Guide to getting corporate credit cards in Singapore

One of the main aspects that business owners have to pay attention to is expenses. It’s no surprise that corporate credit cards get brought up a lot in the context of managing business expenses.

However, with many features, uses, and providers, it can be overwhelming to get started with choosing which corporate cards are the right ones for you.

With digitization being simultaneously one of the biggest challenges and opportunities for Singaporean businesses in 2024, you’ll want the best corporate credit card with automation and digital tools that allows you to keep up with the technology-driven market.

What are corporate credit cards?

As the name suggests, corporate credit cards are cards that are issued to companies. Unlike personal credit cards, business owners and employees aren’t legally responsible for corporate cards and their expenses.

Not only that, but the spending that happens on a corporate credit card doesn’t reflect on the owner’s personal credit score. Instead, they’re attributed to the business credit score.

You can issue corporate cards for employees to enable them to make business expenses without having to rely on reimbursements. Using corporate credit cards for small business is also beneficial as providers often offer rewards and other perks that will help your business spend more efficiently.

How do corporate credit cards work in Singapore?

At its core, corporate credit cards work similarly to personal credit or debit cards. You can use your corporate card to make payments both in-store and online. That said, corporate cards come with additional features that a personal credit card might not have.

For example, it’s likely that any corporate credit card you have for your business will be tied with an expense management dashboard to help you view and control all your cards.

Employees can make purchases on behalf of your business using a corporate credit card. Singapore has many providers that offer corporate credit cards.

After you create your cards, you’ll be able to issue them to your employees while still monitoring the expenses that they make. At the end of your repayment cycle, your business will be required to pay the credit balance of your cards.

What are the various forms of corporate credit cards?

1. Secured corporate cards

Secured corporate cards require collateral(a form of security against the money that will be provided), such as a deposit or a savings account, reducing the risk for issuers.

They're ideal or in some cases the only option for businesses with limited credit history or struggling to obtain unsecured cards.

2. Travel rewards corporate credit card

Designed for businesses with frequent travel expenses, these cards offer travel-related rewards, such as airline miles or hotel points.

They can significantly reduce travel costs for employees. Business executives who tend to have a lot of traveling needs prefer to opt for these types of credit cards.

3. Cashback/reward points corporate credit card

These cards allow companies to earn cashback or reward points on various expenditures. The rewards can be reinvested into the business or distributed among employees as incentives.

In many cases, the cashback earned can also be used to pay off the debt of the credit card itself.

4. Corporate charge cards

Corporate charge cards function like credit cards but require the full balance to be paid monthly. They're excellent for companies that want to control spending and avoid interest charges.

They almost function in the same way a prepaid card does.

5. Fuel cards

Fuel cards are tailored for businesses with a fleet of vehicles. They provide discounts or rewards for fuel purchases, helping to manage fuel expenses efficiently.

These will often be used by logistics, food delivery, and similar transportation-based service companies.

6. Fleet cards

Fleet cards are a specialized type of corporate card designed exclusively for businesses with large vehicle fleets. They offer features like fuel management, expense tracking, and maintenance control, streamlining fleet operations.

These cards can be considered a step up from the fuel cards with more features for managing large fleets.

