Discretionary expenses - Examples and how to manage

Every business is trying to stay competitive in controlling its costs in order to maintain the financial health of the company.

And at the same time, every company is also trying to build the best environment for their employees and customers to ultimately grow the organization. More often than not this comes at a monetary cost.

So to reach a balance between both these agendas, companies must classify expenses as essential or discretionary expenses.

What are discretionary expenses?

Discretionary expenses are those expenses made by a business that are non-essential. These expenses will differ from company to company and can be a bit subjective in certain cases depending on the type of business you run and the type of industry your organization functions within.

An expense may also be discretionary depending on the stage at which your business is in. If you’re still building your product or service, there’s no point in hiring many sales personnel to sell an undeveloped product.

Money that you have should be utilized for research and development at that stage of the business. Advertising, for example, seems to be an essential expenditure for a company. But this might not always be true. Some companies can manage to grow themselves through other forms of marketing without spending a penny on paid media.

Another way of looking at it and having a clear distinction in your head between discretionary and essential expenses is through the legal lens - If not making an expense leads to legal consequences, then it is an essential expense.

If not spending on a particular thing leads to no legal obligation, then it is a discretionary expense. Many would also consider that essential expenses are those that are required for the survival of the business while discretionary expenses are those that are beyond the survival phase and add to the quality of the business.

Marking essential expenses for the business

● Taxes

Paying taxes on behalf of your business is definitely an essential expense and needs to be fulfilled before any other discretionary expense else there will be legal ramifications that can lead to problems in the future and even more expenses.

● Employee salaries

Paying employees on time is also an essential expense so that the operations of the business are done properly and the company does not have any hiccups on the way.

● Debt repayments

Any form of repayment that must be made by the business including loans and mortgages are essential. If these are not paid on time the company will end up spending even more in the form of interest and any legal action that might be taken if the business fails to pay after several notices.

● Office rent

Paying the office rent is an essential form of spending as the workspace is often a crucial part for the employees to have a conducive and productive work environment. (Of course, in the case of businesses that operate remotely, there is no office rent at all.)

● Utility bills of the company

Utilities for a business’s physical office such as electricity, internet connection, etc. are essential expenses as they are the backbone for the entire team to collaborate and function efficiently.

● Inventory

For businesses with physical products, having space to store inventory becomes an essential expense.

● Software

Just like utilities are important for a physical office, software system expenses are essential expenses for employees in a remote business to collaborate.

● Necessary hardware & equipment costs

Factories, machinery, laptops, etc. are all part of hardware and equipment that a business needs to function properly making them an essential expense.

Some discretionary expense examples

1. Is marketing a discretionary expense?

Costly marketing events, ads, PR, video production, outsourced agency & freelancers costs, etc are all part of marketing expenditure. Most would say that these are all essential expenses to get the word out about your business and get people to become prospects.

While marketing is an essential part of business, it is necessary to understand that not all forms of it are needed for every business. Some forms of advertising and marketing channels will yield a better return on investment than others depending on the type of business you have and the industry you operate in. Looking at marketing from this perspective makes it a discretionary expense.

So picking and choosing methods of advertising and marketing is a better way to control expenses and get the most out of your marketing budget.

2. Investments

Merger & acquisition activities can be seen as strategic decisions to enhance and grow your business in the long run but it is definitely a form of discretionary expense as your business would survive in the short term even without doing so.

Funding external startups is again a strategic choice and a form of monetary allocation when your business sees potential in another company and hence decides to support them. But again, it is not anywhere close to an essential expense for your business.

R&D can be looked at as a discretionary or essential expense depending on how much access you have to current and updated information about the business you are in or want to start. Training investments for business employees are often unnecessary and can be avoided with correct hiring decisions.

On the other hand, it can be an important expense if your organization follows non-traditional operational methods for which each employee must be trained properly before they can start executing their daily job requirements.

3. Multiple subscriptions

CRMs, Communication apps, Planning & Data management apps, business suites, and add-on products are all systems that help the management and employees to structure their work and collaborate to get work done more efficiently.

But more often than not, teams go overboard in implementing too many systems and make processes more complicated than they need to be. All of this ends up costing a lot in the form of subscription fees that are recurring in nature and add up to unnecessary expenses in the long run.

4. Business travel

With modern communication technology, most business travel meetings that were deemed necessary years ago have become unnecessary expenditures in the form of time, energy, and money to travel.

Today, a business meeting that had to happen in a conference room can happen easily over a virtual meeting on digital platforms like Zoom without any travel costs.

5. Maintenance & office improvements costs

Many businesses after a point look to expand their office spaces. This is necessary if there is not enough space for existing employees to work in the office and you plan to expand the team even further.

But often businesses spend way too much on expanding an office space more than it is necessary to do so. This extra expenditure is non-essential and can be better utilized elsewhere where it is necessary.

