👋 Exciting news! UPI payments are now available in India! Sign up now →

What is virtual bank account, its features and how it works

As finance and financial management grow to be more and more digital every day we have new, more advanced tools of finance coming up.

Even banking and bank accounts have become more digital than ever before. This digitalization has given birth to one of the most talked about modern tools of business - the virtual bank account.

Banks and payment service providers across the globe are developing and pushing virtual bank accounts as an upgrade to traditional forms of banking.

However, before jumping on the bandwagon, you must consider the implications and prospects of what is a virtual bank account and how it may benefit your business in the long run.

What is a virtual bank account?

Generally speaking, a virtual bank account is not very different from your traditional bank account. They both perform the same functions, only that virtual accounts can be fully operated from a mobile or desktop platform.

Virtual accounts are also equipped with a unique identification number and are able to carry out payments in the same way a normal account does.

Banks do not classify them as separate from physical accounts while conducting transactions or completing accounting tasks.

The major difference between a traditional and a virtual account is that the latter doesn’t hold or contain a closing balance. Instead, it is linked to a primary account that does.

How do virtual bank accounts work?

The virtual or online virtual bank account functions similarly to a traditional bank account, only that it does not have the ability to hold a balance.

This is because it doesn’t settle any payments. They can only receive money, collect necessary information about the sender, and pass it over to a primary account.

The way a virtual account works is via a primary physical account. This physical account acts as a holding base, while the virtual account acts as a vessel that carries transactions to and from the primary account.

1. Account creation and setup

Creating a virtual account is easy. Instead of having to go to a bank branch, all you’ll need to do is fill out some details digitally to generate an account number. A KYC is also not required, as your bank will already have performed a KYC process for your main bank account. All it takes is a few minutes before you are given an account number.

2. Fund segregation and tracking

Because virtual accounts don’t have a physical existence, they act as doors into your main or physical bank account, where money can pass through when you pay with a virtual account number or someone sends money to your virtual bank account.

The funds, however, are stored in your physical account. What you get instead is better tracking of where your money is coming from and going.

3. Transaction process

As you can’t store money in your virtual accounts, any virtual bank account for business will draw or receive its funds into the main account. If you are a seller utilizing virtual accounts, you’ll send your virtual account online number to your customers.

When they input that number as the receiver, you’ll receive the money in your main bank account.

4. Reconciliation and reporting

With virtual accounts, reconciling your transactions can be much easier to do. Typically, you won’t be able to see who sent you money unless you are going through each transaction manually.

However, a virtual account allows you to track which of your customers is paying to that specific account number. You’ll spend less time manually poring over your bank statements.

Suggested read: What is account reconciliation, its types, and best practices

Virtual accounts vs traditional bank accounts - What are the differences?

