6 best business prepaid cards to consider in Australia in 2025

The best business prepaid cards for independent ventures have reasonable charges and easy ways of reloading your balance. When choosing business prepaid cards, you must consider your spending habits and the number of cards you'll need for your employees.

Businesses should select the one that gives access to an online and versatile dashboard and allows them to control their company costs and employee cards.

What is a business prepaid card?

In contrast to regular business debit cards, which pull funds for payments directly from a linked business checking account, a business prepaid card requires you to preload money onto the card before you can use it.

Banks, credit card companies, and other financial service providers all offer prepaid business debit cards. Most of the time, these cards don't check your credit, come with digital tools for managing your finances, and they usually have low fees.

Best prepaid cards in Australia for businesses

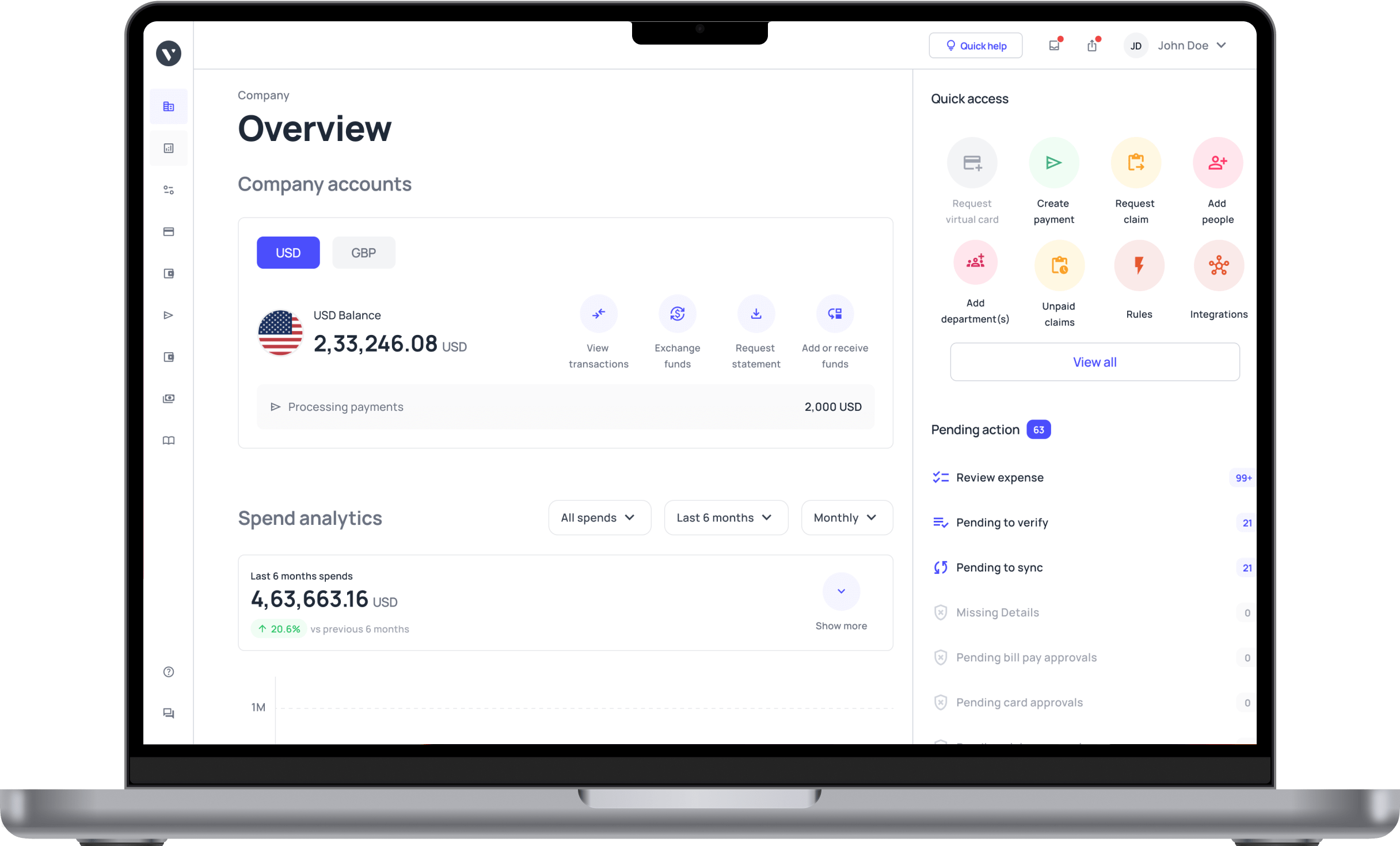

1. Volopay prepaid cards

● Overview

Get business prepaid cards through your Volopay account in just a few clicks. Make spending and managing expenses easy by assigning employees cards that are easily adjustable and can be topped up from anywhere.

