Make hassle-free business money transfer across the globe

Running a global business often means navigating the complexities of cross-border payments. With Volopay, you can handle international business money transfer seamlessly across more than 180 countries, all from a single platform.

Enjoy competitive exchange rates and transparent fees for every company money transfer, all while tracking payments in real time. Whether you're paying suppliers or settling invoices, Volopay makes global payments simple, quick, and secure.

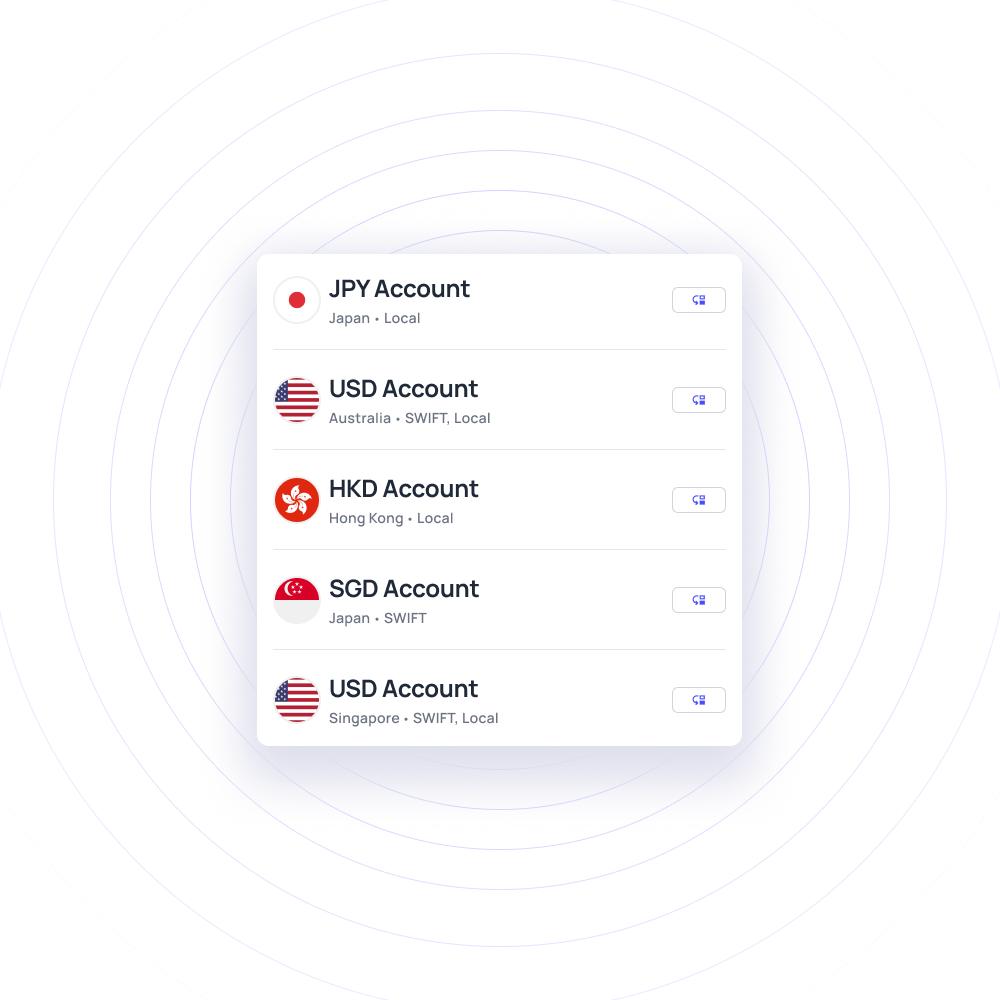

Manage multiple currencies

Volopay’s multi-currency support makes sending payments abroad effortless. With an intuitive B2B money transfer software, businesses can handle foreign currencies efficiently, reducing the stress of currency conversions.

This ensures smooth operations and faster payments across borders, helping businesses remain agile and responsive to their international partners.

