Integrated accounting system - Features & benefits

An integrated accounting system interconnects your accounting and business processes and works collaboratively to achieve maximum efficiency. An integrated system ensures all the methods and procedures go hand-in-hand without leading to data blind spots.

Traditionally, business processes like sales, accounting, finance, inventory management, and customer relationship management were maintained separately, which increased the business's operational costs and left with less working capital.

Not to mention, this process was demanding in terms of time and effort and faced challenges at the time of closing books.

What is an integrated accounting system?

The integrated system of accounting is an automated version of the ERP system, which combines all primary functions of the accounting and finance teams.

It eliminates individual bookkeeping for invoices, reconciliation, sales, and other activities. It ensures that the books are consolidated in time with utmost accuracy.

Though you may wonder if integrating these processes might lead to duplicacy of entries?

The answer is No!

The integration of all the systems is meticulously done through cloud-based platforms. The system keeps everything unified in the back-end; there is no chance of misjudging data.

5 important features of integrated accounting system

The integrated accounting system is the solution companies were looking for to balance the timely filing of financial statements with accuracy and minimal time frame.

What can be expected from the integrated business software system?

1. Vendor management

Vendor management helps with the scattered vendor data, unmanaged supply chain, and in-time invoice processing.

The automated accounting system helps generate purchase orders, send them to the buyer’s accounts team, resolve any queries, and verify the receipt of goods.

2. Reconciliation

Reconciliation is the most arduous process for an accounts team. Matching the invoices and the payments is crucial in keeping track of cash flow.

Sometimes accounts teams end up paying twice for the same invoice.

To avoid situations like these, using an automated system is required. The system ensures timely payments of dues invoice reconciliation and prevents duplication of expenses.

3. Bookkeeping system

By integrating business systems, you need not maintain separate records for each activity. The integrated approach takes into account all the data being stored and ensures daily updation of books and ledgers.

4. Accounts payable and receivable

The next feature of an integrated accounting system is keeping accounts receivable and payable records.

It’s important to know which payments are pending to be paid and which are yet to be received. This helps in identifying a company’s liquidity at a point in time.

5. Automated accounting system

The integrated system of accounting is a contemporary tool with automation at its disposal.

You can unload the burden of your employees by automating invoice approvals, reconciliation, instant fund transfer, and many more features at your fingertips.

What’s wrong with manual accounting?

Many businesses still rely on manual accounting systems owing to fear of change in accounting outlook and lack of expertise in computerized accounting. How long can companies believe their current way of accounting is helping in attaining financial security, enabling cost-saving, and providing flawless financial statements?

Companies don’t realize the existing accounting technique is hampering their accounting records. The manual system of accounting is prone to errors and human inaccuracy. It makes accounting tasks like invoice management, accounts payable, and accounts receivable more time-consuming and complex. The possibility of reversing an entry is also negligible. Not to mention- the cost involved in this process is much higher than other accounting techniques.

4 main benefits of integrated accounting system

An integrated accounting system has accelerated the way companies process their accounting and financial reporting. The results can be seen in easy invoice management, on-the-go reconciliation, and timely closure of books.

Apart from this too, companies have achieved significant results like:

1. Minimum requirement of manual work

The traditional method of accounting and bookkeeping was too exhaustive for employees as they were required to switch between the files and documents every day. The work seemed a burden to them with the increasing number of clients.

Hence, automation dramatically reduces the overloaded employees and ensures minimum paperwork. Every record is stored in a digital format, and tasks like approvals, fund requests, and budget management are done automatically.

2. Say no to complex accounting

Through adopting automation in accounting, the complexities of a manual method can be avoided. This is in regards to the time and money involved in it.

The manual mode causes a gradual increase in the cost per invoice due to the printing and stationery charges. And needless to say, without any machines being involved, the ongoing processes are bound to be slow and tedious.

3. Enhanced financial visibility

The integrated systems are designed to provide companies with an accurate financial picture at any point in time. But going through every transaction and ledger in the system is an appropriate choice for any company.

Hence, the system presents the financial statements in a graphical format that gives every department and activity visibility.

4. Security

Compared to the traditional method of storing records, the modernized way of maintaining financial data and other information is much more emphasized. Here, companies can record and store the data in a digital format without having to worry about any data piracy or phishing. Companies can even have a backup of this information on a hard disk.

On the other hand, the manual system was a significant threat to the company's financial security. Chances of papers being misplaced, exchanged, or damaged always existed.

