👋 Exciting news! UPI payments are now available in India! Sign up now →

12 best corporate credit cards in India in 2025

The business environment is constantly evolving with new technology being introduced every other day to help companies make their processes more efficient and maximize their resource utilization.

Apart from generative AI which has been making the headlines in recent times, other tools like corporate credit cards that are not so new have recently seen a higher adoption rate.

Over the years these cards have become better and some of the best corporate credit cards in India have started making waves in the business finance world.

What is a corporate credit card?

A corporate credit card is a type of payment card similar to a regular credit or debit card. The difference is that it is meant to be used by businesses and their employees for business expenses.

Unlike regular credit cards, corporate credit cards can have multiple versions that can be given to any employee in the business who needs them.

They are generally also linked to an expense management system where you can track all transactions happening through the cards in real-time. This gives a business complete visibility over all expenses that are being incurred using the company budget.

The best corporate credit cards in India also have custom controls to ensure there is no overspending.

Best corporate card providers in India - Detailed comparison

1. Volopay corporate card

Overview

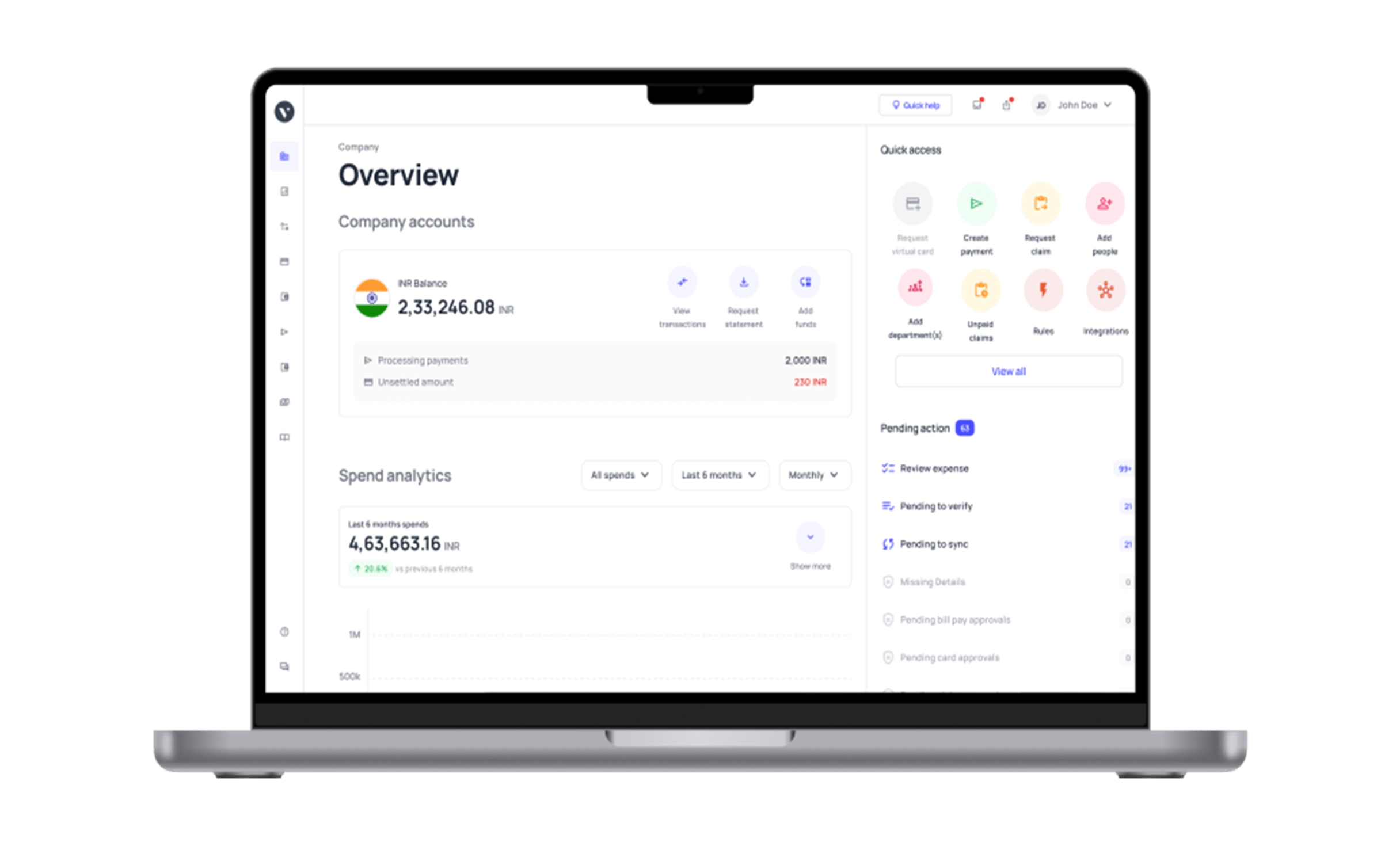

Volopay’s corporate cards are some of the most versatile payment cards you will find in India for businesses.

Unlike other corporate cards that may come as a single product, Volopay corporate card are a part of the expense management ecosystem that they offer.

Set-up process and requirements

Your business must first create an account on Volopay using the sign-up or demo link on our website and complete the registration process.

To start using Volopay corporate cards, you must submit the necessary documents to verify your identity and complete the KYC procedure. Once the due diligence is done your business will be able to issue Volopay corporate cards.

Key features of the card

These cards are perfect for organizations looking to track and control their business expenses. You can set custom spending limits on each card that you issue for an employee. This ensures that there is no overspending.

All the expenses made through each card that you issue are automatically tracked in real-time on Volopay’s centralized platform for expense management. You can access these details anytime by logging into your account through the web portal or by using the mobile app.

