ACH payments vs Wire transfers - 8 key differences

From salaries and mortgages to credit transfers and direct deposits, ACH payments are used to complete countless transactions every single day, all over the world.

Since its first use in 1968, the ACH or Automated Clearing House Payment method has served as the go-to for a majority of low-value domestic payments that take place between participating financial institutions.

What is Automated Clearing House (ACH)?

The Automated Clearing House is a financial network based out of the United States of America.

It is used as a means of electronically transferring funds of low value from one financial institution to another, typically within the same country, i.e. for domestic transfers only.

The ACH payment method, also called ‘direct payments,’ allows fund transfers without wire transfers, credit card networks, paper checks, or cash.

Each country has its own ACH systems. For example, India uses the National Automated Clearing House (NACH) and National Electronic Funds Transfer (NEFT), while Europe uses the pan-European STEP2 for the Single Euro Payments Area.

How do ACH transfers work?

ACH transfers work via a fully automatic, electronic system.

For ACH transfers to work all you need to do is provide your checking account and bank routing numbers and authorize your recipient to draw money from your account. This can be done quite easily online or by filling out the necessary paperwork with your payment service provider or bank.

ACH gives a great deal of control because every time a transaction occurs you will have to give permission. Transfers made via ACH usually take anywhere between one to four days to reflect in your account.

There are two main categories that ACH payments fall under:

● ACH direct deposits

It is used to send funds directly to a receiving account and are initiated by the payer of these funds. For example, paying salaries to your employees.

● ACH direct payments

It is used to request funds and are initiated by the recipient of these funds. For example, auto-collection of recurring payments.

Types of ACH transfers

ACH debit

ACH debit is the most popular type of ACH transfer, it is called so because ACH debit transfers are initiated by the receiver or payee.

Because these transfers involve a receiver “pulling” funds from the payer it is also known as a “pull” transaction.

Examples include consumer payments such as insurance premiums, utility bills, mortgage loans, and other types of bills.

ACH credit

ACH credit is the type of transaction that is initiated by the payer instead of the payee.

Contrary to ACH debit, ACH credit is called a “push” transaction because it involves “pushing” funds from one account to another.

The most commonly found examples of ACH credit transactions include vendor payments, direct deposits, retail payments, and employee salary payments or payroll processing.

Eliminate payment failures and streamline your billing system

What is an ACH payment?

Automated clearing house payments are an electronic funds transfer method that facilitates direct transactions between bank accounts.

ACH payments work through a secure network that processes large volumes of transfers in batches, streamlining everything from direct deposits to bill payments and peer-to-peer transfers.

Unlike wire transfers or card payments, automated clearing house payments are typically low-cost, making them ideal for recurring transactions like payroll, mortgage payments, and subscription services. They also offer a safer alternative to paper checks by automating the process and reducing errors.

You benefit from the convenience, security, and speed of ACH payments, which ensure funds are delivered quickly, often within one to three business days.

This reliable system has become the backbone for many business and personal transactions, enabling you to manage finances with ease and efficiency while avoiding the manual hassles of traditional payment methods.

What are the differences between ACH payments and wire transfers?

Understanding the differences between automated clearing house payments and wire transfers is crucial for managing electronic funds transfers efficiently. Both methods offer distinct advantages depending on your needs, such as speed, cost, and security.

Knowing when to use ACH payments versus wire transfers can accelerate and optimize your financial transactions.

1. Process

● ACH payments

ACH payments use a centralized system to process multiple transactions in batches.

The automated clearing house network manages this process, ensuring payments are grouped and cleared together, which reduces costs. You’ll find ACH payments ideal for recurring expenses like mortgage payments, payroll deposits, and utility bills.

While slightly slower than wire transfers, they are cost-effective, secure, and perfect for businesses and individuals managing routine financial transactions.

● Wire transfers

Wire transfers are direct, real-time electronic transfers between banks, offering almost instant processing.

How international wire transfers work involves each transaction being handled individually, allowing for faster transfers but at a higher cost compared to ACH payments. You’ll find wire transfers especially useful for urgent, high-value payments, such as closing real estate deals or transferring large sums internationally.

