8 benefits of digital business bank accounts for your business

A digital business account separates your personal and business transactions and aids in securing business funds. Both bank accounts serve a financial purpose. Digital accounts, in comparison, make it much easier to keep track of and control business expenditures.

Having a digital business account, rather than having a business bank account, helps you streamline the process of handling taxes and other financial obligations. These accounts give you the ability to use technology to your advantage.

What is a digital business account?

Digital accounts provide improved visibility over expenses, you get to know in real-time where your company's money is being spent. This means you can track expenses as they happen. Fund transfers happen at lower FX fees to support business operations.

Ultimately, these accounts remove the cost of human labor from everything ranging from money transfers, vendor or bill payments to managing subscriptions. And yes, they do this in a more secure form than traditional business accounts.

Digital business accounts are dedicated corporate accounts that offer organizations a full range of financial services. Digital business accounts have you covered, from your data to your documents to your money.

These accounts also come with integrated payment processing and other supplementary financial management services. Such features help firms streamline operations and establish an efficient business management system.

Digital business accounts come with multi-currency compatibility, cheaper payment fees, and corporate card facilities. Global businesses can utilize these accounts as a centralized tool to streamline international payments and get total financial control.

Opening a digital business account is not time-consuming, whereas a traditional business account takes days or even weeks to set up. Digital accounts can be accessed anywhere from user-friendly platforms. Traditional banks have complex websites, which are often poorly optimized for mobile devices and hard to use.

Why should you switch to a digital business account?

Unified global account

With a digital business account, businesses don't need to have multiple bank accounts to send and receive money from different currencies. You can access all your domestic and international transactions from one single global business account.

