Best corporate bank account in Singapore

Navigating the bustling landscape of corporate banking in Singapore demands a discerning eye for the ideal financial ally.

As businesses seek stability and growth, choosing the best corporate bank account Singapore has to offer becomes paramount. Beyond conventional offerings, the nuances of interest rates, transaction fees, and tailored services differentiate the contenders.

Singapore's financial hub status presents a myriad of options, each with its own unique set of offerings. Delving into this realm requires a strategic approach, weighing the merits of accessibility, digital capabilities, and financial expertise.

The journey to find the optimal corporate bank account is a nuanced exploration of financial landscapes and tailored solutions.

What is a corporate bank account?

A corporate bank account is a specialized financial account tailored for businesses and corporations. It serves as a central hub for managing financial transactions, including deposits, withdrawals, and electronic transfers. These accounts often offer business-specific features such as payroll processing, bulk transactions, and business loans.

They play a crucial role in maintaining the financial health of a company, providing a dedicated platform for handling corporate finances, ensuring transparency, and facilitating seamless business operations within the regulatory frameworks of the banking sector.

5 best corporate account in Singapore

1. Volopay

Overview

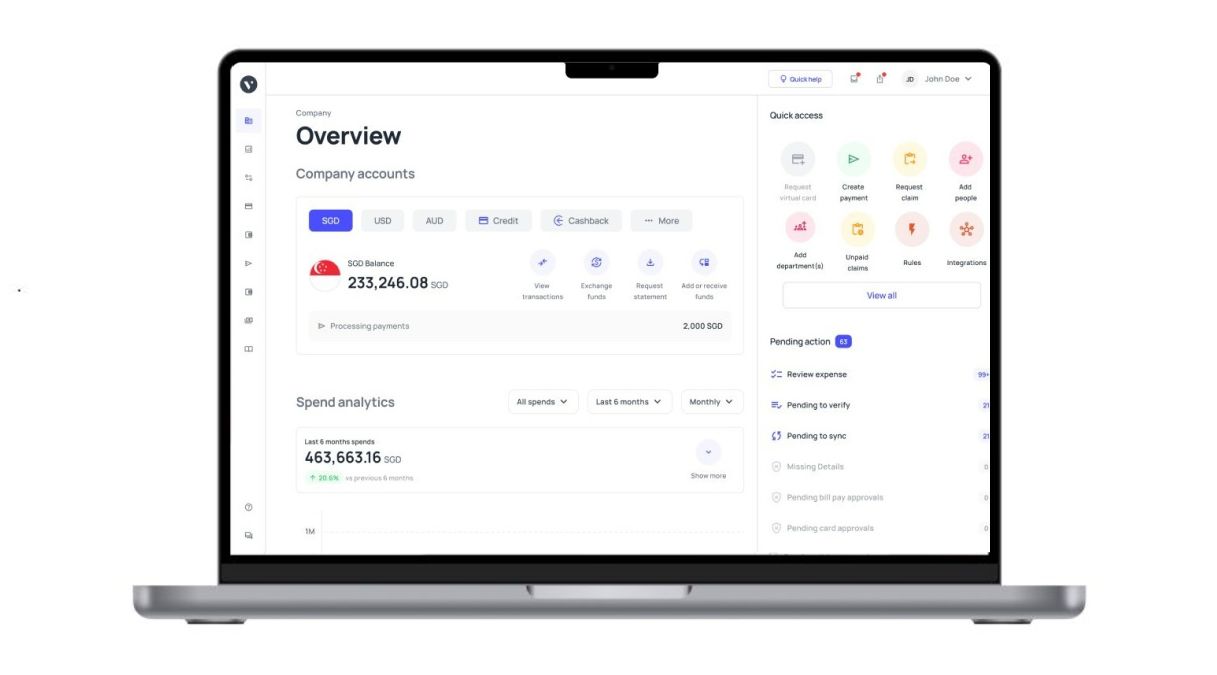

The Volopay business account positions itself as a modern business account solution tailored for businesses. With a focus on simplicity and efficiency, Volopay aims to streamline corporate finances with innovative features and a user-friendly interface.

Unique features and advantages

● Expense management

Volopay excels in expense management, providing businesses with tools to track and control expenses in real-time. This feature is particularly beneficial for companies looking to optimize their spending.

