Mastering accounts payable days: How to calculate accounts payable days?

If you’re managing business finances, particularly in a US-based organization, understanding how to calculate accounts payable days is crucial.

Accounts Payable Days (or Days Payable Outstanding, DPO) measures the average time it takes your business to pay off its supplier invoices. This metric plays a pivotal role in maintaining healthy cash flow and fostering strong vendor relationships.

By tracking your DPO, you gain valuable insights into the efficiency of your invoice processing system, ensuring that your payment practices are aligned with both cash flow needs and supplier expectations.

A well-managed DPO can improve your business’s liquidity, enhance your negotiation power with vendors, and contribute to better financial forecasting and long-term planning.

What are accounts payable days?

When you calculate accounts payable days, you're determining the average number of days it takes your business to pay its suppliers after receiving goods or services.

Also known as Days Payable Outstanding (DPO), this metric is a critical indicator of your company's payment behavior and its financial health. It helps you gauge how efficiently your accounts payable system functions and how your business is managing cash flow in relation to supplier payments.

In practical terms, every time you receive an invoice with net terms (e.g., Net 30), the DPO measures how long it takes to actually pay that bill. A longer DPO may suggest better liquidity, as it allows your business to retain cash longer before payment is due.

However, it can also lead to concerns from suppliers about delayed payments, potentially straining relationships. On the other hand, a shorter DPO shows quicker payments, which can enhance supplier relationships but might limit available cash for other operations.

This is why regularly taking time to calculate accounts payable days is essential. It gives you a strategic view of your payables, helping you balance liquidity, supplier satisfaction, and financial planning.

Why is it important to calculate accounts payable days?

Understanding how to calculate accounts payable days is crucial for maintaining control over your business's financial health, optimizing cash flow, and ensuring smooth supplier relationships.

This metric has a wide-reaching impact on operations, strategic planning, and financial forecasting. Let’s explore the importance of calculating accounts payable days in more detail:

1. Cash flow management

When you calculate accounts payable days, you gain better control over your cash outflows. A longer DPO allows you to keep cash in your business longer, which you can use to cover operating costs, pay employees, or invest in new opportunities. However, paying too late can harm your creditworthiness and might lead to late fees or penalties.

A well-managed DPO ensures you maintain a healthy cash flow by finding the right balance between holding onto cash and making timely payments. Mastering this calculation helps avoid liquidity issues and fosters financial stability in your business.

2. Supplier relationship health

Vendors rely on timely payments. When you calculate accounts payable days, you're assessing how your payment practices impact supplier relationships.

A consistently high accounts payable days ratio could indicate to suppliers that you're delaying payments, potentially leading to strained relationships, stricter credit terms, or even lost discounts.

On the other hand, paying too quickly may not be necessary and could hurt your liquidity. Understanding how to calculate accounts payable days helps you maintain professionalism and transparency in your vendor relationships, ensuring that you uphold good credit terms without overextending your cash flow.

3. Operational efficiency

The accounts payable days ratio isn’t just a payment metric; it’s a reflection of how efficiently your accounts payable process operates. Delays in approvals, discrepancies between invoices and purchase orders, or outdated manual workflows can unnecessarily extend your payables timeline.

By regularly calculating accounts payable days, you identify inefficiencies within your accounts payable department. This insight enables the adoption of accounts payable automation to streamline invoice processing, reduce errors, and accelerate approvals.

The accounts payable days formula is a diagnostic tool, highlighting bottlenecks and revealing where process improvements can be made.

4. Financial forecasting

Accurate financial forecasting depends on understanding the timing of your cash outflows. By incorporating accounts payable days into your financial models, you can project future cash flows with greater confidence.

A well-calculated DPO ensures that you can anticipate when payments are due and plan accordingly for expenditures or investments. It helps you budget more effectively and allocate resources toward upcoming initiatives such as system upgrades or hiring.

By mastering accounts payable turnover days calculation, you enhance your ability to make informed, strategic decisions about your company's financial future.

5. Benchmarking performance

To understand how your business is performing in relation to industry standards, benchmarking is essential. By calculating your accounts payable days and comparing the results with industry averages, you can determine if your business is paying suppliers too quickly, too slowly, or right on time.

The accounts payable days ratio gives you insight into how competitive your payment terms are and how well you’re managing your financial resources.

