👋 Exciting news! UPI payments are now available in India! Sign up now →

Operating expenses (OpEx): Overview, types, and how to calculate

The term "operating expenses" can be used to encompass all costs associated with running a non-manufacturing business.

However, manufacturing businesses separate the cost of goods sold (COGS) from other expenses to calculate a straightforward gross margin by separating revenue from COGS. The majority of other costs are then categorized as operating costs.

A company's overhead costs to carry out its day-to-day operations are known as operating expenses(OpEx). Business owners should be aware of their operating costs and how they affect the bottom line because they significantly affect a company's profitability.

What are operational activities?

Operational activities encompass the daily tasks and processes essential for running a business smoothly. These activities focus on generating revenue and managing the operating expenses in a business, such as production, marketing, and customer support.

They include tasks like inventory management, sales operations, and administrative functions. Properly managing operational activities helps businesses optimize costs, streamline workflows, and maintain profitability.

Understanding what are operating expenses is crucial, as these are directly linked to such activities. Using tools like the operating expenses formula, businesses can calculate operating expenses effectively to improve decision-making and ensure financial stability.

What are operating expenses?

A company's daily operating costs are often referred to as its operating expenses(OpEx). Any overhead costs that support, but do not directly relate to, the production of your service or product are included in your operating expenses.

These expenses are framed on the organization's pay explanation. Operating income and net income are typically reported using the income statement. These are costs a business causes to continue to run, like wages and supplies.

They do exclude the expense of merchandise sold (materials, direct work, fabricating above) or capital consumption (higher costs like structures or machines).

Who needs to understand operating expenses?

Understanding operating expenses in business is crucial for anyone involved in managing or influencing a company’s financial health. Business owners, managers, and financial professionals must grasp what operating expenses are to make informed decisions about budgeting, cost control, and profitability.

Investors and stakeholders also benefit from understanding operating expenses, as they provide insight into a company’s efficiency and financial performance. For startups and small businesses, knowledge of operating expenses helps optimize limited resources.

Similarly, large enterprises use this understanding to streamline operations and boost margins. Clear awareness of operating expenses supports strategic planning and long-term business success.

What is the importance of operating expenses for businesses?

Operating expenses (OpEx) serve as a vital lens through which businesses evaluate their financial health and strategic direction.

Now that you’ve seen a list of all operating expenses (OpEx) above, let’s explore the ways in which these expenses hold significance:

1. Financial performance evaluation

Operating expenses are a cornerstone of financial analysis. They provide a comprehensive view of a company's profitability, helping assess its ability to generate sustainable earnings.

The amount of operating expenses a company has incurred over a particular period can help the management gauge various aspects of the organization’s financial health.

2. Budgeting and financial planning

Effective budgeting hinges on understanding operating expenses (OpEx). By forecasting these costs, businesses can allocate resources judiciously and align their financial plans with operational realities.

Accurate forecasting can happen only when there is a proper record of all the current and previous operating expenses (OpEx). This record will help the company gauge its future requirements and accordingly allocate budgets in the necessary manner.

3. Increases investor and stakeholder confidence

Keeping major stakeholders like investors aware of how the company funds are being utilized is extremely important to help them understand the current action plan and how the business is operating.

Transparent reporting of operating expenses fosters trust among investors and stakeholders. It demonstrates a commitment to financial transparency and responsible management.

4. Cost control and efficiency

Analyzing operating expenses is instrumental in identifying areas of cost inefficiency. This enables businesses to implement strategies for cost reduction and enhance overall efficiency.

Once the management has the necessary data to see how the operational expenses are affecting the business, they can then take the necessary measures to make systems or processes more efficient.

5. Performance benchmarking

Comparing operating expenses across similar businesses provides valuable insights. It aids in assessing competitive positioning and understanding industry norms.

Comparing can help inform the management’s decisions of whether the company should be spending more or less on certain activities that may boost business performance.

6. Operational decision-making

The operating expenses list contains various types of expenses. Decisions regarding product pricing, resource allocation, and expansion strategies are influenced by a clear understanding of operating expenses.

Only when there is a clear picture of all the operating expenses can insights be derived and used to make informed choices.

7. Long-term sustainability

Effective management of operating expenses contributes to a company's long-term sustainability. It is not only important for a business to earn more but also to be sure that they are not spending more than what is needed.

By controlling costs, businesses can weather economic fluctuations more effectively.

8. Debt management

Operating expenses include interest payments on debt. Monitoring these expenses ensures businesses maintain a healthy debt-to-income ratio and manageable financial obligations.

Your company’s debt-to-income ratio (DTI) compares how much you owe each month to how much you earn. It is also denoted by the percentage of your gross monthly income (before taxes) that goes towards payments or other debt.

9. Regulatory compliance

Adhering to financial reporting regulations requires accurate disclosure of operating expenses. Many businesses tend to use modern software solutions to track, monitor, and control these expenses so that they have an accurate record.

Compliance safeguards a business's reputation and prevents legal complications. It also helps make the audit process much faster.

10. Strategic planning

Operating expenses (OpEx) play a pivotal role in shaping strategic initiatives. Businesses can align investments, expansions, and innovation efforts with their financial capabilities.

Only when the ground-level data such as operating expenses (OpEx) are crystal clear can the management take further steps to implement broader strategic plans into action.

11. Resource allocation

Understanding the breakdown of operating expenses (OpEx) aids in optimizing resource allocation. This includes allocating funds for key functions such as marketing, R&D, and administrative needs. The company can allocate resources effectively only when there is a clear understanding of the expense needs of different teams and employees.

It is also important to know the operating expenses formula and how to calculate operating expenses:

Operating expense = Salaries + Promotional and advertising cost + Supplies + Furniture + Sales commission + Property taxes + Insurance

Better manage your business expenses

What are the different types of operating expenses?

Operating expenses can be compared to the vital gears that keep the business machinery running smoothly. They encompass a variety of expenditure categories that are crucial for day-to-day operations and growth.

Let’s dissect what are operating expenses(OpEx) and the different categories to explore their nuances:

1. Selling and marketing expenses

Selling and marketing expenses are paramount for businesses seeking to expand their reach and customer base. These operating expenses (OpEx) include examples like costs related to advertising and promotional activities, sales commissions, and public relations efforts.

Advertising and promotional costs encompass expenses incurred to promote the products or services, be it through digital campaigns, print media, or other promotional events. Sales commissions and incentives motivate sales teams while fostering customer engagement. Public relations expenses are directed toward building and maintaining a positive brand image.

2. General and Administrative expenses (G&A)

General and administrative expenses are the backbone of operational infrastructure. These costs encompass salaries and wages of administrative staff, rent and utilities for office space, expenditures on office supplies, and legal and professional fees.