Fees and charges

Volopay offers transparent and competitive fees for their corporate cards. For full details on fees and charges, please refer to the pricing page at Volopay corporate card pricing.

Limitations

Currently, the physical cards do not support international transactions. But you can make online international transactions using Volopay’s virtual cards.

Targeted customers

Volopay’s corporate cards combined with its expense management platform make it a suitable product offering for small, medium, and large businesses.

2. SBI corporate card

Overview

SBI is one of the most well-renowned banks in India. They offer two types of corporate cards namely the “SBI Signature Corporate Card” and the “SBI Platinum Corporate Card.”

Set-up process and requirements

The exact set-up process is not mentioned on the SBI website but may include basic account registration.

Key features of the card

Both cards have complimentary insurance coverage. The Signature card has Complimentary Priority Pass membership and exclusive concierge services that a cardholder can use.

The platinum card on the other hand is a card that is accepted globally, has smarter expense management, and a multi-layer spending control.

Fees and charges

SBI corporate cards offer a structured fee system with varied features. For detailed information on fees and charges, please refer to their pricing page at SBI Corporate Card Pricing.

Limitations

A high rate of 2.5% or Rs. 450 is charged when using them to withdraw money from ATMs. The rate is 3% when withdrawing cash from international ATMs.

Targeted customers

Both these cards are targeted toward corporate travelers.

3. Razorpay corporate card

Overview

Razorpay is a full-stack financial solution company in India. Their banking and corporate card product is part of RazorpayX.

Set-up process and requirements

To be eligible for the RazorpayX corporate card, you must be an active user of the Razorpay payment gateway, RazorpayX Payroll, or RazorpayX Current Accounts.

Key features of the card

You can issue unlimited cards for your employees, adjust spending limits anytime, set up auto-repay instructions for trusted payments, integrate with other business systems such as accounting software to ensure uniformity of card expenses across platforms, and also use their analytics to get better insights into company spending.

Fees and charges

Razorpay corporate cards have associated registration and maintenance fees designed for corporate users. For detailed information on fees and charges, please refer to Razorpay pricing page.

