Corporate cards for employee and business expenses

Equip your employees with corporate cards and get proactive controls over your business spending. Eliminate the hassle of making company expenses and empower your employees, all by using this powerful tool.

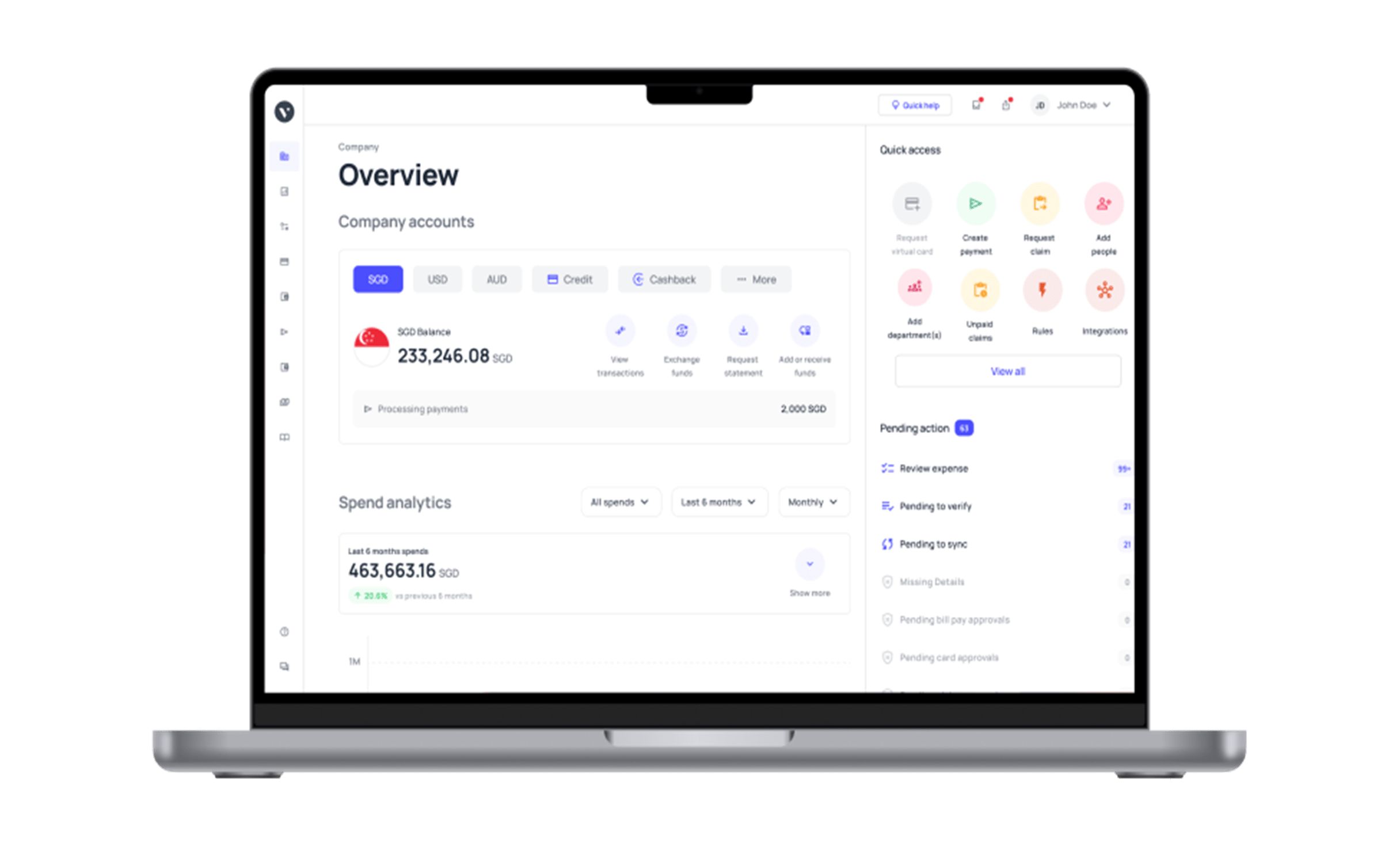

Payments made easy with corporate cards

Avoid delays and make time-sensitive payments hassle-free with Volopay corporate cards. Get access to a user-friendly dashboard to manage and track all your payments.

