Best business bank accounts in Singapore in 2025

Business success starts with a solid foundation, and a crucial element is choosing the best business bank account that fits your specific needs and requirements.

Singapore offers a diverse range of business bank accounts tailored to meet the unique needs of entrepreneurs.

From traditional banks to digital disruptors, these accounts provide essential features like seamless transactions, efficient cash management, and competitive interest rates.

Whether you're a startup or an established enterprise, navigating the options is key to optimizing your financial operations.

What is a business bank account?

A business account or business bank account is a specialized financial account designed to meet the distinct needs of businesses and corporations. It serves as a central hub for managing financial transactions, allowing companies to receive payments, pay expenses, and conduct day-to-day operations. These accounts often come with features tailored for businesses, such as higher transaction limits, business-specific tools, and integration with accounting systems.

Separating personal and business finances, a business bank account enhances financial transparency, streamlines tax compliance, and builds a credit history for the company. The best business bank account can act as a fundamental tool for fostering financial stability and growth within the corporate realm.

Also business accounts cater to a variety of businesses while corporate accounts are tailored for complex financial needs of large and established entities. If your business falls into the category of large corporation, we recommend exploring our detailed guide on steps to open a corporate bank account in Singapore to explore the step by step approach to navigate through the process seamlessly.

Best business bank accounts in Singapore in 2025

1. Volopay

Overview

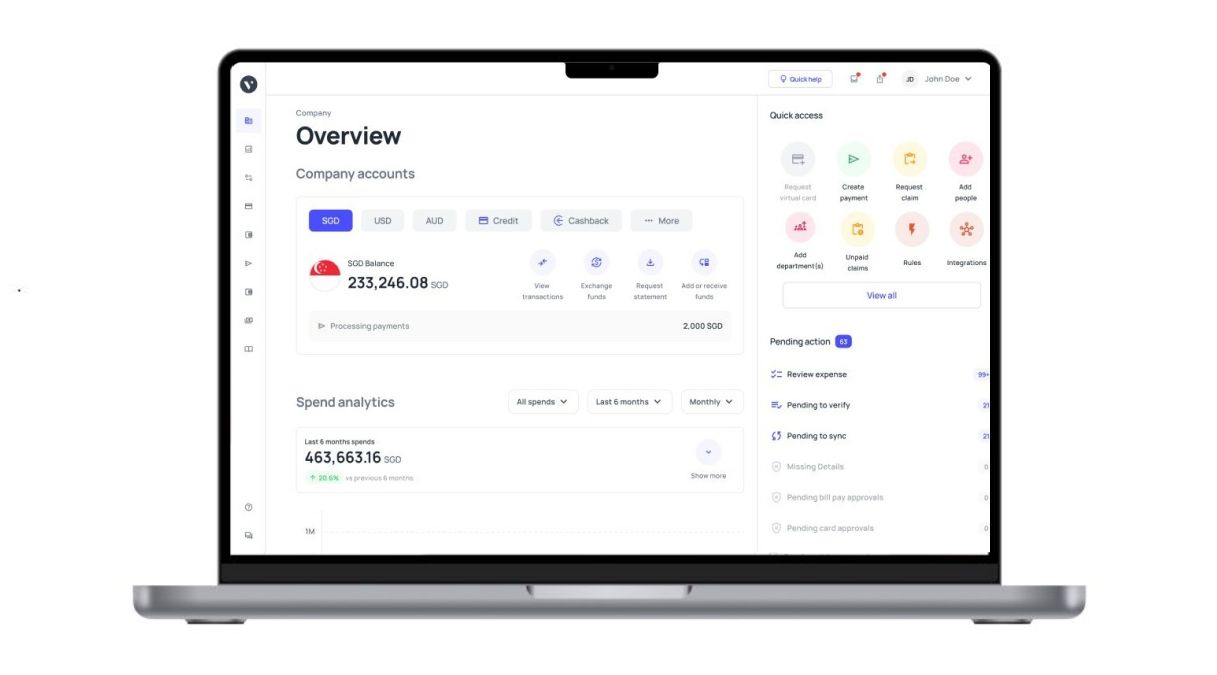

Volopay is a modern business bank account solution tailored for businesses, providing a streamlined approach to financial management. A major reason why this is one of the best business bank account in Singapore is because the platform combines traditional banking features with advanced tools for expense management, procurement, and accounts payable.

