11 Best corporate credit cards in Singapore for 2026

In the world of corporate finances, managing day-to-day expenses can often be as intricate as handling substantial investments. Petty cash, a modest yet vital component, plays a crucial role in maintaining the financial flow within a business. However, managing and handling petty cash comes with its own set of challenges.

To solve these issues, businesses have started using corporate credit cards to streamline daily expenses and accounting. These corporate cards, along with virtual prepaid cards, can benefit businesses of all sizes and are great tools to replace petty cash and make the most of a company’s budget.

What is a corporate credit card?

A corporate credit card, in essence, is a financial instrument tailored for businesses. It allows employees to make authorized purchases on behalf of the company, offering a seamless alternative to traditional petty cash handling.

These cards typically come with higher spending limits and are specifically designed to cater to the unique financial needs of organizations.

How does a corporate credit card work?

Corporate credit cards function on a simple premise: the company issues these cards to its employees, granting them the authority to make business-related purchases. The company then receives a consolidated bill, simplifying expense tracking and reimbursement.

With customizable spending limits and expense categories, corporate credit cards empower businesses to maintain control and transparency in their financial operations.

Best corporate cards in Singapore in 2026

Corporate credit cards are indispensable tools for businesses, offering financial flexibility and control.

Let's explore some of the top corporate card providers in Singapore for 2026, each catering to different needs and preferences.

1. Volopay corporate card

● Overview

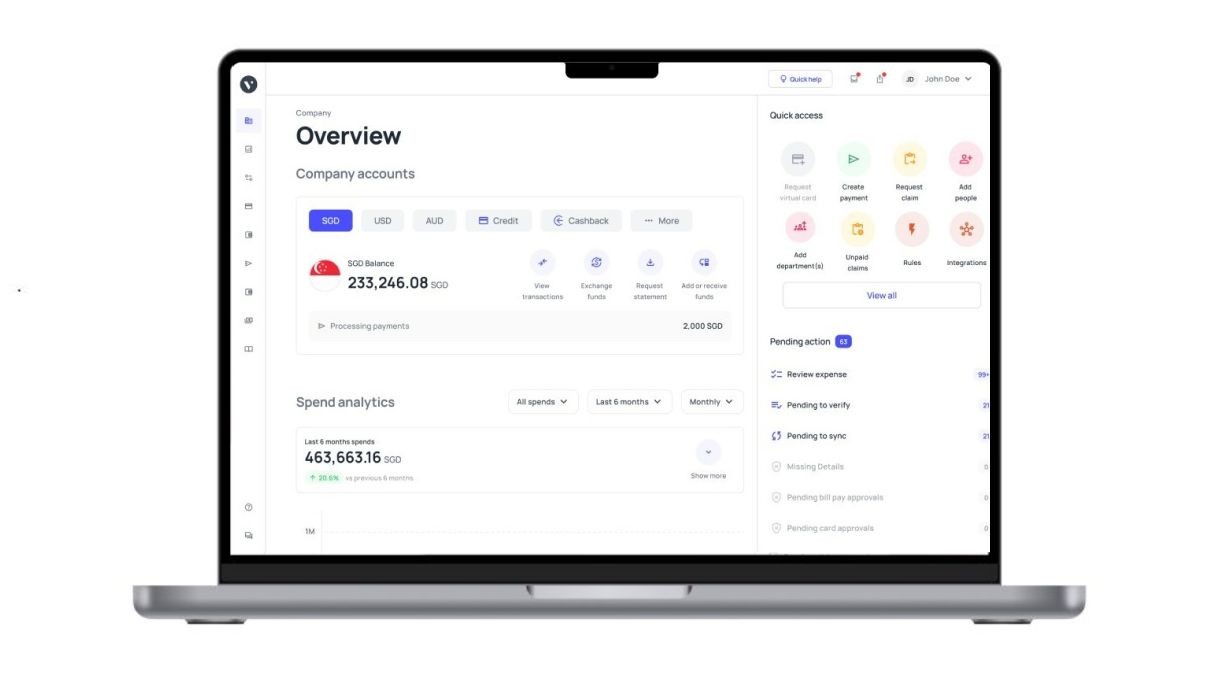

Volopay offers feature-packed corporate cards with a focus on expense management and automation.

Companies can use Volopay’s physical and virtual corporate cards, which are considered among the best corporate card options for businesses looking to streamline their financial operations.

Our platform integrates seamlessly with popular accounting software to ensure all your corporate card expenses are in sync with your company ledger.

● Set-up process and requirements

Setting up a Volopay corporate card is straightforward, with minimal requirements, making it accessible to a wide range of businesses. You must simply complete the registration process through our website after which a representative will get in touch with you to take things forward.