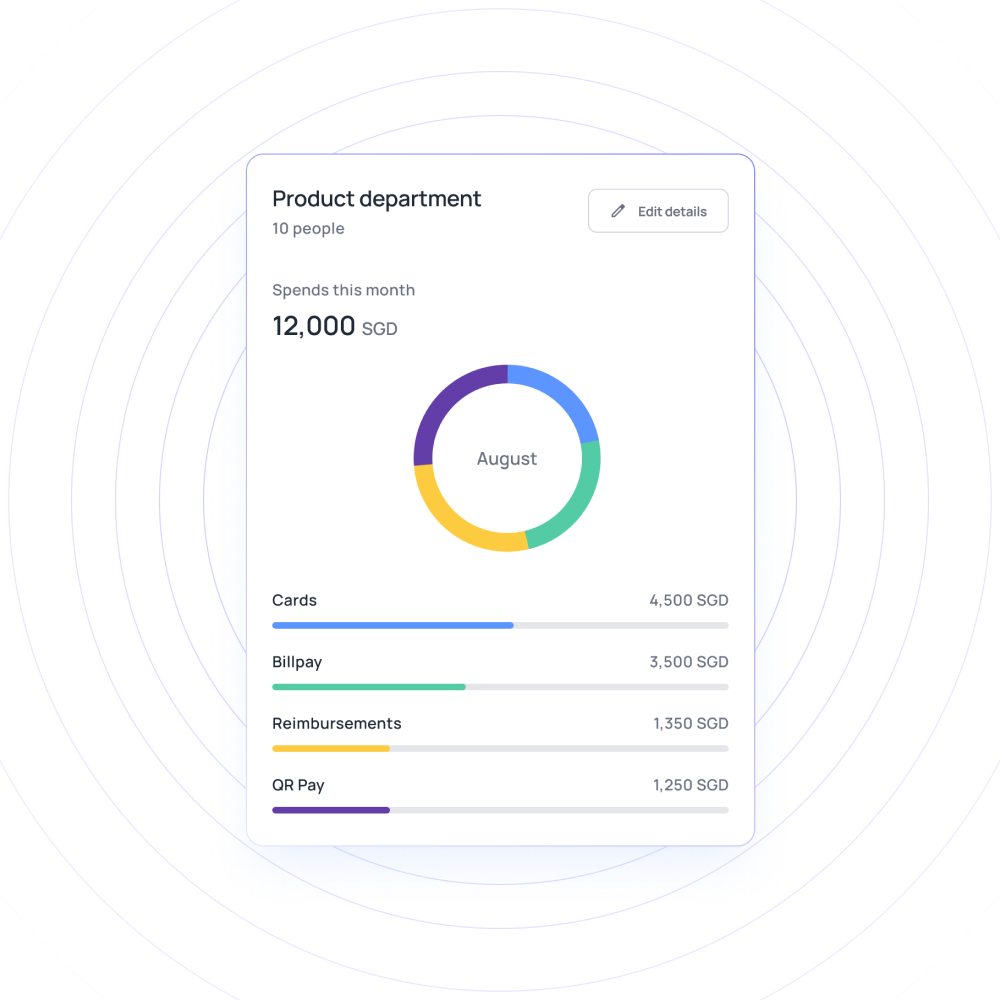

Volopay sends you expense alerts to stay on top of all your card transactions. Just configure the predefined criteria you want transactions to meet before you’re alerted of them! Link every expense to its appropriate department or project, and access insights into your spending.