Key features

● Integrated expense management

Volopay offers an integrated platform for expense management, allowing businesses to track and control expenditures effectively.

● Automated procurement

The platform facilitates automated procurement processes, including invoice processing, approval workflows, and payment processing.

● Multi-currency wallets

Volopay supports multiple currencies, enabling businesses to operate globally with ease and efficiency.

● Real-time tracking

Businesses can benefit from real-time tracking of expenses and transactions, enhancing visibility into financial activities.

● User-friendly interface

The user-friendly interface of Volopay ensures accessibility and ease of use for businesses of various sizes.

Limitations

As with any financial solution, Volopay does have limitations based on the specific needs of businesses. These could include monetary limits or restrictions on specific functionalities for specific packages.

The availability of physical branches for in-person support may also be limited compared to traditional banks.

2. DBS business multi-currency account

Overview

One of the best business bank account in the country, the DBS Business Multi-Currency Account – Starter Bundle is offered by DBS Bank, a prominent financial institution in Singapore. This business account is designed to meet the needs of small and medium-sized enterprises (SMEs), providing a range of features to facilitate financial operations.

Key features

● Multi-currency accounts

Businesses can manage multiple currencies within a single account, simplifying international transactions.

● Online banking

The account includes access to a robust online banking platform, offering convenience for day-to-day financial management.

● Business debit card

DBS provides a business debit card, enhancing accessibility for business expenses and transactions.

● Starter bundle benefits

The Starter Bundle may include additional perks such as fee waivers for account maintenance and transactions during an initial period.

Fees & charges

DBS typically outlines fees for account maintenance, transactional services, and other optional features. Currency conversion fees may apply for transactions involving multiple currencies.

Limitations

The account's features and benefits may be tailored for SMEs, and larger enterprises with more complex financial needs may find limitations. The availability of certain features or benefits may be subject to the business meeting specific eligibility criteria.

3. OCBC business growth account

Overview

OCBC Business Growth Account is a versatile business banking solution offered by OCBC Bank in Singapore. Tailored for businesses of all sizes, it aims to provide a comprehensive suite of services to support financial management.

Key features

● The account offers flexibility with tiered interest rates based on the account balance, ensuring that businesses earn more as their deposits increase.

● OCBC Business Growth Account allows businesses to manage multiple currencies within a single account, facilitating international transactions. OCBC also claims to be the sole bank providing complimentary unlimited FAST and GIRO transactions.

● The account provides convenient access through online banking services, enabling businesses to manage their finances seamlessly.

● The OCBC Business Growth Account is counted amongst the best business bank account in the country also because businesses can enjoy the convenience of a complimentary business debit card for daily transactions.

Fees and charges

OCBC typically outlines fees for services such as account maintenance, transactions, and additional features. Currency conversion fees may apply for transactions involving multiple currencies. The fees and charges structure may vary based on the business's size, transaction volume, and specific requirements.

Limitations

While the OCBC Business Growth Account is versatile, businesses with very specific or complex financial needs may find certain limitations. While the availability of features and benefits is guaranteed, they may not always fit the needs and requirements of all businesses.

4. Maybank FlexiBiz Account

Overview

Maybank, a prominent player in the financial sector, offers the FlexiBiz Account catering to the diverse needs of SMEs.

Apart from its features and services, what makes the Maybank account one of the best business bank account is that the platform aims to provide flexibility and convenience in managing day-to-day financial operations.

Key features

● Flexibility in fund management is one of the most prominent features of the Maybank FlexiBiz Account. Account holders enjoy the flexibility of managing funds, including convenient check issuance and collection.

