Multi currency bank account: A complete guide for businesses

As a business grows and expands the markets in which it operates, it has to start dealing with financial transactions in different currencies. This may also occur when you’re operating within a specific country but have vendors in other countries.

From a finance professional’s perspective, if you don’t have the right systems and processes set in place, transacting in multiple currencies can be a struggle. In order to get the most seamless experience in dealing with foreign currencies a business should set up a multi currency bank account for all its payments.

What is a multi currency bank account?

A multi currency account in Singapore is one that allows a business to create several sub-accounts which can hold money in different currencies and make payments through them. These types of accounts are offered by banks, financial institutions, and NBFCs(Non-banking financial companies).

Each entity offers a variety of unique features and benefits with its multi currency account such as the number of currencies you can access and also the countries across which you can transact. Creating this type of bank account for a business is crucial when there are plans for expansion to new markets or when there is a clear need to make international transactions within the business.

How do multi currency bank accounts work?

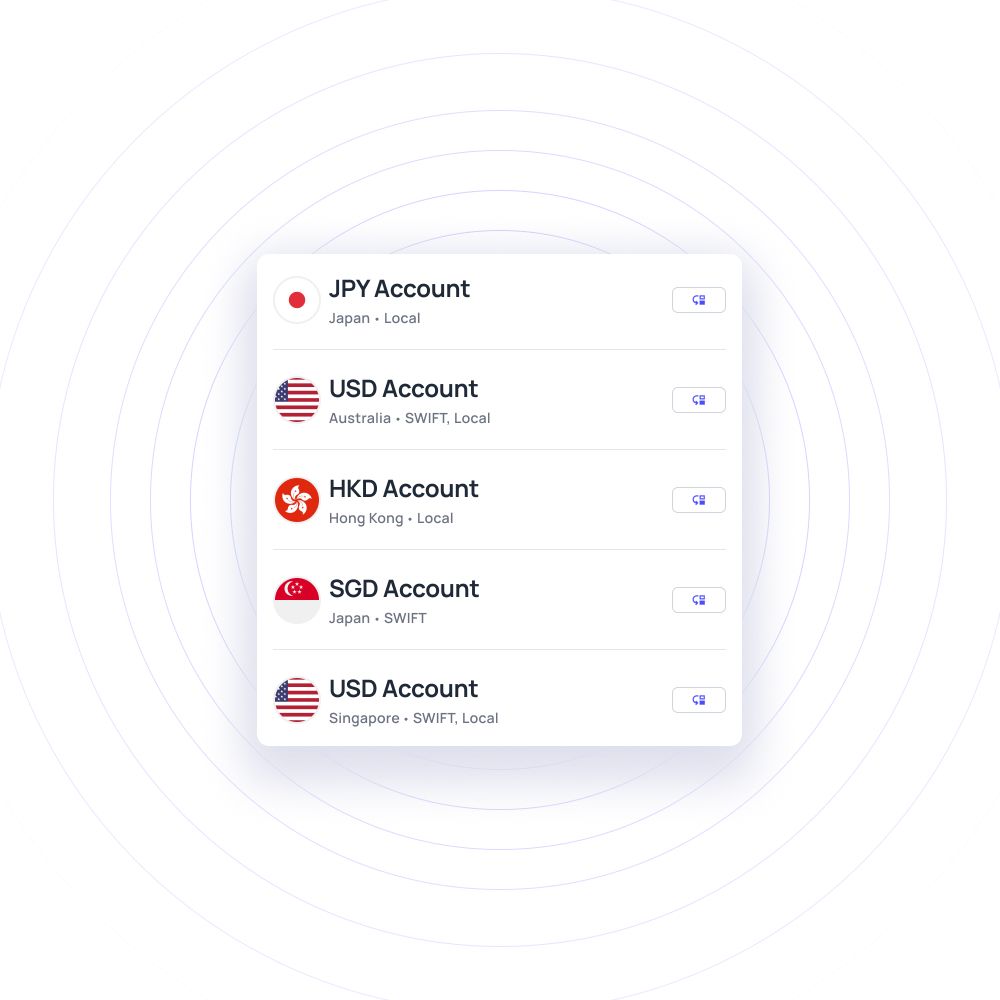

A multi currency account in Singapore is one that will help you transact in currencies other than the Singaporean dollar. This type of account essentially has multiple sub-accounts within it. Each account has its own unique account number and BIC (business identifier code).

Using these accounts you can then make payments to vendors without any transfer fees and also easily make salary transfers to your employees if you have remote workers. This makes the multi currency wallet an affordable option as you don’t have to pay the currency conversion charges each time you want to make a payment.

