What is a digital business account and what are its benefits?

Managing finances efficiently has become a major challenge for many US businesses, especially with outdated banking systems and time-consuming processes. A digital business account offers a modern solution by streamlining how companies handle their money. By embracing technology, these accounts are transforming the way organizations manage transactions, pay vendors, and monitor cash flow.

What are digital business accounts?

A digital business account is an online financial platform designed specifically to support business banking needs in the US. Unlike traditional banks, it provides seamless access to essential services like fund transfers, expense tracking, and card management, all through a digital interface.

A digital business bank account eliminates the need for physical branch visits, enabling entrepreneurs and finance teams to manage operations remotely. These accounts are built for speed, transparency, and the flexibility modern businesses demand.

Why digital business accounts are essential for US businesses

1. Streamlining daily operations

A digital business account simplifies daily tasks by automating vendor payments, payroll, and expense tracking. This saves valuable time, allowing business owners and teams in the US to focus on growth and strategy.

With real-time financial oversight, companies operate more efficiently and reduce delays in decision-making. These streamlined operations give businesses a competitive edge in fast-paced markets.

2. Reducing operational costs

By reducing manual data entry and lowering transaction fees, digital business accounts help businesses cut down unnecessary costs. Small and medium-sized US companies benefit by avoiding typical charges associated with traditional banking.

Automated tools also minimize costly errors, improving overall financial accuracy. These savings directly support profitability and sustainable growth across various industries and sectors.

3. Scaling with ease

Whether you're running a startup or a growing enterprise, a digital business account evolves with your company. It offers flexible features that adjust to increasing transaction volumes and team sizes.

There’s no need to switch providers or reconfigure systems as your business expands. This scalability ensures a stable financial foundation as US businesses pursue larger opportunities and markets.

4. Boosting market agility

With quick access to real-time data, businesses can act fast in response to market changes. A digital business account allows immediate approvals, transfers, and spending adjustments. This financial responsiveness helps US companies pivot strategies, seize new opportunities, or manage risks effectively.

The agility gained ensures stronger positioning in rapidly changing industries.

5. Supporting global transactions

A digital business bank account enables seamless international transfers, making it easier to pay overseas vendors and partners. This is especially beneficial for US businesses with global operations or ambitions.

With competitive exchange rates and reduced delays, companies maintain strong international relationships and avoid bottlenecks in supply chains. Global growth becomes more accessible and cost-effective.

6. Meeting digital expectations

Today’s customers and employees expect fast, tech-forward experiences. A digital business account delivers modern, user-friendly financial tools that match these expectations. Businesses appear more professional and responsive, which enhances reputation and satisfaction.

In the US market, where digital adoption is rising rapidly, embracing this shift helps companies stay relevant and future-ready.

Digital vs. traditional business accounts

24/7 access benefits

A digital business account provides round-the-clock access, letting US business owners manage finances anytime, anywhere. In contrast, traditional business banking relies on limited branch hours and in-person visits. This constant availability helps companies handle urgent payments or view balances on demand.

It’s a major advantage in today’s fast-moving environment, where flexibility and responsiveness are essential for financial management and success. This around-the-clock functionality supports better cash flow control and faster response to unexpected financial needs.

Faster onboarding process

Opening a digital business account typically involves a streamlined, paperless application process. Most US-based platforms allow verification and setup in just a few clicks. On the other hand, traditional business bank account applications often require lengthy paperwork, branch visits, and longer approval times.

Digital onboarding speeds up access to essential banking tools, helping businesses get started quickly and stay focused on growth from day one. It removes unnecessary friction and accelerates time-to-operation for new ventures.

Lower fee structures

Digital platforms often reduce or eliminate common fees found in traditional accounts, like minimum balance charges, maintenance fees, and transaction costs. A digital business account is designed for cost efficiency, making it more attractive for startups and small businesses.

This affordability improves cash flow management and allows more funds to be reinvested into operations, marketing, or expansion efforts. Over time, these savings add up to meaningful financial gains.

