What is a purchasing card? How it works, benefits & best practices

If you're looking for a smarter way to manage business expenses, then understanding what is a P-card can be a game-changer. P-cards are powerful tools designed to make B2B payments faster, more secure, and easier to track.

To simplify and gain control over your business expenses, and to provide your company with an effective substitute for traditional procurement techniques. You can use them to automate recurring payments, manage team spend, and reduce manual paperwork.

What is P-card payment, its advantages, possible drawbacks, and the best practices to implement for maximum use in your company are all covered in this guide.

What is a purchasing card?

Purchasing cards, often known as P-cards, are issued by the company and are used to pay for business expenses such as services or office supplies.

It simplifies procurement by linking to your company's account and imposing vendor restrictions and predetermined expenditure caps. These rules govern your purchases, and transactions are recorded for convenient reconciliation. If you’re asking what is P-card, it’s a secure, pre-approved tool that helps you minimize delays in procurement.

P-cards use approval workflows and real-time monitoring to reduce paperwork, increase productivity, and guarantee compliance. Since the business processes payments, they do not affect your credit, unlike personal credit cards.

P-cards are perfect for low-value, high-volume transactions since they enable transparency and control over your company's financial operations while streamlining the administration of expenses.

How do purchasing cards work?

Purchasing cards streamline business spending. You use them like credit cards for approved purchases, with set limits and controls.

Transactions are tracked, approved, and reconciled, ensuring compliance and transparency while simplifying expense management for organizations. If you're wondering what is P Card payment is, the answer lies in how they streamline low-value transactions without going through lengthy procurement cycles.

1. Card issuance

To provide purchasing cards, your company joins with a financial institution. A card connected to the business's account is given to you as an employee.

Your name is added to the card, which also has restrictions and spending limits that are predetermined based on your role and responsibilities. Each card is associated with your department or user account, and the issuer ensures it is connected to the cost management or procurement system of your business.

2. Defining spending limits

The spending limits on your card are determined by the policies of your company. Depending on your job position, administrators set monthly or per-transaction limits.

To keep expenditure under control and maintain budgetary congruence, limits may be placed on merchant categories such as office supplies or travel. Purchases remain within policy and budget due to these constraints. Customizable limits also reduce fraud and unauthorized transactions.

3. Submitting a purchase request

Understanding an organization's need, such materials or services is the first step in making a transaction. You confirm the cost is in line with business policy and the restrictions on your card.

Before using the card, you may need to submit a purchase request for approval to certain institutions. The system often automatches your request with a supplier, cutting down the manual workload.

4. Approval workflow

● In-policy expense request

Your purchase request will usually be obtained promptly if it complies with business policies. You use a certain system to enter information such as the price, vendor, and goal. You can proceed with the purchase when managers or automated tools look into and authorize the request. Obtaining permissions quickly allows you to respond immediately and saves processing time.

● Out-of-policy expense request

Additional attention is applied to requests that fall outside of authorized categories or exceed limitations. You have to defend the cost, usually by providing a thorough justification. These exceptions are reviewed by managers or finance teams, who then decide whether to approve or deny them based on policy compliance and business necessity.

5. Executing the purchase

After being accepted, you finish the transaction using the purchasing card. You can give the card to vendors directly, submit information online, or swipe it in-store.

If you’ve ever asked how P Cards work, this is the core function. Ensure the purchase adheres to any particular merchant limits and stays within the authorized amount.

6. Recording the transaction

You collect and save receipts, either digitally or physically, following the purchase. You enter the date, amount, vendor, and purpose of each transaction in your company's expense management system.

Precise documentation promotes transparency, facilitates subsequent audits, and reconciliation procedures. This procedure facilitates speedy reconciliation later in the cycle and maintains clean financial records.

7. Reconciling expenses

Generally, once a month, you check your card's transactions against the approvals and receipts. Every purchase is compared to its associated record in the expense system, and any inconsistencies are identified for correction.

This phase guards against fraud and enables correct financial reporting. If you’ve wondered what is P Card payment reconciliation, it's about ensuring the right data flows into your accounting system.

8. Ensuring compliance and audit readiness

Your company maintains monitoring on card usage to ensure rules are being followed. Auditors verify for correct documentation, appropriate approvals, and adherence to expenditure restrictions when they analyze transactions on a regular basis.

Following the rules is important because non-compliance can result in card suspension or other disciplinary action. If your company frequently audits, knowing what a purchase card is and adhering to the rules will help you pass audits with zero issues.

Smarter purchasing starts with Volopay cards

Practical use cases of a P-card

Purchasing cards (P-cards) simplify business transactions. You use them for approved expenses, streamlining payments for recurring or low-value purchases. With set limits, P-cards ensure control, efficiency, and transparency across various business spending scenarios.

Office supplies

You purchase office supplies like pens, paper, and printer ink with your P-card. These items are usually low in cost but frequently needed, making traditional procurement processes inefficient.

P-cards eliminate paperwork while streamlining vendor transactions, ensuring prompt delivery and budgetary compliance, whether it's ordering ergonomic chairs or replenishing the supply room. Instead of creating a purchase order every time, your P Card payment covers it instantly.

Travel & expenses

You use your P-card to pay for lodging, meals, and airfare when you travel for work. Expense tracking is made easier because transactions are automatically recorded.

You adhere to the policy's limitations, and the card's controls stop you from going beyond, which streamlines the reimbursement procedure. It accelerates workflows for spending tracking and approval and lessens the financial strain on staff.

Software and subscription services

You use your P-card to buy or renew software subscriptions, such as cloud services or project management tools. The card can be linked to a vendor account, and spending limitations can be set for automatic renewals.

It gives smooth access to essential tools and is perfect for regular payments. Spending stays in line with authorized vendors thanks to the card's limits and merchant restrictions.

Repairs and maintenance

You use your P-card to pay for minor repairs, such as replacing lightbulbs or repairing a leaking faucet, as part of facility maintenance.

It's ideal for short-term, inexpensive maintenance jobs that let you take care of problems quickly and within your means. There's no reason to put off these small but important duties, like replacing a chair or repairing a light bulb.

Expenses for business events

Using your P-card, you plan business events like client dinners and team-building exercises. It includes décor, venue bookings, and catering. The tracking capabilities on the card make sure that every spending is recorded, which makes budgeting and event policy compliance easier.

You won't have to deal with the hassle of numerous reimbursements or late vendor payments. This real-time control over spending illustrates clearly how P Cards work to make business operations more fluid and organized.

