Best accounting software in Singapore

Accounting software is a vital tool for businesses in Singapore and worldwide, streamlining financial processes and ensuring accurate record-keeping. This software automates various accounting tasks, such as ledger management, invoicing, and financial reporting, significantly reducing human error and saving time.

In Singapore's dynamic business landscape, where compliance with complex tax regulations and financial transparency are paramount, accounting software plays a crucial role. It helps businesses maintain precise financial records, facilitates compliance, and enhances decision-making by providing real-time financial insights.

As Singapore continues to thrive as a global financial hub, the importance of reliable accounting software cannot be overstated, making it indispensable for businesses of all sizes.

Types of accounting software in Singapore

Various types of accounting software cater to the diverse needs of businesses. Here's an overview of three prominent categories of accounting software:

1. Cloud-based accounting software

Advantages

● Accessibility

Cloud-based solutions are accessible from anywhere with an internet connection, facilitating remote work and collaboration.

● Automatic updates

Cloud-based accounting system software updates and maintenance are handled by the provider, ensuring users always have the latest features and security patches.

● Scalability

It can easily scale up or down to accommodate business growth or fluctuations in accounting needs.

● Cost-effective

Typically, these systems require no upfront hardware costs, and users pay a subscription fee, which can be more cost-effective for smaller businesses.

● Data security

Reputable cloud providers invest heavily in security measures to protect sensitive financial data.

Disadvantages

● Internet dependency

Functionality relies on a stable internet connection, which may be a limitation in areas with unreliable connectivity.

● Data privacy concerns

Some businesses may have concerns about data privacy and storing financial information off-site.

● Subscription costs

Over time, subscription fees can add up and may become more expensive than one-time purchases of desktop software.

2. Desktop accounting software

Advantages

● No internet dependency

Desktop software operates offline, ensuring access to financial data even without an Internet connection.

● Data control

Users have full control over their data and do not rely on third-party servers.

● One-time purchase

Typically, desktop software involves a one-time purchase cost, which can be cost-effective over the long term for established businesses.

Disadvantages

● Limited accessibility

Data can only be accessed from the computer where the software is installed, making collaboration and remote work more challenging.

● Manual updates

Users are responsible for manually updating the software and may miss out on the latest features and security patches.

● Hardware requirements

It may require higher upfront hardware investments and maintenance costs.

3. Hybrid accounting software

Advantages

● Flexibility

Hybrid solutions combine features of both cloud-based and desktop software, offering the flexibility to work both online and offline.

● Data synchronization

They often enable data synchronization between desktop and cloud versions, providing accessibility and data backup options.

● Scalability

Businesses can choose the degree of cloud integration based on their needs, allowing for scalability.

Disadvantages

● Complexity

Managing both desktop and cloud components can be more complex and may require additional training.

● Cost variability

Costs can vary depending on the extent of cloud usage and the number of users, potentially making budgeting challenging.

● Data security considerations

Businesses need to ensure data security and compliance when adopting hybrid solutions, especially if sensitive financial data is involved.

Transform your finances today!

Top accounting software in Singapore

Accounting software plays a vital role in the financial management of businesses, helping them streamline operations, maintain accurate records, and ensure compliance with tax regulations.

In Singapore, a highly developed and competitive business environment, choosing the right accounting software is crucial for businesses of all sizes.

In this comprehensive review, we will explore the top accounting software options available in Singapore and delve into their key features to help you make an informed decision.

