Global business account for expense management

Sending money via wire transfers for businesses can be a costly affair. This is especially true when you want to send money across national borders. International money transfers levy currency conversion and hefty bank charges. This is where a global currency account can help startups incur low money transfer costs.

What are business accounts?

A global business account is essentially an online-only finance account provided by fintech solutions like Volopay. The convenience that most individuals experience with online banking for their personal finance is the experience that a business account brings for entrepreneurs to manage all their company finances.

Be it vendor payments, international & domestic money transfers, an online multi currency account, or corporate cards; a business account equips an organization with all the right financial tools to streamline and make better utilization of business budgets. This in turn also leads to better financial accounting.

Suggested read: What is a digital business account and what are its benefits?

Traditional bank accounts vs business accounts

Opening a traditional business bank account might seem like the obvious answer for companies to manage their funds. But, most startups in their early stages do not qualify to open a business account with a bank due to their low credit eligibility and the deferring sources of income which are considered risky.

Opening a digital business account with a provider like Volopay on the other hand is very quick and seamless. Thanks to our flexible infrastructure, we can accommodate businesses of varying sizes and help them in the best possible way.

How Volopay’s business account is better than bank?

A global business account that you can create on Volopay also includes many things that are not part of a traditional business bank account such as real-time expense tracking, creating a physical prepaid card for every employee who needs one, being able to issue unlimited virtual cards, a mobile app to manage expenses, flexible credit lines with easy application and repayment options, vendor management, and much more!

Accounts payable

Our entire expense management software system is a way for your organization to manage all accounts payable. Corporate cards help you streamline employee expenses and money transfer features help with paying vendors within domestic as well as international borders.