Instant, safe domestic transfers

Domestic transactions on Volopay's platform are handled swiftly and securely. Money can be sent promptly within your home country, ensuring timely payments to employees and vendors.

Equipped with advanced security features, the platform ensures each payment is safeguarded against fraud and delays.

Highly competitive fees and rates

Volopay's B2B money transfer software provides full transparency with low, predictable fees for all domestic as well as international transactions. Eliminate hidden fees and excessive exchange rates.

With Volopay, you're always aware of your costs, ensuring budget control and enhanced financial efficiency.

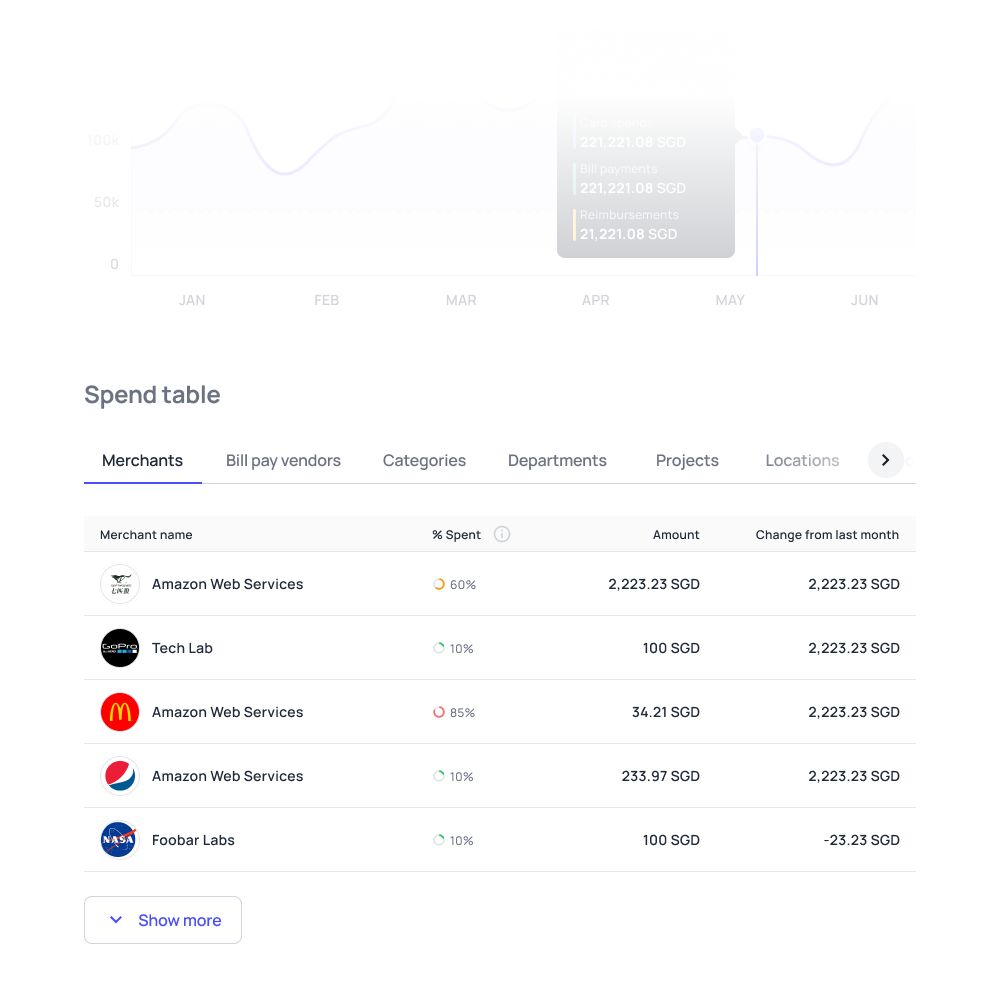

Real-time payment tracking

Volopay’s payment tracking features enable you to follow your company money transfers throughout the payment cycle.

Real-time alerts keep you informed of each payment, supporting efficient cash flow management and providing full visibility into your financial operations.

