Volopay business account vs conventional bank account

Traditional business accounts still come with the same old provisions they always have. While a traditional bank account is good for maintaining the status quo, it is not very useful if you want to grow your business.

Over the years, as the financial sector has grown so have the options businesses have with regard to corporate accounting. Now, with accounting systems like Volopay, you can do so much more than just manage books. Volopay’s Bill Pay feature is a financial marvel that is bound to blow your socks off.

What is a business bank account?

A business account is not very different from a personal account. It works in pretty much the same way, except that business accounts help entrepreneurs keep their personal and business finances separate. A business account also comes with some special features like forex transactions, credit check facilities, and payroll services.

While opening a bank account for business is not compulsory for all companies, doing so can come with a number of advantages. Some benefit of a business bank account include, but are not limited to; (i) Protection on personal liability, (ii) Easier time processing taxes, and (iii) Boosted professional image.

To know more, read - Benefits of digital business bank accounts for your business

Volopay business account vs traditional business account

- Every transaction linked to an employee

- Pre-payment approvals

- Unlimited virtual cards

- Real-time spend tracking

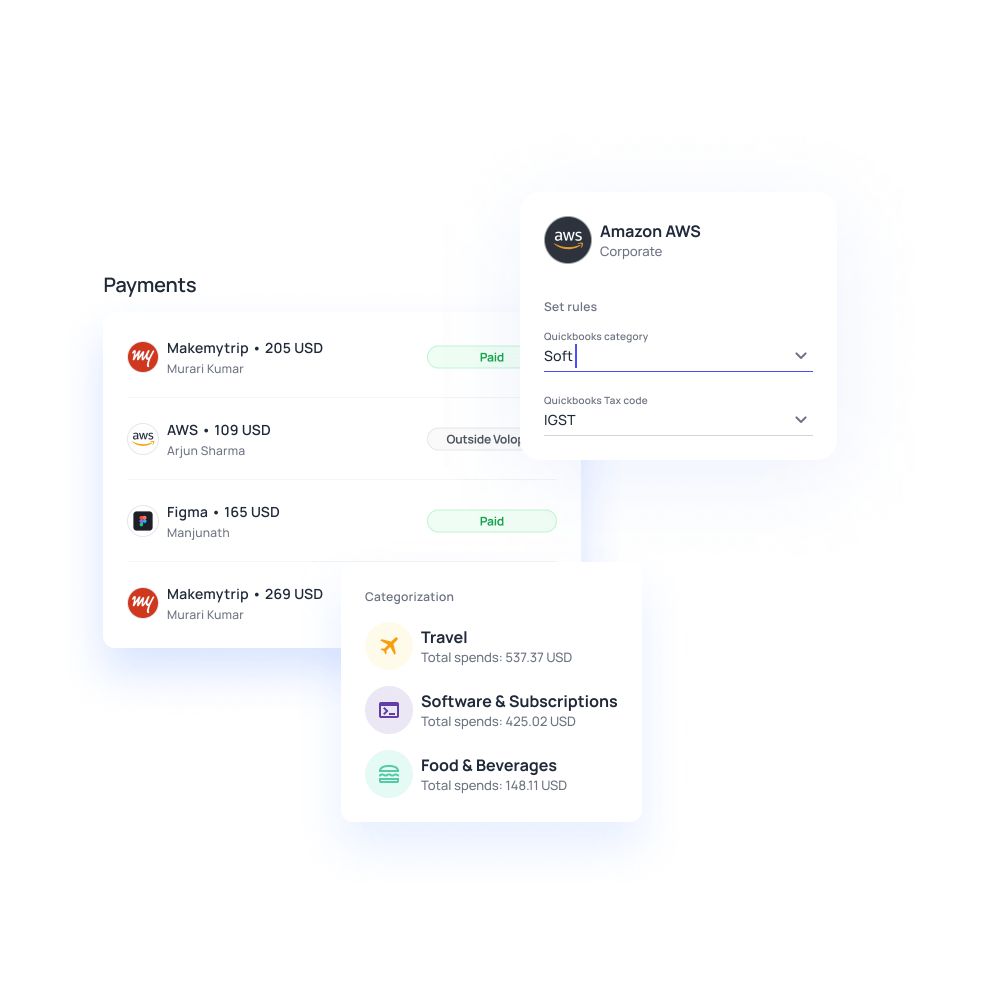

- Accounting Automation

- Automated expense reports

- Vendor management

- Flexible credit lines

Why choose Volopay’s bill payment over a traditional business account?