Multi-currency global account

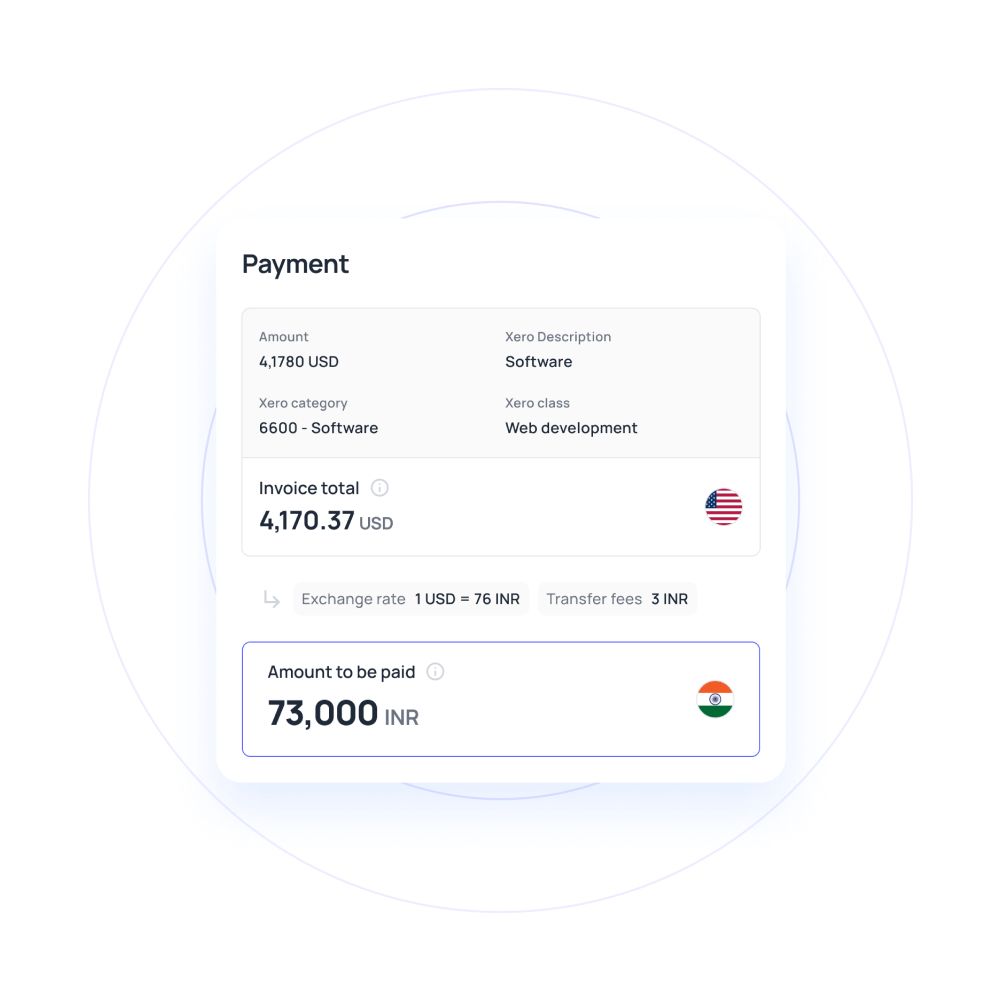

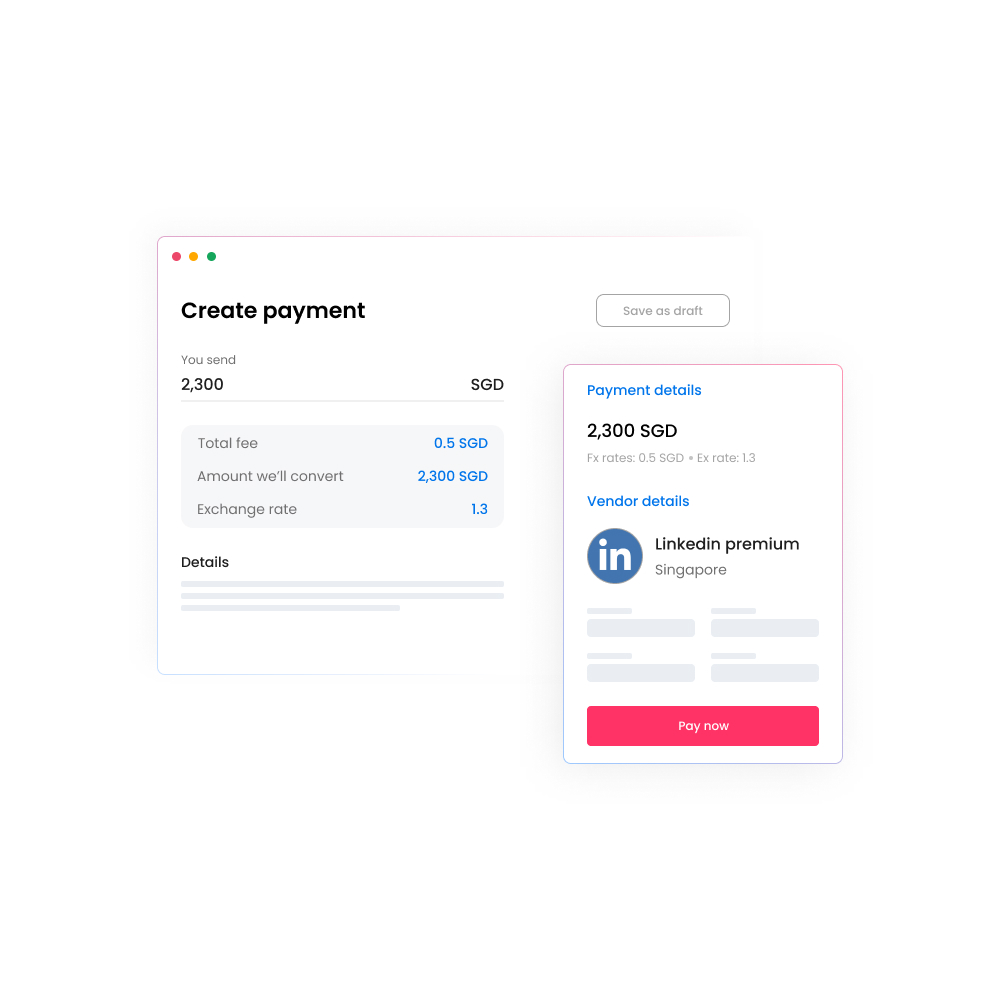

Probably the biggest pain point, when a business wants to transfer money internationally, is the heavy forex and bank charges. The money transfer system within Volopay is built with infrastructure that allows us to levy the lowest interchange fees and in some cases no FX fees thanks to the multi currency capability.