Limitations

These corporate cards might be too expensive for certain businesses that do not have a high payment volume. It also has a high interest rate for cash transactions at 48% p.a. For the amount withdrawn.

Targeted customers

This corporate card is suited more for medium to large corporate companies.

4. HDFC corporate premium credit card

Overview

HDFC is one of the biggest private banks in India. Their corporate card product is a good payment tool for many businesses and their employees who have specific requirements.

Set-up process and requirements

There is no clear information about the eligibility to opt for and use an HDFC corporate card.

Key features of the card

Users of the HDFC corporate card get 5 Reward Points for every Rs. 150 spent (Maximum of 10,000 reward points per statement cycle), 5 domestic airport lounge visits quarterly & 6 International annually via the Priority Pass program, and also better visibility of business expenses through advanced reporting tools.

Fees and charges

HDFC corporate cards charge varying fees as per their terms and conditions. For detailed information on fees and charges, please refer to their pricing page at HDFC corporate card pricing.

Limitations

There are many different types of charges involved in using the card and some might not be favorable for businesses.

Targeted customers

The HDFC corporate card based on its features and benefits seems to be more catered toward business travelers.

5. ICICI corporate credit card

Overview

ICICI Bank offers corporate credit cards to help you manage employee expenses effectively. The cards come in three variants—Gold, Silver, and Platinum. The Gold and Silver variants have no annual fee, while the Platinum variant carries an annual charge.

Setup process and requirements

To apply, you must use ICICI Bank’s official channels, submit the required documents for verification, and complete the bank's due diligence procedures.

Key features

You can enjoy up to 50 days of interest-free credit with Corporate Liability, manage travel and entertainment expenses with individual employee spending limits, and access exclusive airport lounges at select airports in India.

Fees and charges

The cards feature a competitive and transparent fee structure tailored to your business needs. For full details, refer, ICICI corporate card.

Limitations

Some spending category restrictions may apply.

Targeted customers

These cards are ideal for small, medium, and large businesses seeking streamlined employee expense management and enhanced control over corporate spending.

6. IDFC FIRST corporate credit card

Overview

The IDFC FIRST corporate credit card is a lifetime-free card that helps you manage expenses efficiently, offering flexibility in payments and rewards tailored to your corporate spending needs.

Setup process and requirements

You can apply via IDFC FIRST Bank’s official website or branches by submitting the necessary documents for verification and completing the KYC procedures.

Key features

You can benefit from a 45-day interest-free period, choose to pay a minimum due for cash flow flexibility, access emergency cash withdrawal limits, and earn cashback or reward points with higher rebates on your spends.

Fees and charges

The card features a cost-effective, transparent fee structure designed for businesses of all sizes. For full details, refer, IDFC FIRST corporate card.

Limitations

There may be restrictions on reward point redemption or cashback options depending on your spending levels.

Targeted customers

This card is perfect for businesses of all sizes looking for a cost-effective solution to manage expenses with added flexibility and rewards.

7. Axis Bank corporate credit card

Overview

Axis Bank offers corporate credit cards that help you manage travel and entertainment expenses efficiently. Features include lounge access, expense tracking, and customizable spending limits.

Setup process and requirements

To apply, you must meet Axis Bank’s eligibility criteria and submit the required documentation through their official channels.

Key features

You can enjoy exclusive airport lounge access at select airports in India, assign individual employee spending limits, track expenditures with detailed transaction data, and customize the cards with your company’s name.

Fees and charges

The cards come with a transparent fee structure designed to meet your corporate needs. For full details, refer, Axis Bank corporate card pricing.

Limitations

Specific limitations may apply based on your business size and usage.

Targeted customers

These cards are best suited for businesses that are looking to manage employee travel and entertainment expenses with enhanced control and detailed tracking capabilities.

