10 best business checking accounts in the US in July 2025

Checking accounts for business are necessary to manage a company’s funds conveniently without any hassle. Even if you are a small business owner you need to have a checking account for business to keep your business and private funds separate.

However, deciding on the best checking account can be a troublesome task, especially if you are a small business owner. While choosing a business checking account it's important to choose the one that aligns with the company’s requirements.

This blog will help you get a better understanding of business checking accounts so that you can choose from the best business checking accounts for small business operations.

What is a business checking account?

A checking account for business is a place to store and manage your company’s funds. It is separate from any personal or individual accounts you may use to manage business funds.

It works similarly to a personal checking account but with features designed for business owners, allowing you to separate your business and personal funds.

With a business checking account, you can keep track of company expenses, qualify for business loans, reduce personal liability, and simplify bookkeeping and tax preparation.

It can be best for your business to have a dedicated checking account to manage your company finances seamlessly and handle banking as your business grows.

How does a business checking account work?

A checking account for business enables you to deposit and withdraw cash, make purchases, pay bills, schedule online payments, deposit checks, make tax payments, pay suppliers and employees, and cover operating expenses.

The account also allows you and your employees to use a business debit card for expense management. The best business checking accounts usually come with a dedicated dashboard and tools to manage your business expenses.

Depending on the service provider, you can open a business checking account even if your business isn't generating revenue yet.

A business checking account is available for all types of business owners and structures, including sole proprietors, Limited Liability Companies (LLCs), partnerships, and corporations.

Best business checking accounts in the US for 2025

Comparing the best business checking accounts can be a challenging task. To choose a checking account for your business, you need to decide on one based on the specific needs of your business, as well as one that brings you the most usable benefits.

1. Volopay business account

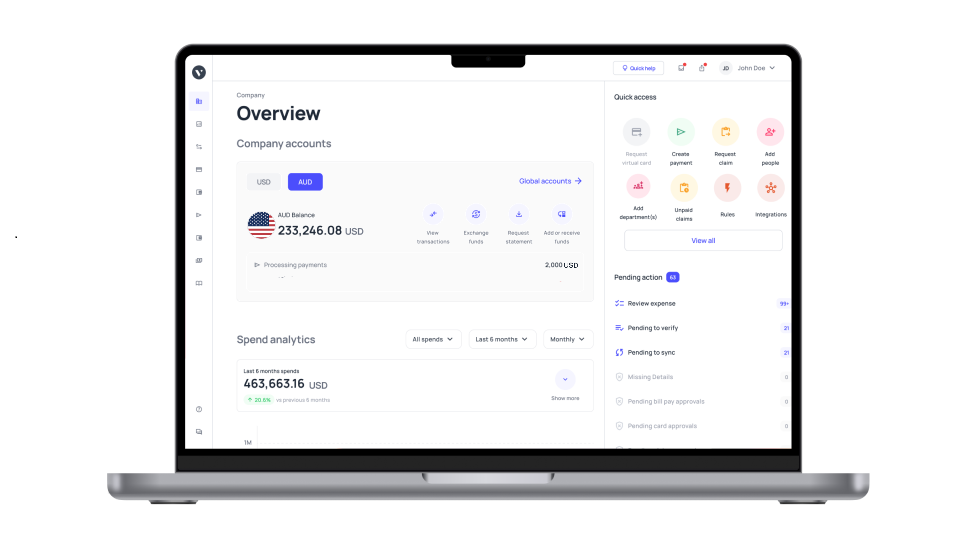

Volopay is a financial solutions provider dedicated to helping businesses streamline financial operations.

It’s a spend management platform that allows you to access an expense dashboard, create physical & virtual corporate cards, and handle all your SWIFT & non-SWIFT payable transactions.

Volopay’s business account can serve as a great alternative to checking accounts due to its distinctive features.

● Key features

Volopay enables businesses to access a global multi-currency account, streamlining international and domestic fund transfers.

Volopay also offers a diverse array of products and services, including virtual and physical corporate cards, automated expense management, and digital payment capabilities.

With Volopay you can seamlessly integrate your ledgers with major accounting software including Xero, QuickBooks, MYOB, NetSuite, Deskera, and more.

● Advantages

Volopay uses technology to streamline and automate business financial processes.

Seamlessly handle manual tasks such as data entry, invoicing, and financial reporting to reduce the workload of finance professionals and improve accuracy and efficiency.

