Detailed guide on business expense management

Expense management is the process of tracking, analyzing, and optimizing expenses incurred by an organization during its daily operations. It is an integral part of financial management and organizational effectiveness.

In today’s ever-changing business environment, where resources must be allocated wisely, business expense management is essential in sustaining profitability, maintaining budgets, and meeting compliance requirements.

What is expense management?

Expense management includes various processes that help a business track, record, organize, and make transactions.

Employee reimbursements, expense approvals, expense database management, T&E policy implementation, and monitoring of all business expenses are all included under expense management.

The expense management process is an essential business aspect, as it helps to understand the cash flow, cost-effective and intensive areas, cost-cutting possibilities, and the overall financial health of the business.

With expense management, you can track and account for each penny and make the right decisions for future growth.

What are the types of expense management?

There are three types of expense management, meaning there are three major ways through which you can practice business expense management.

1. Paper forms

As the name suggests, the paper form is the most basic and manual labor-heavy type of expense management. Paper forms and documents are used to manage the expenses.

As this is a completely manual process, your finance team and other related departments and employees will have to deal with loads of paperwork to fill in their expenses and proofs, check against various other documents for vendor payments, and more.

2. Spreadsheets

This is an advanced technological version of the paper forms. Instead of paper, you use spreadsheets (Excel, Google Sheets) to crunch the company numbers. Everything is still manual, data entry, management, making payments, etc., it is just on a computer rather than physical paper.

With this system, you get to reap the benefits of auto-calculation, formulas, charts, and graphs creation and save on a big chunk of time that was traditionally spent on paper forms.

3. Software

The best type of expense management is by using software. An expense management software takes over everything from inserting data from receipts and invoices to creating a database, processing numbers, creating charts and analytics, and forecasting numbers for the future.

Everything is automated. Your employees will have the time to use their expertise in planning, understanding the numbers, and helping make the right decisions.

What is the importance of business expense management?

Similar to any other business process like raising capital, staff management, goods marketing, etc., expense management is an essential operation. It is basically that process that helps you know how much money the company spends compared to how much it makes, along with the accurate particulars of cost categories, employees' expenses, and more.

To make any growth or investment decisions, you need a robust expense management system.

Here is a list of reasons why expense management is important.

1. Cost control and profitability

If you don't know how much you are spending and the particulars of it, it is possible to overspend. You will start having cash flow problems because of improper expense management.

Hence, business expense management is necessary to maintain cost control and have a proper digit of the profit that the company makes so that you can make further calculated decisions.

2. Control budgets

With overspending comes budget crossing. You can easily spend the budget of the succeeding months without knowing it. An expense management process helps to keep the company spending in check and have accurate numbers for all costs and revenue items.

This is extremely beneficial to set budgets for departments and projects. You will know exactly how much needs to be allotted for what level of results.

Suggested read: How to do business budget planning for new fiscal year?

3. Resource optimization

How will you decide which department or which project should be allotted what resources if you don’t know the spending and revenue generation numbers? Resource optimization can be done best when you practice proper expense management.

Business expense management gives you a real picture of what the company earns, has, and spends in the form of accurate numbers.

4. Financial planning and forecasting

Everything boils down to making the right financial decisions with proper planning and forecasting. Expense management doesn't only include tracking and recording the expense data, but it also includes processes like expense organization and analysis.

This, in turn, helps you to understand the expense database, project future numbers based on present and past patterns, and then form plans to implement changes for better results.

Related read: What is financial planning and analysis?

5. Cash flow management

Cash flow management is basically looking at what is coming into the company and what is going out and properly managing it always to have sufficient liquidity. It is obvious that without knowing the in and out particulars, you cannot maintain a stable cash flow. This is where expense management comes into the picture.

The process helps in getting all the information necessary to ensure that your revenue and payments are evenly distributed over the whole year and that the business is able to survive even the low tides.

6. Risk management

Avoiding any possible capital loss or bottom-line hit is essential to keep your business afloat. However, properly managing your employee expenses, effectively implementing the company T&E policies, and tracking and recording all expenses can help you easily mitigate any financial risks.

