How do international wire transfers work for businesses?

Today, making international money transfers is a matter of minutes. You can do it from anywhere, anytime, all thanks to the rapid advances in technology like digital banking and online apps for money transfers. You can easily make international wire transfers and exchange various currencies without having to go anywhere.

What is a wire transfer?

A wire transfer is an electronic method for sending money between banks or financial institutions. To perform a wire transfer, initiate the transaction through your bank, which securely coordinates with the recipient’s bank. This method is preferred for its speed and reliability.

But how do international bank transfers work? Understanding this can help you manage cross-border transactions more effectively.

For your business, wire transfers provide a fast way to handle international payments, usually completed within a day. They ensure secure and timely financial exchanges.

Types of wire transfers

Wire transfers are a reliable and efficient way to send money electronically between banks or financial institutions. They are categorized into domestic and international transfers, each serving different needs and purposes for your business. Domestic transfers handle local payments quickly, while international transfers manage cross-border transactions.

Domestic transfers

Domestic transfers involve sending money within the same country.

You start the process by instructing your bank to transfer the funds, which are then deposited directly into the recipient’s account.

This method is typically quick, and often completed within one business day.

It’s ideal for routine business transactions and payments, allowing you to manage your financial dealings efficiently and ensuring your transactions are processed in a timely manner.

International transfers

International transfers involve sending money across borders.

To manage an international transfer, provide accurate recipient bank details, including the International Bank Account Number (IBAN).

Knowing the answer to “How do international bank transfers work?” ensures that your funds reach the intended recipient smoothly.

These transactions are crucial for global operations and usually take a few days to process, depending on the countries and banks.

How international money transfers work?

While making an international wire transfer through your bank, you will have to direct them and give them instructions as to where the payment has to go. You can do this by providing them with the recipient’s details by calling your bank or filling out the form.

If you have a business account or business checking account, this can streamline the process and help manage transaction fees more effectively. Business money transfer fees depend on the location of the recipient’s bank.

When the wire payments are made through a non-bank service, the transfer fee is considerably lower. These services also provide the facility to complete the whole process online, which means you won’t have to visit the branch.

You just have to create an account with the company and wire payments online or through the phone. Once you make the payment from your end, the company forwards it to the recipient’s account.

These services have an edge over any traditional bank because it also provides more flexibility to choose exchange rates. One of the options is to conduct the foreign money transfers at the current exchange rate, which is said to be simpler and more convenient.

However, you can also decide to make the international wire transfer on a forward contract. This is extremely beneficial when you want to enjoy the benefits of the present exchange rates but make the wire payments at a later date, as you get an option to lock your transfer at the current rate for 12 months.

Another available option is to opt for a limit order. In this, you can nominate the exchange rate you prefer and the company will make the transfer as soon as that rate is on the market. These can also last up to 12 months but are prone to high minimum transaction amounts.

Whether you're making international transfers via a traditional bank or a non-bank service, having the right business checking account can help streamline the process and reduce costs. To know more, check out our blog on best business checking accounts in the US.

Transfer money internationally with Volopay

How to do international money transfers?

International money transfer allows you to send funds across borders with ease. To ensure a smooth process, follow these steps to choose the right provider, manage details accurately, and track your transfer effectively.

You can achieve your financial goals seamlessly by gaining a clear insight into the workings of international bank transfers.

Pick your money transfer provider

Choosing the right provider is crucial for a successful international wire transfer. You can opt for banks, fintech providers, or money transfer operators, depending on your needs.

● Banks

If you prefer using traditional methods, banks are a reliable option for international bank transfer. They are suitable for large sums or frequent transactions and usually offer robust security measures and customer support.

However, they might charge higher fees and have longer processing times compared to other options.

● Fintech providers

Fintech providers like Volopay offer innovative solutions for international money transfer. They leverage technology to facilitate faster and cheaper transfers, often providing competitive exchange rates.

