👋 Exciting news! UPI payments are now available in India! Sign up now →

8 best expense management software for 2025

Moving into the modern era where there is a shift towards the remote and hybrid working models, it is no surprise that technology is catching up to help with automating business processes.

Streamlining your business processes can be done with the use of expense management software.

For small businesses, it could be the thing that saves you from having too much on your plate. Here are some of the best expense management software for small businesses in India for your consideration.

8 best expense management software in India

- Market segment

- Automated expense tracking

- Receipt scanning & OCR

- Multi-currency & global support

- Approval workflow automation

- Corporate card integration

- Mobile accessibility

There are several popular expense management software for small businesses in India. They range from platforms meant to accommodate smaller businesses to software with complex functions that could be utilized by enterprises.

There are pros and cons to each popular software. Here are 6 of the best expense-tracking software for small businesses.

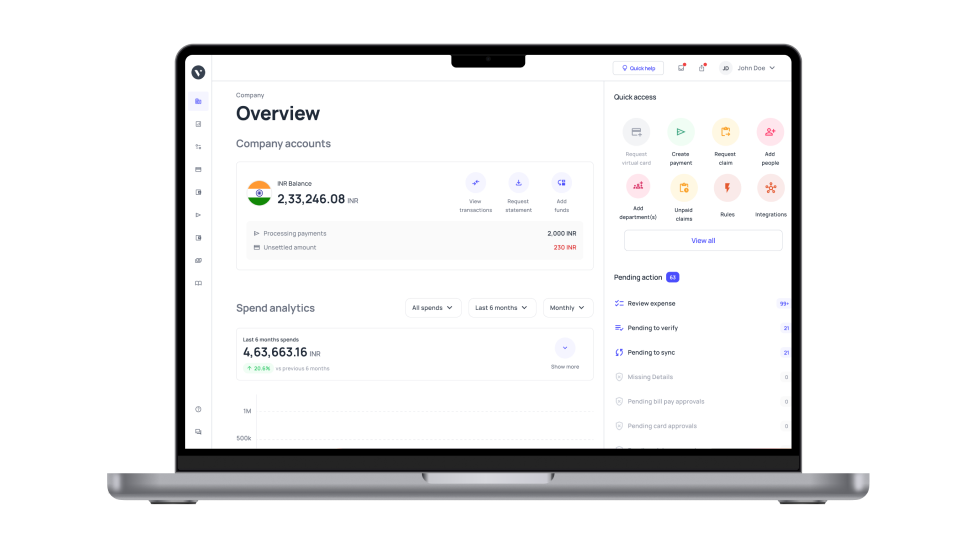

1. Volopay

● Key features

Volopay provides real-time tracking of expenses, enabling users to monitor spending as it happens. You can issue both physical and virtual cards to employees, automate expense reporting, reduce manual work and its potential errors, and also seamlessly integrate with popular accounting software to make reconciliation hassle-free.

● Pros

Volopay has a user-friendly interface that makes it easy for employees to submit expenses and for administrators to manage them.

With multi-currency support, it is suitable for businesses with international operations. The software allows businesses to set spending limits and ensures compliance with company policies.

● Cons

Some users may find the software's customization options lacking compared to other solutions.

The mobile app may lack some features available on the desktop version as the app is mostly for monitoring, tracking, and basic control functions.

● G2 Rating

Volopay has an overall rating of 4.2 stars out of 5 on G2.

2. Zoho Expense

● Set-up process and requirements

Zoho Expense offers a 14-day free trial before you have to commit to any of the plans they offer. Zoho Expense also gives you the option to onboard and set up with experts for an additional fee.

● Fees and pricing

You can start using Zoho Expense for free, but their price plan starts at ₹ 99/month for every active user from your business. They have add-on support and onboarding plans in addition to their priced plans.

● Features

Zoho Expense offers expense tracking, data import and export, workflow management, and approval process workflows. The software also has multi-currency functionality.

Not only does Zoho empower you to streamline your overall expense management, but it also offers robust solutions for handling petty cash expenses. Having the right tools to streamline your petty cash processes can contribute to your overall financial success.

● Benefits

With over five different language supports, Zoho Expense is the expense management software choice for startups, small to medium-sized businesses, and self-employed business owners.

Zoho Expense offers integration of its platform with other Zoho software, such as Zoho Books and Zoho CRM.

● Limitations

Some support functions like live chat are locked behind a paywall as an add-on support plan with Zoho Expense.

With its pricing plan being based on the number of active users, the platform could also get expensive quickly for growing businesses that want many employees using it.

