What is a transaction fee - Types, examples, and working

Along with your total expense, banks often add pesky charges hidden in the fine print, mostly under Terms and Conditions. These are commonly known as transaction fees. These charges are widely applied across debit, credit, and other payment cards and are charged by your bank or any other financial service provider for using their payment gateway to make the transactions.

Every time you issue a transaction request to the bank or account provider, they charge you a certain transaction cost to process it. While these charges appear minimal in value, making multiple business expenses a day can quickly rake in hidden transaction fees up to a couple of hundred dollars every month.

What are the types of transaction fees?

Flat fee

This kind of transaction cost refers to a fixed amount of fee charged on a transaction irrespective of its value. Flat fee is a static charge and will accompany every expense you make through a particular account.

Percentage fee

This fee is usually levied on expenses where the account provider collects a small percentage of the total transaction. In percentage fees, you can also be charged a base flat fee, either in addition to percentage fees or as a minimum charge in case the transaction is too small.

Example of transaction fees

Here’s a small example to help you visualize and understand transaction fees better. Suppose you have a credit card provider that charges a flat fee of around 20-30 cents per transaction with a percentage fee ranging from 0.5% to 5% per transaction. Now if you have made a purchase totaling $100, here’s how the transaction fee could affect your purchasing power.

1. Best case scenario

The best-case scenario for a buyer would be the lowest transaction costs processed. In this case, it would look like this:

Purchase value = $100

Transaction value = Flat fee (20 cents) + Processing fee (0.5% of 100 = 50 cents) = 70 cents

Total spend = $100.7

2. Average case scenario

In this we calculate the median of the two transaction fee scales and calculate how that would appear in our bank statements:

Purchase value = $100

Transaction value = Flat fee (25 cents) + Processing fee (2.25% of 100 = 2 dollars and 25 cents) = $2.5

Total spend = $102.5

3. Worst case scenario

With some account providers, you would be charged on the costlier side of the transaction cost scale, which would look like this:

Purchase value = $100

Transaction value = Flat fee (30 cents) + Processing fee (5% of 100 = 5 dollars) = $5.3

Total spend = $105.3

Interesting read: Guide to Automated Clearing House (ACH) payments

Transaction fees for merchants

This is a different and slightly complicated story. Whenever a customer pays for a good or service through credit card transactions or any other card payment, the business is charged a transaction fee. This transaction fee involves a payment made to multiple parties for using their platform and payment gateway. In short, a business has to pay two types of fees.

Interchange fee

This fee is charged by credit card companies for each transaction initiated through their card. It comprises a small percentage of the transaction, including an additional flat fee on every transaction. This small percentage varies depending on the issuer of the card, the kind of card being used, and so on.

Payment gateway fee

The second kind of transaction fee is levied by the payment portal provided by the merchant bank or any other authorized payment gateway you use. The payment gateway fee is usually a percentage fee, but in some cases can also include a fixed flat fee for every transaction.