Salaries and wages ensure the smooth functioning of administrative roles, while rent and utilities provide the necessary workspace. Office supplies are essential for day-to-day operations, and legal and professional fees cover services such as legal counsel and financial consultancy.

3. Research and Development expenses (R&D)

Research and development expenses are a hallmark of innovation-driven businesses. These costs include employee salaries engaged in research and development, prototyping expenses, and investments in lab equipment.

Employee salaries account for the brainpower driving innovation, prototyping costs aid in refining product concepts, and lab equipment expenses ensure the necessary tools for experimentation and development.

4. Depreciation and amortization

Depreciation and amortization expenses reflect the allocation of costs associated with tangible and intangible assets over their useful lifespans.

Depreciation pertains to tangible assets like buildings and equipment, while amortization deals with intangible assets like patents and trademarks.

Calculating depreciation and amortization involves understanding the asset's value, expected lifespan, and applicable accounting methods.

5. Cost of Goods Sold (COGS)

The cost of goods sold is directly linked to a company's production process. It encapsulates the expenses tied to producing goods or services, including raw materials, labor, and manufacturing overhead.

Calculating COGS is vital for determining a business's gross profit, which is the revenue left after accounting for production costs.

6. Interest expenses

Interest expenses stem from any borrowed capital or loans used to finance business operations. These expenses encompass the interest paid on loans and credit lines.

Calculating interest expenses involves understanding the interest rate and the outstanding loan amount.

7. Other operating expenses

Other operating expenses encompass a broad category of costs that don't fit neatly into the aforementioned classifications. These can include expenses related to maintenance and repairs, insurance premiums, and other miscellaneous operational costs.

Operating expenses vs. non-operating expenses

In financial analysis, the distinction between operating and non-operating expenses holds immense significance. Each category plays a unique role in shaping a company's financial landscape.

Let's delve into the differentiating factors that set them apart:

1. Relevance

● Operating expenses

Relevant to a company's core business operations, operating expenses directly contribute to producing goods and services. They are essential for maintaining day-to-day functionality.

● Non-operating expenses

Non-operating expenses are extraneous to core operations. They include costs that arise from activities not central to a company's primary business functions, such as interest payments on investments or losses from the sale of assets.

2. Impact on profitability

● Operating expenses

Operating expenses have a direct impact on a company's profitability. Efficient management of these costs can bolster or diminish the bottom line.

● Non-operating expenses

Non-operating expenses, while influential, do not directly affect a company's core profitability. They might impact net income but aren't tied to the primary revenue-generating activities.

3. Stability

● Operating expenses

Operating expenses tend to be more stable over time, as they're rooted in day-to-day business activities. They provide a consistent picture of ongoing operational costs.

● Non-operating expenses

Non-operating expenses can be more volatile, as they're linked to external factors like investment outcomes or asset sales.

4. Management focus

● Operating expenses

Businesses closely monitor operating expenses as they directly impact day-to-day operations. Cost control and efficiency are key considerations.

● Non-operating expenses

Non-operating expenses often receive less management attention, as they

5. Financial ratios

● Operating expenses

Operating expenses are integral to various financial ratios like the operating margin and gross profit margin. These ratios gauge a company's operational efficiency and ability to manage costs.

● Non-operating expenses

Non-operating expenses can affect ratios like the interest coverage ratio, which assesses a company's ability to cover interest payments from its earnings.

6. Investor perception

● Operating expenses

Investors view well-managed operating expenses as a sign of operational efficiency and effective cost management, boosting investor confidence.

● Non-operating expenses

Non-operating expenses might be perceived as less relevant to a company's core health and performance, but their impact on net income can still influence investor sentiment.

Operating expenses and Cost of Goods Sold (COGS): What’s the difference?

Operating expenses and cost of goods sold (COGS) are essential financial metrics that help businesses analyze costs and profitability. While operating expenses cover general business operations, COGS refers to the direct costs of producing goods or services.

Meaning

● Operating expenses

Operating expenses are costs incurred to support the daily functioning of a business but are not directly tied to production. These include rent, utilities, and administrative salaries. They represent a company’s ability to manage its operational activities effectively.

Unlike COGS, operating expenses cover general business functions that are necessary regardless of production levels, making them a vital part of a company’s financial stability and day-to-day operations.

● Cost of Goods Sold (COGS)

Cost of goods sold (COGS) includes all expenses directly related to the production of goods or services, such as raw materials, labor, and manufacturing costs. COGS determines the direct cost of delivering products or services to customers.

By focusing on production-related costs, COGS highlights the efficiency of converting resources into finished goods, offering insights into how well a company controls production expenses.

Components

● Operating expenses

Components of operating expenses include administrative costs, marketing expenses, and office supplies. These costs ensure smooth operations and are not tied to specific products.

They also include costs like employee benefits, software subscriptions, and travel expenses, which support overall business activities but do not directly generate revenue. These expenses are necessary to maintain a functioning business environment, but careful management is required to avoid unnecessary overheads.

● Cost of Goods Sold (COGS)

COGS components include raw material costs, direct labor, and production overheads. These elements are directly linked to the creation or delivery of goods and services.

Additional factors such as storage costs, packaging, and transportation expenses related to production may also fall under COGS, depending on the nature of the business. Monitoring these components closely helps companies optimize their production costs and maintain competitive pricing for their products.

Impact on financial statement

● Operating expenses

Operating expenses are recorded on the income statement below gross profit, reducing operating income. They impact a company’s net profitability and highlight operational efficiency.

Proper tracking and management of these expenses are essential for maintaining an accurate financial picture and ensuring long-term operational sustainability. Excessive operating expenses can signal inefficiencies, requiring business owners to reassess their strategies and cost-cutting measures to improve profitability.

● Cost of Goods Sold (COGS)

COGS is subtracted from revenue to calculate gross profit, appearing higher up in the income statement. It directly affects the gross margin and reflects production cost efficiency.

Businesses often monitor COGS closely to improve profit margins by streamlining production processes and reducing unnecessary costs. An increase in COGS, without a corresponding increase in revenue, can signal operational inefficiencies and squeeze profitability.

Impact on profitability

● Operating expenses

Operating expenses affect net income, with higher expenses reducing overall profitability. Controlling these costs helps businesses improve their bottom line and operational efficiency.

Effective management of operating expenses also ensures sufficient resources are allocated for growth-oriented activities like marketing and innovation without compromising financial health. By keeping operating expenses in check, businesses can reinvest savings into areas that drive future growth and long-term profitability.

● Cost of Goods Sold (COGS)

COGS impacts gross profit, with higher COGS reducing profitability at the gross margin level. Managing COGS is vital for ensuring competitive pricing and maintaining profitability.