Streamline your business money transfer process with Volopay

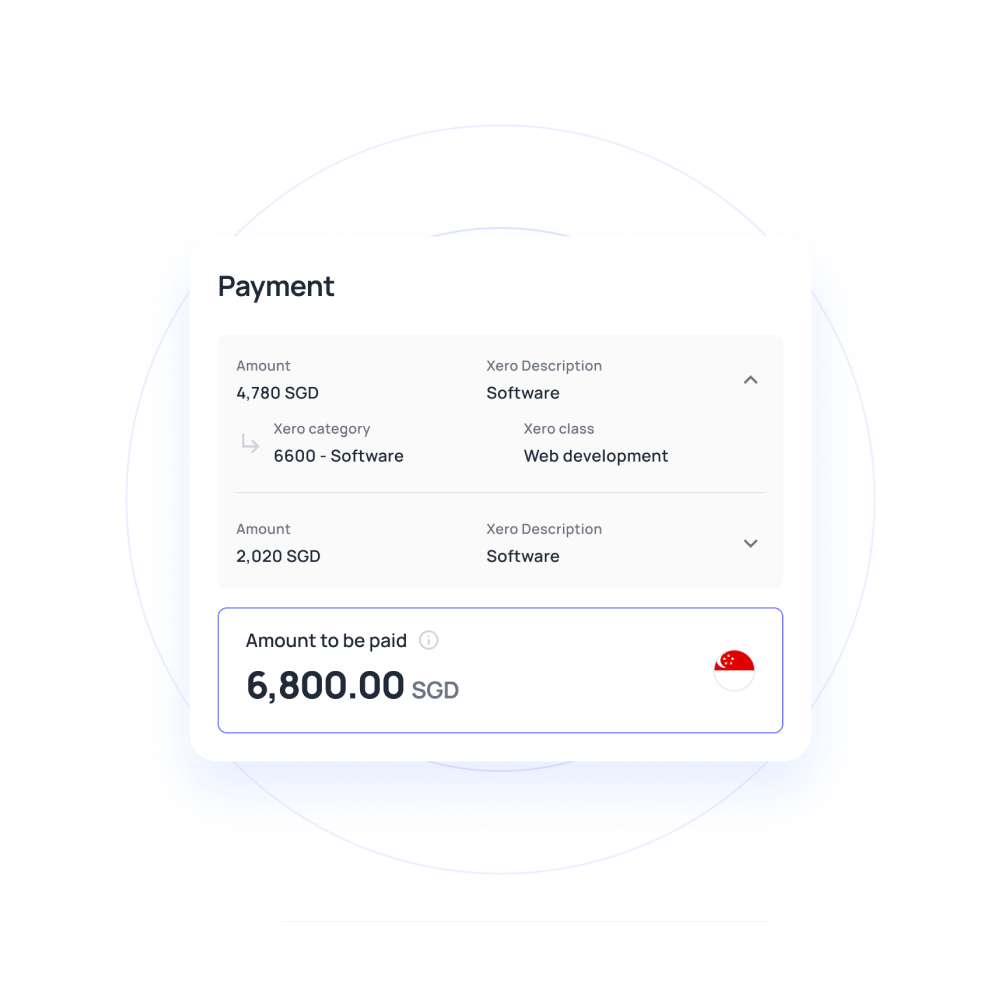

Stress-free accounting integrations

Volopay seamlessly integrates with your accounting system, automating data entry and reconciliation processes.

Say goodbye to manual payment entries, minimizing errors and boosting operational efficiency. This leads to more accurate financial reports, streamlining bookkeeping for your business.