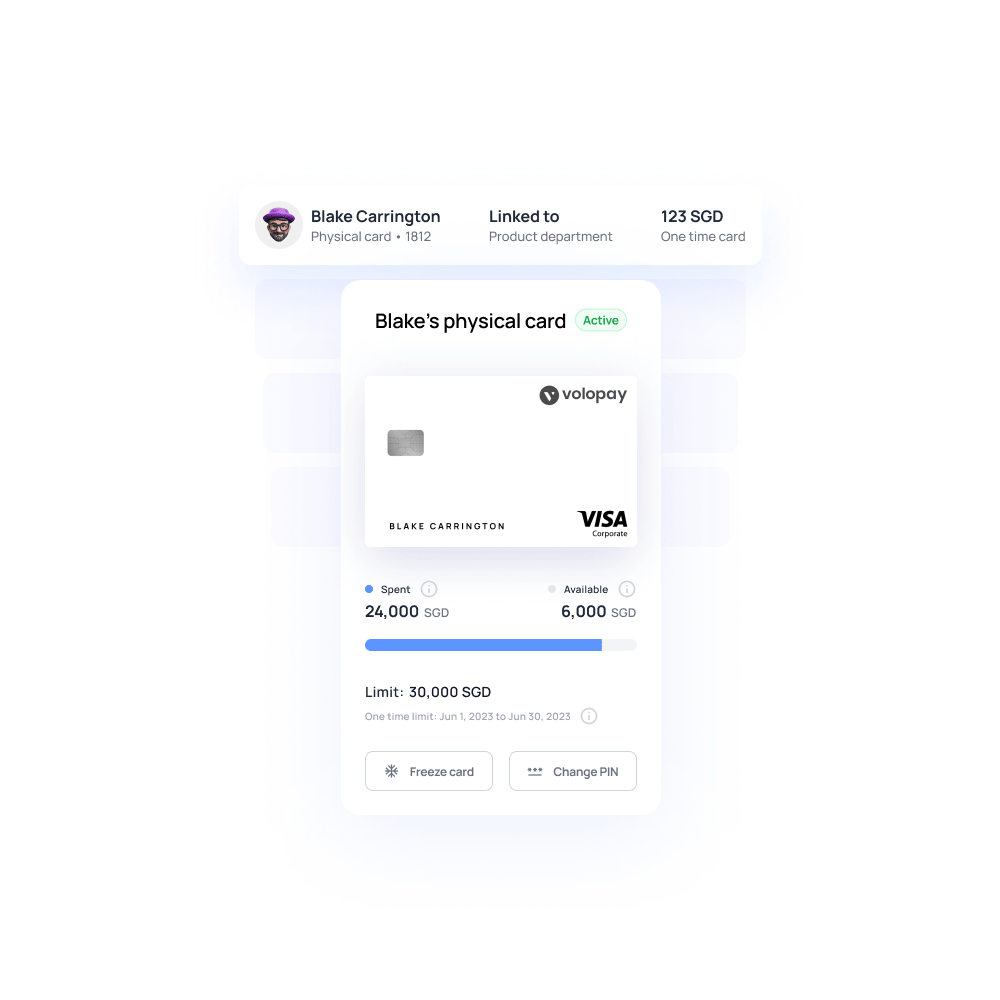

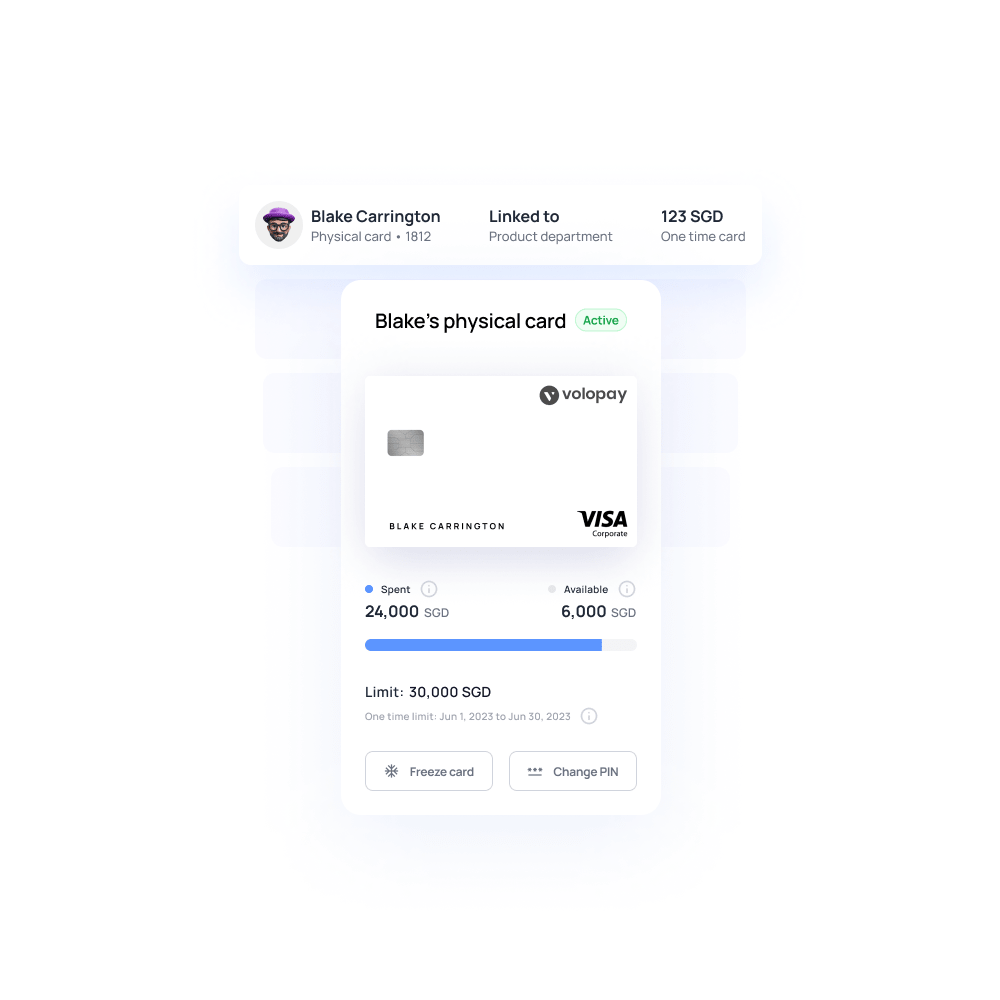

Streamline expenses with physical cards

Give each employee a physical card and avoid the complexities that come with card sharing. Every card issued can be linked to a department and multiple projects it is involved in.

Order cards easily through your dashboard and pick whether you want to personalize cards or not. It’s easy to distribute cards to your team members and manage them with Volopay.