Although more expensive, wire transfers guarantee speed and precision, making them suitable for time-sensitive financial needs.

2. Cost

● ACH payments

ACH payments are among the most cost-effective electronic transfer methods. Banks or payment processors often charge little to no fee for standard automated clearing house payments, especially for direct deposits or bill payments.

You benefit from low transaction costs, making ACH payments perfect for businesses managing payroll or consumers handling recurring bills.

The affordability of ACH payments is one of its main advantages, especially for frequent, smaller transactions.

● Wire transfers

Wire transfers carry higher fees due to their speed and direct processing. You’ll typically pay between $15 and $50 per transaction, depending on whether it’s a domestic or international transfer.

Unlike ACH payments, which are batch-processed, wire transfers are handled individually, justifying their premium cost.

While more expensive, wire transfers ensure immediate, secure delivery, making them ideal for urgent financial needs where cost is secondary to speed and reliability.

3. Speed

● ACH payments

ACH payments process in batches, typically taking one to three business days to complete.

The batch-processing system of the automated clearing house network ensures that transactions are grouped together for cost efficiency.

While slower than wire transfers, ACH payments are reliable for non-urgent transfers like bill payments, payroll, and other recurring expenses. The slight delay is a trade-off for the affordability and security offered by ACH payments.

● Wire transfers

Wire transfers excel in speed, offering almost immediate fund transfers.

Unlike ACH payments, wire transfers are handled individually and typically settle within hours. You can rely on wire transfers for urgent, high-priority transactions, such as last-minute bill payments or large real estate transfers.

The speed comes at a higher cost, but it ensures funds reach their destination instantly, making wire transfers ideal for time-sensitive situations.

4. Security

● ACH payments

ACH payments offer robust security with multiple layers of encryption and verification throughout the batch-processing system.

The automated clearing house network checks transactions for fraud, unauthorized access, and errors before settling payments.

While automated clearing house payments are slower, this delay allows more time for detecting and resolving potential security threats. The automated, monitored nature of ACH payments makes them a reliable and secure option for recurring or non-urgent transactions.

● Wire transfers

Wire transfers are highly secure but require extra caution due to their immediate, irreversible nature. Banks enforce strict verification protocols before processing a wire transfer, reducing the risk of fraud.

However, once the funds are transferred, reversing the transaction is nearly impossible.

You should carefully review all recipient details before initiating a wire transfer. Despite their high cost, wire transfers remain a secure choice for large, urgent transactions.

5. Use cases

● ACH payments

ACH payments are well-suited for routine, recurring transactions like payroll, subscription services, and utility bills.

The batch-processing nature makes these payments both cost-effective and reliable for handling multiple small-value transfers.

Whether you’re managing business payroll or setting up automatic bill payments, automated clearing house payments offer the convenience and efficiency you need for non-urgent, scheduled transactions.

● Wire transfers

Wire transfers are ideal for urgent, high-value transactions that require immediate settlement.

Common use cases include real estate closings, international remittances, or emergency bill payments.

Wire transfers ensure funds are available within hours, providing peace of mind in time-sensitive situations. The higher cost is justified by the speed and security, making wire transfers the go-to choice for significant one-time transfers.

6. Availability

● ACH payments

ACH payments are limited by business hours and the schedule of the automated clearing house network.

Transactions initiated after business hours, on weekends, or on holidays are usually delayed until the next business day.

The processing timeline depends on your financial institution’s cutoff times. While this limits their availability, ACH payments remain efficient for planned, recurring transactions where timing is less critical, such as payroll deposits or automatic bill payments.

● Wire transfers

Wire transfers offer more flexibility in terms of availability, with many financial institutions allowing you to initiate transactions outside traditional business hours.

Domestic transfers can often be processed almost instantly, while international wire transfers may require more specific timing.

Unlike ACH payments, which are batch-processed during set hours, wire transfers provide real-time settlement, ensuring that funds reach their destination quickly, even when sent on weekends or outside regular banking hours.

7. Settlement mechanism

● ACH payments

The settlement mechanism for ACH payments relies on batch processing.

