What is an accounts payable ledger?

It takes money to make money. Every business knows this, which makes planning for company expenses ahead of time crucial for smooth operations.

Spend forecasting is a method that finance teams use to ascertain the budget requirements for months, quarters, or years.

In order to do this, they must analyze the company’s past accounts payable ledger and figure out recurring expenses and spending patterns.

For the financial controllers to do this accurately, they must maintain an AP ledger that helps keep track of all expense particulars.

Accounts payable ledger: What is it & what information should be included?

An accounts payable ledger is simply a record of all the money that your company owes to creditors, vendors, suppliers, investors, etc.

It is a financial record that tracks all credit transactions including your debts & liabilities.

Unlike the general ledger of a company, the AP ledger tracks all individual transactions for multiple accounts.

For example, if your business deals with many vendors or suppliers, then an accounts payable subsidiary ledger is created for each creditor. This helps in tracking each credit transaction more accurately.

The information that is tracked within each of these accounts includes:

• The amount of money that is owed to the supplier.

• Billing and due date.

• Name of the vendor.

• Invoice number.

• The quantity and price of each individual purchase.

How to forecast accounts payable?

If your finance team has completed their balance sheet for the current period, you can easily use it to get a fair idea of all the money you owe and are owed in the coming months.

But there is another accounting forecasting method known as DPO (days payable outstanding) that uses historical data to help you calculate and forecast accounts payable. DPO helps you determine how many days on average it takes for your business to pay vendors.

To calculate DPO, you will need to first know the average accounts payable, cost of goods sold, and then use this formula:

DPO = Average accounts payable x Number of days / Cost of goods sold

The number of days in the formula above represents any number of days that you want to calculate the DPO for, as long as you have the historical data for this period.

So if you wanted to calculate the DPO of your business for the last year, then you would multiply the average accounts payable for the last year by 365 and then divide it by the cost of goods sold within the same period.

Similarly, you can do this for the last 5 years or even as little as last month. Once you get the DPO figure, it’ll help you gain insights regarding how you should allocate your working capital and assign the relevant budgets.

Remember that the more past data you have from your AP ledgers, the more accurate your DPO will be.

Benefits of accounts payable forecasting

Reduce potential risk

When you have forecasted accounts payable, you are able to more clearly identify the costs you are going to incur in the future.

This helps your team take precautionary measures to reduce spending towards less important expenses and ensure that there are enough funds for the accounts payable predictions.

Better utilization of working capital

Knowing the type of expenses that are going to be made, even if on a credit basis during the future helps the finance team allocate budgets in a more mindful manner.

This especially helps the utilization of working capital in a more efficient manner.

Sustain and nurture vendor relationships

When you know your AP expenses in advance towards certain vendors or suppliers and pay their invoices on time, it helps in building and nurturing a good relationship.

It shows them that you trust them enough to a degree where they never have to remind you to send across payments.

Benefits of accounts payable ledger

Improve cash flow

Since all the transactions and invoice requests are reported in real-time when you use software like Volopay, your finance team can track all transactions accurately without any delay, making the payment process much faster.

This increases the cash flow of the business and leads to better operations.

Better visibility

Although the general ledger of the business tracks accounts payable, it is only the total amount.

The AP ledger within the general ledger helps organizations get complete visibility over the invoices and receipts of all their vendors.

It is only when you get the granular financial details regarding your business relationship with suppliers that you can make a forecasting decision about future expenses.

Cost savings

Tracking all the money you owe in a creditors ledger also gives you visibility over upcoming invoices that need to be paid.

This ensures that you don’t miss out on paying your suppliers or creditors on time and helps avoid any late payment fees.

More efficiency

Efficiency on your finance department's part not only helps close accounts payable faster but also reflects improved efficiency for other departments who are dependent on the finance team to make the necessary payments.

Easy for auditing

If your team is not maintaining proper subsidiary accounts for each vendor or supplier, then it will cause problems in the auditing process.

When your accounts payable ledger is up to date and is filled with all necessary information, then it becomes very easy for an auditor to ensure that all the financial dealings of the company are being legitimately carried out.

A strong relationship with a vendor

Keeping track of all transactions between your company and a vendor using an automated AP software like Volopay helps in building a strong business relationship with them.

Everything is transparent and visible on your dashboard helping you pay on time.