1. Volopay

Overview

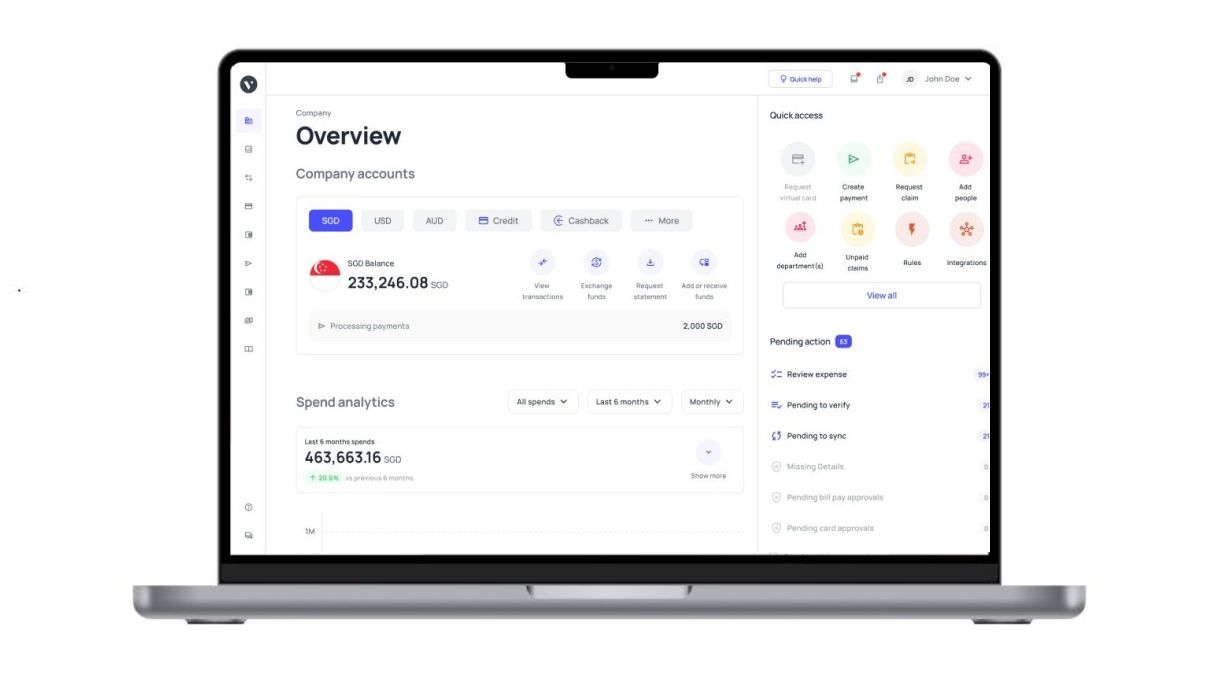

Volopay is an emerging accounting software solution that is gaining popularity in Singapore due to its user-friendly interface and advanced expense management features. It is designed for businesses looking to simplify expense tracking and financial management.

Features

● Expense tracking

Volopay allows users to easily track and categorize expenses, including receipts and invoices, making it convenient for businesses to manage their finances efficiently.

● Real-time reporting

The software offers real-time financial reporting, giving businesses insights into their financial health at any given moment.

● Multi-currency support

Given Singapore's international business landscape, Volopay supports multi-currency transactions, making it suitable for businesses engaged in global trade.

● Integration

Volopay integrates with other popular business software and platforms, streamlining data flow between various systems.

2. QuickBooks Intuit

Overview

QuickBooks Intuit is a widely recognized accounting software solution known for its robust features and ease of use. It caters to businesses of all sizes, from startups to large enterprises, and offers a range of accounting tools.

Features

● Invoicing

QuickBooks allows users to create and send professional invoices, track payments, and automate recurring invoices.

● Expense tracking

Users can easily record expenses and connect their bank accounts to import transactions automatically.

● Payroll management

QuickBooks offers payroll services, simplifying salary processing and tax calculations for businesses.

● Inventory management

For businesses with inventory needs, QuickBooks provides inventory tracking and management features.

● Reporting

Comprehensive financial reporting tools enable businesses to analyze their performance and make informed decisions.

3. Xero

Overview

Xero is another popular accounting software solution in Singapore, known for its cloud-based platform and user-friendly interface. It caters to small and medium-sized businesses and offers a wide range of accounting and financial management features.

Features

● Bank reconciliation

Xero automates bank reconciliation, ensuring that financial records are always up-to-date.

● Online invoicing

Users can create and send invoices online, and clients can pay directly through the platform.

● Expense claims

Xero allows employees to submit expense claims, streamlining the reimbursement process.

● Multi-user access

Multiple users can collaborate on the platform, making it suitable for businesses with different team members managing financial tasks.

● Payroll

Xero offers payroll processing capabilities, simplifying salary payments and tax compliance.

4. MYOB

Overview

MYOB is a well-established accounting software solution with a strong presence in the Singaporean market. It is tailored for small and medium-sized businesses and offers a comprehensive suite of accounting and financial tools.