Companies can optimize COGS by negotiating better deals with suppliers, adopting more efficient manufacturing techniques, or outsourcing specific production activities to cost-effective providers. A reduction in COGS allows businesses to preserve profit margins, even in competitive markets.

Nature of cost

● Operating expenses

Operating expenses are costs associated with the routine operations of a business, and they generally remain consistent over time. These expenses are critical to keeping the business functioning, even when there is no production or sales activity.

While some operating expenses are fixed, others may vary based on business needs, such as office supplies, utilities, and employee compensation. Efficient management of operating expenses ensures smooth operations without unnecessary financial strain.

● Cost of Goods Sold (COGS)

Cost of goods sold (COGS) refers to expenses that are directly tied to the production of goods or services, including the cost of raw materials, labor, and manufacturing overhead. COGS fluctuates with the level of production or sales, as it is variable in nature.

This cost is directly associated with revenue generation, meaning that as a company produces more goods, its COGS increases proportionally.

Time-frame

● Operating expenses

Operating expenses tend to be more predictable and recurring, often incurred monthly, quarterly, or annually. They are essential for maintaining business operations and typically do not depend on production or sales cycles.

These costs, such as rent and insurance, are spread over the long term, making them easier to budget for and plan. During downturns, companies can reduce some recurring expenses to stay stable.

● Cost of Goods Sold (COGS)

COGS is more variable in nature and changes based on production volume and sales cycles. These costs are incurred whenever goods are produced or services are provided, and they fluctuate in response to the level of output.

For example, if a company increases its production to meet higher demand, the associated COGS will rise accordingly. Forecasting COGS is vital for estimating profitability across time frames.

Flexibility

● Operating expenses

While many operating expenses are relatively fixed, businesses do have some flexibility in how they manage and reduce these costs. For example, a company may choose to reduce discretionary spending, such as marketing or travel, during tough financial times.

However, certain operating expenses like salaries and rent are often less flexible in the short term, requiring companies to monitor and manage spending to prevent overspending.

● Cost of Goods Sold (COGS)

COGS is highly flexible because it directly correlates with production output. If a company reduces its production volume, it can effectively reduce its COGS by lowering expenses such as raw materials and labor costs.

Furthermore, businesses can adjust COGS by negotiating better pricing with suppliers or improving operational efficiency. Managing flexibility in COGS is key to optimizing production costs while maintaining consistent quality and profitability.

Fixed costs vs. variable costs

Fixed and variable costs are fundamental to understanding a company’s financial structure. Fixed costs remain constant irrespective of production levels, while variable costs fluctuate with output. Analyzing these costs is essential to managing operating expenses in business, as it helps identify areas for cost control and efficiency.

1. Definition

● Fixed costs

These are expenses that remain unchanged over a specific period, regardless of production or sales. Examples include rent, insurance, and salaries of permanent staff. These costs are predictable, making them easier to manage in financial planning.

Fixed costs provide operational stability but can be a financial burden if revenues decline over time. Businesses often analyze these costs carefully to ensure they align with long-term sustainability.

● Variable costs

Variable costs fluctuate in direct proportion to production levels. Examples include raw materials, utility costs, and commissions tied to sales volume. These costs rise as production increases and fall as production decreases.

While less predictable than fixed costs, they offer flexibility since they align closely with revenue generation. Effective management of variable costs can help improve profit margins and adapt to market demands.

2. Nature

● Fixed costs

Fixed costs are constant and do not vary with changes in production or sales levels. They often represent long-term commitments, such as lease agreements or loan repayments, which remain steady regardless of operational changes.

While these costs provide predictability, they can strain resources if revenues are insufficient to cover them. Businesses must account for fixed costs to maintain consistent operations.

● Variable costs

Variable costs are dynamic, rising or falling with changes in production levels. For example, raw material costs increase as more goods are produced, and utility bills fluctuate with equipment usage. These costs directly relate to a company’s activity level and are more challenging to predict.

However, their flexibility allows businesses to adapt quickly to changes in demand. Proper tracking enables optimization and waste reduction.

3. Impact on financial statement

● Fixed costs

Fixed costs appear as consistent expenditures in the overhead section of the income statement. They are factored into operating expenses, influencing net profit regardless of production levels.

Businesses with high fixed costs need steady revenue streams to maintain profitability. Managing fixed costs efficiently ensures long-term sustainability and helps in break-even analysis.

Additionally, accurate allocation of fixed costs enhances financial transparency and decision-making.

● Variable costs

Variable costs significantly impact the cost of goods sold (COGS) on the income statement, directly affecting gross profit. As production increases, these costs rise, potentially lowering margins if not managed properly.

Conversely, a decline in production reduces variable costs, which can help a business manage its expenses during low-demand periods. Analyzing variable costs helps businesses optimize pricing and profitability.

4. Behavior with production level

● Fixed costs

Fixed costs remain constant, whether production levels are high or low. For instance, a company pays the same rent for its warehouse regardless of how many products it manufactures. This stability allows businesses to forecast expenses accurately.

However, if production is low, fixed costs per unit increase, potentially reducing profitability. Managing fixed costs relative to production levels is critical for operational efficiency.

● Variable costs

Variable costs fluctuate directly with production levels, increasing as output rises and decreasing as output falls. For example, producing more goods requires purchasing additional raw materials and using more electricity, leading to higher variable costs.

Conversely, during a production slowdown, these costs drop, helping businesses maintain liquidity. This flexibility makes variable costs a key component of adaptable financial planning.

5. Cash flow impact

● Fixed costs

Fixed costs create consistent cash flow requirements, as they must be paid regardless of production levels. Payments for rent, insurance, or loan installments remain unchanged, providing stability but potentially straining resources during periods of low revenue.

Businesses must plan reserves to meet these obligations even in downturns, ensuring uninterrupted operations. During economic challenges, these costs can weigh heavily on cash flow, making it important to maintain sufficient liquidity.

● Variable costs

Variable costs directly impact managing cash flow based on production or sales levels. When output increases, these costs rise, requiring higher cash outflows for raw materials or commissions.

Conversely, lower production reduces variable costs, offering cash flow relief. This variability allows businesses to adapt spending to align with revenue trends. Properly managing variable costs enables businesses to be more agile in adjusting to market fluctuations.

6. Treatment

● Fixed costs

Fixed costs are treated as operating expenses and are typically recorded consistently over time. These expenses are not tied to production, ensuring predictability in financial reporting.

Businesses often allocate fixed costs over accounting periods to analyze profitability and calculate break-even points effectively. Fixed costs are typically recorded monthly or quarterly in financial statements, providing a clear view of recurring obligations that need to be met irrespective of output levels.