For example, you have been sent a request to divert more resources towards a project; however, before doing that, you will need to know if that diversion will generate more revenue or not. This is where expense management plays a huge role — can the company divert resources? Will the investment be a fallout? What is the profit margin?

7. Compliance and audit readiness

Keeping a business up and running also means that all your books should be audit-ready. This is done by ensuring that all your expense databases and documents are accurate. Any discrepancy can lead to huge differences in the accounting books, creating challenges for the future.

Any reimbursement process problems, any overspending issues, or any expense fraud challenges can be effectively resolved with a robust expense management process.

Optimize your business expenses!

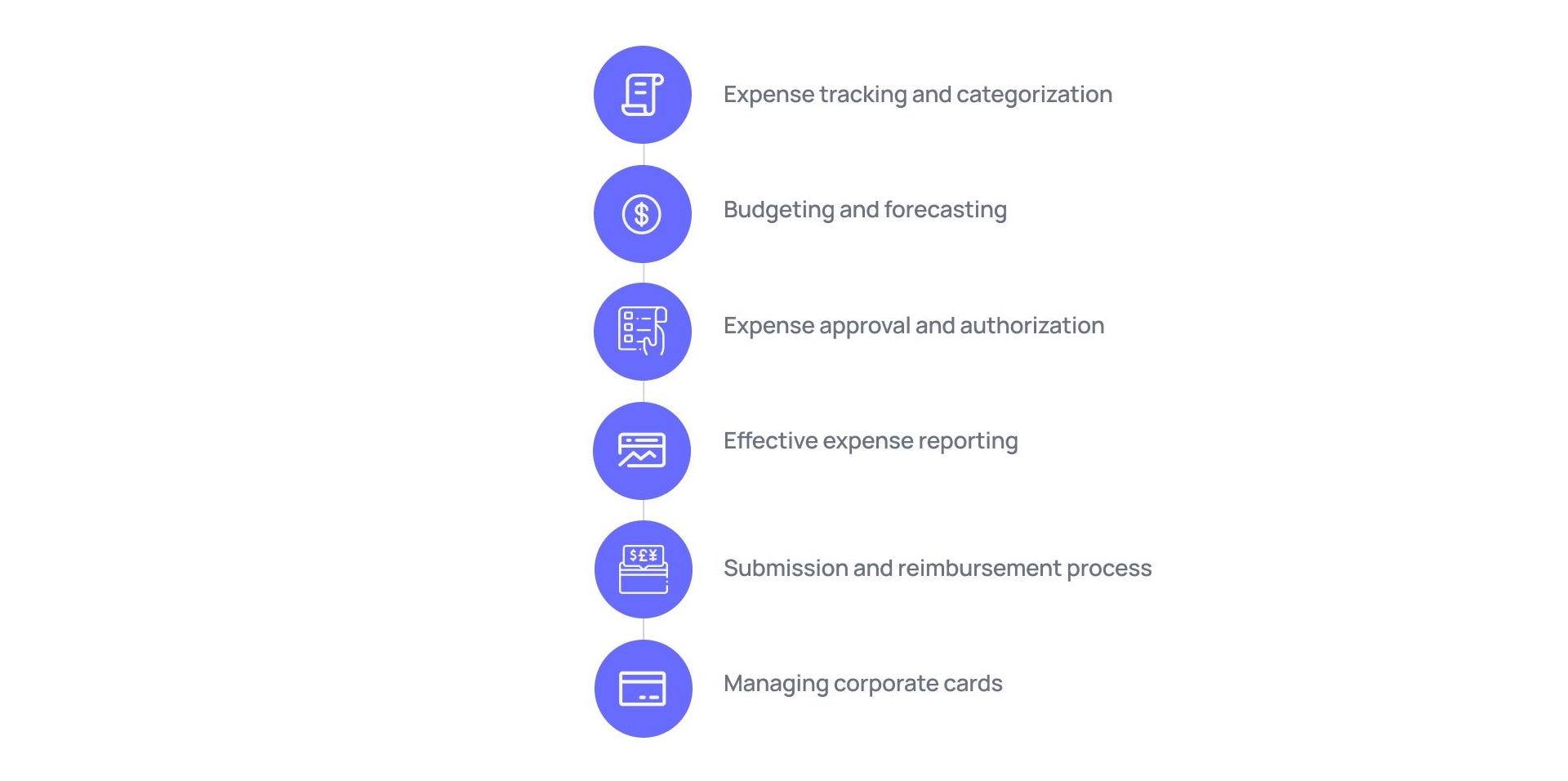

What are the key components of business expense management?

1. Expense tracking and categorization

This is the first step of the expense management process and also the first essential component. It is crucial because, without expense tracking and categorization, you will have nothing to process further. The number gathered in this process builds the foundation for further development.

Real-time expense tracking and auto-categorization are features of an automated expense management system. However, with a manual one as well, you need to record all expenses, gather necessary documents, and categorize them for better understanding and bookkeeping.

2. Budgeting and forecasting

Every department or part of the business operation needs to be given a fixed amount of money and set expected goals to achieve with that money. The expense management process includes processing the gathered numbers, analyzing spending patterns, and evaluating vendor payments and employee expenses; all this is to be compared against the revenue earned by the company to lay a budget plan for everyone.

This process also includes forecasting future numbers and how much the company will generate with a certain spending plan.

3. Expense approval and authorization

Whether you use a manual expense management system or an automated one, all expenses have to be approved and authorized in order to maintain compliance and avoid fraud. All transactions incurred by your employees have to be submitted in the form of expense reports and claim requests to the finance team for approval.

Along with this, many purchases require pre-approval that is secured by submitting funds requests to the managers, who then check and authorize the expenses.

4. Effective expense reporting

Next on the list of essential expense management components is effective expense reporting. Proper reporting and analysis of the company expenses is equally important as all other aspects. This is a way to keep track of all expenses and categorize them.

