👋 Exciting news! UPI payments are now available in India! Sign up now →

What is a corporate credit card and how to get one?

What is a corporate credit card?

Corporate credit cards in India came into existence to help businesses sort out business-related expenses of employees. Though reimbursements are more popular, it increases the workload of employees and accounting teams.

Many expenses go unreported or falsely reported leading to poor expense reporting. The payment mode that overcomes this and also makes the job easy for everyone is the corporate credit card in India, specifically tailored as corporate credit cards for expense management to provide better control and transparency.

By distributing the corporate credit card for employees, you empower them to cover their own business-related expenses with business funds.

How do corporate credit cards work?

Corporate credit cards look and work like any other cards. They come with the names of employees on top of them. Specifically, corporate credit cards work differs from normal business credit cards in the following ways.

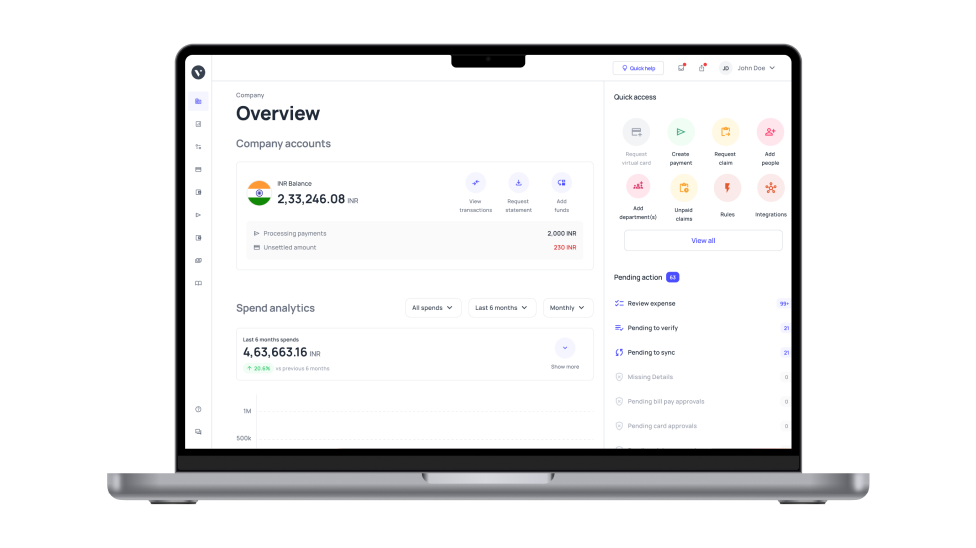

• Corporate credit cards come with the ability to be managed from a centralized dashboard.

• You can set budgets for each card controlling out-of-pocket expenses of employees. You can also set authorizations if more credits must be added.

• You can block or freeze the card anytime from the dashboard if the card should not be used further.

• The corporate credit card for employees gives you real-time visibility. You can keep an eye on where your card is used right from the dashboard.

• Corporate cards come in both physical and digital formats.

• You can link each card to a relevant department. So that makes it easy to see how much each department has spent.

What are the different types of corporate credit cards?

1. Standard corporate credit card

Instead of using a personal credit card to manage company expenses, a corporate credit card is the better option. It’s designed specifically for businesses, complete with a card management system you can use to view, track, and manage your card.

By using a corporate credit card, you can keep business and personal expenses separately easily.

2. Travel rewards corporate credit card

A travel rewards corporate credit card is geared towards businesses that do a lot of travel. It comes with a rewards program that has an emphasis on travel points such as airline miles.

Typically, spending on travel expenses, particularly with certain brands, will also net you more points. This could help you save a lot of money on travel.

3. Cashback/reward points corporate credit card

Similar to travel rewards, corporate credit cards, cashback or reward points cards also make it easy for businesses to earn rewards.

If your business makes a lot of transactions on your rewards corporate credit card, you could save quite a bit of money through points or cashback for future purchases.

4. Premium corporate credit card

Generally, a premium corporate credit card is similar to its standard variation, but with more advanced features and upgrades.