3. Netsuite

● Set-up process and requirements

To start using Netsuite, you have to register and get a Free Product Tour from their website. Only after you have completed this will you get a quote and be able to start the set-up process.

● Fees and pricing

As a general rule, you will need to pay both a one-time set-up fee and an annual license fee with Netsuite. However, pricing can only be obtained after doing their Free Product Tour.

● Features

With a large range of features, Netsuite doesn’t only offer expense management and tracking on its platform. Netsuite also has accounting, asset management, inventory management, and time-tracking capabilities.

● Benefits

Netsuite is an all-in-one business management software. As an ERP platform, Netsuite is suitable for startups, SMEs, agencies, and even enterprises. Netsuite also offers good support for its users.

● Limitations

Considering that there are a lot of features available on the Netsuite platform, as expense management software for small businesses it may prove to be daunting. There could be some intense learning involved before you can navigate your way around the software.

4. Freshbooks

● Set-up process and requirements

Freshbooks is accounting software that also offers expense reporting features. You will get a 30-day free trial with Freshbooks before you have to subscribe to a plan.

● Fees and pricing

Freshbooks’ plans start at USD 15/month, but you get the first four months discounted to USD 6/month. You can add users for an additional cost of USD 10/user per month.

● Features

Some of the expense management features that Freshbooks offers include expense tracking, multi-currency functionality, as well as online banking integration, and auto-capture receipts on mobile.

● Benefits

As accounting software, Freshbooks can also manage your accounts receivable and allows you to invoice your customers in addition to being expense management software for small businesses.

With multiple language supports, Freshbooks is the choice for many freelancers and startups.

● Limitations

At a cost of USD10/user per month for any additional users, the team member add-on on Freshbooks can get expensive quickly if you have multiple users.

For the best expense reporting, you want all your employees to have access to the software so they can report in real-time.

5. Expensify

● Set-up process and requirements

With Expensify, you have to enter your email address or phone number on their website to sign up and start the process. Once you hear back from the team, you will be able to start your set-up process.

● Fees and pricing

For self-employed individuals, Expensify starts with a free plan. However, for businesses, the pricing plan starts at USD 5/month for each user active on the platform. This price is attainable when you pay annually as opposed to monthly.

● Features

At the USD 5 price plan and every plan above it, you will get expense management features like accounting sync, approval process workflow, reimbursement management, expense tracking, and data import and export. Expensify also offers multi-currency functionalities.

● Benefits

Expensify has the added benefit of having cards for your employees to make any business expense. Each active user will have access to an Expensify Card that is linked to the Expensify software and can be tracked.

● Limitations

The downside of the Expensify Card is that right now it’s only available to businesses with a US business bank account. Expensify prices are also based on the number of users, which can get expensive if you have a lot of employees using the platform in your business.

Moreover, Expensify doesn’t have live support and is only available in the English language.

6. Concur

● Set-up process and requirements

Concur’s website offers self-guided demos for anyone interested in exploring expense management software for small businesses. To start the set-up process, you have to get a quote from Concur first.

● Fees and pricing

Pricing plans on Concur are available by request. Get a quote from Concur based on your business and its needs.

● Features

Concur offers expense tracking, reimbursement management, bank reconciliation, and vendor management. Concur also has features specifically for managing travel expenses.

● Benefits

Business travel expense management is one of the benefits Concur has. Concur TripLink has integrations with many suppliers recognizable in the travel industry. Concur is often used by startups, SMEs, and enterprises.

● Limitations

Unlike some other expense management software for small businesses, Concur does not offer live chat support. Despite operating in multiple countries, the only language support they have is only English.

7. Happay

● Set-up process and requirements

Happay provides a simple setup process, allowing businesses to integrate the platform with their existing accounting and ERP systems. Users must create an account, configure workflows, and set spending policies.

The platform offers training materials, live support, and webinars to assist with onboarding and ensure a smooth implementation.

● Fees and pricing

Happay follows a custom pricing model based on business needs. Pricing varies depending on the number of users, selected features, and the scale of operations.

Businesses must contact Happay’s sales team for a quote. The platform may charge fees for advanced features, integrations, or premium support services.

● Features

-Happay automates expense tracking, offering real-time monitoring and policy enforcement.

-The system includes receipt scanning, multi-level approvals, and fraud detection. It integrates with accounting software, enabling seamless data flow.

-Businesses can customize workflows and generate detailed expense reports for better financial control and compliance.

● Benefits

Happay helps businesses reduce manual effort by automating expense management. Real-time tracking enhances financial transparency, while policy enforcement minimizes compliance risks.

Integration with accounting systems simplifies reporting and reconciliation. The platform’s analytics provide valuable spending insights, helping organizations optimize budgets and control costs.

