👋Exciting news! UPI payments are now available in India! Sign up now →

Purchasing card (P-card) - Benefits and how to apply

Businesses today need purchasing solutions that eliminate bottlenecks without sacrificing control. Purchasing cards (P-cards) deliver exactly that: They streamline procurement and provide robust oversight.

These payment tools significantly reduce transaction costs per purchase compared to traditional purchase orders. P-cards give your team purchasing ability with built-in safeguards like spending limits, category restrictions, and approval workflows. Finance departments gain proper visibility into company spending and thus, employees can make necessary purchases without delays.

Whether you're managing office supplies, travel expenses, or software subscriptions, P-cards transform cumbersome purchasing processes into simple transactions. This guide covers everything from implementation to best practices so you can maximize the benefits of P-cards for your business.

What is a purchasing card?

A purchasing card helps employees buy business items without paperwork hassles. Companies give these cards to staff who need to make regular purchases, saving time and money.

So, what is a purchase card? Simply put, it's a company credit card with built-in controls. What is P-card payment? It's when employees use these cards to pay for business expenses directly. The company gets one monthly bill instead of processing hundreds of receipts.

Businesses set limits on these cards—how much can be spent and where.

P-cards work for office supplies, travel expenses, and other small purchases. They cut processing costs by 60% compared to purchase orders. Most businesses see the benefits right away—faster purchasing and better spending records.

How do purchasing cards work?

Let us discuss the answer to the question “How do P-cards work”?

Purchasing cards reduce procurement complexity for businesses. They allow authorized employees to make purchases without traditional paperwork. They function like credit cards with built-in controls, tracking purchases automatically while maintaining spending oversight.

1. Issuing the card

Organizations roll out P-cards to streamline small purchases. They select cardholders based on who regularly buys supplies or services. Cards show both the company logo and the employee's name for accountability.

Before distributing cards, companies run mandatory training sessions where staff learn policies and sign acceptance forms. Security measures include in-person card pickup with ID verification to prevent unauthorized access.

2. Setting the spend limits

Finance departments configure spending parameters for each cardholder. These include monthly budget caps, transaction amount limits, and merchant category restrictions. Limits align with job responsibilities and departmental budgets.

Periodic reviews allow adjustments based on actual needs and compliance history. These boundaries maintain financial control while enabling purchasing efficiency.

3. Initiating purchase request

Cardholders confirm policy compliance before initiating transactions. They document needed items, estimated costs, and business purposes. Request mechanisms vary by organization size—larger companies use formal systems while smaller firms employ streamlined approaches. This preliminary step ensures purchases serve legitimate business purposes.

4. Approval process

● In-policy expense request

Standard transactions receive prompt approval through established channels. Routine purchases within defined parameters may qualify for automatic authorization. Management reviews verify budget availability and business necessity. This efficiency is a primary advantage over traditional procurement methods, significantly reducing acquisition timelines.

● Out-of-policy expense request

Exceptions require additional scrutiny and justification. Cardholders must explain both the business necessity and the reason for policy deviation. These requests require higher approval, typically involving department heads and finance representatives. Processing takes longer than standard requests. Approval depends on demonstrated business need and appropriate justification.

5. Making the purchase

What is a purchase card? It's the payment instrument that enables transaction completion following approval. Cardholders execute purchases through appropriate channels - retail locations, online platforms, or telephone orders.

The transaction is processed immediately through established payment networks. The organization maintains payment responsibility while streamlining the procurement process.

6. Documenting the transaction

Documentation forms the foundation of program integrity. Cardholders secure receipts containing itemized purchase details. They record business purpose and cost allocation information.

Many organizations utilize electronic systems for immediate receipt capture. Proper documentation supports financial reporting requirements and establishes clear audit trails.

7. Reconciliation

Monthly reconciliation matches transactions against supporting documentation. Cardholders review statements for accuracy while accounting teams verify proper expense coding. Management examines spending patterns for appropriateness. This verification process identifies discrepancies before payment submission. Reconciliation ensures financial accuracy through systematic review procedures.

8. Compliance and auditing

What is P-card compliance? It involves systematic verification of program adherence. Audit procedures include transaction sampling, documentation review, and policy compliance verification.

Monitoring identifies potential misuse indicators such as split transactions or inappropriate merchants. Regular audits maintain program integrity. Non-compliance consequences range from corrective action plans to program termination.

Common use cases of a P-card

Purchasing cards cut through procurement red tape for everyday business expenses. These payment tools excel where traditional purchase orders create unnecessary delays, saving time and money across multiple business functions.

Office supplies

P-cards transform office supply buying from a headache into a simple swipe. Staff grab printer paper, pens, folders, and ink cartridges without lengthy approval chains. Most companies set monthly spending caps instead of requiring approvals for every small purchase.

The cost savings are substantial – traditional purchase orders cost $50-$250 to process, but P-card transactions cost just $10-$15. Office managers love the quick response to needs, and finance teams get detailed spending records without the paperwork nightmare.

Travel & expenses

Business travel gets way easier when employees have P-cards. No more fronting personal cash for flights, hotels, and rental cars or requesting advances. Card limits can bump up temporarily during trips, then drop back when travel ends.

Employees snap receipt photos through mobile apps right after purchases. The cards provide a safety net for surprises like canceled flights or extra hotel nights. After the trip, accounting gets clean transaction data that shows exactly where travel dollars went across the company.

Software subscriptions

P-cards bring order to the chaos of software subscriptions. Create dedicated virtual cards with limits matching exact subscription prices to stop overcharges. Set card expiration dates to match renewal deadlines for automatic review points.

Track all your digital subscriptions in one place to kill redundant services and spot unused licenses. Department heads see precisely what software their teams actually use. IT and finance departments finally get control over SaaS expenses that typically hide in scattered department budgets.

Maintenance and repairs

Maintenance teams need P-cards more than anyone. When critical equipment breaks, waiting days for purchase order approvals means extended downtime. P-cards let maintenance staff buy replacement parts or call emergency repair services on the spot. They work perfectly for preventative maintenance supplies and routine service calls, too.

Many businesses create emergency maintenance cards with higher limits for designated staff to access when critical systems fail. This balances cost control with keeping operations running.

Business event expenses

Corporate events require dozens of small purchases from multiple vendors with tight deadlines that procurement processes can't handle. P-cards let event planners book venues, order catering, buy decorations, and cover last-minute needs without delays.

Real-time spending tracking helps keep events on budget without forcing employees to pay from their own pockets. The detailed records make it easy to split costs between departments or bill clients appropriately. Temporary limit increases during event periods provide flexibility without permanent risk exposure.