The automated clearing house network groups transactions and processes them in scheduled cycles, typically taking one to three business days. This delayed, collective settlement is designed for efficiency, allowing for lower transaction costs.

Automated clearing house payments are best suited for recurring or scheduled payments where the slight delay is acceptable, making it a practical option for routine financial obligations.

● Wire transfers

Wire transfers utilize a direct, real-time settlement mechanism that ensures funds move instantly between banks.

Unlike automated clearing house payments, wire transfers are handled individually, providing immediate availability of funds. This quick, one-to-one settlement makes wire transfers ideal for urgent transactions like real estate closings or international money transfers.

The speed comes at a higher cost, but it guarantees precision and immediate completion for time-sensitive financial needs.

8. Tracking

● ACH payments

Tracking automated clearing house payments is typically less detailed than wire transfers due to the batch-processing system.

The automated clearing house network groups multiple transactions together, meaning real-time tracking is limited. You may only receive status updates at key stages, like when the payment is initiated and cleared.

Despite this limitation, most banks offer estimated settlement dates, allowing you to anticipate when the funds will be available in the recipient’s account.

● Wire transfers

Wire transfers offer detailed tracking, allowing you to monitor the payment’s status in real-time.

Unlike automated clearing house payments, which provide limited updates, wire transfers include a unique reference number for easy tracking. You can confirm each step, from initiation to settlement, ensuring funds arrive as expected.

This detailed tracking is especially useful for time-sensitive or high-value transactions where immediate confirmation is necessary, giving you greater control and visibility over the transfer process.

Enjoy hassle-free payments with Volopay!

Steps for making ACH payments

Initiate the ACH payment

The first step in making an ACH payment involves initiation of the payment by an originator.

The originator could be a bank, company, or individual. Both ACH debit and credit transfers have to be started this way.

Originating bank submits entry

Next, the entry has to be submitted by the ODFI (Originating Depository Financial Institution).

ODFI is the primary payment processor or financial institution that is specifically selected by the originator of the payment.

ODFI sends a batch of ACH entries

After submitting the entries, multiple batches of these entries must subsequently be sent to an ACH operator, for example, Reserve Banks or Electronic Payments Network (EPN).

This is carried out by the ODFI, also known as the Originating Depository Financial Institution.

ACH operator sorts and sends entries

These batches of entries then have to be sorted into categories of deposits or payments by the ACH operator.

The ACH operator has to then transfer these entries onto the respective Receiving Depository Financial Institutions (RDFI).

Receiving bank verifies sufficient funds

The recipient’s bank also has to ensure the presence of sufficient funding in the ODFI in case the ACH payment is a credit transfer and involves the removal of funds.

Receiving bank processes debit or credit

Finally, once all the aforementioned steps are successfully completed, the RDFI will debit or credit the receiving account depending on whether the transaction is a deposit or a payment.

Benefits of ACH payments

Automated clearing house payments offer significant benefits for managing electronic transactions. They provide convenience, security, and cost-effectiveness, making them an attractive choice for your business.

By utilizing ACH payments, you streamline your financial operations, reduce transaction costs, and enhance security, all while ensuring timely and reliable electronic transactions.

1. Easy for tracking

ACH payments simplify transaction tracking by providing regular updates from your bank on each payment’s status. This easy access to payment information allows you to monitor transactions effortlessly and stay organized.

With straightforward tracking, you can quickly identify and address any issues that arise. This clarity and organization help you manage your finances more effectively, ensuring that you maintain accurate records and can resolve any discrepancies promptly.

Enhanced visibility into transactions supports better financial management and operational efficiency.

2. Secure

ACH payments provide high levels of security with advanced encryption and verification measures. The automated clearing house network safeguards your transactions from fraud and unauthorized access.

By utilizing these security features, you reduce the risk of financial breaches and ensure the safety of your electronic payments. This high level of protection helps you maintain confidence in the security of your transactions and protects your sensitive financial information, contributing to overall secure and reliable payment processing for your business.

3. More convenience

Automated clearing house payments boost convenience by automating routine transactions like payroll and bill payments. This automation reduces manual intervention, saving you time and effort while ensuring that payments are processed efficiently and on schedule.