These services often feature user-friendly apps that make managing transfers easier from anywhere, anytime.

● Money transfer operators

Money transfer operators specialize in sending money internationally. They offer both online and physical transfer options, allowing you to send funds to a wide range of destinations.

These operators are known for their extensive network and quick service.

Get the details properly

Ensure you have all the necessary details for the international money transfer.

Gather the recipient’s full name, address, and precise banking information. For international wire transfer, you’ll need the recipient’s bank account number and SWIFT/BIC code to direct the funds correctly.

Verifying these details beforehand helps prevent errors and ensures that your money reaches the right destination without delays or complications.

Fill up details and choose the currency correctly

Carefully complete all required fields for the transfer, making sure to input the correct information.

Select the appropriate currency to avoid errors and extra fees. If you are using an online platform, thoroughly review all entered details before submitting.

This careful approach helps prevent any potential mistakes and delays, ensuring that your transfer is processed smoothly and efficiently. By paying attention to these details, you can avoid complications and ensure a successful transaction.

Pay the transfer fee

Most providers charge a fee for an international money transfer. Examine the fee structure of your chosen provider to understand the costs involved. Some providers may offer reduced fees or promotions, so comparing different options can be beneficial.

Being aware of these fees in advance allows you to manage your budget more effectively and avoid unforeseen expenses. This proactive approach ensures that you account for all costs, helping you make informed financial decisions.

Track your transfer

Once you initiate the transfer, use the provider’s tracking tools to monitor its progress. Most services offer online tracking features that allow you to check the status of your international wire transfer.

Regularly tracking your transfer helps you stay informed about when the funds will arrive. This vigilance enables you to promptly address any issues that may arise, ensuring a smooth and timely completion of your transaction.

