👋Exciting news! UPI payments are now available in India! Sign up now →

Prepaid expenses vs accrued expenses: Explained

As a business owner, you deal with different types of expenses, but two of the most essential are prepaid expenses vs accrued expenses.

Knowing the differences between prepaid and accrued expenses helps you manage your books accurately, ensure regulatory compliance, and improve decision-making. Understanding when and how each expense type affects your finances helps you stay on top of budgeting, cash flow, and reporting.

You make prepaid expenses when you pay upfront for services your business will use over time—like rent or insurance. These costs initially appear as assets on your balance sheet and gradually become expenses as the benefits are consumed. On the flip side, accrued expenses come into play when you’ve used services but haven’t paid for them yet, such as utilities or unpaid vendor bills.

These are liabilities, representing obligations your business must settle in the future.

Recognizing the differences between these two types of expenses is crucial for prepaid vs accrued expenses for small businesses. Small businesses often operate on tight budgets, so the timing of expense recognition can greatly affect cash flow and planning.

Accurately recording each type of expense ensures that your financial reports reflect true performance.

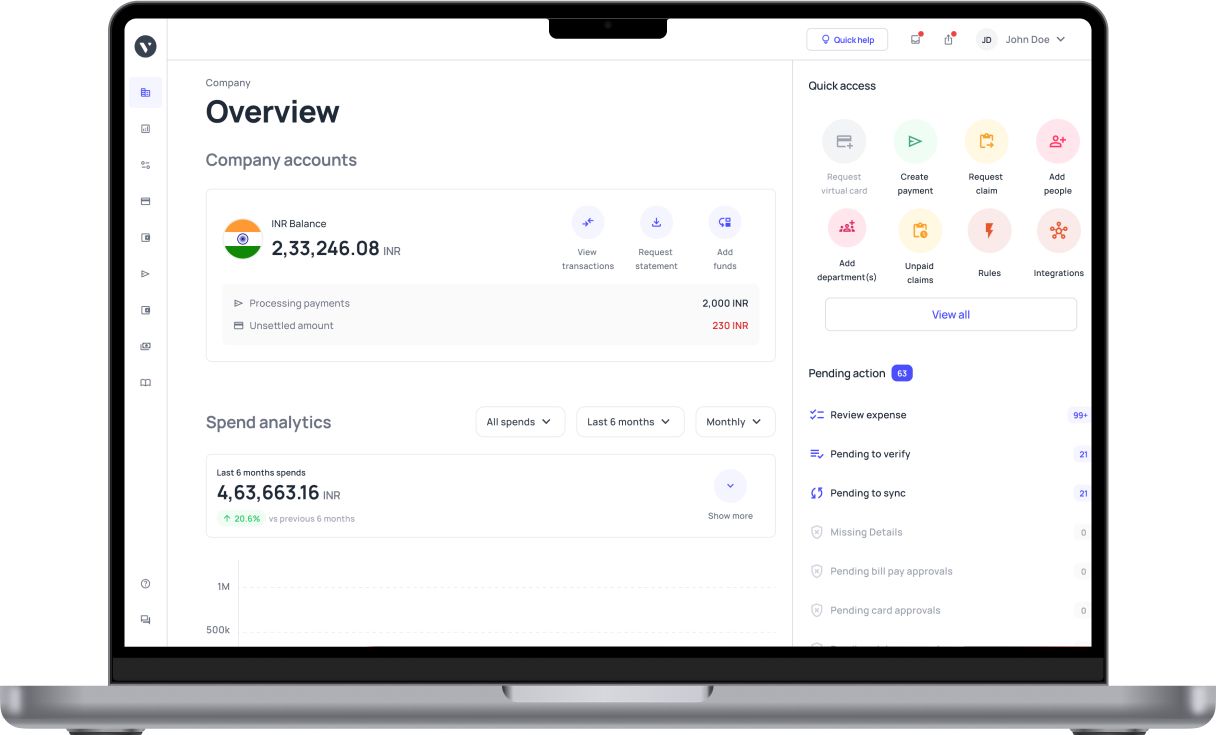

Volopay’s prepaid cards make managing prepaid expenses easier. You can set predefined limits, get real-time expense dashboards, and integrate data directly into accounting platforms like QuickBooks or Xero.