● Corporate cards

Volopay offers both physical as well as virtual corporate cards, empowering businesses to manage employee expenses efficiently. The integration of corporate cards simplifies the reimbursement process and enhances control over company spending, making Volopay one of the best business account provider in Singapore.

● Multi-currency support

For businesses engaged in international transactions, Volopay supports multiple currencies, facilitating seamless cross-border payments and reducing currency exchange complexities.

Customer reviews

Customer reviews and testimonials praise Volopay for its user-friendly interface, efficient expense management tools, and responsive customer support. Businesses highlight the platform's ability to enhance financial control and streamline expense processes.

2. DBS business account

Overview

DBS, another one of the best corporate bank account Singapore banking landscape has, offers a comprehensive suite of business banking solutions. Known for its digital prowess, DBS aims to provide businesses with the tools they need for financial success.

Unique features and advantages

● Digital banking services

DBS is recognized for its robust digital banking services, allowing businesses to manage their accounts, make transactions, and access financial insights conveniently through online platforms.

● Business loans and financing

DBS provides various financing options, including business loans, trade financing, and working capital solutions, catering to the diverse financial needs of businesses.

● DBS IDEAL

The DBS IDEAL platform offers a range of treasury and cash management services, providing businesses with sophisticated tools for liquidity management and financial decision-making.

Fees and charges

DBS's fee structure varies based on the type of account and services utilized. Common charges include account maintenance fees, transaction fees, and fees associated with additional banking services. Monthly fees start at approximately S$40, businesses are, however, encouraged to review the detailed fee schedule to align with their financial requirements.

Customer reviews

Customer reviews often commend DBS for its digital banking experience, robust financial tools, and responsive customer service. Businesses appreciate the bank's commitment to innovation and its ability to cater to both small enterprises and large corporations.

3. OCBC business account

Overview

OCBC, a leading financial institution in Singapore, extends its offerings to businesses with a suite of business banking solutions. The bank's commitment to customer-centric services and technological innovation positions it in the list of best corporate bank account Singapore has available.

Unique features and advantages

● OCBC Velocity

OCBC Velocity is a digital platform that offers comprehensive cash management and treasury services. It businesses to manage accounts, make payments, and access financial insights seamlessly.

● Global trade financing

OCBC's expertise in trade financing is a notable advantage for businesses engaged in international trade. The bank provides solutions for trade financing, import/export financing, and supply chain financing.

● Business Insurance Solutions

OCBC offers a range of business insurance solutions to help companies mitigate risks and protect their assets. This holistic approach to financial services enhances the bank's value proposition.

Fees and charges

OCBC's fee structure includes charges for factors such as the number of accounts, users, account maintenance fees, transaction fees, and charges associated with specific banking services. Pricing for the OCBC business account starts at approximately S$35 and the first 3 months are waived.

Customer reviews

Customers often laud OCBC for its user-friendly digital platforms, efficient cash management tools, and personalized customer service. The bank's commitment to understanding the unique needs of businesses is reflected in positive testimonials.

4. UOB business account

Overview

United Overseas Bank (UOB) is a key player in the Singaporean banking sector, offering a range of business banking solutions. UOB's emphasis on innovation and personalized services sets it up amongst the best corporate bank account Singapore has for businesses of all sizes.

Unique features and advantages

● UOB Business Internet Banking Plus (BIBPlus)

UOB's digital banking platform, BIBPlus, provides businesses with a suite of online banking services, including fund transfers, trade financing, and account management.

● UOB business loans

UOB offers various business loan options, addressing the financing needs of businesses. From working capital loans to expansion financing, UOB provides tailored solutions.

● Business advisory services

UOB goes beyond traditional banking by offering business advisory services, providing businesses with insights and strategies for growth and sustainability.

Fees and charges

UOB's fee structure encompasses account maintenance fees, transaction fees, and charges associated with specific banking services. Businesses are required to provide a minimum initial deposit of S$1000 and there is a monthly fall below fee of S$15.

Customer reviews

Customers appreciate UOB for its personalized approach, innovative digital banking solutions, and commitment to understanding the unique challenges faced by businesses. Positive testimonials often highlight the bank's role as a strategic financial partner.