So, not only gathering data but categorizing and reporting them in a proper manner for effective expense management and decision-making.

Related read: Paperless expense reporting to streamline expense management

5. Submission and reimbursement process

For your business expense management to be proper, all employee expenses have to be correctly filed and reimbursed. Employee expenses are a crucial part of the expense management system because it is the employee who makes the purchases and payments on the company’s behalf; they are the ones who go to business meetings and trips.

There must be a system through which the employee submit their expense claims and receive expense reimbursements as soon as possible.

6. Managing corporate cards

Last but not the least is corporate card management. Expenses management is incomplete without the use of corporate card. These cards are the best tools to make and manage company transactions. You can assign these to your employees with specific spending limits and compliance policies enforced.

This helps get real-time updates of the expenses incurred, and corporate card software automatically records all data into a centric database. However, you also need to effectively manage corporate cards by deciding who gets them, which cards have what limits, how to integrate everything, and so on.

Also, our article on best virtual credit cards in Singapore can help you choose the best corporate virtual card providers in Singapore that suits your business needs.

Traditional expense management process and its challenges

The traditional expense management process involves the same steps as an automated one; expense tracking, categorization, organization, etc. However, this type of expense management basically runs on manual procedures and tools like physical receipts, paper documents, manual data entry, and more.

It is natural that this process will be prone to errors and fraud, plus it is time-consuming as well. To understand the challenges more closely, read along

1. Manual paper-based processes

Challenges:

• Traditional methods involve physically handling documents, leading to delays and potential loss.

• Manual data recording increases the vulnerability to errors.

• The process is time-consuming and labor-intensive, hampering overall productivity.

Impact:

• Expense and reimbursement processing times are slower.

• The likelihood of data entry errors rises, impacting accuracy.

• Employee efficiency is reduced due to administrative burdens.

2. Lack of visibility

Challenges:

• Real-time expense monitoring becomes difficult.

• Dependence on physical documents hinders tracking spending.

• Insights into spending patterns and trends are limited.

Impact:

• Delayed decision-making due to outdated information.