Benefits of a multi currency bank account

Individual accounts for international transactions

Before businesses could opt for a multi currency account, they had to open separate accounts in different banks or institutions to carry out transactions in different currencies. Or they had to pay a hefty transfer and FX fee to their existing bank if they supported international transactions.

This created a lot of issues in terms of managing financial transactions and led to poor visibility of business spending. With a multi currency account, a business can now conduct all its overseas transactions through a single platform. This helps keep all financial transactions in one place for better management and control.

Lower forex charges & huge savings

The biggest gripe businesses have when it comes to international transactions is the forex charges levied to make payments or receive money. Banking networks and infrastructure is such that a percentage of the transaction is cut depending on the banks and network being used.

The receiver of a payment doesn’t get the full amount, so the payer has to pay more than the actual amount to ensure that the receiver gets the actual amount that is due. Repeating this over many transactions costs you a lot of money.

With a multi currency bank account, you can simply bare the forex charge once to transfer money from your existing currency to a new account to hold money in a different currency. This allows you to save a lot of money for each transaction.

Smooth international transactions

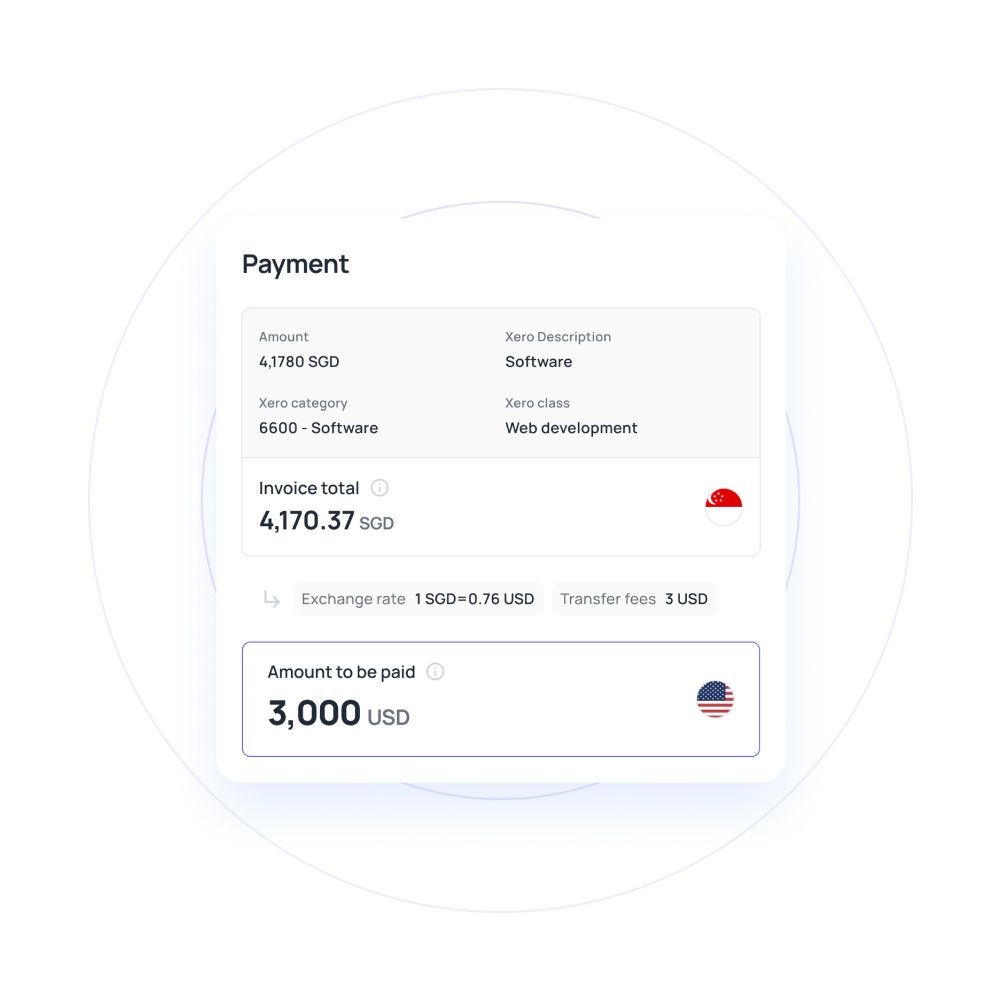

Since you can hold money in different currencies using a multi currency account, you don’t have to pay the FX fee every time you make a payment. The money you transfer to your vendors in a different country ends up being a local currency transfer.

For example, if you operate in Singapore your domestic currency would be SGD. If you have a vendor in the USA, you would have to pay them in USD. With an online multi currency bank account, you can hold money in USD and pay your vendors in the USA without incurring any currency conversion charges for the payment.