5. CIMB SME account

Overview

CIMB, a prominent banking institution, caters to the needs of small and medium-sized enterprises (SMEs) through its CIMB SME Account. With a focus on simplicity and accessibility, CIMB aims to provide tailored solutions for SMEs.

Unique features and advantages

● CIMB BusinessGo

CIMB BusinessGo is the bank's digital banking platform, offering a range of online banking services for SMEs. From account management to fund transfers, businesses can leverage digital tools for efficiency.

● SME financing solutions

CIMB provides various financing options for SMEs, including working capital loans, business expansion financing, and trade financing. This enables SMEs to access the capital needed for growth.

● Merchant solutions

CIMB offers merchant solutions for businesses involved in retail or online sales. This includes payment processing services, enhancing the overall customer experience for businesses.

Fees and charges

Like most of the best corporate bank account Singapore has on this list, CIMB's fee structure also includes account maintenance fees, transaction fees, and charges associated with specific banking services. The bank requires a monthly fee of S$28 for account maintenance and has no minimum monthly balance or fall below fees required.

Customer reviews

Customer testimonials often highlight CIMB's focus on SMEs, the user-friendliness of its digital banking platforms, and the accessibility of financing options. SMEs appreciate the bank's commitment to understanding and addressing their unique challenges.

Enjoy hassle-free business transactions!

Importance of having a corporate bank account

1. Legal requirement

Businesses must establish a corporate bank account; Singapore advises it as a prerequisite for businesses. It delineates personal and business finances, ensuring transparency and adherence to regulatory standards.

Operating without a designated corporate account may expose businesses to legal complications, underscoring the necessity of this foundational step.

2. Financial management

A corporate account or company bank account serves as the epicenter of a company's financial management. It provides a centralized platform for monitoring cash flow, tracking expenses, and reconciling transactions.

This clarity is indispensable for informed decision-making and strategic financial planning.

Suggested read: How to increase cash flow in a business?

3. Credibility

A dedicated corporate bank account enhances a company's credibility. It signifies professionalism and stability, instilling confidence in clients, suppliers, and partners.

This separation of personal and business finances underscores a commitment to sound financial practices, fostering trust in the business ecosystem.

4. Tax compliance

Maintaining a corporate account is pivotal for tax compliance. It facilitates the segregation of personal and business transactions, streamlining the process of documenting income, expenses, and deductions.

Come tax season, this organized approach eases the burden of compliance and reduces the risk of errors.

5. Professional image

A corporate bank account contributes to the cultivation of a professional image. It reflects a commitment to business formalities and financial responsibility.

For startups and small businesses aiming to build a reputable brand, having a dedicated corporate account is an essential step in projecting a polished and trustworthy image.

6. Business expansion

As businesses grow, so do their financial complexities. A corporate bank account or company bank account provides the infrastructure necessary for handling increased transaction volumes, managing payroll for a growing workforce, and accessing financial tools that support expansion initiatives. It is a linchpin for scalability.

7. Financial security

Separating personal and business finances through a corporate bank account enhances financial security. It shields personal assets from business liabilities and vice versa.

In the event of unforeseen challenges, such as legal disputes or financial downturns, this demarcation safeguards personal savings and assets.

8. Payment processing

Corporate bank accounts are designed to facilitate efficient payment processing.

Whether receiving payments from clients or disbursing salaries to employees, these accounts offer streamlined payment solutions. This efficiency not only saves time but also contributes to the smooth functioning of day-to-day financial transactions.

9. Audit trail

The transactional history and documentation provided by a corporate bank account create a robust audit trail. This trail is invaluable during internal audits, regulatory inspections, or in the event of disputes.

It provides a transparent record of financial activities, aiding in accountability and compliance.

10. Compliance with banking regulations

Corporate bank accounts are subject to banking regulations, ensuring that businesses operate within legal frameworks. This compliance is not just a legal requirement but also a testament to a company's commitment to ethical and transparent financial practices.

Staying abreast of banking regulations is crucial for avoiding penalties and maintaining financial integrity.

11. Employee payroll

Managing employee payroll is a critical aspect of business operations. The best corporate bank account Singapore has to offer facilitates seamless payroll processing, allowing for timely and accurate salary disbursements. This contributes to employee satisfaction and organizational efficiency.