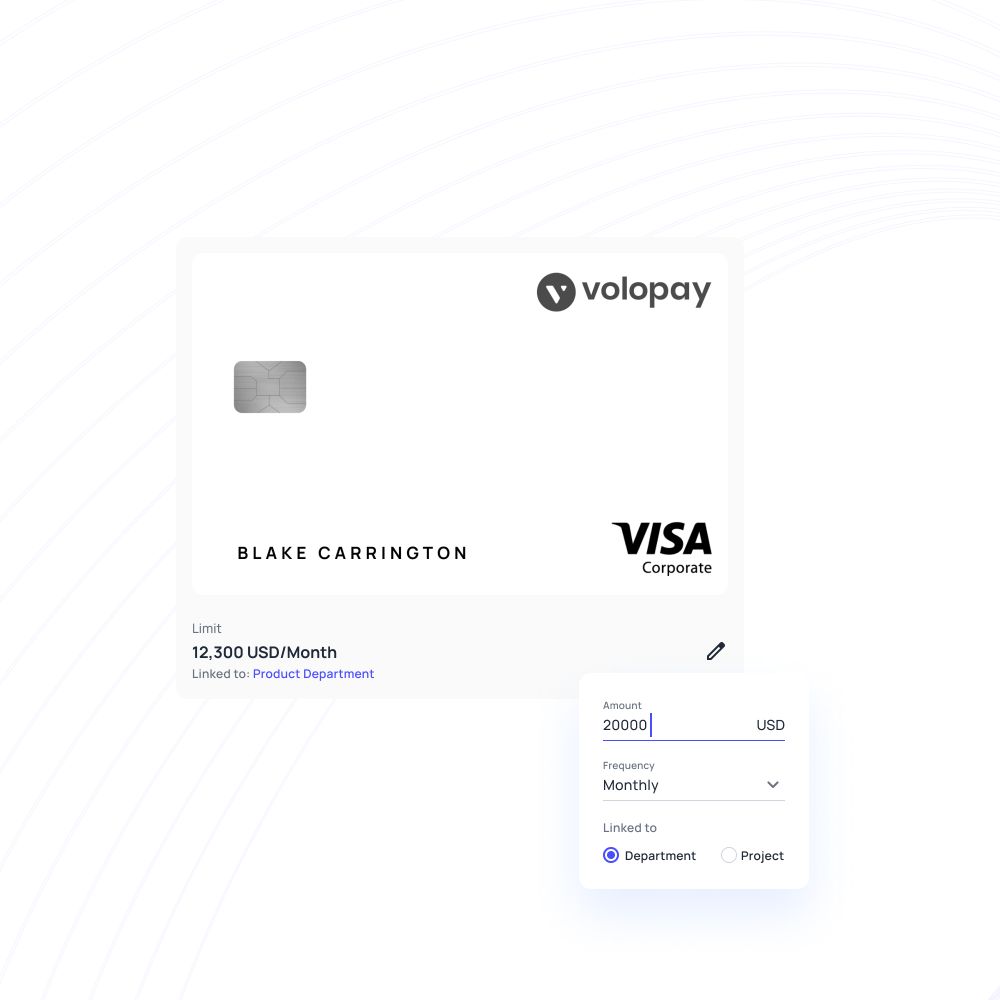

Corporate cards

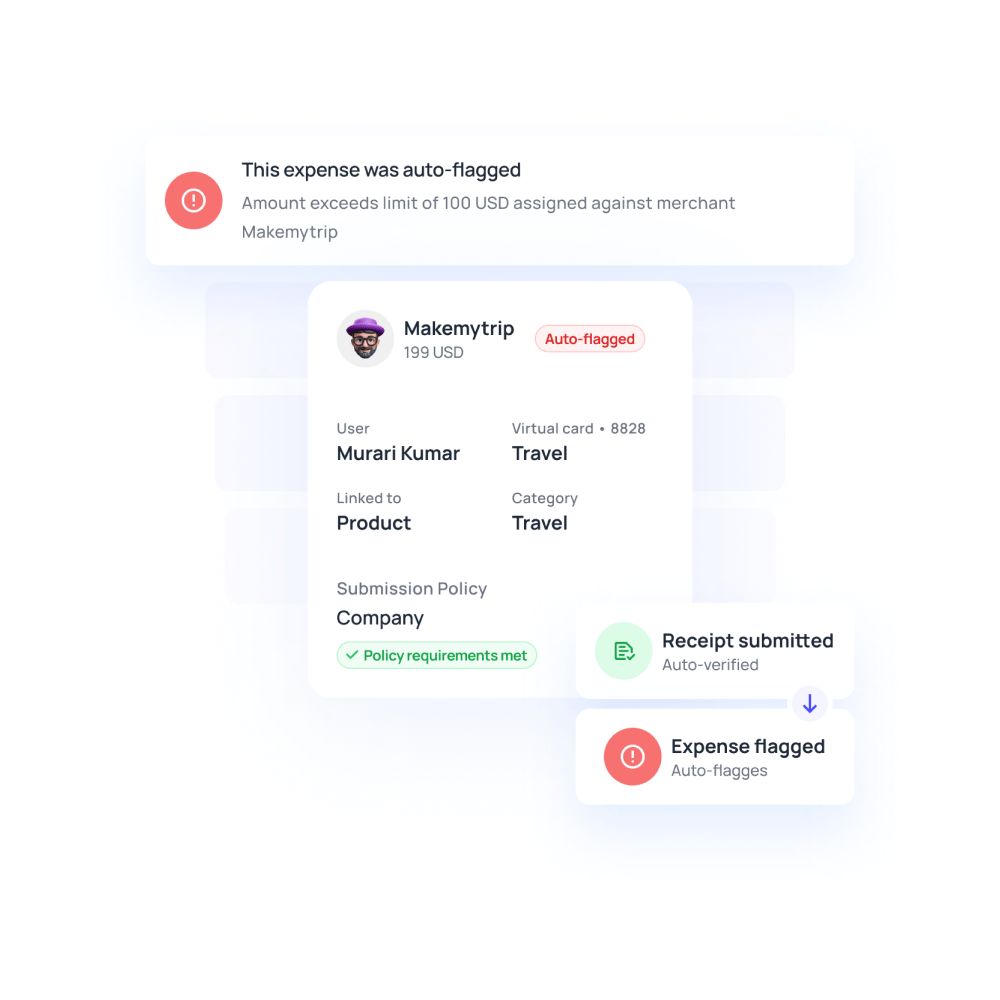

Part of Volopay’s business account is the option to get corporate credit cards to manage employee expenses. You can issue one physical card per employee and also create unlimited virtual cards through the Volopay dashboard. You can set spending limits and create approval policies within our platform and control expenses for each card.

Get real-time visibility of spending

All transactions occurring through Volopay are recorded on our system in real-time. This gives your finance team and admins on the platform visibility of overall expenses. This cuts down the time that employees spend making expense reports and also helps a business stay on top of how the company budget is being utilized.

Domestic & international money transfers

To further minimize the extra cost of sending money internationally, we give our customers the ability to create multi currency accounts that let you store and transfer money in the local currency of a country so that you save money on conversion charges. Wiring money domestically is also extremely fast thanks to a simplified transferring system.

What is multi currency business account?

Generally, a traditional bank account allows a user to transact in only one currency. But even when international transactions are permitted, it costs a heavy currency conversion fee where you end up spending more than what you wanted to.