Small-scale tech and equipment acquisitions

You use your P-card to purchase small electronic devices such as cables, keyboards, and monitors. For low-value equipment needs, it's practical and ensures speedy purchase.

You may keep within allowed budgets and prevent unauthorized purchases by using spending limitations and category restrictions. It's a responsible and safe method of handling minor tech requirements without interfering with daily operations.

From office supplies to software subscriptions, these examples show how P-cards bring control, speed, and simplicity to everyday business expenses. To understand how corporate cards take this even further across your entire organization, read our blog on Why are corporate cards essential for Australian businesses.

Types of purchasing cards

Purchasing cards simplify business spending, offering tailored solutions for different needs. You use these cards to manage expenses efficiently, with each type designed for specific purposes, ensuring control, compliance, and streamlined tracking within your organization’s policies.

1. Corporate purchasing cards

For regular business expenses like office supplies or vendor payments, you use corporate purchasing cards. These employee-issued cards, which contain predetermined spending caps and merchant restrictions, make it easier to track and reconcile transactions and verify compliance with business budgets.

They provide extensive functionality, establish spending caps, and facilitate speedy business acquisitions for your team while maintaining transparency and control.

2. Government purchasing cards

Government purchasing cards are used for agency-related purchases, such as services or equipment, by government employees. These cards, which have stringent spending limits and thorough reporting to ensure accountability and transparency, impose strict adherence to federal laws.

3. Single-use purchasing cards

When making one-time purchases, such as paying a particular vendor, you depend on single-use purchasing cards. To reduce the possibility of fraud, each card has a distinct number, a predetermined amount, and an expiration date.

The card is inactive after usage, allowing safe, restrained spending. You just allocate it to a certain vendor, generate it digitally, and do away with the need for checks or protracted payment cycles.

4. Travel purchasing cards

You pay for business trip expenses like airfare, lodging, and car rentals with travel purchasing cards. These cards, designed for frequent travelers, offer higher limits for travel-related categories and can be easily tracked and reported through integration with expense management systems.

Category restrictions and real-time alerts make it simple to enforce travel policies. In addition, employee payroll cards can be used alongside travel cards to streamline per diem payments or reimbursements, allowing employees to access funds quickly while keeping expenses separate and compliant with company policies.

5. Fleet purchasing card

Fleet purchase cards help you keep track of costs associated with your vehicles, such as gasoline, maintenance, and repairs.

Designed specifically for business fleets, these cards limit purchases to auto retailers, guaranteeing cost containment and offering comprehensive transaction information for effective fleet administration.

While you keep an eye on every transaction, it ensures that drivers have everything they need while driving. To improve vehicle management, these cards frequently interface with telematics devices.

6. Virtual purchasing card

Virtual purchasing cards are digital card numbers that you use to pay online or to vendors instead of actual cards. With limitations and restrictions to stop unwanted spending, they provide recurring or single-use options, making them perfect for safe online shopping.

Whether you're paying freelancers or recurring bills, virtual cards offer speed and visibility, with complete control over P-card payments.

7. Travel & entertainment purchasing cards

You use travel and entertainment purchasing cards to cover client entertainment, such as meals or event tickets, as well as work trips.

These cards' adjustable meal and travel category restrictions guarantee compliance while streamlining cost reporting for regular business hospitality needs. This type highlights what is P-card payment is in action—supporting flexible spending with oversight that keeps your team compliant and your books clean.

Administrative features available with a P-card

Admin controls for purchasing cards (P-cards) empower you to manage employee spending effectively. You configure settings like limits, approvals, and restrictions through a centralized system, ensuring compliance, preventing misuse, and streamlining expense tracking for your organization.

1. Spend limits

You set spending limits on P-cards to control employee budgets. Define monthly, daily, or per-transaction caps tailored to roles or projects.

These limits prevent overspending, align with financial goals, and allow adjustments via admin portals for flexibility as needs change. You’ll eliminate the risk of overspending and gain better forecasting ability while still allowing team members to make the purchases they need in real-time.

2. Verified supplier list

Ensure transactions only take place with reliable providers by limiting P-card purchases to an approved vendor list.

You can enforce policy compliance, minimize illegitimate spending, and streamline procurement procedures for consistent sourcing by configuring merchant category codes or specific vendor IDs. It’s another way that P-cards work—by tightening spending paths and reducing the likelihood of fraud or policy violations.

3. Conditions of ATM use

You can limit or prevent P-card cash withdrawals by configuring ATM use criteria. You can limit ATM access completely or set particular withdrawal amounts and frequencies.

Through limiting cash misuse and ensuring that money is utilized for authorized business charges, these controls uphold financial monitoring. You have the option to prohibit cash withdrawals completely, establish daily limits, or allow them.

4. Approval workflow

Workflows for approval are set up to examine P-card transactions prior to their completion. Establish guidelines requiring manager approval for expensive or non-policy purchases.

The procedure is streamlined by automated technologies, which also guarantee compliance with corporate spending guidelines and alert you to awaiting approvals. Your team maintains oversight while remaining flexible when permission chains are in place.

5. Geographic restrictions

To restrict the areas where P-cards can be used, you set geographic limitations. To stop illegal foreign transactions, set up P-cards to only function in particular areas, such as your state or country.

Limiting card use to specific cities or countries protects your business if your operations are restricted to those areas. This control improves security and synchronizes expenditures with operational or business travel requirements.

6. Real-time monitoring

You get instant notifications for every P card payment, giving you a live view of who’s spending what. This allows you to catch out-of-policy activity as it happens, not weeks later. You can immediately track P-card activities by utilizing real-time monitoring.

Transaction details, such as amounts, vendors, and locations, are shown on admin dashboards. You can take prompt action to address possible fraud or policy violations by receiving alerts for suspicious or out-of-policy purchases.

7. Limitations on transaction type

To regulate the usage of P-cards, you set restrictions on the kinds of transactions. Limit purchases to particular categories, such as office supplies, or prohibit unsafe transactions, such as cash advances or gambling.

These settings lower financial risks and enforce policy compliance. These guidelines assist in enforcing budget control and shielding your business from excessive expenditures. Allowing what’s essential, blocking what’s not, and making every P-card payment traceable and accountable.

8. Date & time controls

Date and time constraints are used to limit the use of P-cards. You can restrict usage to project-specific times or set active hours, such as business days.

By preventing unlawful or after-hours transactions, these controls ensure that spending is in line with operational goals and timelines. These controls are in line with budget enforcement as well as compliance objectives.

