👋 Exciting news! UPI payments are now available in India! Sign up now →

Open business bank account in India

Opening a business bank account is one of the first tasks you must complete while establishing your company. Your business bank account will have all of your financial activities, profits, accounts payable, employee payroll, and more.

The nature of your business will determine whether you need one or not. However, having one is always advisable. Even for a small business, opening a business bank account will not be that difficult.

Why is business bank account important?

Business bank accounts are known by different names. They're also known as company bank accounts or corporate bank accounts. But they all mean the same thing. A business bank account is a separate account set up just for your company. It is the location where your company's funds are managed. You may also manage your other payments from here. This could include everything from payables to payrolls and credit repayments.

A business account can be a checking or savings account, comparable to the personal account options. It lets you keep the personal and business account separate. Furthermore, there are several advantages to having a business bank account (from the time of opening a business account to using a corporate account).

Your choice of bank account and the bank will be determined by your specific demands. Businesses should open a business bank account, regardless of how small the company is. Many banks provide additional support for small business bank accounts, including special incentives. As a result, there is no such thing as "too early" for opening a corporate bank account.

How does it work?

Business banking is distinct in that it is specifically designed to assist businesses and corporations in making the best financial decisions possible. As more businesses choose to open a corporate bank account, the area of business banking is rapidly expanding. The goal is for these financial institutions to assist large and small firms in making better use of their assets and making prudent financial decisions based on their current balances and creditworthiness.

Business banking safeguards your company's status, which is one of the most crucial features. For LLCs and corporations, business bank accounts serve as proof of their legitimacy. As a result, banks will offer your business more services. Small-term loans, low-interest credit allowances, spending management advisory, and payroll administration are just a few of the services available. Business banking is also safer and more fraud-resistant.

Also check out International money transfer regulations in India to know the regulations associated with international transfers in India.

Things you should look for when opening business bank account for your company

Opening process and account set up

Truckloads of paperwork and lengthy processing times are outmoded practices. Opening a corporate bank account is a highly regulated and computerized process. When choosing where to register a corporate account, make a note of which of your options has the best procedure for establishing a business bank account. Verify that you have all the paperwork required to open the account.

Spend minimum requirements

To open a bank account, you should have a minimum deposit requirement that must be satisfied. Additionally, you might need to keep a certain minimum amount to avoid paying penalties. But it's not just about getting money. Depending on the kind of account, some banks have a minimum spending requirement for accounts. Choose a bank with less stringent requirements and a lesser fee if your firm is just getting off the ground.

More accessible

The person whose name appears on the documentation is not accessible to a company bank account. Access to bank facilities is necessary for your finance team, accountants, compliance team, and some employees. Having a financial system with a robust and user-friendly web interface is always a good idea. For personnel to access information while on the go, make sure they have a mobile app.

Additional features and perks

Financial institutions understand how important it is to provide as many benefits to businesses as possible. Business bank account holders have a variety of extra benefits, especially if they open an SME bank account. Accounting integrations and collateral-free corporate cards are just a few examples, as are better interest rates and expenditure analysis capabilities. Examine the advantages and perks that your bank provides to businesses that create an account with them.

Costs

Opening a business account is frequently accompanied by costs. Transaction fees, international currency exchange costs, and even fines for failing to maintain a minimum balance are examples. If you want to run your business with the least amount of collateral feasible, go with a bank that has the best fee offers and the lowest fees. Also, see if your company qualifies for any fee waivers; having a free business bank account is always preferable.

Transaction rules

Many advantages come with a business bank account, and these benefits are based on the assumption that you would use the account. Your business's bank savings account may have deposit limits that must be adhered to. If you choose a business checking account, you may be required to complete a minimum and a maximum number of transactions (or transactional amount). Before picking which accounts to open, carefully review the transaction rules for each option.

What information's are required to open business bank account in India?

Employer information

To open a business bank account in India, you will need to provide the PAN number for your business, as well as Declaration Form 60 and 61 in compliance with the Income Tax Act.

Personal identification

The business owner needs to provide personal identification to open an account in their name. The form of ID will depend on your country of residence and country of operations, but it will need to be a government-issued identification that is not expired. Government-issued ID and residential proof are required for all partners. If you have an office, you will also need address proof for your business.

Business registration documentation

This is the documentation that proves your business entity is registered with the authorities. It could be a tax certificate, an LLC registration document, as well as proof of office space purchase (if your business has an offline office). Your bank will need this to ensure that you are a legitimate business trying to open a corporate account.