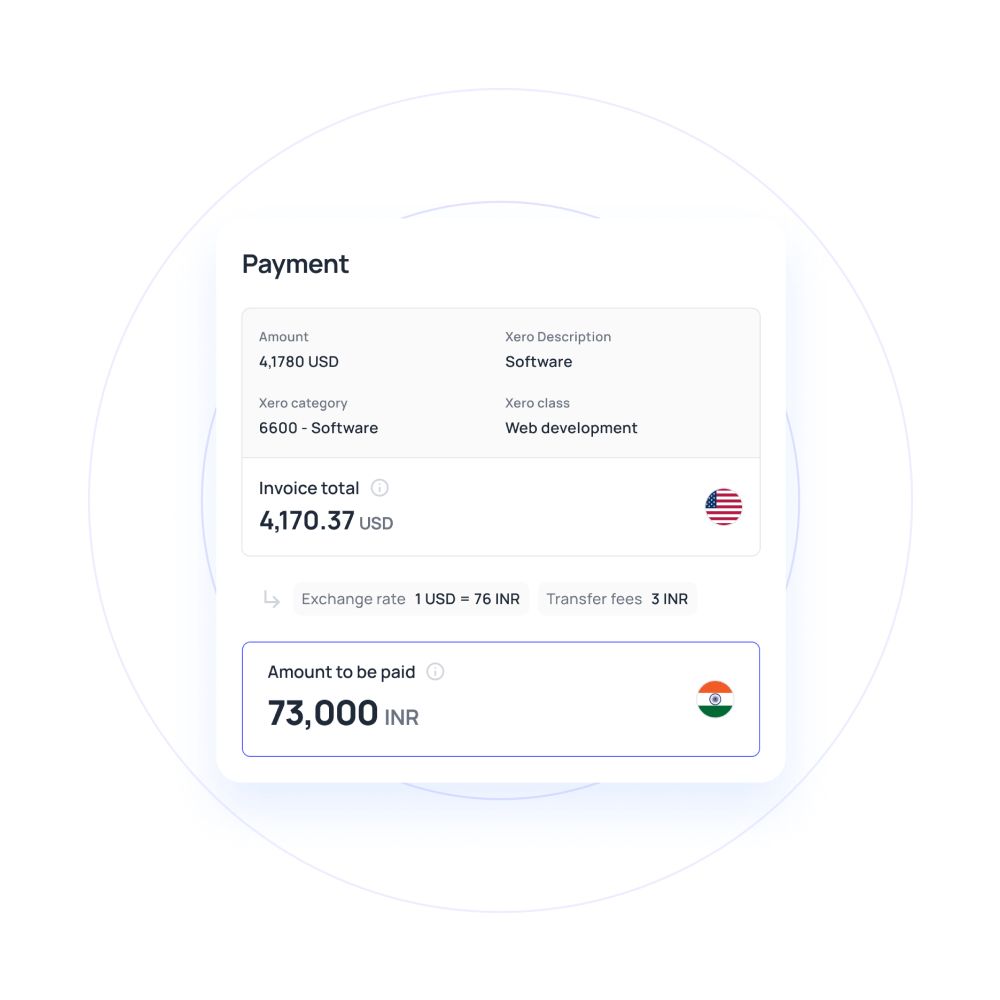

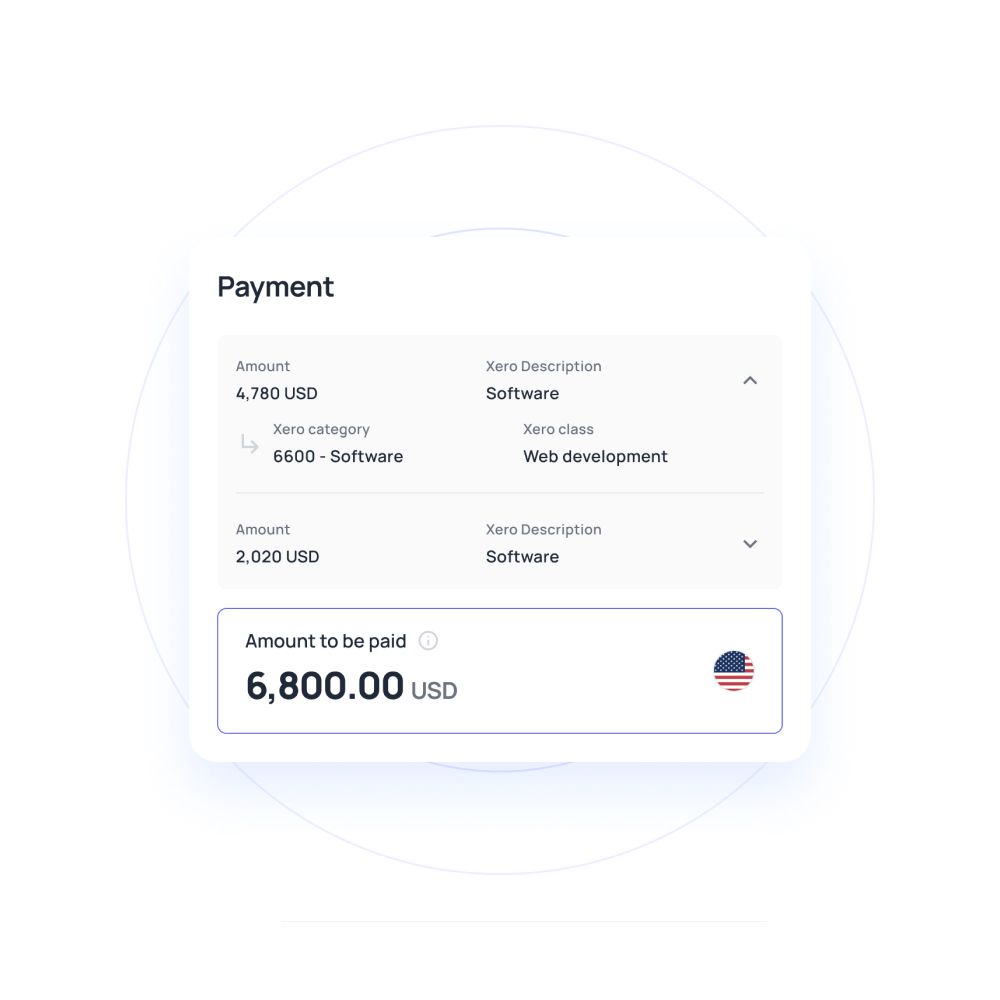

A multi currency account for business on Volopay lets you hold money in different currencies. By doing this you can wire transfer money without incurring any FX charges. For a business, every penny matters. And over time, the costs you save on conversion fees add up to a significant amount that increases financial efficiency.

Pay, receive and hold multiple currencies in a single account

How multi currency global account help your business to manage expenses?

A multi currency account on Volopay basically stores money in separate virtual wallets that are set up with currencies that you want to transact in. This allows you to transfer money internationally much faster as you pretty much end up replicating a domestic transfer where money is being sent in the local currency of the country you are sending it to.

Better customer experience

Not only is using a global currency account extremely convenient for you, but also for the people and businesses that you are transferring money to. When vendors and suppliers receive money quickly and on time, it helps to nurture and build your business relationship with them.

Hold money in multiple currencies

Many businesses deal with vendors and suppliers located in different countries. Paying these vendors can be a hassle if you don’t have a multi currency account for business. By holding multiple currencies within a single global business account, you can easily manage all vendors without having to worry about setting up separate payment methods for them.

Faster payments

The slow transfer of funds is usually the roadblock when it comes to carrying out business operations efficiently. Digitization of the economy, especially the financial industry has helped tremendously in the speed of operations. A FinTech platform like Volopay is very agile and can process payments much faster than traditional networks.