• Identifying opportunities for cost-saving becomes challenging.

• Effective budget management is hindered.

3. Complex approval workflows

Challenges:

• Manual routing and authorization processes are cumbersome.

• Potential bottlenecks and delays occur in approvals.

• Consistent maintenance of approval hierarchies is difficult.

Impact:

• Expense approval cycles slow down, frustrating employees.

• Errors in the approval process are more likely.

• Transparency in the authorization process is compromised.

4. Manual data entry

Challenges:

• Data entry errors and typos are more likely.

• Valuable time is consumed that could be used for strategic tasks.

• Accurate historical expense data retrieval is challenging.

Impact:

• Expense records become inaccurate, leading to discrepancies.

• Productivity suffers due to repetitive and error-prone tasks.

• Generating accurate financial reports becomes problematic.

5. Inefficient reimbursement process

Challenges:

• Reimbursement relies on manual submission and verification of reports.

• Processing reimbursement requests experiences delays.

• Employee frustration arises from delays in fund receipt.

Impact:

• Employee dissatisfaction due to delayed reimbursements.

• Potential inaccuracies in manual verification.

• Cash flow is impacted due to delayed reimbursement processing.

6. Lack of mobility

Challenges:

• Expense submission outside the office becomes impossible.

• Physical documents are required for expense reporting.

• Accessibility for mobile employees is limited.

Impact:

• Inefficient expense reporting for remote or traveling employees.

• Efficiency in expense management for distributed teams decreases.

• The potential for lost or misplaced receipts during travel grows.

7. Difficulty in auditing and compliance

Challenges:

• Automated policy adherence checks are absent.

• Manual audits are prone to errors and oversights.

• Consistent compliance with regulations is challenging.

Impact:

• Risk of policy violations and non-compliance increases.

• Potential for financial inaccuracies and fraud rises.

• Producing accurate audit trails and documentation becomes difficult.

8. Limited integration

Challenges:

• Isolated systems lead to duplicated data entry.

• Transferring data between systems is inefficient.

• Consolidating financial information for reporting becomes impossible.

Impact:

• Expense data across systems is inconsistent and fragmented.

• Accuracy in financial reporting decreases due to data discrepancies.

• Time and effort are wasted reconciling data between platforms.

9. Tracking and reporting challenges

Challenges:

• Automated tracking tools for expenses are lacking.

• Data compilation for reporting requires manual effort.

• Generating comprehensive expense reports is difficult.

Impact:

• Reliance on manual data collection leads to inaccurate reporting.

• Insights into spending trends and patterns are limited.

• Informed financial decisions become harder to make.

Eliminate the headache of manual tracking

How does automated expense management work?

The automated expense management process is a technological version of the manual system. This management type leverages software, specialized tools, and algorithms to conduct the same procedures in less time and with no errors.

Here is how an automated expense management system works:

1. Expense data capture

The automated expense management process begins by capturing the expense data – importing receipts, purchase documents, bills, etc. All this is imported into the system and is accepted in various forms, PDFs, docs, CSV, and more. You can also link your emails to the system so that invoices received on emails can automatically be captured.

2. Receipt scanning and OCR

Step 2 is to get the important information from the captured receipts and invoices. This is done using receipt scanning and OCR technology. Optical Character Recognition technology identifies and extracts important information from the receipts.

This means that data like vendor name, tax numbers, purchase quantity, product name, quantity, total amount due, etc., is extracted.

3. Expense categorization

After recognizing the essential information from the bills, the system takes that information and categorizes it into a central database. All the information is organized in an easy-to-understand manner where everyone in the company can access it. There are separate columns for expense categories, individual amounts, quantity, and more.

4. Policy enforcement

Next comes laying down the policies for making expenses and enforcing the same. Your employees must be well aware of what is allowed, and what are the rules and reimbursement regulations. The automated system enforces the spending policies by setting expense limits and checking all transactions against preset conditions.

5. Approval workflow

One of the most amazing features of automated expense management is the approval workflow algorithm. When an employee submits an expense request or reimbursement claim, it doesn’t have to be physically signed by all approvers. The system notifies the approvers about the request, and they just have to accept or reject the request right on their screens.

