👋 Exciting news! UPI payments are now available in India! Sign up now →

Petty cash reconciliation - Importance, best practices, and procedure

Petty cash reconciliation serves as a vital aspect of financial management, ensuring accuracy and transparency in tracking minor expenses within an organization. Even small inconsistencies in petty cash transactions should not be overlooked as they can add up over time and cause financial issues.

To make sure that all transactions that have happened are legitimate, reconciliation systems need to be set up within the organization. The petty cash reconciliation procedure provides a systematic method to oversee and reconcile small-scale transactions, maintaining a clear record of cash flow and expenses.

What is petty cash?

Petty cash represents a nominal amount of cash reserved by businesses to handle small, routine expenditures. It serves as a convenient method for procuring minor supplies or making incidental payments without necessitating a formal transaction through a bank account.

This fund is typically managed by a designated custodian responsible for its disbursement, documentation, and subsequent reconciliation. The petty cash custodian is responsible for disbursing the funds to employees when needed.

There might be one or more than one petty cash manager/custodian depending on how the budget is disbursed and which system the company is using.

What is petty cash reconciliation?

Petty cash reconciliation refers to the meticulous process of cross-verifying and balancing the petty cash fund to ensure all disbursements and receipts align accurately. It involves comparing the sum of expenditures made from the petty cash with the remaining balance to ascertain that the cash on hand is reconciled and matches the expected amount.

This process is done according to the internal structure and systems set up by the finance team wherein they collect relevant documentation to support and verify the necessary transactions such as receipts and bank statements.

When petty cash reconciliation should be used?

Petty cash reconciliation is essential in various scenarios to maintain financial accuracy. Primarily, it should be conducted at regular intervals, typically monthly or quarterly, to ensure consistent monitoring of the petty cash fund.

Additionally, reconciliation becomes necessary when:

1. Threshold exceedance

When the petty cash fund reaches a predefined threshold or limit, reconciliation helps in controlling and monitoring the business expenses.

2. Periodic audits

In preparation for financial audits or as a part of routine internal audits, reconciliation ensures transparency and accountability in financial transactions.

3. Change in custodian

Whenever there's a change in the personnel responsible for managing the petty cash, conducting reconciliation is crucial to ensure a smooth transition and verify the accuracy of records.

4. Suspected discrepancies

In cases where discrepancies, irregularities, or discrepancies in the petty cash fund are suspected, immediate reconciliation helps in identifying and rectifying errors promptly.

Regularly employing petty cash reconciliation not only maintains financial accuracy but also aids in upholding financial controls, thereby preventing potential errors or mismanagement of funds.

Important terms to keep in mind for petty cash reconciliation

In the finance and accounting profession, when dealing with petty cash reconciliation, one must know the meaning of the following terms:

1. Log

A log is a detailed record documenting all transactions involving the petty cash fund, including the date, purpose of the transaction, amount, and the recipient.

All of this information is essential for accurate reconciliation.

2. Petty cash

A reserved sum of money set aside for minor or routine expenditures within an organization, managed separately from primary accounts. This can be in the form of cash or through other payment tools like corporate cards.

3. Float

The initial amount of cash placed in the petty cash fund to cover day-to-day expenses before replenishment. It can also be referred to as the beginning amount or the opening balance of the petty cash account.

4. Vouchers

Supporting documents such as receipts or invoices substantiating the disbursements made from petty cash, crucial for validation during reconciliation.

These documents must be provided by the employees who have used the petty cash fund to make purchases with it.

5. Disbursements

Funds withdrawn or paid out from the petty cash for authorized expenses, recorded in the log and supported by vouchers.

6. Custodian

The designated individual responsible for managing, safeguarding, and disbursing the petty cash fund while maintaining accurate records.

There may be one or more than one custodian in an organization depending on the internal structure of the company.

7. Restock

The process of replenishing the petty cash fund by reimbursing the custodian for disbursements made, ensuring the fund remains at an appropriate level for ongoing operations.

Enjoy effortless petty cash reconciliation

Importance of petty cash reconciliation in financial management

While the transaction amounts for purchases made through the petty cash fund tend to be relatively small, they still need to be given ample importance in terms of controlling expenses and making sure that no unnecessary expenditures are being made.

This makes the petty cash reconciliation process extremely important.