Minor technological & equipment purchases

Tech teams rely on P-cards for components, peripherals, and smaller equipment. When someone needs an extra monitor or special cables for a project, P-cards eliminate bottlenecks.

Most companies set transaction limits that cover necessary purchases but require formal approval for major equipment. These cards prove invaluable when replacing failed equipment that impacts productivity. Tech managers can respond quickly to team needs without sacrificing proper documentation for asset tracking.

Smarter purchasing starts with Volopay cards

7 types of purchasing card

Purchasing cards (P-cards) streamline procurement by eliminating purchase orders and invoices. These specialized payment cards enable authorized employees to make work-related purchases while giving organizations robust control and visibility over spending patterns and supplier relationships.

1. Corporate purchasing cards

Corporate purchasing cards equip businesses with efficient procurement solutions for everyday operational expenses. These cards eliminate traditional paperwork, reducing processing costs by as much as 80% per transaction.

Companies can customize spending parameters based on department needs, track purchases in real-time, and generate comprehensive spending analytics. With automated integration into accounting systems, these cards streamline reconciliation while maintaining robust audit trails for compliance purposes.

2. Government purchasing cards

Government purchasing cards facilitate streamlined procurement processes within public sector organizations. These specialized cards operate under strict regulatory frameworks, ensuring transparency and accountability in taxpayer fund utilization.

Designed with multiple authorization levels, they support micro-purchases while maintaining mandatory documentation requirements. Government P-cards deliver substantial administrative savings by eliminating paper-based processes while providing detailed reporting that supports compliance with public procurement regulations and transparency initiatives.

3. Single-use purchasing cards

Single-use purchasing cards provide enhanced security for one-time transactions with unique card numbers that expire after a single purchase. Ideal for large, infrequent payments to new vendors, these cards minimize fraud risk by limiting exposure.

Organizations can pre-approve exact spending amounts, preventing unauthorized charges beyond set parameters. The temporary nature eliminates the need to manage physical cards and provides exceptional tracking capabilities. These cards effectively bridge procurement flexibility with enterprise-grade security protocols for sensitive transactions.

4. Travel purchasing cards

Travel purchasing cards centralize and streamline business travel expenses through dedicated payment solutions. These specialized cards consolidate airfare, hotel, transportation, and meal purchases, providing comprehensive visibility into travel spending patterns.

Organizations can implement custom travel policies directly into card restrictions, ensuring compliance with per diem limits and approved vendors. Built-in expense categorization simplifies accounting processes while offering automated integration with travel management platforms. These cards typically include enhanced travel insurance, emergency assistance, and priority customer support for travelers.

5. Fleet purchasing card

Fleet purchasing cards provide specialized solutions for vehicle-related expenses across company transportation assets. These cards capture detailed level III data, including odometer readings, vehicle identification, and fuel grades for comprehensive fleet management. Organizations gain visibility into maintenance schedules, fuel efficiency patterns, and unauthorized usage.

Advanced controls prevent non-vehicle purchases while providing tax exemption automation for eligible fleet expenses. With integrated telematics capabilities, these cards deliver actionable insights for optimizing vehicle utilization, route planning, and preventative maintenance schedules.

6. Virtual purchasing card

Virtual purchasing cards exist as digital payment credentials rather than physical plastic, generated instantly for specific transactions. These digital solutions provide unique card numbers, expiration dates, and security codes for online purchases, subscription services, and digital advertising expenses.

Organizations can create unlimited virtual cards with precise spending controls tailored to specific vendors or projects. The digital nature eliminates physical card distribution challenges while providing enhanced tracking capabilities. Integration with procurement platforms enables automated card generation based on approved purchase requests.

7. Travel & entertainment purchasing cards

Travel & entertainment purchasing cards combine expense management card capabilities for both business travel and client entertainment costs. These comprehensive solutions track expenses across transportation, accommodation, dining, and entertainment categories with automated receipt capture functionality.

Organizations implement policy controls that reflect varying allowances between routine business travel and client entertainment activities. Enhanced reporting provides insight into entertainment ROI by client relationship while simplifying year-end tax reporting.

These cards typically include premium benefits like airport lounge access, concierge services, and priority booking options.

Admin controls available in a P-card

P-card administration controls provide organizations with governance mechanisms to enforce spending policies and prevent unauthorized purchases. These sophisticated management tools create accountability while maintaining the efficiency benefits that make purchasing cards valuable procurement solutions.

1. Spend limits

Spend limits establish precise financial boundaries for purchasing card transactions through multi-tiered control mechanisms.

Administrators can configure transaction limits (maximum per purchase), daily limits, monthly cycle limits, and annual caps tailored to cardholder responsibilities. These parameters prevent unauthorized large purchases while accommodating legitimate spending needs.

Organizations typically implement graduated limit structures aligned with hierarchy levels, with automated workflows for temporary limit increases during exceptional circumstances. This granular approach balances procurement efficiency with appropriate financial controls.

2. Approved vendor list

Approved vendor lists restrict purchasing card utilization to pre-vetted suppliers that meet organizational standards for quality, reliability, and contractual arrangements.

Administrators can implement these controls through merchant category codes (MCCs) or specific merchant identification numbers. This approach enforces compliance with negotiated contract pricing while preventing unauthorized supplier relationships.

Organizations can establish tiered approval structures for different vendor categories based on risk profiles. The system automatically declines transactions from non-approved vendors, requiring proper onboarding procedures before procurement authorization.

3. ATM use conditions

ATM use conditions establish guidelines for cash withdrawals using purchasing cards, with most organizations implementing strict limitations due to reconciliation challenges.

Administrators can completely disable ATM functionality or allow restricted access with documentation requirements and verification protocols. When permitted, these controls typically include withdrawal limits, frequency restrictions, and geographic parameters.

Organizations often implement additional approval workflows specifically for cash access, requiring business justification and supervisor authorization. Transaction monitoring systems flag unusual ATM activity patterns for immediate review to prevent potential misuse.

4. Approval workflow

Approval workflow controls establish multi-stage authorization processes for purchasing card transactions based on organizational hierarchy and spending thresholds.

Administrators can configure automatic approvals for routine, low-value purchases while implementing escalating authorization requirements as transaction amounts increase. These workflows can incorporate role-based permissions, department-specific approval chains, and specialized review requirements for sensitive spending categories.

Organizations typically implement time-sensitive approval notifications to prevent operational delays. The system maintains comprehensive audit trails documenting each approval stage for compliance verification and process improvement analysis.

5. Geographic restrictions

Geographic restrictions limit purchasing card usage to approved locations aligned with legitimate business operations and travel patterns.