Essential features of P-cards for business use

When choosing purchasing cards (P-cards) for your business, prioritize features that enhance control, security, and efficiency. You need customizable, integrated solutions that streamline spending, ensure compliance, and provide real-time insights to manage expenses effectively.

Customizable spend controls

To adjust limitations to your company's requirements, you should look for P-cards with adjustable spend controls. These features, which may include departmental caps, merchant-specific regulations, or daily limits, ensure responsible spending.

To keep the budget in line and avoid overpaying, you can easily alter these restrictions through an admin portal. If you’re wondering what is P-card flexibility in action, customizable limits are where it begins.

Customizable approval workflows

P-cards with customized approval workflows are what you should look for. You can set up rules that dictate which purchases, such as high-value or out-of-policy spending, require management permission.

Automated processes expedite assessments, provide timely notifications, and guarantee that your company's expenditure regulations are followed. Your company's efficiency and compliance are supported by the system, which does not require human approvals or email tracking.

Fraud protection

Select P-cards that offer strong fraud protection. You gain from features like instant card freezing, suspicious activity notifications, and transaction encryption secure, controlled alternative to traditional payment methods.

By reducing unauthorized use, these precautions ensure secure transactions and shield your company from financial damage. Understanding how do P-cards work includes knowing how they guard your business from unauthorized or malicious transactions.

Real-time monitoring and alerts

Select P-cards that offer alerts and real-time monitoring. You get to see dashboards with real-time transaction data, including vendors and amounts. Instant alerts for anomalous activity, such as significant purchases, let you take prompt action to stop fraud or policy infractions.

You may see ongoing spending and detect misuse early with the help of real-time dashboards and notifications.

ERP integration

Choose P-cards that are compatible with your ERP. Transaction data may be easily synced with systems like QuickBooks or SAP, which minimizes the need for human entry.

This integration offers a consolidated view of financials for better decision-making, increases accuracy, and streamlines accounting. Faster closing, fewer human errors in financial reporting, and more precise data all help your team.

Receipt imaging & matching

P-cards with matching features and receipt imaging should be given priority. The technology instantly links receipts to transactions when you upload them via mobile apps.

This saves time and improves audit readiness by minimizing paperwork, guaranteeing correct documentation, and streamlining reconciliation. This function can make managing your expenses much easier if you're tired of looking for receipts. It helps explain what is P-card payment compliance—it reduces paperwork and ensures audit readiness.

Unlimited virtual cards

Select P-cards, which provide a limitless number of virtual cards. To improve security, you might create distinct card numbers for particular suppliers or transactions.

Virtual cards allow for online memberships and purchases, and they can be deactivated or limited as necessary. Virtual cards also reduce risk by limiting card reuse, making them perfect for one-time purchases. If you’re asking what is a purchase card that adapts to modern needs—this is it.

Vendor category restrictions

Search out P-cards that have restrictions on vendor categories. Spending can be restricted to merchant-approved areas, such as travel or office supplies, to guarantee procurement policy compliance.

This tool streamlines vendor management for reliable sourcing and avoids illegal purchasing. These vendor filters help you keep control across departments and locations by ensuring that every transaction satisfies company needs and adheres to procurement rules.

Role-based access controls

Look for P-cards that have access controls based on roles. You restrict who can access or manage card settings by giving staff permissions based on their jobs.

This improves security and operational effectiveness by ensuring that only authorized individuals handle critical financial data. By customizing the platform to fit your organizational structure and internal controls, these measures help safeguard sensitive financial data and improve user experience.

Track, control, and simplify every purchase

Advantages of opting for a purchasing cards program for your business

A purchasing cards (P-cards) program transforms how you manage business expenses. You gain control, flexibility, and efficiency, streamlining procurement and accounting while enhancing security. These benefits save time, reduce costs, and ensure compliance with your financial policies.

1. Advanced controls

With a P-card program, you can take advantage of advanced features that enable accurate spending monitoring. Admin portals can be used to impose limitations on merchant types, transaction amounts, or geographic usage.

You can easily enforce policies, stop abuse, and uphold fiscal discipline with the help of these tools. It allows you to enforce compliance and reduce misuse, giving you a more secure and structured way to handle day-to-day business expenses.

2. Greater spend flexibility

P-cards give you more spending flexibility by allowing staff members to make purchases as needed while following established regulations.

By avoiding the delays associated with conventional approvals, you enable your team to take swift action while maintaining alignment with business goals, whether it is for travel or supplies. You can maintain visibility and control while allowing team members to make decisions on the move.

3. Customizable spend limits

Spend limitations that may be customized to meet jobs, projects, or departments are advantageous to you. Using a centralized system, change the restrictions on a daily, monthly, or per-transaction basis.

This gives you control without compromising operational needs by ensuring spending is in line with budgets. If you’ve been wondering what is a purchase card advantage, this is one of the most effective financial control tools you’ll find.

4. Streamlined approval workflows

P-cards allow you to expedite the approval process for purchases. Manual reviews are reduced when managers get high-value or out-of-policy requests via automated systems.

Notifications for prompt decisions are sent to you, guaranteeing compliance and expediting the purchasing process for maximum effectiveness. Additionally, these workflows may be tailored by department or role, allowing you to precisely replicate your internal structure.

5. Easy accounting reconciliation

Accounting reconciliation is made easier for you by P-cards. Transactions minimize human data entry by syncing with your accounting software.

Time is saved at month-end closings when you can easily match receipts to digital records, reducing errors and maintaining correct financial reporting. It’s another example of how do P-cards work behind the scenes—saving your finance team hours of reconciliation headaches and freeing up time for strategic work.

6. Real-time spend data

With P-cards, you can view spend data in real time, giving you immediate insight into transactions. Dashboards let you keep an eye on your budget and identify irregularities fast by displaying information such as numbers, vendors, and categories.

Proactive financial management and well-informed decision-making are facilitated by this transparency. You receive real-time alerts and dashboards that display the spending patterns and where the money goes.

7. Simplified procurement cycle

P-cards streamline your procurement process by getting rid of time-consuming purchase order procedures. You expedite acquisitions by giving staff the authority to purchase directly from authorized vendors within certain bounds.

This effectiveness keeps things operating smoothly and lowers administrative overhead. It optimizes processes, reduces friction, and releases your team from time-consuming administrative duties so they can concentrate more on strategic sourcing.

8. Improved payment security

P-cards improve your company's payment security. Unauthorized usage is prevented by features including fraud alerts, virtual card numbers, and card freezing.

You reduce monetary risks, guarantee secure transactions, and uphold confidence in your payment procedures. In addition to protecting your money, the built-in safeguards also contribute to the development of trust with both suppliers and staff.