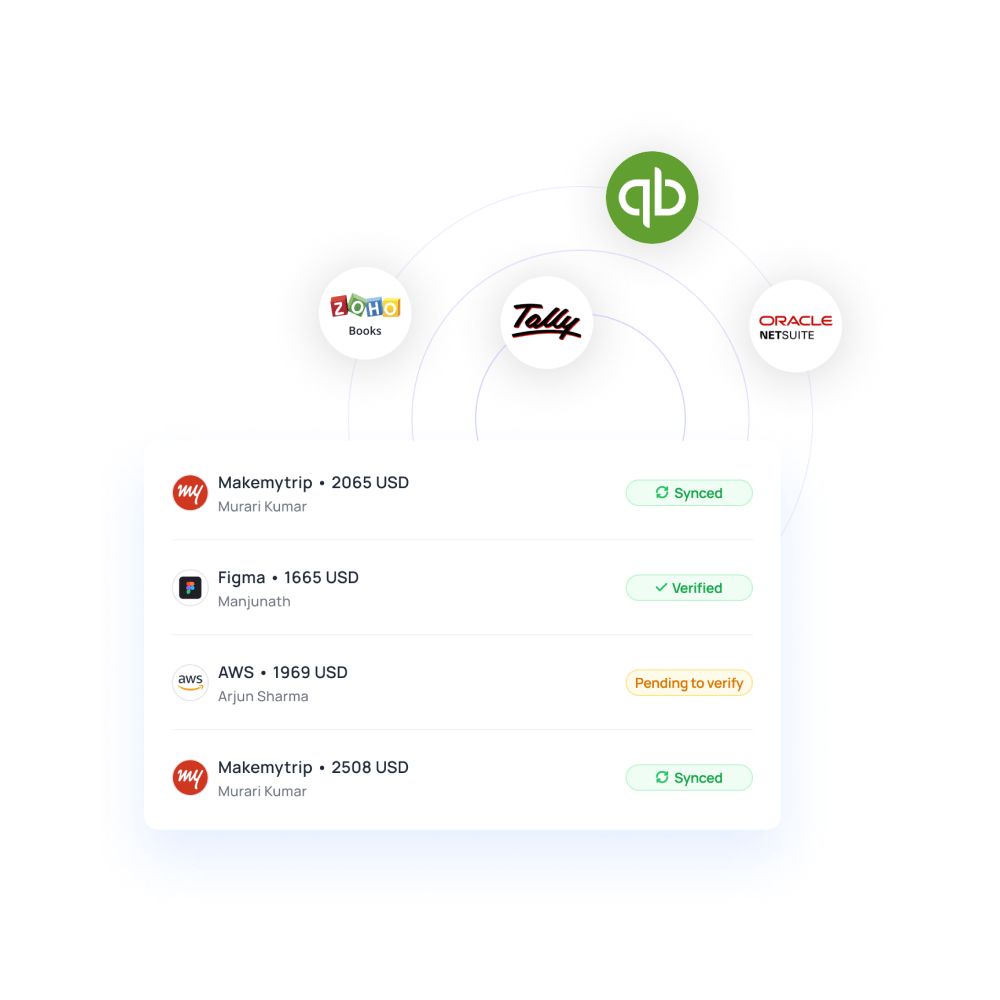

Integration with accounting software

Digital business accounts easily integrate with your accounting software, allowing you to sync your transactions automatically. They also remove the hassles of manually reconciling the receipts against your transactions.

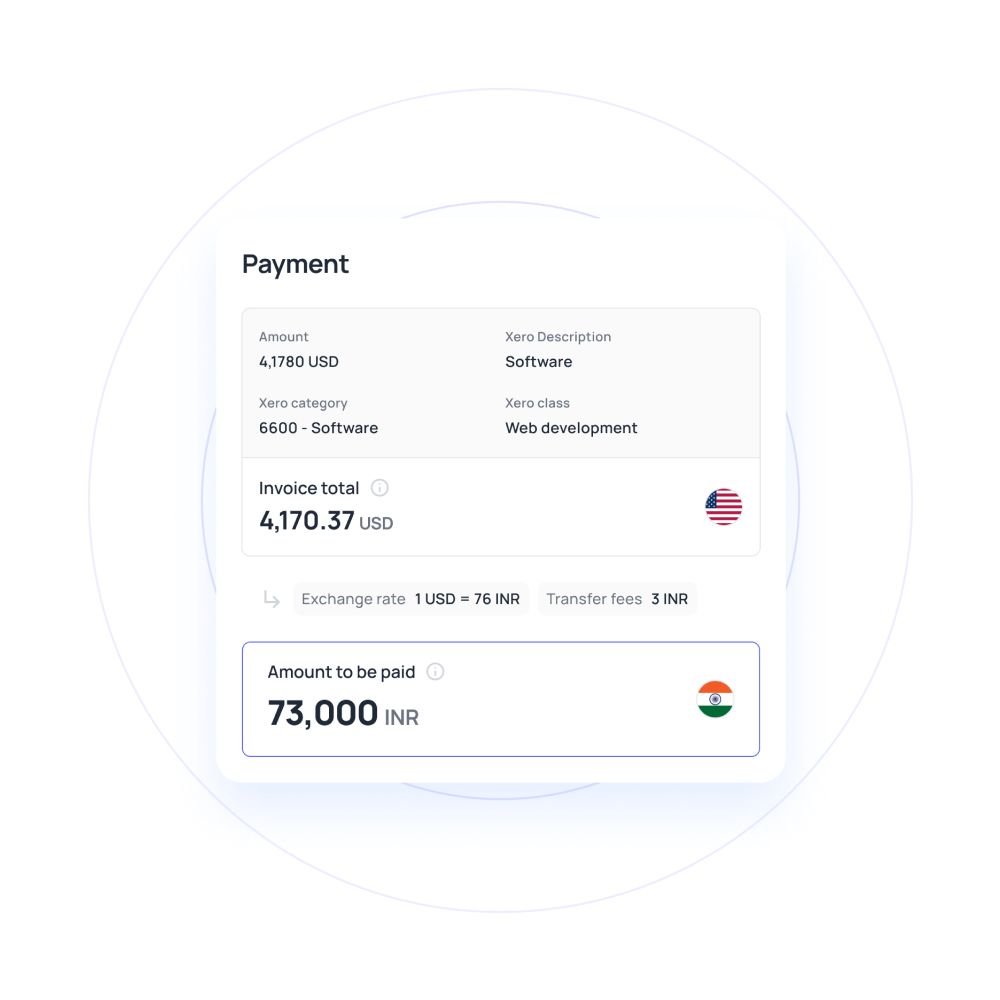

Helps save money on forex

Receiving large amounts of payments in different currencies makes it difficult to convert them to your home currency, considering the high fx commission on currency conversion. Digital business accounts let you maintain multi-currency accounts and receive funds without the need for conversion, saving a lot on fx charges.