1. Accurate expense tracking

Petty cash reconciliation ensures meticulous monitoring of small-scale expenses, maintaining a clear trail of where and how funds are utilized, contributing to comprehensive financial records.

This data also helps the finance managers to better analyze petty cash usage and make the budget more appropriate for the upcoming months and quarters.

2. Financial accountability

By reconciling petty cash, organizations instill accountability among custodians and employees, promoting responsible expenditure practices and transparency.

Having a reconciliation process and system in place will ensure that you spot any discrepancies that have occurred and fix them.

The necessary stakeholders are held accountable and errors are rectified which helps in maintaining the integrity of the petty cash fund.

3. Fraud prevention

If petty cash transactions are not verified and checked often, there may be instances of fraudulent behavior taking place from employees where they use the funds for non-business activities.

Regular reconciliation every month or quarter acts as a deterrent to fraudulent activities, as discrepancies or irregularities are promptly identified, mitigating the risk of misappropriation.

4. Budget control

Small expenses if not kept in check can add up over time to be big liabilities.

Petty cash reconciliation aids in controlling and managing the budget by overseeing small expenditures, preventing overspending, and aligning expenses with the allocated budget.

5. Compliance and auditing

Reconciliation ensures adherence to regulatory standards and facilitates smoother auditing processes, showcasing compliance and accurate financial reporting.

Having performed an internal reconciliation makes an external auditor’s work extremely efficient as all the supporting documents to verify the transactions are already documented. This also makes the auditing process much faster and easier for both parties involved.

6. Financial decision-making

Accurate petty cash records enable informed decision-making by providing insights into spending patterns and areas for potential cost-saving measures.

Your finance managers will be able to see where and which employees need the most amount of funds for daily expenses. This will help them create a more effective budget going forward.

7. Efficient cash flow management

Proper reconciliation ensures the availability of funds when required, contributing to efficient cash flow management within the organization.

If proper reconciliation of petty cash accounts is not done, there might suddenly be a shortage of funds for employees to complete their daily activities. This unavailability of funds can lead to halts in important business operations and slow down productivity.

8. Transparency and reporting

It fosters transparency by maintaining detailed records, and facilitating clear reporting on how petty cash funds are utilized. Transparency enables trust between the custodians and the employees.

The reporting of the necessary documentation for the reconciliation of the petty cash account ensures that finance managers do not have trouble making the financial statements of the accounting period.

9. Streamlining accounting processes

Regular reconciliation streamlines accounting procedures by minimizing errors, ensuring accurate financial statements, and hassle-free bookkeeping.

The accountant no longer has to run behind employees at the last minute to get the necessary documentation when a proper reconciliation system is in place.

The system mandates employees to submit the necessary documentation for the purchase they have made using petty cash.

How to do petty cash reconciliation

While different companies may go about conducting their petty cash reconciliation differently, the overall procedure remains largely the same.

Here is the general step-by-step process that a finance team would follow to complete petty cash reconciliation:

1. Gather documentation

Collect all receipts, vouchers, and petty cash logs to reconcile transactions accurately. This is the very first step to match the transactions with their relevant documents.

2. Prepare reconciliation form

Utilize a standardized reconciliation form or spreadsheet to organize and document the reconciliation process.

You can use a reconciliation form or spreadsheet template available online or create your custom sheet depending on any specific information regarding your company.

3. Count remaining cash

Count the remaining cash in the petty cash box or safe to determine the current cash on hand. Knowing this amount will help you verify at the end of the reconciliation process whether there are any discrepancies or not.

4. Record transactions

Enter all disbursements and expenses into the reconciliation form, referencing supporting documentation.

This is the main step in the reconciliation process where you must check and verify whether each transaction made has the relevant documentation to support it or not.

5. Total expenses

Sum up the total expenses incurred during the period under review based on vouchers and receipts.

6. Reconcile cash and expenses

Compare the remaining cash with the total of recorded expenses to ensure they align accurately.

You may notice that the sum of the expenses may be more or less and it does not match with the remaining balance in the petty cash account.

7. Identify discrepancies

Investigate and address any disparities or discrepancies between cash on hand and recorded expenses.

Check whether there are expenses that were recorded but do not have supporting documents or whether there are some transactions that show up in bank statements but do not reflect in the petty cash account ledger.

