👋Exciting news! UPI payments are now available in India! Sign up now →

Business credit card vs corporate credit card - Key differences

When you're establishing your business in India, choosing the right payment solution becomes crucial for financial management. Understanding the business credit card vs corporate credit card debate helps you make informed decisions that align with your company's operational needs. While both options serve commercial purposes, they differ significantly in eligibility criteria, liability structures, and features.

Understanding business credit cards

Business credit cards serve as essential financial tools designed specifically for small and medium enterprises operating in India. These cards offer you dedicated credit lines separate from personal finances, enabling better expense tracking and professional credibility. You can leverage rewards programs, cashback offers, and business-specific benefits that traditional personal cards don't provide.

The eligibility criteria for business credit cards remain relatively straightforward compared to corporate alternatives. You typically need a registered business entity, GST registration, and minimum annual turnover requirements that vary across different banks.

Most Indian banks require a turnover between ₹10 lakhs to ₹25 lakhs annually, making these cards accessible for emerging businesses and established SMEs.

Startups and growing businesses find these cards particularly suitable due to lower documentation requirements and flexible credit limits.

Understanding corporate credit cards

Corporate credit cards represent sophisticated financial instruments designed for larger enterprises with complex expense management requirements. These cards offer you comprehensive control mechanisms, advanced reporting features, and integration capabilities that support multi-departmental operations across your organization.

Eligibility standards for corporate credit cards demand higher business turnover, typically starting from ₹1 crore annually in India. Banks require detailed financial documentation, audited statements, and established business relationships. You must demonstrate consistent revenue streams and strong financial health to qualify for these premium products.

The best corporate credit cards excel in managing large-scale operations, offering granular control over employee expenses, vendor payments, and departmental budgets. Personal use restrictions remain stringent, with sophisticated tracking systems monitoring transaction patterns and flagging inappropriate usage automatically.

Business credit card vs corporate credit card – Which is the better fit for your business?

Key differences between business credit card and corporate credit card

1. Eligibility standards

● Business credit cards

Business credit cards accommodate smaller enterprises with annual turnover requirements starting from ₹10-25 lakhs, making them accessible for startups and SMEs. You need basic business registration, GST compliance, and minimal financial documentation.

Most Indian banks accept proprietorship firms, partnerships, and private limited companies with simplified verification processes.

● Corporate credit cards

Corporate credit cards demand substantial financial credentials with minimum turnover requirements of ₹1 crore or higher. You must provide audited financial statements, board resolutions, and comprehensive business documentation.

Banks evaluate your creditworthiness through detailed financial analysis, making approval processes more stringent and time-consuming for these premium products.

2. Liability models

● Business credit cards

With business credit cards, you typically assume personal liability for outstanding balances, creating direct financial responsibility for business expenses.

This personal guarantee structure means your personal assets could be at risk if your business defaults, requiring careful financial management and spending discipline.

● Corporate credit cards

Corporate credit cards establish limited liability frameworks where your company assumes responsibility rather than individual guarantors.

This corporate liability structure protects personal assets while placing financial obligations on the business entity, providing better risk management for larger organizations with established financial foundations.

3. Fee structures

● Business credit cards

Business credit cards feature competitive fee structures with annual charges ranging from ₹500 to ₹5,000, depending on card variants and benefits offered.

You encounter lower joining fees, reduced processing charges, and simplified pricing models that suit smaller business budgets and straightforward expense requirements.

● Corporate credit cards

Corporate credit cards command premium pricing with annual fees starting from ₹2,000 to ₹25,000 or higher, reflecting enhanced features and services provided.

You pay for sophisticated reporting tools, dedicated support, and advanced security features that justify higher costs through improved operational efficiency and risk management.

4. Reward offerings

● Business credit cards

Business credit cards provide attractive reward programs, including cashback on fuel purchases, dining, and business-related expenses.

You earn reward points on office supplies, telecommunications, and vendor payment,s with redemption options including statement credits, gift vouchers, and travel benefits tailored for small business needs.

● Corporate credit cards

Corporate credit cards offer comprehensive reward structures with higher earning rates on large-volume transactions and business categories.

You access premium travel benefits, airport lounge access, concierge services, and exclusive corporate discounts that provide significant value for frequent business travelers and high-spending organizations.

5. Interest rates

● Business credit cards

Business credit cards typically charge interest rates between 18–42% annually on outstanding balances, with promotional offers and introductory rates available for new customers.