● Variable costs

Variable costs are treated as direct costs tied to production or sales levels. They are recorded as part of the cost of goods sold (COGS), directly affecting gross profit.

Properly tracking variable costs helps businesses analyze operational efficiency and make data-driven decisions to improve margins. Since variable costs fluctuate with output, they can be adjusted through cost-cutting measures or process improvements to maintain profitability.

7. Level of flexibility

● Fixed costs

Fixed costs offer little flexibility since they remain unchanged regardless of production levels. Adjustments to fixed costs often require renegotiation, such as lease terms, which is challenging in the short term. This rigidity can pose financial risks during periods of declining revenue.

Businesses with high fixed costs may face financial strain if they cannot meet these obligations when revenue drops, making it crucial to maintain a balanced cost structure.

● Variable costs

Variable costs are highly flexible, increasing or decreasing in line with production or sales. Businesses can reduce these costs by scaling back operations or renegotiating supplier agreements. This adaptability helps businesses align expenses with market demand, ensuring greater financial control.

By carefully managing variable costs, businesses can maintain profitability even during periods of lower production or sales, providing flexibility in uncertain economic conditions.

8. Timing of expense recognition

● Fixed costs

Fixed costs are recognized consistently over time, regardless of business activity. For instance, monthly rent is recorded as an expense at the same time each month. This regularity ensures that fixed costs are predictable and provide stability in financial planning and reporting.

The consistent recognition of fixed costs allows businesses to forecast cash flow requirements accurately, preventing surprises when it comes time to make payments or manage resources.

● Variable costs

Variable costs are recognized when they are incurred, typically in alignment with production or sales activities. For example, the cost of raw materials is recorded at the time of manufacturing. This timing reflects their real-time connection to operational activity, offering a clear picture of production-related expenses.

Since variable costs are incurred based on business activities, they help businesses closely monitor the direct costs of goods or services produced.

9. Example

● Fixed costs

Examples of fixed costs include rent, depreciation, insurance, and salaries of permanent employees. For instance, a company pays the same office rent every month, regardless of whether production increases or decreases. These costs remain consistent, helping businesses plan long-term budgets.

Fixed costs like insurance premiums are also predictable, offering clarity on financial commitments. This stability is beneficial for businesses aiming to maintain steady operations with manageable expense forecasts.

● Variable costs

Examples of variable costs include raw materials, sales commissions, packaging, and utilities. For example, as a factory produces more units, it incurs higher raw material costs. Conversely, when production slows, these expenses drop, providing businesses with operational flexibility.

Variable costs like commissions or shipping costs are directly tied to sales volume, allowing businesses to adjust expenses according to demand fluctuations, making it easier to manage overall profitability.

Experience easy business expense management

Operating expenses (OpEx) vs Capital expenses (CapEx)

Operating and capital expenditures are critical components of financial management, each serving different purposes in a business. While operating expenses in business cover day-to-day operational costs, capital expenditures focus on long-term investments that enhance growth and efficiency.

Definition

● Operating expenses (OpEx)

Operating expenses are short-term costs incurred to maintain daily business activities, such as utilities, salaries, and rent. These expenses are recurring and essential to keep the business running smoothly.

Businesses use the operating expenses formula to track and manage these costs efficiently. Properly accounting for operating expenses ensures accurate financial reporting and helps identify areas for cost optimization.

● Capital expenses (CapEx)

Capital expenses are long-term investments made to acquire or upgrade physical assets like machinery, property, or technology. These expenditures support future growth and are typically non-recurring, requiring significant financial planning.

Unlike operating expenses, capital expenses are not immediately deducted but instead depreciated or amortized over time, reflecting their long-term value to the business.

Nature

● Operating expenses (OpEx)

Operating expenses are ongoing and directly related to the core functions of a business. They include costs such as office supplies, repairs, and advertising.

These expenses vary based on business activity and are essential for daily operations. A higher proportion of operating expenses might indicate a focus on sustaining existing processes rather than expansion or innovation.

● Capital expenses (CapEx)

Capital expenses are non-recurring and tied to acquiring or improving assets that have a useful life beyond a single accounting period. Examples include purchasing equipment or constructing new facilities, which add value over the long term.

Capital expenditures are often significant and require careful budgeting to avoid cash flow constraints while ensuring that strategic objectives are met.

Impact on financial statement

● Operating expenses (OpEx)

Operating expenses are recorded in the income statement and reduce the business’s taxable income. They are deducted from revenue to calculate net income, providing a clear view of operational profitability.

Regular monitoring of these expenses helps businesses control spending and maintain financial health, ensuring efficient allocation of resources. Effective management of operating expenses in business can lead to increased cost savings.

● Capital expenses (CapEx)

Capital expenses appear on the balance sheet as assets and are depreciated or amortized over time. Instead of reducing income immediately, these costs are allocated across multiple periods, reflecting their long-term value.

Properly managing capital expenses allows businesses to balance immediate cash flow needs with future growth opportunities, enhancing financial sustainability. These investments also indicate the company’s strategic priorities and commitment to innovation or expansion.

Time-frame

● Operating expenses (OpEx)

Operating expenses occur within a short time-frame and are tied to the daily functioning of a business. These recurring costs, such as salaries, utilities, and rent, are typically accounted for within the same financial period in which they arise, ensuring that operational needs are met promptly and efficiently.

Businesses often evaluate their operating expenses regularly to maintain financial stability and adapt to changes in operational demands.

● Capital expenses (CapEx)

Capital expenses have a long-term time frame as they involve acquiring or upgrading assets that provide benefits over several years. These expenditures, like purchasing equipment or constructing buildings, extend beyond a single accounting period, aligning with the strategic goals and growth plans of the business.

Proper planning of capital expenses ensures that businesses allocate resources effectively while achieving sustained growth and innovation.

Accounting treatment

● Operating expenses (OpEx)

Operating expenses are directly recorded in the income statement for the period they are incurred. These costs reduce the gross revenue to determine the net income.

Properly categorizing operating expenses ensures transparent financial reporting and compliance with accounting standards. Additionally, tracking these costs helps businesses calculate operating expenses accurately, leading to better budgeting and expense management.

● Capital expenses (CapEx)

Capital expenses are recorded on the balance sheet as assets and are not fully deducted in the period of purchase. Instead, their cost is allocated over time through depreciation or amortization, reflecting the long-term value and usage of the acquired assets.

This accounting treatment helps showcase the company’s investment strategies and their potential contribution to future profitability.

Timing of expense recognition

● Operating expenses (OpEx)

Operating expenses are recognized immediately in the accounting period in which they are incurred. For example, a repair bill for equipment used in daily operations is recorded as an expense during the same period it is paid.

Immediate recognition provides a clear understanding of the costs associated with generating revenue and ensures timely financial reporting.