● Key features of the card

Volopay's card boasts features like real-time expense tracking, virtual cards for online payments, and customizable spending limits for each corporate card that you issue for your business and its employees.

These features solidify its position as one of the best corporate card solutions for small to large-sized businesses focused on expense control and customization.

● Limitations

While Volopay offers robust expense management, it may not be as suitable for businesses seeking rewards or cashback options.

● Targeted customers

Small to medium-sized businesses that prioritize expense control and automation with a deep level of customization.

● G2 rating

Highly rated on G2 with an average of 4.3 out of 5 stars for our user-friendly interface and excellent customer support.

2. Citi corporate card

● Overview

Citibank is a global financial giant, and its corporate card offering is no exception. For businesses seeking the best corporate credit card, Citi provides a wide range of services, including travel and entertainment expense management.

● Set-up process and requirements

The setup process for a Citi Corporate Card may involve more extensive requirements, catering to established enterprises.

● Key features of the card

Citibank's card comes with a plethora of perks, including rewards programs, travel benefits, and concierge services. Citibank corporate cardholders also get complimentary travel accident insurance coverage of up to S$1,000,000 per card member if the full fare is charged to the Citi Corporate Card.

● Limitations

It may be less accessible for smaller businesses due to potentially higher credit requirements. The Citi corporate credit card also has many eligibility requirements such as - The business needs to have a minimum net worth of $100,000 depending on the years of operation, the employee using the card must be 21 years or older, and other terms and conditions.

● Targeted customers

Medium to large enterprises seeking a comprehensive corporate card solution.

● G2 rating

Since Citi is a traditional bank and not an online SaaS service provider, they are not rated on the G2 platform.

3. Aspire

● Overview

Aspire was founded in 2018 in Singapore. The company offers corporate cards tailored to startups and SMEs, with a focus on cashback rewards and expense tracking.

● Set-up process and requirements

Aspire's corporate cards are designed to be accessible to startups and SMEs, with a streamlined application process.

● Key features of the card

Cashback rewards, no annual fees, and integrations with accounting software make Aspire an attractive choice for many businesses.

● Limitations

It may not offer the same level of premium services as larger banks. You will also need to pay additional fees for each user that you want to add to the platform to issue cards for them and control and track their expenses. You can issue multiple corporate cards but it comes for $15/card.

● Targeted customers

Startups and SMEs looking for cost-effective corporate card solutions.

● G2 rating

Favorable G2 ratings for its simplicity and transparency. Aspire has an average rating of 4.6 out of 5 stars.

4. UOB Platinum Business Card

● Overview

UOB's corporate card provides various financial services, including expense management and credit solutions, catering to various business needs. It’s often regarded as one of the best corporate credit card options for businesses seeking flexibility and control over their expenses.

● Set-up process and requirements

UOB's setup process is tailored to both small and large businesses, offering flexibility.

● Key features of the card

UOB offers rewards programs, travel privileges, and comprehensive expense management tools to get a complete view of business expenses for enhanced visibility and control. The card also offers an extended payment term of up to 51 days which helps your business manage its cash flow more efficiently.

● Limitations

It may have slightly higher credit requirements for certain features.

● Targeted customers

Businesses of different sizes looking for a well-rounded corporate card.

● G2 rating

Since UOB is a traditional bank they are not rated on the G2 platform.

5. DBS World Business Card

● Overview

DBS offers a corporate card with a strong emphasis on travel and entertainment benefits, making it an attractive choice for companies with significant travel expenses.

● Set-up process and requirements

DBS caters to a wide range of businesses, with varying setup requirements.

● Key features of the card

Travel and entertainment perks, cash rebates, and comprehensive online expense management. Businesses using this DBS car can get up to 2% cash rebate. When you use the DBS World Business Card to book your complete travel fare, you also get up to S$1 million in travel insurance coverage.

Cardholders also get a 10x priority pass that lets them enjoy up to 10 complimentary visits per annum to over 1,000 airport lounges worldwide.

● Limitations

May have higher credit requirements for certain privileges.

● Targeted customers

Companies with significant travel and entertainment expenses.

● G2 rating

Since DBS is a traditional bank they are not rated on the G2 platform.

Related read: Review - DBS corporate card in Singapore for businesses

6. Maybank Business Platinum Card

● Overview

Maybank's corporate card offers various financial services, including expense management and credit solutions, catering to various business needs.

● Set-up process and requirements

Maybank's setup process is tailored to both small and large businesses, offering flexibility.

● Key features of the card

Maybank offers rewards programs, travel privileges, and expense management tools to keep track of card expenses.