Managing in a single platform

A payment method you use for your business might not be available or suitable for a vendor that you are dealing with in another country. With multiple vendors in multiple countries, a business usually ends up having to set up various payment platforms to accommodate this drawback. With Volopay, you can simply use a single platform for all your transfers as we support 65+ currencies in 100+ countries.

SWIFT and NON-SWIFT payment options at the lowest rates

Volopay's business account lets you transfer money through non-SWIFT as well as SWIFT payment methods. So even though we use a simplified banking system, we still maintain the safety and security of your money for domestic and international transfers by adhering to all the security protocols and using safe payment networks like SWIFT.

What is domestic money transfer?

Domestic money transfers refer to when you send funds to another entity within the same national borders as your business. Domestic wire transfers are quite simple and easy to carry out using a business account to vendors and are also used as a means for disbursing salary payments to all your employees within the same country.

Safe and secure transaction

While most companies have moved their vendor payments online, there are still many who carry out their vendor payouts using cash or cheque because they feel it is safer.

Needless to say, but just to make it clear, any transaction you carry out through Volopay corporate credit cards or the money transfer feature is all protected with industry-grade security protocols so that your finances and sensitive data are safe.

Instant money transfer

Domestic money transfers on Volopay are extremely fast. Money transfers that usually take up to a day or two on traditional banking networks take minutes using our platform.

An agile accounts payable system like this helps your business stay on top of all expenses that are due and finish paying them within minutes.

Cost effective

Money transfers through Volopay are processed much faster than traditional methods and hence the receiver receives their payment much quicker.

This in turn leads to faster operations and cost-effectiveness in terms of the time that it takes for your business to move forward and get things done.

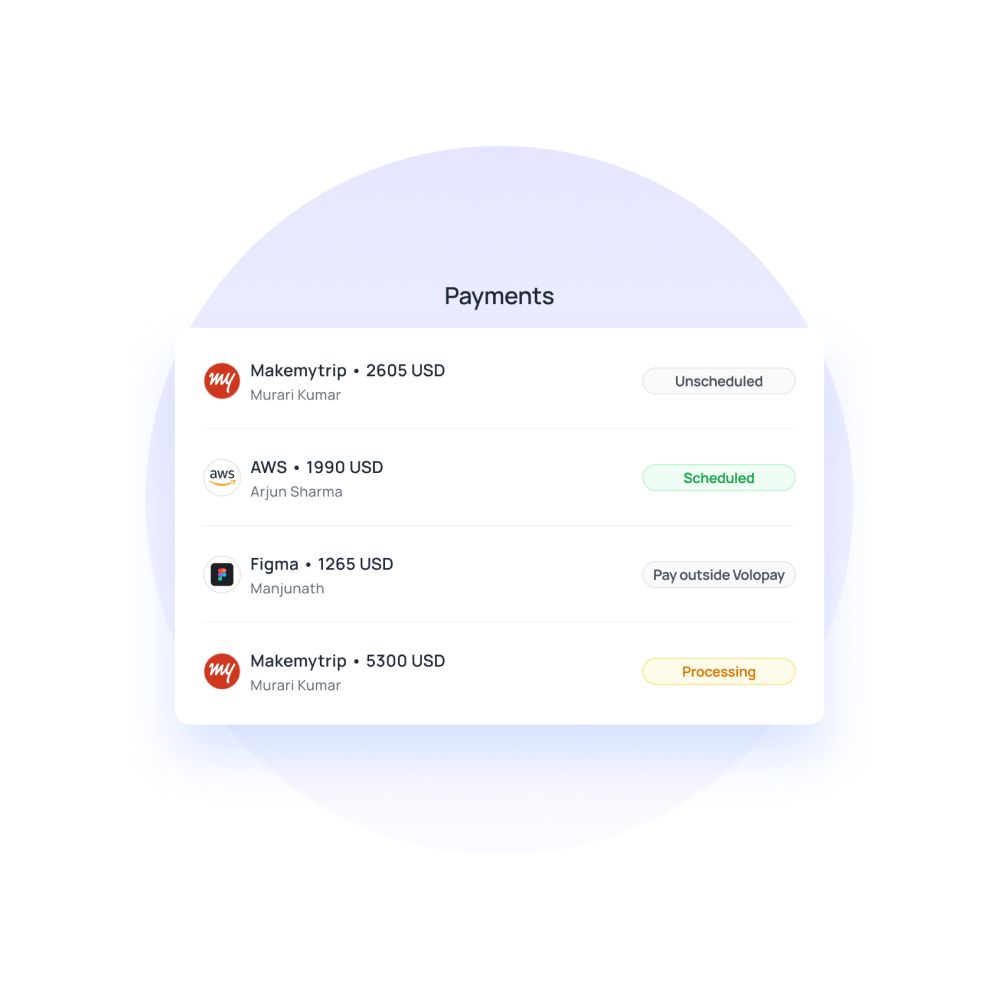

Vendor payments

The local payment transfer method using our platform is great for businesses in various use cases. Two of the most commonly needed and used circumstances are that of paying local vendors and your employees.

