How to calculate opportunity cost in business?

When you're running a business, every decision you make comes with a trade-off. Opportunity cost in business refers to the value of the benefits you give up when you choose one option over another. It’s not always about what you spend, but what you miss out on. Understanding how to calculate opportunity cost helps you make smarter, more strategic choices that can directly impact your bottom line.

Whether it's deciding between launching a new product or investing in marketing, opportunity cost reveals the potential gains you might be forgoing. That’s why it’s a crucial tool for maximizing profitability and staying ahead of the competition.

Tools like Volopay can help reduce the financial pressure of these decisions. By improving your cash flow, you’re better positioned to act on the most profitable opportunities, without sacrificing operational stability or growth potential.

What is opportunity cost in business?

Opportunity cost in business is the value of the next-best alternative you give up when you make a decision. It’s not about the money you spend—it’s about the benefits you miss out on. For example, if you decide to hire new employees to expand into a new market instead of training your existing team, the opportunity cost is whatever potential advantage you would have gained from the training path—like faster execution or better long-term team cohesion.

One of the most important things to remember is that opportunity cost isn’t the same as sunk cost. Sunk costs are expenses you've already incurred and can't recover. Opportunity cost, on the other hand, is forward-looking. It’s about weighing what you could earn or gain in the future if you choose a different path.

Here’s a quick opportunity cost calculation example: Say you have $10,000 to spend and you choose to invest in a marketing campaign. The opportunity cost is the potential innovation or product improvement you forgo by not investing that same amount into research and development. Learning how to find opportunity cost helps you make more rational, data-driven decisions that fuel growth instead of regret.

Types of opportunity costs in business

When you manage a business, especially in a fast-paced SME environment, understanding the different forms of opportunity cost in business can significantly improve your decision-making. By recognizing these categories, you’ll be better equipped to measure trade-offs and maximize returns.

Let’s explore the most common types and how they apply in real-world scenarios.

1. Capital opportunity cost

This refers to the potential gains you miss by choosing one investment over another. If you invest $50,000 in new equipment instead of putting it into a stock portfolio with a 10% annual return, your opportunity cost is $5,000.

Learning how to calculate opportunity cost in such cases helps ensure your capital delivers maximum value.

2. Resource opportunity cost

Using your team or tools inefficiently can result in major lost gains. Say your staff spends time manually entering data when automation could save $10,000 annually.

That lost efficiency is your resource opportunity cost. Identifying these gaps can free up resources for higher-impact work.

3. Time opportunity cost

Time is a limited resource, and how you spend it matters. For example, spending 20 hours managing admin tasks might save costs upfront, but if that time could have generated $2,000 through client outreach, you’re losing potential income.

Knowing how to find opportunity cost in time management decisions is essential for productivity.

4. Revenue opportunity cost

This occurs when one pricing or sales strategy leads to less income than another. If you choose to offer discounts that bring in $1,200 but could’ve earned $5,400 with a premium pricing model, you’ve incurred a revenue opportunity cost of $4,200. This is a classic opportunity cost calculation example.

5. Opportunity cost of delayed payments

When customers have extended payment terms—like 60 days—you may miss chances to reinvest sooner. If that $20,000 is tied up and unavailable for other uses, your opportunity cost is the growth or savings you could have achieved in that time.

Using tools like Volopay helps reduce these lags and protects your cash flow.

How to calculate opportunity cost in business

Understanding how to calculate opportunity cost helps you make smarter financial and strategic decisions.

Whether you're comparing investments, choosing between vendors, or planning team allocation, calculating the cost of the option not chosen gives you a clearer picture of what’s at stake.

Below are three key ways to approach opportunity cost in business, including both quantitative and qualitative methods.

Simple opportunity cost formula

The easiest way to calculate opportunity cost is by comparing the expected returns of two choices using this formula:

Opportunity Cost = Return on Foregone Option − Return on Chosen Option

Let’s say you choose a $1,200 basic pricing plan that brings in 100 customers, generating $180,000 in revenue. A premium plan at $5,400 could bring in 50 customers, but yield $270,000. Using the formula:

Opportunity Cost = $270,000 − $180,000 = $90,000

This opportunity cost calculation example clearly shows the missed potential by going with the lower-priced option. Knowing how to find opportunity costs like this helps you avoid undervaluing high-ROI strategies.

