👋 Exciting news! UPI payments are now available in India! Sign up now →

8 best business credit cards in India for 2025

Ever since it was first introduced in the country the credit card has been a massive hit. Now, credit cards in India are as common as they come.

Credit cards are being used not only for personal needs but for business and corporate purposes as well.

There’s a variety of credit cards available that are specifically designed to suit the requirements of business organizations.

Given the wide variety that is available, it is not surprising that making a choice on the best business credit card in India can be tricky. Making a decision requires a good degree of thought and consideration.

What is a business credit card?

A strategic financial instrument tailored for organizations is a business credit card. Unlike a personal credit card, a credit card for a company allows tracking of business expenses, a higher credit limit, and even a business-related rewards system. This card helps businesses divide personal expenditures from corporate spending for more efficient financial handling.

Using credit cards for business allows companies to manage cash flow better, manage employee spending, and gather rewards in the form of vendor discounts, travel perks, and cashback. Additionally, these cards help in establishing a business credit profile, which may help in getting better financing in the future.

Most of the best business credit cards have advanced features such as automated expense management, integration with accounting systems, and additional security features. These business credit cards make it easy for managers to spend responsibly and enable firms to improve cash flow, streamline bookkeeping, and simplify spending tracking.

Any card, when used responsibly, can help foster a company’s financial discipline while taking full advantage of the rewards and benefits provided.

How do business credit cards work?

The best business credit cards assist companies in managing expenses, managing cash flow, and earning rewards. They allow businesses to make payments, monitor spending, and manage finances better.

With adjustable credit limits and security, business credit cards provide convenience, efficiency, and better expense management for corporate transactions.

1. Issuing the card

For the acquisition of a credit card to cover company expenditures, the organization needs to apply to banks or financial institutions. Applying involves presenting business registration documents, financial reports, and evidence of income.

Issuance depends on the company's credit standing. Once received, the card can be issued to employees so they can effectively cover company expenditures while retaining financial control and transparency.

2. Setting the spend limits

The best business credit cards in India enable organizations to create specific spending limits for employees to improve control over expenditures. Companies can specify limits based on individual employees, departments, or expense types to avoid excessive spending.

The controls are used to efficiently manage budgets while enforcing adherence to organizational policies and improving the financial management process in terms of organization and transparency.

3. Initiating purchase request

Through the best business credit cards, workers can make business expense requests. The request will have such details as the amount, vendor, and purpose. Managers or accounting teams will approve or reject these requests.

This serves to provide controlled spending, policy adherence, and improved financial management, and enables businesses to monitor and handle transactions effectively while keeping unauthorized spending at a minimum.

4. Approval process

● In-policy expense request

For credit cards for business, in-policy expense requests have a streamlined approval process. Employees make requests that comply with company spending policies, indicating the amount and purpose.

Managers or finance departments review and approve them promptly, ensuring compliance. This process improves control, avoids overspending, and establishes financial transparency while enabling businesses to manage and monitor company expenses efficiently.

● Out-of-policy expense request

Out-of-policy expense requests arise when an employee's purchase does not fit company spending policies. Such requests call for extra approval from senior management or the finance department. Rationale may be required before approval or denial.

Having stringent controls for such expenses assists firms in upholding budget discipline, avoiding unauthorized spending, and maintaining adherence to financial policies while maximizing the use of business credit cards.

5. Making the purchase

Once an expenditure request has been approved, the employee is then able to purchase using a business credit card. Every transaction is processed in real time, making tracking and expense recovery simple.

Enterprises can make safe payments while they take advantage of rewards and cashback incentives. Accurate recording of every transaction ensures that accounts are transparent and easy to reconcile during audits or month-end book reviews.

6. Documenting the transaction

With the best business credit cards in India, recording transactions is necessary for proper financial tracking. Every purchase needs to be documented with receipts, invoices, and payment information.

Automated expense management tools can be used by businesses to classify spending and maintain compliance.

Proper documentation makes reconciliation easier, facilitates tax filing, and increases financial transparency, enabling companies to keep their corporate expenses under control effectively.

7. Reconciliation

Reconciliation guarantees financial records of business credit card spending align with records of such expenditures.

It involves confirming purchases made with bank statements, receipts, and invoices, and locating discrepancies among them. This task is performed using automated tools that reduce mistakes and save time.

Regular reconciliation maintains businesses with updated financial accounts, prevents dishonest activities, and verifies that company rules are followed to achieve overall improvement in expense administration and budget effectiveness.

8. Compliance and auditing

Utilizing a credit card for business expenses is subject to tight compliance and constant auditing to preserve financial transparency. Companies are responsible for following company policies and legal mandates by recording transactions accurately.

Audits carried out regularly allow for the detection of discrepancies, avoidance of fraud, and greater financial accountability. Utilizing automated tracking and approval processes increases compliance, guaranteeing that all business expenses are according to company standards and industry practice.

How we ranked the best business credit cards in India

While creating our list of best business credit cards in India, we carefully reviewed several factors, including user-friendliness, cost structure, scalability, and customer support. These efforts ensured that the chosen credit cards offered businesses maximum features, value, and benefits concerning financial flexibility and control.

1. User-friendliness

Ease of use is a key consideration when selecting credit cards for business because it impacts the ease with which employees and business owners can make transactions and track expenditures.

An ideal credit card would be easy to use, with easy-to-use online banking features, and seamless integration with accounting software. This allows for easier tracking of expenses, providing an easy way to check on usage and spending behaviour, ultimately leading to better financial decisions and business operations.

2. Customer reviews & testimonials

Customer reviews and testimonials are essential in the evaluation of credit card for company. Reviews from actual users aid in the rating of a credit card's performance, reliability, and value.

Positive reviews usually commend convenient features, good customer service, and efficient expense management features. Negative reviews highlight potential drawbacks such as high fees or unfavourable cardholder support.

By considering customer experience, businesses can be adequately informed when selecting the right credit card.

3. Compatibility with existing systems

When choosing a credit card for business use, one should determine its compatibility with the existing financial infrastructure.

Simple integration with accounting software, expense management software, and reporting systems can automate processes. This removes the necessity for manual data entry, minimizes errors, and keeps financial records up to date.

A compatible credit card enables more streamlined workflows, conserves time, and provides more precise spending information, making it a vital choice for companies looking to streamline financial processes.

4. Customization capabilities

The most appropriate credit cards for business use need to have features that are customizable according to personal business needs. Adjustable spending levels, staff access control, and tailored reward plans allow companies to harmonize the use of credit cards with unique business goals.

Flexibility facilitates financial control and enables companies to monitor spending better. Reporting functions may also be made customizable so that companies can focus on the most critical financial data used to guide financial choices and overall company performance.

5. Pricing structure & overall affordability

In evaluating the best business credit cards, affordability and cost structure are essential factors. Easy fee structures, minimal interest charges, and minimal hidden fees make a credit card affordable.

Annual fees, transaction charges, and other expenses need to be taken into account. Cost-effective cards can help businesses keep their costs in check while providing the tools and features that stimulate growth without overspending.