You benefit from competitive pricing structures designed to support small business cash flow requirements while maintaining reasonable borrowing costs.

● Corporate credit cards

Corporate credit cards offer preferential interest rates ranging from 14–36% annually, reflecting the lower risk profile of established enterprises.

You negotiate better terms based on your company's financial strength, credit history, and banking relationships, resulting in reduced financing costs for working capital requirements.

6. User permissions

● Business credit cards

Business credit cards provide basic user management with limited add-on cards, typically allowing 2-5 additional users for key employees or partners.

You maintain simple control mechanisms suitable for smaller teams while ensuring expense visibility and accountability within your organization.

● Corporate credit cards

Corporate credit cards deliver sophisticated user management systems supporting hundreds or thousands of employee cards with granular permission settings.

You establish department-wise spending limits, category restrictions, and approval workflows that provide comprehensive control over organizational expenses while maintaining operational flexibility.

7. Transaction limits

● Business credit cards

Business credit cards offer moderate credit limits ranging from ₹50,000 to ₹25 lakhs, depending on your business profile and financial credentials.

You receive limits appropriate for small to medium-scale operations while maintaining flexibility for occasional large purchases or seasonal business requirements.

● Corporate credit cards

Corporate credit cards provide substantial credit limits starting from ₹5 lakhs and extending to several crores, supporting large-scale business operations.

You access higher transaction limits per day, enabling significant vendor payments, equipment purchases, and operational expenses without frequent limit constraints.

8. Documentation needs

● Business credit cards

Business credit cards require basic documentation, including business registration certificates, GST registration, bank statements, and financial records.

You submit simplified paperwork that most small businesses maintain regularly, making the application process straightforward and accessible for emerging enterprises.

● Corporate credit cards

Corporate credit cards demand comprehensive documentation, including audited financial statements, board resolutions, authorized signatory lists, and detailed business profiles.

You provide extensive financial records, credit reports, and legal documents that demonstrate the organizational structure and financial stability required for large credit facilities.

