👋Exciting news! UPI payments are now available in India! Sign up now →

What is petty cash? Types, accounting, management, and examples

Even the smallest expenses can create big headaches if they’re not tracked properly. That’s where petty cash comes in—a simple yet essential tool for managing minor day-to-day payments.

Petty cash refers to a small fund used for minor, everyday expenses that don’t require formal approval processes. Whether it’s office supplies, parking fees, or a quick courier charge, petty cash offers an efficient way to manage such transactions.

For Indian businesses, tracking these expenditures accurately is essential for clean financial reporting. In this blog, we’ll explore what petty cash is, its types, how to manage it, accounting methods, and real-world examples in India.

What is petty cash?

Petty cash refers to a small reserve of physical money kept on hand to cover minor business expenses that don't justify writing a check or processing a digital payment. It is typically used for day-to-day costs such as office refreshments, local transport, or postage.

Petty cash in business functions as a convenient financial cushion to streamline low-value spending without disrupting larger accounting processes. This fund is managed by a custodian and recorded in a petty cash book to ensure accountability.

Maintaining this reserve enables faster decision-making and avoids delays for urgent, small-scale purchases within an organization’s regular operations.

Why is petty cash important in business operations

Facilitates day-to-day operational efficiency

Petty cash helps you handle everyday business expenses without delays. Whether it's buying office supplies or covering a quick delivery charge, you won’t need to go through lengthy approval steps. This means your team can keep things moving smoothly and stay focused on what matters most.

Reduces burden on main accounting processes

By using petty cash for small transactions, you avoid overloading your main accounting system. Instead of tracking every minor purchase in your core ledger, you can consolidate them easily. This keeps your financial processes clean, efficient, and focused on larger, strategic entries.

Supports immediate, small-value transactions

You never know when a quick expense might come up—petty cash ensures you're ready. Whether it’s for parking, client refreshments, or an urgent repair, having cash on hand lets you respond instantly without waiting for formal approvals or digital payments.

Enables quick reimbursements and approvals

With petty cash available, you can reimburse employees for small expenses right away. No more waiting for the finance team to process claims or emails for approvals. This builds trust, saves time, and makes your internal processes far more efficient.

Maintains accountability for minor business expenses

Every time you use petty cash, make sure it's recorded in a petty cash book. This helps you stay transparent, prevents misuse, and keeps your finances audit-ready. Even for small amounts, this level of accountability goes a long way in building sound financial practices.

Helps in budget tracking and expense categorization

Petty cash management gives you a clearer picture of where small amounts are going. It helps you spot trends, categorize recurring expenses, and plan your budgets more accurately. Over time, this makes your overall expense tracking much more effective—even for the tiniest costs.

Advantages and disadvantages of using petty cash

Advantages

- 1. Reduces burden on main accounting system

Petty cash in business allows you to handle frequent low-value expenses without crowding your core accounting platform. It simplifies recordkeeping by minimizing the need to enter each small transaction into the main ledger, helping your finance team stay focused on high-priority and large-value financial activities.

- 2. Useful in emergency or cash-only situations

When emergencies arise or you need to make purchases from vendors who don’t accept digital payments, petty cash becomes a lifesaver. It gives you immediate access to funds so you can act quickly without waiting for formal approval or electronic transfer processes to go through.

- 3. Quick access to cash for small expenses

Having petty cash readily available helps you cover everyday expenses like courier charges or office refreshments without any delay. This speeds up minor transactions, improves workflow, and ensures small needs are taken care of instantly, saving both time and unnecessary paperwork.

Disadvantages

- 1. Difficult to track and audit at scale

As petty cash usage grows, it becomes harder to maintain accurate records and track every transaction manually. Without a solid system, you might miss important details, making it tough to answer what is petty cash spent on, especially when reconciling financials during internal reviews or audits.

- 2. High risk of mismanagement or theft

Because petty cash is physical money, there’s always a risk it could be mishandled, lost, or stolen. Without tight control measures, it’s easy for funds to go unaccounted for, leading to potential losses and damaging trust within your team or financial operations.

- 3. Manual processes increase human error

When you're managing petty cash through handwritten logs or spreadsheets, mistakes are more likely. Transactions may be recorded incorrectly or forgotten altogether. Using a petty cash book helps, but relying too much on manual methods leaves room for human error and reconciliation issues.

Types of petty cash funds

1. Ordinary petty cash fund

This is the most basic form, where you’re given a fixed amount of money to handle daily minor expenses. There’s no strict system for replenishment—you simply top it up when it runs low. It offers flexibility but requires careful oversight to avoid inconsistencies in usage and tracking.

2. Imprest petty cash system

Under this system, you receive a fixed float that is replenished only after you submit receipts and records equal to the amount spent. It’s a popular method for petty cash accounting because it enforces discipline and ensures that every rupee is documented and justified before being refilled.