These features help you allocate funds more strategically and reduce human error. Whether you’re paying for subscriptions or insurance in advance, using prepaid cards streamlines the process, helping you gain control over spending.

With the right tools and awareness of the prepaid expenses vs accrued expenses distinction, you can confidently manage your finances and make informed decisions every step of the way.

What are prepaid expenses?

You make prepaid expenses when you pay in advance for something your business will use over time, such as rent, insurance, or software subscriptions. You don’t expense them right away because they provide future value. Instead, you record them as assets on your balance sheet.

Over time, as you use what you paid for, you gradually turn those assets into expenses. This accounting approach ensures that your financial statements reflect accurate costs for each period.

Understanding the differences between prepaid and accrued expenses allows you to record costs properly and avoid overstating profits. If you’re comparing prepaid expenses vs accrued expenses, prepaid items are paid upfront and recognized later, while accrued ones are recognized now but paid later.

Managing these expenses gets easier when you use Volopay’s prepaid cards. You can allocate funds in advance, set strict budgets, and monitor expenses in real-time. These tools reduce errors and improve visibility.

For prepaid vs accrued expenses for small businesses, prepaid cards are especially useful because they let you maintain better control over cash outflows. You get clear dashboards, secure transactions, and accounting integration. By staying on top of your prepaid expenses, you keep your financial records accurate, compliant, and easier to manage over time.

What are accrued expenses?

You create accrued expenses when your business receives goods or services but hasn’t paid for them yet. These include things like utility bills, wages, interest, or supplier invoices. Even though you haven’t made a payment, you still record these costs because your business has already benefited. That’s the essence of accrual accounting—you recognize expenses when they’re incurred, not when cash leaves your bank.

This approach gives you a more accurate picture of your financial obligations. When you compare prepaid expenses vs accrued expenses, the key difference lies in timing. Prepaid costs are paid upfront and become expenses later.

Accrued costs are unpaid but get recognized immediately. Understanding these differences between prepaid and accrued expenses helps you keep financial statements aligned with reality.

You usually record accrued expenses by debiting an expense account and crediting a liability account, such as “accrued expenses payable.” This entry ensures your balance sheet reflects what your business owes. Accurately tracking accruals helps you plan for future cash outflows and avoid last-minute surprises.

For prepaid vs accrued expenses for small businesses, keeping track of accrued liabilities is vital for compliance and strategic budgeting. While prepaid cards simplify handling prepaid expenses, they also help you budget for recurring obligations, letting you track real-time spend against unpaid costs.

This clarity allows you to operate efficiently, plan better, and remain GAAP-compliant throughout the year.

Key differences between prepaid and accrued expenses

When comparing prepaid expenses vs accrued expenses, it’s essential to understand how these two types of costs impact your business. Both affect your financial records, but in different ways.

Knowing the differences between prepaid and accrued expenses helps you manage your finances more effectively, improve cash flow, and ensure accurate accounting practices. Below, we break down key distinctions in payment timing, accounting treatment, financial statement impact, cash flow effects, and management tools.

Payment timing

For prepaid expenses, you pay upfront before receiving the benefit. For example, when you pay for insurance or a yearly subscription in advance, you make the payment before receiving the service.

On the other hand, accrued expenses are costs that your business incurs before you pay them. You’ve used the service, but the payment is made later.

This timing difference is essential to understand because it affects how you handle your cash flow and track obligations. Prepaid expenses may strain your cash flow initially, while accrued expenses push cash outflows into the future.

Accounting treatment

When you make prepaid expenses, they are recorded as assets on your balance sheet. This is because the payment you've made provides future benefits to your business, which you’ll gradually expense over time.

As you use the prepaid service, you amortize the expense and recognize it as a cost in the corresponding period. Conversely, accrued expenses are recorded as liabilities. They represent amounts you owe but haven’t yet paid.

