11 Best startup business credit cards in Australia in 2026

You’re launching a startup in Australia and need financial tools to fuel growth. The best startup business credit cards streamline expenses, boost cash flow, and offer rewards tailored to your needs. This guide explores the top options for 2026, helping you choose wisely to manage finances, build credit, and scale efficiently.

With countless cards available, selecting the right business credit card can feel overwhelming. From customizable controls to seamless integrations, credit cards for startups empower you to focus on innovation while keeping finances organized. Dive into our curated list to find the perfect fit for your business.

What are startup business credit cards?

Startup business credit cards are specialized financial tools designed for new businesses. They help you manage expenses, access credit, and separate personal and business finances. Tailored for startups, these cards offer rewards, higher limits, and expense tracking to support your growing venture in Australia.

Unlike personal cards, business credit cards for startups cater to unique business needs, such as funding operations or tracking team spending. With features like cashback or travel perks, they simplify financial management, letting you focus on scaling your startup while maintaining control over your budget.

How do business credit cards work for startups?

Business credit cards for startups function like personal cards but are built for business expenses. You make purchases, and the issuer provides credit, which you repay within a set period, often with interest.

These cards offer tools like expense tracking and rewards to optimize your startup’s finances while highlighting the benefits of business credit cards for growth.

In Australia, credit cards for startups provide flexible credit limits and digital integrations for seamless bookkeeping. You can issue employee cards, set spending caps, and monitor transactions in real-time, ensuring smooth cash flow and efficient management while building your business’s credit profile.

Best startup business cards in Australia in 2026

Choosing the best startup business credit cards in Australia means evaluating features, costs, and compatibility with your startup’s goals. This section details 11 top cards, highlighting their key features, advantages, limitations, and application processes to help you make an informed decision.

Each card offers unique benefits, from low rates to robust expense tracking. Whether you prioritize rewards, flexibility, or integrations, these startup business credit cards cater to diverse needs, empowering your Australian startup to thrive in a competitive market.

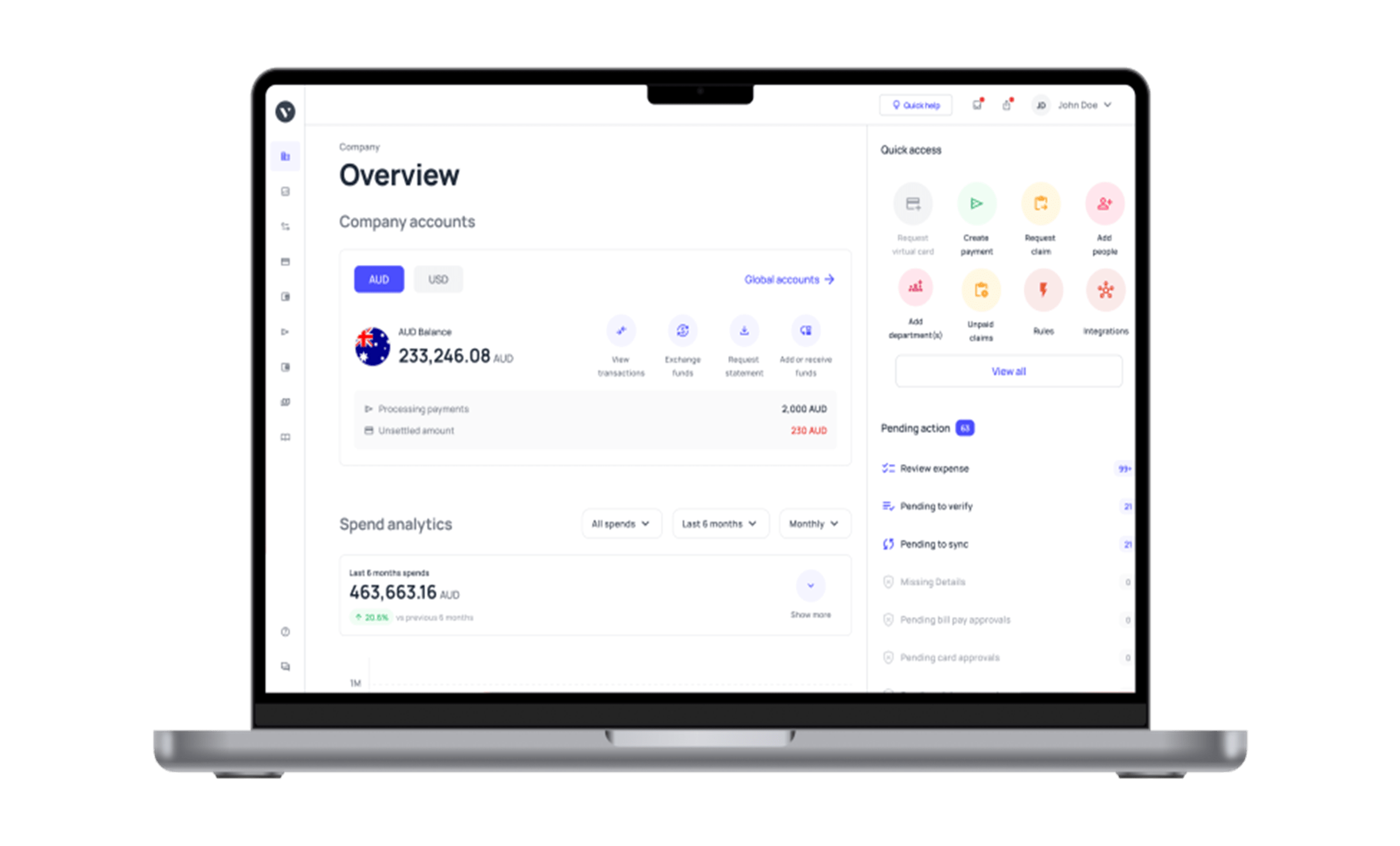

1. Volopay corporate card

You gain powerful features with the Volopay corporate card, designed for startups. It offers instant virtual and physical cards, customizable controls, and seamless expense tracking. With multi-currency support, it’s ideal for scaling businesses. Integrate it with accounting software to streamline financial management effortlessly.