It is equipped with multi-currency accounts to simplify deposits, payments, and expense tracking with competitive fees, no hidden charges, and customizable spend limits.

● Limitations

Given that Volopay is a fintech solution provider, it might not be the best choice for businesses that need traditional banking services such as physical branches or extensive credit requirements.

Additionally, if you operate in multiple locations, then local entities might only be able to open accounts in operational countries (however, the multi-currency account does allow you to transact across multiple locations).

● Setup requirements

Businesses typically need to provide proof of registration, identification of stakeholders, and potential financial statements to open a Volopay business account, ensuring compliance and operational readiness.

● Target audience

Perfect for MSMEs and larger enterprises looking for modern expense management solutions and efficient finance operations beyond traditional banking services.

2. Bluevine Business Checking

Bluevine is a financial technology company that provides banking services through a partnership with Coastal Community Bank, Member FDIC, as well as other program banks, all FDIC-insured.

Bluevine Business Checking accounts are specifically designed for small businesses and provide high-yield interest where you can enjoy a 2.0% APY on balances up to $250,000. Bluevine Business Checking offers zero monthly fees and a business debit Mastercard through which you can conveniently access your funds.

● Key features

Bluevine Business Checking offers a range of features primarily categorized for business owners.

Bluevine's key features include no monthly fees, free standard ACH transfers, two free checkbooks annually, high-yield interest, integration with accounting software like QuickBooks, Wave, and Xero, mobile check deposit, accounts payable (AP) automation for streamlined invoice payments and approval, up to five sub-accounts for better budgeting and control, and no-fee cash withdrawals.

● Advantages

Bluevine Business Checking has several advantages, which include its easy application where you can open your account in a minute without any lengthy process.

Unlike most business checking accounts, Bluevine Business Checking pays 2.0% APY on balances up to $250,000 when you meet monthly eligibility criteria. You also get free bill pay, unlimited transactions, and free checks with a Bluevine Business Checking account.

● Limitations

Bluevine has some limitations that include monthly deposit and withdrawal limits. With the Bluevine checking account, you can spend $7,500 in monthly cash transfers, $2,000 in ATM withdrawals per day, cash deposits of $2,000 per day, and $7,500 per 30 days.

● Setup requirements

To set up a checking account for business with Bluevine, you need to provide the following information: your full name, email address, mobile phone number, home address, date of birth, and Social Security Number (SSN).

Additionally, you need to provide your business information, ownership information, and identification, such as a government-issued photo ID.

● Target audience

Bluevine is the best business checking account for small and medium-sized businesses that prefer digital banking. It is mainly for businesses that deal with cash and need to deposit cash and write checks regularly.

3. American Express Business Checking

American Express is a globally integrated payments company with services available to any small or medium-sized business.

You can open a checking account for your business with American Express using a Social Security Number and two forms of personal ID. American Express can be a good option if you have an eligible U.S. small business account.

● Key features

With an American Express Business Checking account, you can earn 30,000 membership rewards points after qualifying activities.

There are no monthly maintenance fees with American Express, and you also get 24/7 customer support to resolve all your account-related queries. Additionally, you can earn 1.30% APY on balances up to $500,000.

● Advantages

With an American Express Business Checking account, you can enjoy no-fee withdrawals at 70,000+ Allpoint® and MoneyPass® ATM locations nationwide.

You can also use your American Express Business Checking debit card at any ATMs where American Express is accepted (though there might be some fees that you may have to pay).

● Limitations

The limitations of American Express Business Checking include limited cash handling, as it doesn’t allow for direct cash deposits.

This can be inconvenient for businesses that primarily deal with cash. Additionally, it has transaction limits on things like check writing or debit card purchases, and it pays no interest on your account balance if it is over $500,000.

● Setup requirements

To apply for an American Express Business Checking account, you’ll need to gather information such as your Taxpayer Identification Number (TIN), annual revenue, company structure, and a Doing Business As (DBA) certificate if your business operates under more than one name.

You also need to provide personal information such as your date of birth, current address, and personal identification number, such as your driver’s license or Social Security Number.

● Target audience

The target audience of American Express is typically individuals and businesses with steady and reliable cash flow and net profits.

American Express is mainly known for its high-end credit cards and premium travel services geared towards individuals and companies with high incomes and excellent credit scores.

4. Novo business checking

Many consider a Nova business checking account the best business checking account for small business, as it is specifically designed for it.