3. Standing advance petty cash

This type provides a set amount to an individual or department for ongoing use. Unlike the imprest system, it doesn’t require immediate reconciliation. Instead, it stays available until the project or activity ends. It’s often used in recurring fieldwork or remote team operations needing routine spending.

4. Temporary petty cash fund

Used for short-term projects or specific events, this type of fund is issued with a clear purpose and duration. Once the project concludes, the unused balance is returned. It’s an ideal approach for businesses wanting tighter petty cash management around one-time activities or limited-time operations.

5. Departmental petty cash funds

Each department maintains its own petty cash reserve to streamline internal spending. This allows team-specific purchases without depending on a centralized process. It boosts accountability and helps track spending more accurately at the unit level while making operations more autonomous and responsive to day-to-day needs.

6. Centralized vs. decentralized petty cash

In a centralized model, a single custodian handles all petty cash for the organization. In a decentralized approach, different departments manage their own funds. While centralization enhances control, decentralization offers faster access and localized decision-making, especially for organizations with diverse, multi-location teams.

Common examples of petty cash expenses

Office supplies

Purchasing small items like pens, notepads, staplers, or printer paper is a common use of petty cash in business. These day-to-day materials are essential for smooth operations and are often bought on the spot when stock runs low or immediate needs arise in the workplace. Regular access to such supplies helps your team stay productive without interruptions.

Staff refreshments

Petty cash can be used to cover expenses like tea, coffee, snacks, or bottled water for employees. These small hospitality costs help maintain a comfortable work environment and are often managed informally, making them ideal candidates for tracking through a simple cash handling system. It also supports employee morale during meetings or long work hours.

Local transportation

Expenses such as auto-rickshaw fares, taxi charges, or fuel for short business trips within the city are typically paid using petty cash. This avoids the hassle of processing small claims through digital reimbursement, making it easier to respond quickly to time-sensitive travel needs. It’s particularly useful for field staff or last-minute travel needs.

Postage and courier charges

Sending documents or parcels via courier or postal services often requires small, immediate payments. Petty cash is perfect for such situations where the cost is too minor to involve the formal accounting system. It’s essential when dealing with physical paperwork that needs same-day dispatch.

Emergency repairs or maintenance

If a printer malfunctions or there's a plumbing issue in the office, petty cash allows you to quickly pay for urgent services. These unplanned costs don’t wait for formal approvals and are a prime example of what is petty cash designed to support in real-world scenarios. Fast payments help avoid prolonged downtime and business disruptions.

Small event or meeting expenses

For ad-hoc team meetings or client visits, petty cash may be used to pay for light refreshments, decorations, or stationery. These minor but necessary costs help create a professional impression and are easier to manage when funds are readily accessible for quick purchases. They also support a polished, hospitable experience without overspending.

Reimbursement for minor employee purchases

Employees may occasionally spend their own money on small items like a USB drive or a notepad. Rather than routing such claims through formal expense reports, petty cash can be used to reimburse these immediately, keeping employee satisfaction and petty cash in business practices aligned. This approach encourages accountability while keeping processes friction-free.

Petty cash vs. cash on hand: Understanding the key differences

Managing business finances often involves handling both petty cash and cash on hand, but these two terms aren’t interchangeable. Understanding how they differ in purpose, scale, and recordkeeping is essential for better financial control. This section will help you clearly distinguish their roles in day-to-day operations. Knowing the distinction also improves compliance and reduces accounting confusion.

1. Purpose and use case

● Petty cash

Petty cash is used for covering minor, recurring office expenses such as local travel, small supplies, or refreshments. It answers the question what is petty cash by serving as a quick-access fund for routine disbursements that don't justify formal accounting procedures or digital payment processing. This fund supports quick decisions for low-cost needs.

● Cash on hand

Cash on hand refers to all available liquid cash held by a business at any given time, whether for small or large payments. It’s broader in scope than petty cash and includes funds held in safes, tills, or registers for general operating needs, including customer transactions or cash float. This total balance plays a key role in overall liquidity.

2. Fund size and transaction limits

● Petty cash

Petty cash in business typically involves a small, fixed amount of money reserved for low-value transactions. The fund is kept intentionally limited to prevent misuse and usually covers purchases below a certain threshold, such as ₹500 or ₹1,000 per transaction, depending on internal policies. It is regularly replenished as expenses are incurred.

● Cash on hand

Cash on hand can range from small to large amounts and has no predefined transaction limit. It's meant to support both small and high-value cash operations, such as cash sales or emergency payments, and is managed with stricter access controls compared to petty cash. It represents an organization’s cash-based spending power.