Foreign transaction fees

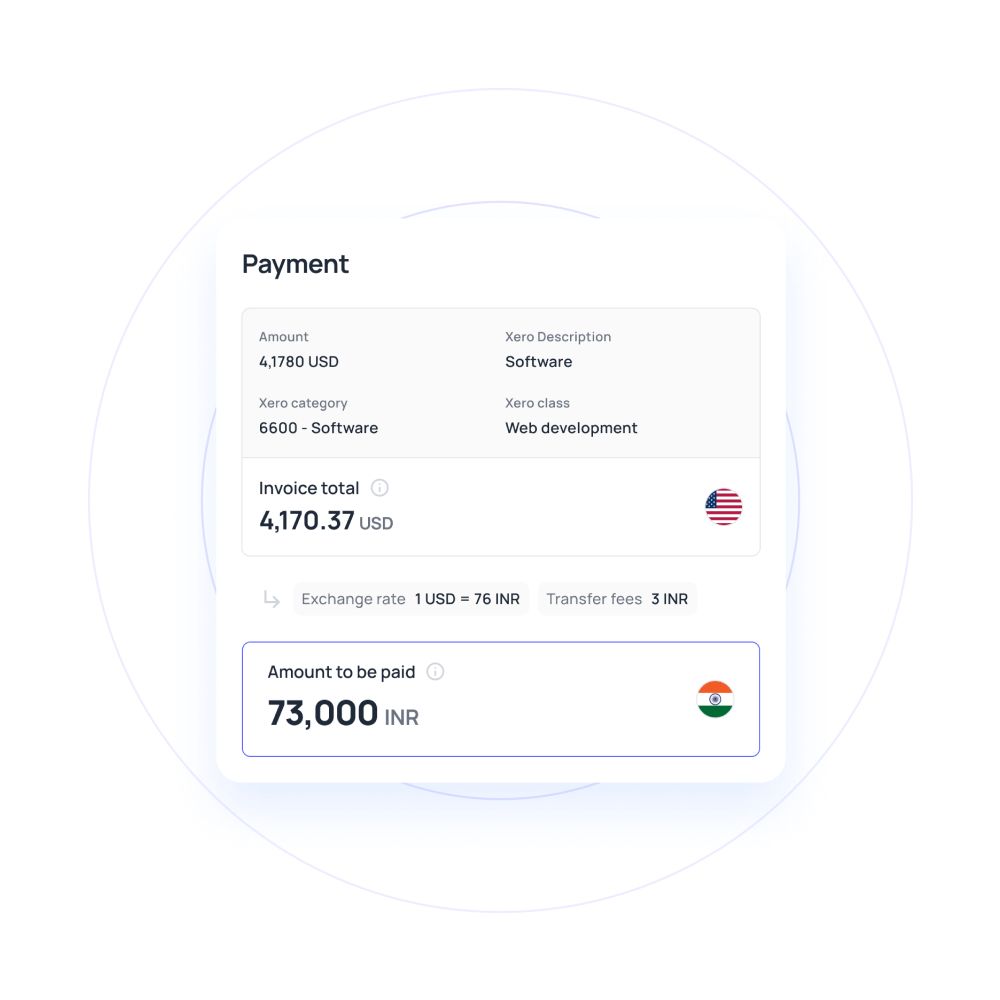

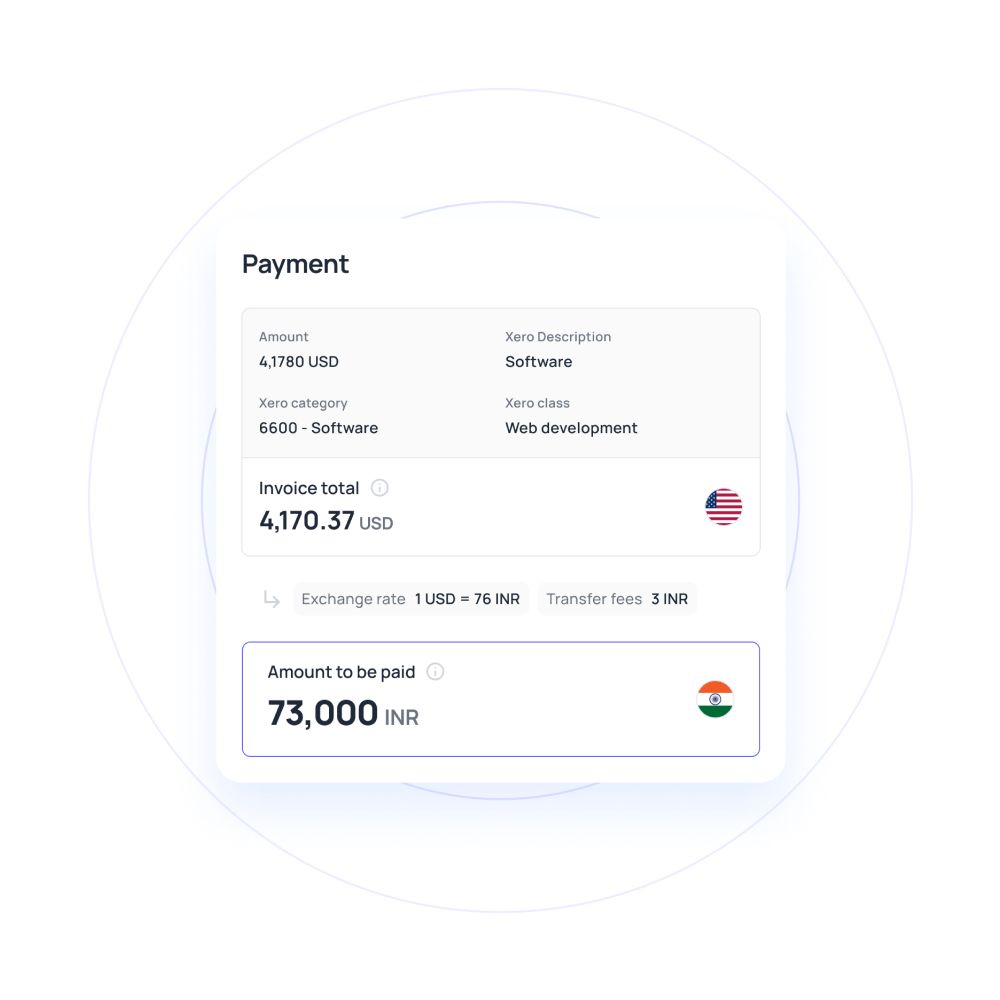

If your business has international vendors, you would have to pay a Foreign transaction (FX) fee, which is a surcharge that appears on your card when your purchase is processed through a foreign bank or is in a currency other than your national currency. These charges are generally on the medium to higher-end since there are multiple processes involved. Generally, these exchange rates are calculated by converting all foreign-denominated transactions to USD. The fee is made up of two parts.

1. Currency conversion or Network fee

This type of FX fee is charged by major payment gateways that allow electronic payment transfer facilities all around the world, such as Visa and Mastercard. They charge a fee of around 1% on all transactions.

2. Issuing bank fee

Depending upon the type of credit card you use, you might end up with an additional 2% on top of your network fee. This charge can be high, depending upon the issuing bank, and is calculated collectively with your conversion rate to reflect your statements more simply.

Pay across the world at the cheapest rates with Volopay

Volopay makes domestic and international transactions a piece of cake, finally giving you the peace of mind you’ve always wanted! With Volopay, you can make local transactions absolutely FREE, no questions asked. Cross border B2B vendor payments are now cheap and highly affordable - pay in 100+ countries across 65+ currencies through Swift transfers at the lowest FX rates.

Effortless payments

Eliminate the hassle of FX charges altogether. Volopay offers multi-currency wallets with free foreign transactions! Open these accounts in the currency of your choice, online and without any fuss. You can pay in local currency and remove the need for foreign processing fees altogether.

Want an even more effortless solution? Introducing USD Cards! Volopay USD cards will eliminate FX charges, allowing businesses to pay in US dollars from anywhere in the world, thereby saving them millions of dollars in fees every year.

Related read: What is transaction success rate and why it is important?