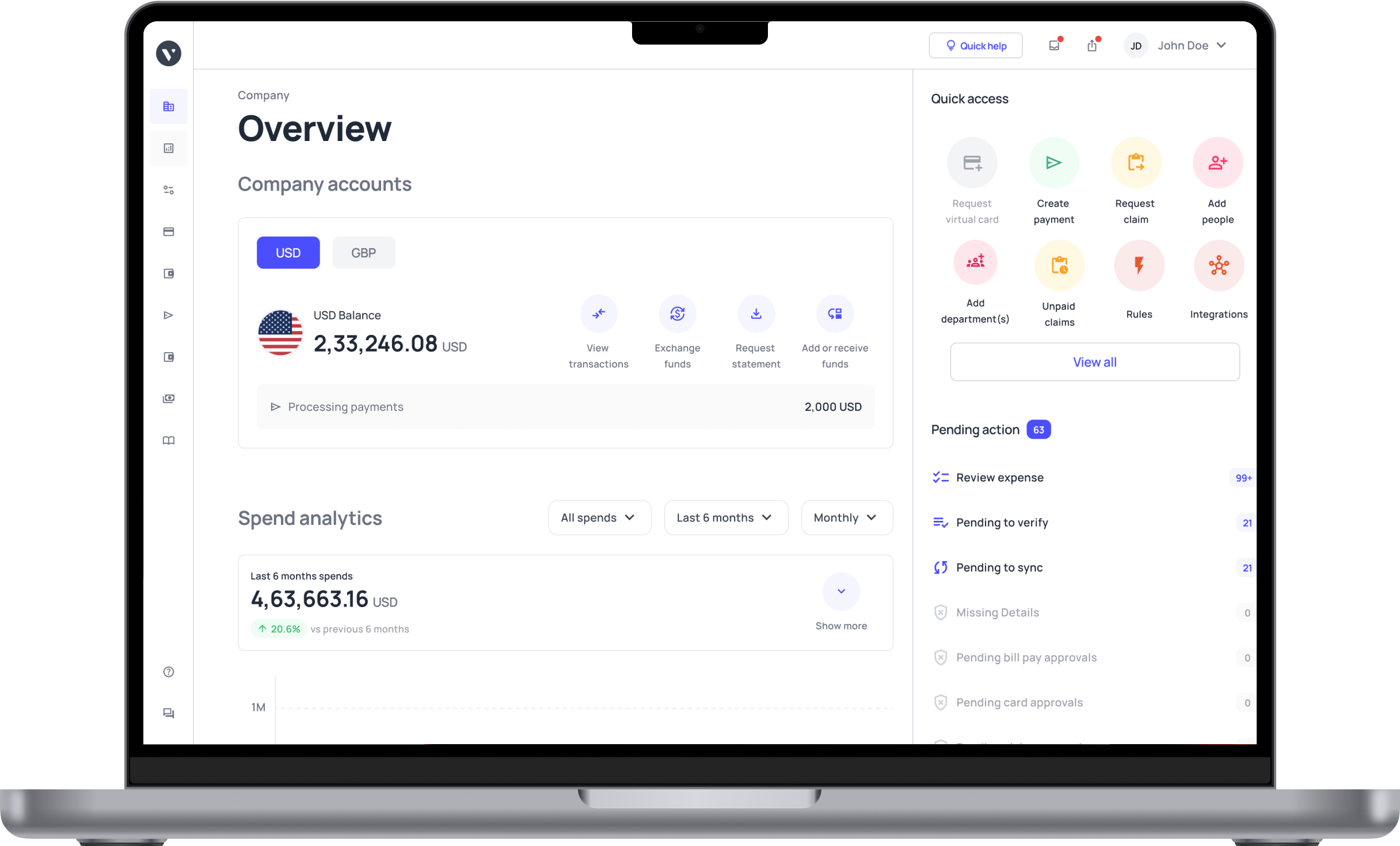

Get started with Volopay

If keeping a track of your accounts payable ledger is a headache, then Volopay's accounts payable module is the perfect solution for you. Tired of sourcing invoices from different departments?

Volopay’s 3-way invoice sourcing allows you to directly pull invoices from your email, accounting software, and/or directly upload them through our platform. This ensures that you never miss out on paying any invoices and avoid penalties from your vendors.

To keep track of transactions with every different supplier, you also get the ability to create separate vendor accounts and manage all their payments. With our robust infrastructure, you can schedule payments for later and also create recurring payments for clients domestically and internationally.

The automated accounting feature where each transaction is automatically synced with your accounting software once the integration is done.