Related read: A comprehensive guide on payroll in Singapore

12. International transactions

For businesses engaged in international trade or collaborations, a corporate bank account is indispensable. It provides the infrastructure for handling foreign transactions, currency exchanges, and international wire transfers.

This global financial connectivity is vital for businesses with a footprint beyond national borders.

You might be interested to read - Guide to international money transfer charges in Singapore

What are the factors to consider while choosing a corporate bank account?

1. Regulatory compliance and licensing

Foremost among the considerations is ensuring that the chosen bank complies with regulatory requirements and possesses the necessary licenses. This establishes a foundation of legal adherence and financial integrity.

All the best corporate bank account Singapore has will transparently communicate their compliance status, instilling confidence in businesses seeking a trustworthy financial partner.

2. Account fees and charges

Understanding the fee structure associated with a corporate bank account is essential. Consider account maintenance fees, transaction charges, and any other potential costs.

A transparent fee schedule allows businesses to anticipate and budget for financial expenditures, preventing unwelcome surprises.

3. Online banking services

In the digital age, the efficiency and accessibility of online banking services are paramount. Evaluate the bank's online platform for ease of use, functionality, and security.

Seamless online banking facilitates convenient transaction management, real-time monitoring, and timely decision-making are all important markers.

4. Interest rates on deposits

For businesses maintaining substantial balances, the interest rates offered on deposits become a crucial factor.

While corporate accounts typically yield lower interest than personal accounts, comparing rates among different banks ensures that idle funds generate optimal returns.

5. Additional services and features

Beyond the basics, consider the array of additional services and features offered by the company bank account. This may include business loans, credit lines, merchant services, or specialized business solutions.

A comprehensive suite of services allows businesses to consolidate their financial needs under one roof.

6. Customer support and service levels

The quality of customer support is a barometer of a bank's commitment to its clients. Assess the responsiveness, accessibility, and expertise of the bank's customer support team.

In times of need or query, prompt and knowledgeable assistance is invaluable for businesses navigating complex financial matters.

7. Integration with accounting software

Efficient financial management often involves seamless integration with accounting software. Confirm that the bank's systems are compatible with popular accounting platforms. This integration streamlines bookkeeping, reduces manual errors, and enhances overall financial efficiency.

8. Security and fraud protection

The security of financial transactions is non-negotiable. Evaluate the bank's security protocols, encryption measures, and fraud protection mechanisms.

A robust security framework ensures the safety of funds and sensitive financial information, safeguarding businesses from potential threats.

9. Multi-currency accounts

For businesses engaged in international transactions, the availability of multi-currency accounts is a critical consideration. This feature simplifies cross-border transactions, mitigates currency exchange risks, and enhances the global financial versatility of the business.

10. Ease of account opening and documentation requirements

A streamlined account corporation bank account opening process is conducive to business operations. Evaluate the documentation requirements and the overall ease of initiating a corporate account with the bank.

A transparent and efficient onboarding process minimizes administrative hassles for businesses.

11. Reputation and track record of the bank

The track record and reputation of the bank serve as a litmus test for its reliability. Researching the bank's background, financial stability, and standing in the business community is crucial.

The best corporate bank account Singapore has to offer should come with a positive track record that bodes well for an enduring and secure financial partnership.

12. Reviews and testimonials

Real-world experiences shared by other businesses provide valuable insights. Explore reviews and testimonials from other companies that have chosen the same bank.

This firsthand feedback offers a glimpse into the practical aspects of the banking relationship, helping businesses make informed decisions.

All-in-one solution for your business!

How to open a corporate bank account in Singapore?

1. Choose the right bank

Selecting the best corporate bank account is a foundational decision when undertaking a corporation bank account opening. Consider factors such as the bank's reputation, range of services, fees, and digital capabilities.

Researching and comparing offerings from different banks will help align the chosen bank with the specific needs of the business

2. Submit required documents

Collect the essential paperwork needed for the application. Typically, Singaporean banks demand documents like the company's certificate of incorporation, business profile, information about directors and shareholders, and proof of address. Organizing these documents facilitates a smoother application process.

3. Apply online

Many banks in Singapore offer the convenience of online application processes. Visit the chosen bank's website and navigate to the corporate banking section.

Follow the online application instructions, providing accurate and up-to-date information as required.