3. Documentation and tracking

● Petty cash

Every transaction from the petty cash fund should be recorded in a petty cash book for transparency. This ledger ensures that expenses are tracked, reconciled, and reviewed periodically, making petty cash management more reliable and compliant with audit and internal control standards. Proper documentation also helps prevent overspending or duplicate payments.

● Cash on hand

Cash on hand is documented as a part of the business’s balance sheet and general ledger entries. While it may not track every small purchase like petty cash, it is subject to daily reconciliation and physical verification to ensure total cash matches accounting records. This helps protect against cash leaks and financial discrepancies.

4. Responsibility and custodianship

● Petty cash

Petty cash is typically assigned to a designated custodian responsible for issuing cash, maintaining receipts, and recording entries. This individual oversees daily usage and ensures the fund is used appropriately. In most setups, petty cash in accounting is directly monitored by this custodian under the finance department guidelines.

● Cash on hand

Cash on hand is usually managed by senior finance personnel, such as a cashier or accounts officer. The responsibility includes securing large sums, disbursing payments, and verifying balances. Due to the higher value involved, access is often restricted and tightly controlled through authorization protocols.

5. Frequency of reconciliation

● Petty cash

Petty cash is reconciled periodically, often weekly or monthly, depending on transaction volume. The custodian tallies receipts with cash on hand and submits a report for approval. Consistent reconciliation is a critical part of effective petty cash management and ensures no discrepancies or misuse go unnoticed.

● Cash on hand

Cash on hand is generally reconciled daily, especially in retail or customer-facing operations. The finance team verifies the cash balance at opening and closing to prevent discrepancies. This high-frequency tracking ensures immediate visibility into financial health and reduces the risk of undetected loss.

6. Accounting treatment and reporting

● Petty cash

Petty cash is recorded as a current asset under cash or cash equivalents in financial statements. Individual expenses are posted to relevant expense accounts after reconciliation. The entries are supported by receipts and often recorded in internal systems or a manual petty cash register.

● Cash on hand

Cash on hand is reported as part of the total cash assets on the company’s balance sheet. It is monitored closely through general ledger entries and contributes to liquidity analysis. All cash movements are tracked in real time or batch entries, depending on the organization's accounting system.

Requirements for setting up a petty cash system

1. Define the purpose and usage limits

Start by clearly identifying what expenses the petty cash fund will cover, such as office supplies or travel fares. Set a maximum spending limit per transaction to avoid misuse. Defining these parameters helps align spending with company goals and maintain better control over small payments. It also prevents employees from using the fund for non-essential costs.

2. Assign a petty cash custodian

Choose a responsible employee to manage the fund, distribute cash, collect receipts, and track usage. This person should be trained in basic financial handling. Their role ensures accountability and consistent administration of the petty cash in accounting and reporting practices. A single point of control also simplifies fund reconciliation.

3. Establish a float amount

Decide on a fixed amount of money to keep in the petty cash fund, known as the float. This should reflect the typical volume of small, recurring expenses. Reviewing this amount periodically helps ensure you’re neither overfunding nor underfunding the reserve. The float should be large enough for routine needs but not excessive.

4. Set clear reimbursement and approval policies

Define rules for reimbursing employees, including when pre-approval is required and what documentation is needed. Specify who can authorize disbursements. These policies reduce confusion, prevent unauthorized use, and ensure all transactions are properly reviewed before cash is issued or replenished. A written policy makes it easier to enforce consistent practices.

5. Use petty cash vouchers and logbooks

Every transaction should be documented using petty cash vouchers and logged systematically. A petty cash book helps track expenses, record balances, and reconcile the fund regularly. Proper documentation ensures transparency and simplifies audits or internal reviews of cash usage. It also supports better tracking of frequently used expense categories.

6. Implement internal controls and security measures

Store petty cash in a locked drawer or safe and limit access to the assigned custodian. Periodic surprise checks and dual verification can deter theft or misuse. Strong controls protect the business from financial discrepancies and build confidence in how the fund is managed. Regular oversight also ensures compliance with company policy.

How the petty cash system works

Issuance of the initial float

The petty cash system starts by issuing a fixed amount of money, known as the float, to a designated custodian. This amount is based on the average small expenses expected over a set period.

The custodian is responsible for securing and managing the float until replenishment is needed. The initial issuance is recorded in the company’s financial books.

Making small payments from the fund

When a team member incurs a minor expense, they can request cash from the petty cash fund. The custodian issues the amount and collects basic details like the date, reason, and recipient's name.

This allows routine purchases without routing through the main finance system. All issued amounts must be within the predefined transaction limit.

Recording each transaction with a voucher

Every payment must be recorded on a petty cash voucher, which includes the amount, purpose, and supporting receipts. The custodian files these vouchers for review and future reference.