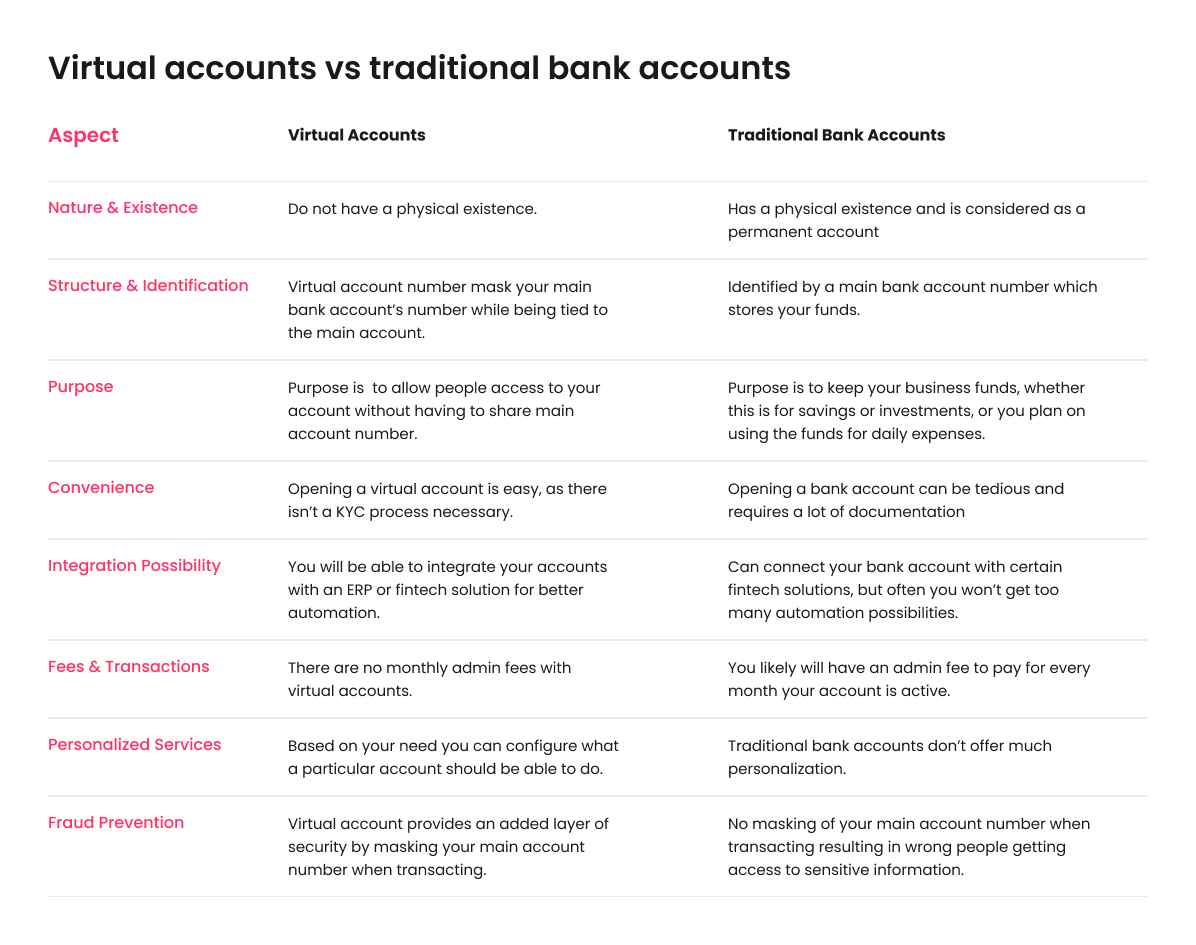

There are several key differences between virtual accounts and traditional bank accounts. Often, they’re meant to be used in tandem with each other to get the best benefits of both.

By noting what their differences are, you’ll have a better understanding of how you can use both for various purposes.

1. Nature and existence

● Virtual accounts

As the name suggests, virtual accounts only exist virtually. This means that they do not have a physical existence. Virtual accounts are also temporary as they cannot store funds.

● Traditional bank accounts

A traditional bank account has a physical existence, meaning that you can use it to store your funds. When you create your physical bank account, it’s also considered a permanent account unless you close it.

2. Structure and identification

● Virtual accounts

Each virtual account that is created is identified by the unique account number generated specifically for the account. They mask your main bank account’s number while still being tied to the main account.

● Traditional bank accounts

Virtual accounts send and receive their funds through the main account they are linked to. You’ll have one main bank account number, which stores your funds but can be risky to give out the number.

3. Purpose

● Virtual accounts

Think of virtual accounts as doors that lead to your traditional bank account. Their purpose is not to store money, but rather to allow people access to it without having to give them your main account number.

● Traditional bank accounts

You’ll use a traditional bank account to keep your business funds. Whether this is for savings or investments, or you plan on using the funds for daily expenses, you’ll need a traditional account.

4. Accessibility and convenience

● Virtual accounts

Opening a virtual account is easy, as there isn’t a KYC process necessary. This makes them convenient, especially when you want to assign different paying customers an account number each.

● Traditional bank accounts

While traditional bank accounts have their own role in storing funds and settling money, opening a bank account can be tedious and requires a lot of documentation. They can also be complicated to maintain.

5. Integration and automation possibility

● Virtual accounts

Your virtual accounts can be automatically integrated into your main physical bank account. Often you will also be able to integrate your accounts with an ERP or fintech solution for better automation.