Transaction speed advantage

Digital transfers are typically processed much faster than traditional methods like paper checks or in-branch wire requests. With a digital business account, US companies experience same-day or even instant transactions, reducing delays in vendor payments or payroll.

This increased speed enhances overall business performance, supports better cash flow planning, and helps build trust with stakeholders through timely financial interactions and commitments. Quick access to funds can be crucial during urgent business decisions.

Software integration ease

Digital platforms integrate easily with accounting software such as QuickBooks or Xero, simplifying bookkeeping and reporting. A digital business bank account syncs data automatically, reducing manual input and errors. Traditional accounts, by contrast, often lack such compatibility or require third-party tools.

Seamless integration empowers businesses to stay audit-ready and gain real-time financial insights, making smarter budgeting and forecasting possible with minimal effort. It also reduces administrative workload, freeing up teams for higher-value tasks.

Modern user interfaces

Unlike traditional bank portals that often feel outdated and clunky, digital business accounts feature sleek, user-friendly dashboards and mobile apps. These modern interfaces are designed for ease of use, allowing quick navigation, expense categorization, and real-time tracking.

For US businesses, this means more control and less confusion when managing money, offering a smoother experience for finance teams, employees, and decision-makers alike. A better interface also increases overall user satisfaction and productivity.

Evolution of digital business accounts

Traditional banking challenges

Business banking once relied on branch visits, paper checks, and manual forms, causing delays in transactions and recordkeeping. These outdated systems hindered real-time decision-making and slowed down operations, especially for growing companies needing agile financial tools.

They often led to inefficiencies, errors, and unnecessary administrative burdens on finance teams.

Rise of digital platforms

Digital banking solutions emerged, offering secure online access, mobile apps, and faster processing. US businesses embraced these platforms for their ease of use and improved transaction speeds, setting the stage for widespread adoption of digital business accounts.

These platforms marked a major shift from reactive banking to proactive financial management.

Regulatory influences

Compliance frameworks from the IRS, SEC, and other bodies guide digital financial services. These regulations promote transparency and ensure that digital business bank account providers maintain industry standards and protect business data and funds.

Regulatory clarity has encouraged broader adoption by reducing risk concerns among US companies.

Technological advancements

Modern platforms use AI for smart analytics and automate routine tasks like reconciliations. Mobile access, real-time dashboards, and integrated tools enhance functionality and make the digital business account experience far superior to traditional methods.

Continuous tech upgrades further drive innovation, enabling faster and smarter financial operations.

Growing user demand

Businesses now expect faster service, mobile convenience, and scalable solutions to support evolving needs. As a result, digital platforms offer features that grow alongside the company, from startups to large-scale enterprises.

These expectations are reshaping the financial services landscape, pushing providers to innovate rapidly.

Global banking trends

With international operations rising, companies need accounts that support multiple currencies and regions. A digital business bank account makes cross-border payments easier, helping US businesses expand globally without major banking disruptions.

These features help bridge time zones, simplify currency conversions, and reduce international transfer fees.

Who uses digital business accounts?

1. Startups gaining traction

Startups use digital business accounts to control costs while managing funds efficiently. These platforms offer low-fee structures, automated tools, and easy onboarding—ideal for lean operations.

With real-time tracking and streamlined payments, startups can focus more on innovation and scaling rather than back-end financial admin. They benefit from flexibility that matches their fast-paced growth.

2. SMEs streamlining finances

Small and medium-sized enterprises (SMEs) rely on digital platforms to simplify daily financial operations. Expense tracking, budget management, and cash flow monitoring become more transparent and accessible.

This reduces manual errors and saves valuable time. For US-based SMEs, it supports better decision-making through data-driven financial visibility.

3. Enterprises centralizing control

Large organizations benefit from consolidating their financial tools into one digital ecosystem. A digital business account helps manage multiple departments, teams, and locations with unified dashboards.

It improves compliance, ensures consistency, and reduces internal process friction. Enterprises gain better control over spending and more streamlined reporting for stakeholders.