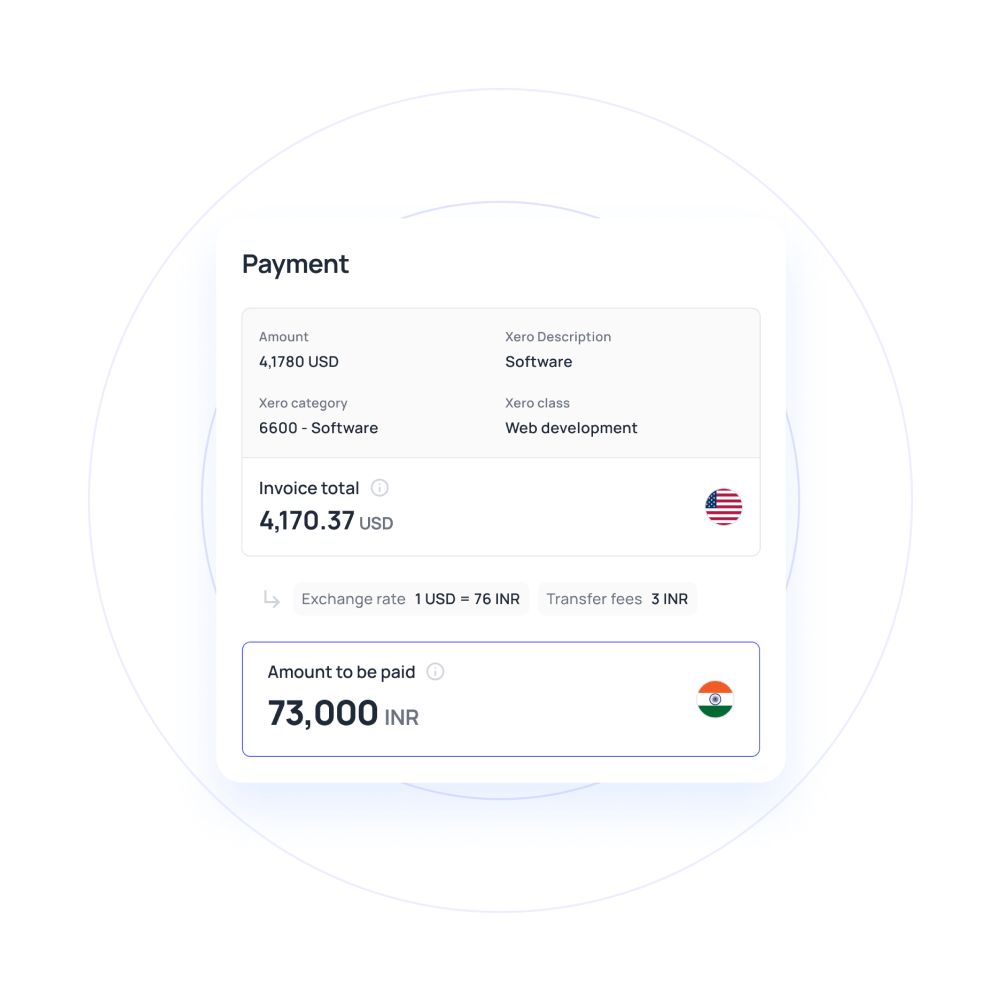

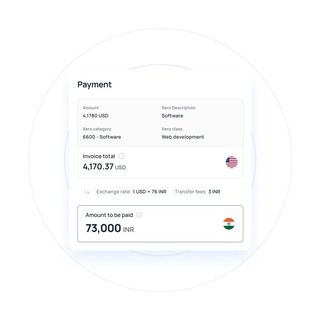

Consider exchange rates

Exchange rates significantly affect the amount your recipient receives. Stay informed about the current exchange rate and its impact on your transfer. Some providers offer competitive rates or allow you to lock in a rate at the time of transfer, which can be advantageous.

By monitoring exchange rates, you can optimize the value of your international money transfer, ensuring that your fund pool is used judiciously and can meet your financial goals.

Ensure security and compliance

Security is vital for international bank transfer. Ensure that your provider employs secure encryption methods and complies with financial regulations. Verify that the provider is licensed and regulated by appropriate authorities to protect your funds and personal information.

By prioritizing security, you safeguard your transfer from potential threats and ensure adherence to industry standards, providing peace of mind throughout the transaction process.

Receive confirmation and documentation

After finalizing the transfer, obtain confirmation and documentation from your provider. This usually includes a transaction reference number and a receipt of payment.

Retain this documentation for your records, as it serves as proof of the transaction and helps you address any potential issues. Proper documentation ensures you have evidence of the transfer, allowing you to efficiently resolve any disputes or discrepancies that may arise.

Cost of international money transfer

Understanding the cost of an international money transfer is crucial for budgeting and managing expenses. Various fees and charges can affect the total amount sent and received.

Here’s a breakdown of the typical costs associated with international wire transfer to help you navigate how international bank transfers work more effectively.

Transfer fees

The main expense for an international bank transfer is the transfer fee, which your provider charges for processing the transaction.

This fee varies depending on the provider, the transfer amount, and the destination.

Generally, an international wire transfer through banks comes with higher fees compared to other methods.

To avoid surprises, check the fee structure of your provider to understand what costs you will incur.

Currency conversion costs

When sending money internationally, currency conversion costs usually apply.

Providers often add a margin to the exchange rate, increasing the total expense beyond the standard transfer fee.

This margin varies widely among banks, fintech companies, and money transfer operators, influencing the overall cost of your transfer.

Be aware of these costs to accurately estimate the total expense and prevent unforeseen charges.

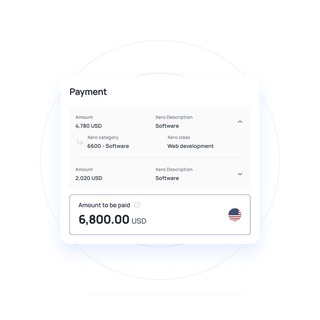

Intermediary bank charge

Sometimes, an international money transfer involves intermediary banks that facilitate routing the funds to the recipient’s bank.