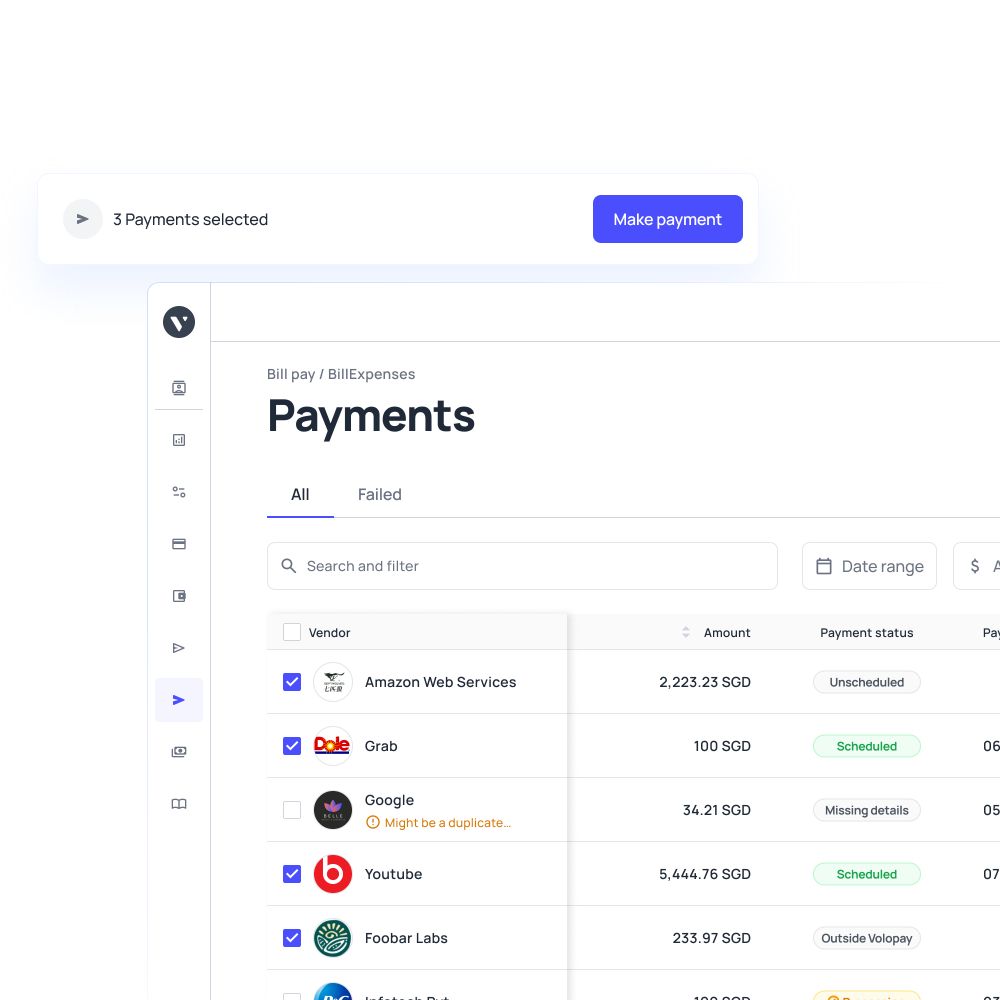

Make payments in bulk effortlessly

Handle bulk payments effortlessly with Volopay’s bulk payment features.

Whether managing payroll or vendor payments, Volopay allows you to process multiple transactions simultaneously, making company money transfers simple and saving you time. This is perfect for businesses that regularly deal with large volumes of payments.