Plus, you can set 4–5 levels of approvers, hence, extra surety that all expenses are legitimate.

6. Integration with corporate cards

Corporate cards are excellent tools for making spends and managing them. Automated expense management systems allow you to integrate with your corporate cards, and all the activity is then tracked on the system. From the amount of the expense to who made it, everything is tracked in real-time and stored accurately.

Plus, you can use the system to assign cards, check status, apply controls, and separate expenses for easier expense organization.

7. Reporting and analytics

Once all the expense data is processed and organized, the system prepares reports and analytics of that data. Graphs, charts, patterns, etc., are displayed to you when you access this feature. It helps better understand the expense information; additionally, you will not have to go through the tiring process of creating reports and analytical sheets.

8. Reimbursement and payment

When an expense or payment is approved, the system automatically goes to the payment section. You must select a card or bank account to pay from, punch in some minimal details like vendor name, amount, etc., and click on pay. The system makes the payment in real-time and gives updates.

These updates are helpful for both managers and employees as they can know the current status of the vendor payment or reimbursement money.

9. Accounting integration

The automated expense management system also seamlessly integrates with your accounting system. This means that not only do you get an expense database with all accurate information but also updated accounting books.

All transactions are automatically entered into your accounting books under the right columns using the auto-categorization and expense mapping rules.

10. Auditing and compliance

Lastly, the system ensures that all the expenses are matched against all information like purchase documents, order receipts, bills, etc. Hence, your books are always audit-ready, and compliance check is not a concern.

Traditional expense management vs. automated expense management

Business expense management is a critical and important process to ensure all expenses are accounted for, and the company runs in optimum financial health. The traditional way to do it involves an intensive amount of manual labor and the use of resources.

However, with new technological advancements, expense management has been made easier and better for businesses. It is a solution to handle expense management in a more streamlined and accurate manner. Let’s look at some key differences between traditional and automated expense management:

1. Less prone to errors

The conventional expense management method requires a lot of manual data entry and paper dealings that are highly prone to errors. Doing the same repetitive work tends to get tedious and cumbersome.

Whereas an automated system is programmed to do repetitive data entry and capturing, there is no possibility of errors. All information is accurate to the point.

2. Minimises expense frauds

Manual expense management has loopholes using which committing expense fraud is very easy. Any of your employees or a third person can change the expense data. Expense amounts can be manipulated and backed with fake receipts, or extra expenses can be added to get more reimbursement.

However, an automated system takes care of the whole expense management process and completes it within seconds in real-time. There is no space for making changes or interrupting the process. Plus, anything against the rules will automatically be flagged, and the admins will be alerted.

3. Adhere to compliance

An automated expense management system runs on specific set rules and commands; anything out of the ordinary is not processed in the system. The traditional way of dealing with expenses is open to non-compliant practices or mistakes.

Receipts can be missing; information can be inaccurate, employee expenses can be way over the limit, etc. Compliance becomes a nightmare with manual expense management.

Related read: How to ensure expense report compliance for your business?

4. Easy approvals and workflow

Wouldn’t it be easier if you didn’t have to carry around the expense reports to different offices for signatures and approvals? This is possible with an automated system. The employees can submit their requests and supporting documents on the system, and the managers will be alerted.

Their screens will show all the necessary information, and they then just have to accept or reject the request.

5. Real-time data insights

There is no possibility of getting real-time expense information with a traditional expense management system. But with an automated expense management system, everything happens in real-time.

You can look up the current status of any of your payments, see what expenses your employees are making at this moment, and more.

Optimize your business's financial health

What are the main challenges in the process of expense management?

Expense management is a complicated task that can pose many challenges. The challenges can be a huge hindrance to the efficiency of the process and the accuracy of expense data. Here are some major issues in the expense management process:

1. Unclear expense policies

The first major challenge for an efficient expense management process is not having clear expense policies. Not knowing how to incur expenses, what is the reimbursement procedures, which expenses aren’t reimbursable, how employees should use company cards, etc., creates confusion among employees. This vagueness is a loophole that gives way to fraud and improper expense management.

