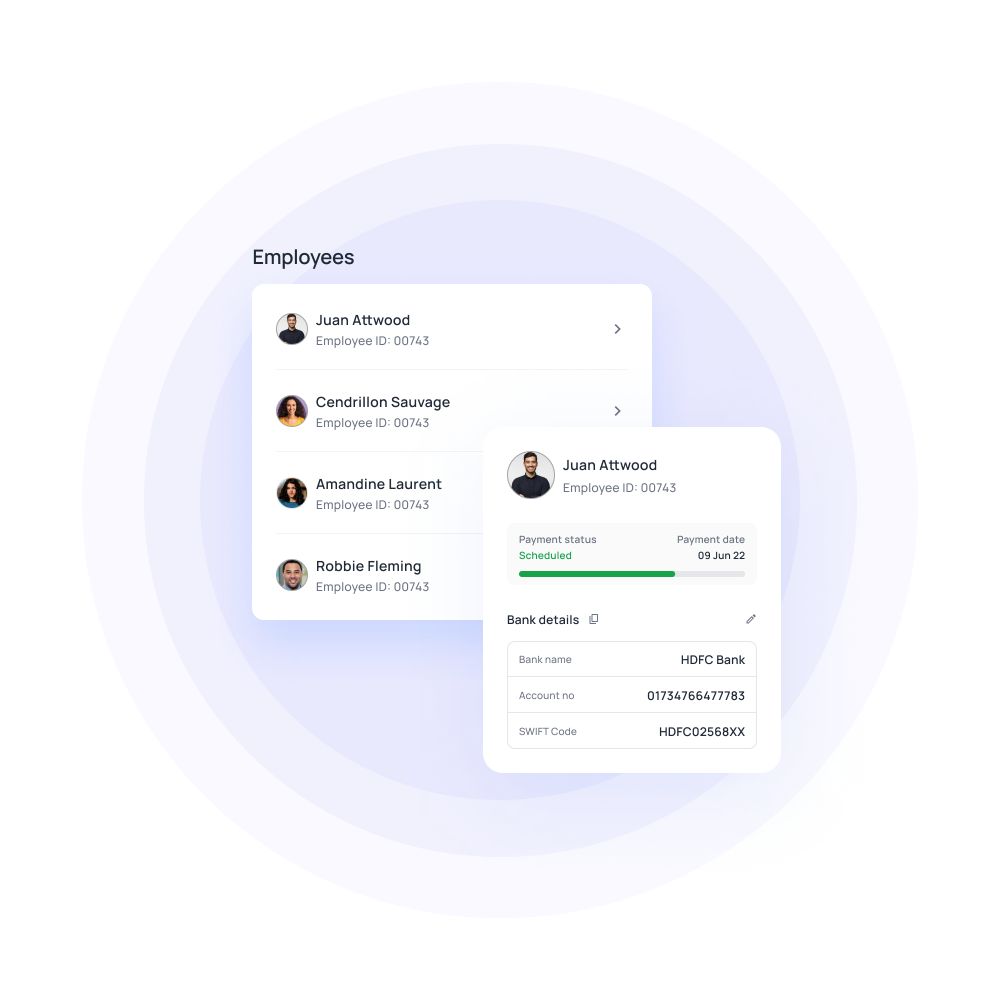

Benefits of issuing virtual card to employees

Eases reconciliation burden

As virtual card payments come with labels and codes, finance teams can track and understand what that payment is. They don’t have to chase the accounting team for receipts or explanations.

These payments also sync with the general ledger automatically and manually. Hence, no manual effort is needed to reconcile card payments.

Simplifies vendor management

Create as many virtual cards as you want, depending on the number of vendors, and assign each one of them. You can monitor them centrally, pay quickly online, and track spending department-wise and vendor-wise.

You'll be able to add more cards as you partner with more vendors and pay them on time.

Faster payment option

Virtual card is the fastest way to make business payments like ticket bookings, reservations, fuel card recharges, etc. Employees can simply enter the card details and finish the transaction without requesting approval.

Both cross-border and local transactions go out faster as card payments are different from wire transfers and checks.

Why should you choose Volopay virtual card?

Compliance & security

Volopay is committed to protecting your data with bank-level security and double encryption. Our payment operators fulfill every requirement of MAS and have valid MPI licenses.

No hidden fees

Volopay offers the best competitive exchange rates in the market. There are no hidden fees while carrying out both local and international payments.

Unlimited cards

Create unlimited cards from the Volopay card management system. This is suitable for growing companies with increasing suppliers and payment categories.

No personal guarantees

You don’t have to share your personal credit score or statements. Your business credit score, statements, and spending history are enough to decide your eligibility.