● Traditional bank accounts

You can connect your bank account with certain fintech solutions, but often you won’t get too many automation possibilities without the help of virtual accounts. You may need virtual accounts to automate transaction categorization.

6. Fees and transactions

● Virtual accounts

Unlike traditional bank accounts, there are no monthly admin fees with virtual accounts. Some virtual accounts may also allow you to bypass the commission fee that you have to pay per transaction with other payment gateways.

● Traditional bank accounts

Given the fact that bank accounts are traditionally more difficult and expensive to maintain, you likely will have an admin fee to pay for every month your account is active. Transacting between different banks may cost a small fee.

7. Personalized services

● Virtual accounts

There are different types of virtual accounts you can create. Depending on whether you need them for single or multi-use, for example, you can configure what a particular account should be able to do.

● Traditional bank accounts

On the other hand, traditional bank accounts don’t offer much personalization. While there may be several options available to you when opening the account, you are largely restricted to just those options.

8. Fraud prevention

● Virtual accounts

Using a virtual account to transact on behalf of your physical bank account helps you mask your account number. This provides an added layer of security and prevents criminals from accessing sensitive information.

● Traditional bank accounts

Your bank account number may not be something that you’re willing to give to just anyone, especially when the wrong people could misuse it. You can hide them by using virtual account numbers.

Unlock efficiency and control with virtual accounts for your business

What are the types of virtual accounts?

Although virtual accounts can be categorized by the different settings that you choose to get them to function exactly as you want, it’s more efficient for businesses to categorize them by their functions.

Here are several main types of usage that you will see a virtual account be beneficial for businesses.

1. Receivables virtual accounts

One of the most useful things about using a virtual bank account for business is that you can automate your accounts receivable reconciliation. Virtual accounts made for this purpose will allow you to identify each incoming transaction easily. With receivables virtual accounts, you can assign each of your paying customers a virtual account online.

Through a virtual account API, each account number can be automatically generated and used by your customers instantaneously. Integrating your accounts with an ERP platform will help you automatically reconcile incoming transactions.

2. Payables virtual accounts

On the flip side, virtual accounts are incredibly useful for accounts payable. When your vendors assign you virtual account numbers, you’ll be able to use them to pay your vendors quickly and easily.

There’s no need to worry about all the bank account details. While keeping every payment receipt is still good practice, the payments you make through virtual accounts will automatically be logged on your vendors’ accounts as well as your own. Pay directly to your vendors in less time with virtual accounts.

3. Escrow virtual accounts

Not all virtual accounts have to be created on top of your main banking account. You can also create a virtual account online on top of an escrow account, making the account temporary. This means that while the money may sit in the escrow account after the transfer has been initiated with a virtual account number, that fund will then be transferred to the recipient once the agreed-upon conditions have been met. This also works if you’re sending or receiving payments through a virtual account with a payment gateway.

4. Disbursement virtual accounts

Virtual accounts can be used by a provider to top up their customers’ wallets or accounts through payments from the customers’ clients.

For example, a financial technology company can provide its customers with a virtual account number to pass around as they see fit to their payers. Instead of those payers paying the fintech company and the company doing disbursements to its customers, payers can pay directly to each dedicated wallet. This means that the money transfer process is a lot more instantaneous.

5. Customer payment virtual accounts

Handing each of your customers a unique virtual account number is a surefire way to improve customer experience, especially when making payments.

More importantly, however, is that this means you’ll get payments made and identified much faster. These accounts will be created specifically with the paying customers in mind, meaning that you’ll be able to identify which of your customers have paid.

While this is often associated with e-commerce businesses, virtual accounts for customer payments are useful for any business managing a large payment volume.

6. Event virtual accounts

You have the ability to pick the specific functions you want to have on each virtual account you create. With a single-use function, you’ll be able to manage one-off payments more efficiently.

If your business is holding a temporary event or project, for example, you can generate virtual accounts and know that every single payment that comes through a virtual account online is for that particular event.

After the event is over, you can simply disable and close all virtual accounts that were created for that purpose.