You also get other features like complimentary business logo printing, a 2-year annual fee waiver, a low-interest rate of 20% p.a., global concierge services, TREATS points for every dollar spent, complimentary travel insurance, and worldwide withdrawal services. You can also redeem S$50 cash credits to offset credit card bills.

● Limitations

It may have slightly higher credit requirements for certain features.

● Targeted customers

Businesses of different sizes looking for a well-rounded corporate card.

● G2 rating

Since Maybank is a traditional bank they are not rated on the G2 platform.

7. AMEX corporate card

● Overview

American Express, a renowned financial institution, offers a corporate card with a focus on travel and entertainment benefits, along with comprehensive expense management solutions.

● Set-up process and requirements

AMEX caters to established enterprises, often requiring robust credit credentials.

● Key features of the card

AMEX's corporate cards provide access to premium travel lounges, rewards programs, and expense management tools. They offer three types of corporate cards namely the Corporate Platinum Card®, Corporate Gold Card, and the Corporate Green Card.

Each card offers monitoring and reporting capabilities forecast future spending by leveraging customizable features, alerts, and status tracking. The 51 interest-free days to pay for purchases make them a great option for businesses with longer cash flow periods.

Complimentary business travel accident insurance, 3-5% Uber Cash, and access to 1,550+ airport lounges in over 500 airports around the world are also among the various benefits for AMEX corporate cardholders.

● Limitations

It may not be as accessible for smaller businesses due to potentially higher credit requirements.

● Targeted customers

Medium to large enterprises seeking premium corporate card services.

● G2 rating

Since American Express is a traditional bank they are not rated on the G2 platform.

Related read: Review - American Express corporate cards

8. Wise business cards

● Overview

Wise offers a globally recognized debit card designed for businesses engaged in international transactions. It facilitates seamless multi-currency operations, making it ideal for companies with cross-border dealings.

● Set-up process and requirements

Account creation: Businesses can sign up online by providing the necessary documentation to verify the company's identity.

Card issuance: The first card is free; additional employee cards can be ordered for a one-time fee of SGD 4 each.

No monthly fees: There are no subscription or monthly maintenance fees associated with the card.

● Key features of the card

Multi-currency support: Hold and manage funds in over 40 currencies.

Real exchange rates: Currency conversions are done at mid-market rates with low, transparent fees.

Expense management: Issue virtual and physical cards to employees with customizable spending limits.

Security features: Instant spending notifications, ability to freeze/unfreeze cards, and real-time expense tracking.

● Limitations

ATM withdrawals: Limited to two free withdrawals up to SGD 350 each month; subsequent withdrawals incur fees.

No credit facility: As a debit card, it doesn't offer credit or financing options.

● Targeted customers

Small to medium-sized enterprises (SMEs) and startups that require efficient international payment solutions without the complexities of traditional banking.

● G2 rating

Wise Business has a G2 rating of 3.9 out of 5.

9. YouBiz corporate card

● Overview

YouBiz, a product of YouTrip in partnership with Mastercard, is a corporate card tailored for SMEs aiming to optimize their global financial operations. It combines multi-currency capabilities with expense management tools, offering a comprehensive solution for modern businesses.

● Set-up process and requirements

Online registration: Businesses can sign up online without any setup fees or minimum balance requirements.

Immediate access: Upon approval, companies can issue unlimited virtual and physical cards to their teams.

● Key features of the card

Unlimited 1% cashback: Earn 1% cashback on all card expenditures with no caps or minimum spend requirements.

Zero foreign exchange (FX) fees: Make payments in over 150 currencies without incurring FX fees.

Multi-currency accounts: Manage funds in up to nine different currencies, facilitating global transactions.

Expense management: Assign roles with varying permissions, set spending limits, and track expenses in real-time.

Integration with accounting tools: Seamless integration with platforms like Xero for efficient financial management.

Additional perks: Access to exclusive deals on business tools and services, enhancing overall value.

● Limitations

Geographical availability: Currently focused on the Southeast Asian market; availability in other regions may be limited.

Credit facility: While offering flexible business financing, terms and eligibility criteria apply.

● Targeted customers

SMEs and growing businesses seeking a robust financial tool that combines global payment capabilities with comprehensive expense management.

● G2 rating

YouBiz’s parent company, Mastercard, holds a G2 rating of 4.2 out of 5.

10. OCBC business credit card

● Overview

OCBC offers Asia's first sustainable business credit card, which rewards companies for eco-friendly spending while helping them track their carbon footprint. The card stands out in Singapore's corporate credit market by integrating environmental consciousness with business expense management.