You will need copies of your business registration, Certificate of Incorporation, GST certificate, and certifications by the state government. If applicable to your industry, you will also need to show a sales tax/service tax certificate, Certificate of Practice, IEC (Importer Exporter Code) issued by DGFT, and FDA/FSSAI certificate.

Ownership and partnership agreements

The best business bank accounts make room for your business to grow and expand. This includes partnerships. If you share your business with other entities or have entities with a controlling amount of shares, then that legal paperwork is required by your bank.

This is purely to ascertain how will be controlling the funds and making authorizations. To do this, you will need to show a Partnership Deed, Power of Attorney, and a notarized document identifying every controlling partner/beneficiary.

Licensing information

Is your company registered? This, of course, is dependent on the industry in which you work and the country in which your headquarters are located. Some licenses are unique and must be obtained after you have established an account. However, some permits must be secured prior to your company's registration. These permits must be given when your company bank account is opened.

Brand and company certifications

Some banks and local laws demand a "doing business as" certificate if your company's registered name and branded name are different. This will be required by your bank, especially if your company has many sub-brands.

Credit score information

Your application will include a credit score if your company has one. If you are creating an account for the first time while starting a business, the credit score of the account owner (the business owner) may be needed.

Related read - Guide on zero balance current account for SMBs in India

Say no to multiple bank accounts for managing business expenses

What are the steps to open corporate bank account in India?

Do your research

Before deciding on a bank, carefully consider all of the available options, advantages, and costs. When opening a corporate bank account, it's critical to conduct your homework on your current status and how you see your company expanding in the future.

Decide which bank you will opt for

Research all of the options and pick a bank you want to create an account with. Discover the top business bank accounts in India offering exceptional features and services to support your entrepreneurial journey.

Decide the type of account you will open

Decide if you'll open a business checking or savings account first (or both). Always consider the interest rates and fees associated with each option.

Gather the required documentation

Once you know which type of account you want, make a list it. Your documents must be notarized, or have originals for verification. Some banks might even need directors and power of attorney holders to be present in person, so be prepared for that.

Fill out the application

Complete the application fully and accurately. Provide as much information as possible, and be as specific as possible. If your data is right, your bank will process everything more quickly.

Deposit the required amount

As with most accounts (especially savings), there needs to be a nominal deposit made to open the account. Gather the funds for this and write the check that meets these nominal requirements. Most banks in India, particularly those geared towards MSMEs, require as little as INR 2000-5000 as an initial deposit.

Activate your bank account

Your task isn't done once you get confirmation that your account has been opened. It is necessary for you to use it to activate your account. Prepare to use your account by familiarizing yourself with the banking services (both online and offline).

Corporate banking fees and charges

Administration fee

This is the operative fee your bank charges for owning the account. It might be charged monthly or annually. Banks in India are very helpful for businesses since many of them don’t charge an administrative fee. However, there are charges for deposits, and Monthly Average Balance (MAB) to maintain to avail these free services.

Cash payments

Charges may apply to cash deposits and withdrawals from the account (as well as charges for ATM usage).

Automated payments

Some banks charge fees for repeated transactions or pre-approved payments. If so, get in touch with your bank.

Manual payments or checks

Both manual deposits and checking procedures can be expensive. Examine these expenses in advance.

Minimum balance charges

You can incur fees if the minimum balance in your savings account is not met. If your cash flow is slow, especially, be sure this price is within your budget.

Overdrafts

Do your credit and banking accounts offer overdraft protection? Is it acceptable to swipe into a negative balance? You run the risk of sliding into debt very easily if you have recurring payments. Make sure your overdraft fees aren't too high by checking them.

Additional services

There may be a fee for some premium services (such as specialty cards, insurance, upgrades, advice, and report preparation). Consult your bank to see whether these services are necessary in order to obtain a low-cost or free corporate account.

International transactions

International transaction fees are determined by several variables, including exchange rates, receiving bank fees, administrative charges for the wire transfer provider, and others. Know the charges associated with sending or receiving money from another country (particularly if you frequently pay for it).

What are the advantages of business bank account?

You can share a corporate bank account with your business partners and staff without transferring any of your personal assets. Authorized individuals can quickly view everything relating to your company's finances, and you can have a transparent system for effective commercial transactions.

It can be challenging to accept payments into a personal account. Sometimes an NEFT/SWIFT transfer or a payment application are required. However, many of your clients and customers could have to pay you using a credit card. With a corporate account, you may accept debit and credit card payments, which broadens your market and improves the experience for your clients.