6. Availability of mobile application

Having a mobile app is a significant aspect when evaluating the top business credit cards. A user-friendly mobile app allows businesspeople to track their expenses in real time, follow up on transactions, and access valuable features like rewards, billing, and spending limits on any device.

Being able to do this keeps businesspeople and employees efficient in their operations by keeping them posted on their financial activity, enabling them to make quick decisions, and having seamless management of their business's finances.

7. Scaling capacity to grow with your business

When looking at the best business credit cards, there is scalability to consider. Your company credit card should grow with your company by having straightforward spending limits, the ability to add staff, and easy adjustments to your account as your financial demands increase.

Having the ability to enhance credit lines or add the features of additional cards without tedious processes means that the card can grow with your business, so you can manage funds easily while your business expands.

8. Data security features offered

Data security is a consideration when deciding on the best business credit cards. The best business credit card should have robust security features such as encryption, fraud protection, and two-factor authentication. Such features protect sensitive financial information, which is inaccessible to unauthorized parties.

Moreover, real-time notifications and transaction tracking provide an added layer of protection, which allows businesses to identify and act on suspicious activity on time. Robust data security makes business money secure and industry-compliant.

9. Unique features offered

The best business credit cards in India offer unique and appealing features. These may include employee spending limit customizability, integrated expense management capabilities, real-time monitoring, and seamless integration with accounting packages.

There are even cards offering cashback rewards, exclusive discounts, and unique rewards aligned with business needs. Moreover, features like virtual cards, instant issue of cards, and instant online access to detailed financial information make these business credit cards convenient and beneficial in effectively managing money.

10. Quality & responsiveness of customer support

In choosing the top business credit cards, there should be good customer support. An excellent company credit card should provide responsive and timely support in answering questions or resolving issues. 24/7 support, various contact avenues, and assigned account managers are factors to consider.

Good customer service enables companies to resolve matters at once, be it transactional, billing, or account issues, so that there will be no disruption in operations and they can function smoothly.

8 best business credit cards in India in 2025

Given below is a list containing the best business credit card India has to offer and some of their features.

1. SBI Prime business credit card

● Overview

SBI Prime Business Credit Card is a high-end credit card for business expenses that provides exclusive features designed for entrepreneurs.

It has high reward points, travel rewards, and free memberships, and it is suited for efficient management of corporate expenditures while gaining worthy rewards on essential business spending.

● Welcome benefits

The SBI Prime Business Credit Card provides exemplary welcome advantages and is thus one of the best business credit cards.

Card members are rewarded with a special e-gift voucher, free lounge visits, and faster reward points for business spending, so value is assured right from the beginning.

● Key features

The SBI Prime Business Credit Card has a set of corporate spending features. The card members receive higher reward points on travel, dining, and utility bills.

It has free domestic and international lounge privileges, fuel surcharge exemption, and milestone rewards. It also has contactless payments, additional security, and worldwide acceptance for smooth transactions.

● Advantages

The SBI Prime Business Credit Card has several benefits, such as high reward points on business expenditures, free lounge access, and milestone rewards. It comes with the benefit of a fuel surcharge waiver, convenient contactless payments, and global acceptance.

The company can also monitor and manage expenses with ease, and it is thus a good financial instrument for corporate expenses and cash management.

● Limitations

Although it has its advantages, the SBI Prime Business Credit Card has its drawbacks. It has a steep annual fee, which may not be suitable for small enterprises.

The reward redemption program can be complicated, and there are categories with limited rewards. Cash withdrawal charges and foreign transaction charges can contribute to increased overall expenses, which may affect efficiency in expense management.

2. HDFC Business MoneyBack credit card

● Overview

The HDFC Business MoneyBack Credit Card provides the best business credit cards that give cashback and reward points on every business transaction.

It is designed for SMEs and startups, offering them better financial flexibility, fuel surcharge waivers, and secure contactless payments, thus making it easier for companies to manage expenses.

● Welcome benefits

HDFC Business MoneyBack Credit Card offers several welcome benefits, making it one of the best credit cards for business.

New customers are provided with bonus reward points on activation, a fuel surcharge waiver, and exclusive discounts on business expenses, which maximize savings and financial flexibility.

● Key features

HDFC Business MoneyBack Credit Card is among the best business credit cards that give business expense accelerated reward points, cashback for online transactions, and a fuel surcharge waiver.

It gives interest-free credit for up to 50 days and accepts payments all around the globe, making it an effortless financial device for managing business expenses in the most effective way.

● Advantages

One of the biggest advantages of the HDFC Business MoneyBack Credit Card is the reward system. It offers reward points accumulated based on spends, as well as cashbacks offered on business expenses such as travel and utility payments.

Balance transfers and waivers on fuel surcharges are also attractive advantages of this card.

● Limitations

The HDFC Business MoneyBack Credit Card has certain limitations, such as a relatively lower cashback rate compared to premium business cards. Reward points have an expiration period, and cashback redemption options are limited.

Additionally, it may have higher foreign transaction fees, restricted airport lounge access, and eligibility criteria that may not suit all small businesses.

3. Axis Bank My Business credit card

● Overview

The Axis Bank My Business Credit Card is designed to meet the financial needs of entrepreneurs and SMEs, offering cashback and rewards on business expenses.

As one of the best business credit cards in India, it provides benefits like fuel surcharge waivers, travel perks, and expense management solutions.

● Welcome benefits

The Axis Bank My Business Credit Card offers exciting welcome benefits, including bonus reward points on first transactions, discounts on partner merchants, and cashback on specific business expenses.

Cardholders also enjoy complimentary airport lounge access and fuel surcharge waivers, enhancing overall savings.

● Key features

The Axis Bank My Business Credit Card comes with several key features, including reward points on business expenses, fuel surcharge waivers, and complimentary airport lounge access.

Cardholders also get flexible EMI options, purchase protection, and expense tracking tools. Additionally, the card provides exclusive partner discounts, making it a valuable financial tool for businesses of all sizes.

● Advantages

The Axis Bank My Business Credit Card offers several advantages, including reward points on business expenditures, fuel surcharge waivers, and complimentary airport lounge access.

It also provides expense tracking tools, EMI conversion options, and exclusive partner discounts. Additionally, businesses can benefit from enhanced security features and seamless online transactions, making it a convenient and efficient financial tool.

● Limitations

While the Axis Bank My Business Credit Card offers multiple benefits, it has some limitations. The reward redemption process can be complex, and certain categories may have lower reward rates.

Additionally, high annual fees and interest charges can increase costs. Businesses seeking a credit card for company expenses may find limited customization options and spending flexibility.

4. Yes Prosperity business credit card

● Overview

The Yes Prosperity Business Credit Card is designed to help businesses manage expenses efficiently while earning rewards.

As one of the best business credit cards, it offers cashback, fuel surcharge waivers, and travel benefits. This card provides flexibility with easy repayment options and business-friendly features.

● Welcome benefits

The Yes Prosperity Business Credit Card offers exciting welcome benefits, including reward points on first transactions, discounts on business expenses, and complimentary lounge access.