Easy to create

In a few clicks, you can create virtual cards and get them assigned to a spending category or an employee.

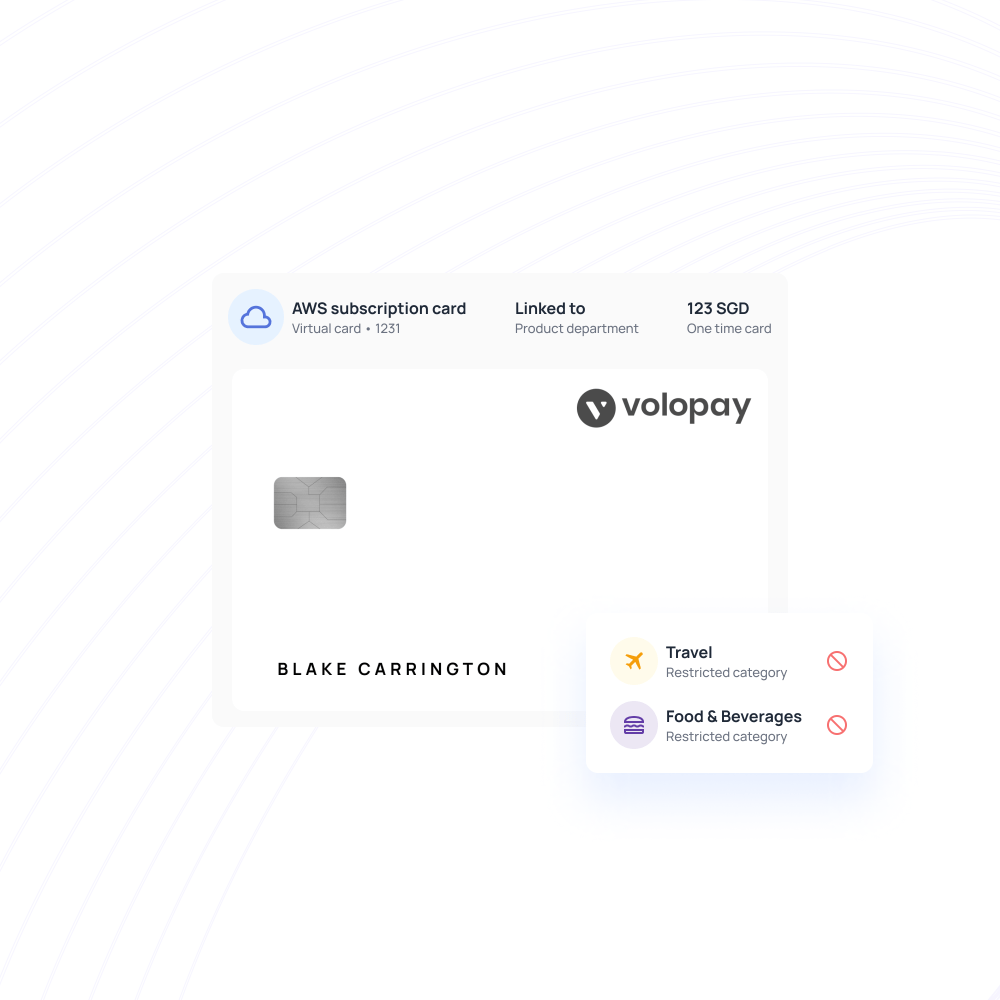

Merchant controls

Smart merchant controls let you block virtual card payments to some vendors. Additionally, you can also greenlight only some merchants for compliant spending.

Maximum control

The admin can set spending limits on each card and assign approvers if limits have to be exceeded. Thus, you get extreme control over spending amounts.