● Maybank also comes with an extensive ATM and branch network. Businesses can benefit from a wide network of ATMs and branches for convenient access to banking services.

● You get the benefit of varied payment options with the Maybank FlexiBiz Account. This is particularly suited for businesses with diverse payment needs, providing versatile payment solutions.

● One distinctive feature of the Maybank FlexiBiz Account lies in its practice of offering interest on balances, rates include: 0.018% for the initial $50,000, 0.028% for the subsequent $450,000, and 0.038% for amounts exceeding $500,000.

Fees and charges

Understanding the fee structure is crucial for any business account, and the Maybank FlexiBiz Account is no exception. It may have competitive fees, however, businesses should pay attention to transaction charges, maintenance fees, and any additional costs associated with specialized services.

Limitations

The multicurrency features provided by Maybank may not be as advanced as other providers. Additionally, businesses that require up-to-date digital banking features may find the platform somewhat traditional compared to other options in the market.

5. UOB eBusiness Account

Overview

The UOB eBusiness Account is tailored for small and medium enterprises (SMEs) seeking seamless banking solutions. UOB, a stalwart in the banking industry, offers a blend of traditional services with digital innovations to meet the evolving needs of businesses.

Key features

● UOB’s user-friendly online platform is one of the features that make it one of the best business bank account in Singapore. Businesses can navigate and manage finances effortlessly through an intuitive online interface.

● UOB also provides comprehensive banking services. You can access a wide range of services, including trade financing and forex solutions.

● International trade support is also provided. This is ideal for businesses engaged in international trade with specialized services.

● The UOB business bank account Singapore has to offer provides financial specialists who help with forex services like FX Forward and FX Spot.

Fees and charges

While the account offers robust features, it's essential to consider the associated fees. UOB eBusiness Account may have maintenance fees, transaction charges, and additional fees for specific services.

It's advisable to review the fee structure carefully to align with your business's financial dynamics.

Limitations

Despite its strengths, the UOB eBusiness Account might have limitations in terms of accessibility. Businesses operating in areas where UOB's physical presence is limited may face challenges in availing of in-person services.

Additionally, businesses with very high transaction volumes might find the fees accumulating, impacting overall cost-effectiveness.

Enjoy hassle-free business transactions!

How to open a business bank account in Singapore?

1. Choose the right provider

Before you open an account you first have to decide which banking partner to go with.

Factors like fees, features, reputation, service, and accessibility range should be thoroughly weighed to ensure the account and its features are suited to the particular needs of your business.

You have to guarantee alignment to make your choice the best business bank account for the entire organization.

2. Understand the requirements

Before diving into the application process, familiarize yourself with the specific requirements of the chosen bank.

Different bank accounts for businesses may have varying eligibility criteria, documentation needs, and account opening procedures. This understanding ensures a smoother application process and helps you prepare the necessary information in advance.

3. Choose the account type

Businesses have diverse financial needs, and banks offer a variety of business account types to accommodate these differences.

Whether it's a basic current account, a savings account, or a specialized account for specific industries, choose the account type that best suits your business operations.

When making this choice, consider factors such as transaction volume, international transactions, and interest rates to ensure you're opting for the best business bank account for your needs.

4. Complete the application form

Once you've selected the bank and account type, the next step is to complete the application form. This form typically covers essential details about your business, such as its legal structure, nature of operations, and details of the account signatories.

Provide accurate information to expedite the processing of your application.

5. Submit the required documentation

Prepare and submit the necessary documentation as specified by the bank. Common documents include the company's registration documents, identification proof for account signatories, and business licenses.

For foreign-owned businesses, additional documentation such as proof of address and information about the company's directors may be required. Thoroughly review the bank's checklist to ensure all required documents are included with your application, as this is essential for opening compliant and efficient bank accounts for business operations.

6. Approval of account opening

After submitting your application and required documents, the bank will review the information to ensure compliance with its policies and regulatory standards.

The approval process duration varies, and you will be notified once your application is processed.

During this phase, the bank may conduct background checks and validate the accuracy of the provided details.