You may separate your personal and business finances by opening a corporate account, which is the biggest and most important benefit. You don't have to combine your household costs with your payroll costs. Everything that has to do with your business is handled and examined independently. So, credit ratings are isolated so that your business' creditworthiness is unaffected by your personal creditworthiness (or vice versa).

A corporate bank account leaves your company with a very clear financial trail. This is useful for compliance, audits, as well as when looking for investors and loans. A clear record of your business's payments enhances your credibility as a corporation.

The legitimacy of your brand might be increased by opening a business bank account. Customers are more inclined to make payments to a registered company account than to an individual account. Payroll and salary slips for employees simplify tax filing. All invoices, receipts, and reports can also be generated in your company's name.

When should you open business account?

A business bank account can never be opened too early. As soon as your business has been registered and the necessary licenses have been obtained, you can open an account. The creation of such an account might even be required for some particular licenses. A business account is also required if you plan to form a partnership.

The early implementation guarantees a clear audit trail from the outset. You don't need to be a unicorn to get a bank account because many provide unique packages and prices for small businesses. Just bear in mind that your financial institution should be able to meet your needs if you want to expand your company.

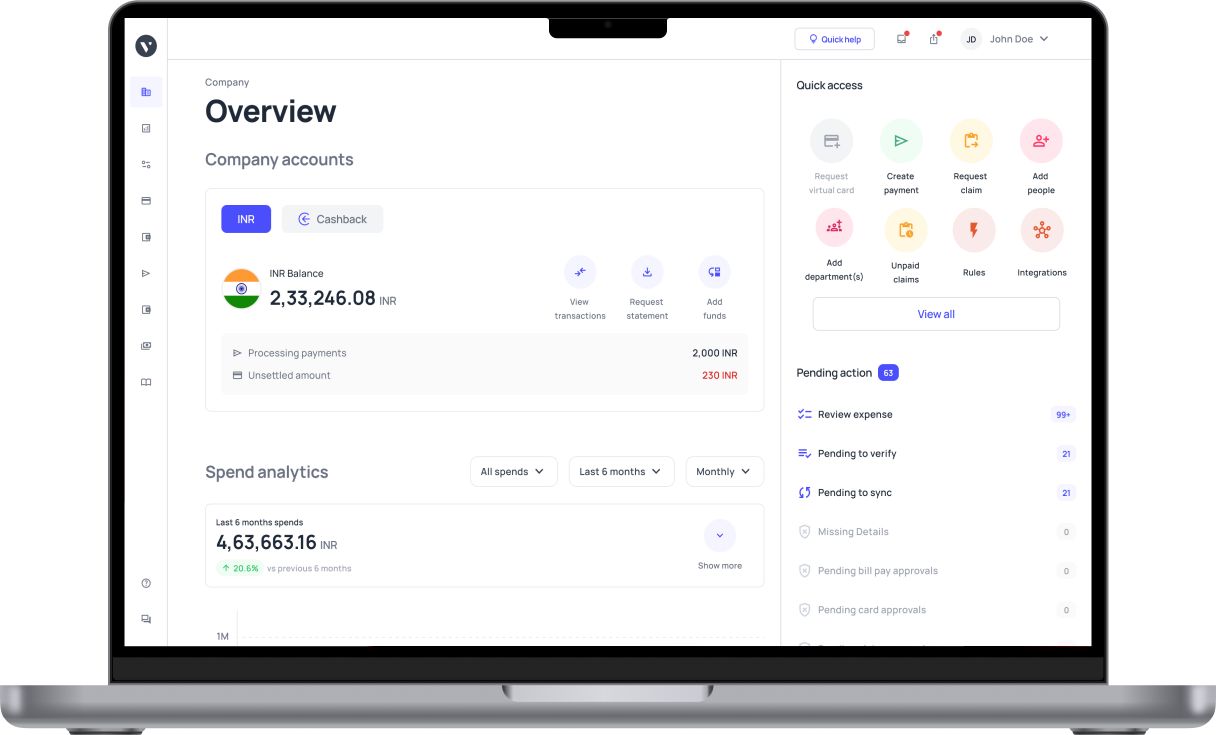

Get started with Volopay's business account

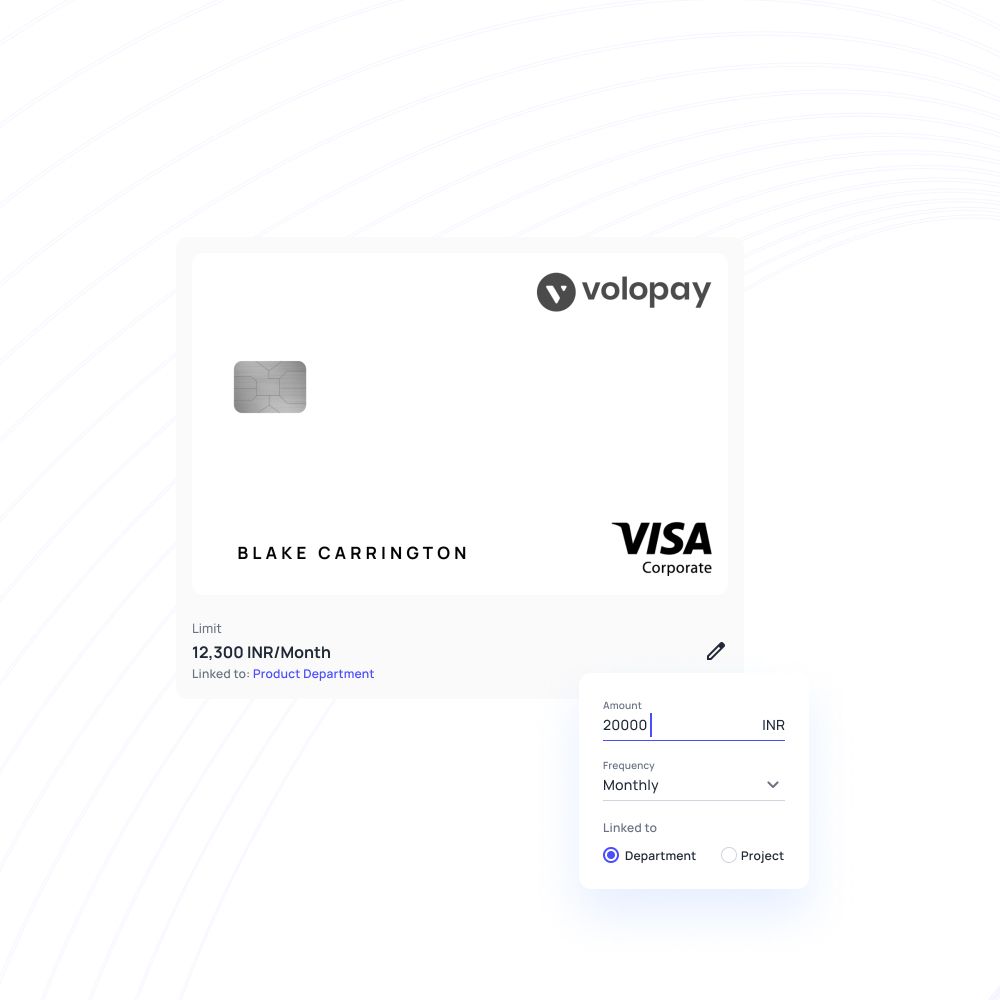

Employee physical cards and virtual cards

Give corporate cards to your employees rather than a wide variety of debit cards. They are much safer and more protected against fraud.

If your employees frequently do offline transactions, you can provide them with physical corporate cards, and you can also issue them an infinite number of virtual corporate cards for online transactions. These virtual cards can be used for vendor-specific payments if your company wants to make SaaS payments or other regular payments.