This creates a clear, traceable history of how the cash was used. Proper filing also ensures readiness for internal audits or financial inspections.

Replenishing the petty cash fund

Once the available cash runs low, the custodian requests a refill equal to the amount already spent. A summary of vouchers is submitted for approval before releasing additional funds.

This ensures that every rupee replenished is backed by documented transactions. The replenishment restores the float to its original level.

Periodic review and reconciliation

At regular intervals, the total of remaining cash and documented vouchers is matched against the original float. Any discrepancies are investigated and resolved immediately.

This step ensures accountability and helps prevent misuse or error. Reconciliation also verifies that all vouchers are correctly recorded and valid.

Adjustments and journal entries

After reconciliation, the expenses are recorded in the company’s accounting system through journal entries. These entries update relevant expense accounts and reset the petty cash balance.

This step finalizes the cycle and integrates the data into financial reports. Any variances or corrections are also adjusted at this stage.

How to record petty cash transactions

1. Use of petty cash vouchers

Each petty cash transaction should be documented using a voucher that includes the date, amount, payee, and purpose of the expense. These vouchers must be signed by the recipient and approved by the custodian.

Keeping accurate vouchers ensures transparency and serves as the first layer of internal control. They also act as proof for reimbursement and audit purposes.

2. Posting entries in the petty cash book

All transactions recorded on vouchers must be entered into the petty cash book to maintain a running balance. The book helps track inflows, outflows, and the current cash position.

It also categorizes expenses for easier review and future budgeting. Regular posting prevents errors and ensures up-to-date records.

3. Accounting for reimbursements and top-ups

When the fund is low, the total of expenses is reimbursed through a top-up, restoring the float to its original amount. This reimbursement is based on submitted vouchers and must be approved.

It ensures continuity of the petty cash system without affecting operations. The top-up is recorded to maintain accurate financial statements.

4. Recording journal entries in the general ledger

At the time of reimbursement, journal entries are posted in the general ledger to account for the recorded expenses. These entries debit the relevant expense accounts and credit the bank account.

This keeps the company's financials accurate and up to date. It also links the petty cash system to the overall accounting framework.

5. Handling discrepancies and corrections

If the actual cash plus vouchers doesn't match the original float, the discrepancy must be investigated. Common causes include calculation errors or missing receipts.

Any confirmed variance should be recorded with a correcting entry and a proper explanation. Clear documentation helps prevent recurring issues.

6. Auditing and reporting petty cash expenses

Periodic audits help verify that all petty cash transactions are valid, authorized, and properly recorded. Reports summarizing expenses by category can be generated for internal use.

This reinforces accountability and helps detect patterns or irregularities over time. Regular reporting also supports better financial planning and compliance.

Petty cash accounting: Journal entries and ledger practices

Initial petty cash float – journal entry

To initiate a petty cash fund, you create a journal entry by debiting the Petty Cash account and crediting the Bank account.

This records the transfer of funds from your main account to cash on hand. It's the first formal step in maintaining petty cash in accounting.

Recording daily petty cash expenses

Each time you disburse money, use a voucher and record the expense by debiting the relevant account and crediting Petty Cash.

The practice maintains control and transparency over minor, routine expenditures made throughout the day.

Restocking petty cash fund – journal entry

When the fund runs low, total the expenses and record a journal entry to reimburse them.

Debit the respective expense accounts and credit the Bank account to reflect the cash outflow.

This brings the petty cash back to its original float level for continuous usage.

Handling shortages or overages

If the physical cash doesn't match your vouchers, record the difference using the “Cash Short and Over” account. Shortages are debited, while overages are credited.

Regular discrepancies may indicate errors or misuse, so it's important to investigate and document any issues thoroughly.

Posting to the general ledger

Once transactions are recorded in the petty cash book, post them to your general ledger for accurate financial reporting. Categorize each entry correctly under the corresponding expense account.

This step ensures your books reflect real-time data and support month-end reconciliation.

Month-end petty cash reconciliation entries

At month-end, you should count the cash on hand and compare it with the vouchers to match the original float. Any differences must be journaled accordingly.

This routine helps keep petty cash records aligned with your company’s official accounts and internal controls.

Understanding and using the petty cash book

Purpose and importance of a petty cash book

A petty cash book helps you track small cash expenses in real time, ensuring nothing slips through the cracks. It provides a quick snapshot of disbursements and available balance.

By maintaining this book, you improve financial control over day-to-day business spending without relying on full ledger access. It also builds accountability across departments handling physical cash.

Common types of petty cash books

The two main types are the columnar petty cash book and the analytical petty cash book. Columnar formats list expenses in a single column, while analytical types categorize them.

Your choice depends on the level of detail you want in your petty cash records. Both types can be maintained manually or digitally, depending on your workflow.