This entry helps you accurately reflect your financial obligations, even before cash changes hands. Tracking both prepaid and accrued expenses allows you to keep your financial records in line with accrual accounting principles, ensuring that your expenses match the periods in which they occur.

Financial statement impact

Your financial statements reflect prepaid expenses vs accrued expenses differently. When you incur prepaid expenses, they show up as assets on your balance sheet, which will gradually convert to expenses over time as the service is used.

On the other hand, accrued expenses impact your balance sheet as liabilities, showing what you owe but haven’t paid yet.

Additionally, accrued expenses also affect your income statement as an expense, reflecting the costs incurred in the current period, even if payment is delayed. Understanding how both affect your financial statements helps you paint an accurate picture of your company’s financial position.

Cash flow effects

When dealing with prepaid expenses, your cash flow takes an immediate hit because you pay upfront. This can cause a short-term strain on your liquidity, but it also means you won’t have to make a payment again for the duration of the contract or subscription.

On the other hand, accrued expenses don’t immediately affect your cash flow because you only pay when the bill is due. However, this can lead to a delayed cash outflow, which may impact your liquidity later.

Managing cash flow is essential. You must be proactive in planning for both immediate payments (prepaid) and future obligations (accrued) to ensure your business has sufficient funds when needed.

Management tools

Managing prepaid expenses is streamlined with tools like Volopay’s prepaid cards. These cards allow you to pay for services in advance, while also enabling you to set budgets, track transactions in real time, and integrate with accounting software. This system helps you stay organized and prevents overspending.

On the other hand, managing accrued expenses requires tracking liabilities and keeping a close eye on payment schedules.

This can be done with accounting software that helps you record and monitor outstanding liabilities, ensuring that you make timely payments when they are due. Using integrated financial management tools helps you stay on top of both types of expenses, improving visibility and minimizing errors.

Accounting for prepaid vs accrued expenses

Proper accounting for both prepaid expenses vs accrued expenses ensures accurate financial records. It’s crucial for businesses to differentiate between the two and understand the correct procedures for recording, amortizing, and complying with accounting standards.

Leveraging tools like prepaid cards can streamline the process and help you maintain better visibility of your finances. Below are the steps involved in accounting for both prepaid and accrued expenses.

Recording prepaid expenses

When you make a prepaid expense, you first record the payment as an asset on your balance sheet. The correct accounting entry is to debit the prepaid expense account and credit cash or your prepaid card. This reflects the fact that you’ve paid for a service or good that will provide future benefits to your business.

As time passes, you will amortize the prepaid expense, shifting it from the asset category to the expense category in your financial statements.

For instance, if you prepay insurance for a year, you’ll gradually move the amount to your expense account each month, reflecting the portion of insurance used. Using a prepaid card makes it easier to track these payments, and integration with accounting software ensures you remain organized.

Recording accrued expenses

For accrued expenses, the process is slightly different since you record the expense even before you make the payment. You debit the expense account and credit the accrued liability account when you incur the expense, but haven’t paid it yet.

For example, if you’ve received a service but have not yet been billed for it, you must record the cost as a liability. As you settle the bill, you’ll debit the liability account and credit cash or your bank account.

This ensures that the cost is accurately reflected in your financial records when it is incurred, not when you make the payment. Keeping track of accrued expenses ensures your financial statements remain up to date and reflect your actual obligations.

Amortization vs settlement

The main difference between prepaid and accrued expenses lies in how you handle them over time. Prepaid expenses are amortized over the course of the period during which the benefit is received.

For instance, if you prepay for a year’s worth of rent, you’ll gradually amortize the cost each month. This reduces the prepaid expense account while increasing the corresponding expense on your income statement.

On the other hand, accrued expenses are settled once payment is made. The liability is cleared when you pay for the goods or services you’ve already received.

For example, when you pay an outstanding utility bill, the accrued liability account is debited, and your cash account is credited. This process ensures that your records reflect the timing of the actual payment.