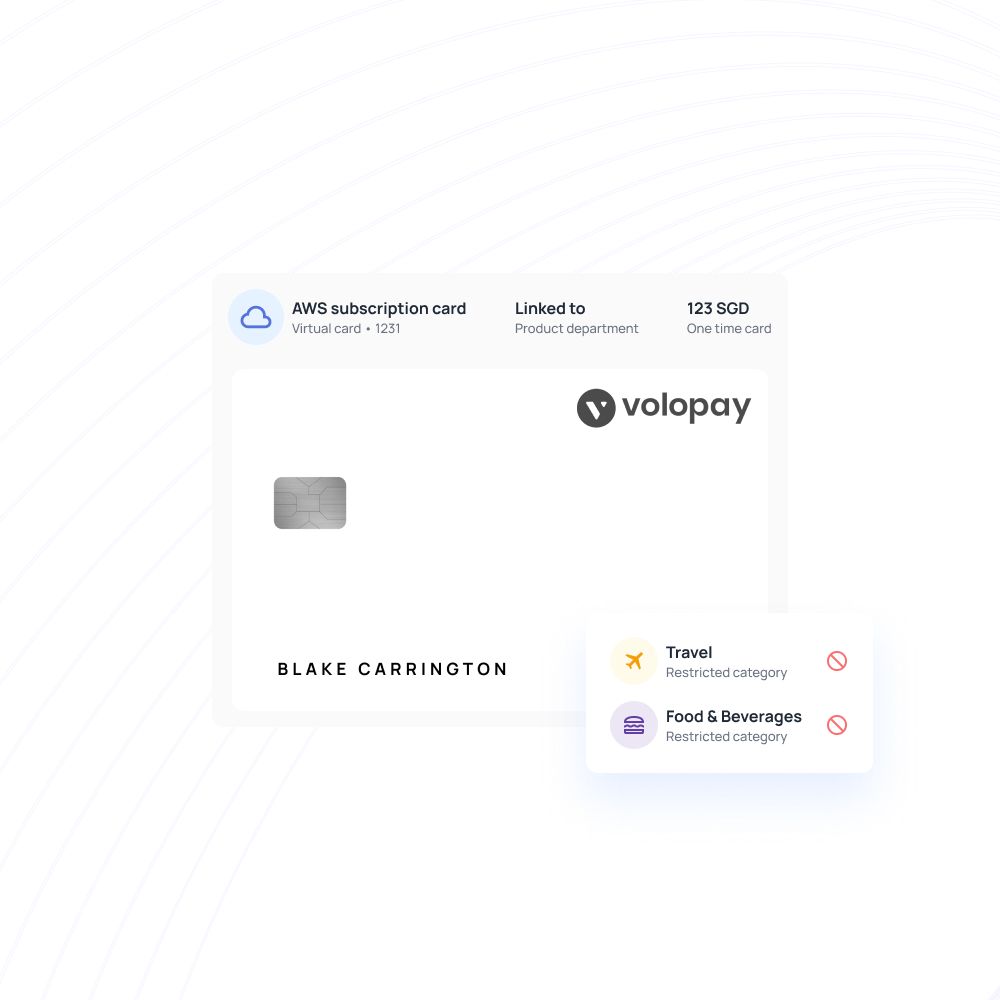

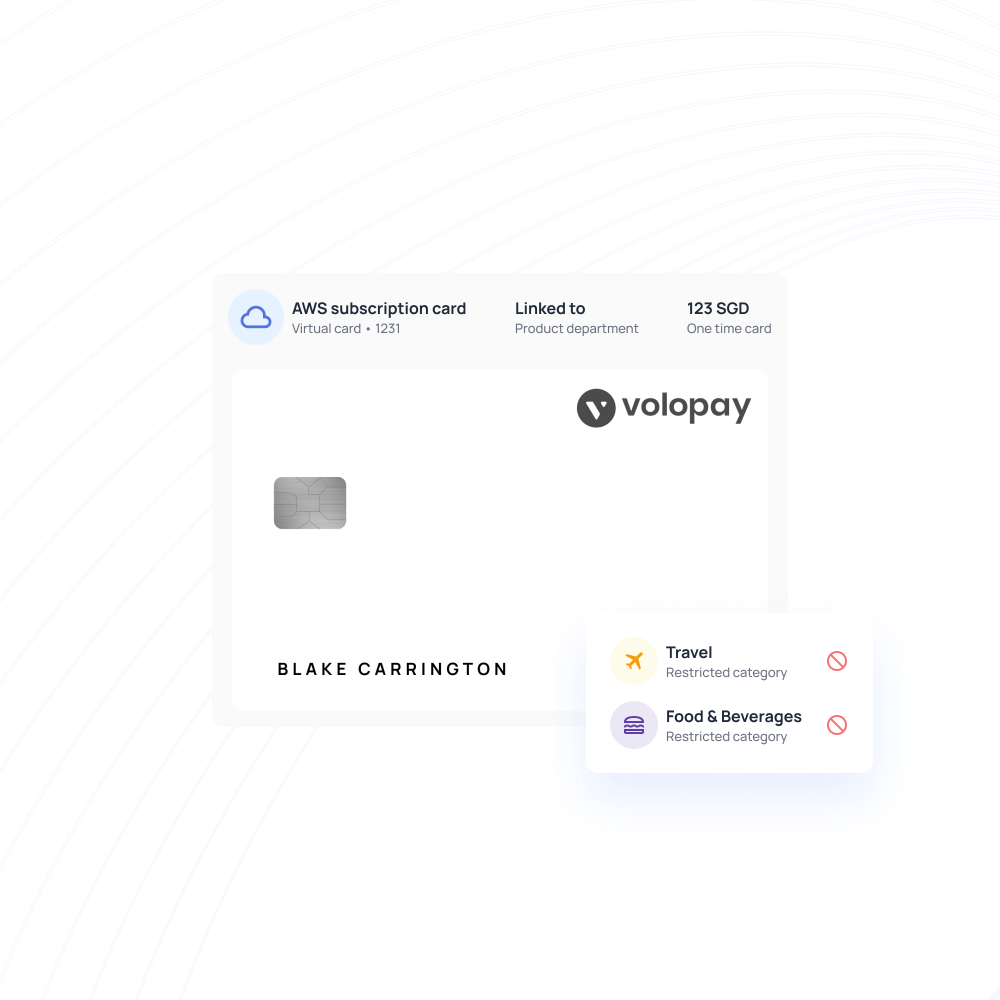

Virtual cards to manage subscriptions

Say you’ve got a remote team and don’t see the need for physical cards. That doesn’t mean your employees don’t still need access to funds. That’s where a corporate virtual card helps out.

Create unlimited cards for burner use or even recurring cards to manage online payments. You can even generate vendor-specific cards for better reporting!

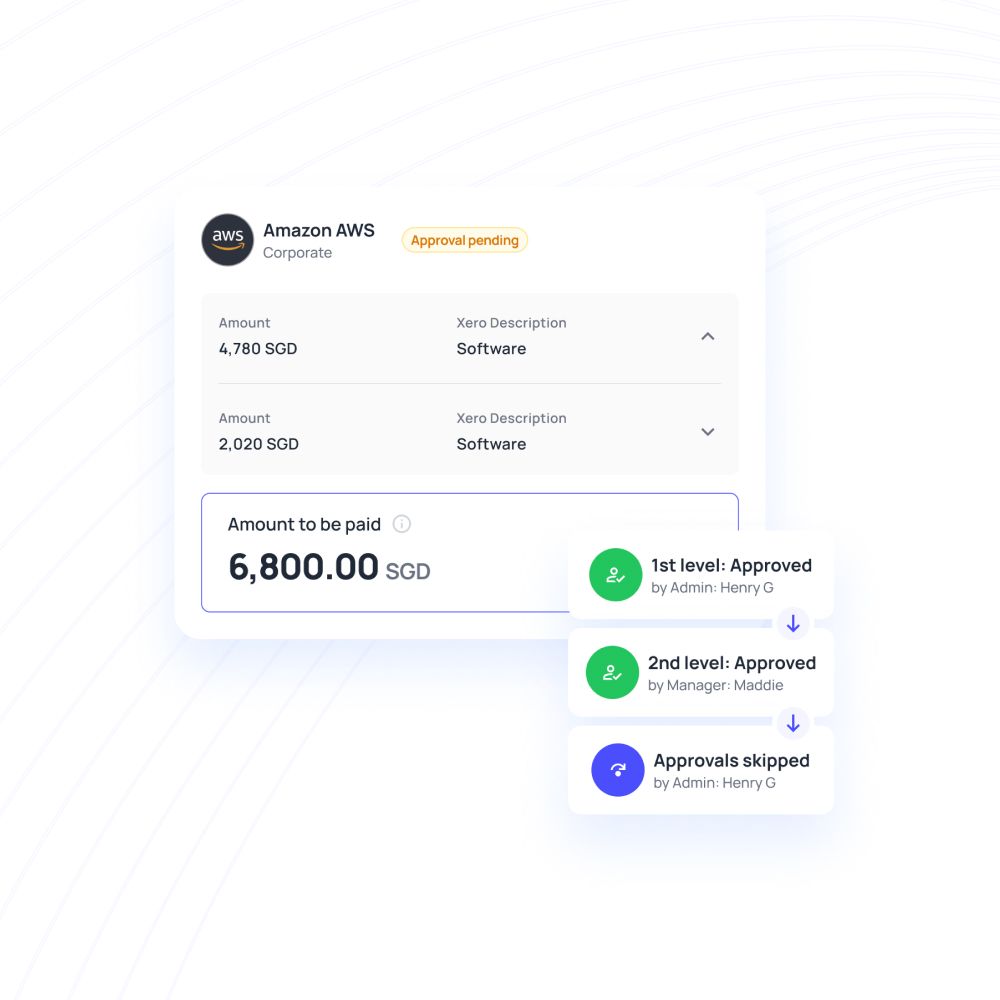

Multi-level approvals for proactive controls

Multi-level approval policies make managing expenses a much more transparent and convenient process. Our corporate card management dashboard allows admins to assign approvers at multiple levels, with all workflows easily customizable.

Use the expense comment feature to discuss expenses and get clarity on them. With the right transaction limit settings, non-compliant expenses can be flagged automatically.