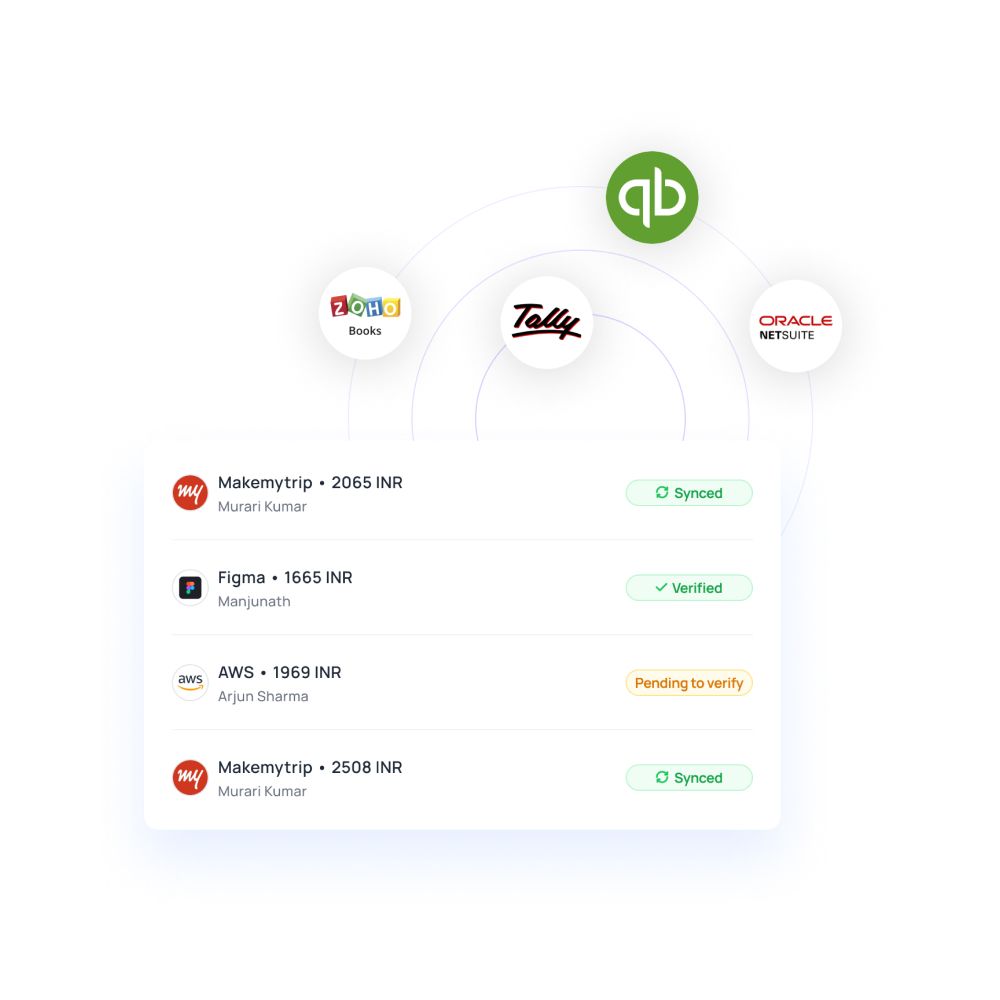

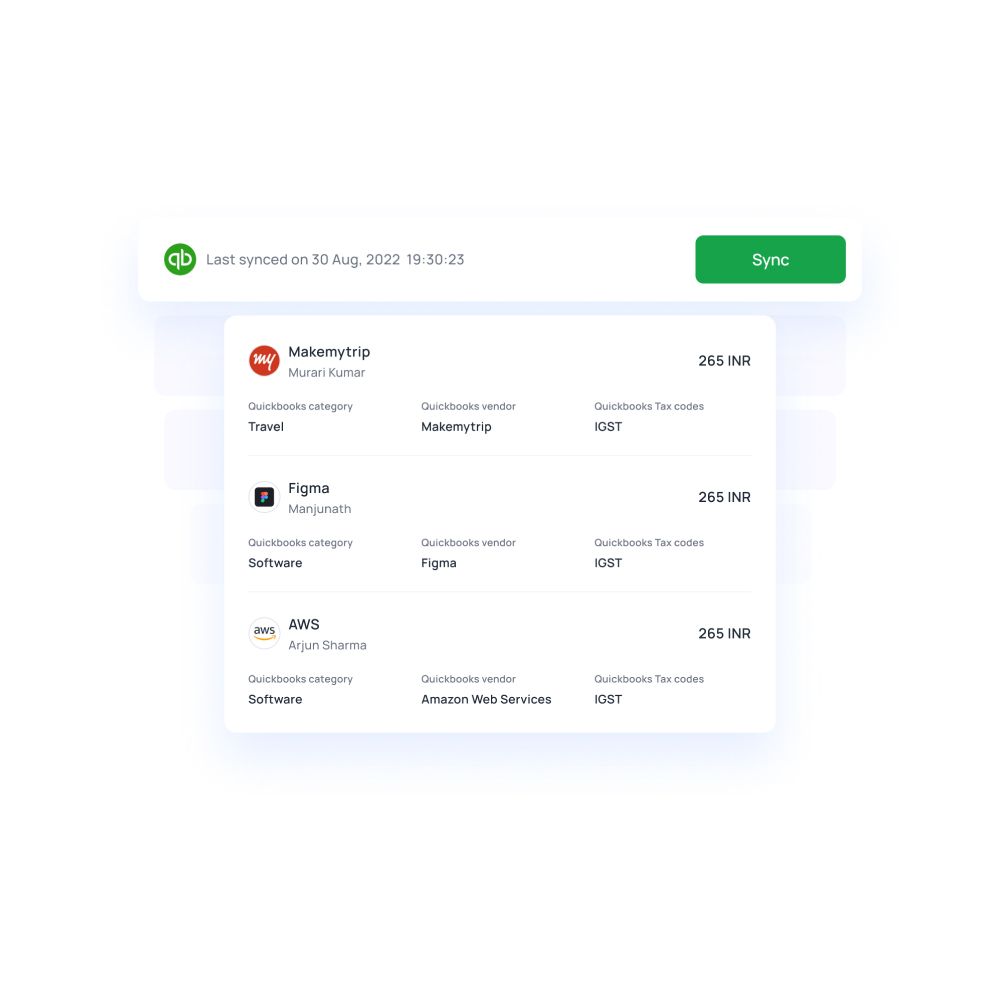

Accounting software integrations

There is a chance that your banking plan won't have accounting integrations, even if you choose it. For businesses, accounting automation has become essential, and having to externally download data just makes the process more difficult.

With the help of Volopay, you can connect your accounting program directly to the gateway, preventing the need for manual data entry. Additionally, Volopay interacts with several HR applications that control payments, like payroll services.