Administrators can implement controls at country, regional, or even city-specific levels to prevent transactions in unauthorized territories. These restrictions protect fraudulent international charges while accommodating planned business travel through temporary geographic overrides.

Organizations typically implement location-based alerts when transactions occur in unusual territories. Advanced systems incorporate IP-based verification for online purchases to ensure digital transactions originate from approved locations despite the borderless nature of e-commerce.

6. Real-time monitoring

Real-time monitoring provides continuous transaction visibility through instantaneous alerts and synchronized dashboards reflecting purchasing card activity as it occurs.

Administrators receive immediate notifications for policy exceptions, unusual spending patterns, or potential fraud indicators without reconciliation delays. These systems employ machine learning algorithms to establish behavioral baselines for individual cardholders, flagging anomalous transactions for review.

Organizations can configure custom alert parameters based on industry-specific risk profiles and internal control requirements. This immediate visibility enables proactive intervention before problematic spending patterns escalate.

7. Limitations on transaction type

Limitations on transaction types establish boundaries regarding permissible purchasing methodologies and payment scenarios.

Administrators can restrict cards from supporting recurring transactions, mail/telephone orders, contactless payments, or international purchases based on organizational risk tolerance. These controls prevent unauthorized subscription enrollments while ensuring appropriate documentation for non-standard purchasing channels.

Organizations typically implement different transaction-type permissions based on cardholder roles and responsibilities. The system automatically declines restricted transaction methodologies, requiring alternative procurement approaches with appropriate oversight and documentation requirements.

7. Date & time controls

Date and time controls restrict purchasing card usage to specific temporal parameters aligned with standard business operations.

Administrators can implement restrictions limiting transactions to business hours, workdays, or custom scheduling based on operational requirements. These controls effectively prevent after-hours purchases that typically fall outside legitimate business needs.

Organizations can implement calendar-based exceptions for special events, travel, or projects requiring non-standard purchasing windows. Advanced systems incorporate time zone intelligence, adjusting permissible transaction windows based on cardholder location during business travel to maintain operational flexibility while preserving control integrity.

Features to look for in P-cards for your business

When selecting purchasing card solutions, organizations should evaluate platforms based on their ability to balance procurement efficiency with appropriate financial controls. The most effective programs provide customization options that align card functionality with specific operational requirements and risk management approaches.

Customizable spend controls

Customizable spend controls transform purchasing cards from simple payment methods into sophisticated policy enforcement tools.

Effective systems provide granular configuration options including transaction limits, monthly caps, merchant category restrictions, and time-based parameters. Look for solutions offering dynamic adjustment capabilities for temporary limit modifications during special projects or emergencies.

Advanced platforms support departmental templating to efficiently maintain consistent policies across business units while accommodating unique operational requirements. The best systems provide hierarchical control structures with delegated administration capabilities to distribute program management responsibilities appropriately.

Customizable approval workflows

Customizable approval workflows establish transaction authorization processes that mirror organizational structures and governance requirements.

Effective systems support multi-level approvals with conditional routing based on amount thresholds, expense categories, or departmental classifications. Look for solutions offering delegation capabilities for uninterrupted operations during approver's absence.

Advanced platforms provide mobile approval functionality with transaction details, supporting documentation, and policy alignment indicators for informed decisions anywhere. The best systems include configurable escalation paths with automated reminders to prevent bottlenecks while maintaining comprehensive audit trails of all approval activities.

Fraud protection

Fraud protection capabilities safeguard purchasing card programs through multiple defense layers combining preventative controls, detection mechanisms, and response protocols.

Effective systems employ advanced authentication methods, including biometrics, one-time passwords, and device verification to prevent unauthorized transactions. Look for solutions providing real-time fraud scoring using machine learning algorithms that continuously adapt to emerging threats.

Advanced platforms offer customizable rule creation for organization-specific risk indicators based on historical patterns. The best systems include immediate suspension capabilities with simultaneous notification workflows when suspicious activities are detected.

Real-time monitoring and alerts

Real-time monitoring and alerts transform purchasing card oversight from reactive reconciliation to proactive management through instantaneous transaction visibility.

Effective systems provide customizable notification parameters based on amount thresholds, merchant categories, geographic locations, and policy exceptions. Look for solutions offering differentiated alert delivery methods, including email, SMS, and mobile push notifications with severity classifications.

Advanced platforms provide administrator dashboards highlighting unusual spending patterns requiring immediate attention. The best systems incorporate machine learning capabilities that establish normal behavior baselines for each cardholder, flagging subtle anomalies that rule-based systems might miss.

ERP integration

ERP integration capabilities seamlessly connect purchasing card transactions with core financial systems, eliminating manual reconciliation processes and data entry errors.

Effective systems provide bi-directional synchronization, ensuring consistent financial information across platforms while supporting automated general ledger coding based on transaction characteristics. Look for solutions offering flexible integration approaches, including API connectivity, SFTP file transfers, and direct database connections.

Advanced platforms support custom field mapping to accommodate organization-specific charts of account structures. The best systems provide real-time synchronization rather than batch processing, ensuring financial systems continuously reflect current purchasing activities.

Receipt imaging & matching

Receipt imaging and matching functionality transform expense documentation from manual paperwork to automated digital processes.

Effective systems provide mobile capture capabilities ,allowing immediate receipt digitization at purchase time with optical character recognition (OCR) extracting key transaction details. Look for solutions offering automated matching algorithms that link receipts with transactions based on the amount, date, and merchant information.

Advanced platforms support configurable exception workflows when discrepancies are identified. The best systems maintain digital receipt repositories with appropriate retention schedules aligned with organizational policies and regulatory requirements.

Unlimited virtual cards

Unlimited virtual card capabilities enable organizations to generate digital payment credentials on demand for specific purchases, projects, or vendor relationships without physical card limitations.

Effective systems provide self-service card generation with customizable validity periods, spending parameters, and merchant restrictions for each virtual credential. Look for solutions offering automated virtual card creation triggered by approved purchase requisitions.

Advanced platforms support recurring virtual cards for subscription management with customizable expiration handling. The best systems provide comprehensive virtual card analytics identifying opportunities for vendor consolidation and enhanced spending controls.

Vendor category restrictions

Vendor category restrictions ensure purchasing cards are only used with appropriate supplier types aligned with organizational procurement policies.

Effective systems provide multi-tiered control options, including broad category limitations through Merchant Category Codes (MCCs) and specific merchant blocking for individual vendors. Look for solutions offering temporary category access for exceptional circumstances with appropriate documentation requirements.

Advanced platforms support customizable category groupings beyond standard MCC classifications for organization-specific supplier management. The best systems provide automatic policy notification when transactions are attempted with restricted vendor categories.