Nova business checking is a free, digital banking account from Novo, a financial technology company. Novo is a fintech and not a bank, and banking services are provided by Middlesex Federal Savings, F.A, Member FDIC.

● Key features

Novo's business checking account offers no monthly fees, minimum balance requirements, or overdraft fees.

There are also no charges for stop payments, ACH transfers, debit card replacements, foreign or domestic wire transfers, paper statements, and bill payments.

● Advantages

Novo's business checking account is specifically designed for freelancers, small business owners, and entrepreneurs in the United States.

With Novo, you also gain a variety of useful perks. These include the ability to instantly freeze and unfreeze cards online, should the need arise for security reasons or to manage funds.

● Limitations

While Novo has unlimited electronic transactions and reimburses all ATM fees, there are limits on specific transactions.

Novo also doesn't offer interest earned on balance. Also, if you are looking for a banking solution that offers loans and other business services, Novo may not be the right choice for you.

● Setup requirements

To set up your account with Novo, you need to provide information about yourself, your business, and documents like your EIN and articles of incorporation.

You'll also need to provide a valid U.S. mailing address, Social Security Number, and mobile phone number.

● Target audience

Novo is the best business checking account for entrepreneurs, freelancers, and small business owners. Novo offers a decent range of business checking account features that specifically benefit them.

5. Chase Business Complete Banking

Chase Business Complete Banking is among the best business checking accounts available, offering comprehensive solutions for small businesses.

Designed for versatility, it caters to a wide range of business needs with features that streamline financial management and support growth.

● Key features

This checking account for business includes unlimited electronic deposits, access to 16,000 ATMs and over 4,700 branches, and integration with Chase QuickDeposit and QuickAccept for fast and easy deposits. Additionally, it provides powerful online and mobile banking tools to manage finances efficiently.

● Advantages

Chase Business Complete Banking stands out for its extensive branch network, robust mobile banking capabilities, and tools like QuickAccept, making it one of the best business checking accounts for small business that seeks comprehensive banking services.

● Limitations

While the account offers numerous benefits, it does come with a monthly service fee of $15, which can be waived with a $2,000 minimum daily balance. Additionally, some services may incur additional fees, which could add up for high-transaction businesses.

● Setup requirements

To set up the account, you'll need to provide business documentation, identification, and an initial deposit. The process can be completed online or at any Chase branch.

● Target audience

This account is ideal for small businesses looking for comprehensive banking services and extensive branch access.

6. Axos Bank Basic Business Checking

Axos Bank Basic Business Checking is a strong contender among the best business checking accounts for small business needs.

It offers a simple and cost-effective solution, ideal for startups and small businesses looking to minimize banking fees while maintaining essential features.

● Key features

This checking account for business provides unlimited domestic ATM fee reimbursements, no monthly maintenance fees, and no minimum balance requirements.

Additionally, it includes up to 200 free monthly transactions and free online bill pay, making it a practical choice for small businesses.

● Advantages

Axos Bank Basic Business Checking is attractive for its fee-free structure, unlimited ATM fee reimbursements, and lack of minimum balance requirements, positioning it as one of the best business checking accounts for small businesses seeking cost-effective banking solutions.

● Limitations

However, the account does have some limitations, including a cap of 200 free monthly transactions, after which fees apply. Additionally, it lacks physical branches, which may be a drawback for businesses that prefer in-person banking services.

● Setup requirements

Opening an account requires providing business documentation and identification. The entire process can be completed online, making it convenient for businesses to get started quickly.

● Target audience

This account is perfect for startups and small businesses looking for low-cost, online-focused banking solutions.

7. Nav Business Checking

Nav Business Checking offers a versatile and user-friendly banking solution tailored for businesses. Known for its seamless integration with various financial tools, it ranks among the best business checking accounts, providing essential features that support efficient financial management.

● Key features

This checking account for business includes unlimited transactions, free ACH transfers, and no monthly maintenance fees. Additionally, Nav provides robust online and mobile banking platforms, integration with accounting software, and customer support to assist with any banking needs.

● Advantages

Nav Business Checking stands out for its no-fee structure, unlimited transactions, and seamless integration with financial tools. It's one of the best business checking accounts for small businesses seeking a straightforward and efficient banking experience.