8. Make adjustments

If needed, make adjustments to rectify discrepancies by adjusting the recorded expenses or cash balance.

You can make these adjustments after rectifying the errors or keeping a separate account to remember that you must reconcile the differences later on.

9. Obtain approval and signatures

Seek approval and signatures from authorized personnel confirming the accuracy of the reconciliation.

Depending on your company’s internal structure, this may be the finance department manager, the finance controller, the CFO, or someone else.

10. Restock petty cash

Replenish the petty cash fund by reimbursing the custodian for verified expenses, ensuring the fund is at an appropriate level for future transactions. This way the employees will be able to start using the replenished funds for their daily operations.

11. File documentation

Maintain comprehensive records of the reconciliation process, including the reconciliation form, receipts, and any adjustment documentation for future reference.

These files will come in handy when the organization needs to perform an internal audit or an external financial audit.

Manage your petty cash with ease!

How to establish a petty cash reconciliation system?

1. Define petty cash policies and procedures

Establish clear policies outlining how petty cash will be used, who can access it, and the procedure for reconciliation.

Making sure that there are clear guidelines for employees and custodians to follow from the very beginning will help in avoiding any mistakes or confusion later on.

2. Determine petty cash fund size

Assess and allocate an appropriate amount for the petty cash fund based on the organization's needs and expenditure patterns.

Look at the different operations that each team needs to fulfill daily and how much petty cash they will need to complete their tasks every day.

Accordingly, set a budget for the week or entire month.

3. Designate responsibility

Appoint a trusted individual as the custodian responsible for managing and disbursing the petty cash fund. Companies tend to give this responsibility to someone in the finance team such as the finance controller, finance manager, or CFO.

But you can choose an employee that you want regardless of their role who can act as the custodian.

4. Establish documentation standards

Define standards for documenting expenses, receipts, and vouchers to maintain accurate records.

Having a systematic process and method to file all the necessary documentation will help conduct the reconciliation process later on in a much more efficient manner.

5. Create a petty cash log

Develop a log to record all transactions, including date, purpose, amount, and recipient, ensuring transparency. To understand more about this foundational record-keeping tool, explore our detailed article on the petty cash book. This can be done manually or electronically through the implementation of a software system that tracks all the transactions happening through the petty cash account.

6. Initiate initial funding

Provide the initial cash amount to start the petty cash fund, maintaining a designated float. The float amount refers to the opening balance of a petty cash account.

It is replenished periodically, generally every month in order to ensure that there are sufficient funds for the employees to use.

7. Distribute petty cash vouchers

A petty cash voucher is a document that records the expenses of an organization. Issue standardized vouchers to track and support all petty cash disbursements.

8. Implement reconciliation procedures

Introduce a structured reconciliation process, outlining steps for regular reconciliation and validation.

Inform all the employees who are using the petty cash fund about this process so that they are aware and know how and when to submit the necessary documents for reconciliation.

9. Create replenishment procedures

Establish protocols for replenishing the petty cash fund when it reaches a predetermined threshold. Usually, the custodian is responsible for making sure that the petty cash fund has sufficient balance.

This can be done manually by checking the fund balance periodically or by using a software system that can notify you whenever the petty cash fund has a balance lower than a custom threshold.

10. Regular audits and reviews

Conduct periodic audits and reviews to ensure compliance, accuracy, and adherence to established procedures.

After going through a few cycles of the reconciliation process and using the system, you and your team will be able to analyze how effective and helpful the system was.

11. Regularly update records

Maintain up-to-date and accurate records by consistently updating the petty cash log and reconciliation documentation.

The reconciliation process might happen once a month, but it is better to have the prep work done already rather than trying to collect all the documentation a few days before.

This is where having a standard submission procedure for documentation can help save a lot of time in the reconciliation process.

Overview of procedures and policy for petty cash reconciliation

The procedures and policies for petty cash reconciliation encompass a structured framework to effectively manage and reconcile minor expenses within an organization. It involves:

1. Documentation protocols

Clear guidelines outlining the documentation required for all petty cash transactions, including receipts, vouchers, and a comprehensive log needs to be set up.

2. Frequency of reconciliation

The next step is to ensure that you establish a specific schedule. Typically, a monthly or quarterly time frame for conducting reconciliation to ensure consistent oversight.