GAAP compliance

Regardless of the differences between prepaid expenses vs accrued expenses, both must adhere to Generally Accepted Accounting Principles (GAAP) for accurate reporting.

GAAP dictates that expenses be recognized in the period in which they are incurred, not necessarily when the payment is made. This is why accrued expenses are recorded when the cost is incurred, and prepaid expenses are recognized over time as they are used.

Following GAAP ensures that your financial statements provide a fair and accurate picture of your business’s financial position. It also keeps you compliant with regulatory requirements, helping avoid issues with audits and tax reporting.

Software integration

Integrating your bookkeeping processes with accounting software like QuickBooks or Xero can simplify the management of both prepaid and accrued expenses.

For prepaid expenses, you can sync your prepaid card transactions directly with QuickBooks, which helps you track prepayments and amortize them correctly. This automation saves time and minimizes the risk of errors.

On the other hand, Xero or similar software can help you track accrued expenses and ensure they’re accounted for when incurred.

Integration ensures that both your prepaid and accrued expenses are updated in real-time, allowing you to make informed decisions and maintain accurate financial records with minimal effort.

Benefits of managing prepaid and accrued expenses

Effectively managing both prepaid expenses vs accrued expenses is crucial for the financial health of your business. By implementing proper accounting practices for both, you can maintain accurate financial records, ensure timely payments, and optimize tax strategies.

Below are some of the key benefits of managing these expenses effectively.

Financial accuracy

Proper management of both prepaid expenses vs accrued expenses ensures that your financial reports accurately reflect your business's financial status.

When you allocate expenses to the correct period—whether through amortizing prepaid expenses or accruing liabilities as they are incurred—you help maintain reliable and up-to-date financial statements. This approach not only enhances your financial accuracy but also makes it easier to track how well your business is performing.

Accurate financial reporting is vital for decision-making, investor relations, and audits. It also helps you avoid any discrepancies when tax season arrives, saving you time and potential headaches.

Budget control

Using prepaid cards to manage prepaid expenses helps you maintain tight control over your budget. Prepaid cards limit the amount you can prepay, reducing the risk of overspending on services and subscriptions.

At the same time, effectively managing accrued expenses ensures that you stay on top of your obligations.

By keeping track of expenses that have been incurred but not yet paid, you can better anticipate future cash needs and avoid unexpected financial strain. The combination of both tools allows you to manage your business’s cash flow more effectively and maintain financial stability.

Tax optimization

Accurate management of prepaid expenses vs accrued expenses plays a significant role in optimizing your tax situation. By timing your deductions correctly, you can maximize your tax benefits in compliance with IRS rules.

For example, by recognizing prepaid expenses in the periods they are used, you can allocate deductions accordingly.

Similarly, recording accrued expenses ensures that you reflect liabilities in the correct period. This approach helps you align your tax deductions with actual business expenses, ensuring you don’t miss out on potential savings while staying compliant with tax laws.

Cash flow planning

Effectively managing prepaid expenses vs accrued expenses helps you balance prepayments and accruals for better liquidity planning. Prepaid expenses can strain cash flow upfront, while accrued expenses allow you to defer payments, giving you more time to manage your cash.

By finding the right balance between these two, you can smooth out your cash flow and prevent liquidity issues.

This flexibility allows you to plan for major expenses while ensuring your business remains liquid. It’s important to closely monitor both to maintain a healthy balance between cash inflows and outflows.

Vendor relations

Using prepaid cards for managing prepaid expenses can improve your relationships with vendors by ensuring timely payments. Prepaying for services or goods through a prepaid card guarantees that your business meets its obligations without delay, fostering trust with your vendors.

By staying on top of both prepaid and accrued expenses, you can avoid late payments and maintain good standing with suppliers.

This positive vendor relationship can lead to better terms, discounts, and overall smoother business operations. Ensuring timely payments through effective expense management reflects well on your business's professionalism and reliability.