7. Initial deposit

Following approval, you'll need to make an initial deposit into your newly approved business account.

The required amount depends on the bank and the chosen account type.

Opting for the best business bank account ensures you have flexibility in deposit methods and other account features, allowing your business to start operations smoothly.

8. Activate your account

With the initial deposit made, your business account is ready to be activated. This often involves receiving account details, such as an account number and electronic banking credentials.

Ensure that you understand the activation process, which may include setting up online banking access, obtaining a checkbook, and any other steps necessary to start using your business account seamlessly.

Fuel your business growth with Volopay

Factors to consider when choosing a business account

1. Legal compliance and separation of finances

Establishing a business account is not just a matter of convenience; it's a legal necessity. In many jurisdictions, operating a business without a dedicated business bank account can be a violation, leading to penalties or legal complications.

Beyond compliance, a business account ensures a clear distinction between personal and business finances. This separation is crucial for legal protection, shielding personal assets from business liabilities.

It lays a foundation for a structured financial environment, reducing the risk of legal entanglements and offering a secure platform for financial transactions specific to your business.

2. Financial transparency and accountability

A business bank account serves as a transparent record of your company's financial activities. Every transaction, from incoming payments to outgoing expenses, is documented, providing a clear financial trail. This transparency is invaluable for internal management and external stakeholders, fostering accountability and trust.

Detailed statements enable businesses to track expenditures, identify patterns, and make informed financial decisions. Whether it's monitoring cash flow or assessing the success of a marketing campaign, the clarity offered by a business bank account is instrumental in maintaining financial health.

3. Tax reporting and filing

Come tax season, a dedicated business bank account simplifies the often intricate process of tax reporting and filing.

The clear demarcation of business transactions streamlines the identification of deductible expenses and ensures accurate financial reporting to tax authorities. This not only facilitates a smoother tax filing process but also reduces the risk of errors that could trigger audits or financial scrutiny.

A business account acts as a financial trail that auditors and tax authorities can easily follow, providing a level of transparency crucial for regulatory compliance.

4. Professionalism and credibility

Beyond the practicalities, having a business bank account enhances the professionalism and credibility of your enterprise. It signals to clients, partners, and investors that your business is well-organized and committed to sound financial practices.

When clients make payments to a business account in the company's name, it reinforces the legitimacy of your operations. This professional image can be a deciding factor for potential clients or investors, influencing their trust and confidence in your business.

5. Access to business banking services

The best business bank account for your business can open the door to an array of specialized banking services tailored for businesses. These may include merchant services, business loans, lines of credit, and other financial products designed to support and accelerate business growth.

For businesses operating internationally, a multi-currency bank account can be an invaluable asset. It allows seamless transactions in multiple currencies, reducing conversion fees and simplifying global operations.

By maintaining a business account, you gain access to these essential services, empowering your company with financial tools that can fuel expansion and provide a competitive edge in the market.

6. Expense management and budgeting

Tracking business expenses is a breeze with a dedicated business bank account. Most business accounts offer tools for categorizing expenditures, generating expense reports, and setting budgetary limits. This not only streamlines financial management but also aids in strategic planning.

By understanding where funds are allocated, businesses can optimize their spending, identify cost-saving opportunities, and ensure that financial resources are allocated efficiently to areas that contribute most to the company's objectives.

7. Mitigating personal financial risk

Operating a business inherently involves risk, but the best business bank account always acts as a buffer, mitigating personal financial risk. In the absence of a dedicated account, personal assets could be vulnerable to business-related liabilities.

The separation provided by a business account shields personal finances, safeguarding assets such as homes or savings accounts from the potential impacts of business challenges, debts, or legal disputes.

8. Facilitates growth and scalability

As a business expands, so do its financial complexities. A business bank account lays the groundwork for scalability by providing a centralized platform to manage an increasing volume of transactions.

It streamlines financial processes, reduces administrative burdens, and ensures that the business can efficiently handle the growing demands of a larger operation.