● Limitations

The account does have limitations, such as no physical branches, which might be a drawback for businesses preferring to visit branches or in-person amenities. Also, cash deposit options are limited, which can be inconvenient for cash-heavy businesses.

● Setup requirements

To set up Nav Business Checking, you'll need to provide business documentation and identification. The account setup process is entirely online, making it quick and convenient.

● Target audience

This account is ideal for tech-savvy small businesses and startups looking for a cost-effective, online banking solution.

8. Bank of America Business Advantage Fundamentals™ Banking

Bank of America Business Advantage Fundamentals™ Banking is among the best when it comes to business checking accounts for small businesses. It provides essential banking services with a focus on convenience and support, making it an attractive option for growing businesses.

● Key features

This checking account for business offers access to Bank of America's extensive branch and ATM network, online and mobile banking tools, and a cash flow monitoring system. It includes 200 free transactions per month and a waiver on monthly fees with a minimum balance.

● Advantages

The account's extensive branch network, comprehensive online tools, and cash flow monitoring make it one of the best business checking accounts for small business teams looking for robust support and accessibility.

● Limitations

The account has a $16 monthly maintenance fee, which can be waived with a $5,000 minimum daily balance. Additionally, transactions beyond the 200 free limit incur fees, which might add up for high-transaction businesses.

● Setup requirements

To open the account, you need to provide business documentation, identification, and an initial deposit. The setup can be completed online or at any Bank of America branch.

● Target audience

This account is perfect for small businesses seeking extensive branch access and comprehensive financial tools.

9. U.S. Bank Silver Business Checking

U.S. Bank Silver Business Checking is a top choice among business checking accounts for small businesses. Designed to offer essential banking services without monthly maintenance fees, it's ideal for startups and small enterprises looking for cost-effective solutions.

● Key features

This checking account for business includes 125 free transactions per month, 25 free cash deposits, and no monthly maintenance fee. Additional features include online and mobile banking, access to a vast network of branches and ATMs, and integration with various financial tools.

● Advantages

U.S. Bank Silver Business Checking is preferred for its no-fee structure and reasonable transaction limits, making it one of the best business checking accounts for small businesses seeking affordable and accessible banking services.

● Limitations

The account has some limitations, including fees for transactions exceeding the monthly limit of 125 and a $0.50 fee per transaction over the free cash deposit limit. Additionally, it might not offer enough features for larger, high-transaction businesses.

● Setup requirements

To open the account, you'll need to provide business documentation, identification, and an initial deposit. The process can be completed online or at any U.S. Bank branch.

● Target audience

This account is perfect for small businesses and startups seeking a low-cost, straightforward banking solution.

10. QuickBooks Money

QuickBooks Money offers a unique and integrated banking solution tailored for small businesses and freelancers. It’s designed to streamline financial management by combining banking with QuickBooks’ powerful accounting tools, making it one of the best business checking accounts for tech-savvy entrepreneurs.

● Key features

This checking account for business includes no monthly fees, free ACH transfers, and unlimited invoicing capabilities. It also offers seamless integration with QuickBooks accounting software, real-time cash flow management, and a comprehensive mobile app for on-the-go financial tracking.

● Advantages

One of QuickBooks Money’s most attractive features is its easy integration with QuickBooks, providing a seamless financial management experience. Its no-fee structure and unlimited invoicing make it one of the best business checking accounts for small business requirements focused on efficient financial operations.

● Limitations

On the other hand, the account lacks physical branches, which might be a drawback for businesses that prefer availing of in-person services. Additionally, cash deposit options are limited, which might be inconvenient for businesses dealing heavily in cash transactions.

● Setup requirements

Setting up QuickBooks Money requires business documentation, identification, and an active QuickBooks subscription. The account setup process is entirely online, ensuring quick and easy access.

● Target audience

This account is ideal for small businesses and freelancers seeking integrated banking and accounting solutions, and are comfortable conducting all their banking actions online.

Streamline your business payments with Volopay

Benefits of a business checking account

Separate personal and business expenses

By having a business checking account one can keep the company’s funds separate from personal finances.Once you’ve separated these, you do not have to classify expenditures as personal or business on your overheads.

It can be best to have a business checking account for small business accounting so that your teams can manage finances and file taxes easily.

Elevate credibility and professionalism

Getting a checking account for your business makes it look more credible and professional. Your clients will also trust you more when they are making payments or doing any transaction with money from an official bank account under the name of your company.