Role-based access controls

Role-based access controls govern purchasing card program administration through precisely defined permissions tailored to job responsibilities.

Effective systems provide granular functionality access across card issuance, limit adjustments, report generation, and policy configuration. Look for solutions offering custom role creation capabilities beyond standard permission templates.

Advanced platforms support hierarchical administration models with departmental-level program management while maintaining enterprise-wide policy governance. The best systems include comprehensive activity logging for administrator actions, creating accountability across all program management functions while supporting the segregation of duties requirements for proper financial controls.

Track, control, and simplify every purchase

Benefits of opting for a purchasing cards program for your business

Purchasing cards streamline how businesses pay for goods and services. They cut paperwork, speed up buying, and give you better control over company spending. Many businesses see major time and money savings after switching to P-cards.

1. Advanced controls

P-cards let you set exactly who can buy what. You can limit purchases to specific vendors or item types. Cards can be restricted to certain times of day or days of the week. You can even block certain merchant categories completely. These controls stop unauthorized spending before it happens, unlike traditional methods that catch problems after money is spent.

2. Greater spend flexibility

P-cards work almost anywhere credit cards are accepted. This means employees can make purchases from new vendors quickly without setting up accounts. Staff can buy from online stores, local shops, or by phone. This flexibility helps teams respond faster to business needs without waiting for lengthy purchase order approvals or petty cash requests.

3. Customizable spend limits

With P-cards, you set different spending caps for each employee based on their needs. You can create daily, weekly, or monthly limits. Some systems even let you set per-transaction limits. For special projects, you can temporarily increase limits. When projects end, you can lower limits again without issuing new cards.

4. Streamlined approval workflows

P-cards eliminate multi-step approval processes for routine purchases. Employees can buy what they need when they need it. Pre-approved spending limits replace approval signatures. For larger purchases, digital pre-approval systems work with P-cards. This means fewer emails, fewer forms, and faster purchasing decisions.

5. Easy accounting reconciliation

Modern P-card systems link directly to accounting software. Transactions automatically appear in your financial system with proper expense codes. Many systems let cardholders upload receipts through a mobile app. This means less manual data entry and fewer coding errors. Month-end closes happen faster with most information already in your system.

6. Real-time spend data

P-card programs show purchases as they happen, not weeks later. Managers can see spending patterns through online dashboards. You can spot unusual transactions immediately. This visibility helps catch potential fraud quickly. Better data means smarter budgeting and more accurate forecasting for future business needs.

7. Simplified procurement cycle

P-cards shrink the typical buying process from weeks to minutes. Employees skip creating purchase requisitions, getting manager approvals, sending purchase orders, and processing invoices. Instead, they simply buy what they need with their card. This saves time for both buyers and the accounting team.

8. Improved payment security

P-cards are safer than checks or cash. Modern cards use chip technology to prevent copying. Virtual card numbers can be used once and discarded. Spending controls prevent unauthorized purchases. Instant transaction alerts flag suspicious activity. If fraud does occur, P-cards typically offer better protection than traditional payment methods.

9. Expense reconciliation

P-cards make expense tracking much simpler. Employees no longer need to pay with personal funds and wait for reimbursement. Digital receipt capture connects proof of purchase to transactions automatically. Managers review expenses through online portals. The finance team spends less time processing expense reports and more time on valuable analysis.

P-card vs. Business credit cards vs. Corporate credit cards

These three payment tools serve different business needs. P-cards focus on procurement efficiency. Business credit cards help small companies separate personal and business expenses.

Corporate cards serve larger organizations with complex spending needs. The right choice depends on your company's size and specific requirements.

How it works

● P-card

P-cards work as payment tools specifically for business purchasing. They connect directly to the company bank accounts. Most systems integrate with accounting software for automatic expense coding and reconciliation.

● Business credit card

Business credit cards function like personal cards but for company expenses. They offer revolving credit with monthly statements. Most provide spending rewards and basic expense categorization features for small businesses.

● Corporate credit card

Corporate cards are complete expense management systems for larger companies. They include advanced software platforms, custom integration options, and dedicated account management. Most offer employee-level controls and reporting.

Primary purpose

● P-card

P-cards primarily streamline procurement by replacing purchase orders, invoices, and check payments. They focus on reducing transaction costs for routine business purchases and supplies.

● Business credit card

Business cards mainly separate personal finances from company expenses for tax purposes. They help establish business credit and provide basic spending tools for small companies.

● Corporate credit card

Corporate cards create comprehensive expense management systems. They handle travel, entertainment, purchasing, and recurring expenses through a single integrated platform for larger organizations.

Control & management

● P-card

P-cards offer precise purchasing controls. Administrators can limit spending by merchant category, amount, time period, and location. Systems typically include approval workflows and automated compliance checking.

● Business credit card

Business cards provide basic controls. You can set individual spending limits and view transactions online. Management features are generally limited compared to more specialized card programs.

● Corporate credit card

Corporate cards deliver enterprise-level control. They offer customizable approval hierarchies, policy enforcement, department-based budgeting, and integration with company systems like ERP and accounting software.

Approval process

● P-card

P-card purchases typically use pre-approved spending limits instead of transaction approvals. Larger purchases may require digital pre-authorization through connected workflow systems.

● Business credit card

Business card spending usually requires minimal formal approval. Most small businesses rely on receipt collection and monthly statement reviews rather than pre-purchase authorization.

● Corporate credit card

Corporate card systems include multi-level approval workflows. These can involve department heads, project managers, and finance team members based on the amount, expense type, or budget impact.

Credit involvement

● P-card

P-cards generally don't impact business credit scores. They function more like debit cards tied to company accounts, with payments typically drawn directly from company funds.

● Business credit card

Business cards directly affect your business credit profile. Payment history, credit utilization, and account standing are reported to business credit bureaus like Dun & Bradstreet.

● Corporate credit card

Corporate cards have minimal impact on company credit. Large corporations negotiate custom terms based on their financial standing rather than traditional credit scoring models.

Impact on cash flow

● P-card

P-cards can improve cash flow by extending payment terms. Companies typically get 25-30 days to pay for purchases without interest charges, helping with short-term cash management.

● Business credit card

Business cards offer revolving credit that can ease cash flow challenges. However, carrying balances incur interest charges that can become significant expenses for growing companies.

● Corporate credit card

Corporate cards provide predictable payment cycles and negotiated float periods. Many programs include working capital benefits designed specifically for large enterprise cash management needs.

Compliance

● P-card

P-cards excel at policy enforcement. Systems can block non-compliant purchases automatically. Digital receipt capture and approval workflows create clear audit trails that satisfy most regulatory requirements.