Best corporate card providers in Singapore

1. Volopay

Features

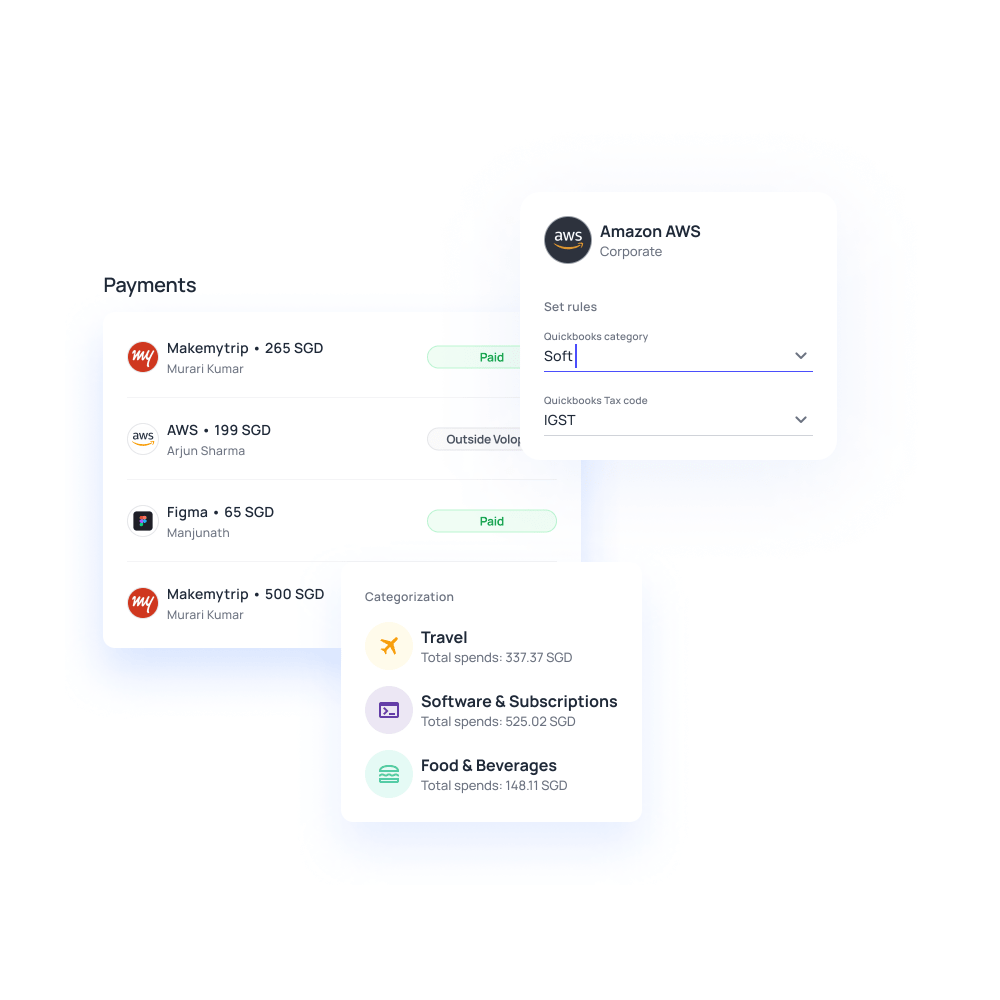

Volopay has a comprehensive corporate card offering with physical and virtual corporate cards for employees. Volopay cards are a part of its expense management software where you can track expenses in real-time, have multi-currency support for international payments, and integrate with popular accounting software.

Pros

Volopay has a user-friendly interface, robust expense management features, and competitive pricing.

Cons

Depending on the region, the cards may have limited merchant acceptance compared to traditional banks.

G2 rating

Volopay has an average rating of 4.2 out of 5 from 82 reviews on G2.

2. Aspire

Features

Aspire provides cashback rewards, expense tracking, virtual cards, and corporate expense reporting. Their corporate cards are a great option for businesses in Singapore. You can save on paying FX fees with multicurrency corporate cards. You can also integrate the platform with accounting software to sync and export the card transactions to your company ledger.

Pros

Easy-to-use platform, cashback rewards, and no foreign transaction fees.

Cons

Limited merchant acceptance outside of Singapore.

G2 rating

Aspire has an average rating of 4.5 out of 5 from 21 reviews on G2.

3. Citi corporate card

Features

The Citi corporate card is packed with features like global acceptance, travel benefits, and comprehensive expense reporting.

Pros

Extensive global network, travel perks, and customizable card options. The card also gives complimentary travel accident insurance coverage of up to S$1,000,000 per card member if the entire fare is charged to this card.

Cons

Higher annual fees and interest rates compared to some competitors. The minimum net worth of a company to obtain this card is $50,000 and may also depend on the years of operation.

G2 rating

Since Citi is a traditional bank, it is not listed on the G2 platform as a SaaS or corporate card provider.

4. UOB platinum business card

Features

UOB's Platinum Business Card comes with rewards, expense management tools, and special privileges for business travelers. They offer dining privileges at over 1,000 locations. UOB also gives S$500,000 worth of travel and personal accident insurance coverage for cardholders. These features make the UOB Platinum card a great option for frequent business travelers.

Pros

Rewards program, dedicated customer support, and airport lounge access.

Cons

Limited international acceptance compared to major global banks.

G2 rating

Since UOB is a traditional bank, it is not listed on the G2 platform as a SaaS or corporate card provider.

5. DBS world business card

Features

DBS World Business Card offers travel rewards, expense management tools, and comprehensive insurance coverage of up to S$1 million. The card users will get up to 2% cash rebate. You will receive DBS reward points as you spend. You can use these to redeem air miles or cash rebates.

Pros

Travel benefits, extensive insurance coverage, and 24/7 customer service.

Cons

Slightly higher annual fees compared to other cards in its category.

G2 rating

Since DBS is a traditional bank, it is not listed on the G2 platform as a SaaS or corporate card provider.

Benefits of using corporate credit cards for business needs

1. Streamlines payments

Reimbursement can be a complex process that takes a long time. Relying on out-of-pocket expenses and reimbursements to make business spending is impractical, especially when you have a lot of transactions.

Corporate credit cards will allow employees to bypass the long processes to make business expenses with ease.