Each intermediary bank may charge a fee for their services, which could be deducted from the transferred amount.

This is especially relevant for transfers that go through multiple banks before reaching the final recipient.

Understand these potential charges to avoid unexpected deductions from your money transfer.

Additional service charges

Providers may apply extra service charges for services like urgent transfers, tracking, or payment corrections.

These added fees can significantly raise the total cost of your international money transfer.

To avoid unexpected costs, review all potential charges and request a comprehensive breakdown from your provider.

Understanding these fees ensures you are fully aware of the expenses involved and can manage your budget effectively.

Streamline your international transfers with ease

How long do international transfers take?

When sending money internationally, knowing the expected delivery time helps you plan better and avoid unexpected delays. The time it takes for funds to arrive can vary based on factors like the transfer method, the recipient’s location, and the banks involved.

Understanding these factors allows you to choose the most suitable option for a timely international wire transfer.

1. Execution time

An international money transfer can range from a few hours to several business days. The speed often depends on the transfer method you choose. For faster transactions, opt for services that offer expedited processing.

Traditional international bank transfer might take longer due to the various processing times and banking procedures involved. Comprehending how international bank transfers work and the timings involved can help you select the best option for your needs.

2. Recipient’s location

The recipient’s location greatly affects the duration of an international wire transfer. Transfers to countries with sophisticated financial systems or those within the same banking network typically complete more quickly.

Conversely, sending money to regions with less developed financial infrastructure can lead to longer processing times. Additional banking regulations and procedures in these areas may contribute to delays. Acknowledging these factors helps you better estimate the transfer time and plan accordingly.

3. Banks involved

Knowing how do international bank transfers work and the banks involved in your international bank transfer significantly influence the transaction. Transfers between banks with established relationships or those using the same clearing systems generally proceed more swiftly.

However, if multiple intermediary banks are involved, each additional step can introduce delays, extending the total transfer time. Understanding how these banking relationships and systems impact transfer speed helps you anticipate potential delays and choose the most efficient transfer method.

Security measures to safeguard international wire transfers

Securing your international wire transfer is crucial for protecting your funds and personal data. Implementing strong security measures helps shield your transactions from fraud and unauthorized access.

By using advanced security protocols and having familiarity with how do international bank transfers work, you can enhance the safety of your financial transactions and ensure that your money reaches its intended destination securely.

Two-factor authentication

Enable two-factor authentication for your international money transfer accounts to enhance security. This feature requires you to confirm your identity using two distinct methods, such as a password and a unique code sent to your mobile device.

By implementing two-factor authentication, you add an extra security layer, making it significantly harder for unauthorized individuals to access your account and execute fraudulent transactions.

End-to-end encryption

Utilize end-to-end encryption to protect your data throughout the transfer process. This technology keeps your information encrypted from the initiation of the international wire transfer until it reaches the recipient’s account.

By using end-to-end encryption, you prevent hackers from intercepting and accessing your sensitive details. This method offers strong protection against potential breaches and ensures that your transaction remains secure from start to finish.

Fraud detection systems

Implement robust fraud detection systems to protect your transactions. These systems use advanced algorithms and machine learning to monitor for suspicious activities. They analyze transaction patterns to spot potential fraud.

If the system detects any unusual behavior in your international bank transfer, it can flag the transaction for review or even halt it, helping to prevent fraudulent activities and safeguarding your financial assets.

Compliance and regulatory standards

Ensure that your provider strictly adheres to compliance and regulatory standards to maintain robust security levels. Providers should follow regulations such as Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements.

Selecting a provider that meets these standards and acknowledges having best practices in place guarantees enhanced security of your international money transfer. These regulations help prevent illegal activities and reduce the risk of financial fraud, ensuring that your transactions remain safe and secure.

Secure communication networks

Verify that your provider uses secure communication networks to protect your data throughout transmission. Secure networks shield against unauthorized access and potential data breaches, ensuring that your sensitive information remains confidential.