4. D2C brands tracking campaigns

Direct-to-consumer brands use digital accounts to monitor marketing and ad spend with precision. Real-time insights into campaign performance allow for faster pivots and smarter budget allocation.

These tools support integrations with e-commerce platforms, making reconciliation easier. Brands stay competitive by aligning financial activity with customer acquisition goals.

5. Tech companies scaling fast

Tech startups and growth-stage firms need scalable, API-friendly banking solutions. Digital platforms accommodate global operations, recurring payments, and fast-growing team needs.

Automated accounting syncs and multi-user access ensure smooth scaling. These features make digital business accounts the backbone of financial infrastructure for fast-moving tech companies.

6. Freelancers managing clients

Independent professionals use digital accounts to simplify invoicing, receive payments, and manage income streams. Features like instant transfers and expense categorization keep finances organized without the need for a dedicated finance team.

It supports clear client records and tax preparation. Freelancers stay focused on their work, not on back-office tasks.

Integration with US financial systems

Seamless ACH transfers

Digital business accounts integrate with the Automated Clearing House (ACH) network for quick, secure domestic payments. This allows businesses to pay vendors, employees, and partners without delays.

Funds move reliably between US bank accounts with minimal fees. It ensures dependable cash flow management and operational efficiency.

Solution for quick payments

Many digital platforms support real-time payments for instant fund transfers to suppliers and contractors. These fast-payment features help US businesses maintain strong vendor relationships and meet tight deadlines.

With minimal processing time, businesses reduce the risk of late fees. It’s a vital tool for time-sensitive financial operations.

SWIFT for global reach

Digital accounts enable international wire transfers via the SWIFT network, connecting with over 100 countries. This supports US businesses with overseas suppliers or clients by ensuring smooth cross-border transactions.

Currency conversion and global compliance features add convenience. It reduces friction in global expansion and trade.

Automated payroll systems

Integrated payroll tools allow companies to schedule and process employee salaries automatically. Digital business accounts ensure timely payments and tax deductions without manual input.

This automation reduces administrative errors and boosts employee trust. It aligns well with IRS requirements and labor law compliance.

Secure transaction protocols

Digital accounts follow strict standards like PCI DSS and end-to-end encryption to safeguard payment data. This ensures that sensitive information is protected during all stages of the transaction process.

Two-factor authentication and fraud alerts add further layers of protection. Businesses gain peace of mind and regulatory confidence.

Eligibility for digital business accounts

1. Business registration needs

To open a digital business account, your company must have a valid Employer Identification Number (EIN) issued by the IRS. Additionally, proof of state-level business registration or incorporation is required.

These verifications confirm the legitimacy of your business entity and ensure compliance with federal and state regulations. This process helps prevent fraud and unauthorized account use.

2. Financial health assessment

Account providers typically evaluate your business’s financial stability by reviewing revenue figures and credit history. This assessment helps determine your risk profile and eligibility.

A strong financial record improves approval chances and may qualify you for better account features and terms. It also reassures the provider about your ability to manage finances responsibly.

3. Required documentation

Applicants must submit key documents, including recent financial statements like balance sheets or profit and loss reports. Identification for all business owners or authorized signers, such as driver’s licenses or passports, is also necessary.

These documents support identity verification and regulatory compliance during account setup. Ensuring accurate documentation speeds up the approval process.

4. Eligible business types

Digital business accounts cater to a broad range of US companies, including small and medium-sized enterprises as well as large corporations. Industry or business size is usually not a barrier, provided the necessary documentation and financial criteria are met.

This inclusivity supports diverse entrepreneurial needs. Many providers also welcome nonprofit organizations and sole proprietorships.

5. Digital infrastructure

Providers often prefer businesses that utilize online financial management tools and have an established digital presence. This facilitates smooth integration with accounting software and payment platforms.

Companies with strong digital infrastructure can leverage the full benefits of a digital business account more effectively. It also enhances security and enables faster transaction processing.

Want to open a secure digital business account to boost growth?

Key benefits of digital business accounts

Robust security measures

Digital business accounts employ advanced encryption techniques and two-factor authentication to safeguard sensitive financial information. These security layers protect against cyber threats and unauthorized access.