To put it in one line - our Bill Pay feature can be used by companies to carry out any bill payment required for business expenses, including money transfers and remittances. Traditional business accounts offer the usual services you would expect from a bank. With Volopay, however, you not only get a bank account but a whole lot more.

Multi-currency wallets & forex

International payments can be quite challenging with a traditional business account. Not only do you have to jump through a long line of hoops, but banks also charge high transaction fees and offer interest rates that are sure to burn a hole in your wallet.

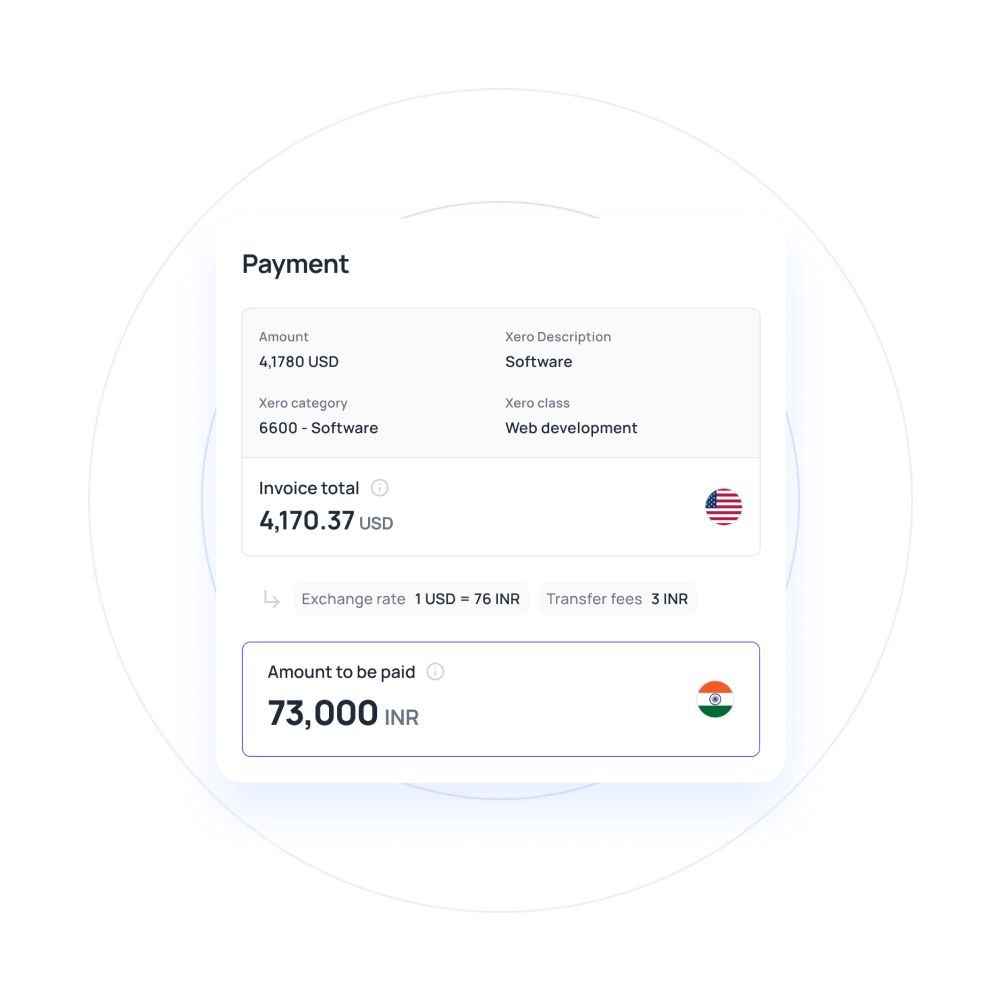

Volopay, on the other hand, gives you the ability to maintain multiple, global wallets in different currencies at the same time. You can easily transfer funds between these wallets, convert currencies at extremely low forex rates and use the wallets to make payments. Both international and national payments can be made through the Volopay platform with zero hassles and at breakneck speeds.