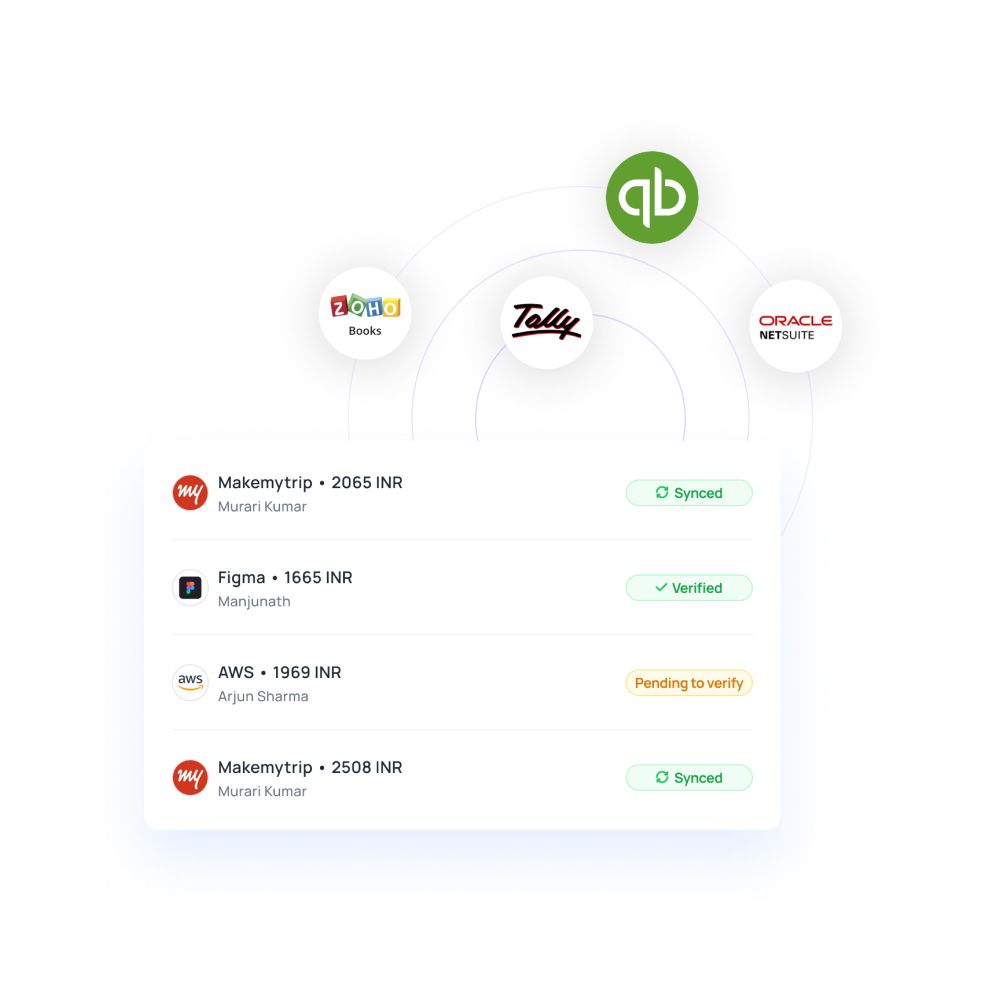

9. Integration capabilities

● Business credit cards

Business credit cards offer standard integration features with popular accounting software like Tally, Zoho Books, and QuickBooks.

You benefit from basic expense tracking, transaction categorization, and financial reporting that support small business accounting requirements without complex customization needs.

● Corporate credit cards

Corporate credit cards provide advanced integration capabilities with enterprise resource planning systems, expense management platforms, and custom financial software.

You access sophisticated APIs, real-time data synchronization, and tailored integration solutions that support complex organizational structures and reporting requirements.

10. Scalability features

● Business credit cards

Business credit cards accommodate moderate growth with incremental limit increases and additional user additions as your business expands.

You benefit from scalable solutions that grow with small to medium enterprises while maintaining cost-effectiveness and operational simplicity.

● Corporate credit cards

Corporate credit cards excel in scalability, supporting rapid organizational growth with unlimited user additions, flexible limit expansions, and custom feature implementations.

You access enterprise-grade solutions that adapt to changing business requirements while maintaining centralized control and comprehensive reporting capabilities.

11. Security measures

● Business credit cards

Business credit cards implement standard security protocols, including chip-and-PIN technology, SMS alerts, and basic fraud monitoring.

You receive essential protection features suitable for smaller transaction volumes while maintaining user-friendly security processes that don't impede daily operations.

● Corporate credit cards

Corporate credit cards employ advanced security frameworks including multi-factor authentication, biometric verification, and sophisticated fraud detection algorithms.

You benefit from enterprise-grade security measures, real-time risk assessment, and dedicated security teams that provide comprehensive protection for high-value transactions.

12. UPI compatibility

● Business credit cards

Business credit cards increasingly support UPI integration, allowing you to link cards with popular payment apps like Google Pay, PhonePe, and Paytm.

You enjoy seamless digital payments for vendor transactions, utility bills, and business expenses while maintaining expense tracking capabilities.

● Corporate credit cards

Corporate credit cards offer advanced UPI compatibility with bulk payment features, automated reconciliation, and enterprise-grade digital payment solutions.

You access sophisticated UPI integration that supports large-volume transactions, automated vendor payments, and seamless integration with existing financial systems.

Choosing the right card for you

Selecting between business credit card vs corporate credit card options requires careful evaluation of your company's specific requirements, growth trajectory, and operational complexity. Your decision impacts long-term financial management, expense control, and accounting efficiency across your organization.

Business size

Small and medium enterprises benefit from business credit cards that align with their operational scale and financial capabilities. You match card features with startup requirements, moderate transaction volumes, and simplified expense management needs. These cards provide essential functionality without overwhelming complexity or unnecessary premium features.

Large enterprises require corporate credit cards that support extensive operations, multiple departments, and complex organizational structures. You need sophisticated features that handle high transaction volumes, diverse user requirements, and comprehensive reporting capabilities that business cards cannot adequately provide for enterprise-scale operations.

Spending patterns

Analyze your monthly expense volumes, transaction frequency, and spending predictability to determine suitable card types. You evaluate whether your business maintains consistent spending patterns or experiences seasonal fluctuations that require flexible credit facilities and adaptive limit management features.

Corporate cards suit organizations with substantial, predictable monthly expenses exceeding ₹5 lakhs, while business cards serve companies with moderate, variable spending patterns. You consider transaction categories, vendor payment requirements, and employee expense needs when matching card capabilities to spending behaviors.

Management tools

Business credit cards provide basic expense tracking, monthly statements, and simple categorization features suitable for straightforward financial management. You access essential tools for small business accounting without complex reporting requirements or advanced analytical capabilities that might overwhelm smaller operations.