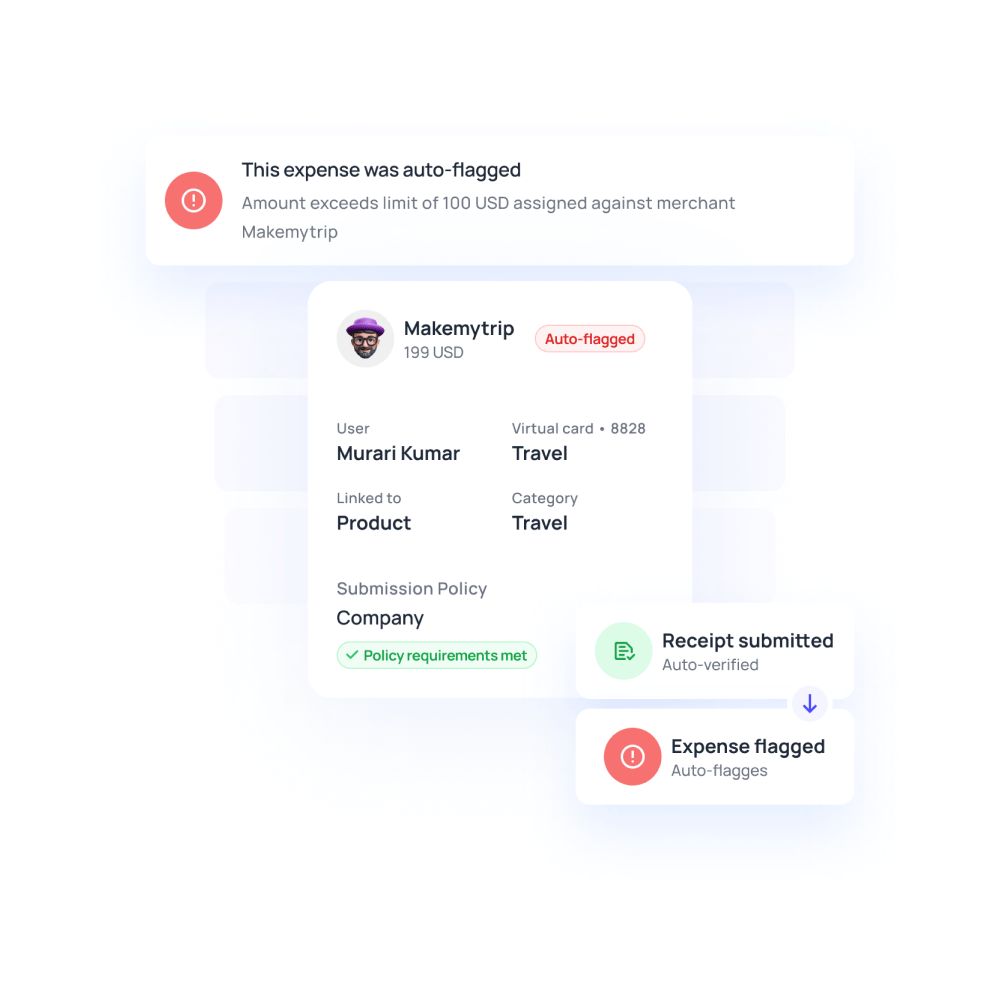

Enhanced security

Extra encryption and fraud monitoring tools make digital business accounts an excellent option to manage your business finances. You can keep an eye on fraudulent activities and resolve the issues quickly, all in real-time.

Multi-user access

Digital business account allow access to multiple users or team members in a company, helping you streamline control. This lets you allocate roles and tasks throughout the team more effectively, and improving your management process. Various team members can access one bank account within the company to approve transactions, transfers and manage the teams' budgets.