Make secure and convenient business payments with corporate cards

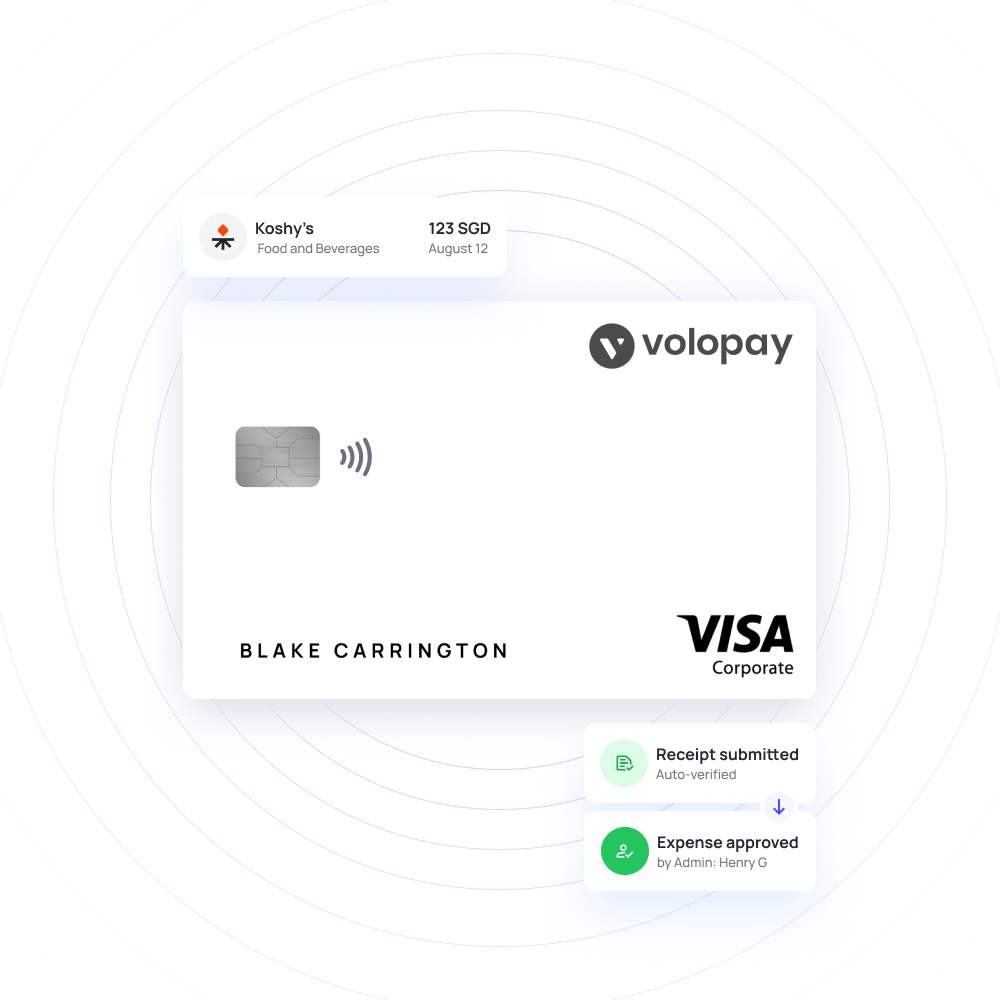

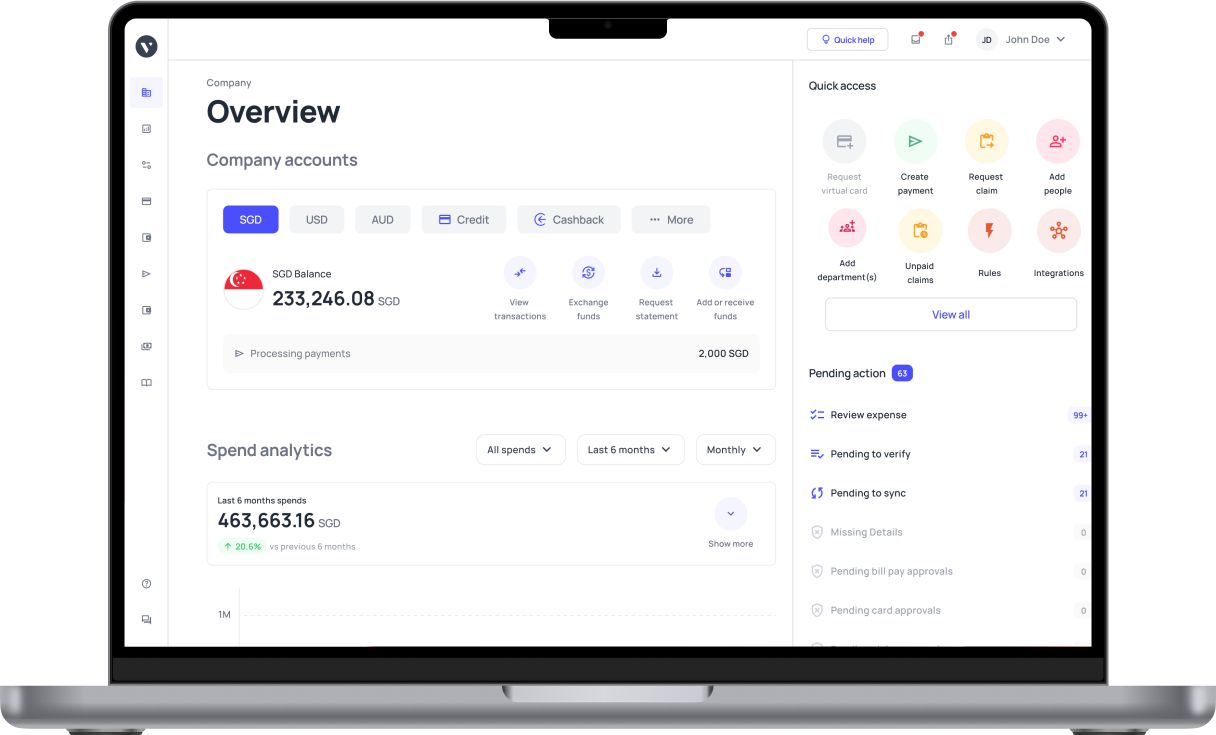

Real-time tracking and expense updates

Skip the hassle and get real-time insights into your spending automatically. With the corporate card Singapore edition, transactions are recorded as and when they happen.