● Set-up process and requirements

The application process for the OCBC Business Credit Card can be completed through OCBC's business banking channels. Businesses need to have an existing OCBC business account or be prepared to open one as part of the application process.

Other criteria also include that the business must be incorporated in Singapore and at least 30% of it is owned by a Singaporean or Singapore PR.

● Key features of the card

The card offers a 3% rebate on spending at eco-friendly merchants like Microsoft, Meta, and Apple. Beyond sustainability rewards, the OCBC Business Credit Card provides businesses with consolidated expense tracking and detailed spending reports. The card also offers an interest-free period of up to 53 days for each transaction.

● Limitations

While the sustainability focus is innovative, the 3% rebate is limited to specific eco-friendly merchant categories, which may not align with all business spending needs. Companies with heavy expenditure outside these designated merchants may find the rewards less attractive compared to general cashback cards.

Additionally, the focus on environmental tracking may be more appealing to businesses with ESG (Environmental, Social, and Governance) commitments rather than those purely seeking maximum financial returns.

● Targeted customers

The OCBC Business Credit Card is ideal for small to medium-sized enterprises that prioritize sustainability and want to monitor their environmental impact.

● G2 rating

G2 ratings are not applicable to credit card products. Customer reviews and ratings for OCBC's business banking services can typically be found on banking comparison websites, Google reviews, or the Monetary Authority of Singapore's financial consumer protection resources.

11. HSBC corporate card

● Overview

HSBC's Commercial Cards Programme offers a range of solutions designed to help businesses reduce costs, leverage merchant spend data to negotiate supplier discounts, and more effectively manage working capital.

The program includes multiple card types tailored to different business needs, with the flagship HSBC World Corporate Mastercard providing increased control and visibility over travel, entertainment, and everyday business expenses.

● Set-up process and requirements

HSBC corporate cards are available to businesses with HSBC corporate banking relationships. The application process requires company registration documents, financial information, and details about the intended number of cardholders.

Once approved, businesses can manage cardholders and their spending through HSBC's online management platform MiVision, which provides control and insight to monitor costs and maximize efficiency.

The setup process typically involves working with an HSBC relationship manager who can customize the card program to the company's specific needs.

● Key features of the card

The HSBC World Corporate Mastercard offers fraud protection with liability waiver, travel insurance protection when air travel expenses are charged to the card, and travel and entertainment privileges.

The program provides powerful online management and reporting capabilities, allowing companies to streamline their procure-to-pay processes and generate detailed expense reports. Additional benefits include the ability to leverage merchant spend data to negotiate supplier discounts and improved working capital management.

HSBC also offers specialized cards within the program, including the Corporate Card for Purchases (focused on procurement), Central Travel Account (for centralized travel bookings), and Virtual Cards for enhanced security and control.

● Limitations

HSBC corporate cards are primarily suited for larger businesses or those with established corporate banking relationships with HSBC. The program may be less accessible for small businesses or startups without significant banking history.

While the MiVision platform offers comprehensive management tools, there may be a learning curve for businesses new to corporate card management systems. Additionally, some of the premium benefits, like negotiated supplier discounts, are most valuable for companies with substantial purchasing volume.

● Targeted customers

HSBC corporate cards are best suited for:

- - Medium to large enterprises with complex expense management needs

- - Companies with significant travel and entertainment expenses

- - Businesses seeking centralized control over multiple cardholders

● G2 rating

G2 ratings do not apply to corporate credit cards, as G2 is a platform specifically for reviewing business software and technology services rather than financial products.

What are the benefits of using corporate credit cards?

1. Expense management

One of the most significant advantages of corporate credit cards is their ability to streamline expense management.

When paired with dedicated expense management cards, they offer enhanced visibility and control—allowing businesses to categorize spending, track usage by team or project, and maintain financial accuracy with greater ease.

2. Separation of business and personal expenses

Corporate credit cards provide a clear differentiation between business and personal spending. This separation not only reduces the chances of mixing finances but also simplifies tax filing and accounting, a critical factor for companies of all sizes.

Separating business and company expenses from a single card statement is very time-consuming and can lead to confusion.

3. Employee spend control

Without a centralized system and payment tools to track employee expenses, it is very hard to control employee expenditures. Businesses can set spending limits on corporate credit cards, allowing them to exercise precise control over their employees' expenditures.

This control mechanism ensures that spending remains within predefined boundaries, preventing overspending and promoting responsible financial practices.

4. Simplified reconciliation

Reconciliation can be a time-consuming task, but using the best corporate credit card can significantly simplify this process.

Since all transactions are neatly documented on a single statement, reconciling expenses becomes straightforward, saving time and reducing errors. This efficiency helps businesses focus on strategic tasks rather than tedious financial administration.