Easy account opening

You can set up your digital business account through an online process with just a few clicks. All that opening a digital business account usually requires is proof of your residence, registered business certifications, and verification ID.

Expense tracking

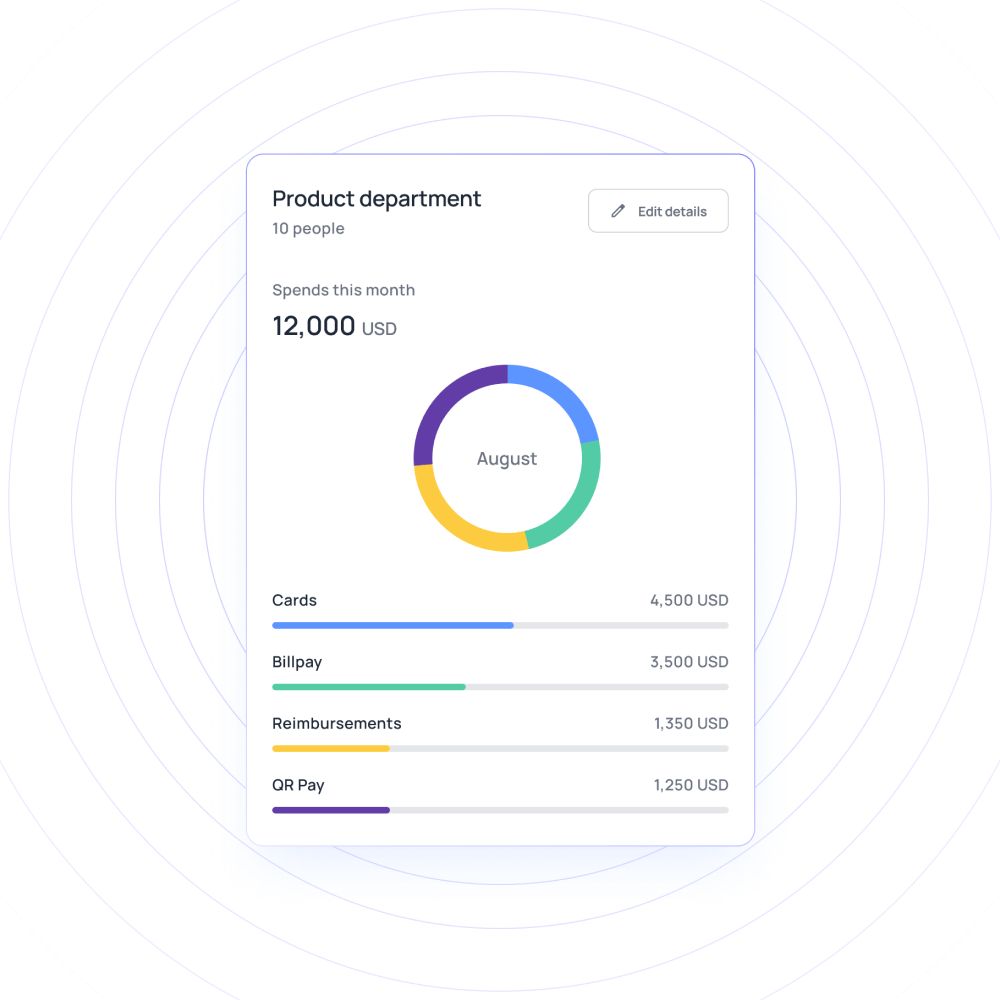

It is extremely important to know the real-time status of your funds. An accurate expense tracking system makes sure your expenses are properly collected, managed, and categorized. Digital business accounts let you do all this and check all your recent, upcoming, and scheduled payments.

Monthly fees

Digital business accounts have low to zero costs. They don't require setup or maintenance fees and don't require a minimum balance or deposit to run your account either.

Get started with Volopay

Volopay is an all-in-one financial solution for your business. It provides your teams with an prepaid business cards with custom controls and a spend tracking feature, free of cost. From software subscriptions to petty cash, business trips to internet advertising, employee reimbursements to vendor pays, we've got everything needed to manage business payments on one comprehensive platform. Volopay makes borderless payments more accessible, faster, cheaper, and more transparent.