● Limitations

Some users find the approval process slow, especially when dealing with denied expenses. Tracking rejected claims can be cumbersome.

Additionally, the platform lacks integration with certain digital payment methods like UPI-based services, which could limit payment flexibility for businesses relying on those options.

8. Fyle

● Set-up process and requirements

Fyle’s setup process is quick and straightforward. Businesses need to register, configure policies, and link their accounting software.

The platform provides user guides, training sessions, and customer support to assist in onboarding. Employees can submit expenses via email, mobile app, or browser extension, streamlining the reporting process.

● Fees and pricing

Fyle offers subscription-based pricing, starting at $11.99 per user per month. The cost varies depending on selected features and business size.

A free trial is available for companies to explore the platform’s capabilities before making a commitment. Additional charges may apply for premium integrations and services.

● Features

Fyle simplifies expense reporting with automated receipt scanning, real-time policy checks, and multi-level approvals.

The system integrates with popular accounting tools, enabling smooth financial operations. Employees can submit expenses through various channels, and finance teams can track and audit spending with built-in analytics.

● Benefits

Fyle helps businesses reduce manual data entry, improving accuracy and efficiency. Automated policy checks prevent fraudulent claims, ensuring compliance.

Real-time analytics provide insights into spending patterns, enabling better budget control. Seamless integration with financial systems enhances operational efficiency and reduces administrative burden.

● Limitations

Some users find that Fyle’s route-mapping feature only suggests the shortest path, limiting flexibility for mileage claims.

The platform does not support UPI-based payments, which may be a drawback for businesses that prefer digital wallets. Certain advanced customization options may require additional setup effort.

Automate your business expense tacking

Evaluation criteria while selecting an expense management software

User-friendly interface and intuitive navigation

A user-friendly interface and intuitive navigation are essential features of effective expense management software.

A simple, easy-to-navigate design significantly enhances user adoption, allowing employees to understand and utilize the software's functionalities quickly.

This minimizes the learning curve, ensuring that team members can manage expenses efficiently without extensive training.

As a result, businesses can achieve smoother operations and improved financial oversight, maximizing the benefits of their chosen expense management solution.

Compatibility with existing financial systems

When selecting the best expense management software, compatibility with existing financial systems is crucial. The software should integrate seamlessly with your current accounting or ERP systems to ensure streamlined operations.

This integration allows for real-time data sharing, reduces the risk of errors, and enhances overall efficiency.

By choosing software that fits well with your existing infrastructure, businesses can simplify their financial processes and improve accuracy, making it easier to manage expenses and maintain financial control.

Ability to customize features and workflows

When choosing expense management software, the ability to customize features and workflows is key to meeting specific business needs.

Flexible software allows businesses to tailor approval processes, spending limits, and reporting formats to align with their unique operational requirements.

This customization enhances efficiency, as companies can adapt the software to fit their workflow rather than changing their processes to suit the tool. Ultimately, it leads to smoother operations and better control over expenses.

Comprehensive insights and data analysis

The best expense management software offers comprehensive insights and data analysis tools, enabling businesses to gain a clear understanding of their spending patterns.

Robust analytics features allow companies to track expenses in real time, identify trends, and uncover inefficiencies.

This data-driven approach empowers management to make informed financial decisions, optimize budgets, and improve overall cost control.

With the right software, businesses can leverage insights to streamline operations and achieve better financial oversight.

Availability of mobile apps for better management

Mobile apps play a crucial role in corporate expense management by allowing employees to manage expenses on the go.

This mobile accessibility boosts convenience, enabling users to submit receipts, track spending, and approve expense reports anytime, anywhere.

It streamlines the entire process, reducing delays and ensuring that financial data is updated in real time.

With mobile-friendly solutions, companies can improve efficiency and allow employees to handle their expenses seamlessly, leading to better overall expense management.

Adherence to regulations and robust data protection

When selecting expense management software, it’s essential to ensure the tool complies with relevant financial regulations and offers robust data protection.

Adherence to regulations, such as tax and auditing requirements, keeps your business compliant and reduces legal risks.

Strong security features, including encryption and access controls, safeguard sensitive financial data from unauthorized access or breaches.

By prioritizing regulatory compliance and data security, businesses can confidently manage expenses while protecting critical financial information.

Features for setting spend limits and controls

Effective expense management software should offer features for setting spend limits and controls to prevent overspending and ensure strict adherence to budgets.

These controls allow businesses to establish predefined spending caps for employees, departments, or projects, promoting financial discipline across the organization.