Regular security audits and real-time fraud detection further enhance protection. This ensures that businesses can confidently manage funds without fearing data breaches or theft. Strong security builds trust with clients and partners.

Seamless accounting integration

These accounts easily connect with popular accounting software like QuickBooks and Xero, automating financial data synchronization. This integration reduces manual entry errors and saves time on bookkeeping tasks.

Real-time updates improve accuracy in financial reporting and tax preparation. It allows businesses to maintain a clear overview of their financial health effortlessly. Simplified workflows help finance teams focus on strategic tasks.

Foreign exchange savings

Digital business accounts offer competitive exchange rates and lower fees for international payments. This reduces the cost of sending funds abroad compared to traditional banks. Businesses benefit from transparent pricing and faster currency conversions.

These savings help companies expand globally while controlling their payment expenses. This advantage supports international growth and cash flow management.

Multi-user access control

With role-based permissions, digital accounts allow businesses to grant specific access levels to team members. This enhances security by limiting sensitive information and functions to authorized users only.

Collaboration improves as multiple users can manage finances simultaneously without compromising control. It supports efficient workflow management within organizations. Customizable permissions also reduce the risk of internal errors.

Cost-effective transactions

Digital business accounts typically have lower fees for wire transfers, ACH payments, and ATM withdrawals. This cost efficiency saves money on routine banking activities and helps manage cash flow better.

Reduced fees make it affordable for businesses of all sizes to handle daily financial operations. It contributes directly to improved bottom-line results. These savings can be reinvested in business growth.

Incentive programs

Many digital business accounts offer cashback rewards and incentive programs for regular transactions. These perks add financial value beyond basic banking services. Businesses can earn bonuses on spending or receive discounts on partner services.

Such incentives make everyday banking more rewarding and encourage continued account use. Incentives also help businesses optimize their operational expenses.

Essential features of digital business accounts

Real-time transaction dashboards

These dashboards allow businesses to track expenses and payments instantly, providing a clear and updated view of all financial activity. This immediate insight helps managers make informed decisions quickly and avoid overspending.

By monitoring cash flow in real time, companies can respond promptly to unexpected expenses or revenue changes. Enhanced visibility improves budgeting and forecasting accuracy.

Automated reconciliation tools

Automated tools link transaction data directly to accounting software, minimizing the need for manual data input. This reduces human errors and accelerates the reconciliation process, saving time for finance teams.

Accurate matching of payments and invoices improves financial reporting and audit readiness, enhancing overall business efficiency. It also supports compliance with tax regulations.

Multi-currency wallet support

Digital accounts support multiple currencies like USD, EUR, and others, enabling seamless management of international finances. This simplifies cross-border payments and reduces conversion costs.

Businesses can hold and transfer funds in various currencies without opening separate accounts, facilitating global trade and expansion efforts. It also helps in managing currency risk effectively.

Approval workflow systems

These systems enable businesses to establish multi-level payment authorization processes, enhancing security and oversight. Each transaction can require approval from designated personnel before processing, reducing the risk of fraud or errors.

Such controls ensure compliance with company policies and improve accountability within the finance team. Customizable workflows can adapt to changing business needs.

Mobile app accessibility

Mobile apps for iOS and Android let users manage their accounts anytime, anywhere, offering unmatched convenience. Businesses can check balances, approve payments, and review transactions on the go.

This flexibility supports timely financial management, especially for teams working remotely or traveling frequently. Push notifications keep users informed of important account activity instantly.

Versatile payment options

Digital business accounts support a variety of payment methods, including ACH transfers, wire payments, and business debit or credit cards. This variety meets diverse operational needs and vendor preferences.

It streamlines both incoming and outgoing transactions, helping businesses maintain smooth cash flow and vendor relationships. Multiple payment choices also improve customer satisfaction.

Choosing a digital business account provider

1. Match your business scale

Select a provider that aligns with your company’s size and needs. Small and medium enterprises benefit from flexible, easy-to-use solutions, while larger enterprises require comprehensive platforms that can handle complex operations and high transaction volumes.