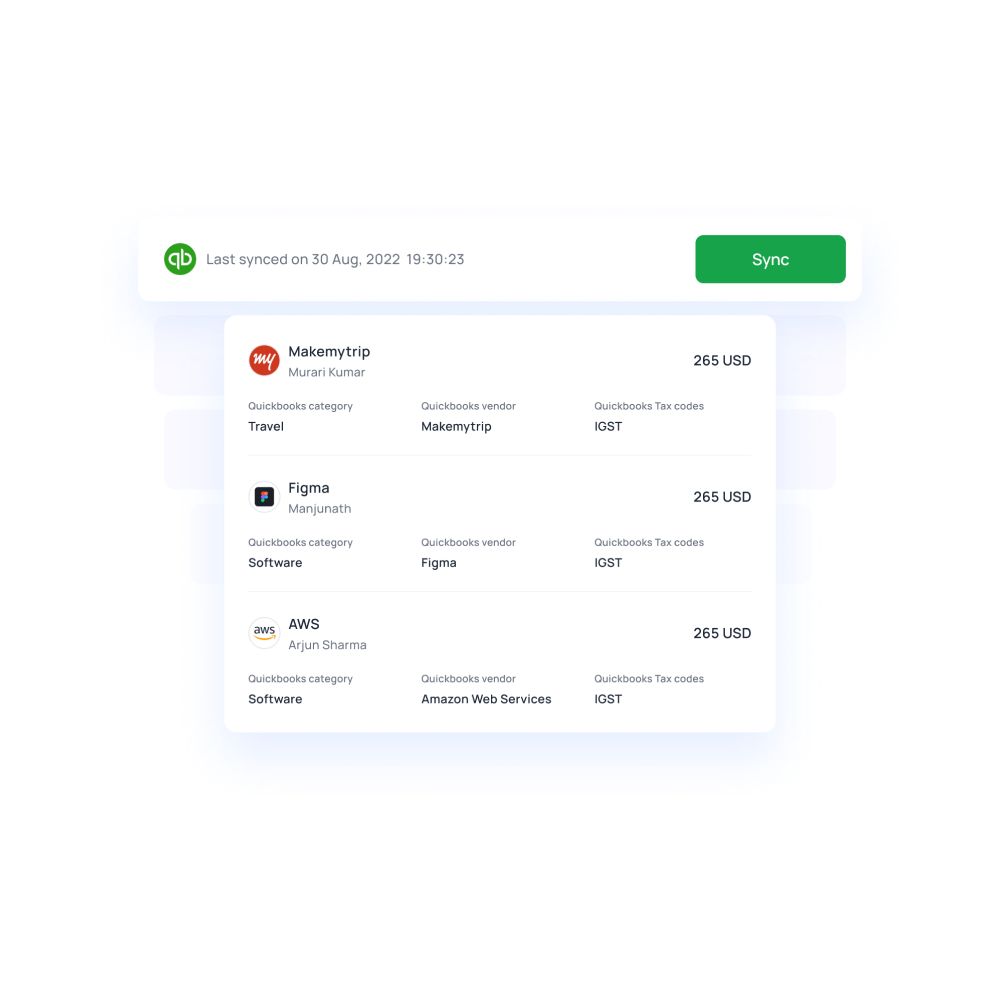

The salary of every employee in the same country can be processed much faster and also easily recorded in your accounting software automatically thanks to our seamless integrations with accounting tools.

Transfer money anytime

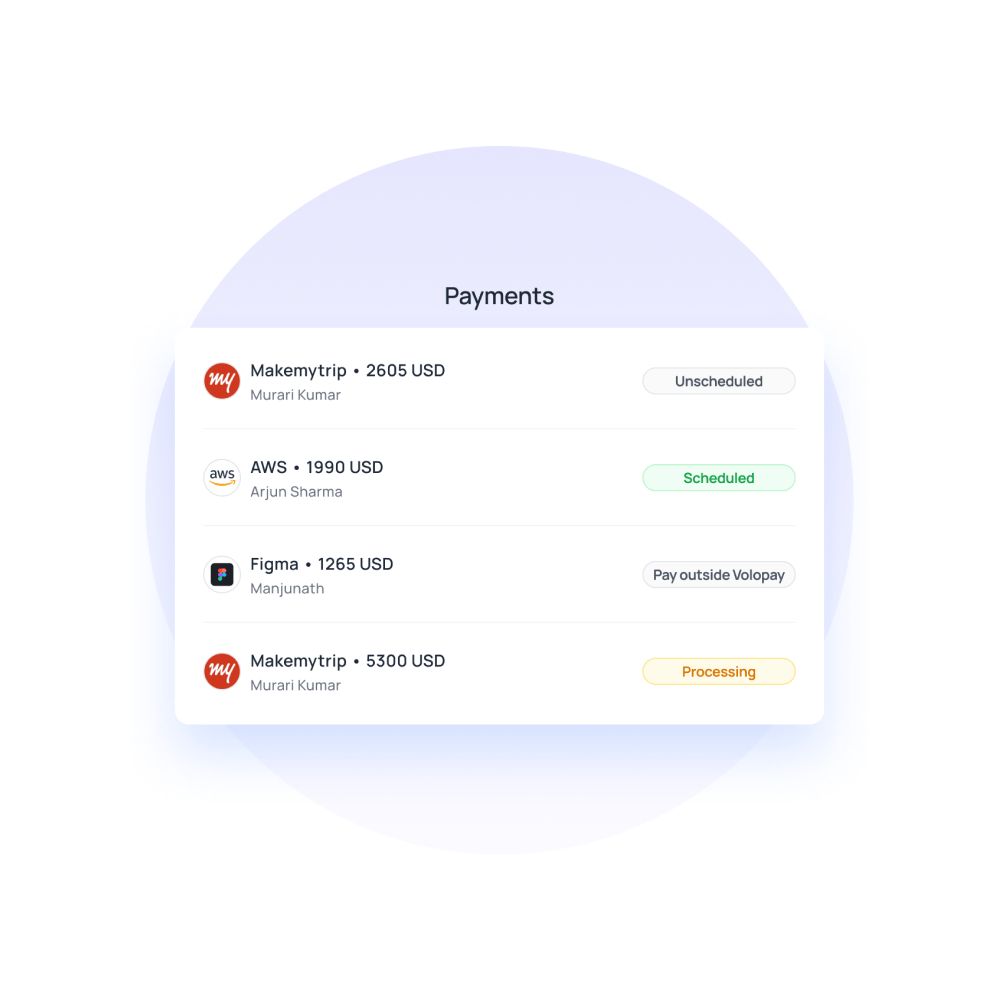

A great feature you get with Volopay’s money transfer system is the ability to schedule and set recurring payments for vendor invoices. You can create recurring payments for regular vendors who supply the same material each month.

You can also schedule payments on a custom date of your choice or set them to automatically pay the invoices once an approver on the system approves the payment request.