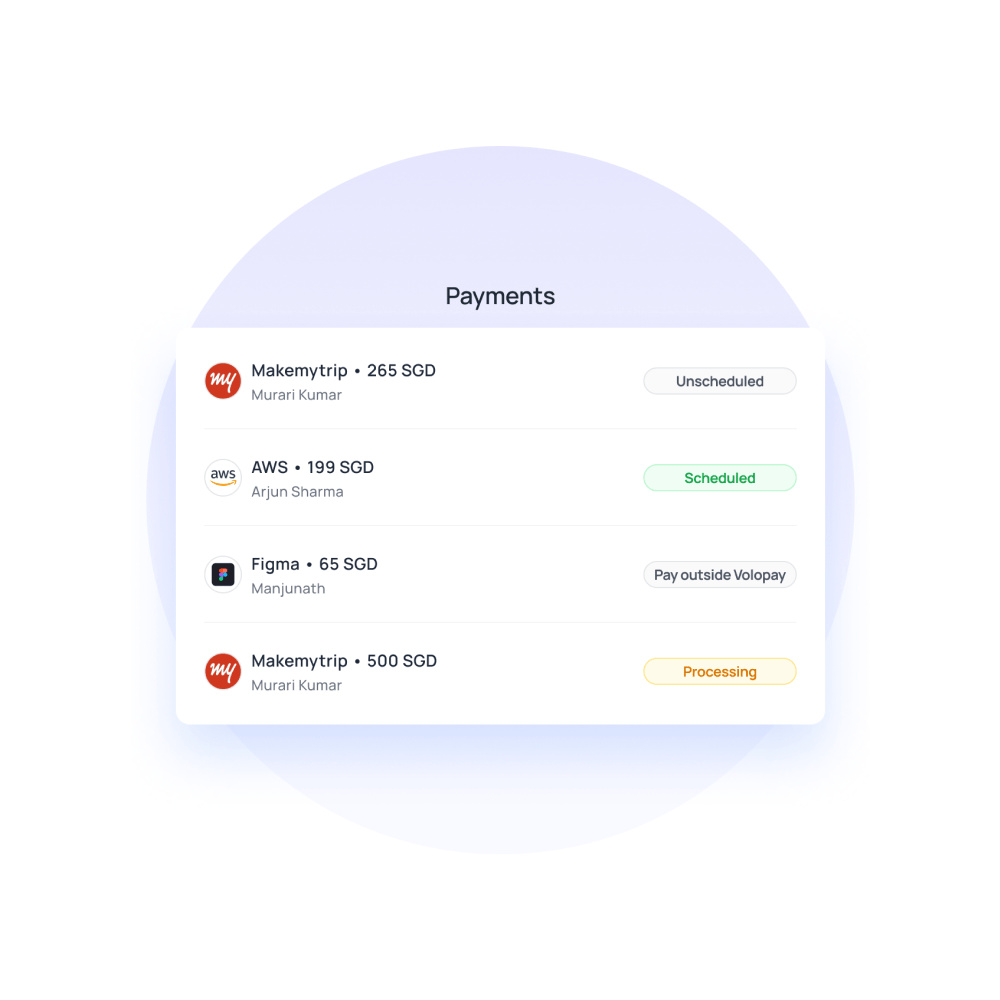

Automated payment scheduling

Volopay’s automated payment scheduling feature makes managing a recurring business money transfer effortless.

Set up regular payments to be processed automatically, ensuring you never miss a deadline. This helps maintain smooth operations and steady cash flow without the need for manual management.