● Business credit card

Business cards offer basic expense tracking but limited compliance features. Most compliance depends on manual review processes rather than automated controls built into the card system.

● Corporate credit card

Corporate cards include comprehensive compliance management. They enforce company policies, capture required documentation, track approval signatures, and generate compliance reports for internal and external audits.

Risks involved

● P-card

P-card risks include potential misuse by employees. Without proper controls, cards might be used for unauthorized purchases. However, spending limits and merchant restrictions minimize potential losses.

● Business credit card

Business cards carry a higher fraud risk. If stolen, cards could be used for large unauthorized purchases. Owner liability is also greater, with personal guarantees often required for small business cards.

● Corporate credit card

Corporate cards face sophisticated fraud attempts. Larger transaction volumes make spotting unusual patterns harder. However, advanced fraud detection systems and dedicated security teams mitigate these risks.

Billing & payment

● P-card

P-card billing typically happens on regular cycles with automatic payment from company accounts. Most programs send consolidated statements that group transactions by department, project, or expense category.

● Business credit card

Business card billing works like personal credit cards. Monthly statements arrive with minimum payment requirements and interest charges on unpaid balances. Payments must be made actively each month.

● Corporate credit card

Corporate card billing includes customized payment terms. Large companies may negotiate extended payment windows, custom billing cycles, and electronic payment integration with treasury management systems.

Expense reporting

● P-card

P-cards often eliminate traditional expense reporting. Purchases automatically flow into financial systems with proper coding. Mobile apps let employees add business purposes and receipts instantly.

● Business credit card

Business cards require manual expense reporting. Employees or owners must categorize transactions, attach receipts, and reconcile statements. Some basic automation exists, but it typically requires extra software.

● Corporate credit card

Corporate cards feature sophisticated expense management. Systems handle policy compliance, receipt matching, approval routing, accounting integration, and reimbursement processing for complex organizations.

Visibility

● P-card

P-cards provide excellent spending visibility. Real-time transaction feeds show purchases immediately. Reporting tools analyze spending patterns across departments, vendors, and expense categories for better cost control.

● Business credit card

Business cards offer limited visibility features. Basic reporting shows spending by category and employee. However, deeper analytics and integration capabilities are typically minimal compared to specialized programs.

● Corporate credit card

Corporate cards deliver enterprise-level spending insights. Sophisticated analytics platforms show spending across global operations. AI-powered systems identify savings opportunities and negotiate vendor terms based on spending patterns.

Limitations of using purchasing cards

While P-cards offer many benefits, they aren't perfect for every situation. Understanding their limitations helps companies implement programs that maximize advantages while minimizing potential drawbacks. Properly managed programs can address most of these challenges.

1. Receipt mismatch with statement

Statement dates and receipt dates sometimes don't match up. An employee might purchase on the last day of the billing cycle, but the charge appears on the next statement. This creates reconciliation headaches.

Some vendors authorize cards on one date but don't finalize charges until days later. Without good systems, these timing differences can cause accounting problems and slow down month-end closing processes.

2. Lack of PO-level terms & conditions

P-cards bypass traditional purchase orders, which often contain important legal protections. When employees use cards, they might miss contract terms like warranties, return policies, or service agreements.

Legal departments worry about missing these protections. Critical purchases might need both a formal purchase order for legal documentation and a P-card for payment to solve this problem.

3. Cost of the program

P-card programs aren't free. Banks charge annual fees, transaction fees, and sometimes implementation costs. Software platforms add additional expenses. Training employees takes time and resources.

For smaller companies with few transactions, these costs might outweigh the benefits. Companies need to calculate their return on investment carefully before implementing a program.

4. Non-compliance by cardholders

Some employees struggle to follow P-card policies. They might forget to save receipts, buy from unauthorized vendors, or make personal purchases accidentally. Even with the best training, human error happens.

Companies must balance convenience with control. Too many restrictions make cards useless, but too few invite problems. Finding the right balance requires ongoing program management.

5. Reconciliation difficulties

Monthly reconciliation can become complicated. Missing receipts, unclear transactions, and disputed charges create headaches. Some employees delay uploading documentation. Statements might show vendor parent companies instead of familiar store names.

Coding errors happen when transactions are misclassified. Without good software and clear processes, reconciliation can become extremely time-consuming.

6. Card misuse and fraud

P-cards face both internal and external fraud risks. Internally, employees might intentionally misuse cards for personal purchases. Externally, stolen card numbers can lead to unauthorized charges.

Even with strong controls, determined fraudsters find workarounds. Companies must balance security with usability. Excessive security measures can make cards too difficult to use for legitimate business purposes.

7. Dispute handling & resolution

Resolving disputed transactions can be challenging. Card issuers have complex dispute procedures with strict timeframes. Documentation requirements are often extensive. A resolution might take weeks or months.

Meanwhile, accounting systems show unreconciled transactions. Finance teams must track disputed charges separately from normal business. Without good systems, disputed transactions create significant administrative burdens.

8. Vendor discounts loss

P-card purchases might miss negotiated vendor discounts. When employees buy directly with cards instead of through procurement systems, they might pay retail prices instead of contract rates.

Volume discounts get missed when purchases spread across many cards instead of consolidating under central purchasing. Companies risk paying more for the same items despite having negotiated better terms.

9. Risk of card proliferation

Companies often issue more cards than necessary. Departments request cards "just in case" they're needed. Temporary cards become permanent. Departing employees' cards might not get canceled promptly.

Each card increases administration and risk. Without strict issuance policies and regular account reviews, card counts grow continuously. More cards mean more risk exposure and higher program costs.

10. Lack of spend visibility

Despite better tracking than cash, P-cards can still create visibility gaps. Transactions show vendor names, but not always specific items purchased. Level 3 data (detailed purchase information) isn't available from all merchants.

Categorizing general retailers like Amazon or Walmart requires manual receipt review. Without this detail, analyzing spending patterns becomes difficult and financial planning suffers.

Automate purchasing with smart corporate cards

Steps for implementation of a purchasing card program

Determine clear objectives

Begin by establishing what you want to achieve with your P-card program. Common objectives include reducing processing costs, streamlining approvals, gaining better spend visibility, or capturing supplier discounts.

Your objectives should align with your company's financial strategy and procurement goals. Setting specific metrics like "reduce procurement processing costs by 30%" gives you clear targets to measure success against.

Conduct needs assessment

Evaluate your current purchasing processes to identify pain points and opportunities. Analyze spending patterns, transaction volumes, and vendor relationships. Determine which departments or teams would benefit most from P-cards.

Consider both high-volume, low-dollar purchases and strategic vendor relationships. This assessment forms the foundation of your program design and helps establish appropriate spending limits and controls.