Corporate cards deliver comprehensive management dashboards, real-time analytics, and sophisticated reporting tools that support complex financial oversight. You require advanced expense management features, departmental reporting, and integration capabilities that provide detailed insights into organizational spending patterns and budget performance.

Accounting integration

Verify seamless synchronization capabilities with your existing accounting software, particularly popular Indian solutions like Tally, Zoho Books, and QuickBooks. You need automated transaction imports, expense categorization, and reconciliation features that reduce manual data entry while maintaining accurate financial records.

Corporate cards offer advanced integration APIs, custom connectivity options, and enterprise-grade synchronization features that support complex accounting requirements. You benefit from real-time data flows, automated expense allocation, and sophisticated reporting capabilities that integrate seamlessly with existing financial systems and processes.

Growth planning

Select cards that accommodate your anticipated business expansion, user additions, and evolving financial requirements over the next 2–3 years. You consider scalability features, limit increase possibilities, and additional service availability that support growing operational complexity without requiring frequent card changes.

Plan for organizational growth by choosing solutions that adapt to changing requirements, support international expansion, and provide enterprise-grade features as your business matures. You invest in cards that grow with your company while maintaining cost-effectiveness and operational efficiency throughout different growth phases.

Regulatory compliance

Ensure your chosen card supports GST compliance, RBI regulations, and business expense documentation requirements mandated by Indian financial authorities. You need proper transaction categorization, detailed reporting, and audit trail capabilities that facilitate tax compliance and regulatory adherence.

Maintain comprehensive compliance records through automated reporting features, transaction categorization, and detailed expense documentation that supports GST filing, income tax returns, and regulatory audits. You benefit from cards that simplify compliance processes while ensuring accurate financial record maintenance.

Automation in credit card management

Modern credit card management leverages automation technologies to streamline expense tracking, reduce manual intervention, and improve financial oversight across your organization. You benefit from intelligent systems that handle routine tasks while providing real-time insights into spending patterns and budget performance.