You might also be interested to read: How to design employee expense reimbursement policy?

2. Lack of visibility and tracking

Proper expense management needs to have real-time tracking and transparent visibility. This means the managers, heads, and employees must be able to access essential information and keep updated on all transactions. However, a lack of visibility and tracking makes it difficult to monitor expenses as they occur, and this, in turn, leads to delayed or ineffective financial decisions.

3. Manual and time-consuming processes

There is no doubt that manual expense management consumes colossally more time. This is natural as automated systems are programmed to take over repetitive tasks and perform them repeatedly. However, humans get tired of data entry tasks as those are tedious, and this, in turn, disrupts the efficiency of the process.

4. Complex approval workflows

As there are various expenses made on a daily basis, having a complex approval workflow will only further delay the transactions. For example, to get an expense approved, your employees have to go to four different people with four different kinds of reports or documents for signature. This is complex and time-consuming.

5. Inefficient reimbursement processes

Again, having to attach a lot of documentation as proof for expense verification or having a long process of reimbursement checks where it takes days to process the claims completely is sheer incompetence. This is also a challenge in the way of creating an efficient process.

6. Lack of integration

Businesses have to enter expense data into their accounting books as well rather than just maintaining an expense database. Without integration between software tools, this will be very time-consuming. Integration facilitates connecting all your systems so your employees don’t have to repeat the same tasks.

7. Data inaccuracy and errors

One of the major challenges in the expense management process is a lack of accuracy in expense data. Wrong information means that your employees will have to invest extra hours in correcting mistakes. More time is consumed, and more energy is wasted completing a task that should have been done correctly the first time.

What are the best practices to simplify the business expense management?

Now that you understand the challenges of a coherent expense management process, it’s time to look at the best practices to simplify the business expense management process, as it is crucial for maintaining efficiency and accuracy in financial operations.

1. Set clear expense policies and guidelines

The company expense policy should outline procedures for reimbursement, the limits for business expenses, and the documentation that is required, basically everything from making expenses to the final submission and approval. It is easier for employees to make appropriate spending decisions when they have clear guidelines.

2. Use expense management software

Adopt an expense management software or automation platform that provides features such as receipt scanning, automatic categorization of expenses, and integration with accounting software to track expenses. The system will help you quickly and easily track and monitor all of your spending, as well as ensure that all of your expenses are properly accounted for.

This can help you identify potential areas where you can cut costs and save money, as well as provide the necessary documentation for tax and other financial reporting purposes.

3. Centralize approval workflows

By having a central approval workflow, it becomes easier to track the progress of tasks and ensure that they are completed in a timely manner. It also makes it easier to keep everyone on the same page and ensure that tasks are completed correctly. Your employees will not have to run around to different people for approvals; everything can be done in one place.

4. Setup pre-approved expenses

Pre-approved expenses are a great way to streamline your expense management. They involve setting up a system where specific categories of expenses are approved based on pre-determined criteria. Not only does this cut down on administrative work, but it also gives your employees more control over how they spend their money.

5. Regular employee training

Employee training is a must-have if you want to keep your organization running smoothly. It's all about making sure your employees are up to date on expense policies, processes, tools, and how to spend responsibly. This also helps in significantly saving time over clearing confusion and expense management-related problems.

6. Use corporate cards

Using corporate cards is a well-established practice for effective expense management in enterprises. Corporate cards are specific credit or debit cards that are issued to employees for authorized business-related expenditures. The utilization of corporate cards provides a number of benefits that simplify the expense management process.

Corporate cards provide features like spend controls, real-time updates, centralized expense database access, and much more.

7. Digital receipts and cloud storage

With digital receipts and cloud storage, you can replace paper receipts with electronic ones. Cloud storage allows you to easily access, search for, and retrieve receipts from anywhere. It improves accuracy, eliminates manual data entry, integrates with your expense management tools, and allows you to track, report, and meet compliance requirements.