This comparison helps identify areas for improvement, align your performance with market expectations, and set realistic goals for optimizing your payment processes in the future.

Streamline your AP process with Volopay

Formula for calculating accounts payable days

To manage your company’s cash flow effectively, you need to understand how to calculate accounts payable days in a structured, accurate way.

This process involves more than just plugging numbers into a calculator—it requires understanding which financial statements to reference, how to apply the correct accounts payable days formula, and how to interpret what the result means for your operations.

Mastering this allows your finance team to make data-driven decisions, forecast more accurately, and optimize working capital and supplier relationships.

1. The DPO formula

The foundational formula used to calculate accounts payable days is known as Days Payable Outstanding (DPO). It measures the average number of days your company takes to pay off accounts payable during a given period. The accounts payable days formula is:

DPO = (Average Accounts Payable ÷ Cost of Goods Sold) × Number of Days in Period

To break it down further:

● Average Accounts Payable = (Beginning AP + Ending AP) ÷ 2

● Cost of Goods Sold (COGS) = Found on your income statement

● Number of Days = 365 (if you are reporting annually)

By applying this accounts payable days calculation, you determine how long your payables sit unpaid, which is essential for evaluating how efficiently your AP department operates.

Knowing your DPO helps you decide whether you need to speed up or slow down your payment practices depending on current liquidity and vendor expectations.

2. Step-by-step calculation

To properly calculate accounts payable days, follow this detailed sequence:

Step 1: Pull your beginning and ending accounts payable balances from the balance sheet for the period in question.

Step 2: Compute the Average Accounts Payable using the formula:

(Beginning AP + Ending AP) ÷ 2

Step 3: Calculate Cost of Goods Sold (COGS) by subtracting ending inventory from the sum of beginning inventory and purchases. COGS is usually available directly from your income statement.

Step 4: Insert your numbers into the full formula:

DPO = (Avg AP ÷ COGS) × 365

This method ensures your accounts payable turnover days calculation is grounded in actual business data, giving you reliable insights. Following this structured approach avoids estimation errors and allows for consistent benchmarking month-over-month or year-over-year.

3. Practical example

Let’s go through an example using 2024 data. Assume your financials show:

Beginning Accounts Payable = $500,000

Ending Accounts Payable = $600,000

COGS = $4,000,000

Step 1: Calculate the average accounts payable:

($500,000 + $600,000) ÷ 2 = $550,000

Step 2: Use the main accounts payable days formula:

DPO = ($550,000 ÷ $4,000,000) × 365 = 50.19 days

This result means it takes your business just over 50 days on average to pay suppliers. This figure is significant because it reflects your ability to retain cash, meet terms, and manage liquidity.

Using this method regularly to calculate accounts payable days helps your company monitor performance and make adjustments as needed.

4. Alternative method

If you need a quick estimate without calculating the average AP, you can use the ending accounts payable balance. This is less precise but useful for rapid internal reviews.

Here’s how that would look:

DPO = ($600,000 ÷ $4,000,000) × 365 = 54.75 days

This version of the accounts payable days calculation is helpful for month-end or quarter-end reviews when you need a current view of your payables behavior. Though it doesn’t account for fluctuations over time, it still provides a valid snapshot of how long you’re holding onto payables.

By regularly applying both methods to calculate accounts payable days, your team can develop a more comprehensive understanding of payment cycles, maintain healthy cash reserves, and proactively manage vendor expectations.

How to calculate accounts payable turnover days?

Learning to calculate accounts payable days also includes understanding turnover. Turnover ratios show how often you settle your payables, complementing DPO analysis.

1. AP turnover ratio

The AP Turnover Ratio = Total Supplier Credit Purchases ÷ Average Accounts Payable

Accounts payable turnover ratio reveals how frequently you pay vendors within a reporting period. A higher ratio means faster payments. When you calculate accounts payable days, this ratio helps confirm whether you're being efficient or overly aggressive with outflows.

2. Turnover in days

Convert turnover ratio into days by applying:

DPO = 365 ÷ AP Turnover Ratio

Example: If your turnover ratio is 8, DPO = 365 ÷ 8 = 45.63 days

This version of accounts payable turnover days calculation offers a different angle, revealing payment frequency rather than duration.