Check this: Guide to Automated Clearing House (ACH) payments

Make international money transfer with Volopay

Traditional international money transfers through banks are usually processed using the SWIFT network to transfer money from your account to the receiver’s account. On average it takes anywhere from a day to a week for the money to be transferred depending on the bank you use and the region you are sending money to.

With Volopay’s global business account, sending money across borders is faster and cheaper than ever before. Your vendors no longer have to wait for days and weeks to receive their payments. Plus, with the lowest interchange rates, you don’t have to spend a lot of extra money to ensure that the receiver receives exactly what they’re supposed to.

The reason why Volopay can offer you cheaper interchange fees as compared to legacy banking systems is the simplified infrastructure that our platform is built on. While it is more simplified, we have still managed to enhance the level of safety and security with better transfer speeds.

Traditional banks often have to rely on a wide network of banks to carry out currency conversion and then finally transfer the amount that you send. The backend infrastructure of Volopay allows money to be transferred much more quickly as compared to traditional banks thanks to the multi currency support.

When you use Volopay to transfer money internationally, you get to control your budget spending by setting up approval policies and enforcing them. So if an employee is sending a vendor payment using the bill pay feature, it will be notified to the approvers. Only once they approve and the amount be deducted from your account and be transferred to the respective entity.

The common problem with having different vendors in different countries is the aspect of not being able to pay all of them through a single platform due to currency and regulation issues. Instead of using separate payment methods for different vendors, Volopay makes it easy to pay and track all payments through one single platform.

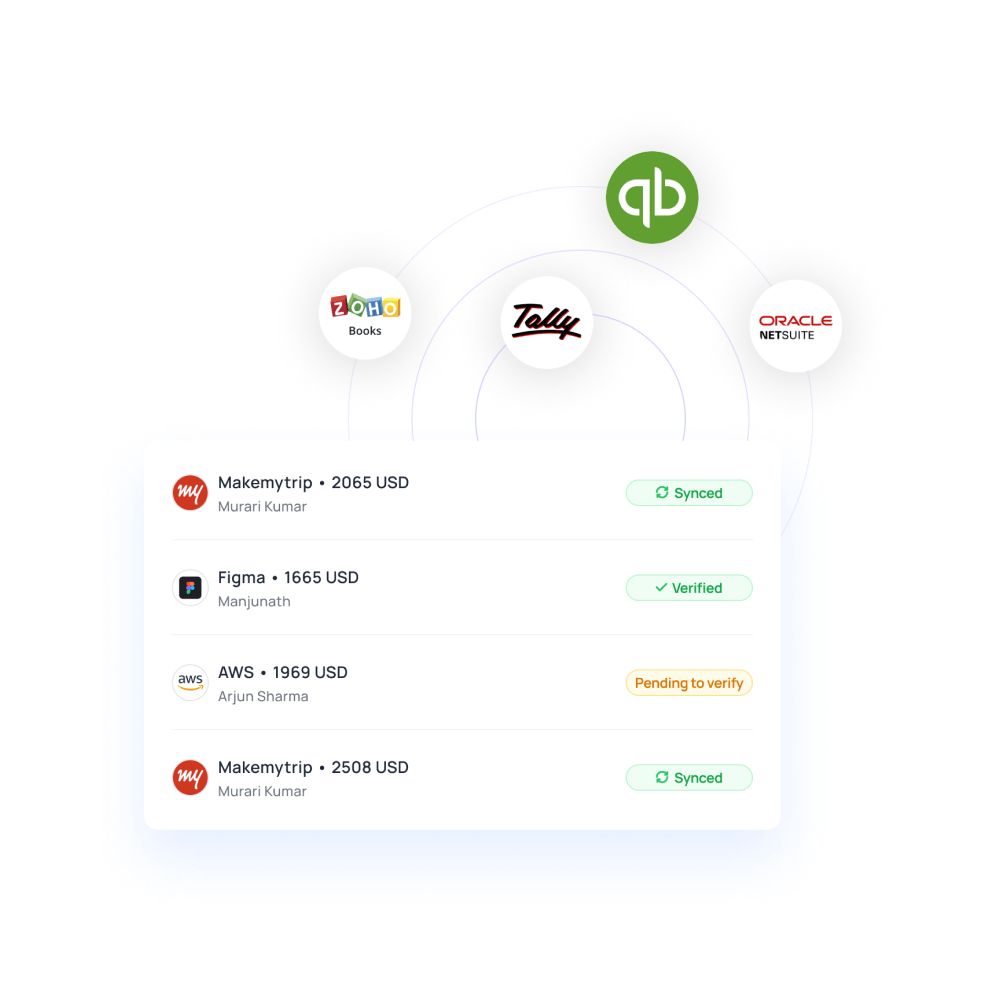

Every transfer that you carry out through Volopay is instantly recorded in an expense tab. This is a type of ledger on the platform that allows you to view and sync the transactions automatically with your accounting software after you have reviewed them. So it is not just the financial part of transferring money that the platform simplifies for you but also the accounting of it.