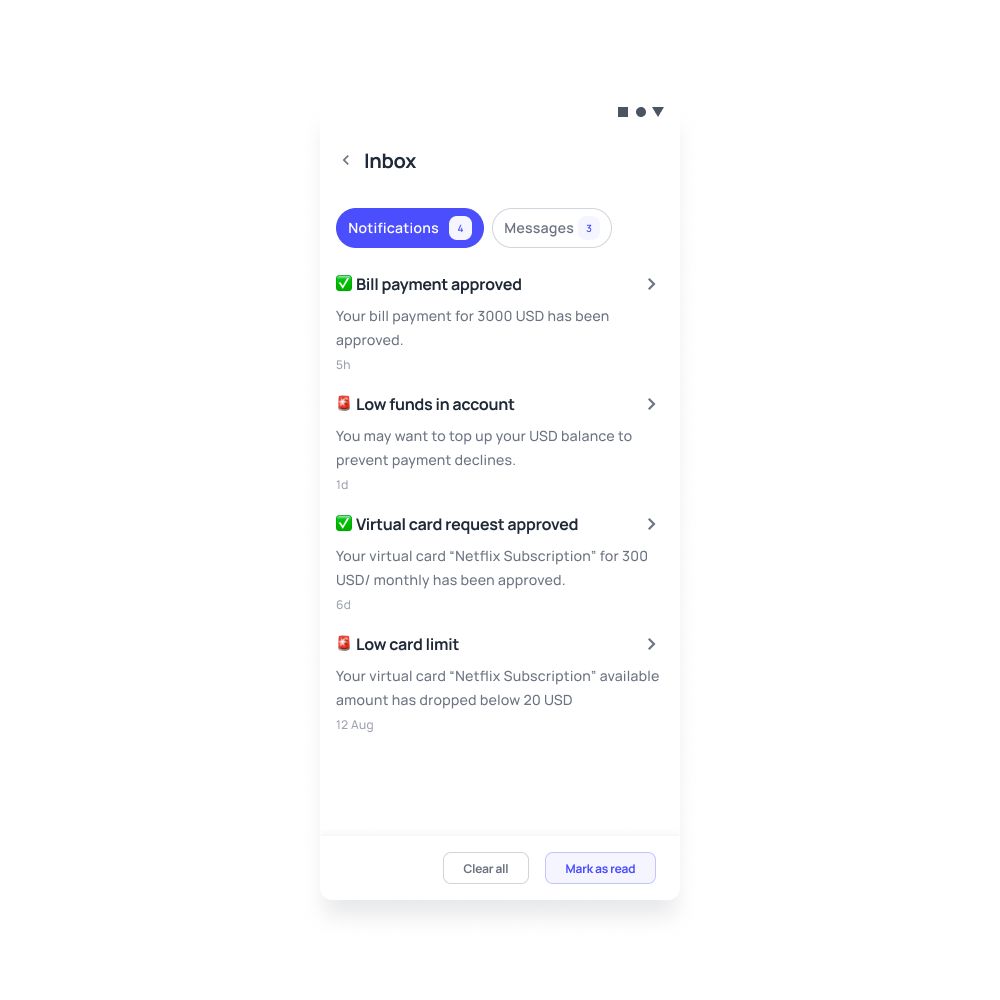

Instant, real-time payment alerts

Keep a continuous check on every business money transfer with real-time alerts.

Volopay provides notifications for each transaction, keeping you constantly informed about your company's financial actions. This aids in monitoring cash flow and preventing delays or mistakes.

Guarantee regulatory compliance

Volopay ensures your business remains compliant with regulations pertaining to both local as well as international standards, including KYC and AML.

This guarantees that your transfers are secure and adhere to legal requirements, enabling your operations to run smoothly across various jurisdictions.