These perks make it a valuable choice for entrepreneurs seeking convenience and savings on their financial transactions.

● Key features

The Yes Prosperity Business Credit Card comes with features tailored for business owners, including reward points on every spend, fuel surcharge waivers, and discounts on travel and dining.

It offers contactless payment, easy EMI conversion, and complimentary airport lounge access. Cardholders also benefit from expense tracking tools and a secure, user-friendly online banking platform.

● Advantages

The Yes Prosperity Business Credit Card is one of the best credit cards for business use, offering reward points on every transaction, fuel surcharge waivers, and dining discounts.

It provides access to airport lounges, easy EMI options, and expense management tools. The contactless payment feature enhances convenience, while online banking ensures secure and seamless transactions.

● Limitations

While the Yes Prosperity Business Credit Card offers multiple benefits, it has some limitations. The reward points have an expiration period, limiting long-term accumulation.

Cashback and rewards are restricted to specific categories. High foreign currency markup fees make international transactions costly. Additionally, eligibility criteria may be stringent, and annual fees can be high for small businesses.

5. Amex Business Platinum corporate credit card

● Overview

The Amex Business Platinum Corporate Credit Card is one of the best business credit cards, offering premium benefits for enterprises.

It provides extensive travel perks, high reward points, and exclusive business privileges. Ideal for high-spending businesses, it ensures seamless expense management and superior financial flexibility.

● Welcome benefits

The Amex Business Platinum Corporate Credit Card offers generous welcome benefits, including a substantial reward points bonus, complimentary airport lounge access, and travel privileges.

Cardholders also get exclusive partner discounts and business-centric perks, making it a valuable choice for corporate expenses.

● Key features

The Amex Business Platinum Corporate Credit Card offers premium features, including high reward points on business expenses, airport lounge access, travel insurance, and concierge services.

Cardholders benefit from flexible payment options, zero foreign transaction fees, and partner discounts. Additionally, it provides enhanced security features and seamless expense tracking for better financial management.

● Advantages

The Amex Business Platinum Corporate Credit Card stands out among the best business credit cards in India, offering premium travel benefits, exclusive rewards, and concierge services.

Cardholders enjoy zero foreign transaction fees, comprehensive travel insurance, and high reward points on business spending. Additionally, it provides enhanced security, flexible payment options, and seamless expense management for businesses.

● Limitations

While the Amex Business Platinum Corporate Credit Card offers premium benefits, it has certain limitations. The annual fee is high, making it less suitable for small businesses.

Acceptance may be limited at smaller merchants compared to Visa or Mastercard. Additionally, the reward redemption process can be restrictive, and eligibility criteria may require a strong credit history.

6. ICICI Bank Business Advantage Black credit card

● Overview

The ICICI Bank Business Advantage Black Credit Card is one of the best business credit cards, offering exclusive benefits for enterprises.

It provides reward points on business expenditures, travel perks, and fuel surcharge waivers. With customized credit limits and expense management features, this card helps businesses streamline their financial operations efficiently.

● Welcome benefits

The ICICI Bank Business Advantage Black Credit Card offers welcome benefits, including bonus reward points on first transactions, complimentary lounge access, and fuel surcharge waivers.

These credit cards for business help companies maximize savings while managing expenses efficiently from the start.

● Key features

The ICICI Bank Business Advantage Black Credit Card offers exclusive benefits, including accelerated reward points on business expenses, fuel surcharge waivers, and complimentary airport lounge access.

It provides flexible repayment options, enhanced security features, and seamless integration with expense management tools. These features make it one of the best business credit cards for corporate spending.

● Advantages

The ICICI Bank Business Advantage Black Credit Card offers numerous benefits, including higher reward points on business expenditures, exclusive travel privileges, and fuel surcharge waivers.

It provides seamless expense tracking, enhanced security, and flexible payment options. These features make it a valuable choice among credit cards for business, helping companies manage finances efficiently while earning rewards.

● Limitations

While the ICICI Bank Business Advantage Black Credit Card offers several benefits, it has some limitations. The annual fees can be high, especially for small businesses.

Reward redemption options may be limited, and cashback benefits might not apply to all transactions. Additionally, businesses must meet specific eligibility criteria, making it less accessible for startups or smaller enterprises.

7. IDFC First Bank business credit card

● Overview

The IDFC First Bank Business Credit Card is a tailored financial solution designed to help businesses manage expenses efficiently.

This credit card for company use offers exclusive rewards, expense tracking, and flexible repayment options, making it ideal for business owners looking for financial convenience and control over their corporate spending.

● Welcome benefits

The IDFC First Bank Business Credit Card offers exciting welcome benefits, including reward points on initial spending, complimentary airport lounge access, and discounts on business expenses.

These perks make it a valuable choice for businesses seeking financial flexibility and exclusive privileges.

● Key features

The IDFC First Bank Business Credit Card comes with features like unlimited reward points with no expiry, zero forex markup on international transactions, and complimentary airport lounge access.

It also provides fuel surcharge waivers, spend-based milestone benefits, and contactless payment options, making it a convenient and rewarding credit card for company expenses and financial management.

● Advantages

The IDFC First Bank Business Credit Card offers numerous advantages, including unlimited reward points, zero forex markup, and complimentary airport lounge access.

It also provides milestone-based benefits, fuel surcharge waivers, and contactless payment options. These features make it one of the best credit cards for business use, ensuring seamless expense management and enhanced financial flexibility.

● Limitations

While the IDFC First Bank Business Credit Card offers several benefits, it has some limitations. It may have high annual fees for premium variants and restricted reward redemption options.

Additionally, certain spending categories may not earn rewards. Despite these drawbacks, it remains a viable option among credit cards for business, offering financial flexibility and convenience.

8. HDFC Business Regalia credit card

● Overview

The HDFC Business Regalia Credit Card is designed for premium business owners seeking exclusive privileges.

As one of the best business credit cards, it offers high reward points, travel benefits, and airport lounge access. Cardholders enjoy superior financial flexibility, making business transactions seamless and rewarding.

● Welcome benefits

The HDFC Business Regalia Credit Card offers attractive welcome benefits, including complimentary airport lounge access, bonus reward points, and exclusive travel perks.

Cardholders also enjoy discounts on business-related expenses, making it a valuable choice for professionals seeking premium privileges from their business credit card.

● Key features

The HDFC Business Regalia Credit Card is a premium credit card for company expenses, offering benefits like accelerated reward points on business spending, complimentary domestic and international lounge access, and concierge services.

It also includes travel insurance, fuel surcharge waivers, and exclusive dining discounts, making it a well-rounded financial tool for business professionals.

● Advantages

The HDFC Business Regalia Credit Card offers premium advantages such as accelerated reward points on business transactions, complimentary airport lounge access, and travel insurance coverage.

It provides fuel surcharge waivers, concierge services, and exclusive dining privileges. Additionally, it ensures seamless expense management with detailed statements, making it a valuable financial tool for business professionals.

● Limitations

While the HDFC Business Regalia Credit Card offers numerous perks, it has some limitations. The annual fee can be high for small businesses, and rewards redemption options may be limited.