5. Enhanced security

Security is a paramount concern in the business world. Corporate credit cards typically come with robust security features, including fraud protection and the ability to monitor and manage transactions in real time.

These measures offer peace of mind, safeguarding against unauthorized or suspicious activities. They also have instant card-blocking features in case the card is lost or stolen.

6. Cash flow management

Maintaining healthy cash flow is vital for any business. Corporate credit cards offer a valuable solution by allowing companies to defer payments while still meeting their financial obligations.

This flexibility ensures that businesses have the working capital they need to seize opportunities or weather financial challenges.

Also dive into our latest article where we unveil practical tips and expert insights on how to increase your business cash flow. From optimizing revenue streams to smart expense management, discover actionable steps to improve your cash flow and empower your financial stability.

7. Real-time spend visibility

Modern corporate credit card providers often offer online portals and mobile apps that provide real-time spending visibility. This transparency empowers businesses to monitor expenses as they occur, aiding in better decision-making and budgeting.

8. Improves credit score

Using a corporate credit card wisely can positively impact a company's credit score. Timely payments and responsible credit management can help build a strong credit history, which can, in turn, open doors to better financing options and partnerships to grow and expand your business further.

Factors to consider before choosing a corporate credit card in Singapore

When selecting the best corporate credit cards in Singapore, you need to evaluate several critical factors that will impact your business operations and financial management. Making the right choice requires careful consideration of your company's specific needs and future growth plans.

1. Expense management and reporting tools

Your chosen corporate credit card should offer sophisticated expense management capabilities that streamline your financial processes. Look for providers that deliver automated expense categorization, receipt capture functionality, and comprehensive reporting dashboards.

These tools help you maintain accurate financial records while reducing administrative burden on your finance team. The best corporate credit cards provide real-time visibility into spending patterns, enabling better budget control and financial decision-making.

2. Card fees and interest rates

Understanding the complete fee structure is essential when comparing corporate credit cards for business. Annual fees, transaction charges, foreign exchange rates, and late payment penalties can significantly impact your total cost of ownership.

Some providers offer tiered pricing based on transaction volume or premium features, while others maintain flat-rate structures. Calculate the total cost based on your expected usage patterns to identify the most cost-effective solution.

3. Spending limits and flexibility

Your business needs flexible spending limits that can accommodate varying operational requirements. The best providers offer customizable limits for individual employees, departments, or expense categories.

This flexibility ensures your team can make necessary purchases while maintaining proper financial controls. Consider whether limits can be adjusted quickly for special projects or seasonal business fluctuations.

4. Global acceptance and multi-currency support

For businesses operating internationally or making frequent overseas purchases, global acceptance becomes crucial. Best corporate credit card providers typically offer Visa or Mastercard networks, ensuring worldwide acceptance.

Multi-currency support helps minimize foreign exchange fees and provides transparent pricing for international transactions.

5. Integration with accounting or ERP systems

Seamless integration with your existing accounting software or ERP systems eliminates manual data entry and reduces errors.

Look for providers offering APIs or direct integrations with popular platforms like QuickBooks, Xero, or SAP. This connectivity streamlines your financial workflows and improves accuracy in financial reporting.

6. Security features and fraud protection

Robust security measures protect your business from financial fraud and unauthorized transactions. Advanced features include real-time transaction monitoring, SMS alerts, spending controls, and virtual card numbers for online purchases.

The best corporate credit cards in Singapore employ multiple layers of security to safeguard your business finances.

7. Employee card issuance and controls

Efficient employee card management allows you to issue cards quickly while maintaining proper oversight. Look for platforms offering instant virtual card creation, customizable spending controls, and easy card activation or deactivation processes.

8. Customer service and dispute resolution

Reliable customer support ensures quick resolution of issues and disputes. Evaluate the provider's support channels, response times, and dispute handling procedures to ensure adequate assistance when needed.