By handling these transactions automatically, you minimize administrative tasks and avoid delays, allowing you to focus on more strategic activities.

The streamlined process enhances your overall operational efficiency and ensures that your payments are consistently accurate and timely, contributing to smoother financial management for your business.

4. Lower cost

ACH payments are cost-effective, usually involving lower fees compared to other payment methods. This affordability benefits your business by reducing transaction costs, especially if you handle numerous transactions or regular payments.

By choosing ACH payments, you minimize expenses associated with processing payments and enhance your financial efficiency. Lower fees mean you can allocate resources more effectively and maintain a budget-friendly approach to managing payments.

This cost-saving advantage supports better financial management and contributes to the overall profitability of your business.

5. Multiple payment types

ACH payments support various transaction types, such as direct deposits, bill payments, and fund transfers. This versatility allows you to handle multiple financial activities through one platform, simplifying your payment processes.

By consolidating these functions, you refine operations and manage your finances more efficiently.

The ability to perform different types of transactions within a single system enhances convenience and organization, making it easier for you to oversee and control your financial activities. This comprehensive approach improves overall payment management and operational efficiency.

6. Better for retention

Using automated clearing house payments can enhance customer retention by fostering trust and reliability. Automated, consistent payments show your commitment to dependable service, encouraging customers to continue using your offerings.

The convenience and reliability of ACH payments create a positive experience, making it easier for clients to stay engaged with your business.

By ensuring smooth, hassle-free transactions, you strengthen long-term client relationships and boost overall satisfaction, contributing to better retention and sustained business growth.

7. Reliable

ACH payments are highly reliable, with the automated clearing house network processing transactions with accuracy. This reliability ensures that funds are transferred correctly, reducing the likelihood of errors.

By using ACH payments, you benefit from smooth and dependable financial operations. The consistent performance of ACH payments reduces transaction issues and enhances your overall financial management, providing peace of mind and contributing to the efficient handling of your payments and financial activities.

8. Faster processing

Automated clearing house payments provide efficient processing times, with recent upgrades in the Ach network speeding up transactions. This improvement makes ACH payments faster than traditional methods while remaining cost-effective.

By using an automated clearing house network, you benefit from quicker payment processing, enhancing your financial operations. The reduced processing time ensures that funds are transferred more swiftly, contributing to improved cash flow and a more streamlined approach to managing your payments and transactions.

9. Improved cash flow management

ACH payments improve cash flow management by automating transactions and ensuring timely, efficient fund distribution. This reduces the risk of missed or delayed payments, helping you maintain better control over your finances.

By streamlining payment processes, automated clearing house networks enhance your ability to manage cash flow effectively, providing a clearer view of your financial status and supporting more strategic decision-making. This efficiency contributes to overall financial stability and ensures that your cash flow remains steady and predictable.

10. Enhanced customer experience

Automated clearing house payments enhance the customer experience by offering both convenience and reliability. Automated processing minimizes errors and ensures a smoother transaction process, leading to increased customer satisfaction.

With reliable and timely payments, you build trust and foster loyalty among your customers. This streamlined experience contributes to a positive relationship and encourages customers to continue doing business with you, reinforcing their commitment and improving overall customer retention.

11. Compliance and reporting

Automated clearing house payments simplify compliance and reporting by providing detailed transaction records through the automated clearing house network. This transparency makes it easier for you to track and report financial activities accurately.

The clear, accessible records support regulatory compliance and optimize your accounting processes

By utilizing ACH, you enhance your ability to manage and document financial transactions effectively, ensuring that you meet regulatory requirements and maintain organized, up-to-date financial records.

12. Reduced risk of chargebacks

Automated clearing house payments reduce the risk of chargebacks by utilizing secure and automated transaction processes.

The stability and security of automated clearing house transactions minimize disputes and reversals, protecting your revenue. This lower risk of chargebacks helps you maintain financial stability and ensures that your transactions are less likely to be contested.

By adopting ACH payments, you enhance the reliability of your payment processing and safeguard your financial resources against potential disruptions.