Additionally, credit cards for business often come with strict eligibility criteria, and this card requires a strong credit history and high-income proof for approval.

Why do you need a business credit card?

A business credit card is a valuable financial tool that allows for the management of expenses, the building of credit, and the simplification of cash flow. The highest-rated business credit cards offer rewards, expense tracking, and financial flexibility. A business credit card ensures proper budgeting and financial planning.

Unlike personal cards, they are tailored to meet the needs of businesses, both large and small. Using a personal credit card for business purposes is not the best idea. For a range of reasons, there are credit cards that are specifically designed for business or corporate use.

Corporate credit cards are typically used for business purposes like vendor payments, employee T&E expenses, and so on, offering better control, tracking, and separation of business expenses from personal ones.

Separates business and personal expenses

A business credit card separates personal and company expenditures for simple financial records and tax returns. It prevents the mixing of private and company transactions, which reduces cumbersome bookkeeping.

It is easier to track spending with a credit card for a company, which minimizes accounting errors. It also makes spending more transparent and compliant, with business expenses appropriately accounted for.

A separate business credit card helps to keep finances professional, which translates into improved cash flow management and financial discipline.

Business credibility

Having a business credit card enhances the credibility of your company by establishing a good financial reputation. Lenders and suppliers assess your company's creditworthiness based on prudent usage of the card, prompt payment, and financial stability.

A well-managed credit card for business spending can improve your credit score, enhancing your chances of getting good loan terms as well as higher credit limits. Having a business credit card also projects professionalism to clients and suppliers, reinforcing dependability and confidence in business relationships.

Simplifies monitoring expenses

Using the best business credit cards simplifies expense tracking by consolidating all transactions in one place. Business credit cards provide detailed statements, categorized spending reports, and real-time monitoring, making budgeting and cash flow management simpler.

Most cards also integrate with accounting software, doing away with manual data entry and errors. This visibility allows business owners to monitor spending habits, recognize opportunities for cost reductions, and make sure that every expenditure is aligned with company policies and financial objectives.

Multi-purpose expenses

A business credit card is a versatile financial tool that funds various expense categories, from stationery and travel to vendor payments and utility bills. It offers companies the flexibility to manage expected as well as incidental expenses efficiently.

The majority of the cards offer rewards, cashback, and discounts on various purchases, maximizing savings. Business credit cards also provide facilities like installment payments and deferred payments, which allow flawless financial management without affecting cash flow.

Helps in building business credit

Using the best business credit cards in India streamlines and strengthens your company's credit profile. Timely payment and prudent usage enhance your business credit score, increasing your eligibility for loans and more preferential loan terms.

A sound credit history also establishes credibility with financiers and suppliers. Amplified credit limits and competitive interest rates also become accessible over time, providing greater financial leverage to develop and grow your business while imparting long-term fiscal stability.

Cash flow management

Proper cash flow management is essential for any business, and a business credit card helps in this by providing instant access to funds whenever needed. It helps businesses to fund short-term expenses, pay suppliers on time, and cover operating costs without draining cash reserves.

With flexible repayment options, interest-free credit periods, and higher limits, businesses can plan their expenses more effectively and maintain liquidity. Additionally, the tracking of expenses through credit card statements makes financial planning and budgeting easier.

Rewards and other benefits

Business credit cards also offer a diverse array of rewards and benefits, making them a valuable financial tool. Companies can receive cashback, travel miles, or reward points for day-to-day expenses, reducing the expenditure.

Airport lounge access, travel insurance, and rebates on business expenditures are some of the benefits that most business credit cards offer. Companies can even get exclusive discounts on office supplies, gasoline, and restaurants, maximizing savings and efficiently managing corporate expenses.

Challenges in using a business credit card for your company

When choosing the best business credit cards in India, it's also crucial to go beyond the benefits to the potential drawbacks. These include higher fees, delayed processing, and possible misuse. You'll be better able to make informed decisions for your business by being aware of these changes.

Higher fees and charges

Higher charges and fees are a typical disadvantage of business use of credit cards. Most business credit cards have annual fees, interest charges, foreign transaction charges, and cash advance fees.

The fees accumulate quickly, particularly if the credit card is used regularly. Pay attention to the fee structure of business credit cards closely in order to avoid surprise fees that could strain your business's bottom line.

Time-consuming approval process

The approval process for the best business credit cards can be long and tedious. Most lenders require comprehensive documentation such as tax returns, financial statements, and business plans.

In addition, the approval process can take several days or weeks, prolonging access to credit when in dire need. It can be a nuisance for businesses in need of rapid access to cash or streamlined approval processes to manage their cash flow efficiently.

Additional cardholder fees

The majority of business credit cards have additional fees for adding additional cardholders to the account. The expenses accumulate quickly, especially for companies with many employees who require cards for various business expenditures.

Although some card issuers issue employee cards for free, others charge annually for every additional cardholder. These extra costs can make business credit cards more expensive than initially anticipated, impacting the overall affordability for companies looking to provide credit access to a larger team.

Impact on personal credit score

Using credit cards for business can impact your credit score, especially if you’re a sole proprietor or have personally guaranteed the card. Late payments or over-utilization of the card may affect your credit, even though the card is utilized for business expenses.

Careful management of balance and transactions should be maintained to ensure that there is no negative impact on your credit score, as it may disrupt your future capacity to borrow both for personal and business purposes.

Complex reward systems

Most business charge cards offer reward schemes, although they are commonly convoluted and time-consuming. Other reward schemes may have two tiers, and some offer category pricing that features different percentages of return.

Some rewards also offer limitations on whether and when businesses may redeem. Examining reward programs requires one to spend time and effort on it, a hassle that one may not do well with being too engaged.

Personal liability

One of the cons of the top business credit cards is personal liability. Business proprietors are usually required to guarantee the card personally, so if the business falls behind on payments, the owner can be held personally responsible.

This makes it more risky for business owners, especially small or new businesses with fewer assets. It is important to include this factor when choosing the perfect business credit card to avoid being at risk with one's personal finances.

Risk of employee misuse

Employee misuse poses a significant risk when applying for a business credit card.

The employees may apply for the card to pay for their own purposes or go beyond the set spending limits. Companies can prevent this by creating robust policies, setting spending ceilings, and periodically checking transactions.

Restricting cards to be used for specific purposes and requiring authorization for high-ticket items can also minimize abuse. Training employees on the policies is necessary to keep finances in check and accountable.

Difference between business credit card and corporate credit card

In a comparison of the best business credit cards in India, it should be mentioned that business credit cards and corporate credit cards differ. Both are instruments of finance for controlling company expenditures, but are suited to different business needs with distinct features and terms of eligibility.

1. Criteria for eligibility

The business credit card requirements typically call for the company to be registered and have an established business address.

The company must demonstrate some revenue and, in exceptional circumstances, meet a minimum requirement for years in business. Personal credit histories of the company owner may be a factor, especially for smaller enterprises, when it comes to credit cards for business.

Corporate credit cards are often given to large organizations with an existing credit history and higher levels of revenue.