Net Present Value (NPV) formula

For long-term decisions, the NPV method is more precise. Use this formula:

NPV = FCF₀ + Σ (FCFₙ / (1 + r)ⁿ)

Where:

● FCF = Future cash flow

● r = Discount rate

● n = Number of periods

Imagine you're deciding between a $50,000 project with an NPV of $60,000 and a $40,000 investment with an NPV of $55,000. Even though the second costs less, the opportunity cost of choosing it is:

Opportunity Cost = $60,000 − $55,000 = $5,000

Using NPV helps you incorporate the time value of money and understand opportunity cost in business from a broader financial lens.

Estimating non-monetary costs

Not all opportunity costs are tied to dollar signs. Sometimes, it's about time, brand equity, or lost influence. Say you spend 10 hours on admin tasks that don’t drive value. If you could have used that time to work with a client worth $1,500, that’s your opportunity cost.

Even though it's not calculated with a formula, estimating non-monetary costs ensures you don’t overlook hidden inefficiencies. When you're evaluating how to calculate opportunity cost, including these intangible factors gives you a fuller picture of your business impact.

Streamline expenses with cutting-edge expense management software

Benefits of calculating opportunity cost

Understanding how to calculate opportunity cost in business is more than a financial exercise—it’s a strategic mindset that empowers SMEs to allocate resources wisely, stay competitive, and avoid costly missteps.

Here’s how this approach delivers value across core areas of business decision-making.

1. Optimized decision-making

When you regularly evaluate opportunity costs, you’re more likely to choose options that deliver higher returns.

For example, selecting a $50,000 project with a $10,000 higher net present value (NPV) than the alternative ensures your investments are working harder for you. This kind of insight leads to consistently smarter decisions.

2. Improved financial planning

Opportunity cost analysis forces you to plan with trade-offs in mind. Say you have a $30,000 budget—choosing to allocate it to a revenue-generating sales initiative instead of administrative overhead can significantly improve your financial outcomes. Recognizing the hidden cost of inaction helps you make every dollar count.

3. Enhanced cash flow management

Delayed payments can cause liquidity challenges. By calculating the opportunity cost of delayed revenue—say, $20,000 held up by extended invoice terms—you can better plan for cash shortfalls.

Tools to track receivables and manage credit lines can bridge these gaps, allowing you to act on opportunities without waiting for client payments.

4. Competitive strategy alignment

Opportunity cost helps you align your moves with market expectations. For example, offering 45-day payment terms like your competitors may secure $100,000 in new contracts.

If you don’t adapt, the opportunity cost is lost business. Knowing how to find opportunity cost makes it easier to adjust your strategy to win deals.

5. Risk reduction

One of the biggest benefits of opportunity cost analysis is avoiding low-return investments.

If a $40,000 project shows minimal return potential, understanding the opportunity cost of that capital lets you divert funds to higher-performing initiatives, reducing financial exposure and improving long-term growth.

Opportunity costs of invoice terms for sellers

Invoice terms are a common tool for attracting and retaining customers, but they come with trade-offs. For sellers, these terms can create hidden opportunity costs in business, especially when cash flow is delayed or the administrative burden increases. Knowing how to calculate opportunity cost tied to invoice terms helps you balance flexibility with financial stability.

Below are the key areas where these trade-offs show up—and how to manage them.

1. Delayed cash flow

Offering 60-day payment terms might help close deals, but it can delay crucial revenue. For example, if $30,000 is tied up for two months, that’s capital you can’t reinvest into marketing, product development, or growth. This delay represents a real opportunity cost.

To mitigate this, you can utilize Volopay’s expense management and data analytics capabilities, which smooth over these cash flow gaps, giving you better insight into how to plan investments smartly.