Confirm that your provider employs industry-standard protocols and maintains a strong reputation for security in international bank transfer. By choosing a provider with robust security measures, you ensure that your data is transmitted safely, minimizing the risk of compromise and safeguarding your financial transactions from potential threats.

Common mistakes to avoid when making international transfers

When making an international money transfer, several steps are involved, and avoiding common mistakes is crucial to saving time and money. By recognizing these frequent pitfalls and understanding how to steer clear of them, you can ensure a smoother transaction.

Proper attention to details helps you avoid errors and ensures your funds reach their intended destination efficiently.

Incorrect recipient information

Entering incorrect recipient information is a major error in international wire transfer.

Double-check all details, such as the recipient’s name, address, and banking information, including the bank account number and SWIFT/BIC code.

Any inaccuracies can cause delays or result in funds being sent to an incorrect account.

Ensure all provided information is precise to avoid complication, guaranteeing your money reaches the intended recipient without issues.

Not checking exchange rates

Neglecting exchange rates can significantly affect how much the recipient actually receives.

Exchange rates fluctuate often, and providers usually add a margin to the market rate.

Always compare rates from various providers to get the most favorable deal.

By doing this, you guarantee to the stakeholders that you have chosen the best service for your international bank transfer and that it is cost-effective and seamless.

Not considering legal requirements

Not considering legal requirements can cause delays or legal issues with your international bank transfer.

Different countries have varying regulations, to prevent money-laundering, fraudulent or non-compliant transactions, and for the security of the customers.

Ensure you understand and follow these regulations to avoid complications.

By adhering to relevant legal requirements, you promote a smooth transfer process and reduce the risk of unexpected issues.

Not understanding transfer times

Failing to understand transfer times can lead to frustration.

International wire transfer can range from a few hours to several days, depending on the method and destination.

Confirm the estimated transfer time with your provider to avoid delays.

Planning ensures funds arrive on time, avoiding disruptions and missed deadlines.

By verifying transfer times, you can manage expectations and maintain smooth transactions.

Using unsecured methods

Use secured methods for your international money transfer.

Choose a provider that uses reliable technology and has compatible views, which includes end-to-end encryption and secure communication networks, to protect your data.

Using unsecured methods can leave your transaction vulnerable to fraud and unauthorized access.

Prioritize security by selecting a provider with robust measures in place, ensuring your funds and personal information remain safe throughout the transfer process.

Failing to track the transfer

Failing to track your transfer can create uncertainty and potential issues.

Use the tracking tools provided by your service to keep tabs on the status of your international wire transfer.

Regularly monitoring the transaction ensures it reaches the recipient as planned.

If you notice any discrepancies or delays, address them immediately.

Staying proactive helps you manage the transfer effectively and resolve any issues before they impact the outcome.

Ignoring transfer fees

Pay close attention to the transfer fees linked with your international money transfer.

Providers typically impose fees for processing transactions, and these fees can vary widely depending on the service and transaction type.

Overlooking these fees can result in unforeseen expenses.

Make sure you are fully aware of all relevant charges before initiating the transfer.

This will help you avoid unexpected charges and ensure you manage your budget effectively.

Overlooking tax implications

Overlooking tax implications can cause unexpected issues.

Be aware of the potential tax consequences associated with your international money transfer.

Depending on the amount and destination, taxes or reporting requirements might apply.

Consult a tax advisor to understand implications and comply with local tax laws.

Addressing tax matters proactively avoids complications and keeps your transactions smooth and compliant.

Experience seamless and secure international money transfers with Volopay

International money transfers with Volopay

Volopay offers a cohesive and impactful accounts payable solution for international money transfer, providing benefits like real-time tracking, multi-level approval, and minimal fees.

Unlike traditional banking options, Volopay prioritizes secure transactions while delivering faster, more transparent services and implementing productive practices in place.

With Volopay, you gain greater control and visibility over transfers, making it an ideal choice for modern business needs.