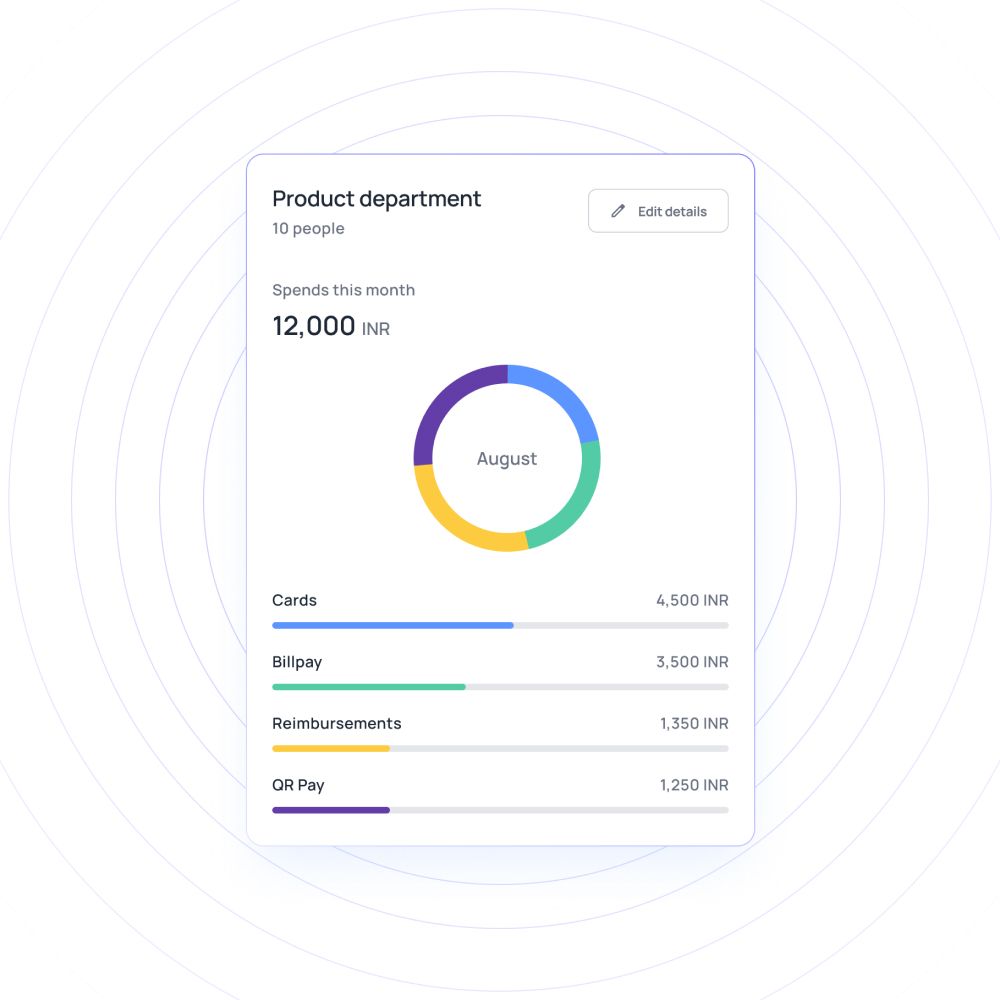

Real-time monitoring

Advanced dashboards provide instant visibility into transaction activities, budget utilization, and spending trends across your organization. You access live updates on employee expenses, department-wise spending, and vendor payments through intuitive interfaces that highlight unusual patterns or budget overruns immediately.

Automated monitoring systems track spending against predetermined budgets, send instant notifications for unusual transactions, and provide comprehensive oversight without manual surveillance. You maintain complete control over organizational expenses while enabling operational flexibility through intelligent monitoring systems that adapt to your business requirements.

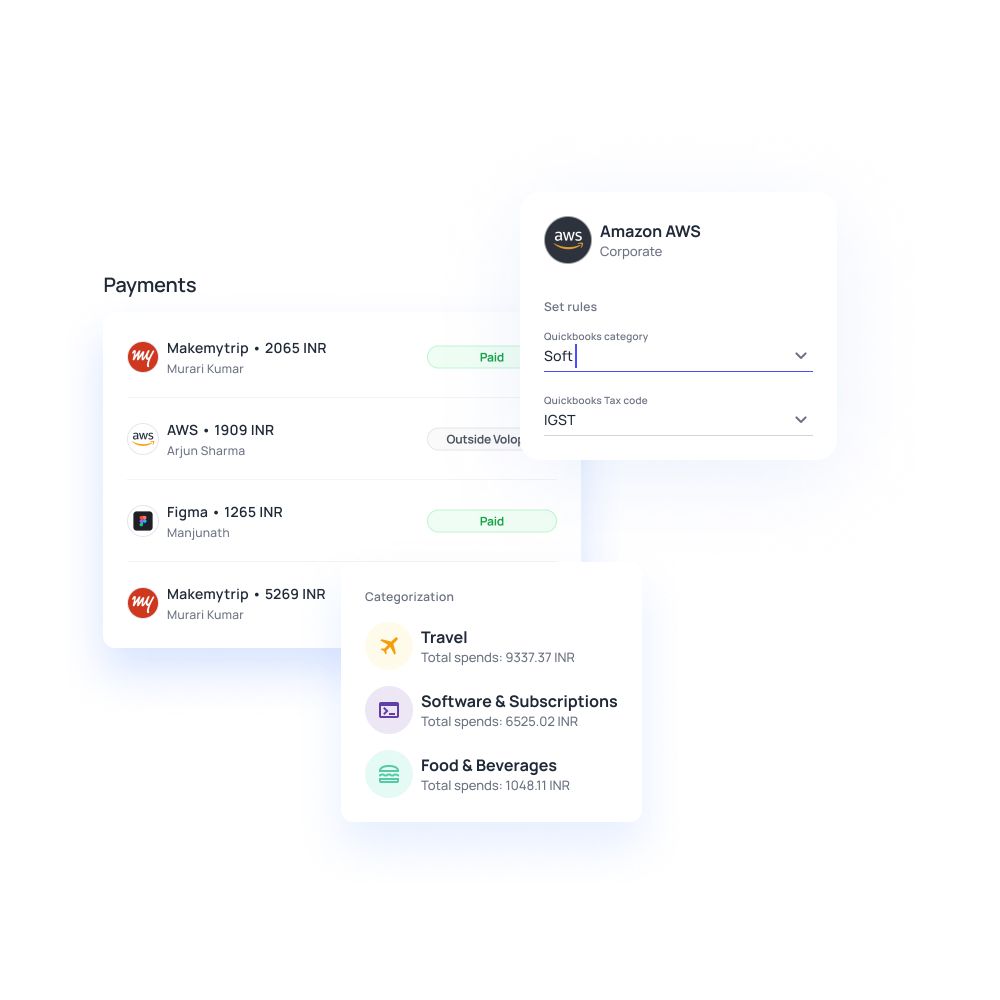

Expense categorization

Intelligent algorithms automatically sort transactions into predefined categories such as travel, entertainment, office supplies, and vendor payments. You benefit from accurate expense classification that reduces manual data entry while ensuring proper allocation for accounting, tax planning, and budget analysis purposes.