Categorize every line item on every transaction and get comprehensive details, complete with the when, where, and why the payment happened. You can also link all card expenses with their respective project or department. Auto-approve trusted merchants for easy card management.

Automated expense reconciliation and compliance

Your Volopay dashboard has a card history feature that makes it easy to view and track every single expense made with a Volopay card.

You can use our built-in merchant category controls and automate non-compliant transaction blocks. Flagged expenses can be discussed straight on your Volopay dashboard using discussion threads.

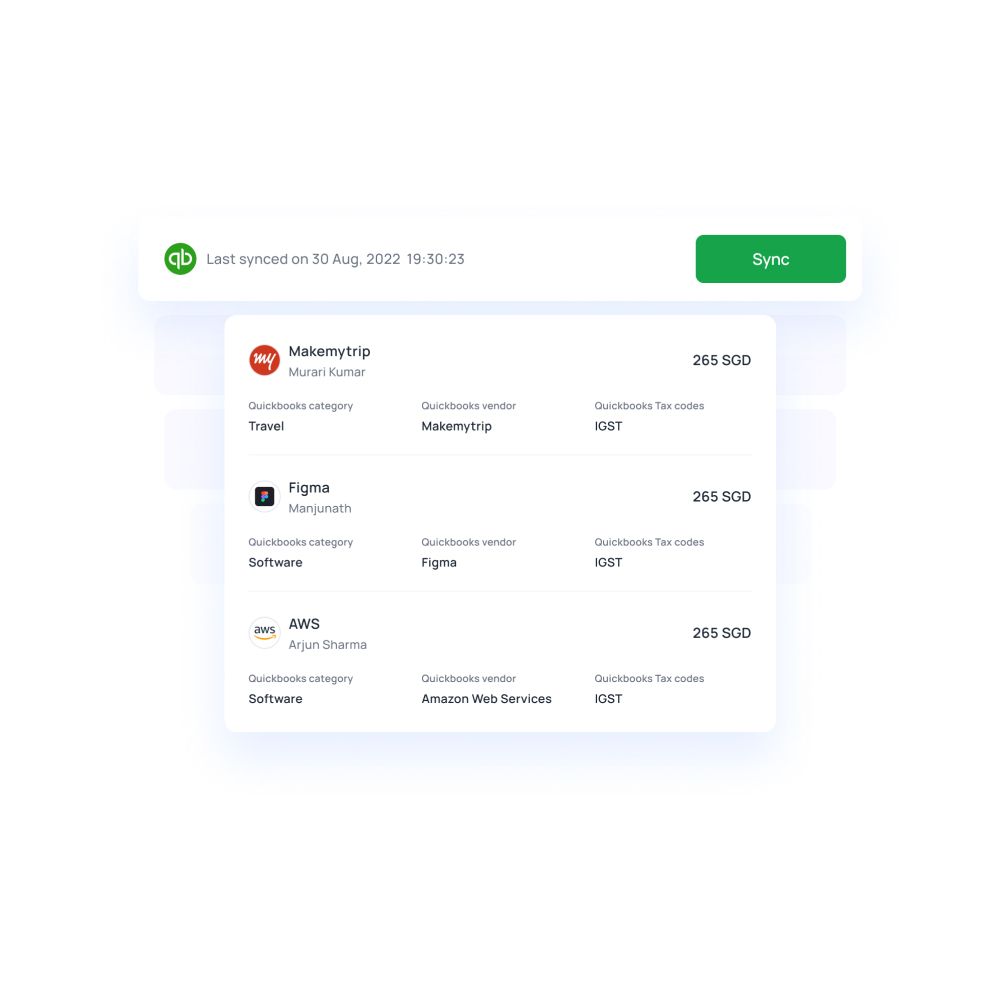

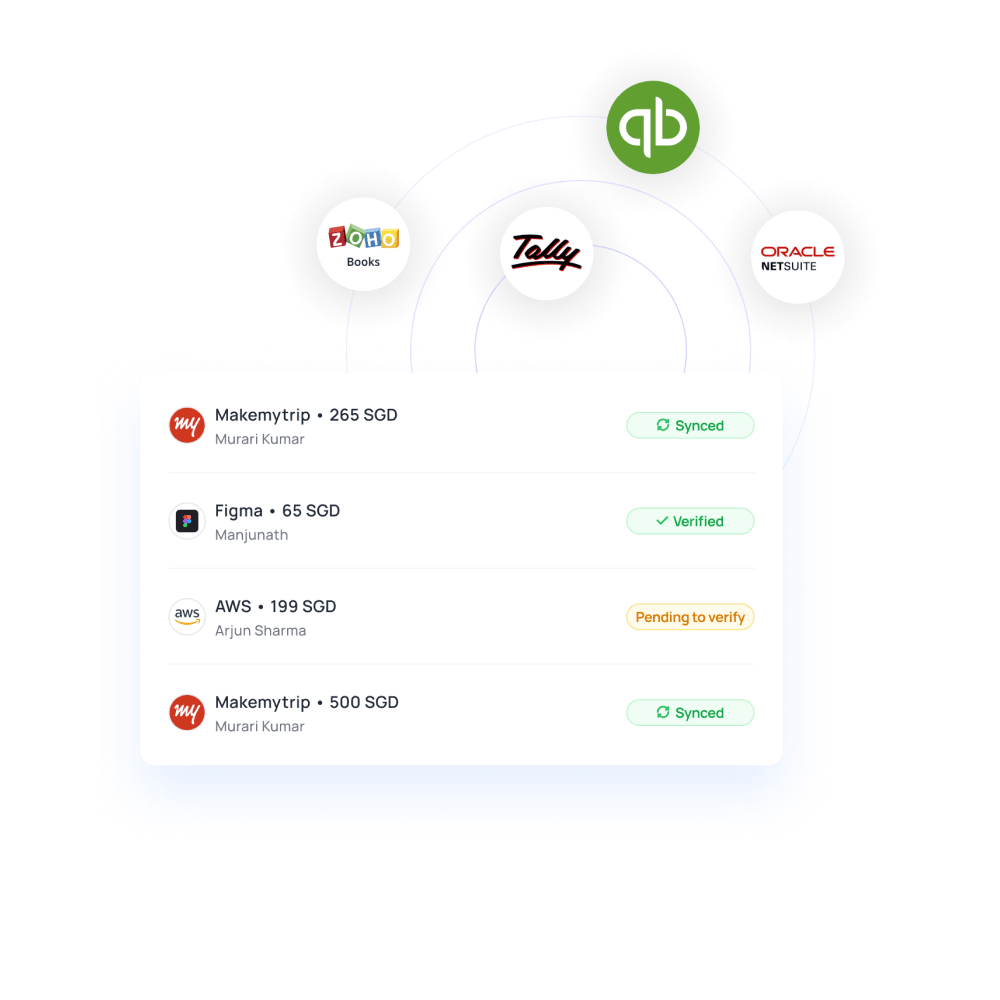

Integrate your business accounting software

Easily integrate your accounting software with Volopay. All it takes is a few clicks and you can directly synchronize your card expenses.

Each transaction can have split expense line items, providing you with more details. Set advanced rules and automate accounting triggers to streamline your bookkeeping even further.

A single dashboard, guaranteed easy to use

Simplify your card management tasks with Volopay’s intuitive and user-friendly dashboard interface. It takes no time to find what you need on our platform.

Get multiple line items for each card transaction, flag non-compliant purchases, and easily request employees to repay flagged expenses in just a few clicks. All your card and expense details are available on a single dashboard.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Why should your business opt for corporate card?

Easy reimbursement process

Employees who constantly travel hate the reimbursement process due to its complications. It’s equally challenging for employees, as they can’t keep tabs on employee expenses. But corporate cards make the process simpler for all.

Employees don’t have to spend their money or collect and hold receipts for longer durations. With readily available funds, employees can book tickets earlier and save money.

Improves business cash flow

Cash flow challenges mainly arise due to improperly planned finances. With Volopay, you can stay up to date with current spending and forecast future expenses. Well-planned budgets help in balancing current expenses without reaching for emergency funds or savings.

With additional controls and accurate reporting, your growth plans and strategies can easily pan out, bringing more revenue.

Reduced expense frauds

Unauthorized spending, producing fake bills, and submitting the same expense report twice are some commonly occurring expense fraud. To save your money, you must have a transparent system that allows expenses and make the data available to every authority.

Thus, your employees can enjoy their allowed privileges while finance teams can remain vigilant to prevent misuse and fraud.

Improves business credit score

The only way to build credit from scratch or reverse a damaged credit is by borrowing responsibly and repaying on time. In order to do that effectively, your in-hand cash and expenses need to be properly planned and accounted for.

Smart corporate cards let your employees practice controlled spending habits so that your teams are not overspending. This way you can properly utilize your company funds to pay back credit on time and boost your score.