● Capital expenses (CapEx)

Capital expenses are recognized gradually over the useful life of the asset through depreciation or amortization. This process matches the cost of the asset to the revenue it generates, providing a more accurate representation of financial performance over time.

This gradual allocation ensures that the financial statements reflect the long-term value of investments rather than short-term cash flow fluctuations.

Example

● Operating expenses (OpEx)

Examples of operating expenses include office rent, marketing costs, and employee wages. For instance, a company paying its monthly utility bill would classify this as an operating expense because it supports day-to-day activities.

Similarly, recurring subscriptions for software tools also fall under operating expenses as they are integral to daily business operations.

● Capital expenses (CapEx)

Examples of capital expenses include buying machinery, upgrading IT systems, or constructing new facilities. For example, purchasing a fleet of delivery trucks for a logistics company is a capital expense, as these vehicles will provide long-term operational benefits.

Additionally, investments in modernizing infrastructure or expanding production facilities reflect significant capital expenditures aimed at future growth.

Operating expenses in an income statement

Operating expenses represent the day-to-day costs necessary for running a business, including staff salaries, rent, utilities, marketing, administrative costs, and depreciation.

These are essential for sustaining operations but do not directly contribute to producing goods or services. Their relevance lies in showcasing the company’s efficiency in managing operational costs, directly impacting operating profit.

A structured income statement helps identify cost-saving opportunities for sustainable finances. It presents an income statement, breaking down the company's financial performance.

It categorizes revenue into operational and non-operational income and expenditures into cost of goods sold and operating expenses. Key figures, including operating profit, net profit before tax, and tax provisions, highlight profitability and tax liabilities, helping stakeholders assess income generation and expense management.

How to calculate operating expenses?

Keep track of and classify expenses

Make a list of everything your business spent during the specified time frame. Utilize the list above to distinguish operating expenses (OpEx) from different costs.

Addition of operating expenses

This will provide you with a clear image of your working expenses. Salaries, costs associated with advertising and promotion, supplies, furniture, supplies, sales commission, property taxes, and insurance will be added to determine the operating expenses.

Also, the cost of goods sold and operating income can be subtracted from total revenue to calculate operating expenses.

Operating expenses = Operating income - Revenue - Cost of goods sold

Let us take some examples to understand it in a better way.

Examples

Example 1

A company is earning a revenue of $500,000 p/a. Its operating income is valued at $1,000,000. The Cost of Goods Sold (COGS) is $300,000.

Operating expenses = Operating income - Revenue - Cost of goods sold

So, by putting the above numerical in the formula, we get,

1000000 - 500000 - 300000 = 200,000

Therefore, the operating expense of the company is $200,000.

Let us take another example to find the operating expenses by adding all the fiscal year expenses.

Example 2

Suppose the sales commission of another company is $1.20M. The advertising expense is $2.00M. Salaries amount to $1.00M, and depreciation is $0.75M. They pay a rent of $0.50M, and the utility is $0.30M.

In this case,

Operating expenses = Sales Commission + Advertising expense + Salaries + Depreciation + Rent + Utilities

So, $1.20 + $2.00 + $1.00 + $0.75 + $0.50 + $0.30 = $7.5

Therefore, $7.5 million is the operating expense.

What is an operating expense ratio?

The operating expense ratio (OER) measures operating expenses in business as a percentage of total revenue. It indicates how efficiently a company manages its expenses relative to its income, helping assess operational effectiveness and cost control.

Components

The OER includes total operating expenses such as rent, utilities, salaries, and maintenance, divided by total revenue. These components reflect both fixed and variable costs incurred during regular business operations, offering insight into a company’s financial efficiency.

A higher OER suggests inefficiency in managing costs, while a lower OER indicates better control and profitability. Tracking these components regularly can highlight trends and areas for improvement.

What is a good operating expense ratio?

A good OER depends on the industry, with lower ratios typically indicating greater efficiency. For instance, an OER of 50% means 50% of revenue covers expenses, leaving the rest as profit. For example, in retail, a 40-60% OER is considered efficient due to competitive margins.

In contrast, industries like real estate often have much lower ratios, reflecting minimal operating costs relative to high revenues. Comparing the OER against industry benchmarks provides better insights into performance.

Importance

The OER is vital for identifying cost-saving opportunities and ensuring profitability. It helps businesses benchmark against industry standards, assess operational performance, and plan budgets. A well-managed OER signals financial health and operational efficiency, providing insights for investors, stakeholders, and management teams to make informed decisions.

By highlighting expense inefficiencies, it enables companies to allocate resources effectively and sustain growth over the long term. Regularly monitoring the OER also ensures businesses remain competitive in changing market conditions.

How to calculate operating expense ratio?

The operating expense ratio (OER) measures operating expenses as a percentage of total revenue. It is a key metric to evaluate a company’s operational efficiency and helps determine how much revenue is consumed by operating costs.

Formula

The operating expenses formula for OER is:

Operating Expense Ratio = (Operating Expenses ÷ Total Revenue) × 100

This ratio allows companies to gain insights into cost efficiency, identify areas for improvement, and make informed decisions to enhance profitability and maintain financial health.

Example

To calculate operating expenses using OER, assume a company has $500,000 in operating expenses and $1,000,000 in total revenue.

Using the operating expenses formula, divide $500,000 by $1,000,000, resulting in 0.5. Multiply by 100 to get an OER of 50%. This means 50% of the company’s revenue is spent on operating expenses.

For instance, if revenue rises to $1,200,000 but expenses remain constant, the OER drops to 42%, indicating improved efficiency. Conversely, if expenses rise faster than revenue, the OER increases, signaling potential cost issues.

Enhance your business's financial health

Relationship between operating expenses and profit generation

Operating expenses play a crucial role in shaping a business’s profitability. They directly affect the company's cost structure and, consequently, its ability to generate profits.

Understanding this relationship helps businesses manage costs efficiently while maximizing revenue and long-term growth.

Direct impact on cost

Operating expenses directly contribute to the overall cost structure of a business. These expenses, including rent, utilities, and salaries, can significantly impact a company’s profitability by increasing the total operating cost.

As operating expenses rise, the business must generate higher revenue to cover these costs, thus affecting profit margins. Reducing operating expenses can increase profits by improving the cost-efficiency of business operations, enabling better allocation of resources.

Net profit calculation

Operating expenses are subtracted from a company's revenue to calculate net profit. A higher operating expense means lower net profit, even if sales remain the same.

Efficient management of operating expenses allows businesses to improve their bottom line by maximizing net profit. In this way, controlling operating expenses is key to optimizing financial performance and achieving sustainable profitability. Lower operating expenses can enhance profitability, even in times of low revenue.