2. Advanced security

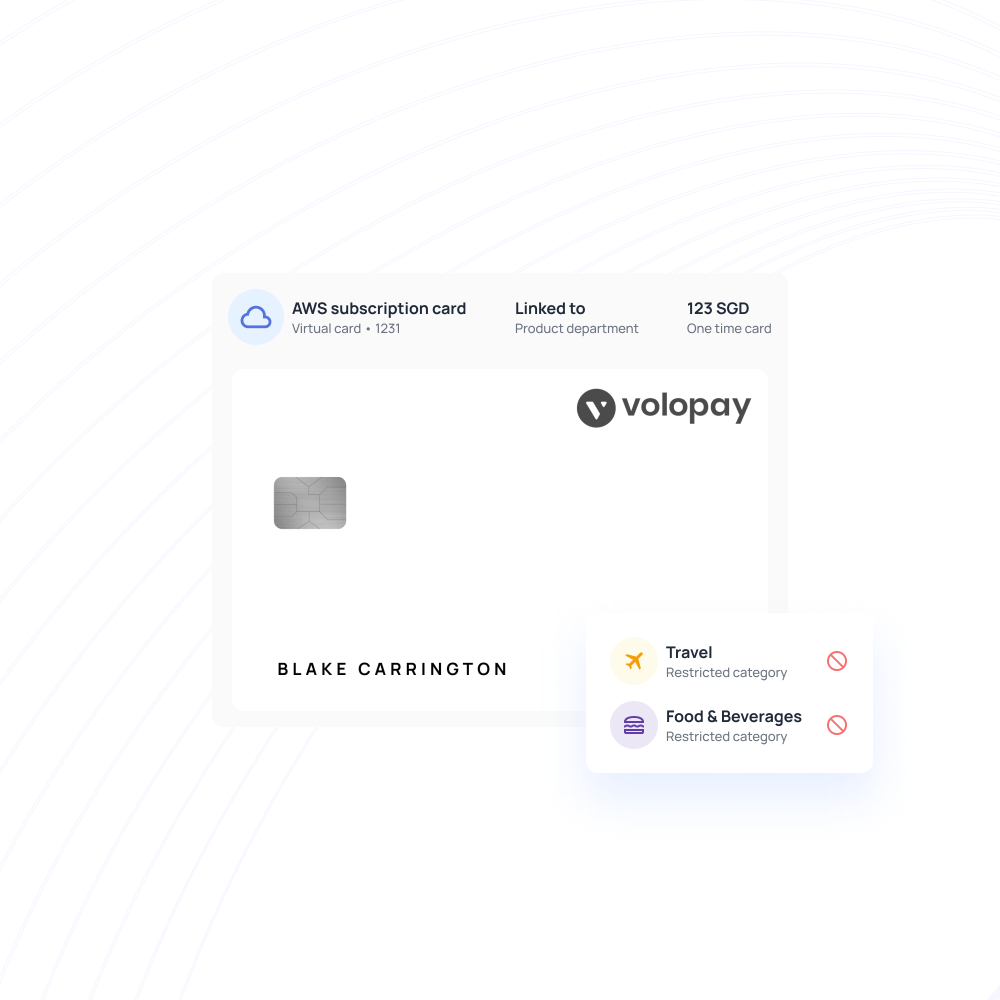

Corporate card enable secure payments, complete with spend controls that make them safe to assign to your employees.

You can adjust spending limits for each of your corporate credit cards, create parameters for where they can be used, and freeze or block your cards instantly. Should a card be compromised, you can immediately act on it.

3. Access to capital

It’s beneficial to use corporate credit cards for small business. You might have previously run into cash flow problems because of customer payment delays.

When you have a credit line, you’ll be able to make purchases to help grow your business while repaying your credit at a later date. Access to more capital makes your purchase cycle more flexible.

4. Easy expense approvals

You can set pre-approved limits according to your company policies. Any card transactions below the given limit will automatically be approved, meaning that your finance team doesn’t have to spend long hours processing approvals.

When a limit update is requested, approvers can also easily review the request from anywhere at any time through the card dashboard.

5. Spending controls

With access to plenty of spend control options for your cards, you won’t have to worry about leaks in your cash flow due to excess spending.

You’ll be able to set individual spending limits for each card, customizable card expiration or termination dates, and even the spending categories the card can be used for. Prevent unauthorized expenses from happening.

6. Financial management tools

Modern corporate credit card providers will have a dashboard that your cards are linked with. The dashboard functions as a control center for all your corporate card expenses.

You’ll have access to a suite of financial management tools that allow you to set spending limits, view expense reports, block or freeze cards, and many more—all in one platform.

Things to consider when getting corporate card

Real-time visibility

When you issue corporate cards for employees, you want to be able to track their spending at any given time as best as you can.

Look for a corporate credit card provider that offers real-time visibility, where your employees’ card expenses are immediately reflected on a web dashboard or mobile app as soon as they happen.

Interest-free credit line

Not all corporate credit cards offer the same interest rate. Luckily, there are several providers that can waive your credit interest temporarily or even offer interest-free credit.

You want to find a card provider with an interest-free credit line that you can take advantage of. Make sure that your provider also doesn’t require a personal guarantee.