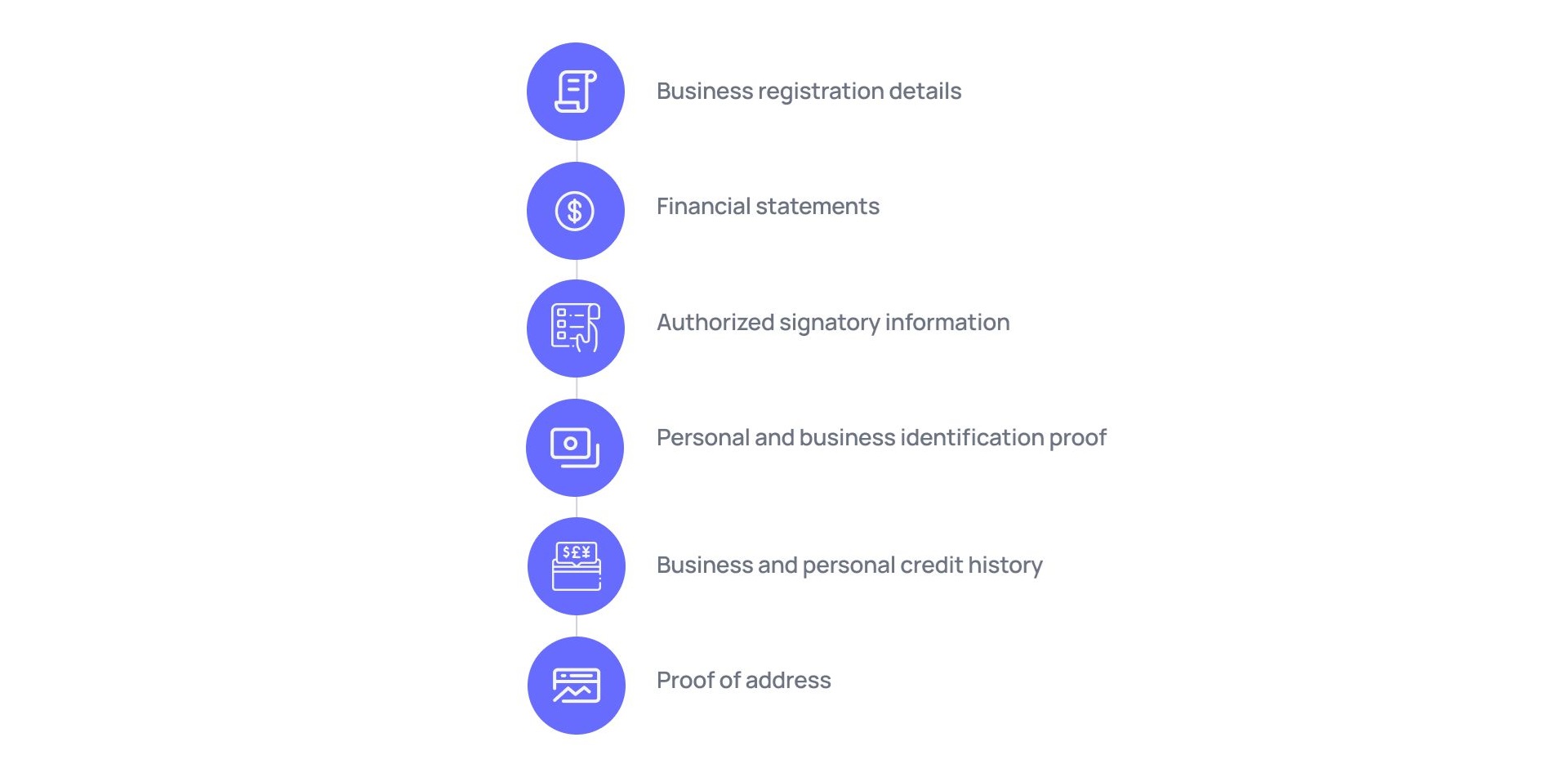

What documents are required to apply for a corporate card in Singapore?

Before you embark on the journey to secure a corporate credit card for your business in Singapore, it's crucial to be prepared with the necessary documentation.

Here's a list of key documents you'll need to provide to ensure a smooth application process:

1. Business registration details

To establish your eligibility, you'll need to furnish your business's registration details, including your company's name, registration number, and any pertinent legal documents.

2. Financial statements

Most financial institutions will require your company's financial statements, such as balance sheets, income statements, and cash flow statements. These documents provide insights into your business's financial health.

3. Authorized signatory information

You'll need to identify the individuals authorized to use and manage the corporate card. This typically includes key decision-makers within your organization.

4. Personal and business identification proof

Provide personal identification documents, such as passports or national identity cards, for the authorized signatories. Additionally, include any business identification documents that apply to your industry.

5. Business and personal credit history

Lenders often assess the creditworthiness of both the business and the authorized signatories. This entails reviewing the credit history of the business and the personal credit history of the cardholders.

6. Proof of address

You may be required to submit proof of the business's physical address, as well as the residential addresses of the authorized signatories. This helps validate the accuracy of the provided information.

Corporate cards for secure and fast payments

How to apply for a corporate credit card in Singapore?

1. Assess your business needs

Each business may have slightly different reasons for issuing corporate cards. Before embarking on the application process, assess your business's financial requirements and how the best corporate credit card can address them.