Unlock financial efficiency with Volopay’s payment platform

Challenges of ACH payments

While ACH payments offer numerous benefits, they also present specific challenges. Recognizing these challenges helps you manage ACH payments more effectively. Key challenges include potential delays, fraud risks, and complexity in dispute resolution.

Understanding these issues helps you navigate the automated clearing house payments system and maintain smooth operations.

Settlement time

ACH payments can pose a significant challenge due to their lengthy settlement times.

Unlike wire transfers, which process almost instantly, automated clearing house payments can take one to three business days to complete.

This slower processing can be a notable problem for urgent transactions that require immediate access to funds in order to meet present financial needs.

The batch-processing nature of ACH payments contributes to these delays, affecting how quickly you can access and use your funds when time is critical.

Returns and fraud

ACH payments carry risks of returns and fraud.

Transactions can be reversed or returned due to insufficient funds or other issues, causing delays and extra administrative work.

Even with strong security measures, the automated clearing house network remains vulnerable to fraud.

To protect against unauthorized transactions, you must implement robust fraud prevention practices and stay vigilant.

This ensures the security of your financial transactions and helps maintain the integrity of your payment processes.

Transaction limits

Automated clearing house payments have transaction limits set by the network, restricting the amount you can transfer per transaction or within a specified period.

These constraints can complicate high-value transactions and affect cash flow management.

To navigate these limits, you may need to manage multiple transfers or adjust your payment strategies.

This limitation impacts your financial operations and overall efficiency, requiring careful planning to ensure smooth and effective cash flow management.

Does my business need ACH payments?

ACH payments offer many benefits, but you need to assess if they suit your business. Consider factors like transaction volume, the need for cost-effective payment methods, and the importance of automated processing.

ACH payments can streamline operations, reduce costs, and enhance financial management, so evaluate these benefits to determine if they align with your specific business needs.

1. Does your business handle recurring payments?

If your business handles recurring payments, like subscriptions or regular billing, ACH payments are highly beneficial. Automation simplifies these transactions, ensuring timely and consistent revenue collection without manual intervention.

ACH payments reduce administrative work and improve accuracy, making them an ideal solution for managing frequent, repetitive payments efficiently.

2. Will your credit-card-using customers switch to ACH?

Evaluate if your credit-card-using customers would prefer switching to ACH payments. If they seek a more cost-effective or convenient payment method, offering an automated clearing house network can attract and retain them.

By providing automated clearing house payments, you give customers an alternative to traditional credit card transactions, potentially improving their satisfaction and loyalty.

3. Are you frequently dealing with paper checks?

If your business regularly processes paper checks, ACH payments can accelerate operations and cut down on administrative tasks.

Switching to automated clearing house payments reduces manual check handling, speeds up transactions, and minimizes errors. This transition saves you time and enhances efficiency, making your payment processes smoother and more reliable.

4. Is a significant portion of your revenue from credit card payments?

If a large part of your revenue comes from credit card payments, consider whether ACH payments could be a suitable alternative.

Offering automated clearing house payments may lower transaction costs and provide your customers with additional payment options, potentially enhancing satisfaction and broadening your revenue streams.

5. Is online credit card payment cumbersome for your customers?

If online credit card payments are cumbersome for your customers, ACH payments might offer a smoother alternative.

Implementing automated clearing house payments can optimize the payment process, enhancing customer satisfaction and reducing cart abandonment rates. This switch could make transactions easier and more convenient for your customers, improving their overall experience.

6. Are credit card fees higher than potential ACH processing fees?

If credit card fees exceed ACH payment processing fees, consider making the switch.

Automated clearing house payments typically have lower transaction costs, offering significant savings, especially if you handle a large volume of transactions. Lower fees can improve your bottom line and make ACH payments a more cost-effective option for your business.

7. Is your business categorized as high-risk, limiting credit/debit card options?

If your business is classified as high-risk, securing credit or debit card processing can be difficult.

Automated clearing house payments offer a reliable alternative, allowing you to process transactions securely and cost-effectively. This option can help you overcome limitations associated with traditional credit card processing and maintain smooth financial operations.

Experience quick and easy payments with Volopay

How much time does it take to process an ACH payment?