It also helps to maintain a clear and organized financial track record in your business name to build your brand authenticity.

Convenient ACH transfers

With a checking account for your business, you can conveniently use ACH transfers for paperless payments through your business checking account.

This way you can send and receive payments electronically, saving time and reducing the need for manual transactions.

Easy issuance of checks

Business checking accounts enable the issuance of checks, and these checks are under the name of the business.

This remains essential for many business transactions, providing a secure and widely accepted method of payment while keeping the business name associated with transactions.

Tracking payments

Business checking accounts streamline the tracking of incoming and outgoing payments, providing clarity on receivables and payables, which is essential for managing accounts payable and receivable efficiently.

These updates and business-specific bank statements give you a bird’s eye view of your business payments.

Easy debit card transactions

With a dedicated checking account for your business, you can seamlessly manage and track all your debit card transactions with ease.

Business debit cards linked to checking accounts offer convenient, reliable, and secure payment options for managing everyday business expenses, ensuring quick and easy access to funds wherever your business takes you.

Monitoring cash flow

It is best to have a business checking account as you can easily monitor cash flow and track your money. Checking accounts for your business enables you to compare your bills, salaries, and property costs.

A business checking account gives you the complete picture of revenue and costs, so you can ensure that you have enough money to pay bills while making a profit.

Simplified record-keeping

It’s always best to have a dedicated business checking account for easier and more organized record-keeping. This way all your business transactions are recorded more easily instead of separating them from personal transactions.

Checking accounts for your business enables you to prevent misunderstandings and mistakes in financial reporting.

Simplification of taxes

With a checking account for your business, you can seamlessly simplify taxes. It is best to have a business checking account as it enables you to keep your personal and company funds separate.

This way your business and personal money won’t get merged allowing you to categorize expenses easily and simply for tax preparation, as well as keeping records audit-ready.

Efficient wire transfers

Checking accounts for business makes wire transfers more convenient. Efficient international wire transfer works as a convenient way to send money and pay bills to a recipient who uses a different bank account in a different country.

With a checking account for your business, you can seamlessly do international wire transfers, since business accounts are primed for large transactions and cost-effective transfer fees.

Steps to open a business checking account in the US

Once you’ve decided on the bank or provider to open a business checking account for your business, the process is simpler than you might think.

You just need to gather documentation based on the bank's (or institution's) requirements and submit them for approval. Once approved you can open your account after depositing the initial funds.

1. Pick the right provider

While opening a checking account for your business in the US, it’s important to thoroughly compare various banks to choose the best features, services, and options available to you

By carefully picking the right provider based on your specific business requirements, you can ensure that all your financial operations run efficiently and that you won’t find yourself lacking in any essential features, amenities, or requirements as your business continues to scale and grow.

2. Understand the requirements

When choosing a checking account for your business, it’s important to understand your budgets to calculate the investment in fees, as well as map your requirements to compare features, branch accessibility, and online banking capabilities.

Research different bank accounts to make more informed decisions. Consider the bank account that offers the best business checking account features suited to your needs.

3. Gather the required documents

To open a business checking account you need to gather all the necessary documents stipulated by your chosen provider.

Usually, you will require your personal address and contact information, your government-issued IDs, such as driver's license or passport, tax ID number (TIN) or your business license.

You can also use your Social Security (SS) number for a sole proprietorship, and Employee Identification Number (EIN) for the corporation, partnership or limited liability company (LLC).

4. Apply for the business checking account

Once you have analyzed your options to open a checking account for your business, and gathered the documentation, you can apply for the best business checking account based on your business requirements.

This process usually involves filling out a form (either online or in-person), or having a detailed conversation with the onboarding team, where they guide you through setting up and completing the application process smoothly.

5. Submit the documentation

Once you’ve filled out and submitted the form, you can then proceed to submit all the required documentation for opening a business checking account.

Before submitting the documentation, it’s recommended to cross-check all your documents, making sure you haven’t missed any crucial details, signatures, or necessary paperwork that could delay the approval process.

6. Wait for approval

Once the documentation and form are submitted, you typically only have to wait for approval. It might take anywhere from an instantaneous turnaround to a couple of days of wait.

If your documentation is complete and accurate then your approval should not be held up anywhere more than necessary. If there is an issue, you will be required to re-apply for the checking account with the correct documentation.

7. Fund your account

Once your checking account gets approved, you’re required to process the initial deposit in order to fully activate your business account.