9. Expense reconciliation

P-cards make expense reconciliation easier since they automatically log and classify transactions. Digitally upload receipts to correspond with purchases, making audits smoother.

This guarantees compliance, cuts down on paperwork, and frees you up to concentrate on important financial duties. Your accounting staff can close books fast and accurately since every card transaction is automatically recorded and compared to receipts.

By streamlining procurement, enhancing control, and simplifying reconciliation, a P-card program lays the foundation for smarter business spending. Ready to bring these benefits to your organization? Learn the next steps in our blog: How to apply for a corporate credit card in Australia.

Differences between P-card, business credit cards & corporate credit cards

Knowing the distinctions between corporate credit cards, business credit cards, and purchasing cards (P-cards) will help you select the best instrument for your company. Each has different processes, regulations, and credit consequences, and fulfills certain functions.

How it works

● P-card

P-cards, which are connected to a business account with strict limitations, are used for particular business expenditures. Spending is limited to authorized vendors or categories, and transactions need approval.

● Business credit card

You access a revolving credit line for business expenses with a business credit card. It offers flexibility for various purchases, with payments managed by you or authorized users.

● Corporate credit card

P-cards, which are connected to a business account with strict limitations, are used for particular business expenditures. Spending is limited to authorized vendors or categories, and transactions need approval.

Primary purpose

● P-card

P-cards are used to facilitate spending tracking within predetermined guidelines and ensure compliance with streamlined procurement for low-value, high-volume transactions such as products or services.

● Business credit card

Company credit cards give small firms and startups the freedom to manage cash flow and establish credit while being used for a variety of general company needs, such as inventory and travel.

● Corporate credit card

You provide corporate credit cards for employee expenses, like travel or client entertainment, in large organizations, focusing on centralized control and expense management.

Management and control

● P-card

You configure P-cards with tight controls, like spend limits and vendor restrictions, managed through admin portals to enforce policies and monitor transactions in real time.

● Business credit card

You have moderate control with business credit cards, setting basic limits or user access. Management relies on cardholder discipline, with less granular oversight than P-cards.

● Corporate credit card

You exercise strong control over corporate credit cards via centralized systems, setting employee-specific limits and tracking usage, with robust reporting for expense oversight.

Process of approval

● P-card

You require pre-approvals for P-card transactions, often through automated workflows. Out-of-policy purchases need manager review, ensuring adherence to company spending rules. It ensures every expense is vetted and policy-aligned.

● Business credit card

You typically don’t need pre-approvals for business credit card purchases. Cardholders spend within credit limits, with post-transaction reviews to ensure policy compliance. Spending decisions are made at the cardholder level, followed by periodic reviews.

● Corporate credit card

You enforce approvals for corporate credit card expenses, often post-transaction. Managers review employee submissions, ensuring alignment with corporate policies before reimbursement or payment.

Involvement of credit

● P-card

P-cards are connected to business accounts, so you don't have to deal with personal credit. Transactions emphasize economical spending and have no effect on personal or corporate credit scores.

● Business credit card

You may tie business credit cards to personal credit, especially for small businesses. Usage and payment history can affect both business and personal credit scores.

● Corporate credit card

You link corporate credit cards to the company’s credit, with no personal liability for employees. Payment performance impacts corporate credit, managed centrally by the organization.

Cash flow impact

● P-card

P-cards help you stabilize cash flow since pre-approved transactions are paid centrally, which helps you stay within budget and prevent unexpected cash withdrawals.

● Business credit card

Business credit cards allow you to improve cash flow by postponing payments, but if you don't manage your outstanding balances, they might limit your liquidity.

● Corporate credit card

With corporate credit cards, you can simplify cash flow because centralized payments lessen personal responsibilities and provide steady cash management. improve short-term cash flow flexibility with strong internal controls to avoid misuse.

Security and compliance

● P-card

Limits, vendor restrictions, and approval workflows are used to strictly enforce P-card compliance, reducing policy infractions and guaranteeing adherence. It helps you stay aligned with internal policies and audit standards.

● Business credit card

When using corporate credit cards, you have to rely more on internal policies and have less control, which increases the risk of non-compliance, and for growing businesses with increasing transaction volumes.

● Corporate credit card

Through centralized controls, audits, and rules, you ensure strong adherence to corporate credit cards, minimizing deviations throughout the company. Advanced compliance capabilities such as policy automation, department-specific rules, and seamless audit trail generation.

Risks involved

● P-card

When you use a purchase card, you reduce risks like receipt loss or misuse by leveraging real-time controls, although card proliferation can become a concern without centralized monitoring.

● Business credit card

Since business cards frequently lack transaction-level safeguards, they may cause employees to overspend or make prohibited purchases if they are not constantly watched.

● Corporate credit card

Large-scale misuse or delayed reporting are the main risks associated with corporate cards, particularly in organizations with numerous divisions and cardholders.

Payment and billing

● P-card

P-cards typically offer simplified, consolidated billing cycles with direct payments, reducing the complexity of invoice processing and helping you streamline what is P-card payment procedures.

● Business credit card

You have flexibility in managing company credit card invoicing and making monthly balance payments, but there is a risk of interest if the balance is not paid in full. It can lead to unpredictable cash flow and delayed expense recognition.

● Corporate credit card

You benefit from centralized corporate credit card billing, where the company handles payments, reducing individual responsibilities. It involves large-scale misuse or delayed reporting, especially in enterprises with multiple departments and cardholders.

Expense reporting

● P-card

When you understand how do P-cards work, you’ll see that expense reporting becomes easier with automated transaction logs and integrated platforms for receipt uploads and notes.

● Business credit card

Employees and finance teams find the procedure laborious and prone to errors because the majority of business cards require manual entry of expenses and receipts.

● Corporate credit card

You follow structured corporate credit card expense reporting, integrated with systems for streamlined submission and approval processes. Platforms frequently combine, making it easier to submit, classify, and evaluate employee spending.

Spend visibility

● P-card

P-cards allow you to monitor employee purchases in real time, which helps you manage spending trends and maximize vendor utilization throughout your company.

● Business credit card

The restricted availability of these cards, which frequently only reveal information after monthly bills are posted, affects your ability to track spending in real time.

● Corporate credit card

Through consolidated platforms, you have access to strong corporate credit card visibility, which offers comprehensive insights into spending across the whole organization. Analytics that enable you to achieve financial transparency at scale.