3. Custodian responsibilities

Defining the roles and responsibilities of the custodian, including disbursement, documentation, and the reconciliation process.

4. Approval and authorization

Implementing a system where all expenditures are authorized and approved before disbursement from the petty cash fund.

5. Replenishment procedures

Outlining the process for replenishing the petty cash fund, ensuring it remains at an appropriate level for operational needs.

6. Auditing and reviews

Conducting regular audits and reviews to validate the accuracy of records, adherence to policies, and regulatory compliance.

7. Adherence to policies

Ensuring all procedures align with organizational policies, financial regulations, and internal controls.

By integrating these policies and procedures, organizations can effectively manage petty cash, maintain accurate records, prevent misuse, and ensure transparency and accountability in financial operations. This structured approach not only fortifies financial controls but also contributes to streamlined financial management and compliance.

Streamline expenses, and enhance control

Common challenges and solutions in petty cash reconciliation

1. Missing receipts or documentation

● Challenge

Difficulty reconciling transactions due to incomplete or absent supporting documentation. This is a common challenge that companies face when they do not have a standardized process to follow.

● Solution

Implement strict guidelines requiring employees to submit receipts for all the expenses they make, and if the receipts are missing or not available, use alternative documentation or require an explanation.

2. Discrepancies in cash amounts

● Challenge

Finding disparities between the actual cash on hand and recorded expenses. This challenge usually occurs when there isn’t a proper system to record all the withdrawals and transactions happening from the petty cash fund.

● Solution

Use an automated software solution to help you keep track of all the expenses and conduct frequent and thorough reconciliations, investigating and rectifying any discrepancies immediately upon identification.

3. Errors in recording transactions

● Challenge

Inaccurate entries lead to misalignment between recorded expenses and actual disbursements. This is a major challenge when the expenses are recorded manually rather than through an automated system. Humans are more likely to make errors in data entry.

● Solution

Train staff on proper recording techniques and implement checks for accuracy during the reconciliation process. Further, you can also implement an automated system to aid the staff in their operations.

4. Lack of oversight and controls

● Challenge

Insufficient monitoring leads to potential misuse or unauthorized access to petty cash. When things are done manually, even with regular checks, sometimes it can be too late to detect fraud.

● Solution

Establish clear procedures, designate responsible custodians, and conduct regular audits to enforce controls and ensure accountability. Use software systems to keep you notified about transactions at all times.

5. Inefficient reconciliation processes

● Challenge

Time-consuming and inefficient reconciliation procedures cause delays in maintaining accurate records. The reconciliation process can be time-consuming when proper processes and systems are not adhered to.

● Solution

Streamline processes by using automated systems, standardized forms, and periodic reviews to enhance efficiency. This way the reconciliation process will not take a long time and not cause any halt in operations due to the unavailability of funds.

6. Compliance and regulatory issues

● Challenge

Non-compliance with financial regulations of a country/state or organizational policies can often be an overlooked aspect that can cause problems later on.

● Solution

Stay updated with the regulatory requirements of your industry and the legal boundaries within which your business operates, conduct internal audits, and implement measures to align with compliance standards.

7. Communication and transparency issues

● Challenges

Lack of communication or transparency leads to misunderstandings or discrepancies. This can happen in the documentation stage or even in the expense stage where employees aren’t fully aware of the type of expenses they can make using the petty cash fund.

● Solution

Foster open communication between employees, provide clear guidelines, and encourage transparency among all the stakeholders involved in petty cash management.