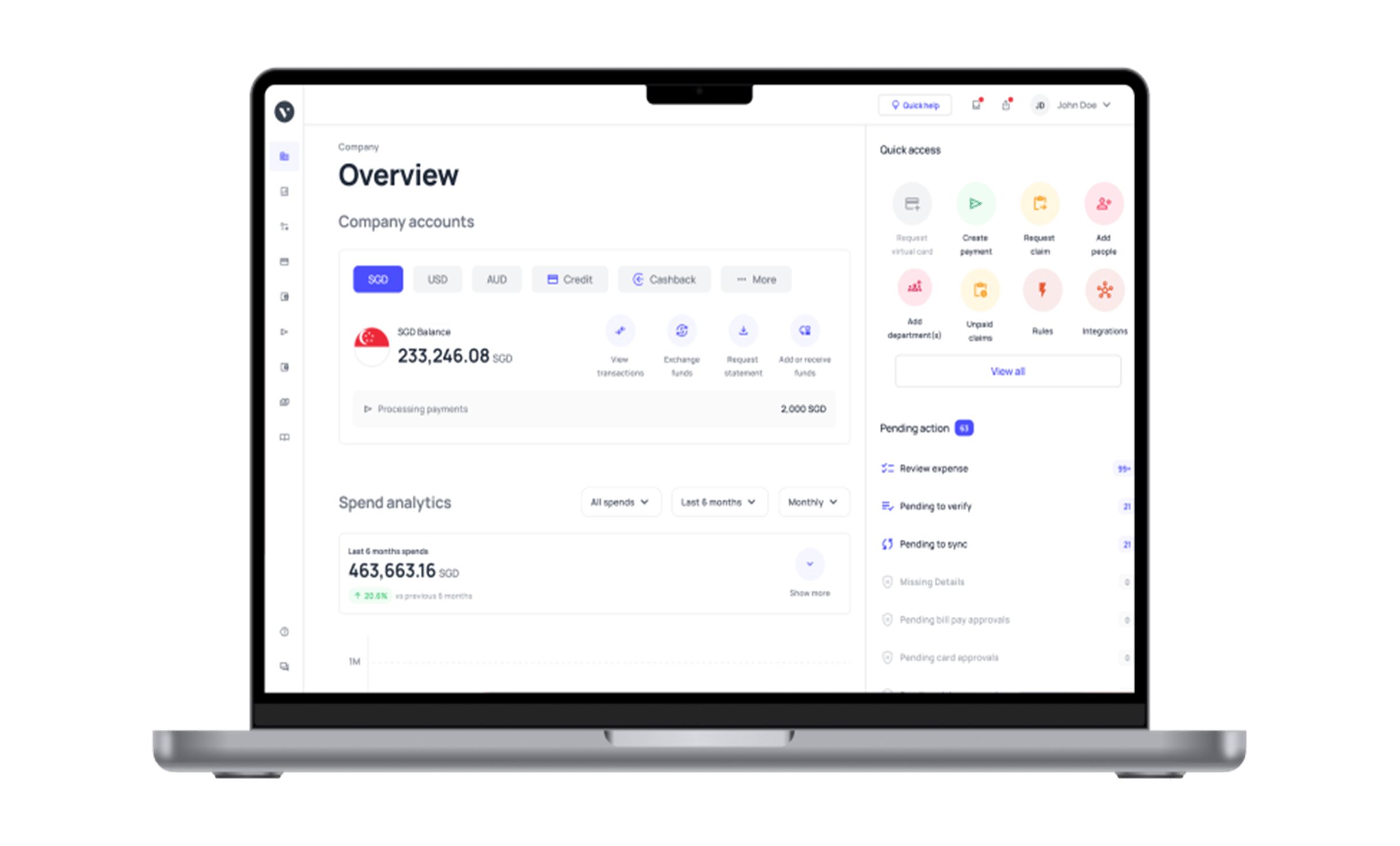

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

How it works—step-by-step process

Account setup

Register your business on Volopay’s B2B money transfer software through a straightforward onboarding process.

After verifying your account, you’ll be ready to start making secure global payments. The setup is quick and hassle-free, allowing your business to begin operations without delay.

Initiating payments

Starting a business money transfer is simple.

Enter the payment details, including the recipient’s information and the amount. Select between domestic or international transfers, and you can efficiently manage payments from a single dashboard.

Review fees and exchange rates

Before finalizing a payment, Volopay offers a clear overview of all fees and the current exchange rate.

This allows you to review and confirm the total transfer amount, ensuring no unexpected charges.

Making the payment

Once you’ve verified the details, approve the payment.

Volopay will handle the company money transfer securely and quickly, whether it’s domestic or international, helping your business fulfill its financial commitments.

Receiving real-time updates

Volopay keeps you informed with real-time updates throughout the payment process.

You’ll receive notifications when the payment is processed, giving you complete visibility and control over your financial transactions.

Manage both local and global payments with ease

International transfers

Volopay simplifies business-to-business international money transfers by providing low fees and competitive exchange rates.

Whether you’re paying suppliers or handling international payroll, the platform ensures efficient company money transfers.

With support for over 180 countries, you can send money globally with ease and security.

Domestic transfers

For local transactions, Volopay efficiently processes payments swiftly and with minimal fees, ensuring a seamless and hassle-free experience for all users involved.

Whether you’re paying your employees or local vendors, you’ll enjoy fast, secure, and reliable transactions, significantly enhancing your ability to manage cash flow effectively and efficiently in your business operations.

One platform for a variety of industries

Healthcare

Healthcare providers can use Volopay to automate supplier payments, payroll, and equipment purchases while staying compliant with industry regulations.

The platform simplifies financial management, allowing healthcare institutions to focus on patient care.

Technology

Tech companies with global teams and vendors benefit from Volopay’s multi-currency features, making any business money transfer seamless.