Format and key columns explained

A typical petty cash book includes columns for date, voucher number, particulars, amount paid, and expense category. Some versions also track the balance remaining.

This structured format helps you stay consistent, organized, and accurate in logging each cash transaction. Properly labeled columns also speed up reconciliations and reviews.

Posting vouchers and updating entries

Whenever you use petty cash, fill out a voucher and post the entry in the petty cash book. Update the balance accordingly after each transaction.

This habit prevents errors and ensures each outgoing amount is matched with a legitimate expense record. It also discourages unauthorized or unrecorded spending.

Choosing the right book for your business

If your business has frequent petty expenses, an analytical petty cash book may serve you better by simplifying categorization. For simpler needs, a columnar format can suffice.

Choose the version that aligns with your reporting style and internal audit expectations. The right format can improve efficiency in daily operations.

Role of the petty cash book in audits

During internal or external audits, the petty cash book acts as supporting evidence for low-value expenditures. It helps auditors verify that cash was spent appropriately and recorded timely manner.

Keeping this book updated can reduce scrutiny and speed up your audit process. It also builds trust in your financial practices.

How to reconcile and balance petty cash

1. Importance of periodic reconciliation

You must reconcile petty cash regularly to prevent misuse and maintain accuracy in your records. It ensures your physical cash matches the recorded balance. Periodic checks help you detect issues early and maintain financial discipline.

Without routine reconciliation, small errors can compound and disrupt your reporting. It also supports transparency and strengthens internal controls over fund usage.

2. Steps to reconcile petty cash

Start by counting the remaining cash in the box and totaling the receipts. Add both amounts and compare the result with the original float. If there’s a mismatch, investigate the cause and verify entries.

Always document the reconciliation date and who performed it. This step-by-step process ensures your petty cash account remains consistent with actual usage.

3. Identifying discrepancies and errors

Discrepancies may include missing receipts, math errors, or unrecorded transactions. You should review every voucher and entry against the receipts and balance. Investigate unusual differences immediately and involve the custodian if necessary.

Early identification avoids issues from escalating. It's important to treat even small errors seriously, as they may indicate larger procedural flaws.

4. Adjusting entries for overages or shortages

If there's excess cash or a shortfall, record an adjusting journal entry to reflect the difference. Overages are usually credited, while shortages are debited with an explanation.

These adjustments should be authorized by your finance team. Make sure to document each correction with proper reasoning. This protects your audit trail and promotes transparency.

5. Maintaining receipts and vouchers

You must collect and store all receipts and petty cash vouchers to validate transactions. These serve as proof of legitimate spending during audits and reviews. Keep them organized by date or category for easy reference.

Secure storage also prevents loss or tampering. Proper documentation is critical to ensure compliance with internal financial policies.

6. Reporting reconciliation results to accounting department

After reconciliation, share a summary report with your accounting team detailing receipts, cash balance, and any adjustments. Include all supporting documents for verification. This keeps the official records up to date and avoids confusion later.

Timely reporting also allows finance teams to monitor petty cash trends. It contributes to overall expense transparency and accountability.

Best practices for managing petty cash efficiently

Set clear usage policies and limits

Create specific guidelines on what petty cash can and cannot be used for, and define maximum spending limits. This prevents misuse and keeps spending consistent across your team.

When everyone understands the rules, the fund becomes easier to manage and track without unnecessary confusion. Clear policies also reduce back-and-forth between employees and the finance team.

Use the imprest system for better control

The imprest system helps maintain a fixed float by reimbursing only the amount spent. This creates a transparent and controlled process for managing the fund.

You’ll always know how much should be in the box, making reconciliation quick and straightforward. It’s one of the simplest ways to stay organized without overcomplicating things.

Assign a dedicated custodian per location

Each site or office should have a designated person responsible for handling petty cash. This ensures accountability and streamlines day-to-day operations.

With one person in charge, it’s easier to manage records and prevent overlap or confusion. It also minimizes the chance of funds being accessed without oversight.

Maintain proper receipts and vouchers

Always collect receipts and issue petty cash vouchers for every transaction. These records back up your spending and support financial accuracy.

Keeping them organized also makes audits and reconciliations smoother. Plus, it helps justify expenses if they’re ever questioned later.

Conduct regular audits and reconciliations

Review petty cash balances frequently to catch errors early and confirm everything adds up. Routine checks help prevent misuse and reinforce good habits.

They also give finance teams confidence that the process is under control. Scheduled audits also encourage staff to stay compliant.

Digitize tracking with expense management tools

Use digital platforms or apps to record, categorize, and monitor petty cash transactions. This simplifies reporting and eliminates manual entry errors.

Going digital also makes it easier to share data with your finance team. Plus, it saves time during monthly closings.