Moreover, the financial history and credibility built through a business account can facilitate easier access to capital, essential for funding expansion initiatives.

Why should businesses choose Volopay business account?

Any business organization looking for a comprehensive financial solution that combines flexibility, international capabilities, customization, and advanced features should consider Volopay business accounts.

By utilizing Volopay, businesses can elevate their financial management, streamline operations, and position themselves for success in a dynamic and interconnected business environment.

Here's how:

1. Flexible and easy to open

Volopay stands out as an excellent choice for businesses due to its flexible and straightforward account opening process. Recognized as one of the best business accounts in Singapore.

The platform understands the value of time in the business world and has streamlined the onboarding journey, ensuring that businesses can swiftly and effortlessly establish their accounts.

2. Supports international transactions

For businesses engaged in global operations, Volopay is one of the best business account options.

The platform supports international transactions seamlessly, facilitating cross-border payments and enhancing the efficiency of global business dealings. This feature is particularly beneficial for companies looking to expand their reach and engage in international trade.

3. Get corporate cards tailored for your business

Volopay provides the benefit of corporate cards that can be tailored to meet the specific requirements and branding of your business.

These corporate cards offers a convenient solution for handling expenses, conducting transactions, and exercising financial oversight.

4. Easy expense tracking features

One of the key reasons businesses should opt for Volopay is its user-friendly interface that simplifies expense tracking.

The platform provides intuitive tools and features for monitoring and categorizing expenses, enabling businesses to maintain a clear and organized record of their financial activities. This streamlines the accounting process and supports better financial management.

5. Integration capabilities

Volopay understands the importance of seamless integration with other business tools and software. The platform offers integration capabilities, allowing businesses to connect their Volopay accounts with various applications and systems.

This not only enhances operational efficiency but also ensures a cohesive and interconnected financial ecosystem for the business.

6. Spend analytics and monitoring

Volopay empowers businesses with robust spend analytics and monitoring tools.

The platform provides detailed insights into spending patterns, helping businesses make informed decisions about budget allocation and expense management.

Real-time monitoring ensures that businesses have a clear view of their financial health and can proactively address any anomalies.

7. Support multi-currency

In today's global marketplace, dealing with multiple currencies is a common aspect of business operations. Volopay addresses this need by supporting multi-currency transactions.

Businesses can transact in different currencies with ease, avoiding the complications and additional costs associated with currency conversions.

This feature is particularly valuable for companies engaged in international trade or those with a diverse client base.

FAQ's

The best type of bank account for a business depends on its specific needs. A business may opt for a basic current account, a savings account, or a specialized account based on factors such as transaction volume, international transactions, and interest rates.

Determining the best bank for business accounts in Singapore depends on various factors like business size, industry, and specific requirements.

Banks such as DBS, OCBC, and UOB are prominent choices, offering a range of business banking services.

However, the ideal bank varies based on individual business needs.

Volopay is regarded as one of the best business account options in Singapore due to a range of factors. It boasts a convenient and flexible account opening procedure, facilitates international transactions, empowers businesses with personalized corporate cards, incorporates user-friendly expense tracking features, allows for seamless integration with other systems, delivers strong capabilities in spend analytics and monitoring, and accommodates multi-currency transactions. These attributes collectively position Volopay as a well-rounded and customized solution suitable for businesses across diverse sizes and industries.

The exact time to open a business account with Volopay may vary, but the platform is known for its efficient and streamlined onboarding process.

Typically, businesses can expect a relatively quick turnaround, allowing them to establish their accounts promptly and start utilizing the financial services provided by Volopay.

Volopay distinguishes itself with its exceptional features, including a streamlined and flexible account opening process that ensures businesses can swiftly establish their accounts.

The platform's support for international transactions, coupled with the provision of customizable corporate cards, offers businesses a tailored solution for global financial operations.

Volopay's commitment to user-friendly expense tracking, seamless integration capabilities, and comprehensive spend analytics and monitoring further solidify its position as a top-tier choice for businesses in Singapore.