ACH payments usually take one to three business days to process.

The exact duration depends on the payment type and the banks' processing schedules. For example, ACH credits, such as direct deposits, typically clear within one to two business days. On the other hand, ACH debits might take up to three days.

This processing time is influenced by the automated clearing house network’s batch-processing system, which groups transactions and processes them in scheduled cycles.

As a result, the funds’ arrival can vary based on the specific timing of these cycles and the nature of the payment.

Understanding these timeframes can help you plan your transactions and manage expectations effectively.

What is the cost of processing ACH payments?

Processing automated clearing house payments is often more cost-effective than other payment methods.

Typically, ACH payments processing fees range from $0.20 to $1.50 per transaction, depending on the provider and volume of transactions. Some providers may also charge monthly fees or setup fees, but these are usually minimal compared to the per-transaction fees.

Additionally, ACH payments do not incur the same chargeback risks and associated costs as credit card transactions.

Overall, the lower transaction fees, reduced chargeback risks, and minimal additional costs make ACH payments an attractive option for managing your business’s financial transactions efficiently and affordably.

Transaction fees

ACH payments typically have lower transaction fees, which is significantly more affordable compared to credit card fees, which can often be much higher and can add up quickly.

By choosing automated clearing house payments, you can save on transaction costs and make payment processes cost-effective.

This decision can lead to significant savings that positively impact your bottom line.

Additional fees

Additional fees for ACH payments can include monthly maintenance fees, returned payment fees, and chargeback fees.

Returned payment fees arise from issues like insufficient funds, while chargeback fees occur if a transaction is disputed.

Be aware of these potential costs to effectively manage your overall ACH payment expenses and ensure smooth financial operations.

Bulk processing discounts

If you handle a high volume of ACH payments, you might benefit from bulk processing discounts.

Payment providers often offer reduced fees for large transaction volumes, which can result in significant savings.

Processing ACH payments in bulk lowers per-transaction costs and enhances cost-efficiency.

Taking advantage of these discounts can greatly improve your business’s financial performance.

Setup and integration costs

ACH payments may require initial setup and integration costs.

These fees cover the process of integrating the automated clearing house system with your business’s financial infrastructure.

Costs can vary depending on the complexity of the integration and the systems involved.

Ensuring a smooth setup can help you fully benefit from ACH payments in the long run.

Simplify payments and manage currencies with Volopay today!