2. Personal liability

In the case of business credit cards, personal liability will be subject to the nature of the card. Most business credit cards require a personal guarantee, meaning the owner's personal property is pledged, and they are individually responsible for delinquent payments if the company is unable to pay.

However, corporate credit cards are unconventionally subject to personal liability as they are designed for larger businesses that have a separate legal entity. This distinction works to protect the owner's assets in the case of corporate cards.

3. Threshold requirement

The threshold requirement varies, especially with the best credit cards for business purposes. Business credit cards will have a lower rate of approval requirements, with ceilings set based on the income and credit of the company.

Corporate credit cards will often require a more substantial amount of fiscal stability and will usually involve more documentation. Companies that seek corporate cards will generally need to show a historical track record as well as broader revenues so that they can be eligible for higher levels of approval-based credit ceilings.

4. Spend limits and requirements

Firm credit cards typically have set or adjustable spending limits based on the firm's creditworthiness, with the limits adjusted as the business grows. The cards are designed to accommodate various sizes of corporations, with spending linked to income and credit history.

Corporate credit cards have higher credit limits, which are appropriate for larger organizations with higher expenditure needs. Criteria for corporate cards are usually more stringent, tending to demand enhanced documentation, such as financial reports and evidence of business income, while business credit cards tend to have fewer and less demanding qualification requirements.

5. Payment terms flexibility

Business credit cards typically offer flexible payment terms, which enable businesses to pay monthly installments with the facility to hold a balance, but with interest. The cards tend to come with a grace period before charges are levied.

Corporate credit cards, on the other hand, often come with stricter payment terms, requiring companies to settle the amount by the due date. Prolonged payment periods are also offered by some corporate cards, although this may vary depending on the specific card agreement and the company's financial condition.

Companies seeking credit cards to settle business expenses need to compare terms before making a choice.

6. Expense tracking and reporting

The best business credit cards offer solid expense reporting and tracking capabilities, allowing companies to track and manage their expenses effectively.

Companies can categorize and track spending in real-time through the use of credit cards, giving them greater convenience to offer detailed reports either for tax purposes or budgeting. The majority of the best business credit cards come with built-in tools or programs that showcase recommendations on spending patterns.

Corporate credit cards, on the other hand, do provide centralized accounting of all staff expenditures, giving a company a clearer understanding of its financial standing.

Factors to consider when choosing a business credit card program

When choosing the best business credit cards, you must evaluate several deciding criteria that align with your business needs. Choosing criteria such as expenditure limits, annual fees, reward programs, security features, and compatibility with accounting systems ensures the chosen card maximizes money management and benefits.

Choose the card that best suits your needs

While choosing a credit card for your business, ensure that you pick one that serves your specific requirements. Consider the core of your business, how you make payments, and what your expenses are going to be like.

Choose a card that offers flexibility, efficient terms, and reward schemes tailored to your business sector. If you require rewards, low interest rates, or variable spending limits, selecting the outstanding credit card will facilitate the financial management of your company and permit you to enjoy better advantages.

Ensure if no personal liabilities

When choosing between the best business credit cards in India, it is essential to ensure that there are no personal liabilities. Though some business credit cards may require the owner to guarantee the card personally, personal assets can be at risk if the business defaults on payments.

Pay special attention in going through the terms and conditions to ensure that the card delivers adequate segregation of personal and commercial finances, securing your personal liability and business safety.

Spending restrictions and limits

In making the most appropriate business-use credit cards, there is a requirement to look at spending restrictions and limits. Credit cards have different policies, with some offering flexible spending limits about your business's financial strength.

Some others set a ceiling, curtailing your ability to make more purchases. Taking into account these limits is imperative to help control cash flow and maintain your business operations fluidly without facing unexpected humps, especially for months with considerable expenditure.

Annual fee

When choosing a business credit card, the fee is something to consider. The best business credit cards are those without an annual fee, while others charge a year's fee for the additional benefits.

The fee varies depending on the card features, such as rewards, credit level, and other services. It's crucial to consider whether the card benefits are worth the cost and whether the fee aligns with your business budget and expenses.

Interest rate

When choosing business credit cards, comparing the interest rates provided is necessary. Most business credit cards have different interest rates based on the issuer and type of card. Save your business money by minimizing interest rates for carried balances.

On the other hand, if your business is one to pay off the balance quickly and in full, the interest rate may not be so important. Always compare the annual percentage rate (APR) to ensure you're receiving a rate that is suitable for your company's financial position.

Rewards and other benefits

When choosing a business credit card, consider the rewards and additional benefits offered. Most cards offer cash back, travel points, or business purchase discounts. Some even offer exclusive access to events, concierge services, or business insurance.

Evaluate the reward structure to make sure that it aligns with your company's expenditure habits. Rewards can help cover a substantial portion of costs and enhance your cash flow. Additionally, ensure that the benefits align with your overall business operations and long-term financial goals.

Integration with accounting tools

When selecting a business credit card, find out whether it integrates well with your accounting tools. Compatibility with accounting software like QuickBooks or Xero will help you monitor and report expenses easily and save time on manual data entry.

It has the capability of real-time updating and maintaining timely books of accounts. This feature is necessary for businesses that wish to ease accounting tasks and avoid errors. Ensure the credit card you choose is compatible with the software currently used by your company.

Security features offered

Security is one of the top priorities when choosing a business credit card. Choose cards that offer additional security features such as EMV chip technology, two-factor authentication, and real-time transaction notifications. These will protect your business from fraud and unauthorized charges.

Also, ensure the issuer offers fraud liability protection and a secure online banking website. Picking a credit card with strong security features guarantees that your business finances are protected against any threats and cyberattacks.

General fees and charges applied in a business credit card

When choosing a credit card for business use, it is essential to be informed about the types of fees that can be incurred. The fees vary based on the type of card, issuer, and benefits. Familiarity with typical fees helps in determining the cheapest card for your business and efficient cost management.

1. One-time card issuance fee

You typically pay a one-time card issue fee when you first apply for a credit card, especially for the best business credit cards. The fee covers the cost of processing and issuing the card.

While some issuers do not charge the fee, others charge a flat fee. It's worth taking this fee into account when comparing your business credit card choices, as it can influence the overall price of using the card for business use.

2. Annual fee

The annual fee is a recurring fee charged to most credit cards, including India's best business credit cards. It is usually charged yearly and can differ based on the card's benefits and features.

Although there are no-annual-fee cards, there are others with a fixed fee. Compare the rewards, options, and benefits with the price of the annual charge to determine if the card is appropriate for your business needs and budget.

3. Reloading fee

A reloading fee is incurred when reloading funds on prepaid business credit cards and can vary by provider. For those considering the top business credit cards, being aware of this fee is necessary since it may influence the total cost of card use.

Whereas some credit card programs may offer fee exemptions or lower fees for frequent reloads, others may charge a flat rate per transaction. Be particular to review the terms before signing up.

4. Card replacement fee

The replacement fee for the card is charged if a company credit card is lost, stolen, or damaged and needs to be replaced with a new card. For an employer-held credit card, this charge would vary with every issuer and will be a sum that never fluctuates.