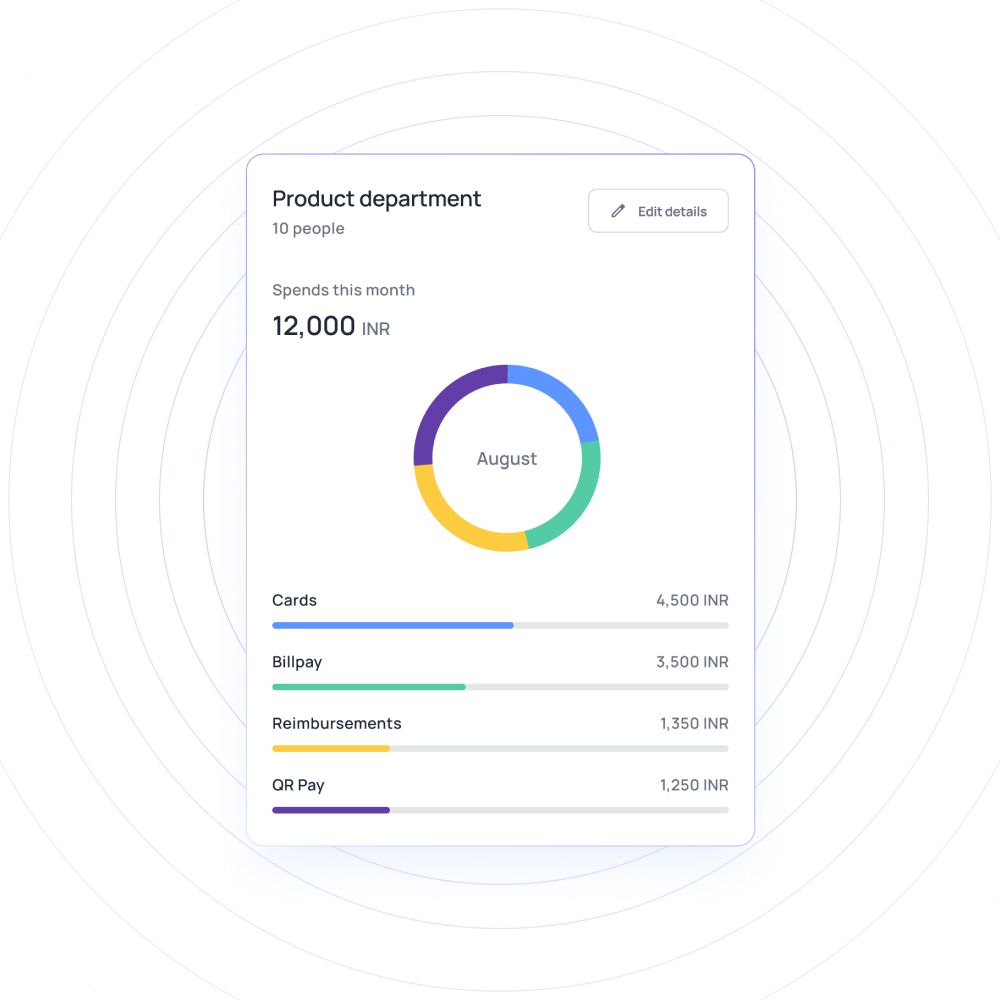

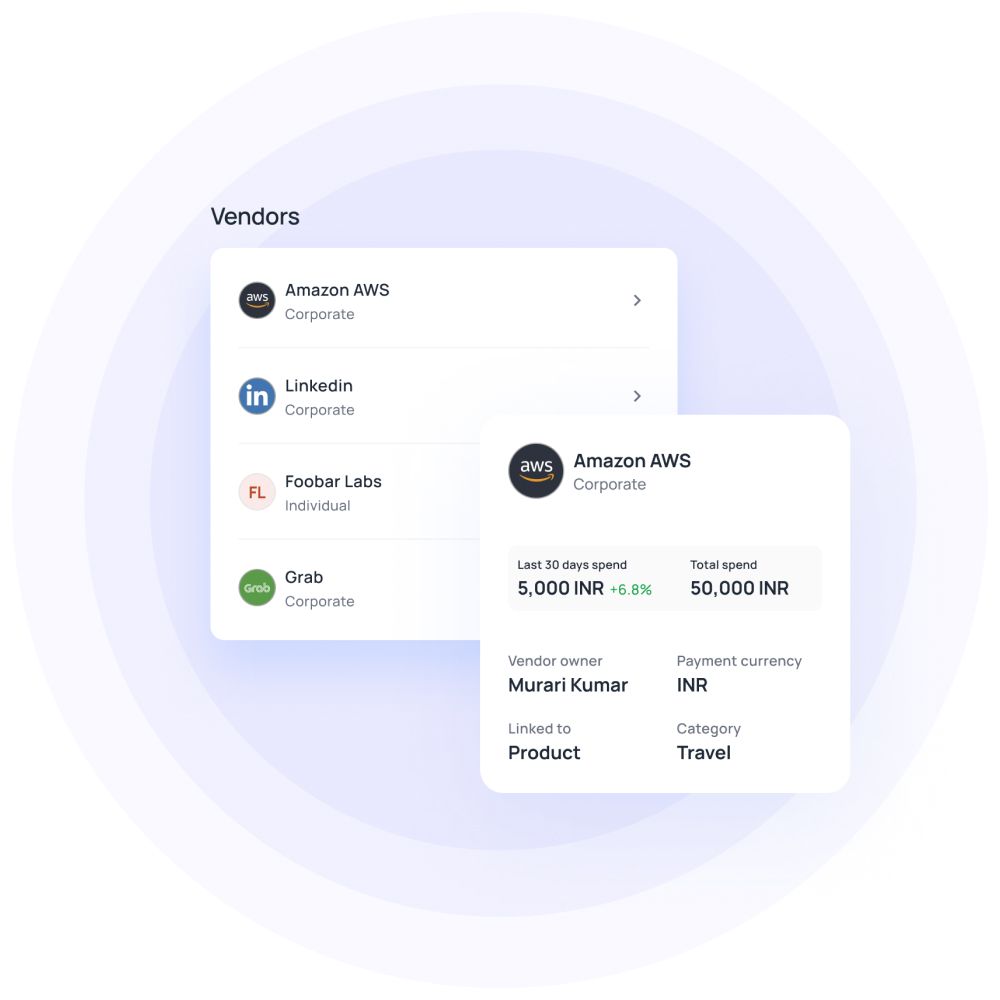

Detailed insights on spending

Everything in Volopay occurs in real-time. All information is updated as soon as an employee pays a vendor, asks for reimbursement, or swipes a card.

Giving all of your staff accounts enables collaborative and fast access to this information, data analysis, and report generation by numerous users. Additionally, Volopay offers a mobile app so that workers may access their accounts while on the go.