Impact of sales and marketing expenses

Sales and marketing expenses have a direct impact on profit generation. While these costs are essential for revenue growth, excessive spending without measurable returns can reduce profitability.

A strategic approach to managing these expenses ensures that spending generates the desired results, such as increased customer acquisition and retention, ultimately contributing to higher profits. Well-managed sales and marketing budgets help optimize return on investment, enhancing overall profitability.

Break even analysis

Break-even analysis helps businesses determine the level of sales needed to cover operating expenses. At the break-even point, total revenue equals total operating costs, with no profit or loss.

Understanding this relationship allows businesses to set realistic sales targets and make informed pricing decisions. Properly managing operating expenses can help reduce the break-even point, enabling companies to achieve profitability more quickly, thus accelerating the path to positive financial performance.

Adaptation to market changes

Operating expenses must be flexible to adapt to market changes. In times of economic downturns or increased competition, businesses may need to cut costs to maintain profitability.

Conversely, businesses may need to invest more in operations during periods of growth to capitalize on market opportunities. This adaptability ensures businesses remain financially resilient, maintaining profitability despite external challenges. Flexibility in managing expenses allows companies to navigate fluctuating market conditions effectively.

Sustainable profitability

Managing operating expenses efficiently is key to sustainable profitability. By reducing unnecessary expenditures and optimizing cost structure, businesses can improve their profit margins over time.

Sustainable profitability requires balancing revenue growth with controlled operating costs, allowing companies to maintain long-term financial health. Effective expense management ensures that a business can withstand economic fluctuations and remain profitable in the long run, ultimately supporting its growth and stability.

Buffer against revenue generation

Operating expenses provide a buffer for businesses when revenue generation is inconsistent. Having controlled and predictable expenses enables businesses to navigate periods of low sales without incurring significant losses.

By keeping operating expenses in check, companies can ensure profitability even during revenue shortfalls. This financial stability allows businesses to continue operations and weather economic uncertainties, ensuring they can seize opportunities when revenue returns to normal levels.

Understanding the tax factor in your operating expenses

Taxes play a crucial role in managing operating expenses in business. Certain expenses qualify for tax deductions, reducing the overall tax burden.

Understanding the tax implications of operating expenses can help businesses optimize their financial strategies and improve profitability through better cost management and compliance. Staying informed about tax regulations ensures businesses fully utilize potential savings opportunities.

Tax-deductible expenses

Tax-deductible expenses are operating costs that businesses can subtract from their taxable income. Examples include rent, utilities, employee wages, and professional services. These deductions lower the overall taxable income, resulting in reduced tax liability. Businesses should maintain proper documentation to ensure compliance and maximize tax benefits.

Strategic planning around tax-deductible expenses can significantly impact financial performance and long-term sustainability, creating room for reinvestment into business growth. Properly identifying these expenses helps businesses take full advantage of available tax incentives.

Taxes on non-deductible expenses

Non-deductible expenses include costs like penalties, fines, and personal expenses that cannot be claimed for tax benefits. These expenses directly affect net profits without reducing the tax burden.

Businesses must be aware of such costs to avoid financial surprises. Proper categorization of expenses ensures accurate financial reporting and prevents issues during tax audits. Proactively identifying non-deductible expenses can help businesses effectively plan for their financial impact.

Tax credits and incentives

Tax credits and incentives are financial benefits offered to businesses for specific activities, such as research and development or sustainability efforts. Unlike deductions, credits reduce the total tax payable, offering more substantial savings.

Leveraging these opportunities requires staying updated on tax regulations and engaging in eligible activities. Effective use of tax credits enhances profitability while supporting business innovation and growth. Collaborating with tax professionals ensures businesses maximize their credit potential.

Key Performance Indicators (KPIs) for operating expenses

Financial key performance indicators, or KPIs, are specific metrics that aid managers and financial experts in analyzing the company and determining how far the company has come toward achieving strategic objectives.

Different businesses use a wide range of financial KPIs to track their success and propel growth. Each business needs to identify the KPIs that have the greatest significance for its operations.

Best practices for running a successful business include measuring and constantly monitoring KPIs.

1. Expense-to-revenue ratio

The efficiency proportion demonstrates the expenses as a level of revenue (costs/income), with a couple of varieties — it is basically how much a partnership or individual spends to earn anything; elements should endeavor to limit productivity proportions.

2. Gross margin

It's determined by dividing gross profit by net sales and is normally communicated as a rate. Net sales less cost of goods sold (COGS), which is the direct cost of producing the goods sold, is gross profit.

It is simpler to compare profitability with that of other businesses and to examine trends in profitability over time when profit is calculated as a percentage of revenue.

3. Return on sales

The company's operating profit per dollar of sales revenue is measured using this metric. It is calculated by dividing net sales revenue by operating income, also known as earnings before interest and taxes (EBIT).

The rate at which a company converts revenue into profit is commonly measured using ROS.

4. Current ratio

This demonstrates a business's short-term liquidity. It's the proportion of the organization's ongoing resources for its ongoing liabilities. Cash, accounts receivable, and inventory are examples of current assets that can be converted into cash within a year.

All obligations that are due within a year, including accounts payable, are considered current liabilities. In most cases, a current ratio that is lower than one could indicate that the business does not have enough convertible assets to cover its short-term obligations.

5. Working capital

It compares the company's current assets to its current liabilities. In any case, it communicates the outcome in dollars rather than as a proportion. The company may have trouble meeting its financial obligations if it has low working capital.

On the other hand, a very high amount might indicate that it is not making the most of its resources.

Choose Volopay for seamless expense management

How to reduce operating expenses?

In the dynamic landscape of business, reducing and knowing how to control operating expenses (OpEx) without compromising quality is a skill every organization aims to master.

Here are actionable tips to achieve that:

1. Conduct a cost analysis

Begin with a comprehensive review of all expenses. Make sure to look at all the operating expenses across the organization and within each department.

Identify areas where costs can be trimmed or eliminated while maintaining operational efficacy.

2. Prioritize expenses

Once the cost analysis is complete, you will have to prioritize them according to your company’s current situation and gauge what is needed and not needed at the moment.

Categorize expenses as critical and non-critical. Focus on maintaining essential functions while seeking opportunities to reduce non-essential costs.

3. Negotiate supplier contracts

Engage in fruitful negotiations with suppliers to secure more favorable terms, discounts, or bulk pricing for materials and services.

Negotiating to get early payment discounts is a great way to reduce costs over the years and at the same time build stronger business relationships.

4. Energy efficiency

Invest in energy-efficient technologies and practices to minimize utility bills and promote sustainable operations. You might not see a significant impact immediately, but changing to sustainable and energy-efficient tech will save costs slowly and add up over time.