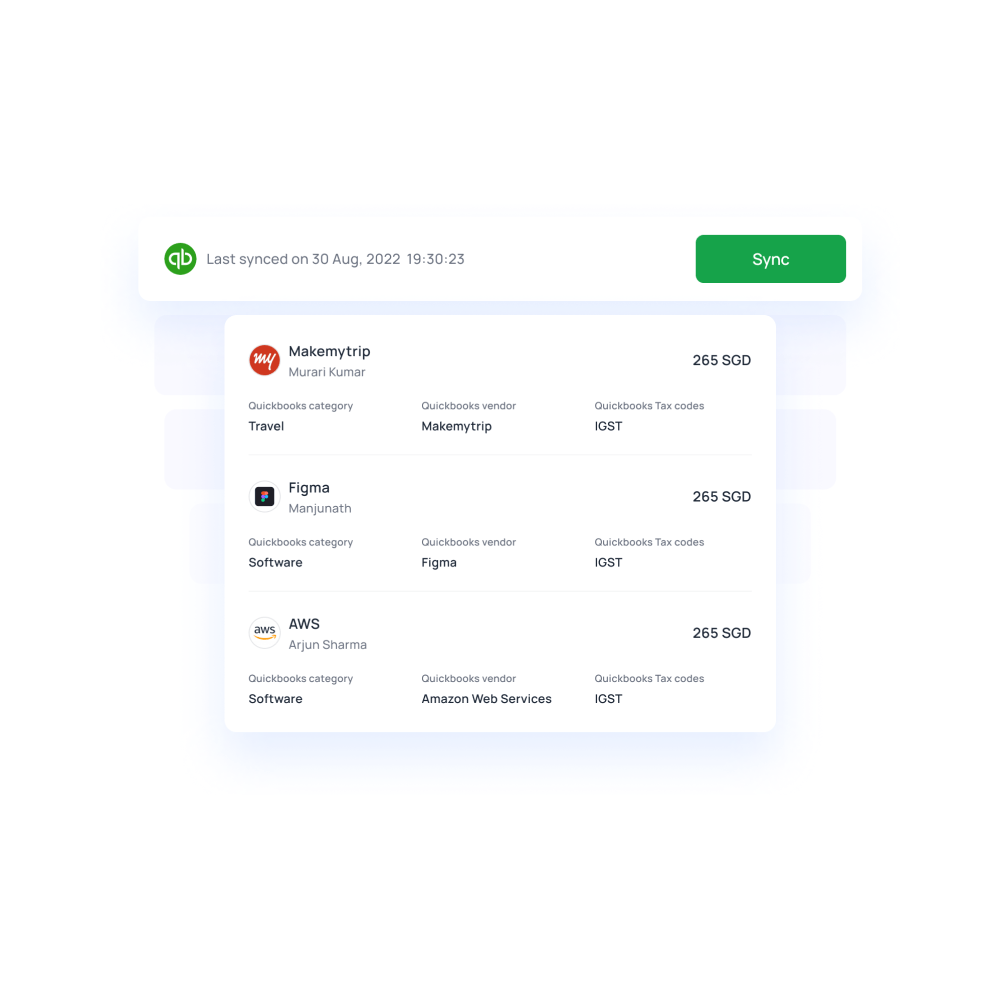

Integration capabilities

Accounting for your card expenses may get complicated because of the transaction volume, but it’s necessary to do. By accounting for all your expenses, you’ll be able to identify spending patterns and make better financial decisions.

You can streamline your accounting processes with integration, making it easy for your team to stay on track.

Multi-currency support

It’s likely that you’ll want to equip your employees with corporate credit cards for travel and entertainment expenses. If you conduct a lot of business internationally, you’ll want your employees to be able to use their cards for overseas business travel.

Pick a provider that allows you to card payments in multiple currencies with low FX rates.

Ease of access and usage

There are many immediate priorities that business owners and executives need to take care of. Even for busy business owners, applying for a corporate credit card should be easy.

Opt for a provider that has a simple digital application process and an easy-to-use card management tool to get yourself started as soon as possible.

Perks and privileges

One of the big differences between corporate card and personal credit card is the rewards and benefits that you can get utilizing a corporate credit card. Singapore has many card issuers that offer various perks and privileges.

You want a corporate card that has rewards such as cashback, vouchers, and discounts to help you make the most of your spending.

How to get a corporate credit card for your business in Singapore?

To be eligible for a corporate credit card, your business must first be registered with ACRA. Most corporate card providers also will only issue cards to companies with 15 or more employees. At least 15 employees must also be eligible cardholders.

Typically, a revenue of over USD 4 million and expenses of over USD 250,000 are the threshold for how big your business must be to get a corporate credit card.

However, while the term corporate credit card may suggest that your business needs to be a larger corporation with high annual revenue, there are also providers of corporate cards that cater to small and medium-sized growing businesses. Providers will want a look at your business financial profile when you apply for a corporate card.

You will also need to have a good business credit score to be able to get corporate credit cards. The approval of your credit line will be determined by documents such as your credit score, bank statements, and past credit repayment history.

If you have fulfilled all the requirements stated by your corporate credit card provider of choice, what you need to do to get started is prepare your business documents to begin the application process. You’ll need some form of identification, proof of your company’s registration, as well as financial documents and statements.

What are the documents required to apply for a corporate credit card?

1. Business registration details

You'll need your Business Registration Number (BRN) or Unique Entity Number (UEN), depending on your business structure. This confirms the legitimacy of your business entity.