Track expenses easily with Volopay

Challenges of managing prepaid and accrued expenses

Managing prepaid expenses vs accrued expenses comes with its challenges, but addressing these issues effectively can help streamline your accounting processes. By understanding the obstacles and implementing solutions—like utilizing prepaid cards—you can significantly improve the accuracy and efficiency of your financial management.

Below are some common challenges you may face, along with strategies to tackle them.

Tracking complexity

The complexity of tracking both prepaid expenses vs accrued expenses can be overwhelming. Prepaid expenses require careful amortization over time, and accrued liabilities need to be tracked accurately until they are paid.

This often involves maintaining multiple spreadsheets or systems to ensure nothing is overlooked. A solution is to automate the process through accounting software or use prepaid cards to track transactions in real-time.

By syncing your card records with your accounting system, you can easily monitor the progress of both prepaid amortization and accrued expenses, making it easier to maintain accurate financial statements without manual tracking.

Cash flow strain

Managing cash flow is often a major concern when handling prepaid expenses vs accrued expenses. Prepaying for goods or services can put a strain on your available cash reserves, while accruing expenses delays payments, which can impact future liquidity.

To mitigate this challenge, you can use prepaid cards for budgeted prepayments, allowing you to manage cash flow more effectively. These cards enable you to set clear spending limits for each prepaid expense, ensuring that you’re not overspending upfront while still keeping track of the expenses.

This makes it easier to allocate your funds appropriately and avoid liquidity issues.

Error risks

The risk of making mistakes while managing prepaid expenses vs accrued expenses is high, especially if manual tracking systems are used. Errors in recording or misplacing transactions can lead to inaccurate financial statements and potential tax complications.

One way to reduce this risk is by using prepaid cards. These cards provide detailed transaction logs, ensuring that every prepaid expense is captured and recorded in real time.

You can easily match card transactions to your accounting records, reducing the likelihood of errors. By automating transaction entry and syncing with accounting software, you also minimize human error, ensuring more accurate financial management.

Compliance issues

Staying compliant with accounting standards, like GAAP, and tax regulations set by the IRS can be challenging when managing prepaid expenses vs accrued expenses. Misreporting prepaid or accrued expenses can lead to penalties or audit issues.

To ensure compliance, it’s essential to keep thorough and accurate records. Using prepaid cards can help with this by automatically recording transactions and providing a clear, organized log for auditors.

By syncing these records with your accounting system, you maintain proper GAAP compliance and ensure that your tax reporting is aligned with IRS guidelines. This method also makes it easier to justify the timing of deductions and liabilities.

Vendor disputes

Disputes with vendors over payment terms or amounts can arise if there’s confusion about your prepayment arrangements. This is particularly common when dealing with prepaid expenses, as vendors might misunderstand the payment schedule or terms.

By using prepaid cards to handle these transactions, you can avoid confusion by clearly documenting each payment and its purpose.

With a well-organized transaction history, you can easily clarify the terms with your vendors, ensuring smoother communication and fewer payment-related issues. It also helps vendors feel secure in knowing that payments are handled according to the agreed-upon terms, which strengthens the business relationship.

How prepaid cards streamline prepaid expense management

Prepaid cards offer a highly efficient way to manage prepaid expenses. They simplify budgeting, enhance transparency, and offer tools that help you manage your expenses effectively.

With features designed for real-time tracking and improved security, prepaid cards integrate smoothly into your business operations, making it easier to track and control your prepaid expenses.

Budget control

Using prepaid cards allows you to take full control over your prepaid expenses by setting clear limits for each payment type, such as rent, insurance, or services.

By preloading funds onto the card, you restrict the amount spent on each expense category, ensuring you don’t go over budget. This kind of budget control ensures you don’t overspend upfront, helping you better manage cash flow.

Whether for monthly rent or recurring service fees, prepaid cards give you the flexibility to limit spending and stay within financial targets without worrying about accidental overspending.

Real-time tracking

One of the most powerful features of prepaid cards is the ability to monitor transactions in real-time. You can track your prepaid expenses instantly through dashboards that update automatically. This allows you to stay on top of every prepayment made, ensuring accuracy in your bookkeeping.