Features

● Invoicing

MYOB enables users to create customized invoices, manage payments, and set up recurring invoices.

● GST compliance

Given Singapore's Goods and Services Tax (GST) regulations, MYOB helps businesses stay compliant with tax requirements.

● Inventory management

The software provides inventory tracking and management features, ideal for retail and e-commerce businesses.

● Budgeting and forecasting

MYOB offers budgeting and forecasting tools to help businesses plan for the future and make informed financial decisions.

● Mobile app

Users can access MYOB on their mobile devices, allowing them to manage finances on the go.

5. Wave Accounting

Overview

Wave Accounting is a free accounting software option that is gaining popularity among small businesses and freelancers in Singapore. It offers essential accounting features without a subscription fee.

Features

● Invoicing

Users can create professional invoices and track payments.

● Expense tracking

Wave allows users to record expenses and categorize them for tax purposes.

● Payroll

While payroll is a paid add-on, Wave offers payroll services for businesses with employees.

● Personal finance

Wave offers personal finance tools, making it suitable for freelancers and sole proprietors.

● Receipt scanning

Users can scan and upload receipts for expense tracking, simplifying record-keeping.

6. Zoho Books

Overview

Zoho Books is part of the Zoho suite of business software and is designed for small and medium-sized businesses. It offers a range of accounting features and integrates seamlessly with other Zoho applications.

Features

● Invoicing

Zoho Books allows users to create invoices, track payments, and automate recurring invoices.

● Inventory management

The software provides inventory tracking and order management capabilities.

● Bank reconciliation

Zoho Books automates bank reconciliation, ensuring accuracy in financial records.

● Expense tracking

Users can easily record and categorize expenses for tax and financial reporting.

● Collaboration

Zoho Books supports multiple users and collaboration, making it suitable for team-based financial management.

7. SAP Business One

Overview

SAP Business One is an enterprise-level accounting and ERP (Enterprise Resource Planning) software solution suitable for mid-sized and large businesses in Singapore. It offers a comprehensive suite of financial management tools.

Features

● Financial accounting

SAP Business One provides robust financial accounting features, including general ledger, accounts receivable, and accounts payable.

● Inventory management

The software offers advanced inventory management capabilities with real-time tracking.

● Business intelligence

SAP Business One includes business intelligence tools for data analysis and reporting.

● CRM integration

It integrates with SAP's CRM solutions for comprehensive customer relationship management.

● Multi-location support

For businesses with multiple locations, SAP Business One offers support for managing operations across branches.

8. FreshBooks

Overview

FreshBooks is a cloud-based accounting software solution primarily targeted at small businesses and freelancers. It offers user-friendly features and an intuitive design.

Features

● Invoicing

FreshBooks allows users to create professional invoices and send them directly to clients.

● Time tracking

Users can track billable hours and expenses, making it suitable for service-based businesses.

● Client portal

Clients can access their invoices and make payments through a secure client portal.

● Expense tracking

FreshBooks simplifies expense tracking and categorization for tax purposes.

● Project management

The software offers basic project management features, including task tracking and collaboration tools.

9. NetSuite

Overview

NetSuite, by Oracle, is an enterprise-level ERP software solution with accounting modules. It caters to mid-sized and large businesses in Singapore, offering comprehensive financial management capabilities.

Features

● Financial management

NetSuite provides robust financial accounting features, including multi-currency support and real-time financial reporting.

● CRM integration

It integrates seamlessly with Oracle's CRM solutions for comprehensive customer relationship management.

● Inventory management

NetSuite offers advanced inventory management capabilities with demand planning and order management.

● E-commerce integration

For businesses with e-commerce operations, NetSuite provides e-commerce integration for seamless online sales management.

● Scalability

NetSuite is highly scalable, making it suitable for businesses with plans for future growth and expansion.

10. Jaz

Overview

Jaz is an AI-first accounting software for business owners, accountants, and finance teams. It's popular for it's user friendliness and free plan with unlimited transactions and multi-currency accounting.

Features

● AI-powered bookkeeping

Jaz allows users to upload documents, which are accurately extracted and auto filled into transaction lines, reducing the need for manual data entry.