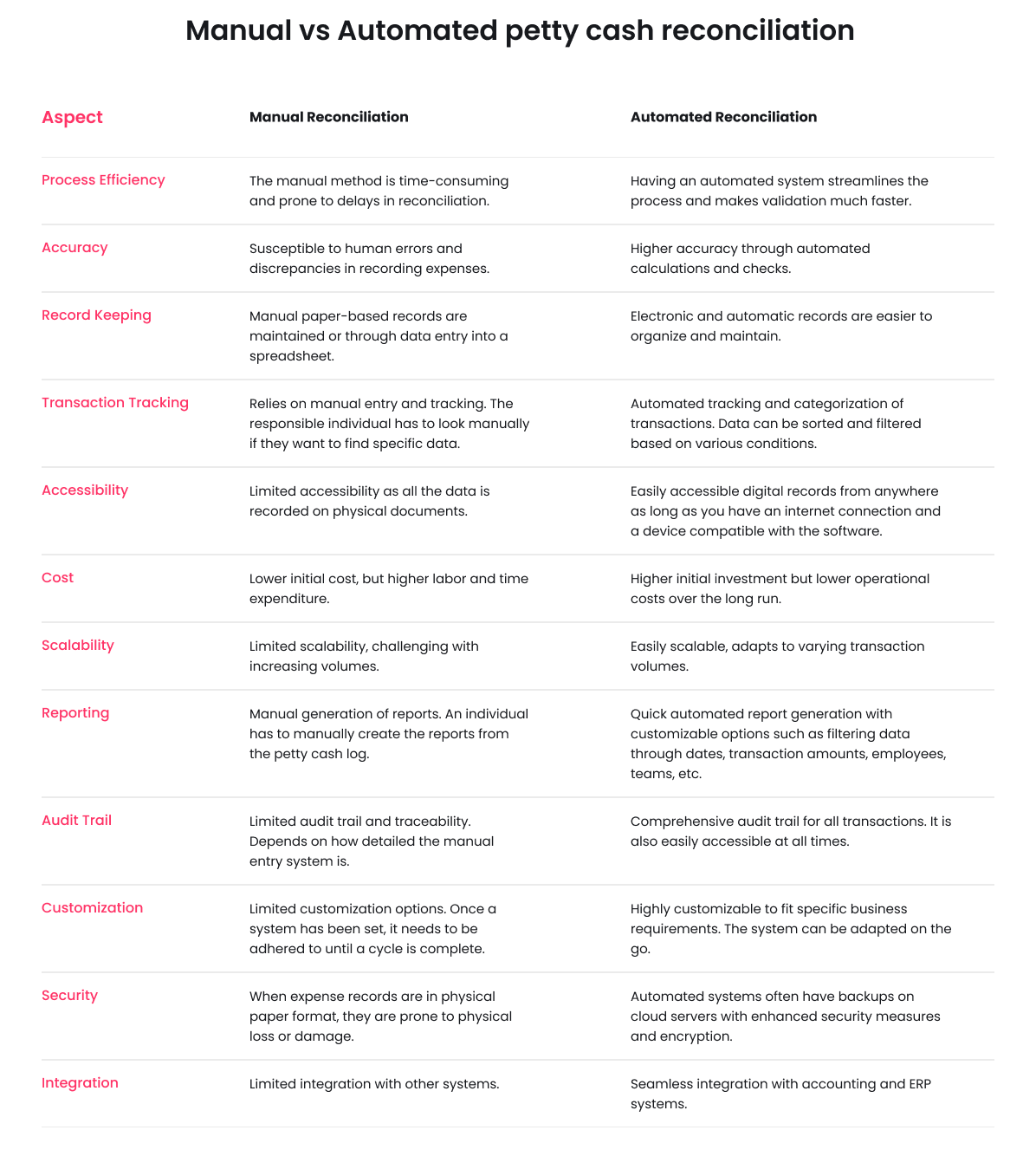

Manual vs Automated petty cash reconciliation

Automated reconciliation significantly outperforms manual methods in terms of efficiency, accuracy, accessibility, scalability, and security.

However, it typically involves higher initial costs but results in long-term savings and improved reliability in managing petty cash transactions.

Simplify reconciliations, reduce errors

Petty cash reconciliation: Best practices

1. Establish clear petty cash policies

Define comprehensive policies outlining the usage, procedures, and reconciliation protocols. Make sure that the employees dealing with the petty cash fund are aware of these established policies.

2. Segregation of duties

Assign distinct roles to different individuals, separating custodial, recording, and approval responsibilities. This will help people stay accountable and reduce the chance of fraudulent activity.

3. Regular reconciliation schedule

Conduct frequent reconciliations to accurately track expenses and cash balances. Do this at least every month so that there is a set review time to make changes or adapt to new needs.

4. Detailed documentation

Maintain thorough records, including receipts, vouchers, and a comprehensive log for each transaction. Use software systems to help make the recording process more efficient.

5. Physical counts and verification

Periodically perform physical counts of cash to verify against recorded amounts. Do this to ensure that the records are not being manipulated in any way.

6. Use of technology or software

Leverage automated tools or software for efficient and accurate reconciliation processes. Using such systems makes the entire reconciliation process much easier.