Understanding the differences between P-cards, business credit cards, and corporate credit cards empowers you to choose the right solution for your company’s unique spending needs. Now that you’re clear on how each option works, dive into our blog on Best corporate credit cards in Australia in 2026 to find the ideal fit for your business goals.

Challenges of using purchasing cards

Purchasing cards (P-cards) streamline business spending, but they come with challenges. You may face issues like reconciliation errors, misuse, or hidden costs, which can undermine efficiency and compliance if not managed carefully within your organization.

1. Discrepancies between receipts and statements

When reconciling P-card statements, you may come across discrepancies in the receipts. Transaction verification becomes challenging when staff members misplace or neglect to upload receipts.

If this disparity is not resolved right away, it makes accounting more difficult, delays reconciliation, and increases the possibility of audit problems. identifying the differences in data accuracy and employee discipline, which can cause delays in reconciliation and compliance problems.

2. Absence of PO-level terms and conditions

P-cards frequently avoid the rules and conditions of purchase orders (POs). Losing the power to enforce particular vendor agreements, such as delivery dates or warranties, may result in uneven procurement outcomes and less robust contractual safeguards for your company.

When disagreements emerge or deliverables are missed, this restriction becomes essential because, if a vendor does not comply, you have less legal standing and less leverage without PO-level terms.

3. High program costs

You have to control the expenses associated with running a P-card program. These consist of setup fees, transaction fees, and tracking software subscriptions.

Budgets may be strained by high transaction volumes or premium services, particularly for smaller companies with fewer resources. Even while it might not seem like much in comparison to operational gains, the overall cost may be more for smaller organizations.

4. Non-compliance by card users

The risk of non-compliance arises when cardholders disregard expenditure guidelines. Employees may circumvent approvals, utilize cards for personal transactions, or go beyond restrictions.

Controls are compromised as a result, necessitating monitoring and training to guarantee compliance. There is a chance of out-of-policy use even with training. This defeats the purpose of what is a purchase card system is built to provide: financial control and oversight.

5. Challenges in reconciliation

When you attempt to match P-card transactions with approvals and receipts, reconciliation issues occur. High transaction volumes, inconsistent data entry, or missing paperwork can all lead to mistakes that slow down accounting procedures and raise the possibility of financial irregularities.

Accurately completing your financial books requires the use of proper systems to prevent mistakes and delays. If you’re wondering how do P-cards work in large organizations, this challenge is amplified.

6. Risk of card misuse or fraudulent activity

Card fraud and misuse put you at serious risk. Criminals may use stolen card information, or employees may make unapproved purchases.

Even with fraud alerts, proactive monitoring is necessary to identify and address misuse, which can put a burden on your resources. Transaction limitations and real-time monitoring help to limit exposure, but without employee accountability and frequent audits, no solution is perfect.

7. Inefficient dispute resolution processes

You may find it difficult to handle P-card transaction complaints. Getting in touch with suppliers or card issuers to resolve problems like inaccurate charges or undelivered items might take time, depending on the bank or card issuer’s timeline.

Resolution delays could cause cash flow or operational disruptions. If you're relying on what is P-card payment workflows for critical purchases, delays can affect vendor relationships.

8. Missed opportunities for vendor discounts

Using P-cards could result in the loss of vendor discounts. Certain suppliers provide discounts for large purchases or early payments made through traditional channels, but P-card transactions frequently do not qualify for these perks, which raises expenses and lowers procurement budget savings.

If you're focused on long-term supplier relationships, what is a purchase card might not always be the most strategic option in terms of pricing advantages.

9. Uncontrolled issuance of cards

You may get difficulties with a lack of expenditure visibility if your tracking isn't strong enough. Decentralized card usage or high transaction volumes might mask expenditure trends, making it challenging to track spending or spot inefficiencies without the use of sophisticated analytics tools. In order to fully see and control the P-card, it is necessary to have strong software integration.

10. Limited visibility into spending

Your risk of card proliferation rises if you issue an excessive number of P-cards. Having several cards for different workers or departments makes monitoring more difficult, increases the possibility of fraud, and imposes a burden on administrative resources, especially if you don't routinely check and deactivate unused cards.

Part of learning what is a purchase card management involves limiting distribution and establishing tiered access levels. Without that, P-cards may become more of a liability than an asset.

Steps to implement a purchasing card program

Establish clear goals and objectives

Setting specific goals for your P-card program is the first step. Choose whether your goal is to improve spend management, expedite procurement, or reduce paperwork.

To properly direct the implementation process, match these objectives with your company's top priorities, such as cost reduction or compliance. To monitor results right away, set quantifiable KPIs like shortened reimbursement times, enhanced compliance, or minimized processing expenses.

Perform a thorough needs assessment

To determine the spending trends of your company, you perform a requirements assessment. Examine staff positions, vendor categories, and transaction volumes.

Find out which costs, such as supplies or travel, are appropriate for P-cards. This ensures that the program maximizes efficiency and meets certain operational needs.

Map your expenses, vendors, and users to determine if what is a purchase card aligns with operational priorities and if the program will address issues like manual approvals or duplicate invoicing.

Research and assess potential P-card providers

To choose the best P-card provider, you do your homework. Examine features offered by banks or fintech companies, including fees, integration possibilities, and expenditure controls.

Examine their support services and scalability to make sure they can accommodate your company's present and future needs.

Make sure the provider can accommodate the size, sector, and compliance requirements of your company, regardless of whether you need virtual cards, physical cards, or both. As part of your assessment, inquire about admin controls, fraud detection, and real-time data tracking.

Review client feedback and case studies

To determine the reliability of a provider, you examine client endorsements and reviews. Look for comments on system performance, customer service, and user experience on review websites or industry forums.

This aids you in selecting a supplier with a track record of success for companies similar to yours. Reviews can also shed light on how effectively the platform supports P-card payments and user training, giving you confidence in your final decision.

Select the most suitable P-card program

After conducting the study, you decide on a P-card program. Choose one that offers connectivity with your systems, strong security, and adjustable controls.

For long-term success, be sure the terms, costs, and support of the provider fit your operating objectives and budget. Examine the program's support for virtual cards, P-cards, or single-use cards to see how relying on payments fits into your company's overall purchasing plan.

Set up and implement control mechanisms

Controls to regulate P-card usage are set up and configured by you. Using the provider's interface, specify transaction categories, spend caps, and vendor restrictions.

Adjust parameters according to staff responsibilities and projects to allow for flexibility while maintaining adherence to your financial regulations. This stage strengthens the foundation by ensuring compliance and reducing the possibility of misuse.