Consider factors like expense management, employee spending, and credit terms to determine the most suitable option.

2. Choose the right provider

Once you have understood your corporate card requirements, research and select a corporate credit card provider that aligns with your business needs.

Consider factors like rewards, fees, and features offered by different providers. Make sure you select an option that is suitable to you in terms of the cost as well as the features that it provides you.

3. Evaluate credit limits

Determine the credit limits required for your business. These limits should be based on your financial needs and the creditworthiness of your organization.

When selecting a corporate credit card provider, ensure that they can provide you with the credit limit that you are looking for.

4. Submit the required documents and application

Compile and submit all the necessary documentation mentioned in the previous section. Carefully complete the application provided by your chosen corporate card provider.

Common documents that most providers will ask for include your company’s financial statements and other legal documents to check your financial health and stability.

5. Wait for approval

The application process typically involves a review by the card provider. It may take some time for the provider to assess your eligibility and creditworthiness. They will also check your credit history if you have one to determine your credit score.

If not, they will look at your financial statements to determine the risk level they can take on for issuing corporate cards to your business.

6. Generate and activate the card

Once your application is approved, your corporate credit card will be generated. You'll receive the physical card, and you may need to activate it according to the provider's instructions. Depending on your needs, you may issue one or multiple corporate cards for your employees.

7. Establish a clear card usage policy

Develop a comprehensive card usage policy that outlines the guidelines and restrictions for cardholders. This is an important step to perform so that there are proper usage and spending guidelines available for employees when they get their corporate cards. This policy should cover spending limits, expense reporting, and authorized card usage.

8. Card issuance

If your business requires multiple cards for different employees, the cards will be issued to authorized individuals according to your card usage policy.

They will be delivered to each one of your employees as per the instructions and address filled out when issuing their cards.

9. Set spending limits

Configure spending limits on each card to ensure responsible usage. Many providers offering the best corporate credit card include tools for real-time monitoring and centralized expense management. These features enable better control over employee expenditures.

10. Train employees

Educate your employees on the proper use of the corporate credit card and the guidelines outlined in your card usage policy. Ensure they understand their responsibilities and limitations.

Conduct specific sessions to train your employees and solve any doubts regarding corporate credit card usage if needed.

11. Integrate with an expense management system

Consider integrating the corporate card usage with an expense management system or software. This will streamline expense tracking and reporting, enhancing financial transparency. Most corporate card providers will provide a platform to manage and track card expenses by default.

12. Monitor and review the usage

Regularly monitor and review the usage of corporate credit cards to ensure compliance with your policy. This will help identify any anomalies or discrepancies in spending.

After a proper review, you can modify and update card usage settings and guidelines to better suit the needs of your employees and manage your business expenses more effectively.

Regulatory and compliance aspects in Singapore

Operating corporate credit cards in Singapore requires adherence to strict regulatory frameworks established by local authorities. Understanding these compliance requirements helps you select providers that meet all necessary legal obligations while protecting your business interests.

1. Monetary Authority of Singapore (MAS) guidelines

The MAS oversees Singapore's financial services sector, including corporate credit card operations. Licensed providers must comply with capital adequacy requirements, operational risk management standards, and consumer protection guidelines.

When choosing best corporate credit card providers, ensure they hold appropriate MAS licenses and maintain compliance with regulatory standards. This oversight provides additional security and reliability for your business's financial operations.

2. KYC and AML verification requirements

Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are mandatory for all corporate credit card applications. You'll need to provide comprehensive business documentation, including company registration certificates, financial statements, and director identification.

These verification processes may take several days but ensure legitimacy and protect against financial crimes. Established providers streamline these procedures while maintaining regulatory compliance.

3. Corporate governance and risk controls

Singapore's corporate governance framework requires businesses to implement proper internal controls when using corporate credit cards. You must establish clear policies for employee card usage, spending approvals, and transaction monitoring.

Regular audits and compliance reviews help maintain adherence to governance standards. The best corporate credit cards provide tools supporting these governance requirements through automated controls and reporting features.

4. Data protection under PDPA

The Personal Data Protection Act (PDPA) governs how financial institutions collect, use, and protect personal data. Corporate credit card providers must implement robust data protection measures and obtain appropriate consent for data processing.

Your business also has obligations regarding employee data when issuing corporate cards. Understanding these requirements helps ensure compliance throughout the card lifecycle.

5. Tax and GST compliance obligations

Corporate credit card transactions affect your GST reporting and tax compliance obligations. Proper documentation and categorization of business expenses are essential for accurate tax filings.

Many corporate credit cards for business offer features supporting tax compliance through automated expense categorization and receipt management.