7. Training and awareness

Provide training to staff involved and raise awareness about petty cash policies and procedures. Conduct specific sessions on different topics if needed to ensure that all the employees clearly understand the importance of it.

8. Internal audits and reviews

Conduct periodic internal audits to validate adherence to policies and identify areas for improvement. After going through a few reconciliation cycles, you will be able to tell where improvements need to be made.

9. Review and adjust procedures

Regularly review reconciliation procedures and adjust them to align with the changing needs of the employees or the organization and the financial legal regulations.

10. Maintain transparency and accountability

Foster an environment of transparency and accountability in handling petty cash to prevent misuse and ensure accurate record-keeping.

What are the tools and software for petty cash reconciliation?

1. Accounting software

Comprehensive accounting software often includes modules for petty cash management and reconciliation. This may or may not be included in the accounting software that your organization uses.

2. Spreadsheets

Excel or Google Sheets can be used to create custom reconciliation templates for tracking petty cash transactions. This is a good temporary alternative to a custom software system to get an idea of how a digital tracking system would work.

3. Mobile apps

Some mobile apps provide features for managing and reconciling petty cash on the go. These apps are usually just mobile versions of their desktop/web app counterparts.

4. Receipt scanning software

Tools that allow scanning and digitizing receipts for easy documentation. This can be a separate application program but it is often part of the mobile app provided by the petty cash management software company.

It is often the case that these software offer varying features and it is thus recommended to do proper research on the best petty cash management software in the market to make an informed decision of what best suits your business requirements.

5. Specialized petty cash management tools

Dedicated software specifically designed for efficiently managing petty cash reconciliation. There will be many such options available in the market.

Conduct thorough research to ensure you choose the right one for your business.

6. Expense management platforms

Platforms offering end-to-end expense management often include features for petty cash reconciliation and tracking.

How does Volopay help businesses to simplify their petty cash reconciliation?

Volopay is an all-in-one expense management platform for businesses. Our expense management platform also comes with the option for companies to create their own physical and virtual corporate cards that can be used to make expenses.

This is a great way for organizations to disburse and manage their petty cash rather than actually handling physical cash.

Here’s how the Volopay corporate cards can help you manage your petty cash:

1. Employee cards

You can issue one physical card for each employee. This helps employees make transactions faster rather than sharing a company credit card or waiting for funds to be disbursed in their account from the finance team.

2. Custom spending limit

Each card can be set with a custom spending limit. This will ensure that there is no overspending by any employee.

3. Automated tracking

Each purchase that is made by an employee using their corporate card will automatically be recorded on Volopay’s central dashboard.

Admins can also set custom notifications for specific cards or employees to know exactly when, where, and how budgets are being spent.

4. Mandatory submission

As an admin, you can mandate employees to submit proof of a transaction and add a custom note regarding the purchase.

They can do this by uploading pictures of the expense receipt. This helps in the documentation and verification process for reconciliation.

5. Budget refresh

As an admin, you can also set custom timeframes for the budget of a corporate card to be replenished such as daily, weekly, and monthly. This ensures that the employees always have sufficient funds to carry out their operations.

Elevate your accounting game

FAQs on petty cash reconciliation

Petty cash reconciliation is the process of cross-verifying and balancing petty cash transactions against remaining cash to ensure accuracy and alignment between recorded expenses and actual cash on hand.

Bank reconciliation, account reconciliation, and petty cash reconciliation are three common types used in financial management.

Typically, the designated custodian or an assigned individual within an organization is responsible for reconciling petty cash transactions. This may differ from business to business depending on their internal structure.

Benefits of reconciling petty cash include accurate expense tracking, financial accountability, fraud prevention, improved budget control, compliance adherence, and informed decision-making.

Yes, various software tools are available specifically designed to streamline and automate the petty cash reconciliation process.

Volopay offers a streamlined platform integrating expense management, real-time tracking, and automated reconciliation features, simplifying and enhancing the accuracy of petty cash management.

Businesses prefer Volopay for its user-friendly interface, automation capabilities, real-time expense tracking, robust reconciliation features, and seamless integration, offering efficient and transparent petty cash management in the form of physical and virtual corporate cards.

The cards help alleviate the drawbacks of hard cash and help finance teams make petty cash management more efficient.