3. Why it matters

Turnover analysis helps businesses align supplier payment strategies with financial goals. Frequent payoffs might win better terms, but limit cash on hand. Integrating this with your strategy to calculate accounts payable days ensures a well-rounded picture of your AP operations.

Stay on top of your payables management with Volopay!

Best ways to reduce your accounts payable days

Reducing your calculated accounts payable days can boost your working capital and improve supplier relationships. By implementing effective strategies, you can streamline your accounts payable processes, improve cash flow, and minimize payment delays.

1. Balance cash outflow/inflow

To optimize your cash flow, balance the timing of your outflows and inflows. When you calculate accounts payable days, compare them with your Days Sales Outstanding (DSO).

If you’re paying your suppliers faster than customers are paying you, it can cause cash strain. Adjust your payment terms with customers or suppliers to align these inflows and outflows.

By balancing these cycles, you can reduce the need for borrowing or cash shortfalls while ensuring you meet supplier expectations. A well-calculated accounts payable days formula ensures better financial management and liquidity.

2. Cut invoice processing time

The longer it takes to process invoices, the longer your accounts payable days calculation will be.

Leverage automation tools such as optical character recognition (OCR) for invoice capture, integrate centralized invoice approval workflows, and connect your Enterprise Resource Planning (ERP) system with invoice platforms.

This reduces manual tasks and speeds up the process. By doing so, you ensure a quicker calculation of accounts payable days without backlogs, allowing you to pay suppliers faster and improve your business's financial efficiency.

3. Save on processing costs

Reducing processing costs improves both efficiency and cash flow. Every manual step in your accounts payable workflow adds time and expense.

By adopting digital workflows, you eliminate unnecessary labor, reduce errors, and lower overhead. These savings can be reinvested into enhancing your AP system or used to take advantage of early payment discounts.

By doing this, you not only streamline the process but also reinforce the value of calculated accounts payable days, making your business more cost-effective. Consistent tracking using the accounts payable days ratio ensures long-term operational gains.

4. Pay suppliers on time

Always meet your agreed payment terms to avoid late fees and maintain goodwill with suppliers. When you track and calculate accounts payable days, it ensures that you consistently pay on time.

Some suppliers offer early payment discounts, which can improve your profit margins if you pay ahead of the due date.

Regularly tracking your accounts payable turnover days calculation helps you never miss a payment deadline, allowing you to take advantage of any potential cost savings. It’s a simple but powerful way to enhance supplier relationships and improve financial discipline.

5. Streamline AP processes

Simplify and centralize your accounts payable system. Integrate your accounting software with bank feeds and invoice management platforms to give you full visibility and control over the payment process.

A centralized system reduces errors, increases transparency, and helps improve decision-making. With better oversight, you can more accurately calculate accounts payable days and implement improvements.

By streamlining your AP processes, you gain efficiency and ensure that payments are timely, giving you more flexibility to optimize your cash flow and meet supplier demands.

How does Volopay help in reducing your accounts payable days?

Volopay's accounts payable automation software is a powerful platform designed to transform how your business handles accounts payable. If you're looking to calculate accounts payable days and actively reduce them, Volopay offers a streamlined, automated solution that covers the entire invoice management cycle.

By digitizing and accelerating every phase of the payable process, the platform helps your finance team take full control of cash flow, vendor payments, and financial reporting.

At the core of Volopay’s offering is its invoice automation capability. Using OCR (Optical Character Recognition) technology, the platform scans and extracts crucial invoice data in seconds, eliminating manual data entry and minimizing errors.

This efficiency dramatically shortens the time needed to review, approve, and post invoices, allowing you to calculate accounts payable days with accuracy and speed. As invoices flow through the system faster, payments are processed on time, contributing to a healthier DPO and better vendor relationships.

Volopay also integrates seamlessly with popular accounting platforms like QuickBooks, Xero, and NetSuite. This ensures that your accounting system and Volopay stay in sync, creating a real-time financial environment.

When you pull data to calculate accounts payable days, you’re always working with the most current figures, leading to more precise analysis and reporting. Automated syncing also eliminates the risks and inefficiencies of manual reconciliation, giving you more reliable data for decision-making.