Quicker and smoother international transfers

Volopay speeds up your international wire transfer with its advanced platform. By employing cutting-edge technology, Volopay minimizes delays, ensuring that funds are transferred swiftly and effortlessly. This efficiency contrasts with traditional banking methods, which often involve lengthy processes and complications.

For time-sensitive transactions, Volopay provides a more dependable solution, allowing you to address urgent financial needs promptly without unnecessary waiting or issues.

Experience faster, smoother transfers with Volopay’s enhanced capabilities.

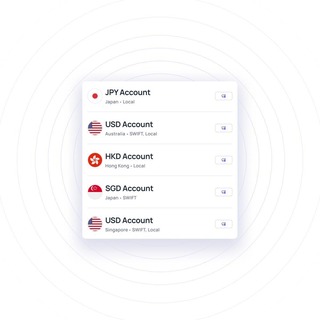

Global multi-currency account

With Volopay, you gain access to a global multi-currency account, allowing you to hold and manage funds in various currencies. This feature enhances your international transactions by reducing the need for frequent currency conversions.

Managing multiple currencies in a single platform simplifies your international money transfer and cuts down on conversion costs. This streamlined approach makes global business operations more efficient and cost-effective, eliminating the complexities and expenses associated with constant currency exchanges.

Manage vendors on a single dashboard

Volopay offers a unified dashboard that lets you manage all your vendors and transactions in one location. This setup simplifies your financial management, making it easier to handle multiple international bank transfer and oversee payments efficiently.

Unlike traditional banking solutions that often require managing several accounts and interfaces, Volopay consolidates everything into a single, user-friendly platform. This consolidation enhances your control and refine your operations, making financial oversight and management more effective.

Real-time tracking

Volopay’s real-time tracking feature offers complete transparency and control over your international wire transfer. You can monitor the status of your transfers in real-time, keeping you informed about the whereabouts of your funds and their expected delivery time.

This capability enhances convenience and security, distinguishing Volopay from traditional methods that often lack detailed tracking options. With this feature, you stay updated and can manage your transfers more effectively, ensuring a smooth and secure process.

Get multi-level approvals

Volopay’s multi-level approval system is a significant advantage. It enables you to establish approval workflows for transactions, ensuring each international money transfer undergoes the necessary checks before processing. This extra layer of oversight boosts security and reduces the risk of errors or fraud.

By providing a structured approval process, Volopay offers a higher level of control compared to traditional banks, making it easier to manage and secure your financial transactions effectively.

Related pages to international transfers

Essential guide for small businesses on international money transfers, including transfer methods, advantages, security, and key considerations.

Get to know remittance money transfer, including its process, types, fees, risks, and ways ti mitigate them. Read to learn more.

Learn about remittance in our comprehensive guide: what it is, how it works, and its benefits for international money transfers.

FAQs

An international bank transfer is a general term for transferring funds between banks across countries, while an international wire transfer specifically refers to electronic transfers using a network like SWIFT.

To reduce fees, compare providers, choose options with lower fees, and use services like Volopay that offer minimal fees for international bank transfer.

Yes, international money transfer are generally safe when using reputable providers with robust security measures like encryption and fraud detection systems.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes are used for identifying banks, while IBAN (International Bank Account Number) helps identify the specific bank account for the transfer.

Yes, most providers offer tracking tools for international wire transfer, allowing you to monitor the status and location of your funds in real-time.

You can cancel an international wire transfer if it hasn’t been processed yet. Contact your provider immediately to request a cancellation and check their specific policies.

Yes, you can send an international wire transfer from a personal account, though business accounts often offer additional features and benefits for larger or frequent transactions.

Yes, many providers, including Volopay, allow you to schedule recurring international money transfer, making it easier to automate regular payments.

Businesses benefit from international wire transfer through efficient global payments, faster transactions, and streamlined cross-border operations, enhancing their global financial management.