2. Increased sales potential

Flexible payment terms can be a sales booster. For instance, offering 30-day terms might increase customer orders by $50,000. But there’s still a trade-off—delayed payments may affect your ability to fulfill growing demand.

Understanding how to find opportunity cost helps you assess whether increased sales justify the lag in cash flow. A balanced approach lets you grow revenue while staying liquid.

3. Competitive positioning

To stay competitive, you often need to match or beat industry-standard payment terms. If your competitors offer 45-day terms, doing the same could help you secure $100,000 in new contracts.

But the opportunity cost is delayed access to cash that could be earning returns elsewhere. The key is understanding how to match competitors without compromising on operational efficiency—again, tools like Volopay help bridge this gap.

4. Risk of late payments

Beyond agreed terms, late payments are a major risk. If a $20,000 invoice is delayed by 90 days, your opportunity cost isn’t just lost time—it’s missed opportunities to invest or scale.

Mitigating this risk requires proactive strategies like enforcing late fees or using Volopay’s payment tracking system to flag overdue invoices and follow up faster.

5. Administrative costs

Managing invoice terms isn’t just about money—it takes time and effort. Let’s say your team spends 40 hours monthly chasing payments, costing $5,000 in internal resources. That’s an operational opportunity cost that many businesses underestimate.

Automating this process through Volopay’s platform reduces human error, cuts overhead, and frees your team to focus on growth-focused tasks.

Common mistakes in opportunity cost analysis

Even when you understand how to calculate opportunity cost in business, it’s easy to misstep if your analysis isn’t grounded in accuracy and consistency.

Below are common pitfalls SMEs encounter—and practical solutions to avoid them, especially with the help of tools like Volopay.

1. Ignoring non-monetary costs

You might focus too much on direct expenses and forget to factor in time, brand reputation, or employee satisfaction. These intangible elements can carry significant opportunity costs.

The solution? Estimate these factors using Volopay’s analytics tools to help you assign value to non-monetary trade-offs and make more holistic decisions.

2. Focusing only on short-term costs

Short-term savings can sometimes blind you to long-term value. For example, choosing a cheaper option now may lead to missed profits later.

To avoid this, use Net Present Value (NPV) calculations to project multi-year outcomes, ensuring your decisions are optimized over time, not just immediately.

3. Inaccurate estimations

Relying on outdated or imprecise data can skew your opportunity cost calculation. If you’re not working with accurate financial inputs, your conclusions won’t reflect reality.

Sync your accounting systems—like QuickBooks—with Volopay to ensure your analysis is based on current, real-time financial data.

4. Overcomplicating calculations

Overly complex models can make decision-making harder, not easier. If you're drowning in spreadsheets and formulas, try simplifying with the basic FO–CO formula (Foregone Option – Chosen Option). This quick method gives you a reliable estimate without overwhelming your process.

5. Lack of regular review

Opportunity costs aren’t static—they shift as your business and market evolve. One-time analyses quickly become outdated. Make it a habit to review opportunity costs quarterly using Volopay’s reporting features, helping you stay responsive to new opportunities and risks as they arise.