They’re also typically only offered to businesses with higher annual revenue. In return, you get better reward rates and benefits such as insurance and complimentary lounge access for your business travelers.

Stay ahead of your expenses with our corporate card solutions

What are the documents required to apply for a corporate credit card?

Interested in assigning the corporate card for employees? The corporate credit card in India requires a business to submit the following documents.

To apply for corporate credit card in India, the list of documents that you should gather is

Personal and business identification proof

Any government-issued ID card like Aadhar, pan card, voter ID, driving license, or passport works. This ID proof should have the full name and age of the applicant.

Address proof

For address proof of the business, you can submit rental or lease agreements, utility bills, licenses or ownership documents, property tax, and rental receipts.

GST certificate and GST number

Every eligible and registered tax-paying business in India can obtain the GST certificate. You can download yours by logging into the government GST portal. GST number will be present in your login details of the GST platform.

CIN number

CIN number means Corporate Identification Number or Company Identification Number. This is a unique identification number given to businesses.

You can find yours by running a search on MCA 21 portal. Search with your company name, ROC registration number, or old CIN. CIN number is a must to apply successfully for a corporate credit card in India.

Recent bank statements

Bank statements of a business are considered an important document proof to validate your eligibility to own a corporate card. They decide how much credit you are eligible for.

Fetch bank statements of your business checking account for the past 3 to 6 months.

How to apply for a corporate credit card?

1. Identify the need

Determine which employees need corporate credit cards based on their roles, responsibilities, and business travel requirements.

Also, define the specific purpose of obtaining a corporate card to ensure its alignment with business objectives.

2. Establish a clear card usage policy

While giving corporate credit cards to your employees helps them spend flexibly, you must also set certain rules and guidelines for their usage.

Create a comprehensive card usage policy outlining spending limits, authorized expenses, and reporting procedures. This policy will serve as a guideline for employees using the corporate credit card.

3. Research and select a provider

Conduct thorough research on various corporate credit card providers, comparing their features, fees, and customer reviews.

Choose a provider that best aligns with the company's requirements and preferences.

4. Submit the required documents

Once a provider is selected, gather and submit all the necessary documents as per their application requirements. These documents may include company registration details, financial statements, and identification proofs of authorized signatories.

5. Submit the application

Complete the corporate credit card application form with accurate information and submit it to the chosen provider.

Ensure that all required fields are properly filled to expedite the approval process.

6. Wait for approval

The corporate credit card provider will assess your company's creditworthiness and the applicant's financial history. The approval process may take some time, and the provider may request additional information during this stage.

7. Generate and activate the card

Upon approval, the provider will issue the corporate credit card(s) for your employees. Activate the card as per the instructions provided by the provider.

8. Card issuance

Distribute the approved corporate credit cards to authorized employees according to the company's card usage policy.

9. Employee training

Conduct training sessions for employees on the proper use of corporate credit cards, the card usage policy, and the importance of responsible spending.

10. Set spending limits

Establish individual spending limits for each cardholder based on their respective job roles and responsibilities.

11. Integrate with an expense management system

If applicable, integrate the corporate credit card transactions with the company's expense management system to facilitate seamless tracking and reporting.

12. Monitor and review the usage

Regularly monitor corporate credit card usage and review expense reports to ensure compliance with the company's policies and identify any potential issues or discrepancies.

Unlock financial flexibility with our corporate card solutions!

Factors to consider when choosing a corporate credit card in India

There are countless options for Indian SMEs to provide corporate credit cards for employees. Before choosing an ideal product, you must be aware of certain factors related to the features of this product.

1. Meets specific business needs

No two businesses spend alike. The spending habits vary based on the location, nature of the business, industry, and many more factors.

If you look at the types of corporate credit cards offered in India, there are travel cards, premium cards, platinum user cards, charge cards, cards with usage limits, etc.

Depending on your business requirements and employee travel needs, you can choose a card and plan that works well for you.