2. Financial statements

Most issuers require financial statements, including profit and loss statements and balance sheets. These documents demonstrate your company's financial stability and ability to manage credit.

3. Authorized signatory information

Details about the authorized signatory, usually a senior executive or director, are necessary. This individual will have the authority to use the corporate card on behalf of the company.

4. Personal and business identification proof

You'll need to provide identification documents for both the business and personal representatives. This typically includes passport copies, NRIC (National Registration Identity Card) copies for Singapore residents, and business-related documents like ACRA Bizfile reports.

5. Business and personal credit history

Lenders assess your business and personal credit history to gauge creditworthiness. A strong credit history can increase your chances of approval and better terms.

6. Proof of address

Proof of the business's physical address, such as utility bills or tenancy agreements, is crucial. It confirms the location and legitimacy of your operations.

How to apply for a corporate credit card?

Applying for a corporate credit card in Singapore involves a series of steps to ensure that the card aligns with your business needs and financial strategy. Here's a detailed guide:

1. Assess your business needs

Begin by understanding your company's specific financial requirements. Determine if you need a travel rewards card, cashback card, or a card designed for fuel and fleet expenses.

This is the very first step that you must complete before approaching or contacting any corporate card provider.

2. Establish a clear card usage policy

Develop a comprehensive card usage policy outlining who can use the card, for what purposes, and the spending limits. This policy ensures responsible card use within your organization.

These policy details and usage specifications will be a result of the reason why you are opting to issue corporate cards within your organization.

3. Compare the features and benefits

Research and compare corporate credit card offerings from different providers. Analyze interest rates, fees, rewards, and other benefits to find the best fit for your business.

Use relevant and reliable sources of information available online to decide and do your research as well.

4. Evaluate credit limits

Determine the credit limit your company needs. It should align with your monthly expenses while considering your ability to repay the balance promptly. Make sure that you don’t compromise on the credit limit you need.

Choose providers with a suitable repayment cycle to help you manage your company’s cash flow efficiently.

5. Submit the required documents and application

Compile all necessary documents, as discussed earlier with your chosen provider and submit your application to them.

Accuracy and completeness are vital as they will help with the verification process and enable you to issue your corporate cards much faster.

6. Wait for approval

Once your application is submitted, be patient while the issuer reviews it. Approval timelines can vary, so stay in touch with your provider for updates.

If your application is not approved, seek assistance and feedback on why this is the case so that you can avoid such roadblocks in the future.

7. Generate and activate the card

Once approved, the issuer will generate the corporate credit card. Follow the activation process provided by the issuer to make the card operational.

Depending on the negotiation with your provider, you may issue one or many corporate cards for various employees or teams.

8. Card issuance

Cards can be issued for individual employees or department heads as per your policy. Ensure that they understand their responsibilities regarding card usage.

Depending on the provider you might even be able to issue virtual corporate cards through their platform. These are especially useful and safer to use for online payments.