Do keep this potential cost in mind when selecting your card, though, as a frequent rate of card replacement would end up costing money in the long run. Make sure to compare the replacement policy and fees when selecting the optimum credit card for your business.

5. International transaction fee

Business credit cards that are provided tend to have an international transaction fee when purchasing products or receiving cashback in a foreign currency. The fee varies between 1% and 3% of the cost.

Companies that have international operations regularly or international vendors need to review these fees carefully. To minimize expenses, opt for business credit cards with little or no foreign transaction fees, which can prevent businesses from overpaying for foreign transactions.

6. ATM withdrawal fee

The majority of business credit cards charge you an ATM withdrawal fee when you withdraw cash from an ATM using your business credit card. It is typically in the form of a flat fee plus a percentage of the withdrawn amount.

Some have a limited number of monthly withdrawals free. But frequent withdrawals can add up, so it is worth shopping around for the lowest ATM withdrawal fees before deciding on a business credit card. Always check the terms of your card.

What are the documents required to apply for a business credit card in India?

When applying for the best business credit cards in India, it's crucial to provide several documents to establish your business's legitimacy and financial well-being. These documents allow the issuer to evaluate your eligibility and decide on your credit terms. The paperwork typically includes identity, address, and financial records.

Proof of identity

Identification proof is one of the must-have documents while applying for business credit cards. It ensures the applicant's identity is similar to that of the business.

Some of the most commonly used documents are a government-issued ID like an Aadhaar card, passport, or driving license. It authenticates the business owner's or authorized signatory's identity and is a critical component in business credit card approval processing, which ensures safe and authenticated transactions.

Proof of address

Proof of address is an essential document in the application for a company credit card. It is used to verify the applicant's or business's location.

The accepted documents include utility bills, rental agreements, or bank statements showing the business owner's or company's address. This document serves the crucial purpose of authenticating the address associated with the business and ensuring compliance with regulations when applying for business credit cards. It protects the application process.

GST certificate

At times, a GST certificate is required while applying for India's best business credit cards. This certificate proves that the company is a registrant under the Goods and Services Tax (GST) Act and is authorized to charge tax.

This is a significant document for businesses involved with taxable goods and services. The lender relies on the GST certificate to confirm the legitimacy of the company and tax compliance, and therefore it is a critical part of the credit card application process.

CIN number

Corporate Identification Number (CIN) is a unique number assigned to companies registered in India under the Companies Act, 1956. While applying for a company credit card, the CIN number must be furnished to verify the corporate existence and form of the business.

The number is allocated by the Ministry of Corporate Affairs and is a mandatory requirement for companies to establish their authenticity. The CIN enables lenders to peek into the legal status of the business and its operations before they issue a credit card application.

Bank statement

A bank statement is an important document that is required when applying for a business credit card. It is an exhaustive list of your business's financial activities, such as income, spending, and account balance.

The lender relies on the bank statement to evaluate the monetary status and solidity of your business. It assists them in gauging your capability to reimburse borrowed funds and to complete payments on time.

Your recent bank statements (generally the previous 3–6 months) are predominantly sought to gauge the cash position of the firm.

Latest audited ITR

A bank statement is also a crucial document needed when availing a credit card for the business. A bank statement includes a comprehensive overview of your financial transactions including income, expenses, and accounts.

Lenders will use the bank statement to estimate your business's monetary stability and well-being. The statement helps determine your ability to manage credit and meet payment obligations within due time.

Bank statements no older than recent months (ideally the last 3–6 months) are usually demanded to confirm stable cash flow.

Proof of business continuity

Evidence of business continuity is also a very essential document when acquiring the best credit cards for your business. This letter ensures that your business has been operating for some time, demonstrating stability and long-term viability.

Frequent proofs are a certificate of incorporation, a partnership deed, or a business registration certificate. Lenders need this information to establish the level of risk in granting credit, and that your business has a consistent business history before approving a business credit card application.

Steps for implementation of a business credit card program for your company

A business credit card program makes company spending easier, improves cash flow, and strengthens financial management.

Choosing the best business credit cards optimizes benefits, including rewards, monitoring of spending, and security features. A well-planned approach streamlines implementation and ensures staying on track with your company's financial goals.

Determine clear objectives

Before introducing a business credit card program, the need for specific goals must be ascertained. Determine whether the card will be used for travel, office supplies, paying vendors, or employee purchases.

Specify the spending limits, reward selection, and security measures. Precise goals help select the right card, ensure effective management of finances, and ensure company policy compliance.

Comparing the usage of cards with business goals supports cost control, improves cash flows, and achieves optimal benefits, hence enhancing program effectiveness and durability.

Conduct needs assessment

Conducting a needs assessment is crucial before selecting a business credit card program. Assess your company's purchasing patterns, volumes of transactions, and most significant expense classes.

Identify how many employees require cards and measure the priority for benefits like reward points, cost tracking, and interfacing with accounting software.

Understanding your business requirements makes it easier to choose a card with the right benefits, spending capacity, and security. A good analysis guarantees that the selected program is aligned with the business goals and operational requirements.

Find the right provider

Finding the right credit cards for business involves comparing banks and financial institutions based on features, fees, and benefits. Look for providers that offer competitive interest rates, simple repayment terms, and robust security features.

Review their reward programs, cost-tracking facilities, and accounting software integration abilities. Inspect customer support quality and online accessibility.

Choosing a good provider offers trouble-free financial handling, cash flow maximization, and enhanced business expense monitoring with the maximum advantage of a business credit card.

Submit application and necessary documents

To access the best business credit cards, gather required documents such as proof of identity, proof of address, GST certificate, CIN number, bank statements, and audited ITR. Provide accurate information during the application to ensure no delays.

Apply online or at a bank branch. Verification may take a few days, followed by approval. Once approved, you’ll receive your business credit card, allowing seamless financial transactions and improved expense management for your company.

Receive and activate your card

After approval, your credit cards for business will be dispatched to your registered address. Upon receiving the card, verify the details and follow the activation instructions provided by the issuer.

Activation can be done through internet banking, a mobile app, or customer service. Set a safe PIN and enable features as required, like international transactions, if essential.

The card can be utilized after enabling business expenditure with smooth transactions, increased financial control, and effective company expenditure management.

Establish clear card usage policies

To achieve the complete benefit of the top business credit cards in India, develop accurate usage policies for employees. Establish spending limits, approved types of expenses, and regulatory conditions.

Institute transaction approval processes and keep documentation in order. Educate staff on responsible card usage, security measures, and early notification.

Regular audits prevent misuse and facilitate transparency. A clearly defined policy not only grants financial control but also accelerates effortless operation along with the advantage of having a business credit card.

Issue card to employees

Granting business credit cards to employees enhances financial efficiency and streamlines expense control. Assign cards based on job functions and spending needs, and set predetermined limits to control spending.

Define usage policies, including accepted transactions and reporting processes. Regular monitoring and audits prevent misuse and ensure compliance.

Granting business credit cards to employees simplifies payments, erases reimbursement lag, and maximizes financial oversight, ultimately creating smoother business operations and greater corporate expense control.