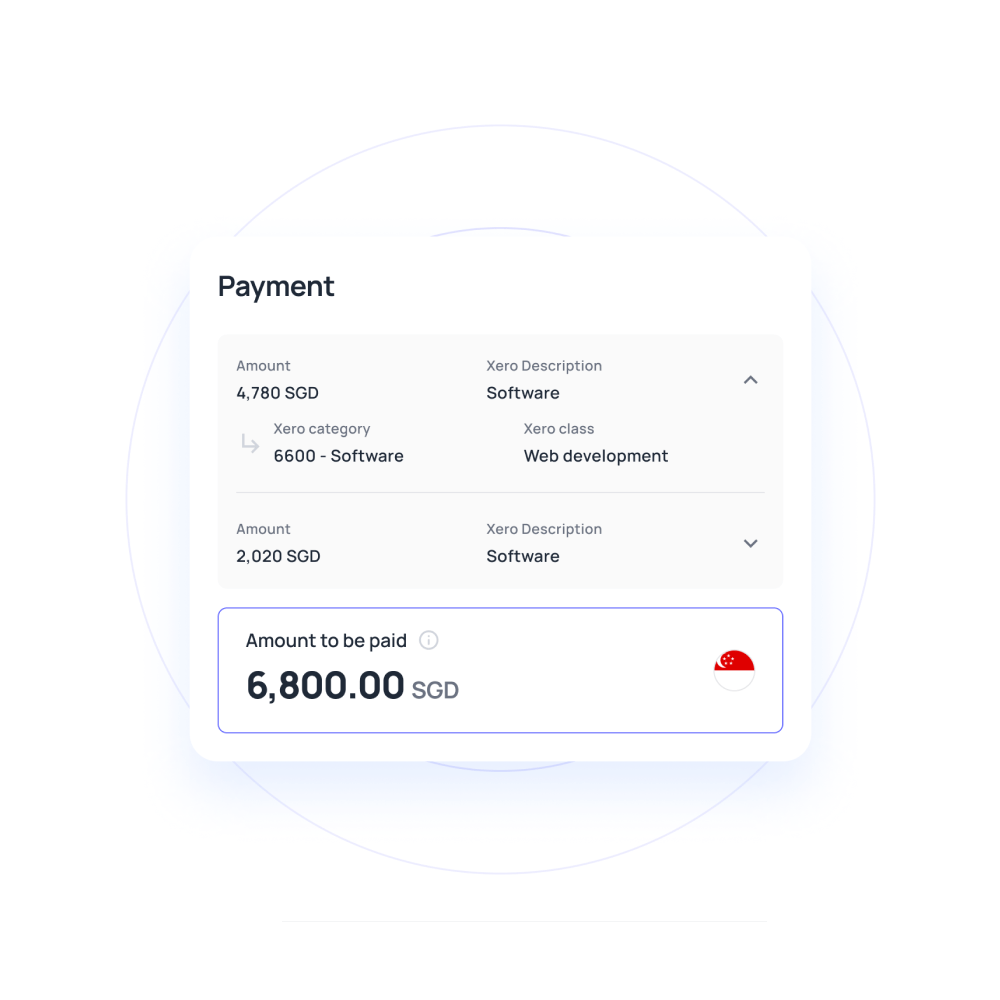

Integrations

Minimize manual work and sync accounts payable automatically with GL by integrating relevant applications with Volopay. Volopay syncs with Quickbooks, Xero, and most ERPs.

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Be on top of your business expenses with Volopay cards

Keep your spending in check with virtual cards

Issue individual virtual card

Employees are tired of the labor-intensive expense reporting process. They can be assigned virtual cards to help them make business spending by themselves.

As you can create unlimited virtual cards, each authorized employee can receive a virtual card. It also helps in controlling and regulating employee-related and departmental expenses.