Research & evaluate P-card providers

Compare at least three P-card providers based on fees, rebate structures, reporting capabilities, and integration options. Look for providers offering robust fraud protection, spending controls, and mobile functionality.

Consider their implementation support and ongoing customer service reputation. Ask for detailed explanations of all fees, including annual, transaction, and international charges. Request demo accounts to test user interfaces and reporting tools.

Study customer reviews & testimonials

Gather feedback from businesses similar to yours that've implemented P-card programs. Industry forums, LinkedIn groups, and review sites offer valuable insights into real-world experiences.

Ask providers for reference customers you can contact directly. Pay attention to feedback about customer service quality, ease of implementation, and system reliability. Customer experiences often reveal strengths and weaknesses that sales presentations might gloss over.

Choose your P-card program

Select the provider that best matches your requirements and budget constraints. Negotiate favorable terms, including rebate structures, annual fees, and implementation support.

Get clarity on contract length, renewal terms, and cancellation policies. Request a detailed implementation timeline and support plan. Ensure all stakeholders agree on the choice and understand the upcoming implementation process.

Setup & configure controls

Establish spending limits at both the card and transaction levels. Configure merchant category code (MCC) restrictions to limit where cards can be used. Set up time-based controls to prevent off-hours purchases if needed.

Implement geographic restrictions for cards if your business is location-specific. These controls should balance risk management with employee convenience, preventing misuse while enabling legitimate purchases without unnecessary friction.

Define your approval policy & workflow

Create clear approval hierarchies based on transaction amounts, department budgets, and role responsibilities. Determine which purchases require pre-approval and which can be reviewed post-purchase. Document escalation procedures for exceptions and urgent purchases.

Your workflow should include automated notifications to approvers and built-in reminders for pending actions. The policy should balance control with operational efficiency, avoiding bottlenecks that defeat the purpose of P-cards.

Integrate with existing systems

Connect your P-card platform with accounting software, expense management systems, and ERP platforms. Ensure data flows automatically to eliminate manual entry and reconciliation.

Map expense categories consistently across systems to maintain reporting accuracy. Test integrations thoroughly before full deployment. Proper integration is crucial for realizing efficiency gains and ensuring accurate financial reporting across your business systems.

Conduct employee training programs

Develop comprehensive training materials covering card usage policies, approval workflows, and reporting requirements. Include both technical system training and policy compliance education.

Create quick-reference guides for common tasks and questions. Schedule multiple training sessions to accommodate different schedules and learning styles. Follow up with refresher sessions after implementation to address common issues and reinforce best practices.

Conduct system testing

Perform thorough testing with a small pilot group before full deployment. Test every aspect of the workflow from purchase to reconciliation. Verify that controls work as expected and that reporting provides the required insights.

Document any issues and ensure they're resolved before expanding the program. Testing should simulate various scenarios, including policy violations, to ensure detection systems work properly.

Assign card to employees

Distribute cards strategically, prioritizing employees with regular purchasing needs. Have cardholders sign usage agreements acknowledging policies and responsibilities. Document card issuance carefully, including activation dates and assigned limits.

Consider implementing a phased rollout to manage change effectively. Maintain a centralized record of all cardholders, their approval chains, and any special permissions or restrictions.

Monitor analytics & performance

Regularly review spending patterns, policy adherence, and savings realized through the program. Track key metrics such as processing cost reduction, payment timing, and rebate earnings.

Analyze vendor concentration and negotiate improved terms with frequently-used suppliers. Identify outliers and unusual patterns that might indicate misuse or opportunities for policy refinement. Good analytics turn your P-card data into actionable business intelligence.

Continuous improvement

Gather feedback from cardholders, approvers, and accounting staff to identify enhancement opportunities. Regularly benchmark your program against industry standards and best practices.

Stay informed about new features from your provider and implement those offering clear benefits. Review and adjust spending limits, control settings, and policies based on actual usage patterns. A well-maintained program evolves with your business needs.

Methods to manage your P-card program

Effective management ensures your P-card program delivers maximum value while maintaining appropriate controls. Here are the primary approaches to managing your program.

Manual recording & reconciliation through spreadsheets

● Overview

The basic approach uses spreadsheets to track purchases, reconcile statements, and generate reports. While affordable for small operations, this method becomes increasingly error-prone as transaction volumes grow.

● Step of manual process

Begin by downloading monthly statements from your P-card provider. Create spreadsheets where cardholders enter purchase details and categorize expenses. Collect and attach digital receipts to each entry.

Reconcile entries against bank statements, flagging discrepancies for investigation. Generate reports by filtering spreadsheet data as needed. Export data for accounting system entry. This approach requires discipline from all users to maintain data quality and timely submissions.

Traditional expense reporting

● Overview

This method incorporates P-card transactions into existing expense reporting processes, treating card purchases similarly to out-of-pocket expenses that employees submit for approval and reimbursement.

● Step of manual process

Cardholders collect receipts for all P-card purchases. At month-end, they create expense reports categorizing transactions and attaching supporting documentation. Reports route through predetermined approval workflows. Approved reports move to account for reconciliation against card statements.

Finance teams process legitimate discrepancies with the card issuer. Accounting codes each transaction and posts it to the general ledger. While familiar to employees, this process still involves substantial manual effort and potential delays.

Expense management software

● Overview

Dedicated expense management platforms automate much of the P-card administration process while providing better visibility and control over spending across the organization.

● Step of manual process

Employees capture receipts via mobile apps immediately after purchases. The software automatically matches receipts to card transactions using OCR technology. Built-in rules flag policy violations and route transactions to appropriate approvers. Approvers review flagged items while compliant transactions flow through automatically.

The system generates accounting entries based on predefined rules and exports them to accounting software. Dashboards provide real-time spending visibility to managers and finance teams. This approach significantly reduces administrative overhead while improving compliance.

P-card management systems

● Overview

Purpose-built P-card management platforms offer the most comprehensive solution, with features specifically designed for corporate purchasing workflows and compliance requirements.

● Step of manual process

The system pulls transaction data directly from the card issuer daily. AI-driven categorization automatically codes purchases based on merchant data. Employees verify categorization and add business purposes through web or mobile interfaces. The system applies multi-level rule sets to ensure policy compliance.

Automated workflows route exceptions to appropriate approvers while compliant transactions are automatically approved. Detailed analytics highlight spending patterns, savings opportunities, and potential misuse. Integration with accounting and ERP systems ensures financial data remains synchronized across the organization.

Best practices to follow when using purchasing cards in a business

For the employer

● Phased implementation approach

Roll out your P-card program gradually rather than company-wide immediately. Start with a pilot group from different departments to identify and address process issues. Collect feedback systematically and refine procedures before expanding.