8. YES FIRST corporate credit card

Overview

The YES FIRST corporate credit card is designed to streamline payments and track expenses with low fees, high spending limits, and reward points tailored for corporate needs.

Setup process and requirements

To apply, you must submit company financials, KYC documents, and business registration details to YES Bank. Your application will be approved based on the bank’s eligibility criteria.

Key features

You can enjoy up to 50 days of interest-free credit on business transactions, earn reward points on every transaction (redeemable for flights, hotels, or business expenses).

Benefit from a fuel surcharge waiver on fuel transactions across India, receive comprehensive insurance coverage (including travel accident insurance, purchase protection, and lost card liability), and access detailed statements for better financial planning.

Fees and charges

The card offers a competitive fee structure designed to meet your business’s expense management needs. For full details, refer, YES Bank corporate card.

Limitations

It offers limited global benefits compared to premium cards and has a smaller market presence.

Targeted customers

This card is best for small and medium businesses (SMEs) and growing enterprises that need low-cost expense management solutions with rewarding benefits.

9. OmniCard

Overview

Omnicard offers a corporate card solution designed to simplify business expense management. The platform provides digital and physical cards for employees, equipped with tools that aid in reducing fraud and improving financial oversight.

Set-up process and requirements

The setup process is easy, typically requiring businesses to sign up via Omnicard’s platform. Companies must provide details such as corporate registration documents, proof of business operations, and bank account information.

Once verified, businesses can begin issuing cards to employees within a few business days.

Key features of the card

Key features of this card include real-time tracking of expenses, customizable spending limits per card, multi-currency support, and integration with accounting software.

It also offers automated reporting, making expense management easier and more efficient.

Limitations

Some limitations include limited international availability and potential fees for specific services such as currency conversion or ATM withdrawals.

Targeted customers

Omnicard targets small to mid-sized businesses (SMEs) and startups, especially those looking for efficient, scalable expense management solutions.

10. Happay corporate card

Overview

Happay offers businesses a collateral-free corporate credit card known as “EPIC” to make business payments and manage expenses efficiently.

Set-up process and requirements

The setup process to start using a Happay corporate card is by signing up for an account on their platform and then completing the necessary steps to issue your cards.

Key features of the card

You get robust expense tracking, spending controls, real-time spending visibility, integration capabilities with finance apps, and a reward program.

Fees and charges

The fees and charges related to acquiring and using a Happay corporate card are not clear.

Limitations

According to some G2 reviews, the service seems to be bad for Happay customers who face issues with the product. Queries are not resolved on time and customers have faced problems dealing with the support system in place.

Targeted customers

Happay might be suitable for small to medium-sized companies.

11. Enkash corporate card

Overview

Enkash corporate cards are available in multiple variants and users can customize their own card and expense management system to suit their needs.

Set-up process and requirements

The process to get Enkash corporate cards is to onboard on their platform by creating an account and completing the necessary registration process with a one-time activity that requires simple KYC documents.

Key features of the card

You get to create, manage, set limits, track, and block the corporate cards & more with a simple-to-use DIY platform. You get a flexible billing cycle for your corporate card that makes it easier to make repayments and manage your cash flow.

The cards can be used unlimitedly without any sort of cap and you can set up different cards for different expenses such as fuel, utility, T&E, etc.

Limitations

The Enkash system to use and manage cards might be a bit complex for many users.

Targeted customers

Enkash corporate cards are flexible in nature and can be used by many different types of businesses including small and medium-sized businesses.

12. American Express corporate card

Overview

The American Express Corporate Card is perfect for businesses that require premium expense management and travel benefits. It offers extensive rewards, business expense tracking, and travel perks for both executives and employees.

Setup process and requirements

To apply, your business must meet Amex’s eligibility criteria, submit company financial documents, and complete the verification process through American Express’s website or corporate sales team.

Key features

You’ll get detailed reports to manage spending, earn reward points on every transaction (redeemable for flights, hotels, and business expenses), enjoy access to airport lounges, travel insurance, and concierge services, and track employee expenses in real time via a dedicated online portal.