Check this out: A complete overview of Volopay business accounts

Cross-border B2B payments

Pay your vendors in over 130 countries using low-cost, fast, and non-swift payment alternatives.

High security

We utilize encryption and access methods comparable to those used by banks. One of our significant values is customer privacy, and your information is kept safe with Volopay.

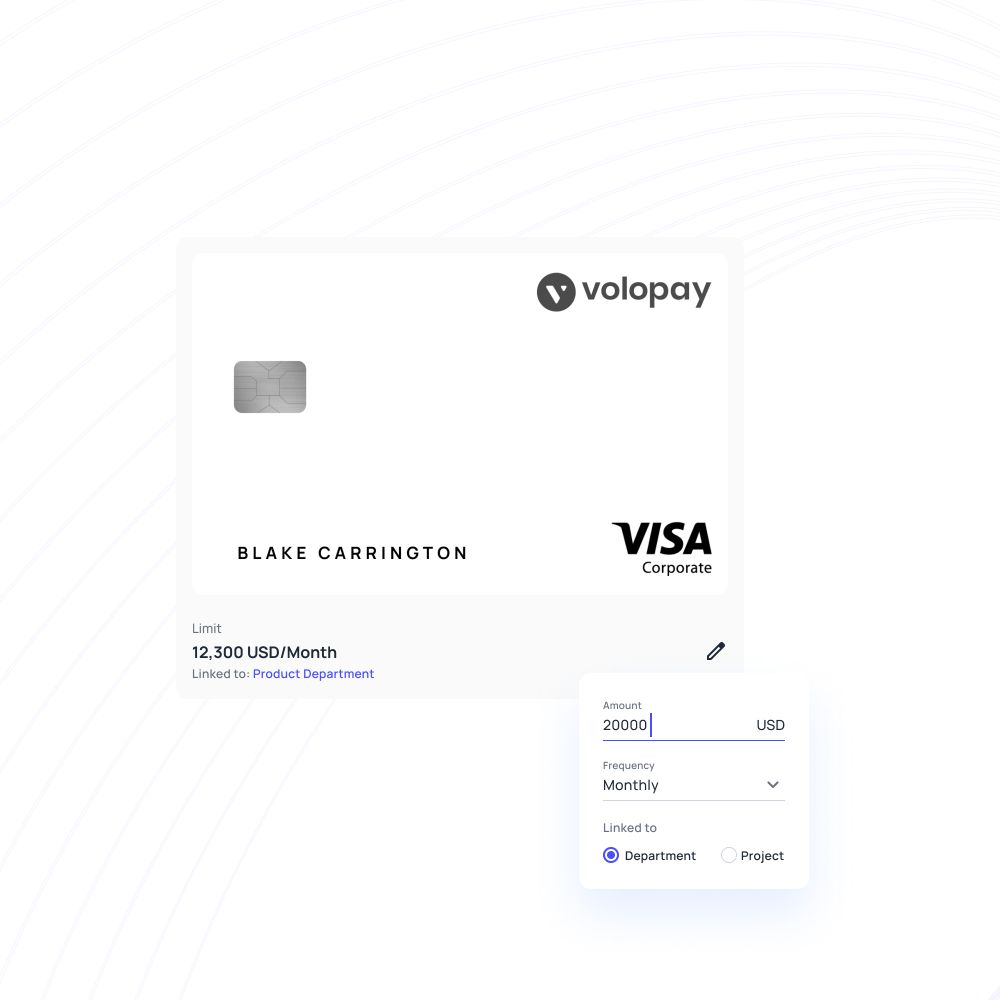

Corporate cards

Get access to corporate physical cards and unlimited virtual cards to handle various expenses, and day-to-day payments. With just a few clicks, you can control, manage, block or freeze ATM withdrawals, overseas transactions, and more on these cards.

Accounting integrations

Sync and integrate all your transactions and receipts into your accounting system and automatically match your receipts with the transactions.

Reporting and analytics

Get instant notifications concerning incoming and outgoing money with real-time transaction data at the tip of your fingers. Receive complete spend statistics, such as spending information, future and periodic payments, and granular transaction information.