Choosing the right scale ensures smooth financial management and room for future growth. An ill-fitting provider can lead to inefficiencies or unmet needs.

2. Prioritize security standards

Look for providers that comply with industry security requirements such as PCI DSS and offer two-factor authentication. Strong security measures protect sensitive financial information from cyber threats and fraud.

Ensuring these standards gives your business peace of mind and builds trust with customers and partners. Security breaches can cause significant financial and reputational damage. Regular updates and audits from providers also demonstrate a commitment to safeguarding your data.

3. Integration capabilities

Choose digital accounts that seamlessly integrate with popular accounting software like QuickBooks, Xero, or similar platforms. This connection automates bookkeeping and reduces manual work.

Smooth integration enhances accuracy and allows your finance team to focus on strategic tasks instead of data entry. Integration also supports real-time financial insights, helping managers make timely decisions. Check if your provider offers APIs or custom integrations to suit your unique workflows.

4. Reliable customer support

Opt for providers offering 24/7 support through chatbots, phone, or email. Effective onboarding assistance and prompt issue resolution are crucial for uninterrupted business operations.

Reliable customer service helps maintain productivity and reduces downtime caused by account or transaction problems. Poor support can delay critical transactions and frustrate users. Prioritize providers with positive reviews and multiple support channels.

5. Transparent fee structures

Select accounts with clear and straightforward pricing to avoid unexpected costs. Transparent fees help businesses budget accurately and evaluate the true cost of banking services. Avoiding hidden charges fosters trust and allows for better financial planning.

Complex or opaque fee models can hurt your bottom line over time. Ensure the provider clearly outlines fees for transactions, transfers, and account maintenance.

6. Global financial tools

Consider providers offering foreign exchange savings and multi-currency account support. These features are essential for businesses dealing with international suppliers or customers. Access to global tools simplifies cross-border payments and reduces currency conversion expenses.

Efficient global payment options help businesses expand without banking barriers. Look for features like competitive FX rates and support for multiple currencies to maximize value.

Setting up your digital business account

Submit online application

Complete the application by providing your EIN and necessary financial documents through a fully digital process. Accurate information speeds up approval and minimizes delays. Keep digital copies of your submissions for easy reference.

A streamlined application lets you start managing your finances quickly and efficiently. The online method saves time compared to traditional paperwork.

Research US providers

Evaluate a variety of banks and fintech companies to find the best match for your business needs. Consider fees, security features, and customer reviews to ensure the provider offers suitable services.

Reviewing multiple options helps you make an informed decision that supports your growth. Reading terms carefully avoids surprises later. This foundation ensures smooth financial operations.

Business identity

Undergo digital identity verification by submitting ID documents and completing secure authentication steps. These measures protect your business from fraud and ensure compliance with regulations.

Providers use advanced technology to make this process fast and user-friendly. Strong identity verification secures your account from unauthorized access. This step is essential for maintaining financial safety.

Activate your account

Activate your account via the provider’s app or website to gain immediate access to banking tools and features. Setting up login credentials and security settings enables you to start transactions right away.

Activation marks the beginning of your digital banking experience and helps you manage funds without delay. Most activations are quick and simple. This step allows you to take full advantage of your account.

Configure integrations

Connect your digital business account with accounting software like QuickBooks or Xero for automated workflows. Integration reduces manual data entry and improves reporting accuracy. Many providers offer APIs or direct sync features to make setup easy.

Proper configuration allows real-time tracking and smooth bookkeeping. This connection streamlines your financial management processes.

Assign team permissions

Set role-based access controls to regulate which employees can manage or view funds. Assign permissions based on job functions to enhance security and accountability. Flexible permission settings allow you to adjust access as your team evolves.

Controlled access prevents unauthorized transactions and reduces risks. Effective user management supports smooth collaboration within your organization.

Streamlining operations with digital business accounts

Instant financial insights

Leverage real-time dashboards to monitor your business expenses as they occur. Immediate visibility helps you make faster financial decisions and manage cash flow effectively.