6. Employee gifts & team perks

While it is fruitful to have a positive and jolly work environment so as to improve the culture and in turn improve performance, there are many expenses that a company incurs for employees that can be considered discretionary. For example, dine-outs, reward program costs, etc. are all non-essential spending. Building an open and flexible culture where all employees can thrive is not just about having as many material perks as possible.

Nowadays, more often than not people see these perks as superficial ways of making a job seem more than what it is.

So it can be a good idea to cut back expenses on unnecessary perks and focus instead on inculcating a good culture through empathetic leadership and letting employees explore their potential by giving them the freedom to expand their work capabilities.

Discretionary expense - Key consideration

Discretionary costs fluctuate a lot more than essential spending and vary from business to business. You need to remember that discretionary expenses are not something that should be avoided altogether but rather something to be controlled so that your company’s financial health is not in jeopardy.

Making sure your business survives is always the first step to making it thrive. When the financial foundation of your business is strong, then you should look to improve the quality of work life for your business and its employees.

And the smart way to do this is to make sure you budget discretionary spending. Set aside an amount of money and limit the expenses you plan to make for your business that isn’t necessary only to that extent. This way you will be able to create a balance between not spending too much on non-essential items but still ensuring that your business is doing enough tertiary activities that have an impact on the longevity of your business.

A company might also find itself in a situation where discretionary costs are important to stand apart from the competition in some form that helps them grow its business. Something that seems non-essential on a surface level may well turn out to be an important differentiating factor for a potential employee or customer to make the decision of choosing your company over others.

How do you budget discretionary spending?

● Figure out overhead costs

An overhead cost is that that cannot be attributed directly to a revenue unit or the production of a good or service. These costs might be slowly chipping away at your company funds without having a significant impact. So identify these costs so that you can decide what is to be done with them based on your situation.

● Strategize to pay off any business debt

Out of all business expenses, you should always strategize to pay off any form of loan first. Not doing so will increase expense burdens through the interest rates. Paying off loans early also improves your business credit score.

How to manage discretionary spending using Volopay?

1. Examining discretionary spending is critical

The first step to managing non-essential spending is to analyze and answer the question “What are discretionary expenses for my business?” Once you identify all the discretionary spending within your organization, you must then discuss with relevant stakeholders with regard to whether a particular expense can be removed altogether, replaced with a cheaper alternative, or not be changed at all.

Examining all your expenses and classifying them as necessary or not necessary will help you with the process of reducing costs. An important thing to remember while doing this task is that the decisions you make at one point in time are not obsolete and can be revisited in the future for changes to be made.

2. Clear & effective expense policy

An expense policy is nothing but a system that has protocols set in place to mark out essential & non-essential spending for the company within a defined budget. Creating such a policy is important for all employees and management to be on the same page about the utilization of company funds.

The expenses that can be made, the expenses that cannot be made, the limit to which an employee can spend a particular budget, and many other such rules are mentioned within an expense policy.

Creating an expansive document with all such rules is very time-consuming and mistakes might still occur because employees did not read the documents properly. This is the case in many organizations.