2. Product features

The reason that pushes businesses to go for corporate credit cards is its features. Some features that must be present ideally are

• Ability to set budgets for each card

• Monitor expenses of all cards in one place

• Should be able to set limits

• The number of cards generated shouldn’t be limited

• Should be able to delete or freeze the card if it’s not needed anymore

3. Perks and privileges

The bonus benefits of having a corporate credit card are enjoying rewards and cash back. Corporate credit cards in India typically offer cash back. They might also offer cheap international transactions at a cut-down fx rate.

There are also cards that offer you discounts for specific spending, let’s say a hotel or air ticket booking through a particular app. By choosing such products, you can reap more of what you spend.

4. Annual fees and other charges

The corporate credit card in India is indeed an expensive product. But the price range differs from provider to provider. There might be annual costs or charges associated with each transaction.

Some providers emphasize hidden charges also. Compare the charges of different card providers and also analyze if their pricing is transparent.

5. Credit limit

You can predict how much you need to manage employee expense needs. Your credit lender must be able to provide that. Also, your current loan and other liabilities will be taken into consideration to determine your eligible credit.

Hence, you need to make sure that you will get the required amount of credit needed to load the corporate credit for employees.

6. Ease of application process

Most providers of corporate credit card in India have a single-click application process. They require minimal information and documentation.

At maximum, it will take only a few minutes to fill out and submit an online application. They are also prompt in sharing the updates and sending the card.

Choosing such a provider will make the task easy for you. If you go for providers with lengthy forms and those who ask for old documents and statements, it will prolong the process.

Looking for corporate cards to manage your business expenses?

What are the benefits of using a corporate credit card?

1. Streamlined expense management

One of the primary benefits of using a corporate credit card is the streamlined expense management it offers.

Rather than juggling multiple reimbursement claims and paper receipts, businesses can use a corporate credit cards, like expense management cards to consolidate all spending into a single, organized statement. This not only simplifies the accounting process but also significantly reduces administrative overhead.

2. Improved cash flow and working capital

If an organization faces a cash crunch, it can be difficult to maintain daily operations.

Corporate credit cards can improve cash flow by providing businesses with a short-term credit facility. This allows companies to pay for expenses upfront while providing them with more time to generate revenue and manage their working capital more efficiently.

3. Enhanced control of expenses

Issuing corporate credit cards to employees allows businesses to set spending limits, control where the cards can be used through merchant category blocking, and track expenses in real-time.

This level of control ensures that all employees with the cards adhere to company spending policies, reducing the risk of overspending or misuse.

4. Simplified travel expense management

Corporate credit cards simplify travel expense management for companies with frequent business travelers. Employees can use their cards to pay for flights, accommodations, and other travel-related expenses.

Plus, all the transactions are automatically recorded on the card provider’s platform. This negates the need for employees to manually fill in all the details about their travel expenses.

5. Real-time expense tracking and reporting

Corporate credit cards often come with online portals or mobile apps that provide real-time expense tracking and reporting.

Both the employee and the manager/admin who issued the card for them will be able to see all the transactions on their online portal or mobile app.

This feature enables businesses to monitor expenses as they occur, allowing for proactive financial decision-making.

6. Reduce the reimbursement burden on employees

Employees having to use personal funds for business travel purposes can be a burden as it might leave them with less cash in hand for their personal lives.

By utilizing corporate credit cards, employees no longer need to use personal funds for business expenses and wait for reimbursements. This helps alleviate financial strain on employees and improves overall job satisfaction.

What are the limitations and risks of using corporate credit cards?

1. Overspending

It can be easy to forget how much you have budgeted for spending when you have credit. You only need to repay your cards at the end of each billing cycle, which sometimes can lead to overspending.

You have to ensure that you have tight control over your expenses with corporate credit cards.

2. Fraud and misuse

No matter how strict you are about your policies and card usage, it doesn’t eliminate the risks of fraud or misuse entirely.

Considering that cards work on the basis of reporting after spending instead of requesting approval first, you could run into some delinquent employees who use their cards for out-of-policy transactions.

3. Liability and responsibility

If your credit cards are issued under your company name, your company will be liable for all expenses made on them.