Using prepaid cards, you don’t need to wait until monthly reports to see how much you’ve spent; you can access up-to-date records anytime. This real-time visibility helps you avoid surprises and gives you full control over your prepayments.

Fraud protection

With prepaid cards, you can secure your prepaid expenses payments with built-in fraud protection features. These cards typically require PINs for each transaction, adding a layer of security that helps prevent unauthorized use.

Additionally, you can lock and unlock cards as needed, protecting your business from potential fraud.

This peace of mind ensures that even if a card is lost or stolen, your prepaid funds remain protected, helping you maintain control over your expenses without worrying about financial risks.

Simplified bookkeeping

Managing prepaid expenses becomes much easier when you use prepaid cards. The transaction data is automatically synced with your accounting software, reducing the need for manual data entry. This integration simplifies bookkeeping by ensuring all prepaid expenses are accurately recorded without any effort on your part.

By automatically syncing card transactions, you can maintain real-time financial records that align with your business’s spending patterns, saving time on reconciliation and reducing the chances of errors.

Vendor flexibility

Paying your suppliers is simple with prepaid cards, especially when dealing with prepaid expenses. Whether you’re using a Visa or Mastercard, prepaid cards offer flexibility to pay vendors anywhere that accepts these major card networks.

This means you can easily handle prepayments to a wide range of suppliers, ensuring timely payments and smooth business operations.

With prepaid cards, you avoid complications that may arise from traditional bank transfers or checks, and you can manage supplier payments conveniently while staying within your budget limits.

Use cases for prepaid and accrued expenses in small businesses

Prepaid and accrued expenses are crucial for small businesses to manage cash flow and financial planning. By integrating prepaid cards into these processes, you can streamline payments, improve budgeting, and ensure accurate financial reporting.

Below are some practical use cases for each type of expense, showing how prepaid cards can help simplify your business operations.

Prepaid expenses

When managing prepaid expenses in your small business, you can prepay for services such as SaaS subscriptions with prepaid cards. Many software services, like accounting tools or project management platforms, allow you to pay annually, giving you a discount for upfront payments.

Using a prepaid card for these expenses means you can budget effectively by controlling the amount spent at the beginning of the year.

Prepaid cards allow you to track these expenses easily, reducing the risk of exceeding your budget and providing clarity for your financial records. This method also reduces the complexity of recurring payments.

Accrued expenses

Accrued expenses come into play when you have services used but not yet billed, like utilities. You incur the cost for services such as electricity or water in one month, but the bills arrive the following month. Accruing these expenses means you record them as liabilities until payment is made.

By tracking these expenses carefully, you ensure you report accurate liabilities on your balance sheet, avoiding unexpected expenses. By managing these accruals effectively, you maintain an accurate picture of your financial situation.

Combined scenarios

In some cases, your small business might have both prepaid and accrued expenses at the same time. For instance, you may use prepaid cards for prepayments, such as paying for a software license, while also accruing costs like rent or utilities. This combination allows you to streamline both prepayment and accrual processes.

With prepaid cards, you can track prepayments easily while monitoring accrued liabilities through accounting software. Using both methods in tandem ensures that your financial records remain accurate and well-organized, providing clarity in your overall budget management.

Small business benefits

Prepaid cards offer significant benefits for SMEs managing expenses. They help simplify the process of making prepayments, such as for office supplies or recurring service subscriptions.

With prepaid cards, you can easily set spending limits, track transactions in real-time, and integrate card data with accounting software for smooth record-keeping.

This reduces the administrative burden, enabling you to focus more on growing your business. Prepaid cards also provide transparency, ensuring you always know where your money is going and helping you stick to your budget.

Compliance support

Using prepaid cards for managing expenses helps you stay compliant with accounting standards and tax regulations. The transaction records from prepaid cards are invaluable for GAAP or IRS audits, as they provide clear, transparent documentation of your financial activities.