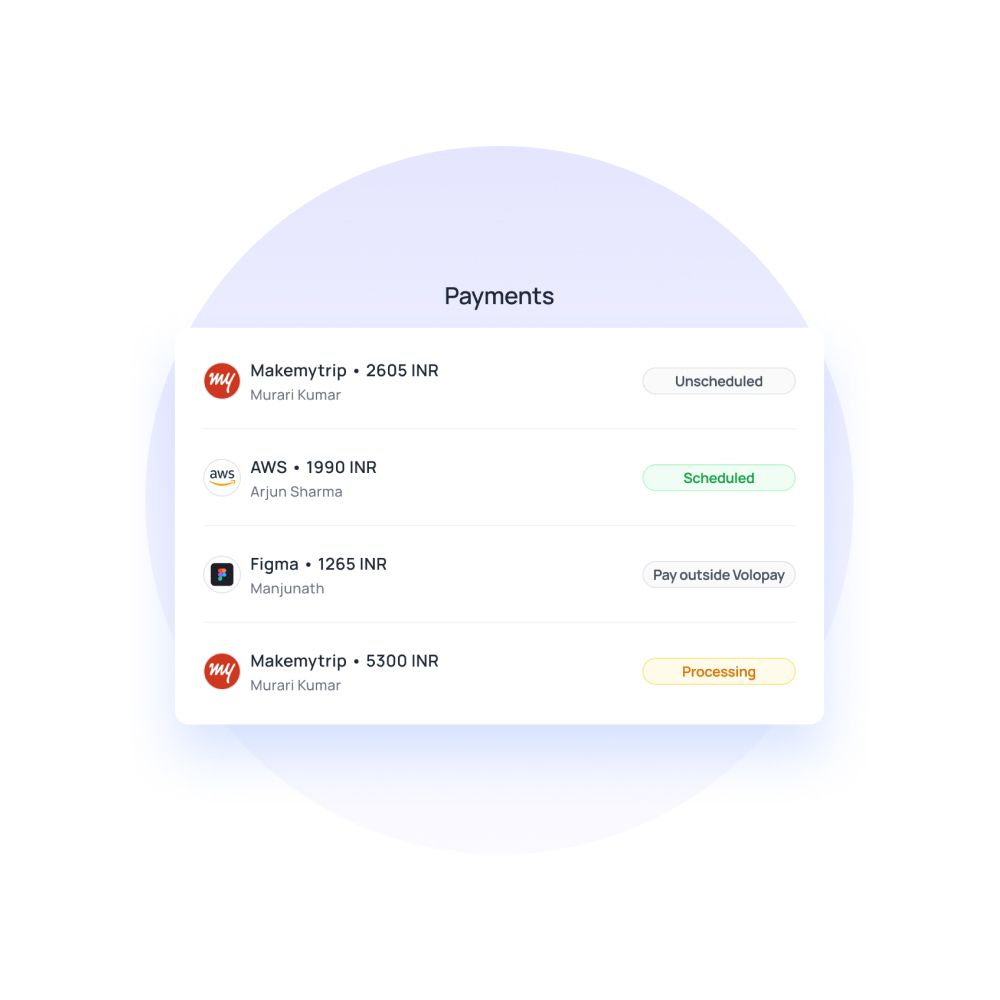

Volopay’s Bill Pay feature

It works better than a bank account. A centralized location for all your finances, it eliminates the need for multiple bank accounts in different locations. Regardless of where your company is located or how many branches it has, your business can access an eagle-eye view of all its funds from a singular interface.

Moreover, the Bill Pay feature allows you to make a variety of payments at the lowest possible fees. International transactions occur at competitive exchange rates, with significantly lower charges compared to wire transfers (and lesser time!). Your company policies can be assigned to transactions to manage accounts payable in compliance with audit requirements. Budgets can be applied to different departments. It is a one-stop shop for your business banking needs.

FAQs

Opening a bank account with Volopay is as simple as signing up on our platform and completing the onboarding process. Once you do so, you will have access to your Volopay business account to start making payments.

You will need the following documents to open a business bank account with Volopay - Memorandum of Association (MoA), Articles of Association (AoA), filled application form, duly-signed board resolution, company’s PAN card, certificate of incorporation that is obtained at the time of company registration, company address proof, and the certificate of commencement of business if it’s a public company.

On the surface, they function the same way. But a corporate account has functionalities specific to a business, unlike a traditional bank account. A corporate account can have offerings such as debit cards for employees, more lucrative interest rates, and payroll processing services. The balance requirements and fees are also, overall, better for your business.

The purpose of opening a business bank account in India is to have all your business-related transactions in one place. It separates all personal and business payments. Additionally, business accounts have certain benefits that do not apply to personal accounts (benefits that depend on the bank you choose).

No, opening a business bank account will not affect your personal credit score. However, if you avail of credit facilities, then your business credit score will be calculated separately.

The process of setting up your Volopay account is fairly quick and simple. Once you’ve signed up for a plan and provided your documentation (KYB documentation for verification purposes), you will be invited to create an administrative account. You can get started immediately after that.

Business checking accounts do not, but a business savings account does earn interest. The interest rate depends on the bank you use, and the tier of the account you open.

Volopay is not a bank. It is a spend management platform that allows you to access your funds, manage expenses, create physical & virtual corporate cards, and handle all your SWIFT & non-SWIFT payable transactions. Volopay is the software that you use to access and utilize your funds, while also managing them without the need for multiple accounts in multiple countries.

Extremely so. Volopay does not keep your money in its own pocket. Your funds are stored in a bank, which is in compliance with RBI. Your data is protected with bank-grade security encryption and access protocols.

Volopay only charges a subscription fee for its software, and there is a range of plans to choose from. All transactional fees (such as currency conversion, administration fees, bank markup fees) are charged by banks, depending on the country to which the payment is being made and the country in which your business is located. This fee is not charged by Volopay.