This approach builds institutional knowledge, creates internal advocates, and prevents widespread disruption if adjustments are needed. Each phase should have clear timelines and success criteria before proceeding.

● Cross-functional dedicated P-card team

Form a team with representatives from procurement, finance, IT, and major user departments. This team should oversee program design, implementation, and ongoing management. Regular team meetings help identify cross-departmental issues and opportunities.

Designate clear roles for policy management, training, auditing, and technical support. This structure ensures all perspectives are considered and creates multiple points of expertise throughout the organization.

● Establish industry-grade performance benchmarks

Develop metrics that measure both efficiency gains and risk management effectiveness. Compare your program performance against industry standards and similar-sized organizations. Track processing costs per transaction, cycle times, rebate earnings, and compliance rates.

Benchmark supplier discounts captured and the percentage of eligible spend captured on cards. These measurements demonstrate program value to leadership and identify specific improvement areas.

● Develop a robust employee training program

Create training that covers both technical operations and policy requirements. Develop role-specific modules for cardholders, approvers, and administrators. Incorporate real-world scenarios and common pitfalls.

Make training materials available on demand for refreshers and new employees. Conduct annual refresher training that incorporates program changes and addresses common compliance issues identified through audits.

● Clearly defined & identified inactive cards

Establish formal processes for monitoring card activity and addressing inactive cards. Define inactivity thresholds (typically 3-6 months without transactions). Implement automated alerts for cards approaching inactivity thresholds.

Contact cardholders to determine if inactive cards are still needed. Promptly cancel unnecessary cards and document the actions taken. Regular pruning prevents forgotten cards from becoming security risks.

● Perform periodic audits

Conduct both scheduled and random audits of P-card transactions. Review documentation completeness, policy compliance, and approval timeliness. Verify business purpose justifications and expense classifications. Cross-reference transaction data with other systems to identify potential duplication.

Document audit findings and require corrective actions for identified issues. Trend analysis across multiple audits helps identify systemic issues requiring policy or training adjustments.

● Perform thorough vendor-match analysis

Regularly analyze spending patterns to identify opportunities for vendor consolidation and negotiated discounts. Look for similar purchases made from different vendors at varying prices. Identify departments using different suppliers for identical products.

Use this data to negotiate volume discounts with preferred vendors. This analysis turns P-card data into strategic sourcing intelligence that creates additional savings beyond process efficiencies.

● Create clearly defined accepted vendor list

Develop and maintain a list of approved vendors for common purchase categories. Negotiate preferred pricing and terms with these vendors. Configure systems to flag or prevent purchases from non-approved vendors.

Establish a process for employees to request additions to the vendor list. Regularly review vendor performance and update the list accordingly. This approach balances purchasing flexibility with appropriate controls.

For the employee

● Adhere to policies strictly

Familiarize yourself with all company P-card policies before making purchases. Understand your spending limits, approved merchant categories, and documentation requirements. Follow prescribed approval processes for exceptions. Recognize that policy compliance protects both you and the company.

Violations can result in card revocation or disciplinary action, even for seemingly minor infractions. When in doubt about a potential purchase, consult your program administrator before proceeding.

● Avoid overspending

Verify budgetary approval before making significant purchases. Split purchases among multiple transactions to circumvent spending limits is explicitly prohibited and easily detected. Consider total costs including taxes, shipping, and potential add-on charges.

For recurring services, evaluate the full contract commitment. Coordinate with colleagues on large purchases to leverage volume pricing.

● Use cards responsibly

Never use company P-cards for personal expenses, even with intentions to reimburse. Keep your card secure and never share card details with unauthorized users. Use secure payment methods when making online purchases.

Sign the back of physical cards and immediately report lost or stolen cards. Remember that each transaction creates an audit trail linked directly to you as the cardholder.

● Ensure proper receipt management

Capture detailed receipts for every transaction immediately after purchase. Digital receipt apps make this process simple and prevent loss. Ensure receipts show itemized purchases, not just payment totals. Attach receipts to transactions in your expense system promptly.

For missing receipts, follow your company's documentation procedures immediately rather than waiting until month-end reconciliation. Organized receipt management prevents compliance issues during audits.

● Report card issues immediately

Notify your program administrator promptly about any card problems, including declined transactions, suspected fraud, or lost cards. Challenge any unrecognized charges through proper channels.

Report merchants who add unexpected surcharges for card usage. Timely reporting minimizes disruption and financial risk. Most card issuers have 24/7 support lines for urgent issues requiring immediate resolution.

● Stay informed

Keep up with policy updates and program changes affecting cardholders. Attend all required training sessions and refresher courses. Understand the reasoning behind policy requirements, not just the rules themselves.

Ask questions when procedures seem unclear. Knowledge prevents inadvertent violations and helps you maximize the program's benefits while maintaining compliance.

● Leverage real-time updates

Take advantage of mobile alerts for transaction notifications. Review pending transactions regularly rather than waiting for monthly statements. Address flagged transactions promptly when notified by the system.

Use spending analytics to understand your purchasing patterns. Real-time engagement with the P-card system prevents end-of-month surprises and helps maintain accurate departmental budget tracking.

How can Volopay cards help your business?