Fees and charges

The card comes with a premium suite of services backed by a structured fee system. For full details, check the pricing details on American Express corporate card.

Limitations

High eligibility requirements apply, and premium services are offered at a significant cost.

Targeted customers

This card is ideal for large enterprises and multinational corporations that are seeking premium travel perks and advanced expense management tools.

Discover the power of corporate cards

Benefits of using corporate credit cards

1. Ease business expense handling

Anyone who has run a business before knows how out-of-hand expenses can go if they are not tracked properly and kept in check.

Corporate credit cards are tools that can help you control business expenses by letting you set custom spending limits on each card. This way you’ll know that there can never be a case of overspending as you’ve set the limits to how much can be spent through a card.

2. Helps separate personal and business expenses

We can’t stress enough how crucial it is for an entrepreneur to separate their personal and business expenses.

Using your personal credit card for business expenses may not only hurt your personal credit score but also doesn’t help you build your business’s credit score.

A corporate credit card lets you separate expenses and minimize tax implications.

3. Ensure hassle-free reconciliation

When an employee is making an expense using a corporate credit card and if the card is linked to an expense management system, then the admins of the system can make it mandatory for employees to attach an expense receipt for the purchase that they have made.

This way the finance team can easily check later on whether the expenses being made through the card comply with company’s expense policy.

4. Improves cash flow

Often times businesses can be in a tough spot with low cash reserves due to lengthy periods of payment cycles with their clients.

When your business has not received payments but is in need of liquid cash to keep operations going, corporate credit cards help in keeping a positive cash flow.

5. Real-time spend visibility

The best corporate credit cards in India are the ones that are linked to an expense management platform rather than as a stand-alone product.

This ensures that each transaction made using your corporate cards is tracked and recorded on the platform’s ledger in real-time.

6. Improves credit score

Using a corporate credit card that is registered under your business entity helps build your business credit score.

The more time you use corporate credit cards without defaulting and making timely payments, the better your business credit score will be.

Documents required to apply for a corporate card in India

1. Identity proof and signature

Any ID card issued by the government, such as an Aadhar card, Pan card, voter ID, driver's license, or passport, is valid. The applicant's full name and age should be on this ID evidence.

2. Address proof

You can provide rental or lease agreements, utility bills, licenses or ownership documents, property tax receipts, and rental receipts as evidence of the business's address.

3. GST certificate & GST number

The GST certificate is available to all eligible and duly registered tax-paying businesses in India. By logging into the GST portal run by the government, you can get your own. Your GST number will be on the GST portal login information.

4. CIN number

CIN is a unique registration number for your business that is assigned based on registration with the Ministry of Corporate Affairs (MCA), done through ROC (Registrars of Companies) in respective states.

This CIN number needs to be provided to apply for corporate credit cards in India.

5. Latest bank statements

Business bank statements are considered as an important document proof to validate the eligibility of a business to own a corporate card. Bank statements can help decide how much credit you are eligible for.

Fetch bank statements of your business checking account for the past 3 to 6 months.

Take charge of your business expenses

What are the eligibility criteria to get a corporate credit card?

Different corporate credit card providers will have different criteria to give businesses access to these cards. But apart from these, there are a few general requirements that almost all providers look for when a company wants to issue their corporate credit cards:

1. Financial statements such as balance sheets, profit and loss statements, and cash flow statements are required to show the provider your financial health and stability.

2. Your company should have a proven track record of business operations.

3. When it comes to company structure, your business must either be a bank, a limited firm, a partnership firm, a small-scale business, and/or a government-funded company to be eligible for a corporate credit card in India.

4. Apart from all of the above, if your business has a good credit score, it can help fast-track the process of getting your corporate cards.

How to apply for a corporate credit card?

Applying for a corporate credit card can significantly boost your business's financial agility and control. This process, while varying slightly by provider, generally involves meeting specific eligibility criteria and compiling essential documentation to ensure a smooth application.