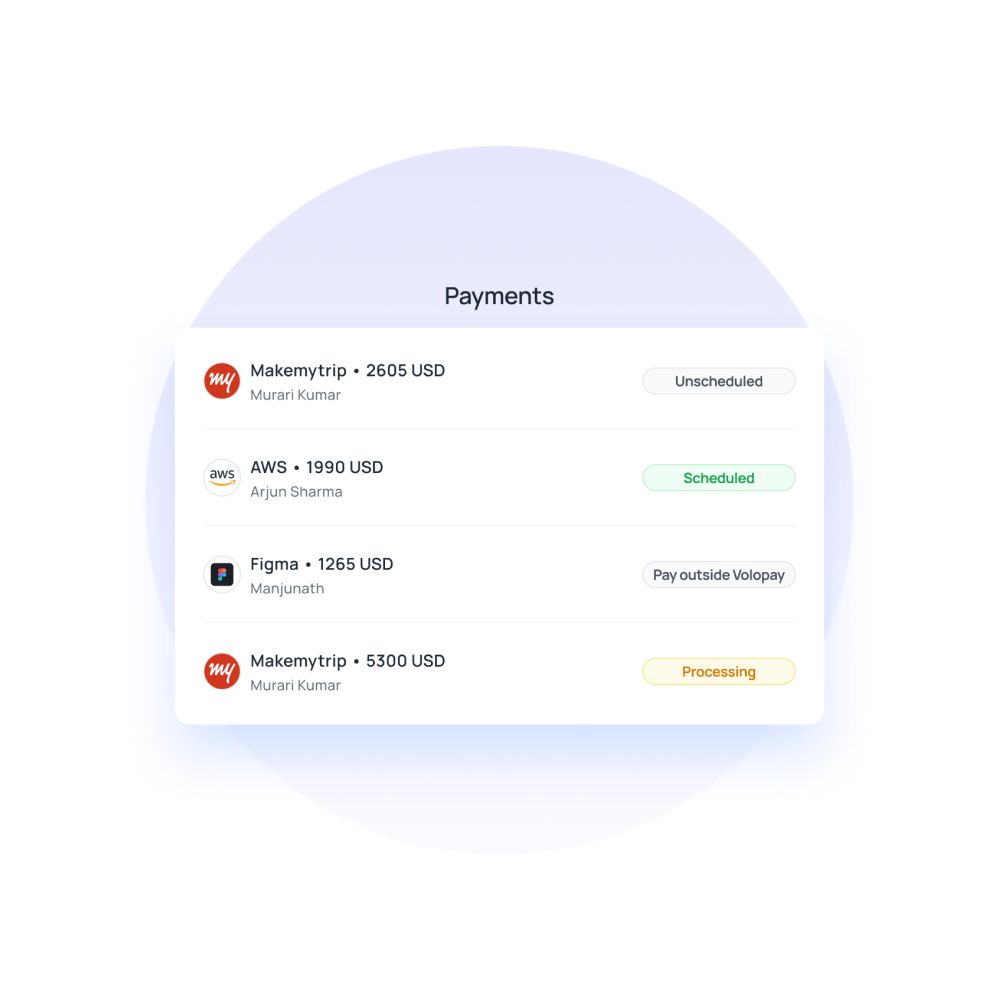

Simplify your domestic and international payments with Volopay

Volopay accelerates and optimizes international payments with its advanced features that ensure efficiency and cost-effectiveness, all accessible from your business account. You can easily manage both domestic and global transactions through a unified platform.

With competitive foreign exchange rates, multi-currency support, and a user-friendly interface, Volopay helps you handle international payments smoothly and efficiently, optimizing your financial operations.

Domestic and international payments

Volopay lets you handle both domestic and international payments with ease. For domestic transactions, it supports various methods.

When handling international payments, Volopay ensures secure and efficient cross-border transfers. Its platform integrates seamlessly with your existing systems, offering competitive foreign exchange rates and multi-currency support.

This comprehensive approach simplifies your payment processes, enhances accuracy, and helps you manage both local and global transactions smoothly.