Easy money transfers

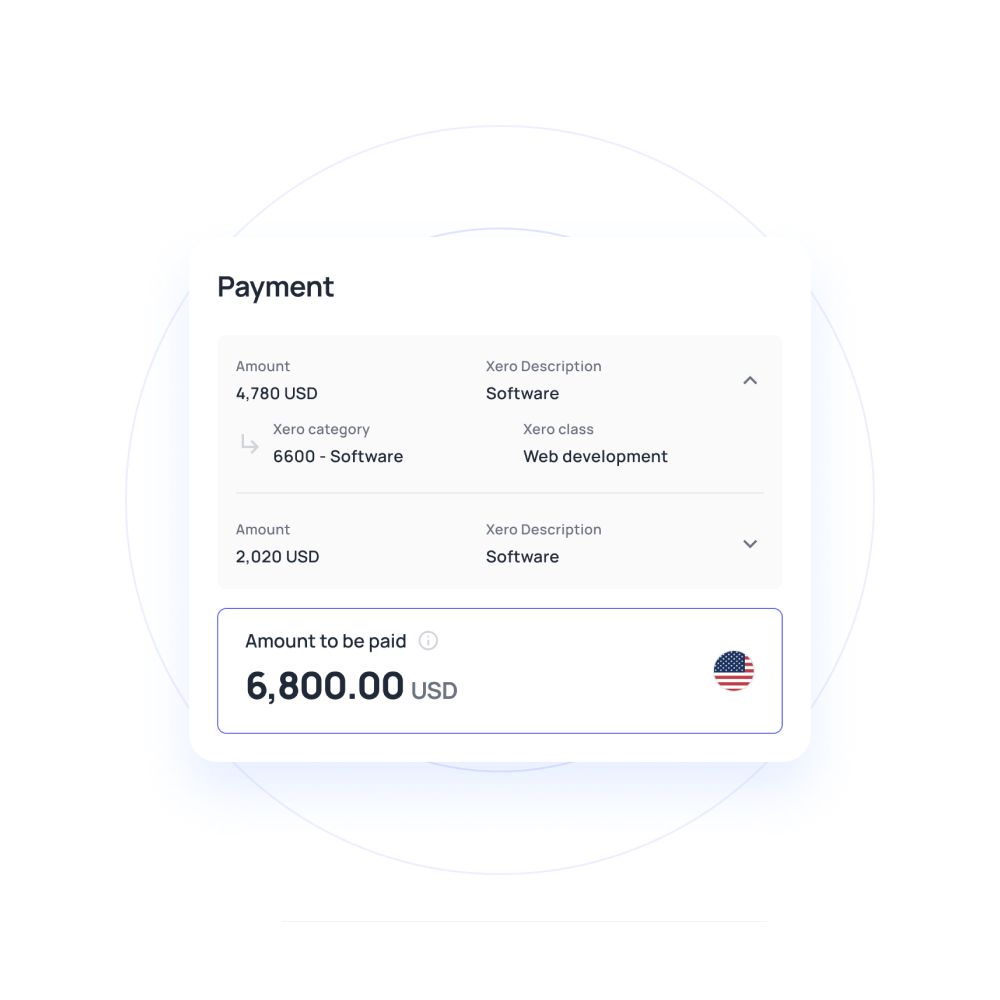

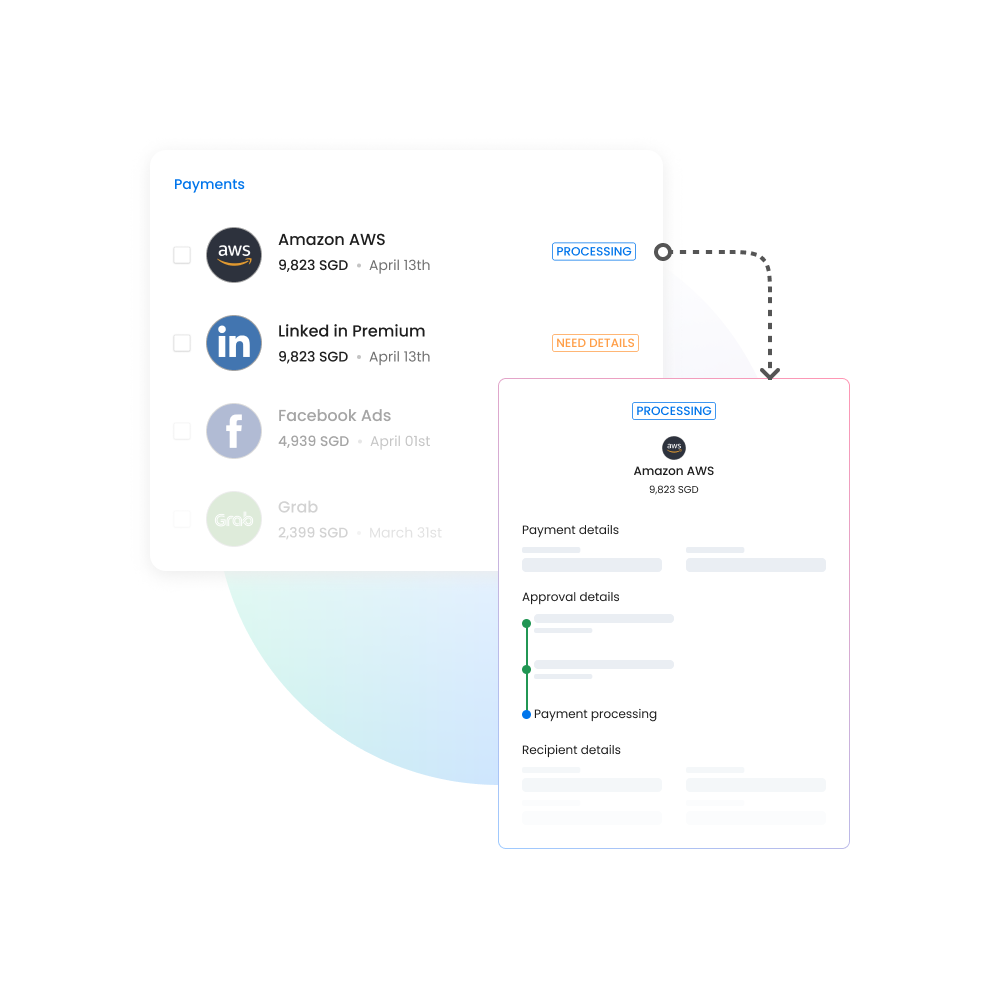

With Volopay transferring money can be as easy as clicking a few buttons on your phone or computer. You get one comprehensive dashboard from which you can manage all your vendor payouts. All you need to do is add vendors or suppliers and upload the invoices that need to be paid. The system recognizes and stores data from invoices to create bills, and subsequently automates the accounts payable process.

While this entire process can be automated by the system you can also choose to do it manually. With Volopay you both have the freedom to act on and maintain control over all your payments. With a traditional account, on the other hand, the same process involves a number of manual steps that must be painstakingly followed before a payment can be made.

SWIFT and Non-SWIFT

Volopay gives you the freedom to access both SWIFT as well as Non-SWIFT or local payment networks. With the SWIFT payment network, you can send funds to over 40 countries in their own local currencies. If, however, you wish to transfer your funds using local payment networks you can do that as well.

Using Non-SWIFT payment networks with Volopay lets you transfer funds in USD. Regardless of your choice, Volopay completes your fund transfer in a fraction of the time it would have taken a normal bank; payments get reflected in the recipient's account within 2 hours.

All-in-one solutions

With Volopay you can issue corporate cards to cover any business expense your employees might need to make. These cards can be issued in both physical as well as virtual forms. In fact, you can issue an unlimited number of virtual cards with Volopay, completely free of charge.

All expenses that go through Volopay are vetted by an approval matrix. This approval matrix is highly customizable, you can design it as per your company spend policy once and let it work its magic on your expense claims. You can also set up auto-approvals for recurring payments.

Volopay comes with a comprehensive analytics dashboard. This dashboard gives you concrete, actionable insights into your company’s spending behavior. You can affix custom parameters to this as well, this can help you get the exact data you need.

Pay your bills on time, every time

How do Volopay’s bill payments work?

Capital transfers

When companies transfer funds to international bank accounts they incur high fees. This is because of a combination of high remittance fees and hidden markups in currency conversions.

By using Volopay, companies can carry out capital transfers at a cheaper rate. The platform helps you save money via low remittance charges and extremely reasonable conversion rates. This feature is especially useful for companies with multiple entities working across the globe.