When you track prepayments and accruals through your card transactions, you ensure that your financial records are well-organized and easily accessible for audits. This reduces the risk of compliance issues and makes it easier to provide accurate information during tax season or when preparing financial statements.

Simplify prepaid expense management with Volopay’s prepaid cards

Managing prepaid expenses vs accrued expenses can make or break your budgeting and reporting. Prepaid outlays—like insurance or annual software fees—require a different approach than liabilities you record but haven’t paid yet.

Recognizing the differences between prepaid and accrued expenses ensures that you capture costs in the right period and maintain clean books. Volopay’s prepaid cards give you the tools to handle these challenges effortlessly.

Budget control

You preload each card with a fixed amount—say, exactly what you need for a year’s worth of rent or a quarterly marketing package. That way, you never accidentally exceed your budget, because the card simply won’t authorize more than the set limit. You can assign different cards to different departments or projects, each with its own cap.

This not only prevents overspending but also simplifies reconciliation: when the card balance hits zero, you know you’ve used up that expense bucket and can top up only when you’ve approved the next cycle.

Real-time tracking

With Volopay’s dashboard, you see every transaction the moment it happens. You watch your prepaid vs accrued expenses for small businesses unfold live—no more end-of-month surprises.

Need to check which vendor got paid for that ad campaign today? It’s there. Did an unexpected refund land back in your account? It shows up immediately, so you can reallocate those funds right away.

This instant visibility lets you spot duplicate charges, correct misallocations on the fly, and keep your forecasting razor-sharp.

Enhanced security

You’re in full control of who can spend what. Every card has its own PIN, spending limit, and optional lock/unlock toggle in the app. You can require multi-level approvals for any payment above a threshold you set—ideal when you’re handling large prepayments like annual insurance or vendor retainers.

If a card gets lost, you lock it instantly with one tap. And because each payment ties back to a specific cardholder and purpose, you build an auditable trail that deters fraud and enforces accountability across your team.

Vendor flexibility

Whether your supplier is down the street or overseas, Volopay’s network handles it. You pay local catering bills, buy equipment from global vendors, or settle digital subscriptions—all from the same interface. You no longer juggle wire transfers, ACH windows, or foreign-exchange headaches: the card does the heavy lifting.

Then Volopay automatically tags each payment by vendor, category, and project.

That means you see exactly which contracts you’ve prepaid and which obligations remain outstanding, without sifting through bank statements or paper invoices.

Compliance and reporting

When tax season or an audit rolls around, you don’t scramble to prove timing. Volopay generates clear, timestamped reports showing when you paid in advance and when you booked a liability. The platform lets you filter by date, card, department, or vendor, so you can slice your data however auditors or regulators ask.

For prepaid vs accrued expenses for small businesses, this level of detail demonstrates that you’ve honored GAAP timing rules and local tax laws—saving you from costly back-and-forth or penalties. You export to Excel, PDF, or sync directly with your accounting system for final sign-off.

Automate expense tracking with Volopay

FAQs

Prepaid expenses vs accrued expenses is all about timing. Prepaid expenses are advance payments recorded as assets and expensed over time. Accrued expenses are unpaid costs recorded as liabilities to match when the expense is incurred.

Prepaid cards give you instant visibility and strict budget control by capping spend on specific categories. A real-time dashboard tracks every transaction, reducing errors and manual entry. This simplifies managing prepaid expenses vs accrued expenses, with clear audit trails for smarter financial decisions.

Prepaid expenses are recorded as current assets and expensed over time. Accrued expenses, as current liabilities, reflect costs incurred but unpaid. Properly recording both gives stakeholders an accurate view of your assets and obligations.

Neither prepaid nor accrued expenses is better—they impact cash differently. Prepaid expenses reduce liquidity upfront, while accrued expenses delay payment but add future obligations. Balancing both with prepaid cards and accurate forecasting helps maintain healthy cash flow.

You maintain compliance by tracking prepaid and accrued expenses with the right tools. Prepaid cards log transactions automatically, while accounting software records liabilities. Regular reconciliation ensures GAAP alignment and protects against audit risks.