It also provides disaster recovery, cost reduction, and environmental benefits while providing data analytics for better decision-making.

8. Regular audits and reconciliations

Efficient expense management relies on regular audits and reconciliation. They involve the systematic review and cross-checking of financial information, records, and transactions to ensure accuracy, identify errors or fraudulent activity, and ensure policies are adhered to.

By catching problems early, organizations can correct problems, increase financial visibility, and make better decisions while reducing expenses.

9. Streamlined expense categories

Expense management can be made easy by grouping similar costs together under clear, pre-defined labels. This makes it easier to report, less confusing, and more consistent. It helps you keep track of your budget, makes it easier to make decisions, and makes approval workflows faster. Minimizing confusion helps to analyze spending patterns and allocate resources, resulting in better financial management.

10. Real-time visibility

Real-time spending visibility is a key aspect of expense management that you can get using software tools for immediate visibility into spending. It helps you keep an eye on expenses as they happen, so you can spot any discrepancies, bad buys, or spending that's way out of budget. Real-time visibility means you can fix problems immediately and keep your expense management processes running smoothly.

11. Regular reviews and optimization

Expense processes need to be regularly evaluated and optimized to stay on track with your organization's goals. This means looking at spending patterns to see where you can save money, increase efficiency, and make changes when needed. It's a proactive approach that helps you make better decisions and keeps your expense management system coherent.

Keep your business expense under control

What is expense management software?

If you're looking for a digital solution to help you keep track of, submit, approve, and reconcile business expenses, then expense management software is the way to go. It's designed to make it easier and more efficient to track, budget, and analyze expenses. It's got all the bells and whistles you'd expect, like receipt scanning, auto-categorization, and integration with your accounting systems.

Plus, it reports in real-time, so you can stay on top of expenses and make sure your employees are following all your expense policies. Expense management software helps you stay on top of your financials, reduce mistakes, and maximize your resources.

Why should businesses use automated expense management software?

1. Efficiency and time savings

With automated expense management software, you don’t have to spend as much time on manual tasks. Instead, your employees and finance team can spend time on strategic activities while the software handles mundane tasks such as data entry, approval, and reporting. Efficiency boosts productivity and speeds up expense processing, resulting in significant time savings throughout your organization.

2. Accurate expense tracking

Manual input errors are minimized when using expense management software. It helps you keep track of expenses by categorizing them correctly, matching receipts and transactions, and ensuring you're entering data consistently. This helps you keep your finances more transparent, reduce mistakes, and make sure your reports are accurate so you can make the right decisions and meet audit requirements.

3. Real-time visibility

In expense management software, the real-time visibility feature lets you track expenses as they happen. This quick look helps you keep an eye on spending, spot trends, and make fast decisions. With real-time visibility, you can stay on top of your budget, handle issues right away, and make financial choices based on the latest info, all of which boosts your overall financial management.

4. Policy compliance

The automated expense management software makes sure everyone follows company rules by sticking to the spending guidelines. It checks expenses against the set rules, points out any transactions that don't match, and stops any unauthorized spending. This cool feature keeps things fair, cuts down on rule-breaking, and keeps everything clear and accountable, all in line with the company's expense policies.

5. Reduced fraud

With built-in controls, automated expense management software reduces the risk of fraud and misuse by identifying unusual spending patterns, detecting unauthorized expenses, and enforcing approval processes. This helps protect company funds, preserve financial integrity, and reduce the risk of fraud or improper expenses, creating a safe and reliable expense management environment.

6. Streamlined approval workflows

Automated expense management software simplifies approval processes by automating the flow of expenses. It routes expenses to the right people for approval based on preset rules, reducing delays and speeding up reimbursement. This streamlined workflow ensures that expenses are reviewed and approved promptly, enhancing efficiency, reducing administrative bottlenecks, and improving overall expense management efficiency.