These insights reduce surprises and improve budget control, keeping your business on track. Instant updates allow for proactive expense management and better resource allocation.

Automated tax reporting

Generate IRS-compliant reports automatically to simplify your tax filing process. Automation cuts down manual work, reducing errors and saving valuable time during tax season.

These reports ensure accuracy and help you stay compliant with federal requirements. Automated reporting improves efficiency and minimizes the risk of penalties.

AI-powered fraud detection

Receive instant alerts for unusual or suspicious transactions, enhancing your account’s security. AI algorithms continuously analyze patterns to detect potential fraud before it causes harm.

This proactive protection safeguards your business funds and sensitive information. Advanced fraud detection tools reduce risks and provide peace of mind.

Efficient vendor payments

Schedule automatic, recurring payments to vendors, ensuring invoices are paid on time without manual intervention. This consistency strengthens vendor relationships and avoids late fees or service disruptions.

Efficient payment workflows help maintain smooth operations and vendor trust. Automated transfers streamline cash management and improve business reliability.

Collaborative team access

Grant multi-user access with customizable roles and permissions to securely manage financial activities across your team. Controlled access helps prevent unauthorized transactions while enabling smooth collaboration.

Role-based permissions support accountability and transparency within your organization. Secure team access balances flexibility with strong financial oversight.

Tax-ready categorization

Automatically categorize expenses for easy tax preparation and accurate bookkeeping. Proper sorting simplifies audit processes and supports better financial reporting throughout the year.

This feature reduces manual effort and helps ensure compliance with tax regulations. Tax-ready categorization makes managing business finances more efficient and organized.

Cost-saving strategies for digital business accounts

1. Utilize reward programs

Take advantage of cashback offers and incentive schemes to increase your financial gains. These programs can reduce overall expenses by returning a portion of your spending.

Regularly using rewards helps improve cash flow and provides added value to everyday transactions. Maximizing these benefits supports smarter business spending.

2. Minimize FX expenses

Leverage multi-currency wallets to make international payments more affordable and avoid costly conversion fees. This approach helps businesses save on foreign exchange charges while dealing with global suppliers.

Efficient currency management improves profit margins and supports smoother cross-border operations. Minimizing FX costs is crucial for businesses with global reach.

3. Reduce transaction fees

Plan transfers and withdrawals carefully to avoid unnecessary charges that can add up quickly. Selecting fee-free options or timing transactions strategically lowers banking costs.

Monitoring fees regularly helps keep expenses under control and maximizes your account’s cost efficiency. Reducing transaction fees contributes to healthier business finances.

4. Automate financial tasks

Streamline expense tracking and reporting through automation to cut down on manual labor expenses. Automating routine tasks increases accuracy and frees staff to focus on higher-value work.

This reduces operational costs and enhances productivity across the finance team. Automating workflows leads to long-term savings and efficiency.

5. Monitor spending patterns

Use data analysis tools to identify trends and adjust budgets for better resource allocation. Spotting overspending or inefficient areas helps tighten controls and avoid wasteful expenditures.

Optimizing spending ensures that funds are used strategically to support growth and profitability. Consistent monitoring drives smarter financial decisions.

6. Conduct regular audits

Perform periodic reviews to uncover inefficiencies and ensure financial processes are cost-effective. Audits help identify areas for improvement and prevent potential losses or oversights.

Maintaining lean operations through audits strengthens financial health and boosts accountability. Regular audits are essential for sustainable cost management.