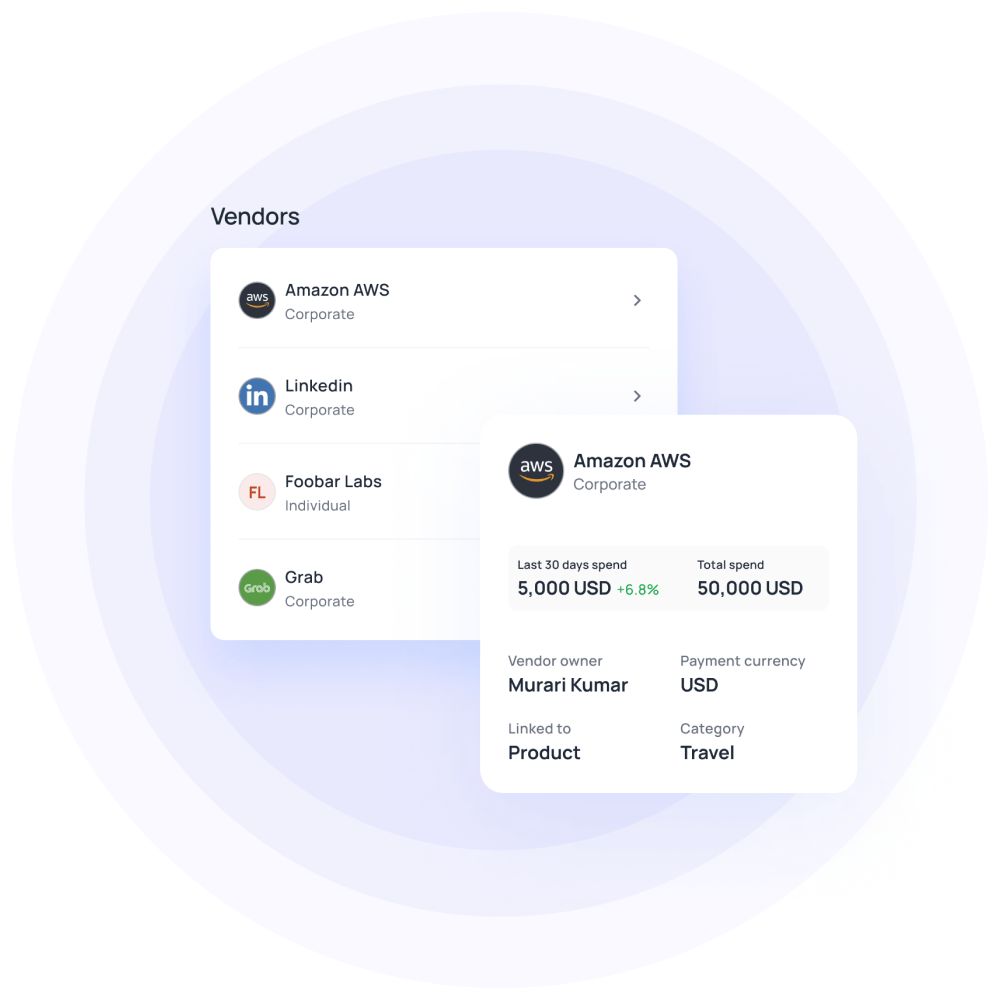

Your business might have many vendors spread across different places. It can become tough to manage all their accounts and related information. Volopay allows you to create individual and corporate vendor accounts directly on the platform with all the necessary information to carry out payments. This way, you don’t have to enter a vendor’s details every time you need to make a payment to them.

What are multi currency wallets?

A multi currency account on Volopay allows you to create individual wallet balances that hold money in a particular currency. This is a great innovation in the financial services industry as it helps businesses avoid currency conversion charges and reduce the cost of transferring money overseas.

Manage international currencies

Volopay’s multi currency account for business lets you transfer money in 65+ currencies in over 100+ countries. This includes all the major currencies that the global economy uses for international transactions. Our platform is also being updated with support for new currencies and countries periodically.

Faster payments method

An online multi currency account allows your business to bypass all the time it takes for money to be converted from one currency to another when using traditional banking services online. Since you will be using a wallet that holds money in the receiver’s currency, the transaction will be processed much quicker.

Easy to set up

Setting up a global currency account on Volopay is extremely simple. With minimal documentation and a fast and interactive onboarding process, we ensure that you can start using your Volopay business account as soon as possible. Our customer success team is always just a message away to help you with any problem or queries you may have.

Reduced costs

A multi currency wallet reduces transfer costs by removing these intermediaries in the transfer process. Since there is no currency conversion taking place when you use the local currency of the receiver to transfer money from Volopay, you get the benefit of saving money on those charges and also incur the lowest interchange fee on for foreign transactions.

FX at the lowest exchange rates

You need to send a payment with a currency that is currently not supported by our platform, you can still do so as we offer the lowest exchange rates possible in the market.

Benefits of having business account for your company

A simplified money transfer system is not just fast but also more secure. The fewer points your money has to go through in a transaction, the better it is. An online business account reduces the number of entry points for hackers or fraudulent activity to occur.

Since a transaction passes through fewer to almost no intermediaries when you send money using Volopay, the cost you incur will also be very low. A Volopay business account offers the lowest FX exchange rates and markup fees. If you use a multi-currency wallet, there is no FX cost at all.

Every transaction, be it a vendor payment or employee salary disbursement that you carry out through Volopay is recorded in real-time on the platform. The financial controller or the admins can see these at all times and be aware of how, who, and when company funds are being spent.

Traditionally, when you are sending money from your country to another one, there can be multiple banks in between for the transaction to pass through and make the currency conversion happen. Each extra mediator will charge a small percentage of the transaction for their service. You can avoid these costs by having a digital business account on Volopay.

Being able to hold money in different currencies through a single business account is not something that you would come across with traditional banks. The ability to do so is truly an advantage to the financial efficiency of your company when you choose a fintech solution like Volopay.

FAQs

Volopay offers the cheapest FX exchange rates for businesses to conduct cross-border payments. Businesses having several vendors in different countries can easily create individual vendor accounts on our platform, pay them, track all transactions, and manage all invoices.

Any business that deals with multiple suppliers or vendors situated in different countries will benefit from using a multi currency global account. You will be able to hold and transfer money in separate currencies and avoid FX charges.

Volopay allows businesses to carry out transactions through the SWIFT payment mode which is a global messaging network connecting banks and financial institutions. The benefit of using this payment method is that you will always know where your money is in the transaction process.

SWIFT and non-SWIFT transfers refer to the two types of payment methods that you can carry out with a business account on Volopay. While the SWIFT payment mode has excellent traceability due to its connectivity with institutions across the globe, a non-SWIFT transfer is much faster and generally used for sending money to someone in their local currency through our multi currency account.

Trusted by finance teams at startups to enterprises.