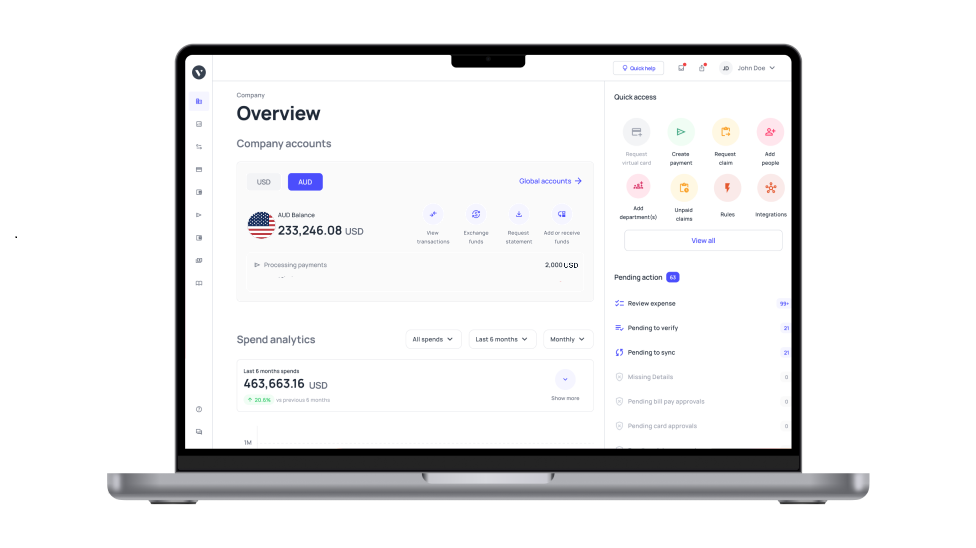

With Volopay’s centralized dashboard, you can oversee all payables activities in one place. From tracking invoice statuses to viewing upcoming payment schedules, everything is visible at a glance.

You can create automated multi-level approval workflows to ensure invoices are reviewed on time, preventing any bills from slipping through the cracks. This transparency helps you spot delays, fix inefficiencies, and make faster decisions—all essential when working to calculate accounts payable days and reduce them effectively.

Moreover, Volopay’s analytics tools empower your finance team to evaluate payables performance over time. By analyzing trends, forecasting cash flow, and identifying areas for improvement, Volopay helps guide your strategic decisions.

Volopay doesn’t just help you track DPO; it enables you to take meaningful action that enhances liquidity and strengthens your financial position.

Optimize finances with accounts payable process automation

FAQ's

A high DPO (Days Payable Outstanding) means your business is taking longer than average to pay its suppliers after receiving goods or services. This may seem beneficial because it improves your short-term liquidity, giving you more cash on hand for operational needs or investments.

However, it can also signal potential financial risk to suppliers, who may respond by tightening credit terms or delaying future shipments. Monitoring and regularly taking time to calculate accounts payable days helps you determine if you're pushing your payment timeline too far and risking valuable supplier relationships or long-term credibility.

A low DPO shows that your business pays invoices quickly, often within a few days of receiving them. While this demonstrates financial responsibility and can strengthen vendor relationships, it may also limit your access to working capital. Paying too early might mean missing out on cash that could be used for strategic reinvestment or managing operational challenges.

To understand whether your payment practices align with your goals, you should consistently calculate accounts payable days. Doing so gives you a clearer view of your financial strategy and helps you maintain the balance between liquidity and trust with your suppliers.

Increasing your DPO can help conserve cash and give your business more time to use working capital elsewhere. This might support growth initiatives, cover payroll, or address short-term financial challenges. However, there are risks involved—suppliers may grow wary of delayed payments, impose stricter terms, or even deny credit altogether. Additionally, late fees and missed early payment discounts can quietly increase your operational costs.

When you consistently calculate accounts payable days, you gain visibility into how these decisions affect both your financial health and your vendor relationships. Informed adjustments prevent future disruptions and maintain trust with your partners.

There’s no one-size-fits-all answer. A higher DPO is generally better for businesses looking to preserve cash for investments, growth, or managing uncertain financial conditions. However, it can negatively affect supplier relationships if pushed too far. A lower DPO signals prompt payments and strong partnerships, but may reduce your financial flexibility. The right choice depends on your industry, goals, and cash flow needs.

That's why it’s important to calculate accounts payable days regularly. Doing so allows you to set the right benchmarks, evaluate your financial strategy objectively, and make data-backed decisions that balance growth with reliability.