What are the main features of a virtual account?

1. Highly secure platform

Virtual accounts function on highly secure platforms and therefore provide a guaranteed level of security. Virtual accounts use virtual IBANs which are encrypted to ensure consumer data is always kept secure.

The encryption of the platform makes sure that an extra layer of security is provided that physical accounts don’t.

Additionally, virtual accounts come with multi-factor authentication and biometric login features to your mobile apps and online bank accounts for added security.

2. Ease of access to banking services

Unlike a traditional bank account, virtual accounts do not require a physical location to operate out of.

This makes for much easier access to banking services. Virtual accounts can be easily accessed online from a mobile device or a desktop, anytime and anywhere.

3. Multi-currency support

Another key feature of virtual accounts is multi-currency support. You could be based out of one country and still pay and receive money in multiple currencies from different countries.

For example, if you were a merchant based out of India and wanted to accept payments from the US, all you need to do is create an online virtual bank account that accepts USD payments.

This means you no longer have to set up multiple bank accounts in different countries to work with multiple currencies. Not only does this feature help companies expand their global reach but it also reduces costs on forex fees and conversion charges.

4. Faster processing of transactions

Virtual accounts work way faster than traditional accounts do. With a traditional account, there would be a lot of hoops to jump through before making a transaction successful.

However, with a virtual account, it is possible to make same-day or even instant transfers, making the processing of transactions much faster.

5. More visibility into business spends

Another great feature of virtual bank accounts are the dashboards or payment platforms that come attached to the accounts. These dashboards or platforms allow you to track and manage every single penny you spend with that account.

This can help you highlight areas of spending, identify spending patterns and gain an overall increased level of visibility over all your business spending.

6. Low cost & more savings

You can save a lot of money in banking fees simply by using a virtual account.

Traditional banks typically charge high FX transfer fees. Virtual accounts, on the other hand, have their own pricing models that usually come with small convenience fees, much lower or zero transaction fees, and no hidden charges.

Related read: How to open a business bank account in India

7. Easy reconciliation

One feature that encourages many businesses to start using virtual accounts is that you can automate payment reconciliation, which is useful for both one-time and recurring payments from customers.

Instead of having to manually reconcile hundreds or thousands of transactions daily, businesses can open as many virtual accounts as they need and assign them to customers to easily track where each payment comes from.

8. API integration

You’ll be able to create and manage your virtual accounts through your API, which can be integrated with other systems that you use for your business. Integration with your finance management or accounting platforms, for example, will make it much easier to have your transactions automatically reflected and ready to log. No more manually passing or moving around data.

9. Transaction reporting

Get automatic transaction reports through the use of virtual accounts. You’ll be able to export the transaction data in multiple formats, making it easier for you to keep accurate and detailed records of customer transactions.

By directly integrating your virtual accounts with other systems such as your ERP, transaction reports will also be easily and automatically available to you on those platforms.

Explore the future of financial management with Volopay

What are the main applications of a virtual account?

While most commonly thought to be useful for receivables and reconciliation, you’ll find that that’s not the only application for a virtual account. Many processes will become much easier to do for you and your employees when you use virtual accounts.

Here are some ways virtual accounts prove to be effective for you.

1. Corporate cash management

As a whole, the application of a virtual bank account in your business will assist and improve the way you manage your company’s cash.

Virtual accounts are easy to create and don’t require all the tedious steps of opening a new physical bank account, meaning that you can manage your cash all through a single account effectively.

Suggested read: Ultimate guide on cash flow management

2. Receivables management

When you send a lot of invoices to customers, it can get difficult to track which invoices have been paid. Even when you see that your bank balance has increased, you’ll still need to manually reconcile each payment and find out the sender.

When you assign each customer a virtual account, however, you won’t need manual reconciliation.

3. Payables management

Using virtual accounts doesn’t only make your accounts receivable and reconciliation easier.

On the flip side, as a customer of another supplier, being able to use a virtual account online to pay your supplier also saves you plenty of time and enables you to shorten and simplify your accounts payable cycle.

Related read: What is accounts payable management, its process and how to automate it?