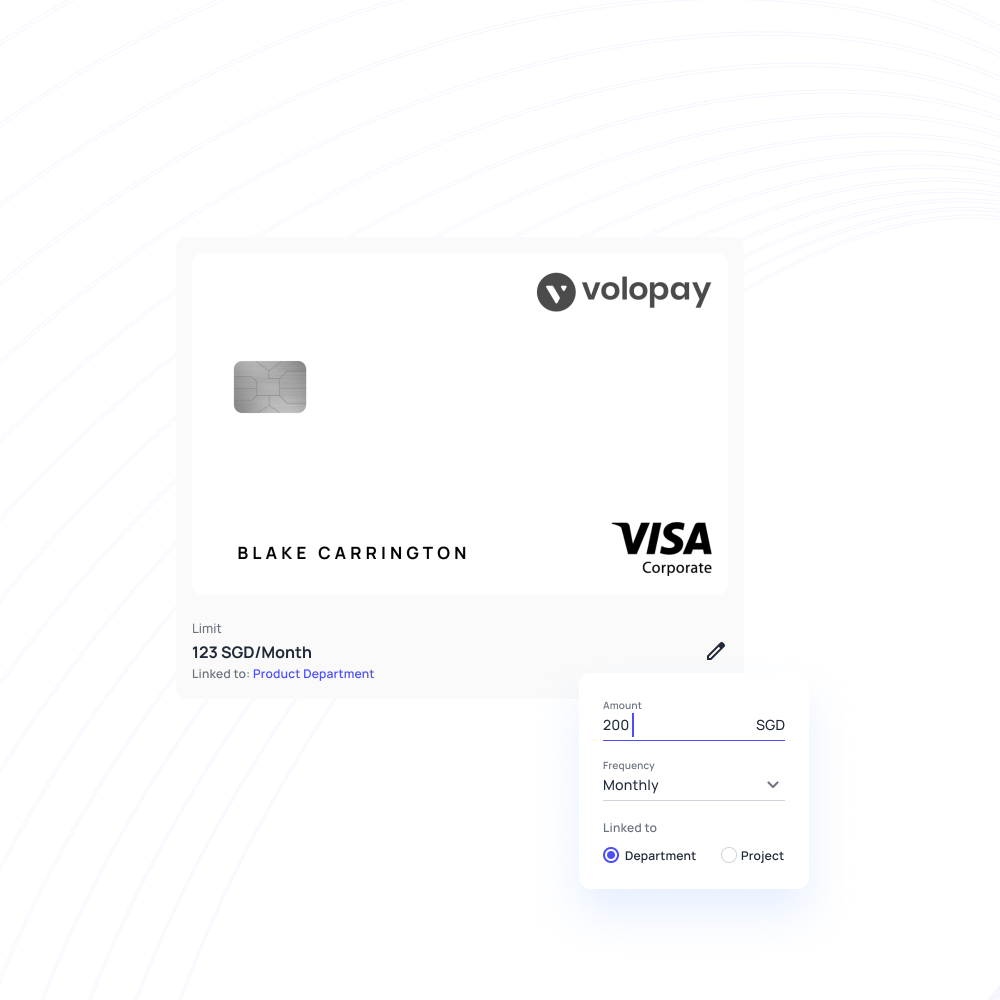

9. Set spending limits

To make sure that there is no case of overspending by any employee or team, you can set specific spending limits on each corporate card that you issue.

Customize spending limits for each cardholder based on their role and responsibilities. This helps in maintaining budget control.

10. Train employees

Provide proper training to cardholders on how to use the card responsibly, adhere to the card usage policy, and submit expense reports promptly.

Train them on how the card operates, how to submit expense receipts if mandated, and what to do in case the card is stolen or lost.

11. Integrate with an expense management system

Consider integrating the corporate credit card with an expense management system to streamline expense tracking and reporting.

In many cases, the corporate card provider will already have an expense management system as a web app or mobile app through which all the card transactions are automatically synced.

12. Monitor and review the usage

Regularly review card statements, expense reports, and compliance with your usage policy. This helps in identifying any irregularities or opportunities for optimization.

How to manage your corporate credit cards effectively?

Managing corporate credit cards is essential to ensure they remain valuable financial tools for your business. Here are key strategies for effective management:

How to handle multiple corporate credit cards?

Managing multiple corporate cards can be complex. Consider appointing a card administrator to oversee issuance, usage, and policy compliance.

This person will be responsible for handling all queries and issues related to the corporate cards that a company and its employees use.

Importance of integrating corporate cards into business financial processes

Integrating corporate card data into your financial systems streamlines expense tracking, reduces errors, and enhances transparency in financial reporting.

In most cases, the corporate card transactions will directly be recorded on an expense management system that can be integrated with the company’s accounting system.

How to deal with lost or stolen credit cards?

Immediately report lost or stolen cards to your issuer to prevent unauthorized usage. Many issuers offer 24/7 helplines for such emergencies.

Employees or administrators can also temporarily freeze or permanently block lost or stolen cards through the main dashboard of the card provider to avoid any kind of payments being made using those cards.

Reporting and dispute resolution

Regularly review card statements and expense reports. Promptly address discrepancies or disputes with the issuer to maintain financial accuracy.

The card-providing company will usually have a specific customer support representative who will be assigned to help you deal with any issues. Maintain constant contact with them for immediate assistance.

Why choose Volopay corporate cards over others?