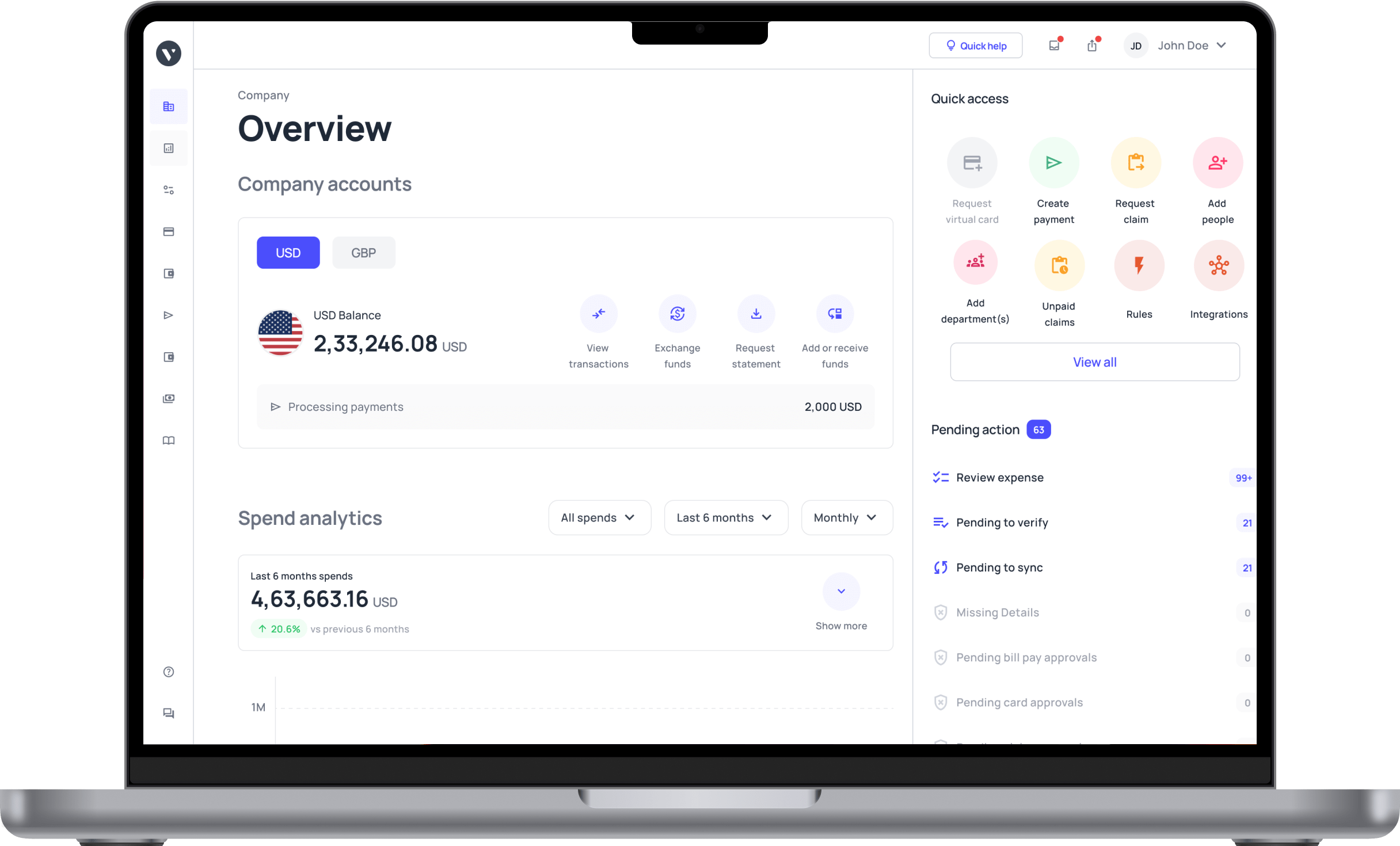

To solve this, people adopt expense management systems like Volopay that help you automatically enforce expense policies so that there is no overspending on behalf of the employees.

3. Customized budgeting for each department

Setting clear boundaries for each employee for the amount they can spend and the authority they have over a company budget based on their management level is a crucial aspect of cost control. But it is not feasible for an individual to be appointed who keeps checking how much each employee has spent.

So to streamline such a task companies use digital expense management systems to onboard their employees based on their team or department and allot them a certain budget. This can be done through the use of financial tools like corporate cards.

Using the expense management system, you can easily customize and set limits to how much each card that is given to an employee can spend from a team budget. Implementing such a system empowers your employees to make spending decisions on their own and build their trust and at the same time allows you to control the company budgets.

Suggested read: 7 effective budgeting tips for small businesses

4. Set up an efficient spend management system to manage all business spends

A spend management system is essentially a software tool that allows a company to track all payments in real-time and get complete visibility over all the spending that is occurring through the company budget.

Be it card payments, domestic & international wire transfers, or settling reimbursements; a spend management system is usually capable of doing all of this and acts as an expense management ecosystem.

5. Approving & purchasing requests management

When managing expenses of a company there must be a balance between giving employees the freedom to make payments easily without any barriers and at the same time also ensuring that there is no overspending happening.

One way that companies have solved this problem is by using software systems like Volopay that allow you to set up custom approval policies for reimbursement claims or transferring money to someone. So making payments through a corporate card is controlled by setting spending limits and making wire transfers on behalf of the company is controlled using approval policies.

Within Volopay you can set 5 levels of approval stages for an expense so that money never leaves your budget without proper authorization from respective team leads or managers.

6. User-friendly receipt upload system with invoice processing & integrated accounting tools

Volopay has an easy-to-use mobile app for employees to easily attach images of receipts for reimbursement claims. This way they no longer have to worry about keeping the receipt safely till the end of the month and then creating an expense report.

You can also easily process invoices from vendors and send them payments by scheduling them or by creating recurring payments. Furthermore, to make things easy for your finance and accounting team, Volopay has the capability of being integrated with accounting tools for easy ledger management.

Related read - Benefits of receipt scanning app for your business

7. Flexible methods of payment for employees (virtual cards, physical cards)

Another way that an expense management system like Volopay makes managing discretionary expenses easier is through the use use of virtual cards. While every employee gets a physical card that can be used both online and offline, you also get to create unlimited virtual cards and use them to manage all your online spending such as marketing subscriptions, one-time employee gift payments, etc.

8. Real-time expense records

Every expense that is made using the financial tools provided by Volopay is instantly recorded in real-time. This not only gives the finance team complete and up-to-date visibility at all times but also allows them to perform analyses on spending.