● Bank reconciliation

Bank statement lines can be easily imported in any format. Matching entries are then immediately and automatically reconciled.

● Multi-currency accounting

Jaz supports multiple currencies and automatically handles all conversions and revaluations.

● Free invoicing

Businesses can create and send invoices to clients and set recurring transactions.

● Mobile app

Users can use the Jaz mobile app to collaborate with teammates and create or approve transactions while on the go.

Automate your accounting process

Key features to consider in accounting software

When selecting accounting software for your business in Singapore, it's crucial to consider key features that align with your specific needs. Here are important features to consider:

1. General accounting features

● Financial statements

The software should be capable of generating essential financial statements like income statements, balance sheets, and cash flow statements, providing a comprehensive view of your financial health.

● General ledger

A robust general ledger feature helps manage all financial transactions, ensuring accuracy and transparency in your financial records.

● Accounts payable and receivable

Efficiently manage money owed to and by your business, streamlining invoicing, payment processing, and tracking outstanding payments.

● Bank reconciliation

Simplify the process of matching transactions in your accounting records with those in your bank statements, reducing errors and ensuring financial accuracy.

● Budgeting and forecasting

Advanced accounting software should offer budgeting and forecasting tools to help you plan for the future, set financial goals, and track progress.

2. Taxation features

● GST/VAT handling

Ensure the software can handle Goods and Services Tax (GST) or Value Added Tax (VAT) calculations and reporting in compliance with Singaporean tax regulations.

● Tax compliance

The software should assist in ensuring your business stays compliant with Singapore's tax laws, helping you avoid penalties.

● E-filing capabilities

Look for e-filing capabilities to streamline the submission of tax returns electronically to relevant government agencies.

● Reporting for tax purposes

The software should offer specific tax-related reporting features, making it easier to calculate and report taxes accurately.

3. Reporting and analytics

● Customizable reports

The ability to create custom reports tailored to your business's unique needs allows for more in-depth financial analysis.

● Dashboards

Dashboards offer a visual representation of key financial data, providing real-time insights into your business's performance.

● Real-time data

Access to real-time financial data ensures you have the most up-to-date information for decision-making.

● Integration with BI tools

Integration with Business Intelligence (BI) tools like Tableau or Power BI allows for advanced data analysis and visualization.

4. Ease of use and user interface

● User-friendly design

A user-friendly interface simplifies the learning curve and encourages efficient use of the software.

● Accessibility and navigation

The software should be easily navigable, with intuitive menus and search functions for quick access to features.

● Mobile compatibility

Mobile compatibility allows you to manage your finances on the go, making it convenient for busy professionals.

5. Integration capabilities

● Compatibility with other software

Ensure the accounting software can seamlessly integrate with other business applications you use, such as CRM systems or payroll software.

● API availability

An open API (Application Programming Interface) allows for custom integrations with other software or third-party solutions.

● Third-party integrations

Look for support for third-party integrations with popular productivity and business tools, extending the software's functionality.

6. Security and compliance

● Data encryption

Robust data encryption ensures the security of your financial data, protecting it from unauthorized access or breaches.

● Access controls

Implement user access controls to restrict access to sensitive financial information, granting permissions based on roles and responsibilities.

● Compliance with Singaporean regulations

Ensure the software complies with Singaporean data protection and financial regulations, safeguarding your business from legal issues.

Choosing the right accounting software

Choosing the right accounting software is a critical decision for any business, as it directly impacts financial management and operational efficiency. To make an informed choice, consider the following factors:

1. Assessing your business needs

Start by evaluating your specific accounting needs. Different businesses may require software with varying features, such as invoicing, payroll, or inventory management. Understanding your unique requirements is key to finding the right fit.

2. Budget considerations

Your budget plays a significant role in selecting accounting software. Some solutions are subscription-based, while others involve one-time purchases.

Calculate the total cost of ownership, including licensing, training, and ongoing support, to ensure it aligns with your financial capabilities.

3. Scalability

Consider your business's growth potential. Choose accounting system software that can scale alongside your company's expansion. Scalability ensures the software continues to meet your needs as your business evolves, including features that support business expense management for growing transaction volumes and complexity.