Define approval workflows and policies

You create a workflow and approval procedure for P-card transactions. Establish guidelines for managers to follow when evaluating expensive or non-policy acquisitions.

Establish escalation routes and automated notifications in the system to expedite approvals while preserving supervision and policy compliance. Making roles and duties clear guarantees that everyone is aware of their role in the ecology of purchasing cards.

Integrate the program with existing systems

The P-card program is integrated with your current accounting or ERP software. Ensure smooth data flow for reporting and transactions. To reduce interruptions and improve the effectiveness of the financial process, test connections with your provider and IT team.

Verify whether the service offers native compatibility with your software stack or allows API integrations. Integration is key to understanding how do P-cards work at scale, particularly when tracking budgets and spend data.

Provide comprehensive training to employees

To guarantee that P-cards are used correctly, you run training programs for your staff. Educate cardholders on receipt management, approval procedures, and spending caps.

Reinforce compliance with workshops or online modules to cut down on misuse and get staff ready for a seamless program adoption. This prevents abuse and guarantees compatibility with business objectives. Provide instruction on how to access support channels, report fraud, and record receipts.

Conduct end-to-end system testing

System testing is conducted prior to a complete rollout. Verify integrations, test approval processes, and simulate transactions. Look for problems such as control failures or faults in data synchronization.

To guarantee that the P-card program runs consistently throughout your company, fix any issues. This prevents abuse and guarantees compatibility with business objectives. Provide instruction on how to access support channels, report fraud, and record receipts.

Distribute cards to designated employees

Employees are given P-cards based on their roles and requirements. Provide virtual or actual cards, making sure each has its own set of rules and limitations.

Keep track of all cards provided for monitoring and guidance, and confirm that cardholders are aware of their duties. To prevent problems during the official launch, modify settings, rules, or restrictions in response to test results.

Track performance and analyze data

The dashboards of the P-card system are used to track analytics and performance. Monitor transaction volumes, spending trends, and compliance indicators.

To ensure the program satisfies your strategic goals, check alarms for odd activity and examine data to find areas for cost savings. By requiring formal agreements detailing cardholder responsibilities, you can promote responsibility.

By recording the issuing methodology and keeping a central log for upcoming audits, you can streamline the procedure.

Continuously optimize and refine the program

You demonstrate your dedication to ongoing development by assessing the P-card program on a regular basis. Ask staff members for their opinions and examine performance information.

As necessary, modify workflows, controls, or training to solve problems, boost productivity, and conform to changing business requirements. Review vendor relationships, credit restrictions, and feature needs on a regular basis.

A proactive approach ensures that what is a purchase card remains relevant and beneficial as your business grows and changes.

Strategies for effectively managing your P-card program

Managing your purchasing card (P-card) program ensures efficient spending and compliance. You can use manual methods like spreadsheets, traditional reporting, expense software, or dedicated P-card systems, each offering distinct processes to track and reconcile transactions.

Spreadsheet-based manual tracking and reconciliation

● Overview

P-card transactions are manually tracked and reconciled using spreadsheets. Although this low-cost approach is appropriate for small firms, it necessitates care to prevent mistakes and guarantee correct financial records. Despite being time-consuming, smaller businesses continue to employ it to keep costs under control.

● Step of manual process

You gather statements and receipts and enter information into a spreadsheet, including the date, amount, vendor, and purpose. Sort expenses, indicate inconsistencies, and cross-reference inputs with bank statements.

Maintain records for audits by updating the spreadsheet frequently, checking totals, and storing backups. As an administrator, it is your responsibility to personally make sure that every entry matches the statement, that receipts are included, and that policy compliance is followed.

This process gives you hands-on control but comes with risks of error, delays, and missed fraud indicators—especially if your understanding of how P-cards work isn’t supplemented by automated checks.

Conventional methods of expense reporting

● Overview

You use traditional expense reporting, in which staff members submit digital or paper forms for P-card transactions. Although this approach is well-known, it is difficult and prone to delays.

It is frequently employed when there is a formal process but no digital integration. Although it offers structure, it is not as effective or visible as contemporary techniques.

● Step of manual process

Employees must fill out expense forms, attach receipts, and provide transaction data. Gather forms, check for adherence to the policy, then accept or deny submissions.

Enter data into accounting systems by hand, compile authorized spending into financial records, and save records for upcoming audits. This approach lacks real-time insights into what constitutes P-card payment activity, although it encourages accountability.

Form submission mistakes or delays can result in problems with reconciliation and may cause violations to go unreported, particularly as your company expands and the number of transactions rises.

Use of automated expense management software

● Overview

To make P-card tracking more efficient, you employ cost management software. By automating data entry and reporting, these solutions help medium-sized and large enterprises become more efficient. If you want to get real-time program control and be clear of paper trails, these tools are perfect.

● Step of manual process

The software is configured to synchronize with P-card accounts. Through smartphone apps, staff members upload receipts, and the system classifies transactions. To keep an eye on spending and compliance, generate reports, export data to accounting software, and review and approve expenses in the platform.

Understanding how P-cards work in conjunction with software analytics empowers you to make informed decisions, identify unusual activity quickly, and maintain audit readiness without spending hours on manual reconciliation.

Dedicated P-card management platforms

● Overview

For complete control, you put in place specialized P-card administration systems. These platforms are perfect for complex applications because they provide integration, strong controls, and real-time tracking. These platforms are built specifically for managing what is a purchase card program at scale with enhanced control and visibility.

● Step of manual process

You set up approval workflows and spend restrictions in the system. Transactions are recorded by staff members, and the system automatically compares receipts.

Integrate data with ERP systems, approve transactions, and keep an eye on real-time dashboards. Create analytics to evaluate performance and make sure policies are being followed.

Employees use desktop or mobile devices to upload receipts, and you can view a consolidated dashboard for tracking performance. These technologies simplify P-card operations in larger enterprises, reducing fraud risks and reconciliation delays while guaranteeing flexibility and control.

Best practices to follow when using purchasing cards

Purchasing cards (P-cards) optimize business spending when used correctly. As an employer, you implement structured controls and training to ensure compliance. As an employee, you follow policies and manage transactions responsibly to maintain efficiency and trust.

For the employer

● Phased implementation approach

To ensure seamless acceptance, you implement your P-card program in stages. Test controls, start with a pilot group, and get input. Increase staff numbers gradually while streamlining procedures to reduce interruptions and better suit company requirements.

You'll lower the risks involved in a company-wide rollout and gain a greater understanding of your particular operating structure. Stakeholder buy-in is also easier to obtain with a controlled approach.