Streamline integrated accounting with Volopay

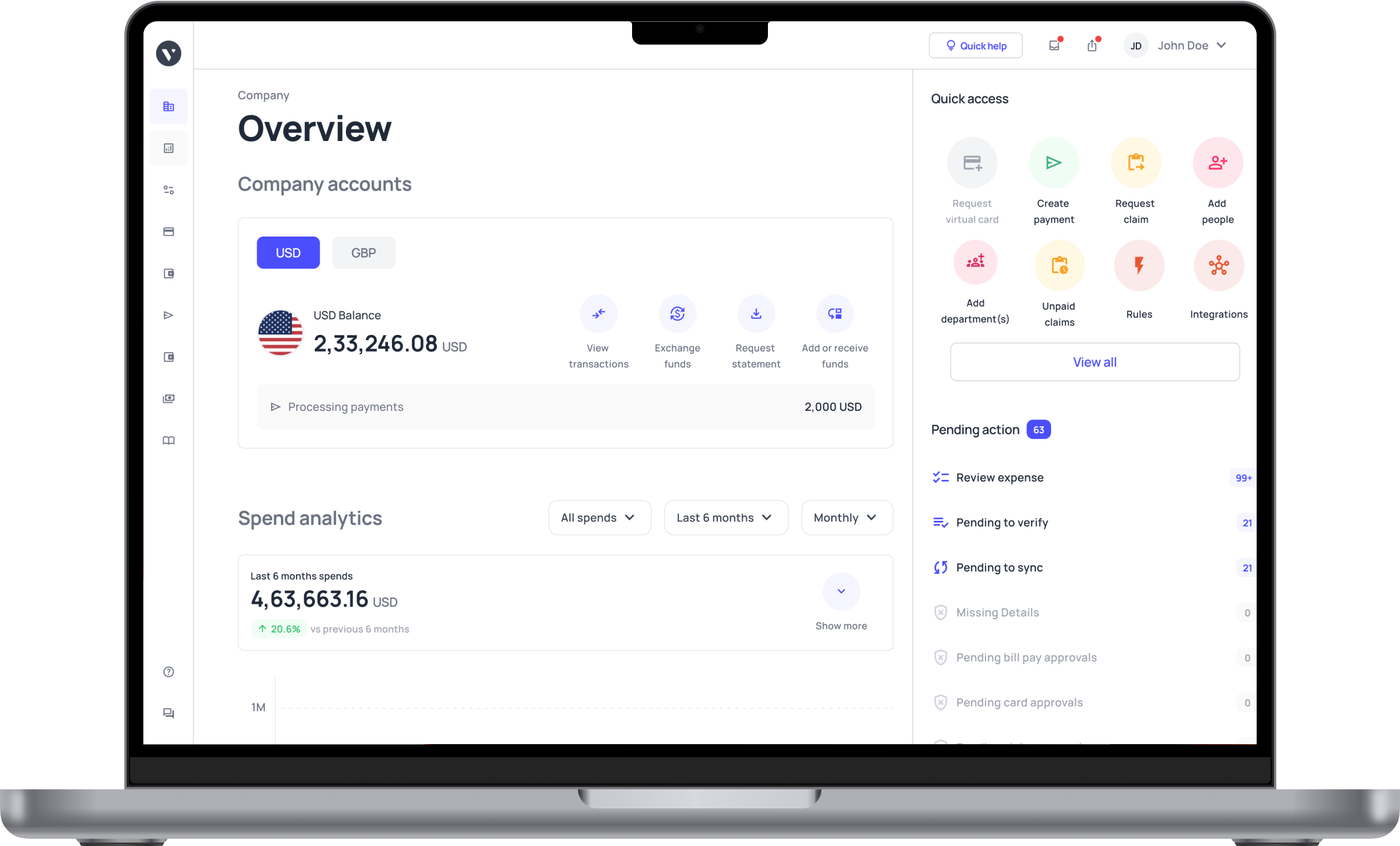

Volopay offers an end-to-end solution for an integrated accounting system. Automation being the key driver of our software, processes can now seamlessly integrate and allow an uninterrupted flow of information.

Our financial accounting software allows you to comprehend your company's financial health, revise the budgets of each department, and establish financial controls for the workforce. Tools like corporate cards help you keep track of your business expenses. Reimbursements are valid for out-of-pocket expenses. You can send and receive remittances domestically and internationally in more than 130+ countries with minimum fees.

We provide integrations with software like Netsuite, Xero, and Quickbooks to enhance your business reporting. Apart from this, companies stand a chance to earn lucrative rewards like cashbacks on Bill pay. Our powerful integrations allow users to close books 10x faster by enabling intelligent workflows that auto-categorize the transactions and place them into the correct ledgers.

Seamlessly sync all your transactions and receipts into your accounting software without jumbling up your accounting books. Changes to your Volopay account shall be reflected in your accounting software to ensure both the databases are updated and on the same page.

We believe every company needs a tailor-made solution for their business, considering their unique accounting practices and methodologies. We ensure our users fully utilize our platform in streamlining their accounting workflow.