Train staff on petty cash protocols

Make sure employees know how to request and report petty cash usage properly. A quick training session or guide goes a long way in reducing mistakes.

When your team knows the process, things run more efficiently and with fewer disruptions. It also creates a shared sense of responsibility and transparency.

Challenges in manual petty cash handling

1. Lack of centralized oversight

Without a centralized system, you cannot maintain complete visibility into petty cash usage across departments. Transactions are often recorded manually, making it difficult for finance teams to monitor spending in real time.

This absence of oversight can lead to fragmented financial data and prevent senior management from enforcing consistent cash-handling policies across the organization.

2. Risk of theft, misuse, or fraud

Manual handling of petty cash significantly increases the chance of unauthorized withdrawals or misappropriation. Since cash is often kept unsecured and lacks digital traceability, it becomes easier for staff to misuse funds without detection.

In the absence of audit trails, it’s difficult to investigate discrepancies or hold individuals accountable for suspicious activities.

3. Delays in reimbursement and reporting

When employees use personal funds for minor purchases, reimbursement often depends on slow, paper-based approval processes. These delays not only frustrate staff but also impact productivity.

The lack of real-time reporting further complicates monthly closings and creates gaps in expense documentation for internal and external audits.

4. Difficulty in tracking and reconciliation

Petty cash transactions are frequently logged on paper, making it hard for you to track real-time balances or spot irregularities. Without automated tracking, monthly reconciliations become time-consuming and prone to human error.

This creates a risk of unreported expenditures and inaccurate financial statements, affecting your overall cash flow visibility.

5. Inconsistent record-keeping across locations

In a multi-branch setup, each office may follow its own process for maintaining petty cash logs. This inconsistency leads to incomplete records, misaligned formats, and irregular audit compliance.

Without standardized templates or systems, you cannot consolidate expense data effectively for accurate company-wide reporting.

6. Increased administrative burden on staff

Managing petty cash manually adds repetitive tasks like logging entries, checking receipts, and reconciling balances to your team’s workload. These low-value activities consume time that could otherwise be spent on strategic finance functions.

The administrative burden also increases the chances of oversight and delays in financial reporting.

Manual vs. digital petty cash management

Overview of manual petty cash tracking

Manual petty cash tracking typically involves using physical ledgers or spreadsheets to record daily cash transactions. You assign a custodian who manages disbursements and collects receipts for each expense.

Although this method is simple and low-cost, it heavily depends on human accuracy and trust. Over time, the lack of automation can slow down approvals and create reconciliation challenges for finance teams.

Common issues with manual systems

Manual systems are prone to errors, delays, and inconsistent record-keeping due to handwritten entries and scattered documentation. You may face difficulties in retrieving past records or identifying discrepancies during audits.

The lack of real-time visibility also increases the risk of overspending or misuse. As transaction volumes grow, manual tracking becomes unsustainable and exposes your organization to compliance and operational risks.

Introduction to digital petty cash tools

Digital petty cash tools offer automated platforms to track, control, and reconcile cash transactions in real time. You can set spending limits, approve requests, and generate audit-ready reports from a centralized dashboard.

These solutions minimize human error, enhance transparency, and reduce administrative workload. With cloud access and mobile compatibility, digital tools offer flexibility while ensuring regulatory compliance and data accuracy.

How automation is transforming petty cash management

Automation is changing how you manage petty cash by replacing slow, error-prone manual processes with real-time digital solutions. It streamlines cash flow, strengthens internal controls, and minimizes administrative overhead.

With enhanced visibility and integration, automated systems help finance teams stay audit-ready, track spending accurately, and maintain compliance with company policies and regulatory standards.

1. Eliminates manual errors and data duplication

Automated petty cash systems remove the need for manual entries, reducing the risk of arithmetic mistakes and duplicate transactions. You no longer depend on handwritten logs or spreadsheets, which often result in inaccuracies.

By validating data inputs automatically, automation improves the overall reliability of your expense records and ensures consistency across all levels of reporting.

2. Enables real-time tracking of cash transactions

With automation, you gain immediate visibility into every petty cash transaction as it occurs. You can monitor spending, view balances, and track approvals in real time through a centralized dashboard.

This transparency allows your finance team to detect unusual activity promptly and ensures better decision-making through up-to-date financial insights.

3. Improves accountability and reduces fraud risk

Automated workflows require proper authorization and document submission before funds are released, holding every user accountable for each transaction. You can assign role-based access and track individual spending behavior.

This level of transparency and control discourages misuse, enhances internal governance, and significantly lowers the potential for fraud or unauthorized cash handling.

4. Simplifies reconciliation and reporting processes

Automation simplifies monthly closings by consolidating data from all petty cash activities into a unified system. You no longer need to reconcile separate paper logs or chase receipts.