● Cross-functional P-card team

You build a cross-functional P-card team that includes IT, finance, and procurement personnel. By supervising implementation, establishing guidelines, and keeping an eye on usage, this group guarantees effective management, prompt problem solving, and alignment with corporate objectives.

Each team member brings a different perspective on what is a purchase card and how best to use it. Additionally, a centralized staff guarantees improved administration, ongoing oversight, and speedier reactions to security breaches, fraud warnings, or vendor troubles.

● Establish industry-grade performance benchmarks

To evaluate the success of P-cards, you establish industry-standard performance metrics. Monitor data such as reconciliation time, compliance rates, and transaction volume.

To find gaps, streamline procedures, and make sure your program offers the most value possible, compare it to industry standards. Establish attainable goals that encourage expansion, precision, and smart buying by using past data and peer comparisons.

● Develop a comprehensive employee training program

To demonstrate to staff members how to utilize P-cards, you develop a comprehensive training curriculum. Attend workshops or take online courses to learn about regulations, spending caps, and receipt management.

Frequent refreshers ensure constant adherence, minimize errors, and reinforce compliance. To avoid misconceptions and encourage ethical usage of your purchasing card system, reinforce training once a year or whenever policies are updated.

● Clearly defined & identified inactive cards

You keep a procedure in place to find and deactivate P-cards that aren't in use. To stop abuse, periodically check card usage, identify inactive accounts, and cancel them.

Maintaining accurate records of both active and inactive cards improves security and simplifies program administration. Maintaining greater control and lowering the risk of fraud is made easier with clear documentation and visibility into active versus dormant cards.

● Conduct periodic audits

To ensure P-card compliance, you perform audits on a regular basis. Check for policy compliance in transactions, approvals, and documents. In order to preserve confidence and financial integrity, use audit findings to resolve non-compliance, improve controls, and fortify oversight.

Check for anomalous spending patterns, policy violations, or duplicate transactions. These audits serve as proactive inspections to guarantee that your P-card program stays effective, compliant, and resistant to fraud.

● Perform in-depth vendor-match analysis

To confirm that transactions correspond with authorized suppliers, you do vendor-match analysis. Verify purchases against your list of vendors to identify any instances of unapproved spending. This lowers risks from unreliable providers, improves procurement, and guarantees compliance.

With a good understanding of what is a purchase card, you can better enforce policies around approved vendors and avoid fragmented spending. You can streamline your vendor ecosystem and get volume discounts by examining purchasing habits.

● Create a defined accepted vendor list

You create a list of approved vendors for P-card purchases that is well-defined. Set up P-cards to limit non-listed vendors and specify permitted suppliers by category, such as travel or office supplies.

This streamlines procurement and upholds policy. There is a far lower likelihood of policy infractions when people are aware of which providers are allowed.

For the employee

● Strictly adhere to policies

You have to strictly follow the P-card rules. Observe the rules regarding transaction kinds, authorized vendors, and expenditure caps.

Always make transactions in accordance with company policies to maintain confidence, as noncompliance might result in card suspension or other disciplinary action. Adhering strictly lowers the possibility of policy infractions and ensures that you help create a safe, legal procurement process.

● Avoid overspending

You remain inside the restrictions of your P-card to prevent overspending. Before making a purchase, review the budget and acquire permission for any exclusions.

Budgeting helps you avoid financial stress and makes sure that your transactions match the resources allotted to your position. Always compare costs to guarantee cost-effectiveness, spend sensibly, and refrain from splitting purchases to get around restrictions.

● Use your cards responsibly

You limit the usage of P-cards to authorized business expenses and utilize them appropriately. Keep clear of unapproved suppliers and personal purchases, as misuse may result in fines.

The P-card program's integrity is preserved and compliance is supported through responsible use. Don't use your card for personal purchases, and never give it away. Responsible use maintains the program's functionality and fosters trust.

● Ensure proper receipt management

You ensure appropriate receipt management by promptly gathering and uploading receipts. Enter transaction information in the expenditure system, such as the date and the reason.

Precise documentation facilitates audits, reconciliation, and adherence to your business's financial regulations. This habit reflects a deeper understanding of how P-cards work and how your records support company audits and reporting. You can maintain organization and compliance with the use of digital solutions, like as applications that gather receipts.

● Report any card issues immediately

You promptly report P-card problems, such as misplaced cards or questionable transactions. To freeze the card or look into it, get in touch with your manager or program administrator.

Prompt reporting reduces the likelihood of fraud and shields your company from financial loss. Duplicate charges or system faults must also be reported. Knowing what is P-card payment means knowing how to keep it secure, which includes acting fast in emergencies.

● Stay informed

You remain up to date on P-card updates and policies. Examine training materials, go to refreshers, and look over employer communications.

You can use the card correctly and adjust to any software modifications if you are aware of the existing instructions. Understanding the changes in what is a purchase card ecosystem helps you avoid unintentional errors and remain a compliant contributor to your organization’s spending strategy.

● Leverage real-time updates

You use P-card systems' real-time updates to monitor your spending. To stay within bounds and identify mistakes, keep an eye on transactions using dashboards or applications.

You may stay compliant and make well-informed decisions by using real-time data. Using real-time insights gives you greater control over every purchase you make and shows that you are dedicated to comprehending how to operate in an advanced digital workflow.