Ensure seamless business travel

When employees have to use their personal funds to make business travel arrangements, limited fund availability can delay that. Also, employees are required to promptly collect receipts and bills till they come back and apply for a reimbursement.

With corporate cards, both drawbacks are excluded, and employees can travel stress-free. They spend less time organizing bills and focus fully on their trip.

Simplifies vendor management

A significant part of your business funds go for vendor payments. If you want to streamline and track them, corporate cards can help you. Each vendor can be assigned a card through which their payments can be made from time to time.

You can tag the vendor to the respective department. Now finding how much you have spent on the vendor and department-wise vendor payments will be quicker and more accurate than ever.

Be on top of your business expenses with corporate cards

Factors to consider when choosing a corporate card provider

Type of card offered

Corporate cards can be used in many ways. Depending on the use, they can be one-time cards, recurring payment cards, virtual cards for travel, physical cards, and many more.

When you choose a corporate card provider, make sure you get the type of cards your business needs. If you have many monthly subscription payments, cards that process recurring payments should be considered.

Fees and other charges

Corporate cards generally have an annual payment structure. Research the payment plans of different card companies and choose based on your needs.

Some corporate card companies also have hidden charges that they charge when you make payments. Others might only offer a limited number of free payments and will start charging you after that.

Ease of applying

Lengthy application forms, endless document requests, and physically appearing in the bank location can be a waste of time. Gathering old documents can take time and further delay the process.

Opt for corporate card providers that offer online applications you can fill in minutes. This can save time for business owners.

Software integrations

Accounts payable applications synchronizing with ERP software can minimize manual data entry tasks. To make the data transfer happen automatically, you need to choose software that offers integration facilities.

By connecting two applications, syncing your payments in real-time with the accounting applications becomes simple.

Why should you choose Volopay corporate cards?

Card security

As one corporate card isn’t dependent on another, each card can be isolated from the network by freezing or blocking it, thus making it safer than regular credit cards.

Physical and virtual cards

Get whatever suits your business. Volopay has both physical and virtual corporate cards which can be operated within the same platform.

Multi-currency wallet

Don’t waste pennies and time on international payments. Volopay has multi-currency wallets, where you can load money in a different currency and pay using that.

No personal liability

Bad personal credits won’t ruin your chance to get qualified for credit and corporate cards. Volopay only analyses your business spending capacities, credit score, and repayment history.