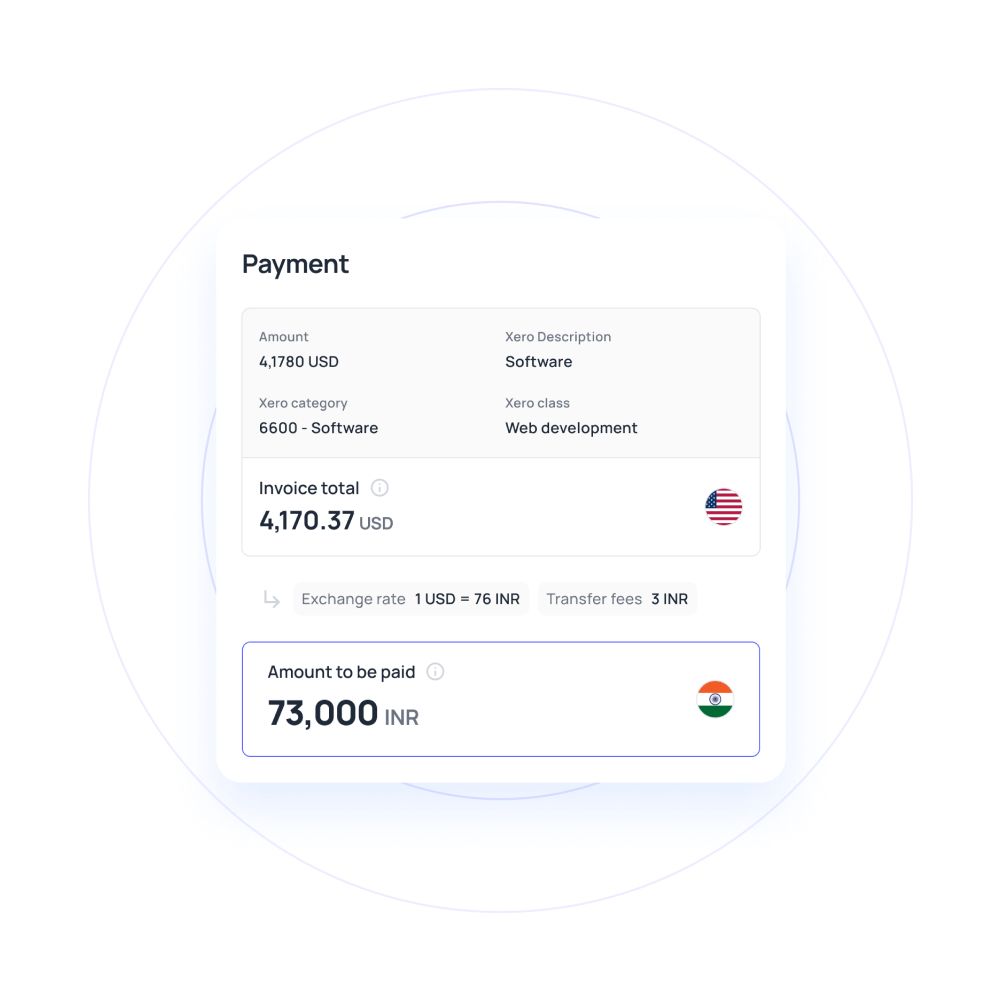

Competitive FX rates

Volopay offers competitive foreign exchange (FX) rates for international payments, helping you minimize costs associated with currency conversion. By taking advantage of these favorable rates, you ensure that your cross-border transactions are more cost-effective.

Volopay’s approach reduces the impact of exchange rate fluctuations and enhances your overall financial efficiency.

With better FX rates, you achieve more value for your money and refine your global payment processes, making international transactions smoother and more economical.

Multi-currency digital wallets

Volopay offers multi-currency digital wallets that let you manage and hold funds in different currencies. This flexibility is essential for businesses with global operations, as it simplifies the handling of various currencies from one platform.

By using Volopay’s digital wallets, you can easily convert and transfer funds between currencies without the need for multiple accounts or complex processes.

This feature enhances your ability to manage international transactions efficiently and reduces the administrative burden of dealing with different currencies.

User-friendly payment process

Volopay provides a user-friendly payment process with a streamlined interface.

Whether you’re managing domestic payments or handling international transactions, the platform simplifies the entire experience. You’ll find it easy to navigate and complete payments efficiently.

Volopay’s intuitive design reduces the complexity of payment processes, allowing you to handle transactions swiftly and accurately. This focus on user experience ensures that you spend less time on administrative tasks and more time focusing on your core business activities.

Bring Volopay to your business

Get started now

FAQs

ACH payments are a very secure form of payment. They are controlled by regulatory bodies and can also be reversed in case of fraud or errors.

Unfortunately, If your ACH payment is rejected then your business might have to pay a penalty fee.

Yes, there are limits on automated clearing house payments. These limits vary by bank and type of transaction, often setting caps on the amount you can transfer per transaction or daily.

If an ACH payment fails, it may be returned due to issues like insufficient funds. This can result in fees or delayed processing, requiring you to resolve the issue with your bank.

Same-day ACH payments allow you to complete transactions within the same business day. This expedited service is available for certain ACH transfers, providing quicker settlement compared to standard processing times.

Yes, you can schedule recurring ACH payments. This feature automates regular payments, such as subscriptions or payroll, ensuring they are processed on a set schedule without manual intervention.

ACH payments are primarily designed for domestic transactions within the U.S. However, they can also facilitate international payments by collaborating with clearing houses in the recipient’s country. It may involve additional steps and processing time compared to domestic ACH payments.

NACHA (National Automated Clearing House Association) regulates automated clearing house payments in the U.S. It sets standards and ensures the smooth operation of the ACH network.

Yes, you can use ACH payments for business-to-business (B2B) transactions. It is a common method for managing B2B payments due to its cost-effectiveness and reliability.