Based on the specific checking account you’ve chosen for your business, the amount you need to deposit will vary—so, when considering which provider to go with, keep this initial financial investment in mind.

8. Activate your account

Once the initial amount is deposited, you can activate your business checking account. This typically involves familiarizing yourself with the features, setting up online accounts, integrating software, activating notifications, and downloading mobile apps for updates.

After that, you can easily manage your business's finances without affecting your personal funds.

Simplify your company finance with Volopay's business account

Key features to look out for in business checking accounts

Fees and charges

Before opening a business checking account, you should compare checking account fees.

Business checking accounts can charge a variety of fees, including monthly service fees, transaction fees, cash deposit fees, wire transfer fees, and ATM usage fees.

These charges can add up quickly, so it’s essential to choose an account that aligns with your business’s financial activities and minimizes unnecessary costs.

Account limits

Business checking accounts may have specific limits on the number of transactions and cash deposits allowed per month, which could significantly impact your business operations.

It’s crucial to thoroughly check these business checking account limits in advance to ensure smoother financial operations and avoid any unexpected issues or delays in the future, especially when making necessary and time-sensitive transactions.

Interest rates

Business checking account interest rates can vary depending on the institution and can range from 2.5% to 5.48% APY (Annual Percentage Yield).

Before opening a checking business account with a bank, it is necessary to carefully and compare check their interest rates so that you can handle your finances seamlessly and know exactly what kind of potential interest earnings you can reasonably expect.

Corporate cards

A corporate card is a credit card that a company provides its employees to effectively manage business expenses without dipping into their personal funds.

It's best for you to compare options for corporate cards linked to the account while opening a business checking account.

This will streamline your expense management and provide additional flexibility in how your employees make payments.

Transaction fees

Checking accounts for business often include domestic, as well as international transaction fees. The service provider charges these fees for each electronic payment processed for a customer transaction.

The transaction fees can be a few dollars or a percentage of the total deposit. It’s important to check business checking account transaction fees so that you can be prepared for any payment costs.

Legal compliance

It’s important to consider legal compliance with banks for your checking account. Aside from the high value of transactions, these money transfers are directly linked to your business name.

It is vital that you follow government regulations (both domestic and international) while making transfers, and receiving payments, so that your business remains compliant with the law, and all transactions are safe and secure for all parties involved.

Tax reporting and filing

Look for account features that ease tax reporting, such as integration with accounting software or detailed ledgers that make tax preparation easier.

By having a business bank account, you can keep your business expenses in one place, thus saving you from separating them from personal finance when it comes to filing taxes or for applying business-specific tax calculations.

This makes it easier to accurately report your revenues and expenditures at the year's end.

Minimum account balance requirements

While opening a checking account for your business, you should always check the minimum account balance requirement carefully. Minimum account balance requirements can vary significantly by bank and account type.

Some checking accounts require an opening deposit, which can range from $25 to $100, while others expect you to maintain a minimum amount in the account at all times (or pay a fees for not maintaining it).

Accounting integrations

It’s important to consider banks that offer accounting integration features for your business checking account. These integrations simplify financial reporting and significantly reduce the need for manual data entry.

By syncing your business checking account with popular accounting software such as QuickBooks or Xero, you can ensure seamless data transfer and eliminate the risk of human error in your financial records.

Online usability

Whenever you are evaluating an online checking business account, you must consider its usability and features. Some functionalities may include mobile check deposits, bill pay options, online access to account information, or even online statements.

A user-friendly online checking business account enhances convenience and efficiency in managing your business finances remotely.

Customer support

Evaluate the availability and quality of customer support offered by the checking account provider. Look for options such as 24/7 support availability, access to dedicated business banking specialists, and support channels like online chat or customer service phone lines.

The best customer service ensures reliable and seamless financial operations for your business checking accounts.

Overdraft facility

To manage cash flow effectively and avoid interruptions, familiarize yourself with the overdraft facilities available with your account provider. These include fees charged, interest rates, and coverage policies.

This will enable you to prevent unanticipated costs and manage finances efficiently while minimizing negative effects on your business’s credit rating.

Managing your business checking account

To efficiently manage your business checking account, always monitor the account activities to detect any discrepancies and keep an eye on cash flow. One way to secure financial stability is by ensuring compliance with regulations.