1. Identify the need

Identify the specific purpose of obtaining a corporate card to ensure its alignment with business objectives.

Determine the need for corporate credit cards and assign to employees based on their roles, responsibilities, and requirements.

2. Establish a clear card usage policy

Let your employees spend flexibly by setting certain rules and guidelines for card usage.

Create a comprehensive card usage policy outlining spending limits, authorized expenses, and reporting procedures. This policy will serve as a guideline for employees using the corporate credit card.

3. Research and select the right provider

There are various corporate card providers in India. Compare the features, price, and the customer reviews of all the providers and choose the one that suits your business requirements.

4. Submit the documents and apply

Once you select a provider, complete the corporate card application form with all the accurate information and submit it to the chosen provider along with all the required documents.

5. Generate and activate the card

Once your application gets approved, start generating and activating the cards as per the instructions provided by the provider.

6. Issue cards to employees

Distribute the approved corporate credit cards to authorized employees according to the company's card usage policy.

7. Integrate with an expense management system

If applicable, integrate the corporate credit card transactions with the company's expense management system to facilitate seamless tracking and reporting.

8. Set spend limits and monitor the usage

Set individual spend limits on cards to keep your business expense under control.

Also, regularly monitor corporate credit card usage and review expense reports to ensure compliance with the company's policies and identify any potential issues or discrepancies.

Get the best corporate credit card program

Key factors to consider when choosing a corporate card provider

1. Security features offered

When you choose a corporate credit card provider, you should make sure that they have very good features when it comes to security.

Whether it's physical cards or virtual cards, you should have the ability to temporarily freeze or permanently block the card in case you lost it or it was stolen.

This will ensure that the funds in your card cannot be used by someone and it stays safe until you get your card back or have to issue a new card.

2. Fees and charges

Using corporate credit cards for your business will rarely come free of cost.

Most providers will either charge you for the usage of the cards based on the amount you spend through them or charge a monthly/annual subscription fee to use the cards.

You should make sure that you are aware and good to bare these charges before you sign up with a provider.

3. Accounting software integration

The best corporate credit cards in India are the ones that easily fit into your existing financial ecosystem or make it better.

A huge part of this equation is the ability to sync and export all your card expense records to your accounting software. You should ensure that the corporate card provider you choose has the feature to let you integrate your accounting software with their platform.

4. Transaction limits

Each corporate card provider is different from the others in some ways. One of the aspects that you should check for is the maximum transaction limit permitted by a card.

If you have extremely high volume payments to be made using your corporate credit card, you should ask and check with the provider whether their cards can carry out transactions of such volumes or not.

5. Acceptance

The last thing you want after selecting a corporate credit card for your company is to realize that it is not supported by certain platforms or merchants that you need to make payments on.

You should ask and check during the product demo whether the card will be accepted on the merchant sites where you need to make payments.

6. Mobile access

Choose a corporate card provider that has a mobile app for their expense management system. This will ensure easy and remote control for managers and employees using their corporate cards.

You won’t have to constantly open your laptop or desktop to access your card information and controls. The mobile app itself will let you check the transaction information and change the controls if needed.

7. Access to spending analytics

Last but not least, select a card provider whose platform is capable of taking the spending data from all your corporate cards in the organization and using it to show insightful analytics about business expenses.

This will not only show you how budgets are being utilized but also show a way to make efficient changes to corporate spending.

Volopay corporate cards - the #1 choice for businesses

Whether it is physical corporate cards or virtual cards, Volopay is a class apart from the competition and one of the best corporate card in India.

With the ability to issue one physical card for each employee and unlimited virtual cards, you can be sure that managing online and offline business expenses is a simple and transparent process for all the stakeholders involved.

To know and learn more about the capabilities of our corporate cards, you can book a demo with us at your convenience and see how our system can transform your business finance for the better.