6. Reporting duties for businesses and banks

Both businesses and financial institutions have reporting obligations to regulatory authorities. Banks must report suspicious transactions and maintain transaction records, while businesses must ensure accurate financial reporting.

These dual obligations create a comprehensive compliance framework protecting Singapore's financial system integrity.

Volopay: The future of corporate cards for Singaporean businesses

Volopay represents the next generation of the best corporate cards in Singapore, combining cutting-edge technology with comprehensive expense management solutions.

Our innovative platform addresses modern business needs through advanced features designed specifically for Singapore's dynamic business environment.

Instant issuance of virtual and physical cards

Volopay revolutionizes card deployment by offering instant virtual card creation alongside physical card delivery. You can issue virtual cards immediately for online purchases, vendor payments, or employee expenses, eliminating waiting periods that traditionally delay business operations.

Physical corporate cards arrive within days, providing complete payment flexibility for your team. This dual approach ensures your business maintains operational continuity while adapting to digital-first payment trends.

Customizable spend controls and limits

Advanced spending controls allow you to establish precise parameters for each card or user. Set daily, weekly, or monthly limits, restrict merchant categories, or limit transaction types based on employee roles and responsibilities. These granular controls prevent overspending while ensuring legitimate business expenses proceed smoothly.

Real-time enforcement means unauthorized transactions are declined instantly, protecting your business from potential financial exposure. You can also implement approval workflows requiring manager authorization for transactions exceeding predetermined thresholds.

Seamless integration with accounting software

Volopay's robust API ecosystem connects directly with popular accounting platforms, including QuickBooks, Xero, NetSuite, and other ERP systems. Transaction data flows automatically into your accounting software, eliminating manual data entry and reducing reconciliation time.

This integration ensures accurate financial records while streamlining month-end closing processes. The platform supports custom field mapping, allowing you to align transaction categories with your specific chart of accounts.

Real-time expense tracking and insights

Comprehensive dashboards provide instant visibility into spending patterns, budget utilization, and expense trends across your organization. Real-time notifications alert you to unusual spending activity or budget overruns, enabling proactive financial management.

Advanced analytics help identify cost optimization opportunities and improve budget accuracy for future planning cycles.

Multi-currency support for global payments

Singapore businesses operating internationally benefit from Volopay's multi-currency capabilities. The platform supports major global currencies with competitive exchange rates and transparent fee structures.

This feature eliminates the complexity of managing multiple currency accounts while providing cost-effective international payment solutions.

Automated approval workflows

Streamlined approval processes reduce administrative overhead while maintaining proper authorization controls. Configure multi-level approval chains based on transaction amounts, expense categories, or organizational hierarchies.

Mobile approval capabilities ensure decisions aren't delayed when managers are traveling or working remotely.

Centralized dashboard for team management

A unified management interface provides complete oversight of all card activities, user permissions, and spending analytics.

This centralization simplifies administration while providing the detailed insights necessary for effective financial management, establishing Volopay as among the best corporate credit cards for comprehensive expense oversight.

Robust security and fraud protection

Enterprise-grade security features protect your business through advanced fraud detection, real-time transaction monitoring, and secure virtual card technology.

These comprehensive protection measures ensure your financial assets remain secure while maintaining operational flexibility.

Scalable for startups and enterprises

Volopay's flexible architecture scales from startup operations to large enterprise deployments, adapting to your business growth without requiring platform changes. Scalability makes it an ideal choice for ambitious Singapore businesses planning sustainable growth trajectories.

This flexibility accommodates various business structures and accounting practices, making implementation straightforward regardless of your existing financial systems.

Vendor payments made easy and fast

FAQs on corporate cards

Yes, responsible use of a corporate card can improve your business's credit. Timely payments and effective credit management can build a positive credit history for your company.

Yes, corporate card providers may deny your application based on factors such as creditworthiness, financial stability, or failure to meet their specific eligibility criteria.

It may be challenging to secure a corporate card with bad credit. Many providers require a strong credit history for approval.

However, options for businesses with less-than-perfect credit do exist, albeit with limitations.

Volopay corporate cards are Visa cards and are generally accepted worldwide, both within and outside Singapore.

However, acceptance may vary depending on the specific location and local payment networks.

Yes, Volopay corporate cards support cross-border payments, making them suitable for businesses with international operations or expenses.

Yes, most corporate card providers, including Volopay, allow you to set spending rules and customize limits for individual cards. This feature provides control and flexibility in managing employee expenses.

Yes, corporate cards typically allow ATM withdrawals, but it's important to be aware of associated fees and interest rates. This should be used judiciously, and businesses often set specific ATM withdrawal limits to manage cash access.