How Volopay helps manage opportunity costs in business

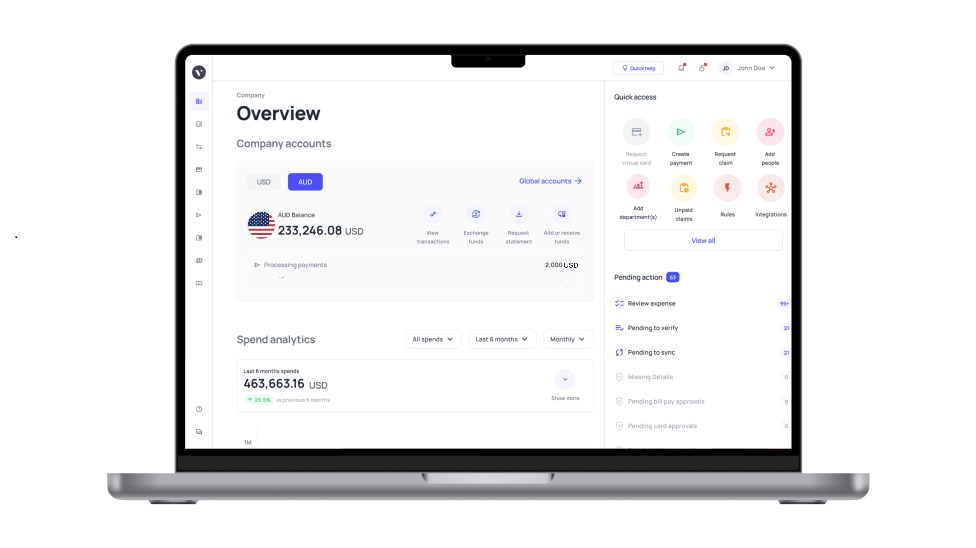

Effectively managing opportunity cost in business requires smart tools that give you control, visibility, and real-time insights. Volopay’s platform is designed to empower SMEs like yours to optimize spending and cash flow, helping you make better decisions every step of the way.

1. Corporate cards for spending control

One of the biggest drains on your resources can be uncontrolled or unnecessary spending. Volopay’s corporate cards let you set customized spending limits for departments, projects, or individual employees. This control ensures that expenses align with your highest-return options.

For instance, if you identify a recurring $10,000 spend that delivers little return, you can cap or restrict it, freeing capital to invest in initiatives with stronger growth potential. By preventing low-value expenditures, you reduce hidden opportunity costs and keep your budget focused on what drives profitability.

2. Real-time financial analytics

Volopay’s platform delivers real-time analytics that provide deep insights into your spending patterns, cash flow, and budget adherence. This transparency helps you quickly identify areas where opportunity costs may be accumulating, such as overspending in certain categories or delays in payment cycles.

Instead of waiting for month-end reports, you can monitor your finances daily, enabling agile decision-making.

For example, if you see cash tied up in non-essential expenses, you can immediately redirect those funds toward higher-impact projects, improving your overall financial health.

3. Automated invoice tracking

Invoice terms often introduce hidden opportunity costs, especially when payments are delayed, affecting your cash flow and reinvestment capability.

Volopay automates invoice tracking by monitoring payment due dates, alerting you to upcoming deadlines, and flagging overdue invoices. This automation reduces the time and effort spent chasing payments, while also helping you negotiate better payment terms or manage credit lines from other vendors when needed.

For example, if a $30,000 invoice is due in 60 days, Volopay’s platform ensures you don’t overlook it, helping you maintain steady liquidity and avoid costly cash flow gaps.

Streamline your expense management with Volopay

FAQs

The importance of opportunity cost with regard to cash flow lies in cash flow projections. Opportunity cost can be taken into account for forecasting future cash flow but is not actually included in the cash flow statements.

Opportunity cost is not included in the IRR calculation. However, it can be tied to IRR. An investment is marked as having a positive NPV if the IRR is higher than the opportunity cost of the capital.

The constant opportunity cost for business refers to opportunity cost that remains constant even if the benefits of the opportunity change. For example, when calculating the cost of production of a particular product, the cost will remain constant in proportion to the rate of production. It is different from decreasing opportunity costs, which could happen if you get discounts for purchasing in bulk.

Yes, software can significantly simplify how you calculate and monitor opportunity costs. Volopay’s advanced analytics tools automatically gather and analyze financial data, while its integration with QuickBooks ensures your numbers are always accurate and up to date.

This automation reduces human error and saves you time, allowing you to focus on interpreting results and making informed decisions without getting bogged down in manual calculations.

No, they are different concepts. Opportunity cost is about the future—it represents the benefits you give up by choosing one option over another. For example, selecting one project means losing potential gains from the alternative.

In contrast, sunk cost refers to money that has already been spent and cannot be recovered, like past expenses on failed projects. Importantly, sunk costs should not influence current decision-making, while opportunity costs are essential for evaluating future choices.