4. Escrow services and fund management

Escrow services can utilize virtual accounts to make the transfer of funds between all parties easy. With the nature of virtual accounts being temporary and easy to open and close as needed, there’s no hassle in having to manage these accounts. Businesses can feel more secure managing their funds through virtual accounts.

5. Supplier and vendor management

It’s much simpler to collect a vendor’s virtual account number than having to get a lot of different details from each vendor.

With a traditional bank account, you may have to get additional details like the bank branch, vendor address, and many more. Simplify your supplier and vendor management when paying with virtual accounts.

Who grants virtual accounts to businesses?

Virtual accounts are provided to businesses by different banks and payment service providers based on the country the business is working in.

In India, for example, virtual accounts are provided by banks such as Axis, ICICI, HSBC, and so on while these virtual accounts and their activities are regulated by the RBI or Reserve Bank of India.

In Singapore, on the other hand, Singtel & Grab, Sea Limited, and other banks provide virtual accounts while the regulatory body is the MAS or Monetary Authority of Singapore.

Australia, on the other hand, operates in a highly regulated environment that is primarily overseen by three independent government agencies: the Australian Prudential Regulation Authority, the Australian Securities and Investments Commission, and the Reserve Bank of Australia.

How to open virtual bank account for business?

The exact process for opening a virtual bank account for business will differ from country to country and provider to provider.

To be eligible to open an online virtual bank account for a business you will either need to have a registered business or meet the required transaction volume.

Generally speaking, you will need to provide documentation as proof of business, residence, and so on. In India, for example, you will need to complete a KYC process to be able to open a virtual bank account.

Open a virtual account for seamless financial management and growth

What is the process of implementing virtual accounts?

Once you decide that you want to be using virtual accounts for your business, you’ll have to draft out a plan on what is the best way to introduce your new tools. You want to keep these points in mind to make the implementation process as smooth as possible for you and your employees.

1. Assess needs and objectives

Before even beginning to introduce the usage of virtual accounts within your organization, the first thing you want to do is assess where your business is currently and what your pain points are.

Consider how using a virtual account will be able to help you solve those problems. You also want to list some objectives you want to achieve with virtual accounts.

2. Partnering with financial institutions

There are many financial institutions in Singapore that will be able to provide you with a virtual account. This could be the bank that you have your main account opened with or another financial institution that can offer you the ability to create virtual accounts to manage your finances.

Make sure that you do thorough research before choosing which institutions to partner with.

3. Define virtual account structure

There are many types and features of virtual accounts, each giving you different benefits. It’s important that you understand which virtual account functions align the best with your business needs.

This will help you define a structure and allow you to provide yourself with the right virtual account number example for each use case, which will be helpful in the long run.

4. Integration with existing systems

First, you want to make sure that your virtual account partner has the right integration capabilities to help support you. Many will be able to integrate with your current ERP, finance management platform, and other systems.

The integration will be helpful in numerous ways, so find out if your banking partner can help you set them up before you get started.

5. Set up access control

When you introduce virtual accounts to your organization, you want to properly set up the rules around it. This includes who gets to access your virtual accounts and who are the people responsible for them.

You should also determine who has the right to generate a virtual account online. Assign roles and let everyone know what their roles are, along with the appropriate access controls.

6. Staff training and onboarding

While virtual accounts are not difficult to use, it’s still highly recommended that you conduct training sessions. This ensures that all your employees are well-educated on how to use virtual accounts and know who they should go to if they have questions.

After your staff has been trained, you’ll want to help them get onboarded so that they can start using virtual accounts.

7. Conduct thorough testing of the account

It’s unwise to get started with your virtual accounts without first making sure that everything is working as you intended. When you get access to your virtual accounts, make sure that you first test them.

Create a few accounts for transaction testing and familiarize yourself with how they work. Only proceed once you’re comfortable with them and are confident they work.

8. Gradual rollout

It can be overwhelming both for staff and managers alike to utilize virtual accounts for everything you plan immediately, especially if you haven’t previously used them.

What you want to do instead is to have a plan where you can gradually roll out your virtual account implementation. If you are assigning virtual account numbers to customers, for example, do it one small group at a time.