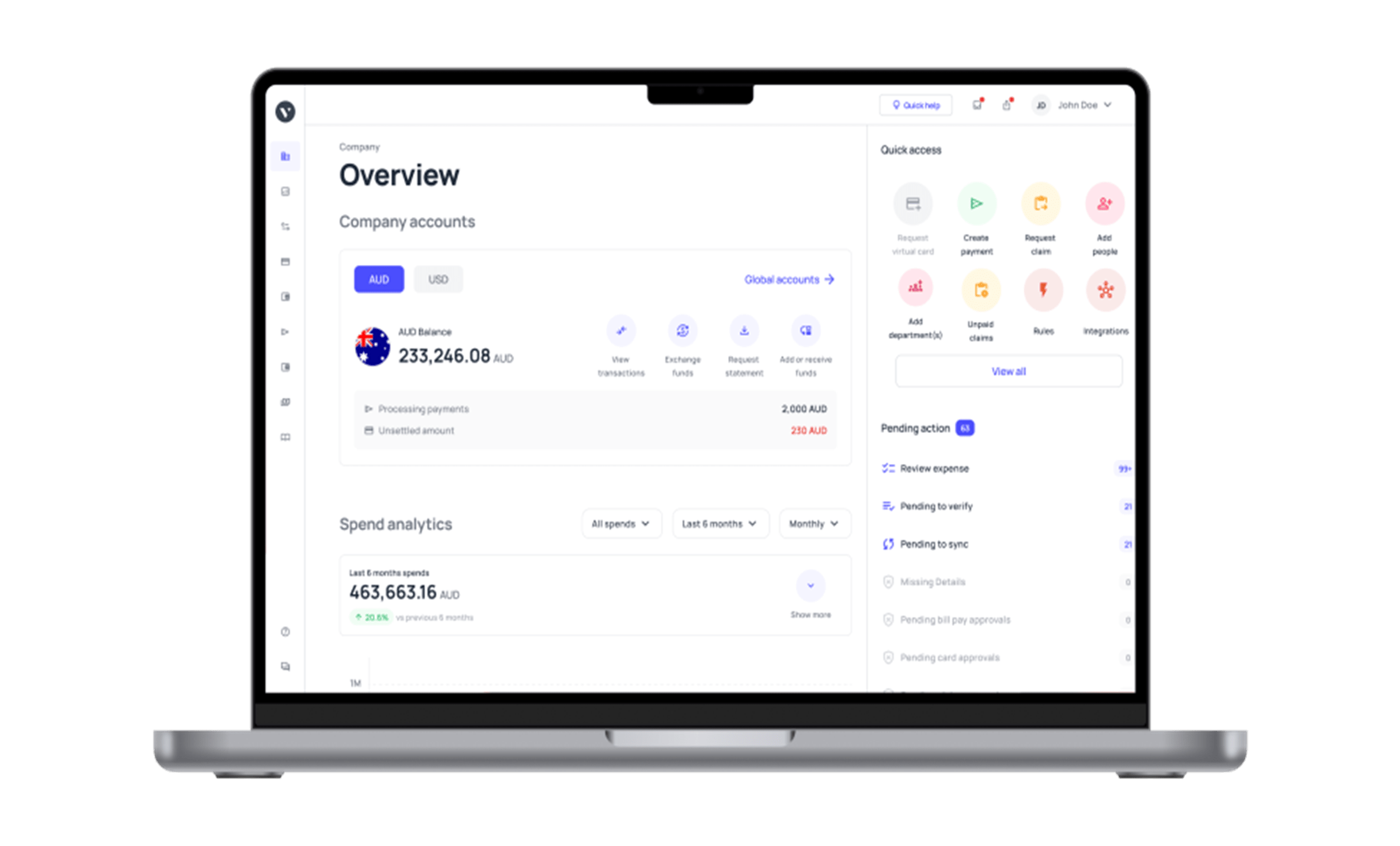

How can Volopay's corporate cards help your business?

Volopay's corporate cards revolutionize your business’s financial management. You streamline payments, enhance control, and boost efficiency with features like automation, real-time tracking, and robust security, all tailored to simplify expense processes and ensure compliance.

Automate recurring payments

Volopay cards allow you to automate recurring payments, making vendor payouts and subscriptions easier. Schedule utility bills or SaaS technologies to ensure on-time payments without the need for human interaction.

This simplifies your accounts payable procedure and lowers late fees. If you're new to what is P-card payment, automation brings efficiency and helps align financial workflows with strategic business needs.

Unlimited employee virtual cards

Employees are given limitless virtual cards for safe internet shopping. With adjustable restrictions, assign cards to particular departments, projects, or vendors. This improves control, removes reimbursement headaches, and makes employee spending tracking easier.

You become less reliant on shared physical cards and have more control over your spending. Virtual cards reduce the possibility of fraud and increase the transparency and precision of budget control.

Multi-level approval workflows

With Volopay, you set up multi-level approval workflows to guarantee transaction oversight. Five approver levels can be set for payments or changes to the card limit.

Customizable restrictions and automated alerts improve adherence and stop wasteful spending. The risk of unapproved or untracked purchases is greatly decreased by structured approval flows, which ensures that expenditure remains compliant and pre-verified.

Real-time spend visibility

With Volopay's dashboard, you can track your spending in real time and see every transaction right away. View vendor, amount, and purpose details, arranged by department or personnel.

You may rapidly identify overspending and make wise financial decisions due to this openness. Without waiting for monthly statements or pursuing employees for receipts, it facilitates improved forecasting, budgeting, and decision-making.

Auto payment categorization

Volopay automatically tags transactions by vendor, department, or tax code, which is advantageous to you. Your finance staff will save time as a result of the reduction in manual bookkeeping, accelerated reconciliation, and guaranteed correct expense reporting.

This automation makes bookkeeping more efficient and guarantees uniformity in reporting. In audits and financial assessments, when classification and clarity are crucial, it is quite beneficial.

System integrations

For smooth data syncing, you may combine Volopay with accounting programs like NetSuite, Xero, or QuickBooks. Manual entry is eliminated as transactions happen automatically.

This improves precision, simplifies financial procedures, and offers a cohesive picture of your company's financial situation. becomes considerably more potent when linked to your primary financial stack. It speeds up your month-end close, minimizes silos, and guarantees continuity.

Up-to-date compliance & security

Enterprise-grade security procedures and ongoing compliance audits safeguard your financial information. Features like spending caps, category limitations, and real-time alerts are included with Volopay cards.

If you're still unsure what is P-card usage is under compliant frameworks, Volopay ensures adherence to company policies and industry regulations, helping you reduce risk, maintain audit readiness, and build a trustworthy financial ecosystem.

FAQs on purchasing cards

You can ensure compliance by setting clear spending limits, tracking every P Card payment, requiring documentation, and regularly auditing transactions. Automated alerts also help you stay within purchase card policies.

Volopay uses real-time transaction tracking, fraud detection, and virtual cards to protect your company. You get full visibility into how P cards work, with built-in approval workflows and advanced controls.

To use a P-card, simply swipe or enter card details online after your request is approved. The expense gets logged automatically. This is the core of what a P card is designed for.

You’ll get onboarding assistance, live support, help articles, and personalized training. Volopay ensures you’re confident in using the system and understand exactly how P cards work in your setup.

Yes, Volopay integrates seamlessly with most ERP and accounting software. You won’t have to worry about manual entry, making P Card payment processing efficient and audit-ready.

Startups, SMEs, and large enterprises can all benefit. If you need to manage spending, streamline purchase card use, and track expenses, Volopay suits your needs.

P-cards let you make quick, approved purchases without waiting for a PO. If you’ve asked what is a purchase card, think of it as a faster, controlled alternative to POs.