● Features and benefits

Every Volopay card can be topped up accordingly before it is assigned to an employee. The cardholder won’t be able to spend more than the assigned amount, allowing you to have better control over your expenses.

All transactions are automatically recorded and can be directly synced with your accounting platform.

● Limitations

Volopay does not have a physical branch in Australia, meaning that you have to manage all your cards and expenses online. This requires you to have all the necessary devices and employee training to do it effectively.

● How to apply

Applying for a Volopay prepaid card is done fully online—no visiting necessary. You’ll need to fill out all the required details and attach supporting documents.

Get in touch with a Volopay representative to get more information and allow them to assist you with the process.

2. Weel corporate card

● Overview

Weel offers reloadable virtual Mastercards to manage business expenses. Day-to-day operational and employee expenses, for example, can be controlled with Weel’s virtual cards and dashboard.

● Features and benefits

Easily generate virtual cards from your Weel app. With your Apple or Android phone, they can be used to make in-store payments through Apple Pay or Google Pay. Virtual cards can be set for one-time payments or recurring usage.

● Limitations

The bigger your company is, the more expensive Weel gets for you because of its user add-on payment scheme.

You’ll have to pay close attention to how many users you’re adding to the platform to keep costs manageable. You also don’t get physical cards to assign to all employees.

● How to apply

Considering that a Weel corporate card is geared toward businesses, you will need to prove that you have a business and intend to use the card for business purposes.

For this reason, an ABN is required to open a Weel account, along with personal identity details. You can sign up online to get started.

3. Wise prepaid card

● Overview

The Wise card is an international debit card connected to your Wise multi-currency account to spend in more than 40 currencies in 170+ countries. It provides real-time currency conversion at mid-market exchange rates, making transactions cost-effective without hidden fees. Control your money easily with the Wise app.

● Features and benefits

Wise prepaid cards allow spending in more than 40 currencies abroad. Get mid-market exchange rates with no markups, low commissions, and free ATM withdrawals up to a certain limit. Get instant access to a digital card, activate spending limits, freeze/unfreeze your card, and get real-time notifications.

● Limitations

Wise only offers two free ATM withdrawals per month, after which there are fees. Funds in the account do not earn interest. The card is not provided in all countries, so check eligibility. As a prepaid card, it will not help build a credit history.

● How to apply

Sign up online or through an app for a free Wise account. Identify documents as per the requirements. Buy a digital or physical card upon identification. You can seamlessly deposit funds in your currency of choice. Activate the physical card upon receipt; digital cards are ready instantly.

4. Mastercard business debit card

● Overview

As one of the biggest card networks, you can ensure you have flexibility, convenience, and security by using a Mastercard business debit card for your payments. Debit Mastercards are accepted worldwide by a majority of merchants, making it easy for you to do business in Australia and overseas.

● Features and benefits

Mastercard allows you to manage your business cash flow and expenses better. With the Zero Liability program, you can also ensure that your funds are protected.

● Limitations

As a card network, you’ll have to find a Mastercard provider to be able to apply for a card for your business. This means that you’ll have to do thorough research to get the best card. Some features may not be available with some providers.

● How to apply

Get a Mastercard business debit through one of the Mastercard providers or issuers in Australia. Some providers include Citibank, Coles Mastercard, NAB, Westpac, Bendigo Bank, Qantas Money, and more.

5. Westpac business prepaid card

● Overview

Westpac customers in Australia can apply for business debit cards with the bank. There is also an option to get business prepaid cards with the New Zealand branch for businesses that also operate in New Zealand.

● Features and benefits

With a debit Mastercard, you won’t have trouble getting a wide range of merchants to accept your card. 24/7 transaction monitoring ensures that suspicious transactions get flagged and are investigated as soon as possible.

● Limitations

While business debit cards are impressive tools that can help you manage your business finances, you have to directly link them with a bank account, unlike a prepaid card.

● How to apply

If you’re not already a Westpac business bank account customer, you can start your application online as long as you are over 18 years old and have a business operating in Australia. In some cases, however, if you have a registered company with multiple directors, you may have to apply at a bank branch.

6. Airwallex corporate cards

● Overview

Airwallex offers Visa cards that can be used worldwide to manage your business expenses. You can adjust their spending limits accordingly through your Airwallex account.