9. Monitor and evaluate

As with any other implementation process, it’s necessary that you monitor not just the initial implementation but also after that. Your employees may have more feedback once they are properly familiar with using virtual accounts, which you’ll want to take into consideration.

Have a proper evaluation process in place and conduct reviews regularly so that you can continuously improve your virtual account usage.

10. Compliance and regulatory considerations

The regulations on many digital payment methods can change from time to time, with virtual accounts being no exception to this. Work together with your legal and compliance team to find out what the regulatory requirements are at the time of implementation.

Make sure you take these into account and comply with all related regulations. Any future regulatory changes should also be taken into account.

What are the challenges associated with implementing virtual accounts?

Virtual accounts undoubtedly will bring a lot of benefits and positive changes to your organization, starting with easier reconciliation to customer convenience.

However, they do come with their own set of challenges. Make sure that you acquaint yourself with them and come up with a plan to tackle them before you get started.

1. Integration complexity

Your virtual accounts will not exist in a vacuum within your organization. You’ll want to integrate them with other tools you have in place, particularly your ERP and finance management systems.

This may be somewhat complicated, especially when setting up in the beginning. Not to mention that you’ll have to first ensure all these integrations are possible.

2. Change management

While it may not be the most efficient, you’re likely to already have a working system to manage your payments.

Introducing virtual accounts will be a change to that—likely one that impacts many of your current processes and departments. This is why it’s crucial for businesses to establish how they will conduct change to employees.

3. Regulatory compliance

With digital payment methods growing in popularity, there are a lot of new regulations popping up, which you’ll have to note and follow.

Make sure you know what exactly these regulations are and what steps you have to take. Non-compliance with any regulations can lead to both legal and financial consequences for your business.

4. Migration plan

For many businesses, the plan is to give each paying customer a virtual account so that tracking and reconciling payments are much easier.

This, however, would require you to migrate from the current payment gateways you have to the new virtual account online system. You’ll have to plan accordingly and consider all involved.

5. System reliability

As you do need to rely on a digital system for payments with virtual accounts, it can be a challenge to guarantee that the system will always work.

The best way to avoid making it more complex than it should be is to ensure that your banking partner is a reliable one with good customer support.

Open a virtual account and transform your financial management

Increasing adoption of virtual accounts in different industries

With the increasing focus on digital payments and finance automation across many markets and industries, it’s no surprise that the usage of virtual accounts has also increased in multiple industries.

Plenty of players in different industries are aware that allowing each of their customers to pay with a virtual account online is beneficial for all parties involved.

Manufacturing

Manufacturing companies receive and hold large amounts of funds in their physical bank accounts. Most of the companies they work with will also be of the same caliber.

This makes it risky to pass around sensitive information such as bank account numbers, especially for fear of misuse of this information.

Using virtual accounts to identify payers without revealing physical account numbers mitigates risk.

Healthcare

As an industry that is often associated with large payment volumes and time-sensitive orders, virtual accounts offer a better way to get higher visibility of customer payments in a shorter time.

Allowing customers to automatically generate a virtual account number to send a payment shortens the cycle. With the addition of automated reconciliation, businesses can begin fulfilling their orders faster without having to worry about unfinished transactions.

Hospitality and travel

When faced with the confirmation and payment page for a travel booking, customers may get cold feet. This is especially true if the payment method is complicated, as it allows plenty of room for doubt.

By offering your customers a simple and easy payment method that takes no time at all via the use of virtual accounts, customers are less likely to change their minds.

Technology and IT service

Many technology and IT companies will already be trying to get ahead of the digitization trend, automating plenty of things to streamline processes. For companies that conduct business internationally, this is especially important, as the traditional and manual processes can be extremely lengthy.

Companies that sell their products and services to foreign customers can use virtual accounts to make payments easier and faster to receive.

Small and medium-sized enterprises (SMEs)

Most small and medium enterprises, or SMEs, have a limited number of employees. It’s no surprise that they won’t have plenty of people on the finance and accounting teams.