Elevate your finances with Volopay’s business account

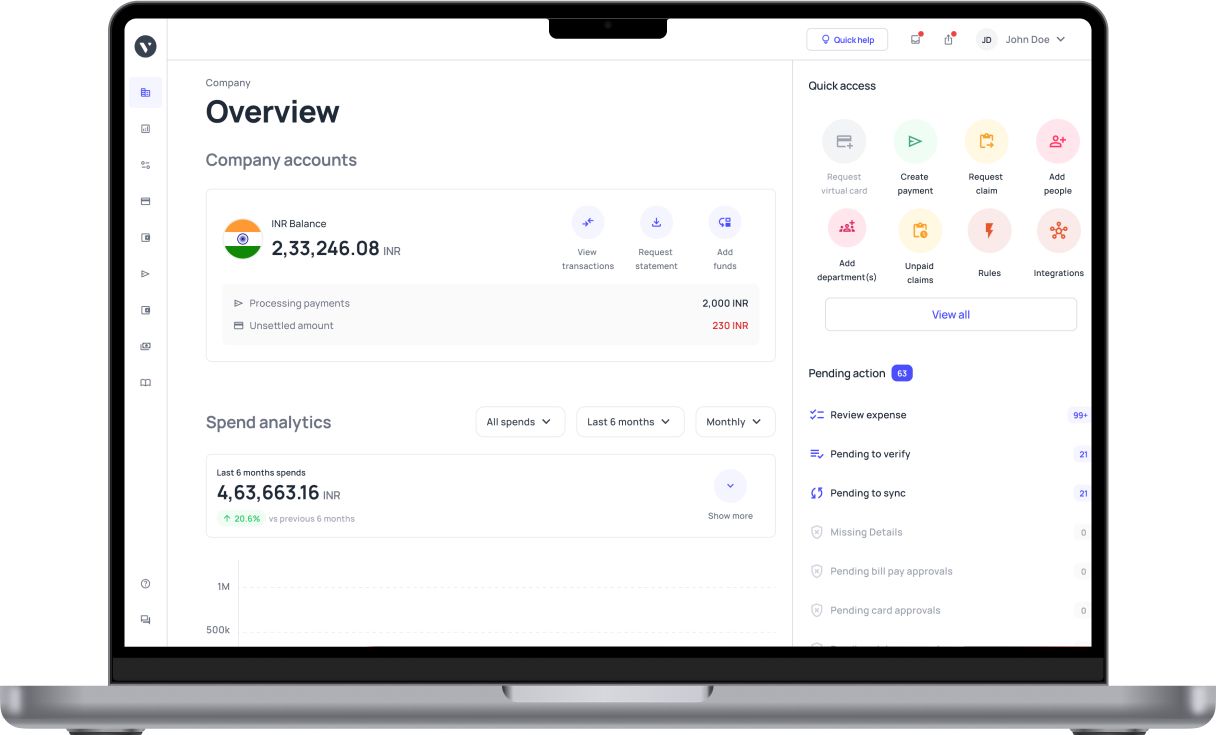

The Volopay business account is designed to revolutionize how your company manages its money. It goes beyond traditional banking by integrating all essential financial operations, providing you with unprecedented control and clarity over your expenses, payments, and reporting.

Comprehensive financial platform

Volopay provides a unified system to manage payments, expenses, and reporting all in one place. This simplifies your financial workflows and keeps everything organized. Having a single platform helps reduce errors and improves overall efficiency.

It makes managing your business finances smoother and less time-consuming.

Seamless software integrations

Connect effortlessly with popular accounting software like QuickBooks, Xero, and NetSuite for automated bookkeeping. These integrations eliminate manual data entry, saving you time and reducing mistakes.

Automated syncing keeps your financial records up to date without extra effort. It allows your accounting processes to run more smoothly and accurately.

Real-time financial dashboards

Access live dashboards that give instant visibility into your expenses and cash flow. This helps you stay on top of your finances and make quick decisions. Real-time tracking improves budget control and reduces surprises.

With up-to-date data at your fingertips, you can proactively manage your business spending.

Unmatched security standards

Volopay implements advanced security protocols to protect your financial data and prevent unauthorized access. These measures ensure your sensitive information stays safe from cyber threats.

You can rely on the platform’s robust security to keep your accounts secure. Strong protection builds trust and peace of mind for your business.

Team collaboration features

Easily assign roles and control permissions for multiple users to manage finances efficiently as a team. Customizable workflows streamline approvals and ensure secure access to funds.

This setup enhances transparency and accountability within your organization. Team collaboration tools make financial management more organized and controlled.

Bring Volopay to your business

Get started now