● Features and benefits

An Airwallex corporate card allows you to spend in multiple currencies with ease. You can also control your Airwallex cards through an app to set spend controls, adjust limits, and freeze cards as needed.

Direct sync with Xero is available to streamline your accounting processes.

● Limitations

Airwallex doesn’t have a physical presence in Australia, meaning that managing your cards must all be done fully online. If the ability is important to you, keep in mind that you also can’t withdraw money with your Airwallex corporate cards.

● How to apply

Make sure that you are applying for Airwallex corporate cards for business purposes rather than personal ones. The application can be completed online and will require you to provide your company’s details as well as your own details.

Start saving on business expenses with the best prepaid cards in Australia

Alternatives to business prepaid cards

You have the accompanying choices as options in contrast to prepaid business cards:

1. Small business credit cards

You can float expenses with this best business credit card while expanding your company.

Develop your FICO assessment, and set aside cash with low basic and continuous loan fees and applicable rewards.

2. Purchasing cards for businesses

Business-to-business transactions require purchasing cards. The balance must be paid in full each month, just like a credit card.

Our gathering of the top buying cards is a decent spot to begin searching for one that possesses all the necessary qualities.

3. Secured business credit cards

Secured business credit cards are a decent choice for individuals who can't fit the bill for a non-tied down card because of poor or low credit or no record as a consumer, as you just have to put aside a security installment to qualify.

Why should businesses consider using prepaid business cards?

1. Speed up how you pay the suppliers

You can even use funds loaded directly from the acquiring balance when you launch a card program with a full-stack issuing provider, removing the complexity of pre-loading your business prepaid cards.

2. Better control of spending

The best-prepaid business cards let businesses limit how much money they can spend on the card, keep track of how much money employees spend, and get detailed reports on all transactions.

For travel expenses, prepaid travel cards are an excellent option, as they eliminate the need for employees to pay out of pocket or use their own cash reserves.

3. Boost your cash flow

Your business can move cash rapidly and effectively through a solitary stage by means of your virtual pre-loaded card while smoothing out your expenses and making it simpler to accommodate exchanges.

4. Increment approval rates

Due to the issuer's direct scheme connections, some prepaid business card issuers enable faster and more reliable issuing.

This implies your business can begin spending and further developing its income more rapidly than it could while applying for a credit card.

5. Risk of fraud is reduced

Because they can be easily deactivated in the event that they are lost or stolen, the best business prepaid cards may be more secure than cash or conventional credit cards, which can increase the likelihood of fraudulent transactions.

Why Volopay cards are the best solution for businesses?

1. Safe & secure

Volopay cards are protected with high-tech bank-grade security measures. Along with this, two-factor authentication, 3DS protocol for expense authentication, and spend controls like expense limit and transaction type specification.

All these measures make Volopay cards extremely safe and secure for storing and transferring money.

2. Instant approval

With Volopay cards, you get the option to set spending limits. Hence, all transactions under the spend limit are instantly approved. Plus, you can set who can access the card and the expense category. This means employees will no more have to run around to get payment or expense approvals.

It can easily be done on the system. Any expense over the limit can also be approved in seconds. The expense request is displayed on the approvers' screen with all the necessary details. The approver just has to click approve or reject. It's that fast.

3. No hidden fee

Any charges or fees you pay for Volopay cards are disclosed upfront. Nothing is hidden or secretly charged to your chards.

You get complete transparency and clear visibility of all your spends and charges like international transaction fees, interest payments, etc.

4. Easy to use

Volopay cards are easy to create and use. You can create unlimited virtual cards from the cards section. These cards get created instantly. Transfer money from the Volopay account to the card, and voila, you can start using it immediately.

Moreover, to make any payment, you just have to add some basic vendor details, enter the total amount and transaction currency and click on pay. The payment is initiated then and there.

5. Unlimited virtual cards

Customers can create unlimited virtual cards. No fees, costs, or charges. Unlimited virtual cards for free. These can be assigned to different employees, projects, departments, and vendors.

Specific virtual cards can help in better expense management and organization as the expense will be properly separated.

6. Integrate with accounting systems

All Volopay features on the platform are internally connected. All Volopay cards are integrated with the accounting system. This means that every transaction made through the cards is automatically entered into the accounting sheets.

The expense information is entered under the right categories in the accounting books with the help of auto-categorization and expense mapping features.

7. Real-time tracking

One of the best features of Volopay cards feature is real-time tracking. Every transaction is tracked and recorded in real time. Hence the managers will have a complete look into when the transaction was initiated, what is its current status and when will the end receiver get the money.