By automatically monitoring and enforcing these limits, the software reduces the risk of budget overruns and provides real-time visibility into spending patterns. This leads to better financial management and optimized resource allocation.

Pricing structure and overall affordability

When selecting the best expense management software, evaluating the pricing structure is crucial. Ensure that the software fits within your budget while delivering the features essential for your business needs.

Consider the value offered by different pricing models, including subscription-based or tiered options, and assess whether they align with your company's financial goals.

Affordable solutions that still provide robust functionality allow businesses to manage expenses effectively without overspending on unnecessary features or services.

Quality and availability of support services

When choosing expense management software, the quality and availability of support services are critical factors.

Reliable customer support ensures that any technical issues or user queries are addressed promptly, minimizing downtime and disruptions to your financial processes.

Look for software providers that offer multiple support channels—such as chat, email, and phone support—along with dedicated help desks or account managers.

Quick and effective support contributes to smoother operations and enhances the overall user experience with the software.

Ability to grow and adapt with your business needs

In corporate expense management, it's essential to choose software that can grow and adapt to your business needs.

Scalable solutions allow for smooth expansion, ensuring that as your business evolves, the software continues to meet your requirements.

Whether you’re adding new users, managing more complex workflows, or handling higher transaction volumes, adaptable software ensures long-term usability.

This flexibility helps businesses avoid costly migrations to new systems and supports sustainable financial management as the company expands.

Which features to consider when choosing expense management software?

1. Seamless expense reporting process

Expense management software for small businesses should allow its users to report expenses from anywhere.

Having a mobile application means that your employees would be able to digitally capture receipts and report expenses as they happen.

You want software that offers Optical Character Recognition (OCR) so that your receipt data can be uploaded straight onto the platform without additional manual data entry.

Ideally, you also want multi-currency functionality for your expense reporting in the case of international expenses.

2. Real-time expense tracking

Having real-time expense tracking that you can view from anywhere enables you to get insights and plan budgets better.

You can see where your money is going at any given time and ensure that nothing is amiss with the help of expense management software for small businesses.

3. Automated workflows

When you establish a system for approval workflows in your business, you can then automate it using expense management software.

For small businesses, there might not be many levels of approvers, but expense management software will speed it up nonetheless. Having automated workflows means that your software will also be able to flag any policy violations in the process.

4. Integrated corporate credit card management platform

The best expense management software for small business will allow you to integrate your corporate credit cards with its expense management platform.

Recording and reconciling card expenses on your accounting platform can prove to be tedious. However, this can be mitigated by integrating your cards with your expense management software.

For small businesses, this means that you don’t have to worry about misuse of credit cards. Get real-time insights into your corporate credit card spending.

5. Digital audit trails

Good expense management software for small businesses should be able to help you be audit-ready.

Expense reports should not only be stored in one centralized system, but they should also be easy to access and find whenever necessary.

Ensure that you are ready for audit and that you have all your data straight with expense management software.

6. Advanced data analytics, insights, and reports

Expense management software, for small businesses, can help visualize data without you having to spend time manually creating graphs and reports.

Get insights into your employees’ spending and identify trends in your business expenses. Expense management software that allows you to do this will make it easier for you to generate reports and help in better cost control of your expenses.

7. Easy expense approval process

You want to speed up your expense approval process with expense management software. For small businesses, any time lost could easily add up and be detrimental to your business processes.

However, when you have a fast and smooth expense approval process, you don’t have to worry about losing time to manual processes and can direct your attention elsewhere.

Use expense management software for small businesses to automatically send alerts to approvers to make sure no expense request is missed.

8. Easy reimbursement system

Having reimbursement systems on expense management software for small businesses is a must. It simplifies your expense reimbursement processes and helps you settle out-of-pocket expense claims in just a few clicks.

Some of the best expense management software for small business will have a built-in mileage tracker to easily calculate reimbursements.

9. Compatible with any accounting software

Accounting integration with expense management software for small businesses will save you time and energy. Instead of manually entering your data across multiple software or checking between different software

You can automatically perform two-way sync to ensure that your accounting software data matches your expense management software data and vice versa.

You want expense management software that is compatible with any accounting software and supports direct integration with many accounting software.

If your accounting software can’t be directly integrated with the expense management software, you want to ensure that you choose expense management software for small businesses that supports Universal CSV and export your data onto your accounting software.

Streamline expenses with cutting-edge software

Manage your business expenses efficiently with Volopay

There are many features that you should consider when picking expense management software for small businesses.

From corporate credit card integration to approval workflows to reimbursement systems, you want to choose expense management software that can help you manage your business expenses efficiently.