5. Telecommuting and remote work

Offer remote work options where feasible. This reduces office space needs and associated costs while promoting employee satisfaction.

Nowadays not all jobs need employees to travel to an office as they can be done remotely through a laptop. A hybrid work environment can also bring balance for employees and employers.

6. Technology optimization

Leverage technology to streamline processes, reduce manual efforts, and enhance overall efficiency. There are many repetitive tasks that are still done manually across different teams in an organization. These can easily be automated using technology so that humans have more time to do impactful and strategic tasks.

7. Outsourcing and automation

Consider outsourcing non-core tasks and automating routine processes to cut labor costs and enhance productivity.

Certain processes within an organization may not need to be eternal and can be outsourced to help the organization reduce costs.

8. Expense tracking and monitoring

Implement robust expense tracking systems to identify areas of overspending and promptly address them. This can be done in an effective manner using modern cash management systems that helps you track, monitor, and control different types of expenses across the organization.

9. Flexible work arrangements

There might be instances where the company has to pay for an employee’s commute to and from the office. This can be curbed by implementing flexible work schedules such as a hybrid schedule to accommodate employees' needs while potentially reducing operational costs.

10. Inventory management

Maintain optimal inventory levels to avoid overstocking or stockouts, minimizing storage costs and potential losses.

You should implement methods to estimate how much inventory you will need in a particular period and stock up accordingly with minimal buffer inventory to reduce storage costs.

11. Implement expense approval process

Establish a stringent approval process for expenses to ensure every expenditure aligns with organizational goals. This is an essential step that can drastically save costs by eliminating any payment that was not supposed to be made.

12. Optimize rent and office space

Reevaluate office space needs. Downsizing or relocating to a more cost-effective location can yield substantial savings. For businesses that are majorly digital in their offering, shifting to a coworking space can also be a better option overall.

13. Use lean management

Apply lean principles to identify and eliminate wasteful processes, enhancing efficiency and reducing unnecessary expenditures. Lean management applies to work processes as well as to the staff that you employ.

Strategies for managing operating expenses

Adeptly managing operating expenses (OpEx) is a cornerstone of fiscal responsibility and sustainable growth. Employ these strategies to navigate the complexities of expense management:

1. Develop a comprehensive budget

Creating a detailed budget is a foundational step in managing operating expenses. Outline expected costs, allocate resources appropriately, and set spending limits for each department. This approach ensures that all expenses are accounted for and prevents overspending.

Regularly revisiting and adjusting the budget allows businesses to address changes in revenue, market conditions, or unforeseen costs effectively. Incorporating contingency plans into the budget can further safeguard against unexpected financial challenges, helping maintain operational stability.

2. Benchmarking

Benchmarking involves comparing a company's operating expenses against industry standards or competitors to identify areas for improvement. It helps businesses understand where they stand in terms of cost efficiency and highlights potential savings.

By measuring performance against the best in the industry, organizations can adopt strategies that reduce unnecessary spending and boost profitability. Regular benchmarking enables businesses to remain competitive and optimize their expense management.

3. Evaluating supplier performance

Regularly evaluating supplier performance ensures that businesses maintain cost-effective and reliable vendor relationships. By analyzing suppliers based on factors like cost, quality, and delivery times, companies can identify opportunities to renegotiate contracts or find more competitive alternatives.

Strengthening supplier relationships and performance also leads to better terms, discounts, and improved efficiency, which directly impacts the company’s bottom line. Supplier evaluation ensures that businesses only work with the most cost-effective partners.

4. Employee training & engagement

Investing in employee training and engagement helps optimize productivity and reduce costs in the long term. Well-trained employees are more efficient, make fewer errors, and can find innovative ways to streamline processes.

By fostering a culture of cost-consciousness and continuous improvement, companies can empower their workforce to contribute to cost-saving initiatives. Engaged employees are also more likely to take ownership of operational tasks, leading to better resource management and reduced waste.

5. Encourage cross-departmental collaboration

Collaboration between departments fosters transparency and shared accountability for managing operating expenses. Encourage teams to work together to identify overlapping costs and streamline processes. Shared input can lead to innovative cost-saving measures and better resource allocation.

Regular communication between departments aligns priorities, reduces redundancy, and ensures teams work toward common financial goals, boosting efficiency. This approach also enhances a company’s ability to adapt to market changes while controlling costs.

6. Conducting regular expense audits

Conducting regular expense audits is a vital strategy to identify inefficiencies and control costs. Audits allow companies to track where money is being spent and uncover potential areas of waste.

By periodically reviewing financial statements, businesses can spot discrepancies, eliminate unnecessary expenditures, and ensure expenses align with business objectives. Regular audits contribute to a more transparent financial structure and help identify opportunities for operational improvement.

7. Prioritize expenses based on contribution

Focus spending on areas that generate the highest value or directly support business objectives. Evaluate each expense category's contribution to revenue, productivity, or customer satisfaction. This strategic approach ensures that resources are allocated effectively, minimizing wasteful expenditures.

By prioritizing high-impact costs, businesses can optimize their budgets and drive long-term growth without compromising operational efficiency. This approach helps businesses identify and eliminate non-essential expenditures that do not contribute directly to profitability.

8. Review & adjust budgets periodically

Regularly revisiting budgets ensures they remain aligned with evolving business needs and market conditions. Analyze financial performance to identify areas for adjustment or reallocation. This proactive approach allows businesses to address potential issues before they escalate.

Periodic budget reviews also provide insights into spending trends, helping companies stay agile and maintain financial health. Regular adjustments enable businesses to adapt to unforeseen challenges or capitalize on new opportunities that may arise.

9. Conduct periodic benchmarking

Benchmarking allows businesses to compare their operating expenses with industry standards or competitors. This practice highlights inefficiencies and uncovers potential areas for improvement. Use these comparisons to set realistic cost targets and identify best practices.

Periodic benchmarking ensures businesses remain competitive and aligned with market trends, fostering continuous improvement in financial management. It also provides actionable insights for refining strategies to enhance profitability and operational efficiency.

10. Set up an expense management system

Implementing an expense management system simplifies tracking and controlling business expenses. These systems provide transparency, streamline approval processes, and reduce errors in reporting. Automating workflows ensures timely reimbursements and compliance with company policies.

Expense management tools also generate insights into spending patterns, enabling better decision-making and fostering a more disciplined financial environment. A well-structured system helps to identify spending trends, providing opportunities for cost-cutting and operational improvements.

How does an expense management software help in managing operating expenses?

Expense management software is beneficial to businesses that deal with a bulk of paper receipts. When your company deals with a lot of people who need to be paid a lot of money, it's even more important to be able to keep track of expenses.