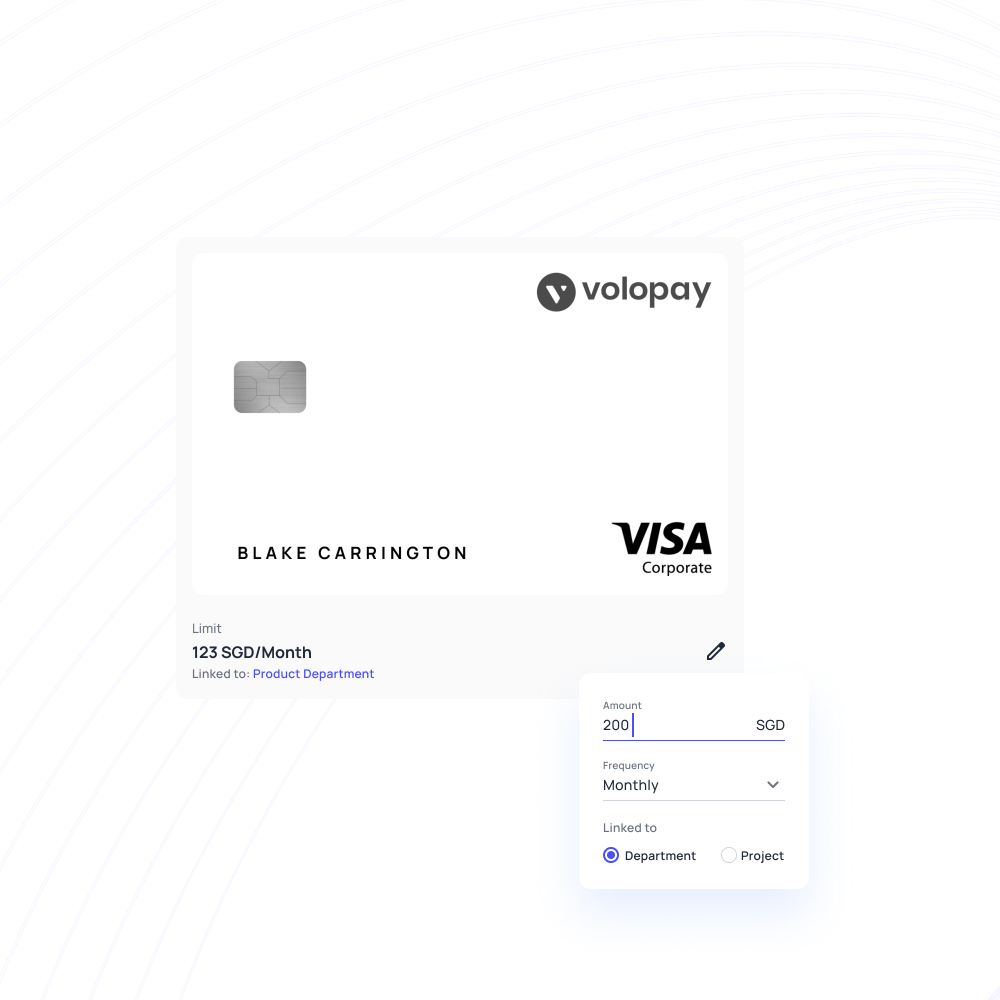

Allocate separate budget

Every virtual card can be internally linked to a department or project, thereby allowing you to assign the spend limits based on your requirements. You can also spot overspending and track expenses related to the linked department or budget. By assigning limits to card payments, you get deeper control of your company funds utilization.

Monitor employee spending

Virtual cards allow employees to take care of their business expenses without relying on the accounting teams.

It also help accountants to keep track of where employees spend their money. This is very helpful in staying compliant with the expense policies. Any anomalies in the spending can be identified and notified earlier.

Set limits on spending

Offering separate cards to employees empowers them to spend on their own. But it also restricts them by placing a spending limit. By adding limits, you control how much they can spend.

For expenses that are uncontrollable, you can create virtual cards and set only needed limits.

Set custom multi-level approvals

If a card requires more amount than the assigned limits, the card owner can request additional funds. It is possible to set multi-level approvals to authorize these requests. This trigger is to ensure that employees comply with your company’s spending policy.