4. User training and support

Assess the availability and quality of user training and support provided by the software provider. Adequate training resources and responsive customer support can minimize disruptions and help you fully utilize the software's capabilities.

5. Trial periods and demos

Most reputable accounting software providers offer trial periods or product demonstrations. Take advantage of these opportunities to explore the software's features, user interface, and suitability for your business before committing.

6. Reviews and recommendations

Read user reviews and seek recommendations from other businesses in your industry or network. Feedback from users who have hands-on experience with the software can provide valuable insights into its performance and reliability.

7. Consideration of industry-specific needs

Some businesses have industry-specific accounting requirements or compliance standards. Ensure that the accounting software you choose can accommodate these unique needs. Industry-specific solutions often offer tailored features and templates.

8. Mobile accessibility

In today's business landscape, mobile accessibility is crucial. Accounting software with mobile apps or responsive web interfaces enables you to manage finances on the go, access real-time data, and stay connected, which can be especially useful for busy professionals or remote work scenarios.

Implementation and migration process

Implementing and migrating to new accounting software is a crucial process that requires careful planning and execution. Here's an overview of the key steps involved:

1. Setting up the software

Before you can start using the new accounting software, you need to set it up to align with your business's specific requirements. This involves configuring various settings, such as a chart of accounts, tax codes, payment methods, and user permissions.

Additionally, you may need to integrate the software with other systems or import data from external sources.

2. Data migration

Data migration is a critical step in the implementation process. You'll need to transfer your existing financial data from your old accounting system or spreadsheets into the new software. This includes historical financial records, customer and vendor information, transaction history, and inventory data.

Data migration should be performed accurately to ensure that your financial records remain consistent and error-free.

3. Employee training

Proper training is essential to ensure that your employees can effectively use the new accounting software. Offer comprehensive training sessions covering various aspects of the software, including data entry, report generation, and compliance with accounting processes.

Training can be conducted through in-person workshops, online courses, or with the help of user manuals and video tutorials.

4. Troubleshooting common issues

As your team starts using the new software, it's common to encounter issues or challenges. Be prepared to troubleshoot and address common problems promptly. Establish a support system, whether it's an in-house expert, a designated support team, or assistance from the software provider's customer support. Addressing issues promptly helps minimize disruptions to your financial operations.

To ensure a successful implementation and migration process, consider the following best practices:

● Thorough Testing

Before fully transitioning, conduct thorough testing to identify and resolve any software issues or data discrepancies.

● Backup data

Always keep a backup of your data before making any major changes to mitigate the risk of data loss.

● User feedback

Encourage feedback from employees who use the software regularly to identify areas for improvement.

● Regular updates

Stay updated with software updates and patches to ensure security and access to the latest features.

● Documentation

Maintain clear documentation of your implementation and migration processes for reference and future audits.

Transform your accounting workflow

Volopay — Your ultimate accounting software in Singapore!

In the vibrant business landscape of Singapore, managing your finances efficiently is essential for success. That's where Volopay steps in as your ideal accounting software solution.

Volopay is more than just accounting software; it's a comprehensive financial management platform tailored to meet the unique needs of businesses in Singapore.

Why choose Volopay?

● Expense management

Volopay's expense management software simplifies tracking and controlling your company's spending with intuitive tools. From automated receipt capture to expense categorization, it streamlines expense tracking like never before.

● Automated bill payments

Say goodbye to the hassle of manual bill payments. Volopay offers automated bill payments, ensuring your bills are settled on time, eliminating late fees, and enhancing your financial credibility.

● Multi-currency support

In Singapore's international business environment, Volopay supports multiple currencies, making it perfect for businesses engaged in global transactions. It seamlessly converts and tracks expenses in various currencies.

● Real-time financial reporting

Volopay provides you with real-time financial reporting and analytics, empowering you to make data-driven decisions. Stay on top of your financial health with customizable dashboards and detailed reports.

● Integration with popular accounting software

Volopay integrates seamlessly with popular accounting software such as QuickBooks and Xero. This means your financial data is always synchronized, ensuring smooth accounting workflows.

In Singapore's dynamic business environment, Volopay stands out as the accounting software of choice. It not only simplifies your financial management but also empowers your business to thrive and grow. Make the smart choice today with Volopay and experience the future of accounting software in Singapore!