Bulk payments, real-time tracking, and smooth accounting integration help tech firms efficiently manage their global finances.

Construction

With numerous financial needs, construction companies can leverage Volopay’s features to make big savings.

The bulk payment capabilities especially help manage supplier payments, contractor fees, and labor costs, keeping projects on time and within budget.

Hospitality

Volopay streamlines financial management for hospitality businesses by automating recurring payments and managing vendor expenses and payroll.

With real-time alerts and fast domestic transfers, the platform simplifies cash flow management.

Logistics

Logistics firms can manage international shipping costs, fuel payments, and vendor settlements through Volopay’s fast and transparent payment system.

Real-time tracking provides full visibility of payments, improving overall cash flow management.

Retail

Retailers can efficiently handle supplier payments, employee wages, and day-to-day expenses using Volopay.

Its multi-currency and bulk payment capabilities make it easy to manage payments across regions and high transaction volumes.

Providing versatile solutions for all types of organizations

Volopay simplifies financial management for eCommerce businesses by offering automated payment workflows, multi-currency support, and integration with accounting systems.

This ensures that eCommerce companies can efficiently handle supplier payments, track expenses, and manage global transactions, all while saving time and minimizing errors.

Enterprises can use Volopay’s robust business money transfer platform, which offers features like bulk payment capabilities, automated approvals, and real-time expense tracking.

These solutions help enterprises manage large-scale transactions, financial operations, and maintain cash flow visibility, ensuring global financial operations run smoothly.

Volopay provides small businesses with affordable and user-friendly financial tools to manage domestic and international payments.

With low fees, automated schedules, and real-time payment tracking, small businesses can stay on top of their expenses without the need for complex financial systems, allowing them to focus on growth and expansion.

Why Volopay?

Cost savings on fees and exchange rates

Volopay offers cost-effective solutions with low fees and competitive exchange rates, helping businesses save on every business money transfer.

Transparent pricing means no hidden fees, giving businesses more control over their finances.

Security & compliance with regulatory standards

Security is a top priority at Volopay.

The platform uses advanced encryption and meets KYC and AML standards, ensuring secure transactions and regulatory compliance, whether domestic or international.

Improved cash flow management

With real-time payment tracking and multi-currency support, Volopay helps businesses manage cash flow effectively.

By providing instant visibility into payments, businesses can plan their finances with ease.

Compliance with local and international regulations

Volopay adheres to strict compliance regulations, including KYC and AML.

This ensures secure and legal financial operations across different jurisdictions, giving businesses peace of mind for their international transfers.

Consistently rated at the top

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Volopay helped BukuWarung in managing their expenses across different countries.

Volopay helped Deputy smoothly integrate with an accounting system.

Using Volopay, AdCombo eliminated the hurdles of cash flow management.

They loved Volopay, you will too

Bring Volopay to your business

Get started now

FAQs

Yes, Volopay’s platform enables you to send bulk payments across borders and domestically. Whether you’re processing payroll, vendor payments, or reimbursements, Volopay simplifies the task, allowing multiple transactions to be completed in a single action, regardless of location.

Yes, Volopay offers the option to automate recurring payments. You can set schedules for regular transactions like employee salaries, vendor agreements, or subscriptions, ensuring they are automatically processed on time without requiring manual involvement.

At the moment, Volopay doesn’t offer an exchange rate locking feature for future payments. However, you can benefit from its competitive, real-time exchange rates when initiating transactions, ensuring you get the best available rate.

Volopay adheres to stringent KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, ensuring compliance with global standards. These protocols safeguard businesses by reducing fraud risks and maintaining transparency throughout business-to-business international money transfers.

Volopay’s platform provides real-time tracking for all your transactions. You can monitor the entire payment process directly through the dashboard, receiving updates on each stage—from initiation to completion—ensuring full visibility and control.

Security is a top priority with Volopay. Your transactions are protected by end-to-end encryption, multi-factor authentication, and fraud detection systems, ensuring that both your data and payments are safe from unauthorized access or breaches.