Operating in India, Volopay is your ideal solution for expense management. Offering corporate cards, easy reimbursements, and vendor management, the platform is your one-stop shop for managing all your business expenses.

Expense reporting will be made easy with the help of a mobile application that your employees can log into and record the expenses that they make as they go. On top of that, Volopay also has direct integration with some of the most popular accounting software like Netsuite, Quickbooks, Xero, Tally, and Zoho Books.

If you use another accounting software, Volopay offers Universal CSV to export your data according to the format of your accounting software. All your expense management processes can be made easy with the right software. Get the best expense management software for small businesses and enhance your business processes with Volopay.

Volopay: Expense management solutions for every business type

Startups

● Automated expense categorization to track startup costs

When it comes to expense management for startups, automated expense categorization is invaluable. This feature simplifies tracking expenditures related to growth, enabling startups to maintain financial clarity.

By automatically sorting expenses, startups can focus on strategic decisions rather than getting bogged down in manual processes, ensuring they stay on top of their financial health during critical development stages.

● Simplified financial oversight for lean teams

The best expense management software provides simplified financial oversight for compact teams. By streamlining processes, it allows small teams to maintain effective control over expenses while avoiding overwhelming workloads.

This efficiency enables team members to focus on essential tasks, ensuring that financial management remains organized and manageable, ultimately supporting the overall success of the organization.

● Automated expense reporting for reduced manual work

The best expense management software offers automated expense reporting, significantly reducing manual work for startups.

Streamlining the reporting process saves time and minimizes errors, allowing teams to concentrate on scaling their operations.

This automation enhances efficiency and accuracy, providing startups with the financial clarity they need to thrive in a competitive environment.

Small businesses

● Enhanced control to prevent overspending and fraud

Enhanced control mechanisms are vital to prevent overspending and fraud. By implementing spend controls, small businesses can safeguard against unauthorized expenses, maintaining financial integrity.

This proactive approach not only helps in budget adherence but also fosters a culture of accountability, ensuring that every expense aligns with the company’s financial goals.

● Empower employees with customizable corporate cards

Customizable corporate cards empower employees by providing the flexibility to manage their expenses while maintaining oversight.

These cards allow businesses to set specific spending limits and controls, ensuring that expenditures align with budgetary constraints.

This approach fosters trust and accountability, enabling employees to make necessary purchases without compromising financial oversight or control.

● Scalable features to accommodate growth and changing needs

Scalable features in expense management software are essential for accommodating the growth and changing needs of small businesses.

As these businesses expand, they can effortlessly adapt the software’s functionalities to align with new demands.

This flexibility ensures that financial processes remain efficient and effective, allowing small businesses to manage expenses seamlessly as they evolve.

Large enterprises

● Monitor expenses across multiple departments and locations

Large organizations benefit from the ability to monitor expenses across multiple departments and locations, facilitating consolidated expense management.

This approach ensures transparency and accountability across all teams, enabling better oversight of spending patterns.

By centralizing expense tracking, organizations can identify inefficiencies, enforce compliance, and optimize resource allocation, ultimately leading to improved financial management and operational efficiency.

● Adherence to company regulations and industry standards

Adherence to company regulations and industry standards is crucial for effective corporate expense management.

Compliance features within expense management software ensure alignment with internal policies and external regulations.

By automating compliance checks, organizations can mitigate risks and avoid potential legal issues.

This proactive approach enhances accountability and fosters a culture of transparency, allowing businesses to maintain integrity in their financial processes.

● Multi-currency support for global operations

For enterprises with international business operations, expense management software with multi-currency support is essential.

This feature simplifies transaction tracking across borders, allowing businesses to manage expenses in various currencies effortlessly.

By providing real-time conversion rates and streamlined reporting, the software enhances financial oversight, ensuring accurate budgeting and expense management in a global landscape.

Simplify expense tracking with Volopay

FAQ's

Instead of making your employees create long expense reports at the end of the month, a company using Volopay can simply let its employees use our mobile app to instantly create a reimbursement claim, add the necessary info, and attach the relevant receipts.

If your company uses Volopay corporate cards or our money transfer feature to make payments, then all these transactions are automatically recorded in ledgers within our system with all the necessary details. This automated expense reporting helps employees and finance & accounting teams save a lot of time.

Since Volopay is a completely online platform, the need to maintain a physical paper trail is completely eliminated. All the tracking, approval, rejection, and management of expenses are done within the platform itself.

Yes, any purchase you make using Volopay virtual cards is instantly recorded and reflected on your dashboard. Real-time tracking of expenses across the organization helps maintain visibility over budget utilization ensuring that the finance team is able to take informed managerial accounting decisions.