Machine learning systems improve categorization accuracy over time by learning from your transaction patterns and manual corrections. You achieve consistent expense classification that supports detailed financial reporting, departmental cost analysis, and compliance requirements without ongoing manual intervention or category assignment.

Fraud detection

Advanced security algorithms monitor transaction patterns, identify suspicious activities, and provide instant alerts for potentially fraudulent charges. You benefit from real-time fraud prevention that protects business assets while minimizing false positives that could disrupt legitimate business operations.

Machine learning systems analyze spending behaviors, geographic patterns, and transaction types to identify anomalies that indicate potential fraud or misuse. You receive immediate notifications for suspicious activities, enabling rapid response and prevention of financial losses through intelligent security monitoring.

Accounting sync

Seamless integration with popular Indian accounting software like Tally, Zoho Books, and QuickBooks eliminates manual data entry while ensuring accurate financial records. You benefit from automated transaction imports, real-time synchronization, and error reduction that streamline bookkeeping processes and improve accounting efficiency.

Real-time data synchronization ensures your accounting systems reflect current transaction information, enabling accurate financial reporting and immediate expense tracking. You maintain up-to-date financial records that support decision-making, budget monitoring, and compliance requirements without delays or manual reconciliation processes.

Spend limits

Customizable spending controls allow you to establish individual card limits, category restrictions, and approval workflows that prevent overspending while maintaining operational flexibility. You create sophisticated control mechanisms that balance expense management with employee autonomy across different organizational levels and departments.

Automated limit monitoring provides instant notifications when approaching spending thresholds, prevents unauthorized transactions, and requires approval for exceptional expenses. You maintain budget discipline through intelligent control systems that adapt to business requirements while preventing financial overruns and unauthorized spending.

Industry applications of credit cards

Different industries leverage credit card solutions to address specific operational requirements, expense patterns, and financial management challenges. You benefit from understanding how various sectors utilize these tools to optimize cash flow, streamline procurement, and improve financial oversight.

Tech startups

Technology startups utilize business credit cards to manage software subscriptions, cloud services, and digital marketing expenses that characterize modern tech operations.

You handle recurring SaaS payments, development tools, and online advertising costs while building business credit history separate from personal finances.

Startups benefit from reward programs that offer cashback on digital services, cloud computing, and business software expenses.

You access flexible credit limits that accommodate irregular income patterns while maintaining expense tracking for investor reporting and tax compliance requirements essential for growing technology companies.

Retail operations

Retail businesses leverage credit cards for inventory purchases, supplier payments, and marketing campaigns that drive customer acquisition and sales growth.

Manage seasonal inventory needs, handle vendor relationships, and process expenses while maintaining detailed transaction records for inventory management and profitability analysis.

Retail operations benefit from extended payment terms, bulk purchase discounts, and supplier financing options available through corporate credit facilities.

You optimize cash flow timing, take advantage of early payment discounts, and maintain supplier relationships while managing working capital requirements effectively.

Manufacturing

Manufacturing companies utilize corporate credit cards to streamline procurement processes, vendor payments, and equipment purchases essential for production operations.

You centralize purchasing decisions, maintain vendor relationships, and track material costs while ensuring proper expense allocation across different production lines and cost centers.

Manufacturing operations benefit from high credit limits, bulk payment capabilities, and integration with procurement systems that support complex supply chain management.

You handle raw material purchases, equipment maintenance, and vendor financing while maintaining detailed cost tracking for production analysis and profitability assessment.

Freelancers

Independent professionals use business credit cards to separate business and personal expenses, maintaining clear financial boundaries essential for tax compliance and professional credibility.

You track client-related expenses, office supplies, and professional development costs while building business credit history independent of personal financial activities.

Freelancers benefit from simplified expense tracking, professional payment methods, and business-focused reward programs that provide value for common professional expenses.

You maintain organized financial records that support tax filing, client billing, and business growth while accessing credit facilities for equipment purchases and business development.

Why choose business credit cards when Volopay offers corporate cards

While traditional business credit card vs corporate credit card comparisons focus on conventional banking products, modern fintech solutions like Volopay provide superior alternatives that combine the best features of both options while addressing common limitations.