Integrate with an expense management system

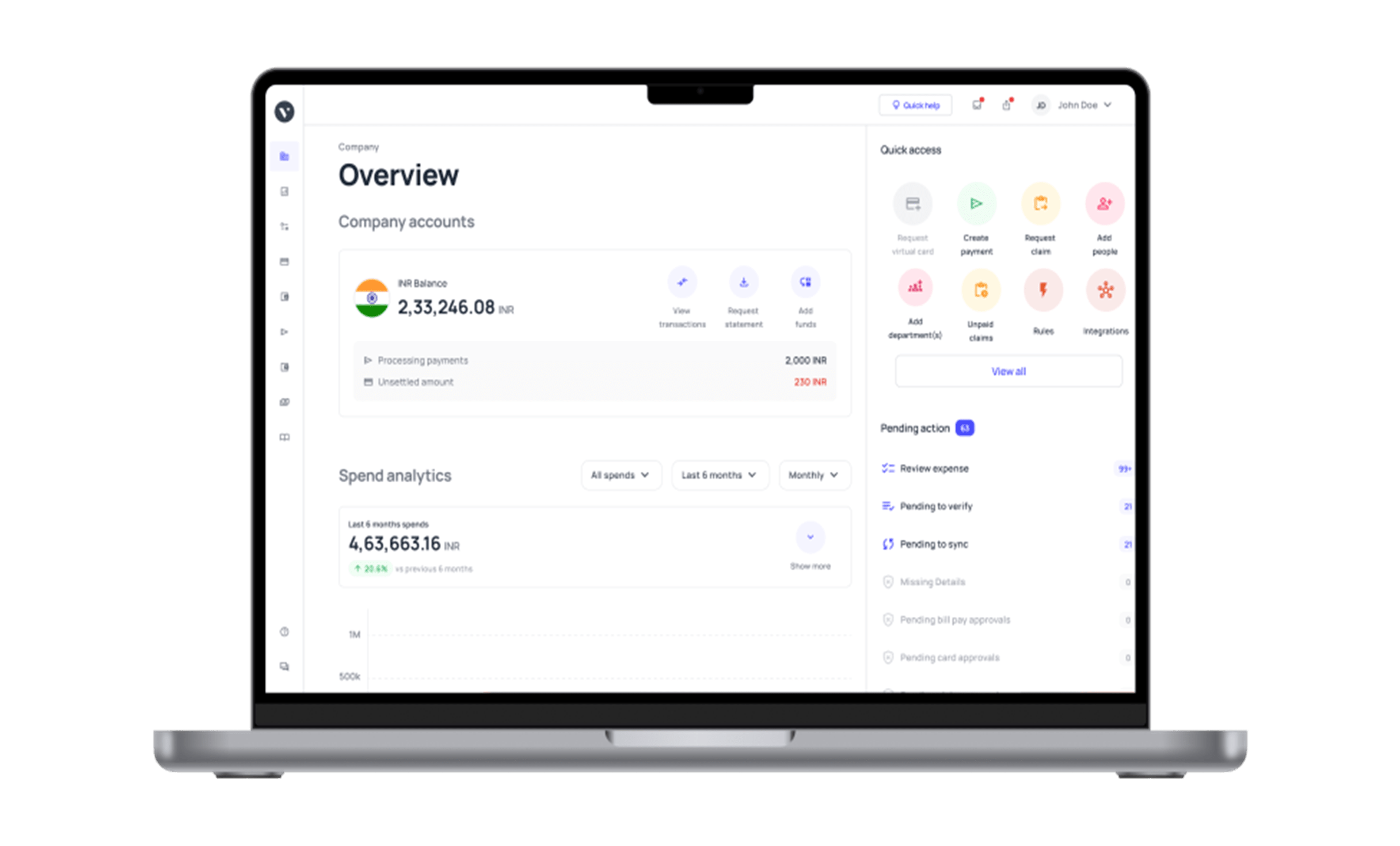

Equipping cards with an expense management tool like Volopay provides seamless expense tracking and company expense management.

Volopay offers automatic expense reporting, real-time categorization of transactions, and auto-syncing with accounting software for accuracy. It accommodates spending controls, policy enforcement, and fraud notifications, reducing manual work.

By centralizing the monitoring of expenses, businesses can automate approvals, reimbursements, and financial analysis. The integration makes it easier to increase transparency, increase budget control, and easily manage finances for growing companies.

Monitor card usage and spending pattern

Monitoring card spending and expenses is essential to maintain financial management and prevent overspending.

Regular transaction analysis helps to detect anomalies, unauthorized spending, or policy violations. Businesses can set spending limits, label expenses, and generate reports to guide financial planning.

With analytics programs, organizations can track spending patterns, automate budgets, and improve cash flow management. Real-time monitoring ensures company policy compliance and security, thus making company credit card usage more efficient and transparent.

What are the best practices when using business credit cards?

Utilizing business credit cards efficiently is essential for controlling company expenses, enhancing cash flow, and better tracking finances.

Companies can reduce risks and maximize the advantages of credit cards by embracing best practices, thus ensuring sounder financial management and adherence to company policies.

Below are some of the top tips for optimizing your credit card for business.

Maintain strict accounting demarcation

While using credit cards for business, different types of expenditure must be properly distinguished. By doing so, you can make bookkeeping easier and seamlessly keep detailed accounting information of your organization safe.

This also makes tax reporting simpler since business expenditures stand out and avoid troubles during audits. Sorting expenses ensures transparency, enhances financial accuracy, and avoids confusion or compliance issues.

Pay off outstanding bills monthly

When working with business credit cards, you must be in the habit of paying off due bills regularly. This prevents you from having high-interest charges and keeps your credit score strong.

By paying the balance on time, you can prevent late fees and keep your company out of debt. Timely credit card payments for business assist in strengthening your company's financial well-being and a good relationship with the card issuer.

Monitor your spending closely

Monitoring business spending on credit cards is vital for maintaining cash flow control and detecting unnecessary expenses. Card statement monitoring regularly helps business managers identify spending patterns and keep the firm within its means.

Monitoring also prevents unauthorized or fraudulent purchases and provides avenues to modify spending behaviors. Creating routine check-ups will assist in determining any anomalies and encourage greater fiscal responsibility in the firm.

Set spending limits

Setting spending limits is a smart way to manage the use of the best credit cards for business use effectively. With the help of maximum spending limits for employees, companies can help prevent themselves from overspending their budgets.

Such limits are particularly useful in terms of maintaining cost control and ensuring that the credit card is not abused. Applying such limitations safeguards the company's finances and maintains compliance with company policy regarding expenditure. This is a forward-thinking measure for improved financial management.

Utilize rewards wisely

Most business credit cards provide handy rewards in the form of cashback, travel miles, or rebates on office supplies. Businesses can maximize rewards by using credit cards for purchase transactions that serve their purposes.

For instance, utilizing cards for regular operational expenditures like travel, gasoline, or office supplies will result in rewarding amounts that offset company expenses. It is imperative to ensure efficient redemption of rewards to derive the highest benefit.