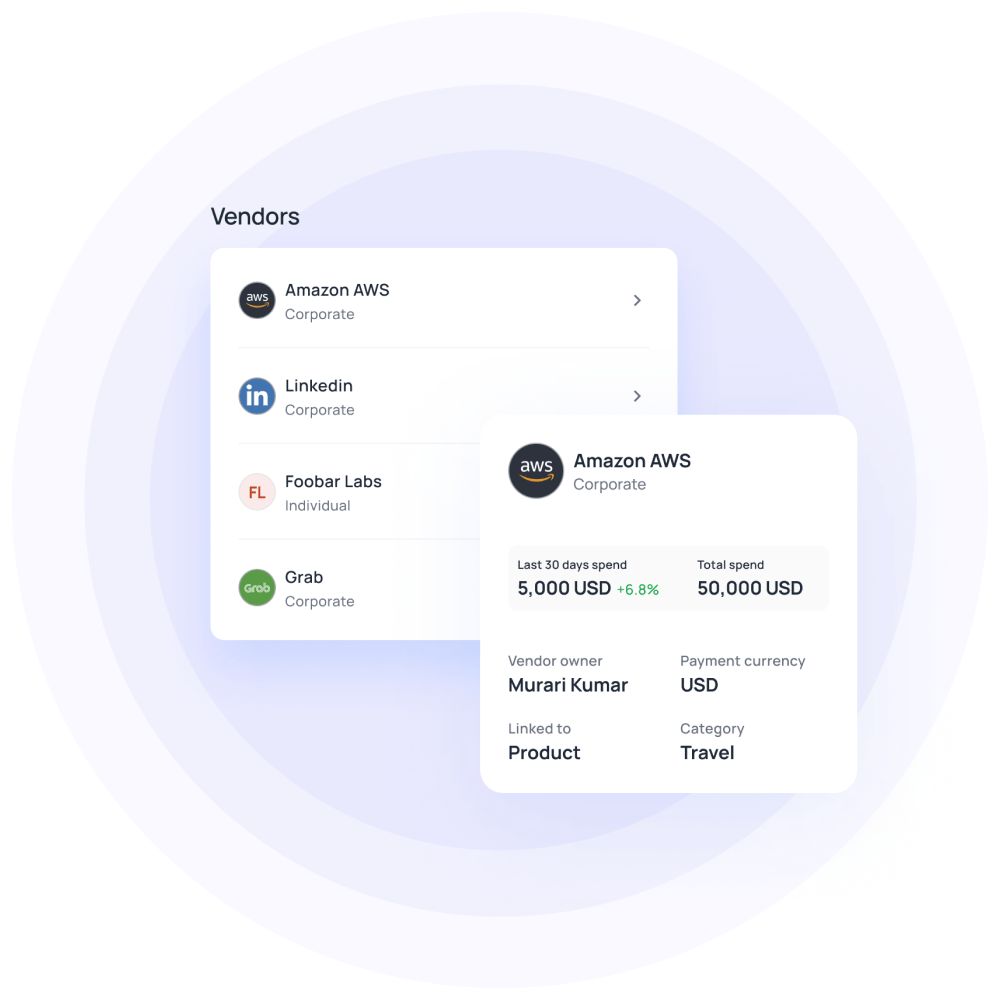

Paying vendors

Easily create, schedule & pay vendors on time with the Bill Pay feature on Volopay. Send money to over 130 countries at some of the cheapest possible rates and enjoy the perks that come with early payments.

Volopay works as a recurring billing software as well, you can also save time by creating recurring payments on Volopay for repeat vendors. Manage outstanding vendor invoices, process and execute payments in seconds in a single dashboard.

Reimbursement

Companies dealing with a lot of offline procurements and bill payments often face a high number of expense claims from employees. Employees might have to incur cash payments or payments at POS that does not accept Visa.

In these cases, they usually have to pay out-of-pocket. You can reimburse these out-of-pocket expenses using Bill Pay as well. Employees can directly submit claims on the platform, post which your managers can review and approve the claims directly on Volopay.

Payroll

Payouts to employees can also be done through Bill Pay. These include salary payments to employees stationed in both domestic as well as international locations.

For international salary payments, you can greatly benefit from our low remittance fees and conversion rates. This is especially useful if you have a lot of employees working across the globe.

How to create bill payments easily in Volopay?

Step 1: Create vendor

First you need to create and add a vendor to your list of payees on Volopay. Make sure you fill out all vendor details accurately, if you input erroneous information the payment might not go through. Here you can also add details like payment method, the currency of choice, and so on.

Step 2: Create Payment

Once you’ve created and added your vendors to the platform making the actual payment is basically a cakewalk. All you need to do is select the payment you want to make, select the vendor, fill in payment details and let Volopay take care of the rest.