Instant payments

Another benefit of using a multi currency wallet is how fast the transactions are processed. While traditional bank accounts could take anywhere from 3 days to a week for international transfers, a multi currency account transfers money within minutes. Fast payments to your vendors help build better business relationships.

Interesting read: Benefits of opening a local currency account

Open a multi currency bank account and expand your business today!

Process of opening a multi currency bank account in Singapore

The documents required to open a multi currency account depend on the bank or institution you choose. On a basic level, you should have all the necessary legal documents to prove that you run a business entity. For companies providing credit, you will have to submit the necessary financial statements for the company to assess your creditworthiness.

Certain providers of a multi currency account might have eligibility criteria for your business to use a multi currency wallet. The criteria to qualify might include things like your monthly spending requirements. Depending on the volume of international payments that your business needs to make you will be able to get access to an online multi currency bank account.

When you choose traditional banks or older financial institutions, you might have to complete an offline in-person process to get a multi currency account. But when it comes to new-age FinTech companies, you can easily open a multi currency wallet through a simple online process.

Charges associated with a multi currency bank account

• Set up fee - Depending on the provider you choose to set up your multi currency account, you may or may not have to pay a set-up fee.

• Initial deposit - There is usually a minimum balance requirement or an initial deposit that you will need to keep in the account to keep it active.

• Account fee - To run and operate a multi currency account, the provider offers affordable monthly or annual plans to carry out all your international payments.

• Cash conversion fee - Every time you want to add more money to a particular currency account within your multi currency account, you will need to update the balance by adding money from your local currency. To do this, you will incur a currency conversion charge so that you can hold the money in the other currency.

Related read: Airwallex business account review

Who offers multi currency accounts in Singapore?

DBS Bank

Founded in 1968, DBS is one of the most trusted financial institutions in Asia. DBS bank in Singapore offers their business customers multi currency accounts for overseas transactions but it is limited to 10 currencies. They support GBP, INR, HKD, and CAD. They also offer Multiplier accounts and E-multi currency autosave accounts.

UOB Bank

UOB was established in 1935 and is a major player in Southeast Asian countries. Using their multi currency account you can transact in NZD, EUR, and HKD as part of the 10 currencies they support. One benefit is that you get free ATM cards and cheques. Some UOB branches offer online multi currency account applications as well.

OCBC Bank

OCBC is also an old bank founded back in 1932. OCBC offers a ‘business growth account’ without any initial deposit and the need to maintain a minimum balance. But if you opt for a ‘business entrepreneur account plus’, you’ll need to maintain SGD 30,000 as a minimum balance. The account also supports only 13 currencies which include some major currencies like AUD, USD, CAD, and EUR.

Volopay

Our platform allows your business to transact in 100+ countries and hold money in 60+ currencies including all the major currencies like the USD, EUR, JPY, GBP, AUD, CAD, and many more. Being able to use an online multi currency bank account through a platform like Volopay improves your global reach and relationships with your vendors, thanks to the ease of financial transactions.

Scale your business with a multi currency bank account with Volopay

Companies in Singapore who are planning to expand their business beyond their country’s borders should definitely opt for a Singapore multi currency account provider they can trust. Volopay is a B2B expense management platform that offers a multi currency business bank account as part of its ecosystem of financial tools.

Instead of having to create multiple bank accounts for each currency at a different location, having a multi currency bank account lets you view, manage, and control all transactions from a single dashboard. This gives better visibility of the company’s entire spending patterns including all the international payments.

A multi currency account is also great for companies setting up new offices in a country to manage employee payroll. Volopay’s payroll feature combined with its multi currency wallet means you can easily process salaries for all your employees without any hiccups. Your employees will receive money in their account almost instantly as compared to the slow and old banking infrastructure that often took days to a week for transfers to be completed.

FAQs

Depending on the bank you choose, you can open a multi currency account directly with them provided they have the infrastructure to do so. Some banks might require you to have an existing account with them while others will directly allow you to open a multi currency account with them.

If your business has a regular requirement of making international payments, then opening a multi currency bank account will help manage your expenses and keep forex charges to the lowest possible. Volopay offers an online multi currency bank account that completely helps you get rid of currency conversion charges wherever applicable.

While a traditional bank account may allow you to transact in different currencies, you will have to bare all the currency conversion and remittance fees. This can be a costly affair. Businesses opt for a multi currency bank account to avoid the hefty fees of a normal bank account for international transactions.

As a business dealing in multiple currencies, the best way to store or hold money in separate currencies is by creating an online multi currency bank account. This will let you make payments in various countries easily without having to open new bank accounts for each different currency.