Additionally, online banking features facilitate ease of management and accessibility for all necessary business personnel. Control of authorized users and account alerts add to security and oversight.

1. Monitor account activity

To keep accurate financial records and promptly detect any anomalies, you should regularly check the activity on your business checking account.

Regular scrutiny of transactions will enable you to recognize unauthorized charges, discrepancies, or possible fraudulent activities.

2. Manage cash flow

Cash flow management involves monitoring both incoming revenue and outgoing expenses.

By examining your checking business account balances and transaction history frequently, it is possible to identify patterns and shifts in cash flow.

This will help you predict likely shortages or surpluses of cash so that you can take pre-emptive measures to adjust your spending, saving, or investment strategies.

3. Comply with regulations

To open a checking account for your business, you will be required to comply with several regulations.

Aside from the required documentation while opening the account, your transactions will also need to comply with monetary authority regulations, which your account provider should support you with.

Ensuring that your provider holds necessary licenses and follows all regulations, and cooperating with them, will keep your account compliant with all laws.

4. Use online banking features

It's best to confirm with a provider before opening a business checking account whether they offer online banking services.

Online banking features for business checking accounts allow businesses to conduct financial transactions digitally, such as making payments, viewing account balances, and transferring money. They also provide online alerts and remote controls for ease of management.

5. Manage authorized users

Secure your checking account for business personnel by limiting access to authorized users only.

Activating strong authentication measures and conducting regular reviews prevents unauthorized transactions, reduces the risk of fraud, and ensures accountability within your organization.

It also keeps sensitive financial data secure and prevents unauthorized leaks.

6. Set up account alerts

You can set up account alerts for your checking account, which notify you of real-time developments, such as low balances, upcoming transfers, and large transactions.

Therefore, they ensure financial discipline, enhancing reasonable control over the company’s monetary affairs, and allow for timely intervention whenever necessary.

7. Review your account regularly

In order to make smart and strategic business decisions, it is important to review business account statements, balances, and financial trends regularly.

Analyzing account data periodically will help you identify areas for potential cost savings, increase efficiency, and make fruitful investments.

Detecting patterns or anomalies is also advantageous since these will necessitate either further investigation or adjustments in strategies.

Keep track of your company finances with Volopay

What makes Volopay the ideal choice for businesses?

Volopay’s business account offers an innovative alternative to traditional business checking accounts, focusing on advanced expense management solutions tailored for modern businesses.

Volopay’s services are equipped with multi-currency accounts to simplify the process of loading wallets, making payments, and tracking expenses—all with competitive fees, customizable transaction controls, and no minimum limits.

Volopay is the best business checking account for small business teams as it facilitates companies to also automate other functions like accounting, reimbursement, invoice management, corporate card control, and more.

Due to its comprehensive features designed to streamline financial operations and enhance efficiency, Volopay is one of the best alternatives for business checking accounts.

1. Access a global multi-currency account

With Volopay global multi-currency account you can hold money in different currencies and avoid paying sky-high exchange rates and transaction fees.

Volopay enables you to make cross-border B2B payments and remittances at lower FX rates.

Volopay’s business account allows businesses to send money worldwide quickly and transparently via automated invoice payments.

2. Utilise corporate card options—both virtual and physical

With Volopay's corporate cards, you can issue virtual and physical cards to your employees and control, track, and set spending rules for each card. Whether it’s business travel or online subscription management, corporate cards will help you manage them all.

Even if it’s T&E payments for business travel or any local business expenses, you can seamlessly use Volopay’s widely accepted physical corporate card for your business spending.

Moreover, with the card management dashboard, you can create unlimited virtual cards seamlessly to make online payments, manage SaaS subscriptions, and make vendor payments.

3. Conveniently transfer funds internationally and domestically

With Volopay you can conveniently make domestic and international wire transfers using a single platform.

Volopay offers competitive rates compared to traditional banks because it allows users to maintain balances in multiple currencies and transfer money at low FX rates.

Volopay also offers both SWIFT and non-SWIFT payment options, with non-SWIFT transactions being faster and cheaper for local currency transfers.

4. Manage users with ease

Volopay makes it easy for administrators to manage user access and permissions. They can assign roles, set spending limits, and control transactions.

Users can be assigned to specific departments and projects so they can access their allotted funds, and so that transactions are mapped accurately.

This helps follow company policies, improves security, reduces administrative work, boosts efficiency, and strengthens financial oversight.