Digital records are organized, searchable, and exportable, allowing your finance team to generate reports and complete reconciliations quickly with improved accuracy and less manual effort.

5. Speeds up reimbursements and approvals

Digital petty cash systems allow employees to submit requests and upload receipts instantly through web or mobile platforms. You can review, approve, or reject expenses in real time, reducing turnaround time for reimbursements.

Automated notifications also ensure faster processing, eliminating unnecessary delays and improving employee satisfaction with the reimbursement experience.

6. Integrates seamlessly with accounting and ERP systems

Most automated petty cash platforms are designed to integrate directly with your existing accounting software or ERP systems. This integration ensures smooth data synchronization, eliminating the need for manual uploads.

You can maintain accurate general ledger entries and streamline your overall financial operations, reducing discrepancies between cash records and accounting books.

7. Provides audit trails and compliance readiness

Each transaction within an automated system is logged with user details, timestamps, and supporting documentation. You can easily retrieve historical records and ensure compliance with internal policies and regulatory standards.

These built-in audit trails simplify both internal and external audits by offering clear, verifiable records of every petty cash activity.

8. Scales easily across multiple locations or departments

Automated petty cash tools allow you to deploy uniform policies and controls across branches, departments, or business units. You can monitor usage centrally while empowering local teams with predefined budgets and approval limits.

This scalability ensures consistency in financial practices and supports organizational growth without adding complexity to petty cash management.