Customizable spend controls

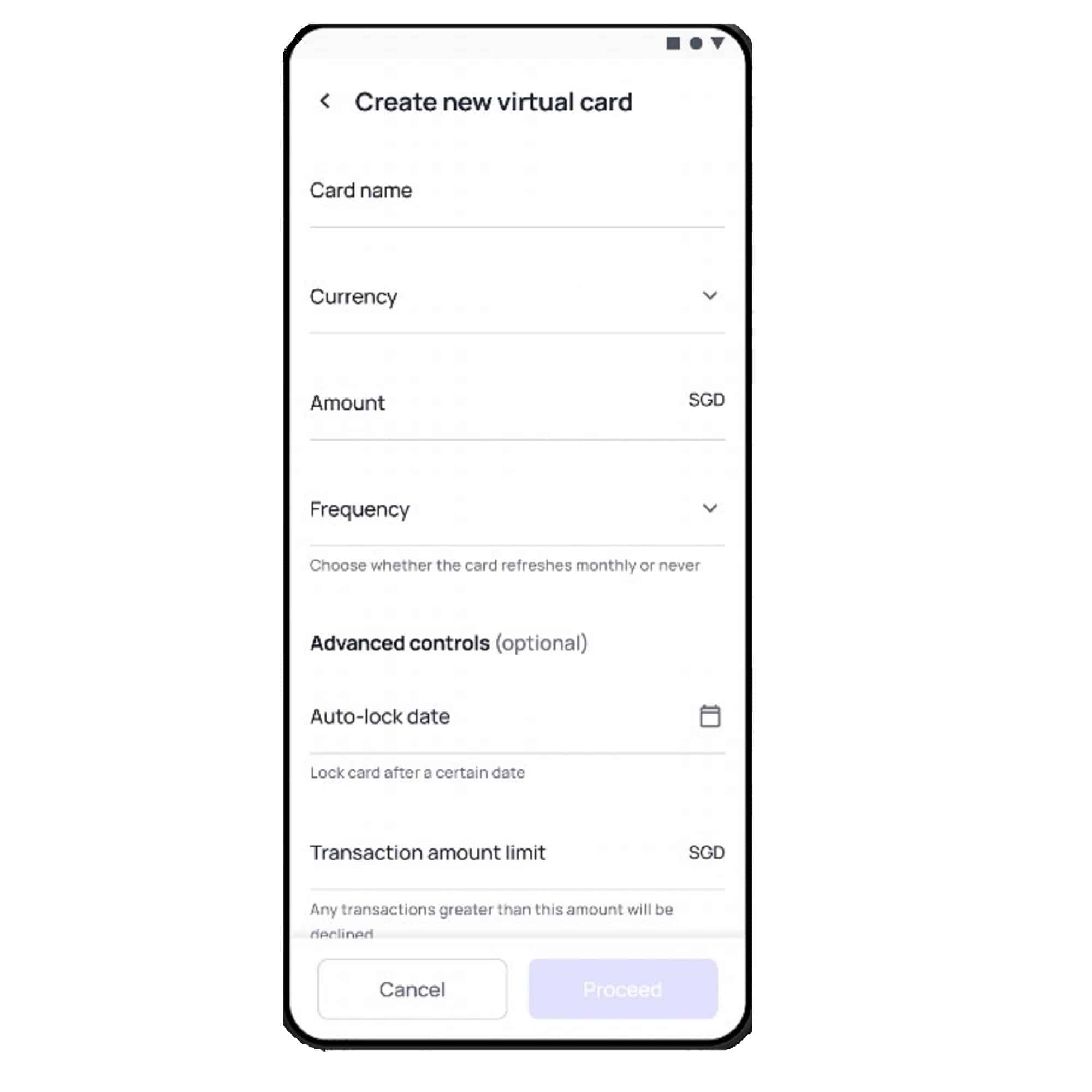

Volopay cards come with card management tools that enable you to customize spend controls according to your business needs and company policies.

You can set budgets and department spending limits, as well as customize termination dates for your cards. In just a few clicks, you’ll be able to apply controls to individual cards.

Unlimited virtual cards

Along with physical cards for T&E expenses, you can also generate an unlimited number of virtual corporate cards with Volopay. You no longer have to worry about losing your cards.

Assign a card specific to each department, subscription, or project to manage your spending better. Virtual cards also come with added security. Also, these virtual cards simplifies expense management.

Flexible credit line option

You can get an interest-free credit line with no personal guarantees when you apply for Volopay corporate cards. Moreover, you’ll be able to grow your credit parallel to your business growth.

You also have flexibility when it comes to your repayment cycle, meaning that you can choose what best suits your business cash flow.

Real-time expense tracking

All your card expenses are reflected on your Volopay account as soon as they happen. Spenders and approvers will both be able to see which data is missing from the expense report.

As soon as they’re filled, they can instantly be reviewed. With no delays, you get better information to make quick yet well-informed decisions.

Mobile app functionality

While it’s handy to have your cards linked to a web dashboard where you can exercise spend controls and review expense records.

It’s even more convenient when you have a mobile app to help manage your expenses. Employees can submit card expense reports and approvers can review requests on the go through the Volopay app.