While this is good for managing business expenses, it becomes a problem if an employee makes an unauthorized transaction. Chances are the company will still be held liable for that transaction.

4. Interest and fees

Corporate credit cards are great tools for managing business payments, but you’ll have to keep in mind the costs attached to them before you start using them.

Most card providers will an annual fee. On top of that, you may also be subject to interest, especially if you make late or partial payments.

5. Impact on credit score

While it’s possible to use cards to start building your credit score, you could also negatively impact it if you’re not careful.

Making a late card payment, for example, could damage your score to lenders. Either way, keep in mind that your corporate credit card usage will inevitably affect your credit score.

6. Limited supplier acceptance

It’s a good idea to use cards to make your payments in theory, but you may discover that some of your suppliers don’t take card payments, requiring you to use other methods like a bank transfer. You’ll have to be sure that most if not all of your suppliers take credit card payments.

Best practices for managing corporate credit cards

1. Establish a clear corporate credit card policy

While corporate credit cards are powerful payment tools, you’ll want to ensure that you have proper policies in place when you use them.

Establish a clear and comprehensive policy about all procedures involved in using a corporate credit card, including how to request a card and file expense reports.

2. Monitor spends regularly

Similar to other payment methods, you want to figure out a way to monitor your card expenses to ensure that you don’t go out of budget.

Luckily, corporate credit card transactions should be automatically recorded on your card management platform. Make it a habit to regularly check your dashboard to look at your business expenses.

3. Train and educate employees

Your corporate credit card policy is only good if your employees are aware of them. You want to conduct training sessions to brief employees on your policy and ensure that everything is clear to them.

Familiarize your employees with corporate credit cards, card management platforms, as well as other related technologies.

4. Setup spend alerts and notifications

Most corporate credit card providers will allow you to easily track your expenses through a dashboard. You want to take advantage of this feature and ensure that you’re monitoring your expenses regularly.

Make use of spend alerts and notifications to let you know when a card is approaching its limit or if any suspicious activity happens.

5. Timely repayment

Don’t fall into the trap of late repayments with your corporate credit cards, which will incur late fees that add up. Late payments can also put you in negative standings with your card provider.

Ensuring timely repayments are made will ultimately be beneficial for everyone involved, including your own team and business.

6. Issue cards only when necessary

It’s tempting to issue as many cards as you can when you get corporate credit cards.

However, make sure that you know the purpose of each card before you issue them. Each cardholder also needs to have strong use for the card.

Doing this reduces the risk of misuse and fraud attempts.

Volopay corporate cards for your business in India

Looking for a powerful card that comes with all the above features? Volopay is right here for you. Volopay corporate cards are the best for making online payments and out-of-pocket expenses for employees.

Here is why you must consider Volopay for providing corporate cards for your business.

● Volopay has both physical and virtual cards. Physical cards are premium, sleek-model, plastic cards with your employee names on top.

● Virtual cards can be created within the Volopay dashboard and used anywhere. Each card comes with unique card details. And you can create as many as you need.

● Along with assigning the cards for employees, they also work best to schedule monthly subscription bills in auto-pay mode.

● Be able to set budgets for each card and control how much employees spend. If they need more, they must get approval.

● No longer need a card? Simply freeze or block the card.

● Monitor from the main dashboard the transactions processed through each card.

Compared to other corporate card providers in India, Volopay cards are cheaper, reliable, and best for both local and international payments.

Get the best corporate credit card program for your business

FAQs

No. Corporate credit cards only check the financial status of your business and verify your previous months’ bank statements and profit and loss statements.

It typically takes 3 to 5 business days to apply, verify your profile, and be issued a corporate credit card in India.

The credit score of your business is required to determine your creditworthiness and eligibility to own a corporate credit card in India.

With many fintech players and prominent banks in the game, it’s very easy for any growing business to apply for a corporate credit card for employees. But it also depends on the financial condition and other liabilities of the business.

No. On the contrary, it helps in boosting the credit score, given you repay the borrowed credit on time.