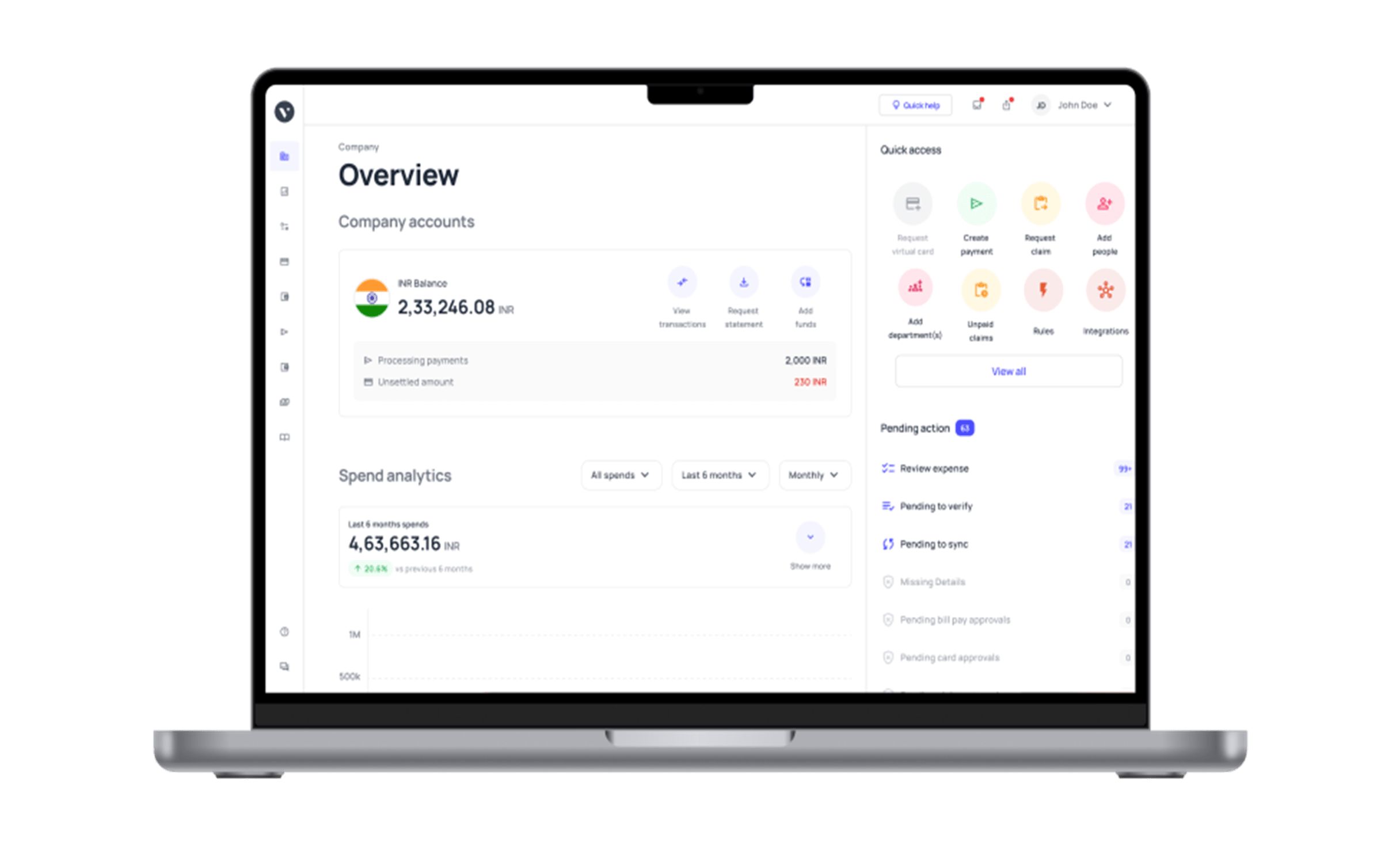

Why Volopay is the smartest choice for petty cash automation

Volopay's intelligent expense management software modernizes your petty cash management through complete automation. It eliminates manual errors, enhances visibility, and ensures compliance by combining smart workflows with real-time data.

With built-in policy controls and seamless integration features, Volopay allows your finance team to handle cash-related expenses efficiently, securely, and with full traceability across departments and locations.

Real-time tracking and visibility of expenses

Volopay provides live access to every petty cash transaction through a centralized dashboard. You can monitor spending activity, view pending approvals, and identify anomalies instantly.

This real-time visibility allows better oversight and timely decision-making. Each transaction is automatically recorded, enabling you to maintain accurate and transparent financial records without relying on delayed manual reporting.

Automated reconciliation reduces manual errors

Volopay streamlines reconciliation by automatically matching expenses with uploaded receipts and assigned categories. You eliminate the need for paper logs and minimize the risk of duplicate or incorrect entries.

Automated summaries simplify month-end closings and ensure financial accuracy. Your finance team can focus on analysis rather than spending time correcting manual errors.

Policy enforcement and role-based access control

With Volopay, you can enforce spending policies directly within the platform. Set custom limits, define approval workflows, and assign access based on roles and responsibilities.

These controls ensure that only authorized users can initiate or approve petty cash transactions. By embedding compliance into every step, you reduce policy violations and financial misuse.

Elimination of paper vouchers and spreadsheets

Volopay replaces outdated paper-based methods with digital tools that log every transaction automatically. You no longer need physical vouchers or spreadsheets to track petty cash usage.

This shift not only reduces administrative burden but also enhances data integrity. All records are stored securely and can be accessed instantly during audits or reviews.

Integration with accounting and ERP systems

Volopay integrates with major accounting platforms and ERP systems, enabling automatic syncing of expense data. You avoid double entries and reduce reconciliation delays by maintaining consistent financial records.

Integration also helps standardize reporting formats and supports faster book closures. Your finance operations become more agile, accurate, and fully connected across platforms.

Multi-branch oversight from a central dashboard

Volopay enables centralized control over petty cash activities across all your branches or departments. You can set standardized policies, track disbursements, and monitor balances in real time from a single interface.

This centralization ensures uniform financial practices, eliminates data silos, and improves oversight. You gain better visibility and control, regardless of your company’s geographical or departmental spread.

Improved fraud detection and audit readiness

Every transaction on Volopay is digitally recorded with time stamps, user roles, and attached documentation. This transparency helps you detect unauthorized activity or policy violations quickly.

Built-in audit trails make it easy to retrieve historical data for internal reviews or external audits. Volopay’s automation strengthens internal controls and ensures compliance with your financial governance policies.

Employee empowerment through instant reimbursements

Volopay allows employees to submit expense claims and receive approvals digitally, reducing delays in petty cash reimbursements. You can process requests instantly and transfer funds without involving manual paperwork.

This quick turnaround improves employee satisfaction and eliminates the burden of personal cash advances. Staff can focus on their tasks without financial disruption or wait times.

Scalable solution for growing businesses

Volopay’s platform is designed to grow with your organization, whether you expand to new branches or increase expense volume. You can configure policies, budgets, and user permissions as needed, without additional infrastructure.

This scalability ensures consistent expense management while supporting growth. The system remains flexible, efficient, and reliable as your operational complexity increases.

Bring Volopay to your business

Get started now

FAQ’s

Volopay automates petty cash tracking, approval, and reconciliation, eliminating manual errors and delays. You gain real-time visibility, enforce policies, and maintain accurate records through a centralized digital platform.

Petty cash should be reconciled at regular intervals—typically weekly or monthly—to ensure accuracy. Frequent reconciliation helps you detect discrepancies early and maintain up-to-date financial records for reporting.

When petty cash runs out, you must replenish the fund through an authorized top-up process. With Volopay, you can easily reload the balance digitally and maintain uninterrupted cash availability.

No, petty cash is strictly for approved business expenses. Using it for personal purposes violates company policy and may lead to disciplinary action or reimbursement requirements for the misused funds.

Petty cash is classified as a current asset on your balance sheet. While it is used for expenses, the cash itself represents available funds until disbursed and recorded against appropriate expense categories.