7. Data analytics and reporting

Automation tools for data analytics and reporting enable the analysis of spending trends, vendor associations, and potential cost-saving avenues. It produces thorough reports containing insights into expense patterns and the allocation of budgets. This attribute empowers well-informed decision-making, facilitates expenditure optimization, and aids in strategic planning for enhanced financial management and resource allocation across the organization.

8. Integration with accounting systems

Integration with accounting systems is a compelling reason to adopt automated expense management software. This feature ensures seamless sharing of expense data between expense management and accounting platforms, eliminating manual data entry and reducing errors. It streamlines financial processes, enhances accuracy, and enables a cohesive financial management approach, ultimately leading to more efficient and error-free financial records.

9. Cost savings

Using automated expense management software saves costs by reducing administrative overhead, minimizing errors, and optimizing resource allocation. It streamlines processes, cutting down on manual tasks and the associated extra employee efforts. Additionally, by preventing fraud and identifying cost-saving opportunities, the software maximizes financial efficiency.

10. Scalability & growth

Another reason why businesses need automated expense management software is that it supports scalability and growth. As a business expands, the software easily accommodates increased transaction volumes without sacrificing efficiency. It adapts to evolving needs, ensuring consistent and streamlined expense processes. This scalability minimizes the need for extensive adjustments to expense management systems, allowing organizations to focus on growth strategies while maintaining efficient financial operations.

How to choose the best expense management software for your business?

Assess your business needs

Start by figuring out what your expense management needs are. Think about how many transactions you have, how complicated your expense policies are, and any unique business requirements.

This assessment will help you find software that fits your operational needs, making your expense management more accurate.

Scalability and flexibility

Make sure your software is flexible enough to keep up with your business's growth. Choose a solution that can handle more transactions and keep up with changing needs.

This way, you can keep running smoothly and efficiently even as your business grows, so you don't have to worry about spending cuts or major changes.

Integration capabilities

Prioritize software that integrates seamlessly with your existing accounting, human resources, and other systems.

seamless integration improves data flow between systems, eliminating manual data entry, improving accuracy, reducing mistakes, and improving overall expense management.

Security and data protection

Focus on software that puts data security first. Strong encryption, strong authentication, and compliance with data protection regulations are essential features.

This way, sensitive financial information stays secure, creating a reliable and secure environment for your expense management.

Compliance and policies

Choose the software that supports your spending policies. Look for features like pre-defined spending limits, automated policy validation, and alerts for out-of-compliance spending.

This proactive strategy helps you follow best practices, reduce policy violations, and create a compliant spending environment.

Analytics and reporting

Choose software with advanced analytics and reporting capabilities. This lets you look into how your money is being spent, spot opportunities to save money, and make smart decisions.

With comprehensive insights, you can make better decisions, manage costs better, and steer your business in the right direction.

Expense approval workflow

Check that the software supports flexible and streamlined approval processes. Look for features such as automated routing, multilevel approval, mobile-friendly reviews, etc.

These features help streamline approval processes, reduce delays, and increase transparency, making your organization’s expense management more efficient.

Training & support

Take a look at the level of customer service offered by your software provider. Ensure you can access training materials, quick help, and a robust knowledge base.

Reliable customer support and resources ensure a seamless migration to your software and solve any issues, improving user experience and customer satisfaction.

Manage your business expenses with Volopay!

Volopay is the perfect expense management software for modern businesses. It's got all the bells and whistles you need, like automated expense reporting, corporate cards, and smart expense tracking.

Plus, it has all the practical features you need to make your accounts payable processes better and your expense management more efficient.

FAQ's

Business expense management is the process of tracking and managing the costs associated with the day-to-day operations of a business.

Organize your business expenses by categorizing, using digital tools for receipts automating expense management processes, and maintaining clear records.

An expense management system is an advanced digital tool that automates the process of tracking, approving, and reporting business expenses.

The process of reviewing, verifying, and reconciling expense information in accordance with policies before processing reimbursements is followed to manage expense reports.

Expense management can help you save money, make sure your policies are followed, make better decisions, and streamline processes.

Manage employee expenses by having clear policies, using digital tools, setting up approval processes, and conducting regular reviews and audits.