An expense management software will permit you to:

1. Improve the utility of time and funds

The greatest advantage of using software for expense management is the time it saves. Because time is money, you can save money by completing other tasks at the same time.

This isn't just about getting repaid quicker; it's also about having the option to invest more energy zeroing in on different things in your business.

2. Employee spending reports in real-time

With paperless expense reporting, you can track and manage expenses efficiently, thanks to the software's ability to provide instant reports on employee spending.

It also ensures that you can be reimbursed for overspending, restricted from excessive spending, or compensated for under-spending. Having an expense policy in place is another effective way to prevent overspending.

3. Compliance

Software for expense management is essential for ensuring that directives from the IRS and other tax agencies are followed.

The software helps businesses determine which expenses they are eligible to deduct and makes documentation that is simple to access in the event of an audit.

4. Dashboards

Dashboards present unified expense data to managers in a visual format that facilitates comprehension and analysis. Constant data gives knowledge into the present status of business tasks.

Additionally, having expense data in a single location can assist finance teams in developing budgets for future expenses.

5. Custom reports

The specifics of who is spending, how much, and in which categories are examined in depth in custom reports. Trends like the time it takes to approve an expense report, the status of reports, and where they are in the approval cycle are also brought to light.

This helps finance teams find areas where they can save money, improve efficiency, and strengthen the bottom line by controlling spending.

Streamline and optimize your business expenses

Choose Volopay's all-in-one expense management platform for your business

Now that you know that an expense management platform is essential to run your business in optimal conditions, why would you go for a faulty system? Choose the best. Get Volopay!

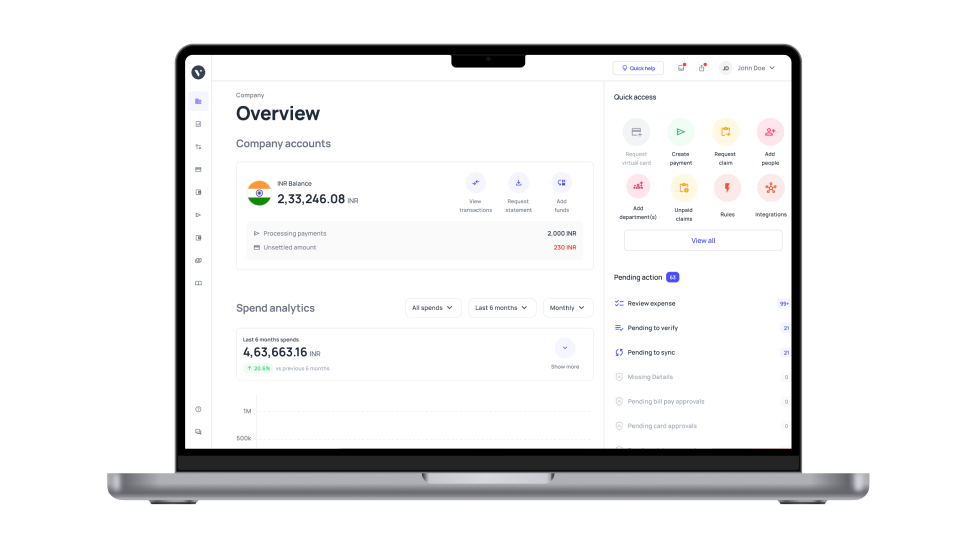

Volopay’s comprehensive expense management platform helps businesses to track, manage, and optimize their spending.

With innovative features designed to streamline financial operations, Volopay helps businesses achieve greater control and efficiency, enabling smoother financial workflows and faster decision-making.

Automated expense reporting

Volopay automates the entire expense reporting process, eliminating manual data entry and reducing human error. Employees can easily capture and submit expenses, which are automatically categorized and integrated into your financial system.

This improves accuracy, saves time, and ensures compliance with company policies, enhancing overall operational efficiency. It also accelerates the employee reimbursement processes, freeing up time for employees to focus on more strategic tasks.

Customizable spend controls

Volopay allows businesses to set customizable spending controls to align with specific financial policies and needs. With customizable approval workflows, businesses can define spending limits for each user or department, ensuring that all expenses remain within budget.

These controls prevent unauthorized spending and reduce financial risk, promoting more responsible and transparent expense management. Businesses can also quickly modify controls based on evolving needs or regulatory changes.

Real-time expense tracking

With Volopay, businesses can monitor expenses in real-time, providing immediate insights into current financial activities and trends. This visibility allows finance teams to quickly detect overspending or discrepancies before they escalate into larger issues.

Real-time tracking also ensures that departments adhere to set budgets and policies, improving overall financial discipline and accountability. Moreover, having up-to-the-minute data enables better forecasting, more accurate budgeting, and enhances decision-making regarding future expenditures.

Integration capabilities

Volopay seamlessly integrates with various accounting systems, ERP platforms, and payment gateways, making financial management more efficient. These integrations ensure that all expenses are automatically recorded in the appropriate ledgers without requiring manual input.

This reduces errors, enhances accuracy, and streamlines your financial workflows. Volopay's integration capabilities enable businesses to maintain smooth financial operations while saving time on data entry and reconciliation.

Automated expense reconciliation

Volopay's automated expense reconciliation feature matches transactions with corresponding receipts, simplifying the process of verifying and closing accounts. This reduces manual work, improves accuracy, and accelerates the financial closing process.

With Volopay's AP automation, businesses can ensure their financial records are always up-to-date and accurate, allowing for faster audits and financial reporting. The system also flags discrepancies, making it easier to resolve any issues promptly.

By automating accounts payable, companies can streamline invoice processing, reduce manual errors, and gain better control over cash flow.

Schedule payments and smart triggers

Volopay’s platform allows businesses to schedule payments and set smart triggers for recurring expenses or specific payment deadlines. This reduces the risk of missed payments and late fees, enhancing cash flow management.

By automating payments, businesses ensure timely and accurate transactions while freeing up time for other important tasks. These smart triggers also help maintain consistency in managing regular vendor payments, payroll, and other financial obligations.

Maximize your business potential with Volopay

FAQ's

Operating expenses fund rent, payroll, inventory costs, insurance, etc.

Volopay helps streamline all your expense activity, tracks every money movement in real-time, provides corporate cards with spend controls like expense limits and category allocation, auto-categorizes expenses, and maintains an accurate database that is easily accessible.

Operating expenses can be both fixed and variable. Fixed operation costs include office rent and company insurance. Variable operating costs are labor rates, packaging costs, delivery charges, etc.

Any increase in the price of operating cost categories like rent, delivery charges, labor costs, and raw material charges will definitely affect the company's profit.

Volopay is the best software to manage operating expenses as it is an all-in-one spend management platform that offers management tools along with corporate cards for better spending management and ease of making expenses.