Multi-currency wallet

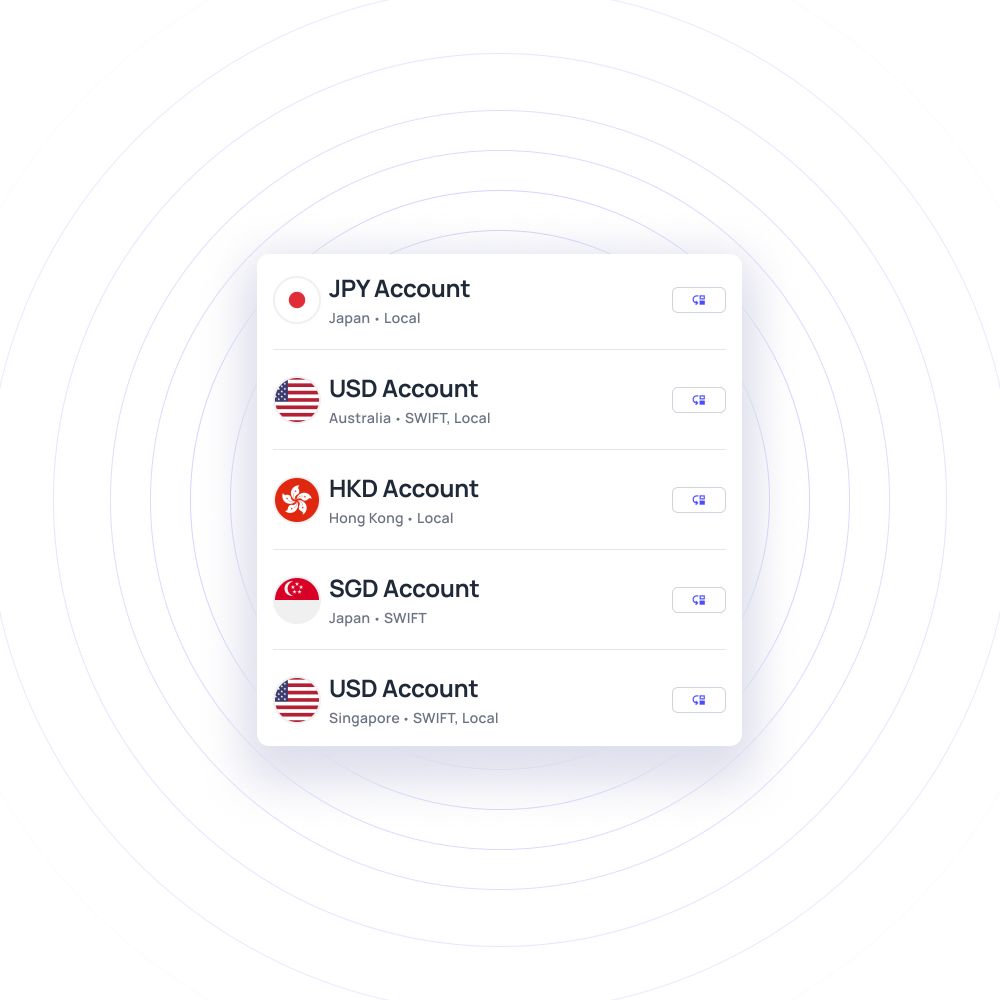

Instead of relying on expensive international money transfers, you can make payments using your Volopay corporate card in different currencies.

Load and spend in foreign currencies to conduct international business transactions without having to switch between platforms. Use your cards for overseas expenses while easily maintaining control through multi-currency wallets.

Best practices for Volopay corporate card usage

1. Establish clear policies

Develop comprehensive card usage policies outlining who can use the card, spending limits, and proper procedures to ensure compliance.

Having these rules and regulations set in place is extremely important. They will help prevent unnecessary monetary issues and also keep spending in check.

2. Limit cardholders

Restrict the number of cardholders to essential employees who require them for business purposes, reducing the risk of misuse.

Not all the employees in a business will need a corporate card. Issue cards are only for employees who genuinely need them, have been with the organization for a while, have shown that they are trustworthy, and senior executives with similar attributes and responsibilities.

3. Set spending limits

Customize spending limits for each cardholder based on their role and responsibilities to control expenses effectively. The last thing you want is to deal with people within the organization spending more than the planned budget for the quarter or year.

Setting custom spending limits on each card helps control expenses while still giving each employee or team the necessary funds they need to complete their tasks.

4. Use expense categories

Categorize expenses to track where funds are allocated, aiding in budget management and expense reporting. Looking at past expense records that are categorized appropriately will help the finance team understand the company’s spending patterns and behaviors.

This in turn will inform future financial and budgetary decisions for more accurate allocation of funds.

5. Regularly reconcile statements

Consistently review card statements to identify errors, discrepancies, or unauthorized transactions promptly.

Ideally, use an automated system like expense management software that can spot and flag discrepancies so that you can spend time resolving them.

6. Implement approval workflows

Implement approval processes for expenses to ensure that all expenditures align with your business goals.

It is important to set approvals for renewing card budgets or for additional funds so that there is accountability for the added expenditure taking place through the corporate cards.

7. Enforce accountability

Hold cardholders accountable for their spending by requiring detailed expense reports and adherence to policies.

You can mandate cardholders to submit documentation such as expense receipts as proof of the expenditure and use it for verification.

8. Train cardholders

Provide comprehensive training to cardholders on responsible card usage, policy compliance, and reporting procedures. Each cardholder must know the proper usage guidelines along with what they should do in different situations.

9. Regularly reevaluate card usage

Continuously assess the necessity and effectiveness of corporate cards, making adjustments as your business needs evolve.

Check spending patterns, get feedback from users on whether it is helping them, and evaluate the effectiveness of the corporate card program accordingly.

How can Volopay corporate cards help streamline business expenses?

Reimbursement is a complex process. Paper receipts can get lost, reports misplaced, and there might be errors in your data. As a result, it could take your finance team many hours to settle reimbursement claims. It’s tiresome for your finance team and frustrating for other employees to have to wait for out-of-pocket expenses to be reimbursed.

On the other hand, solving these issues by relying on the owner’s personal credit to make business expenses is not a smart decision. You’ll need a personal guarantee, the owner’s credit score will be affected, and you’ll have a hard time tracking all your business expenses.

Luckily, corporate cards provide a solution to this problem. With Volopay corporate cards, you can allow employees to make business expenses without having to wait for reimbursements.

Assign each employee a corporate card, complete with card management tools to give you more visibility and control. Payments can be much faster, simpler, and more secure. Empower your whole business with corporate cards.