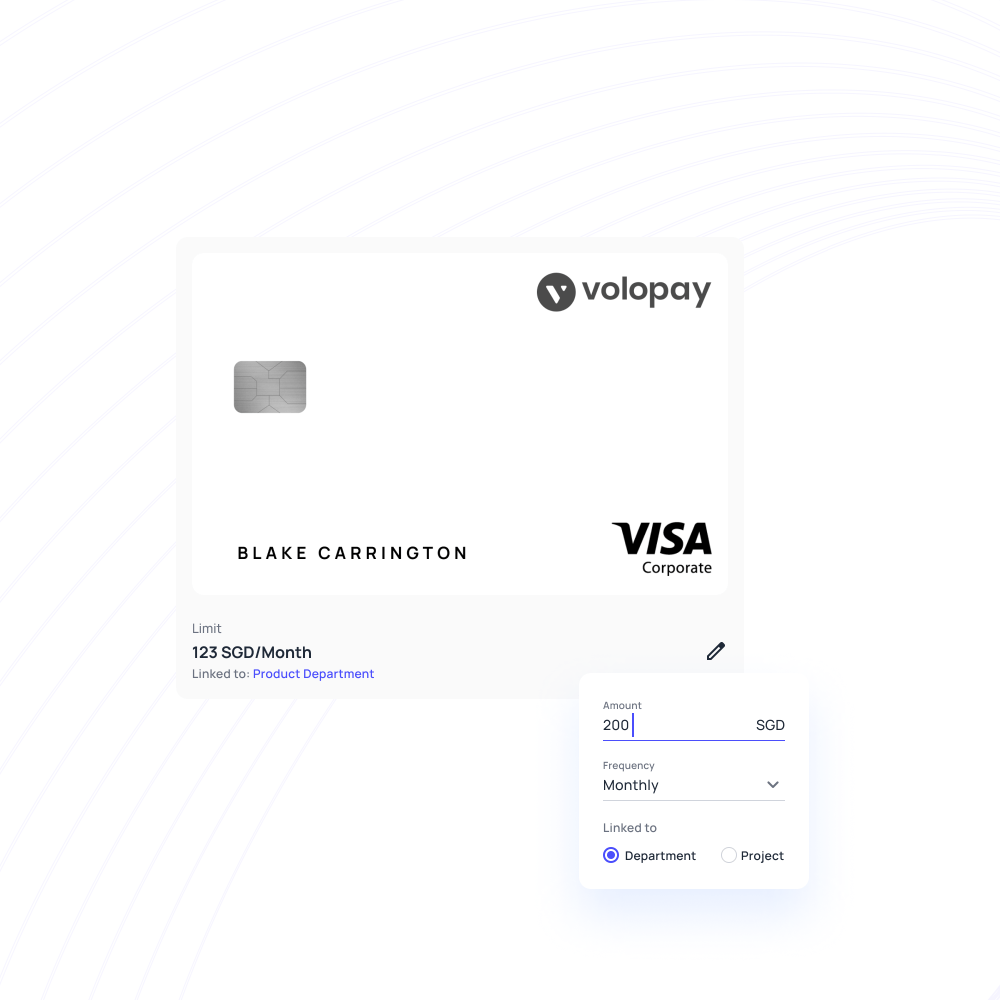

In-built spend controls

Budgets and departments will ensure limited spending. Set limits on corporate cards above which it will require approval.

No hidden fees

Volopay offers unbeatable exchange rates in the market. You won’t find hidden fees lurking in your domestic and international payments.

Volopay corporate cards vs traditional business cards

Volopay corporate cards vs business cards

Make secure and convenient business payments with corporate cards

Learn more about our corporate cards

Every single expense management needs collaborated into a single spot. The same expense management center for all admins, employees, and accountants. From cards to approvals, reimbursements and accounting, we have a solution for all.

Physical cards

Allow your employees to spend smarter and wiser with the help of corporate physical cards. Issued with the security and quality of VISA, these cards can be used for various merchant portals and offline transactions. They make expense tracking much simpler, without forcing employees to dip into personal funds.

Virtual cards

Unlimited virtual cards at your fingertips. These cards can be created for employees, departments, or even to manage payments to specific vendors. Functioning the same way as physical cards, they’ve made contactless and online payments much more efficient than before.

Consistently rated at the top

Volopay takes pride in being consistently recognized as a top performer on G2. Our G2 badges are a testament to the outstanding value and satisfaction we deliver to our users.

These recognition demonstrates our commitment to offering cutting-edge financial solutions and outstanding customer support, which positions us as a reliable option for companies all around the world.

Explore more about corporate cards

Know how corporate cards work and some of the best options to get a corporate card.

Get to know how introducing corporate cards into your system help in logistics cost management.

Get to know what a prepaid card is, benefits, and its use cases for businesses.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Paralleldots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

They loved Volopay, you will too

Bring Volopay to your business

Get started now

FAQs on corporate cards

Corporate cards are payment instruments issued by banks or other financial institutions to the employees of an organisation. Corporate cards are given to the employees of a company to manage their business expenses so that employees don't have to make out of pocket expenses.

Our corporate cards are VISA-issued cards, and they have international payments available. So, yes, both physical and virtual corporate cards can be used to make cross-border payments. Employees can also travel with their cards - both physical, and virtual on the mobile app - to make payments in other countries.

Yes, Volopay does support cross-border payments. Corporate cards are enabled to make payments internationally. Additionally, cards can be created for purely international payments, as well (such as specific SaaS fees, vendors, and international employee allowances).

Yes, that is one of the primary ways in which businesses can financially empower their employees. If your team travels frequently, then they can be given a recurring card that gets reloaded every monthly cycle. If an employee has a one-time travel need, you can give them a card with a limited budget and expiration date. If more funds are required at any time, they can be requested and approved from the dashboard.

All company expense and accounting policies are automatically applied to cards. Aside from these default settings, department-specific rules can also be applied. Along with this, when a card is generated, you can choose who the approvers are, what the reload cycle is, and what the maximum budget allowance is.

Yes. The card transactions are all synced in real-time, with expenses being recorded as they occur. This ledger of transactions is accessible from the website as well as the mobile application, making it easy to track and review card expenses. Approvers also have the ability to request additional information for a transaction, if required.

The main difference between corporate cards and business cards is whom the liability of payment & fees lie upon. The liability to pay any debt or fees for corporate cards lies upon the company whereas the liability to pay any debt or fees with a business card lies upon the primary cardholder.

Corporate cards are suitable for an organisation with employees who need to make business expenses regularly. Anyone can apply but whether your company qualifies for corporate cards is dependent on the provider you choose. There is no standard metric among all the different corporate card providers.

Certain things that definitely affect your eligibility include your companies profitability, credit history, and bank statements to check financial health. Depending on these and a few other financial metrics, a corporate card provider can decide whether you are eligible or not.

Corporate credit cards do not directly affect the user's credit score but builds the credit score for a business entity. Corporate cards indirectly help boost the credit score of an individual by helping them avoid making business expenses from their personal cards and maintain a low credit utilization rate.