Unified platform

Volopay integrates expense management, corporate cards, and accounting synchronization into a single platform that eliminates the need for multiple vendors and complex integrations. You access comprehensive financial management tools through one interface, reducing operational complexity while improving expense visibility and control across your organization.

The unified approach streamlines financial operations by combining Volopay’s corporate cards with expense tracking, vendor payments, and accounting integration into cohesive workflows. This eliminates data silos, reduces manual processes, and ensures complete financial oversight. With intelligent automation tailored to your business needs and growth trajectory.

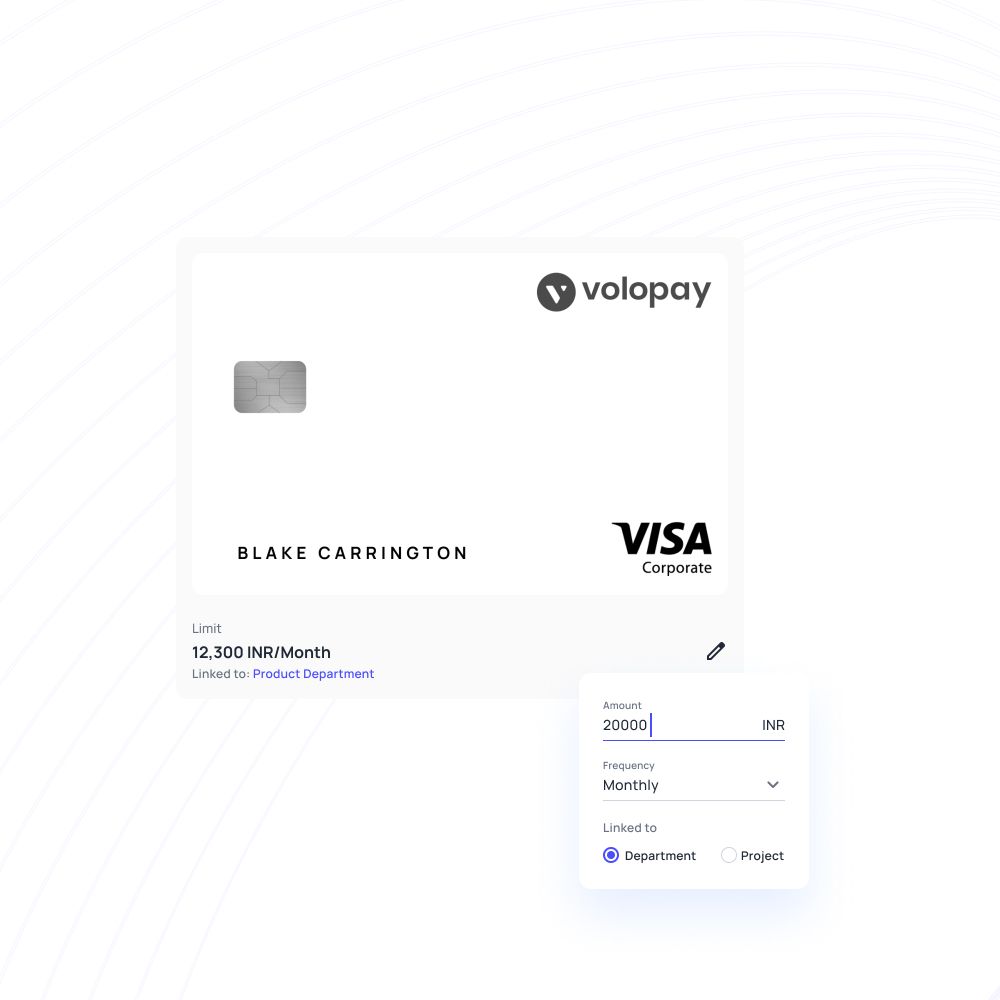

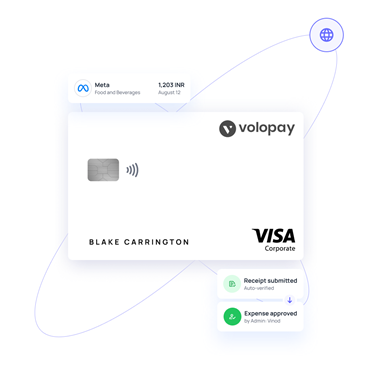

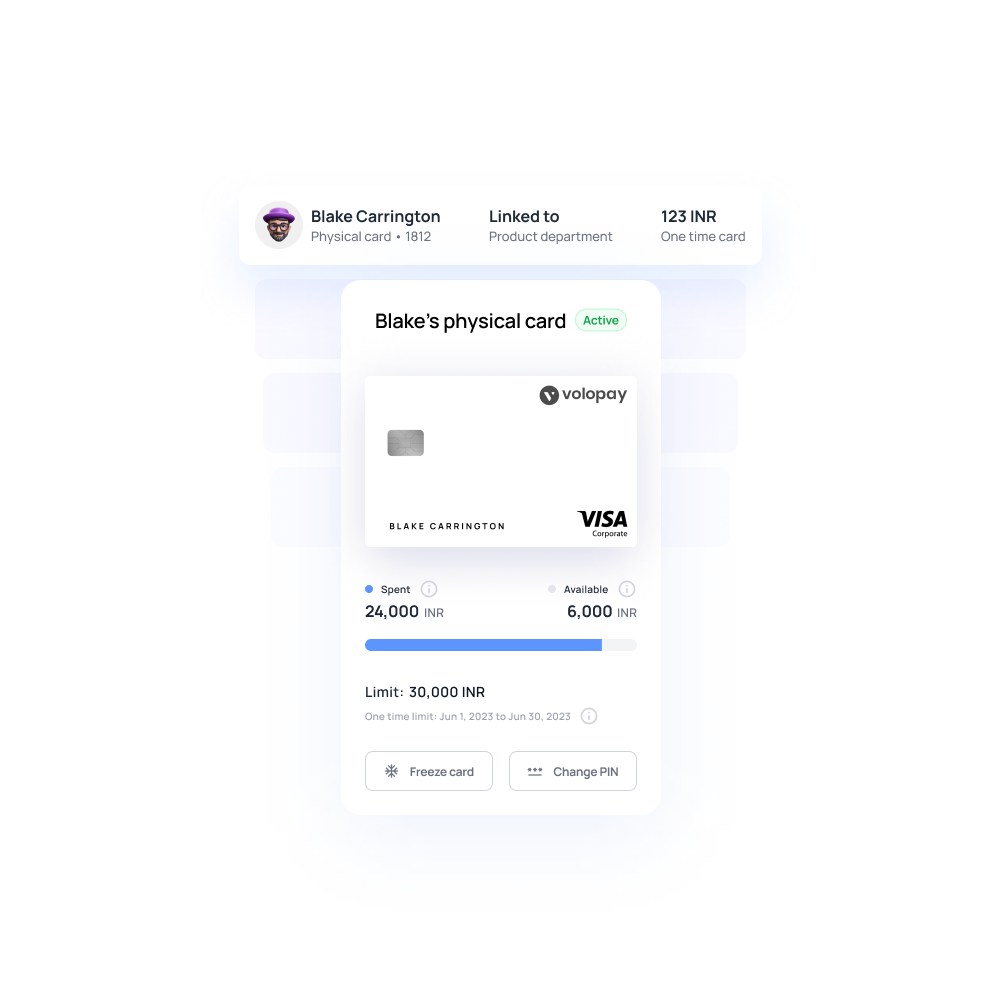

Virtual cards

Advanced virtual card technology provides instant card generation, enhanced security, and granular spending controls that traditional physical cards cannot match. You create purpose-specific virtual cards for different vendors, campaigns, or departments while maintaining complete transaction visibility and automated expense categorization.

Volopay's virtual cards offer superior fraud protection, unlimited card generation, and instant activation that supports modern business operations requiring flexibility and security. You eliminate physical card management overhead while accessing sophisticated spending controls, real-time monitoring, and automated reconciliation features that improve financial oversight.

Real-time analytics

Comprehensive analytics dashboards provide instant insights into spending patterns, budget performance, and expense trends across your organization. You access detailed reporting capabilities that support decision-making, budget planning, and financial optimization through intelligent data visualization and automated insights generation.

Real-time reporting enables immediate expense tracking, budget monitoring, and financial analysis that supports agile business management and rapid decision-making. You benefit from automated insights, trend analysis, and predictive analytics that help optimize spending patterns and improve financial performance across different business areas.

Accounting integration

Seamless synchronization with popular Indian accounting software ensures accurate financial records without manual data entry.

You maintain real-time accounting accuracy while reducing administrative overhead through intelligent automation that handles transaction categorization, expense allocation, and reconciliation processes automatically.

Bring Volopay to your business

Get started now