To lighten the administrative and manual workload of employees who are in those departments, SMEs use virtual accounts. Customers can make payments with a virtual account online, allowing employees to spend less time on reconciliation.

Startups and entrepreneurial ventures

Any business that is in the startup stage will be determined to focus its resources on what it thinks will allow it to achieve its fastest growth. Naturally, tedious administrative work is not included in those priorities.

However, considering how necessary processes like reconciliations are, startups and other entrepreneurial ventures will opt to use virtual accounts to lighten their load while allowing them to focus elsewhere.

Education

Those in the education sector can combine the use of virtual accounts with a student portal to automate many different processes involving payments.

By allowing students to pay their tuition through virtual accounts, for example, the system can automatically acknowledge that a particular student has made a payment. This will give them immediate access to otherwise locked content, such as their academic transcripts.

Retail and e-commerce

Some of the biggest use cases for virtual accounts are in the retail and e-commerce spaces, which makes sense considering that these businesses could receive hundreds or thousands of incoming transactions per day from paying customers.

With no previous way to track where every transaction comes from easily, automatically assigning each customer a unique virtual account number to pay their bill helps you know the source of each transaction.

How do Volopay virtual accounts function?

Creating a Volopay account will allow you to get access to a virtual account number that you can use to receive payments from your customers directly to your Volopay business account. You can use these funds to make expenses through Volopay, allowing you to pay your suppliers and make employee expenses easier.

Say you need to top up your Volopay wallet. At the same time, you know that you’ll have a payment coming in from one of your clients. However, that payment is typically made to one of your other bank accounts. This would mean that you’ll have to wait for the payment to be received on your other bank account and then initiate a transfer yourself to your Volopay business account. It’s tedious and a time-wasting process. Cut an entire step and let your clients transfer directly to your Volopay virtual account number.

Make the most of your virtual accounts by enabling wallets in foreign currencies within your account. With the help of multi-currency wallets, you can collect and store funds in multiple currencies with ease. Your money will be ready to use whenever you need to make a payment in any of those currencies. Conducting international business doesn’t have to be complicated!

Achieve clearer communication with your customers while streamlining your whole payment process. By taking out tedious and unnecessary steps in the process through the use of virtual accounts, you’ll receive funds faster and be able to use them for your expenses in a timely manner. With Volopay’s virtual accounts, all processes can happen on one platform.

Make expense management a breeze with Volopay

FAQs

The virtual international bank account number, also known as Virtual IBAN or vIBAN, works in a very similar way to the IBAN. The IBAN is essentially an International Bank Account Number. Bank accounts in most parts of the world, including the EU, are assigned an IBAN automatically. The IBAN is a 34-number and letter-based code that is unique to every bank account. This code tells a payment provider or bank where to send a payment.

Account matching is a key point of difference between IBANs and vIBANs. Normally, each unique IBAN has only one account linked to it. A virtual IBAN, on the other hand, allows you to have more than one unique vIBANS that are all sending payments to the same central bank account. What this means is that a virtual IBAN can function as a sub-account linked to a master, centralized account.

A VAN, or virtual account number, is a uniquely generated number that is associated with a particular virtual bank account. By generating an account and a VAN, companies can mask their physical account number. It provides security while still allowing you to make transactions on behalf of your physical account.

Yes. You can create a multi-use virtual account and give a particular customer that number. That way, you can associate the customer with that account number, giving you better tracking and control over the recurring payments.

Yes. In fact, plenty of businesses generate virtual account numbers to receive payments from customers. Instead of sending over their physical bank account details, businesses can send a unique VAN for customers to make a payment. This also helps them track who each payment is from.

You’ll have to first pick a banking partner or another financial institution that can support virtual accounts. Then, the process involves filling out a form and submitting several required details.

There’s no KYC process necessary, meaning that you can create your virtual account online in no time at all. Typically, the whole process will also be possible to do online.

No. Unlike your physical bank account, your virtual account does not have a physical presence and therefore cannot store funds that your debit card will be able to pull from.

However, considering that the virtual accounts you create will be linked with your main bank account, you can use your debit card in conjunction with the main account.