4. Complete application form

Fill out the corporate bank account application form thoroughly and accurately. This form captures essential details about the business, its structure, and the individuals associated with it.

Be prepared to provide information such as the business's nature, anticipated transaction volumes, and details of authorized signatories.

5. Wait for approval

After applying, patiently await the bank's approval. The processing time may vary depending on the bank and the complexity of the application.

During this period, banks may conduct background checks and verify the submitted documents.

6. Make initial deposit

Once the application is approved, the next step is to make the initial deposit. Different banks have varying minimum deposit requirements, so ensure that the initial deposit aligns with the bank's stipulations. This deposit establishes the financial foundation for the corporate account.

7. Activate your account

After the initial deposit, the corporate bank account is ready to be activated. This may involve visiting the bank in person or following additional online procedures.

Some banks provide secure online portals for account activation, making the process convenient for businesses.

Why should you choose Volopay corporate bank account for your business?

Choosing Volopay for your corporate banking needs unveils a host of advantages, all of which cater to the modern demands of financial management.

Here's why businesses should consider opting for the flexibility and efficiency that Volopay offers:

1. Flexible and easy to open

Volopay stands out as one of the best business account in Singapore because of its user-friendly and flexible account opening process.

Businesses can navigate the application seamlessly, making the onboarding experience hassle-free.

The simplicity of the process ensures that companies can establish their corporate bank account with ease, saving time and administrative effort.

2. Customized corporate cards

Volopay goes beyond the conventional by providing businesses with the option to customize corporate cards according to their specific needs. This flexibility allows companies to tailor their corporate spending solutions, aligning with their unique financial requirements and operational preferences.

Check out our article on best corporate credit card in Singapore to discover alternative options, compare their features, and understand why Volopay stands out as the preferred choice.

3. Easy to do international transactions

Volopay provides an effective solution for facilitating international transactions, simplifying the process of cross-border payments.

This capability is especially beneficial for businesses operating on a global scale, alleviating the challenges commonly associated with overseeing financial activities across diverse countries.

4. Multi-currency support

Volopay recognizes the diversity of today's business landscape and provides robust multi-currency support. This functionality allows businesses to operate in different currencies without the burden of constant currency conversions.

It simplifies financial management for companies involved in international trade or with diverse global transactions.

5. Monitor and track your spending

Volopay empowers businesses with tools to monitor and track their spending in real-time. This transparency ensures that companies have a clear understanding of their financial activities, enabling them to make informed decisions and optimize their spending patterns for greater efficiency.

6. Real-time insights

The provision of real-time insights sets Volopay apart as a forward-thinking corporate banking solution, another reason why it falls amongst the best corporate bank account Singapore has to offer.

Businesses can access up-to-the-minute information on their financial activities, allowing for agile decision-making and proactive financial management. Real-time insights are crucial in a fast-paced business environment.

7. Seamless integration with accounting tools

Volopay recognizes the significance of effortless integration with accounting software. The platform is designed to seamlessly connect with various accounting tools, simplifying financial management processes.

This integration enhances accuracy, reduces manual workload, and ensures consistent updates of financial data across different platforms.

Fuel your business growth with Volopay

FAQ’s on corporate bank account

Volopay business account opening is typically instantaneous, however, it can vary from case to case. The platform is designed for efficiency, and the user-friendly interface streamlines the application process.

However, the exact duration can depend on factors such as the completeness of the application and the internal processes of Volopay. Generally, the aim is to provide a quick and hassle-free account opening experience.

The best features of the Volopay business account include its flexibility and ease of opening, customized corporate cards, simplified international transactions, multi-currency support, real-time spending monitoring, and seamless integration with accounting tools. These features collectively contribute to a robust and adaptable financial management experience.

To apply for a Volopay corporate account, businesses can initiate the process by visiting the Volopay website. The platform typically provides an online application process, allowing users to follow step-by-step instructions for account opening.

The application process is designed to be user-friendly, and businesses can expect guidance on providing necessary information and documentation for a seamless experience.

Yes, Volopay business account offers the advantage of customizable corporate cards (physical as well as virtual) according to the specific needs of the business.

This customization allows companies to tailor their corporate spending solutions, aligning with unique financial requirements and operational preferences.