5. Streamline accounts payable process

Volopay automates accounts payable tasks such as vendor payments and invoice management, reducing manual workload significantly.

By automating these processes, businesses can improve accuracy in financial transactions while saving time and resources previously spent on manual data entry and reconciliation.

Schedule advance payments and take advantage of OCR-powered Magic Scan to efficiently manage invoices and payables.

6. Manage employee payments and reimbursements with ease

Volopay simplifies employee payments and reimbursements through streamlined processes.

It offers automated approval workflows and direct deposit capabilities, ensuring efficient expense management for payroll and employee expense reconciliation.

This feature not only enhances employee satisfaction by providing timely reimbursements but also reduces administrative overhead for payroll and finance teams.

7. Implement multi-level approval workflows

Multi-approval workflow is a hierarchy based on the employee’s roles within the expense management software dashboard.

While using Volopay you can set multiple levels of approvers to manage company’s spending, payments, and fund requests.

This makes the whole process transparent, simple, and quick, and also keeps all approval requests in one place for a traceable paper trail.

8. Enhance bookkeeping procedures

With Volopay you can enhance the bookkeeping procedure by quickly analyzing financial transactions.

Easy access to digital receipts, invoice balancing features, and automated reconciliation allows a clear overview of spending.

Automated transaction records and facilities to upload transaction-relevant paperwork streamline bookkeeping, making Volopay one of the best alternatives to a business checking account for small business accounting teams.

9. Integrate with accounting and HR systems

Volopay integrates smoothly with accounting software like Xero, Netsuite, and QuickBooks, automating reconciliations and syncing transactions.

It also works with HR systems to manage payroll, onboarding, and benefits. Virtual cards help with HR expenses, and the platform ensures faster reimbursements and streamlined financial management. Additionally, dedicated travel cards and allowances make T&E management much smoother.

10. Gain real-time visibility of spends

With Volopay you can gain real-time visibility into every business expense. Volopay’s payments and cards come with enhanced controls.

With a single click, you can track employee spending, set payment controls, and sync transactions with your ledgers.

You also get real-time access to card spending patterns, and admins and managers can view up-to-date spending by department, by project, and by vendor, without the need to dig through mountains of paperwork.

Keep track of your company finances with Volopay

FAQs

Business checking accounts are associated with a variety of fees, including maintenance fees, transaction fees, and fees for specific services. It's best to check with your bank or provider what kind of checking account fees they charge. This will enable you to budget your finances seamlessly.

Opening a business account with Volopay is a simple process. You will be required to provide business owner ID documents, business registration information, as well as paperwork required for legal compliance. In order to know the exact requirements for your business type and location, sign up for a demo with our team.

Many business checking accounts offer integration with accounting software, payroll services, and financial management platforms. This integration ensures that various tasks like expense tracking, invoicing, and payroll management are made automatically improving efficiency and accuracy. Before opening an account it's best to check whether the provider offers integration with other financial services or not.

Yes, businesses can use their checking account to manage online invoicing. Many account providers offer services that include invoicing tools that can help businesses create, send, and track invoices electronically. With this feature, the process of billing becomes easier leading to better cash flow management. However, do check with the provider first to see if they provide such a service.

Yes, virtually all account providers offer their business customers online banking services for their checking accounts. Online banking enables businesses to manage accounts, view transactions, transfer funds, or pay bills, while conveniently accessing statements through any internet-enabled device.

The time taken to open a business checking account differs based on the provider and which services you’ve opted for. Online applications can take several days before they are approved, while opening an account at a bank branch can cause delays due to manual verification procedures. Funding the account and obtaining necessary materials such as checks and debit cards can also take additional time once your account has been approved. It’s best to talk to a customer service team member to understand the exact timeline you can expect for your business.

Yes, businesses can open a business checking account without forming an LLC. Banks typically accept various business structures such as sole proprietorships, partnerships, corporations, and LLCs. Requirements may vary based on the business type and banking institution.

Yes, some providers allow companies to connect their checking accounts directly to savings accounts, credit lines, and merchant accounts that process credit cards along with investment accounts. This enables effective management of cash flow so that funds can be accessed across different financial services.

It's advisable to keep business and personal finances separate for clarity and tax purposes. Using a business checking account for personal expenses can complicate accounting, and tax reporting, and potentially violate business regulations. Personal expenses should ideally be managed through a personal account to maintain financial clarity and compliance.