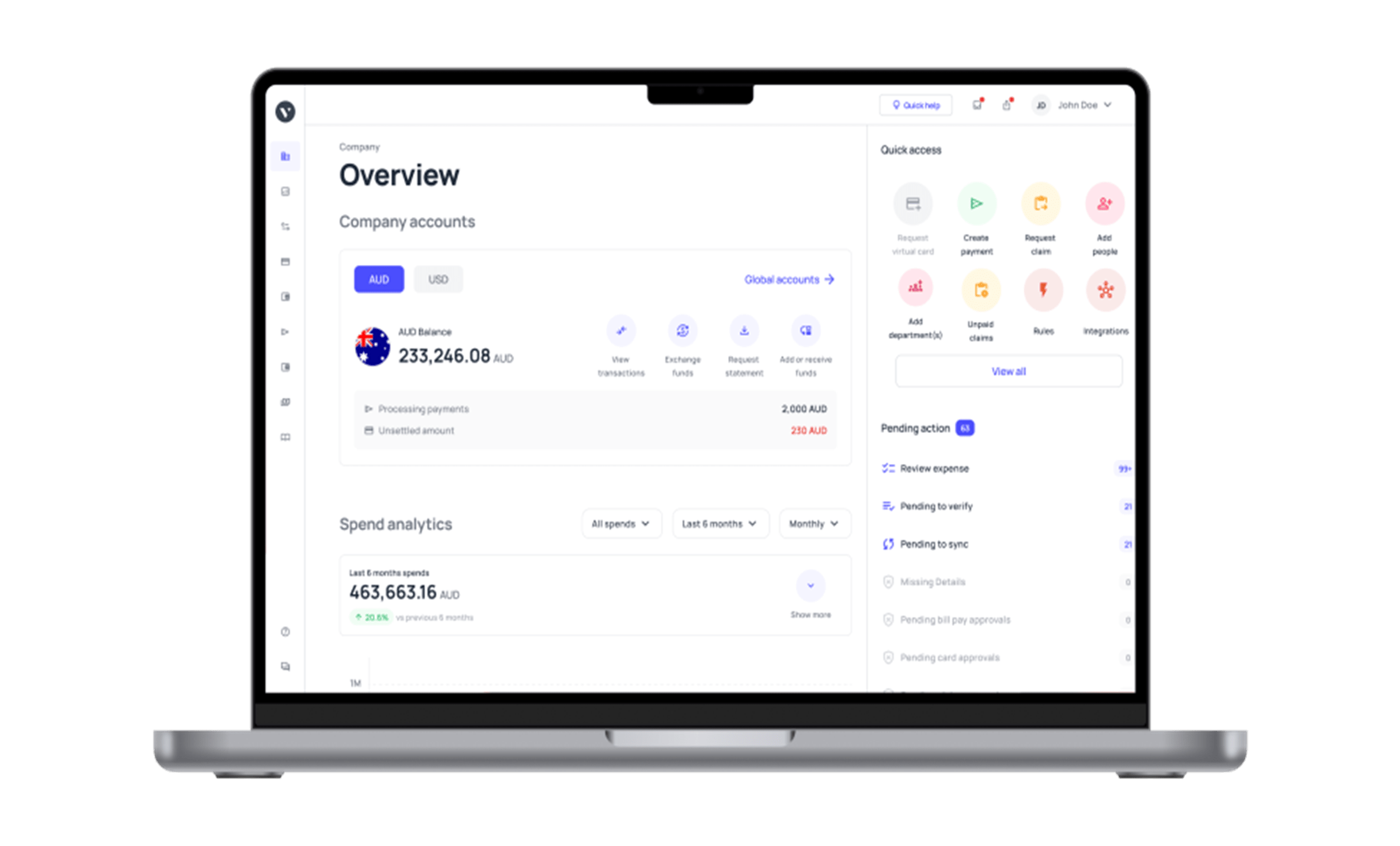

Volopay offers an advanced corporate card solution that addresses common pain points in business spending while providing powerful controls and insights that traditional P-card programs often lack.

Automate recurring payments

Volopay enables you to set up and manage subscription payments without manual intervention. Schedule payments with precise timing and amount controls. Receive notifications before the payment process, allowing review or cancellation if needed.

Track all subscriptions in one dashboard to eliminate forgotten services draining your budget. The system flags unusual changes in recurring payment amounts automatically. This automation reduces administrative overhead while ensuring critical services continue uninterrupted.

Unlimited virtual cards for employees

Create dedicated virtual cards for specific vendors, projects, or employees instantly. Each card can have unique controls and visibility settings. Virtual cards eliminate the security risks of sharing physical card details across teams.

Use single-use virtual cards for one-time purchases with maximum security. Virtual cards can be created, modified, or canceled instantly without waiting for physical cards. This flexibility scales with your business needs without additional paperwork.

Multi-level approval workflows

Configure approval chains matching your organizational hierarchy and spending authorities. Set different approval requirements based on amount thresholds, departments, or expense categories. Enable temporary approval delegation for vacations or busy periods.

Approvers receive notifications via email, mobile app, and dashboard alerts. The system tracks approval timing and escalates delayed requests automatically. These workflows ensure appropriate oversight while maintaining purchasing efficiency.

Real-time spend tracking

Monitor transactions as they happen rather than discovering overspending after the month-end. View spending by department, project, employee, or vendor through intuitive dashboards. Drill down into transaction details with a single click.

Set budget alerts that notify stakeholders when spending approaches defined thresholds. Export detailed reports in multiple formats for further analysis. Real-time visibility transforms reactive expense management into proactive financial control.

Auto-categorization of payments

Volopay automatically categorizes transactions based on merchant data and spending patterns. The system learns from manual corrections, continuously improving categorization accuracy.

Consistent categorization ensures accurate reporting and budget tracking across the organization. Custom categories can be created to match your chart of accounts or project structures. This automation eliminates hours of manual coding and improves data consistency.

System integrations

Volopay connects seamlessly with popular accounting platforms including QuickBooks, Xero, and NetSuite. Synchronize vendor lists, account codes, and project tracking fields across systems.

Automated data transfer eliminates duplicate entry and reconciliation discrepancies. Custom integrations are available for proprietary systems through well-documented APIs. These connections ensure your financial ecosystem operates as a cohesive unit rather than disconnected islands of information.

Latest compliance and security

Benefit from enterprise-grade security including encryption, multi-factor authentication, and fraud monitoring systems. Stay compliant with financial regulations through automated record-keeping and audit trails.

Implement IP restrictions and login time controls for additional security. Receive immediate notifications of suspicious transactions or policy violations. Regular security updates protect against emerging threats. This comprehensive approach protects sensitive financial data while maintaining operational efficiency.

Empower teams with efficient corporate cards

FAQs on purchasing card

Combine clear policies, regular training, automated controls, and consistent auditing. Use systems that enforce rules at the point of purchase rather than relying solely on after-the-fact reviews. Transparently share audit results and consistently address violations.

Volopay employs bank-grade encryption, real-time fraud monitoring, and multi-factor authentication. Virtual cards minimize exposure to actual account details. Suspicious activities trigger immediate alerts, and granular controls prevent unauthorized transactions.

Use it as easily as you would any other credit card for business purchases within your authorized limits and categories. Capture receipts immediately, add required transaction details, and submit for approval according to company policy. Never use it for personal expenses.

Volopay provides dedicated implementation specialists, comprehensive training materials, and 24/7 support through multiple channels. Regular webinars and knowledge base updates keep users informed about new features and best practices.

Yes, Volopay offers pre-built integrations with major platforms like QuickBooks, Xero, NetSuite, and SAP. Custom integrations are available through our API for proprietary or specialized systems used by your business.

Companies of all sizes benefit, from startups to enterprises. Volopay particularly helps businesses with distributed teams, multiple departments, significant SaaS spending, or complex approval requirements that traditional banking products can't efficiently manage.

P-cards enable immediate purchasing without pre-approval paperwork, ideal for lower-value or routine purchases. They reduce processing costs, speed up fulfillment, and provide better spending visibility while eliminating invoice matching and payment delays.