Enforce clear policies

Clear and precise credit card use policies for business purposes are crucial in ensuring control and accountability. Create policies regarding which expenses can be charged to company credit cards and who is qualified to make payments.

Educate all employees about acceptable usage, approval procedures, and limits. These policies discourage abuse and promote responsible use, ensuring business cards are used within the intent and scope of company operations.

Ensure regular communication with issuer

Routine contact with the issuer of your business credit card is vital for keeping abreast of any updates regarding terms, fees, or rewards programs.

By staying ahead of the game, businesses can respond to any changes to credit card products, capitalize on new benefits, or resolve any issues before they become problematic. Maintaining open lines of communication can also translate into a more positive relationship with the issuer, which can help during negotiations or requests for support.

Understand the T&C properly before use

It is crucial to read and understand the terms and conditions of business credit cards in India carefully before using them. Know the interest rates, fees, credit limits, and reward system.

The card's total scope and limitation must be understood for informed decisions. If your company needs special features such as cashback or travel benefits, ensure that they are included.

Knowledge of the T&C prevents unintended charges and confirms the credit card is suitable for business requirements.

Is there a better alternative to business credit cards?

While some of the best business credit cards in India provide rewards and spending flexibility, they have steep interest rates, strict limits, and manual tracking of expenses. Companies looking for an advanced solution can try Volopay's corporate cards, which feature real-time monitoring, automated approval, and native integrations.

In contrast to conventional credit cards for business, Volopay provides higher control, personal liability elimination, and simplified expense management. Before venturing into the best business credit cards in India, have a look at the difference between the Volopay corporate card and business credit card.

Elevate your cash flow management with Volopay cards!

Effective management of business expenses is essential to ensuring a satisfactory cash flow. Best business credit cards give businesses complete financial control, with all transactions standing completely transparent and efficient.

Volopay's corporate cards have strong financial management capabilities, real-time tracking, and automated reconciliation, making them a perfect option for businesses seeking to streamline their expense management process.

Streamlined expense management

Maintaining a streamlined expense management system is vital to the success of businesses. Volopay corporate cards enable organizations to automate the tracking of expenses, minimize manual effort, and make approvals simpler.

With seamless expense reporting integration, organizations have access to real-time insights on expenditures, promoting better budgeting and compliance. Volopay corporate card has comprehensive expense management, analytics and customized controls, making it easy for teams to take control of business spend without undue paperwork or lag.

Fast and secure payments

Volopay corporate card provides businesses with the ability to process transactions securely and promptly. From paying suppliers to paying employee expenses and operational expenditures,

Volopay's system provides efficient and smooth transactions. Through multiple layers of security controls, encrypted payment channels, and fraud protection, financial transactions can be made with confidence by businesses.

Advanced security components shield against unauthorized transactions, financial data integrity, and peace of mind.

Instant approval

Approval for business credit cards can take a prolonged time. Volopay corporate card provides instant approval for approved businesses, doing away with lengthy waiting times.

Organizations can apply, validate information, and obtain an operational payment solution in a matter of minutes. This aspect is valuable for startups and established businesses, enabling them to procure working capital effectively and maintain cash flow without interruption.

Unlimited virtual prepaid cards

Companies usually require multiple payment systems to cover various expenditures. Just like how the best business credit cards in India must offer versatile payment options, Volopay offers limitless virtual prepaid cards. You can get both virtual and physical business prepaid cards from Volopay.

These authorize companies to dispense funds among employees, departments, or groups and have strong control over expenditures. Virtual cards are compatible with online shopping, help manage subscription costs, and ensure timely payment to vendors, ensuring better security and responsibility in corporate spending.

Real-time tracking

Visibility into business expenses is essential for sound financial management. A company expense card should have real-time tracking capabilities to track transactions in real-time.

Volopay's real-time visibility feature makes sure that all transactions are captured in real time, enabling finance teams to view real-time reports and avoid overspending. This feature authorizes businesses to review spending habits, effectively manage budgets, and make informed financial decisions.

System integrations

Seamless compatibility with currently used financial and accounting solutions is a prerequisite for business efficiency. Credit cards for business must be supported by accounting applications such as QuickBooks, Xero, and NetSuite.

Volopay enables businesses to reconcile their finances with multiple systems, eliminating tedious manual data input and making reconciliation seamless. Volopay's seamless integration capabilities make bookkeeping easy and improves the overall accuracy of finances.

No hidden fees

Volopay is absolutely transparent in terms of its pricing model, as it does not have any hidden charges. Companies can leverage the platform with no surprise expenses like foreign transaction fees, overdue payment charges, or yearly upkeep fees. All this helps keep companies in good financial predictability and cost control.

Latest compliance and security

Security comes first while dealing with business transactions. Volopay makes sure that all transactions meet industry standards with features such as multi-factor authentication, fraud prevention, and regulatory compliance.

Businesses can work assured, knowing their financial information and transactions are secured against possible risks.

FAQs on business credit card

An exemplary or excellent credit score, usually 680 or better, is required to qualify for the most desirable business credit cards. Lower-scoring applicants might be approved by some issuers, but they could also be charged more in interest or have smaller credit lines.

The credit card approval process for business accounts is not consistent. Instant approval is available for outstanding credit applicants, while others can take anywhere from a few days to a few weeks based on document checks and banking processing times.

Obtaining a business credit card is based on your credit history, business finances, and banking record. Small organizations and new businesses with inadequate credit might struggle, but some providers have options for new businesses.

Generally, rewards from business credit cards, such as cashback or points, are not taxable. Yet, if benefits are cashed out and spent on non-business expenses, they could be classified as taxable income. Seek advice from a tax expert for adequate guidance.

It is not resourceful to combine company and personal expenses on one credit card. Most business cards have benefits such as categorization of expenses and tracking, allowing improved financial organization and ease of tax reporting.

The best business credit cards give cashback or reward points on supplier payments. Providers collaborate with vendors on some of these cards, providing special discounts. Strategic use of a business credit card can help optimize cash flow and cut costs.

As opposed to personal credit cards, business credit cards may come with reduced grace periods and increased interest charges. A few provide extended payment periods, making them perfect for handling cash flow and paying vendors effectively.

Most business credit cards have purchase protection, extended warranties, travel insurance, and coverage for liability due to fraud. They cover your transactions and reduce your potential financial losses.

Business credit cards reward you with cashback on office supplies, travel benefits, software subscription discounts, and greater reward points for business classes such as advertisements, bills, and dining.

Volopay’s corporate cards are prepaid, which means there is no credit borrowed. As a result, it has no negative impact on your credit score. However, Volopay’s expense management ecosystem and effective use of the cards to pay bills can help you manage business expenses and investments efficiently, which can have an indirect positive effect on your business credit score.

Report the loss instantly to Volopay to lock the card and prevent unauthorized transactions. Volopay also has the mobile app to freeze lost cards instantly, keeping security in place while a replacement can be issued.

Yes, Volopay enables you to set variable spending limits for each employee card. You can track real-time spending, limit categories of spending, and use approval workflows to manage expenses effectively.