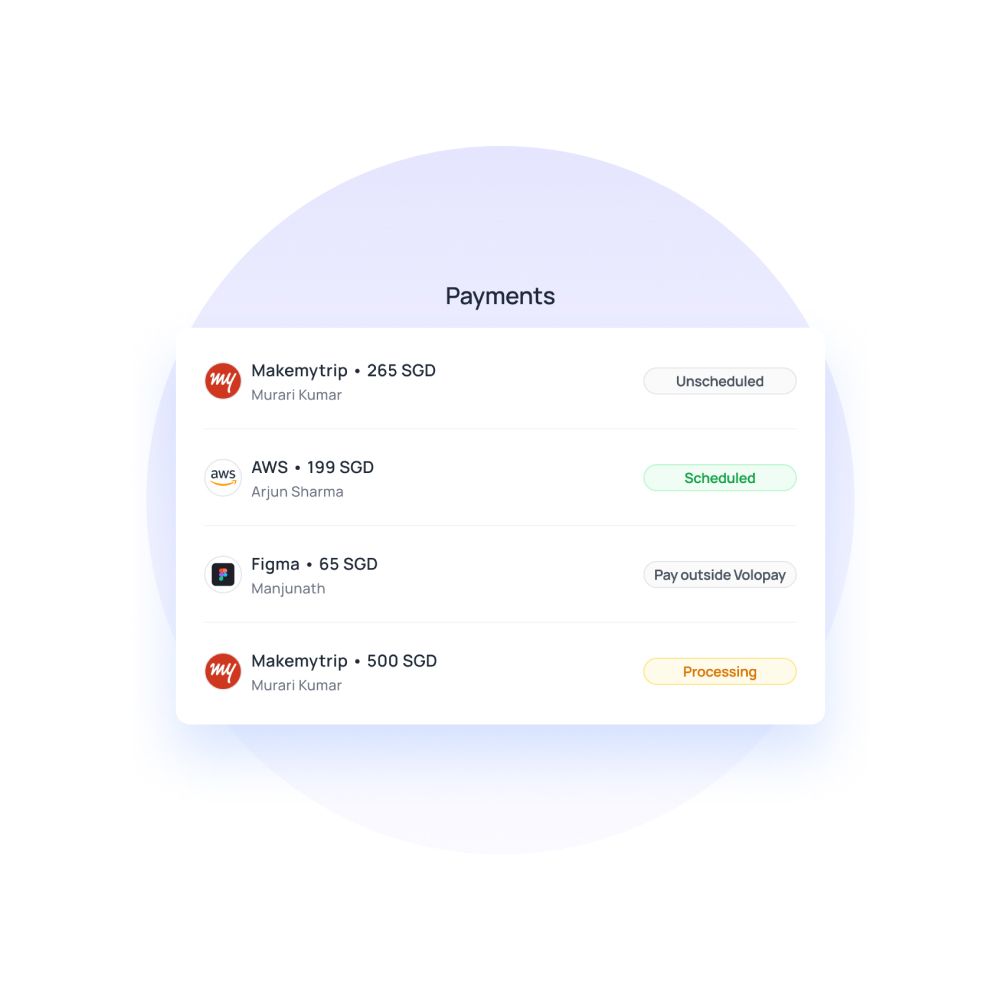

Automate vendor payments

Subscription payments are hard to manage. If you forget a payment, you won’t be able to use the product further. But you can automate them with the help of virtual cards.

Once you set this up for a vendor, a fixed payment goes out automatically every month at a fixed date and time.

Recognized as a leader in financial management

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our virtual card

Volopay is a single, consolidated business financial control centre bringing together innovative products like smart corporate cards, AP automation, efficient automated accounting, approvals, and employee reimbursements.

Subscription management

With our virtual cards for subscriptions, create payments and schedule them to avoid late penalties or service interruptions. You can prevent making multiple payments by using real-time tracking.

Furthermore, block and freeze options prevent you from overpaying for SaaS models that you no longer need.

Real-time visibility

Our business virtual cards allow tracking payments. Our expense-reporting system is completely transparent and accountable. All of your transactions' data are updated as soon as they occur, giving you a bird's-eye view of your whole cash flow.

Whether it's accounts payable or a simple swipe of a card, everything is accurately recorded right away.

Multi level approvals

Using maker-checker processes and approval levels, instill a sense of accountability. You can create up to five tiers of approvers on the platform, each of whom verifies and ensures that payments are correct and that nothing is done arbitrarily.

Non-compliant transactions are automatically refused due to pre-set limits.

Accounting automation

Accounting automation can considerably benefit your account structure from the initial card swipe to the closing of the books. For smooth reconciliation and data analysis, the world's most popular accounting software list connects effortlessly with our platform. There's no need to manually sync. Simply connect the two systems and watch how they work together to keep your data current.

Explore more about virtual cards

Get a complete overview of how businesses in Singapore can manage expenses via virtual debit cards with enhanced security.

Know how corporate virtual cards work and the documents required to apply for a virtual card in Singapore.

Explore the key use cases of virtual cards for enterprises and how to introduce and implement it in your organization.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Paralleldots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

They loved Volopay, you will too

Bring Volopay to your business

Get started now

FAQs on virtual cards

Create the card whenever you want to and it is ready to use. It will remain valid until you set an expiration date for it, or unless an administrator blocks or freezes the card.

Your virtual card is completely under your control when it comes to spending. For expense verification and card loading requests, administrators can assign up to five levels of approvers. It works in a hierarchical fashion, with first-level approval followed by second-level approval, and so on, with approval only going through when the highest level of permission has been cleared. To keep track of your spending, you can also freeze and block cards, as well as set expiration dates for them.

Yes, you will. All Volopay cards, both virtual and actual, can be used to make overseas payments. Your company's expense policy will set a limit on how much you can spend. However, you will be allowed to use it for foreign payments as long as the amount is approved.

Yes, a virtual credit card is totally legal for banks and other providers to create after meeting the necessary requirements and for consumers to use them.

When you create a virtual card on a provider's platform like Volopay, the card number is automatically generated and visible to the owner/user of the card.

There are few banks and digital banks that offer an instant virtual debit card in Singapore. A better option most corporate choose is to go with providers like Volopay, who let you create virtual cards for your business.

Virtual credit cards are not linked directly to a bank account making them safer to use for online payments on any website.

A burner card is basically a one-time-use card. These are usually digital in nature and are used for online transactions. Using Volopay you can create unlimited burner virtual cards for various different online payments.

The usage limits of a virtual card depend on the type of virtual card you create on the provider's platform. For example, Volopay allows its user's to create one-time or monthly recurring virtual cards. Users can also choose a custom expiry date for it.