This card empowers your team with flexible spending options while maintaining control. Real-time insights and automated workflows save time, letting you focus on growth. Volopay’s premium features make it a top choice for startups seeking efficiency and scalability in Australia’s fast-paced market.

● Key features

You get unlimited virtual cards, real-time expense tracking, and customizable spending limits with Volopay. It integrates with Xero, QuickBooks, MYOB, and NetSuite, and supports multi-currency payments, ensuring robust financial control for your startup.

● Advantages

You benefit from customizable, policy-compliant corporate cards and seamless accounting integrations. Volopay’s real-time alerts and controls enhance expense management, saving time and boosting efficiency for your startup’s financial operations.

● Limitations

It may require a brief initial setup for advanced integrations, though this is quickly offset by its powerful automation features for ongoing use.

● How to apply

You apply online via our website, submitting your ABN, financial details, and director IDs. The process is quick, with a quick account approval and immediate card generation.

● Setup process and requirements

You set up Volopay by registering online, verifying your business, and linking accounts. Requirements include an ABN, director identification, and basic financial records. Approval is fast, enabling quick card issuance.

2. Airwallex corporate card

Airwallex corporate cards simplify expense management for startups. You issue unlimited virtual cards, track spending in real-time, and enjoy multi-currency support for global transactions. With no annual fees and seamless integrations, it’s a cost-effective choice for Australian startups scaling internationally.

You control employee spending with customizable limits and gain insights through Airwallex’s dashboard. Its focus on international payments and low FX fees makes it ideal for startups with global ambitions, ensuring you manage finances efficiently while expanding your business.

● Key features

You access unlimited virtual cards, multi-currency payments, and real-time expense tracking. Airwallex integrates with Xero and QuickBooks, offers low FX fees, and provides customizable spending controls for efficient financial management across your startup.

● Advantages

You save on FX fees and enjoy no annual card fees. Airwallex’s global payment capabilities and integrations streamline expense tracking, making it ideal for startups with international operations or suppliers.

● Limitations

You may find limited physical card options restrictive. Airwallex’s rewards are minimal, focusing more on cost savings than points or cashback, which may not suit startups prioritizing traditional perks.

● How to apply

You apply online at Airwallex’s website, providing your ABN, business details, and director IDs. The process is straightforward, with quick approval and digital onboarding for immediate card access.

● Setup process and requirements

You set up by registering online, verifying your business, and linking accounts. Requirements include an ABN, financial statements, and director identification. Airwallex’s fast approval ensures you start using cards quickly.

3. Revolut corporate card

Revolut corporate cards offer startups flexibility with virtual and physical cards. You manage expenses with real-time tracking, set spending limits, and handle multi-currency transactions effortlessly. Its user-friendly app and integrations make it a strong choice for tech-savvy Australian startups.

You benefit from Revolut’s global focus, with competitive FX rates and no hidden fees. The card’s digital tools streamline expense management, letting you focus on growth while maintaining control over your startup’s finances in a dynamic market.

● Key features

You get virtual and physical cards, real-time spending alerts, and multi-currency support. Revolut integrates with accounting tools like Xero, offers customizable limits, and provides competitive FX rates for seamless global payments.

● Advantages

You enjoy low FX fees and no annual card costs. Revolut’s intuitive app and real-time tracking simplify expense management, making it ideal for startups needing flexibility and global payment solutions.

● Limitations

You may face subscription fees for premium features. Revolut’s physical card issuance can be slow, and customer support response times may vary, potentially impacting urgent financial needs.

● How to apply

You apply online via Revolut’s business portal, submitting your ABN, financials, and director IDs. The process is digital, with quick verification and approval, enabling fast access to cards.

● Setup process and requirements

You set up by registering online, verifying your business, and linking accounts. Requirements include an ABN, director IDs, and financial records. Revolut’s streamlined process ensures quick card activation.

4. American Express® Business Gold Plus card

The American Express business gold plus card offers robust rewards for startups. You earn points on business spending, enjoy travel perks, and access expense tracking tools. With flexible credit limits, it’s ideal for growing Australian startups needing premium benefits and financial flexibility.

You leverage Amex’s rewards program to maximize savings on office supplies and travel. Its comprehensive reporting tools simplify bookkeeping, while high credit limits support your startup’s operational needs in a competitive market.

● Key features

You earn Membership Rewards points, access travel insurance, and enjoy flexible credit limits. Amex integrates with accounting software, offers expense tracking, and provides premium perks like airport lounge access.

● Advantages

You gain generous rewards and travel benefits. The card’s high credit limits and detailed reporting tools enhance financial flexibility and simplify expense management for your growing startup.

● Limitations

You face a high annual fee and interest rates. Limited merchant acceptance in Australia may restrict usability, and rewards redemption can be complex for smaller startups.

● How to apply

You apply online via Amex’s website, providing your ABN, financials, and director IDs. The process involves credit checks, with approval typically within days, enabling quick card access.

● Setup process and requirements

You set up by registering online, verifying your business, and linking accounts. Requirements include an ABN, financial statements, and director IDs. Amex’s process ensures fast activation for startups.

5. NAB Low Rate business credit card

NAB’s low rate business credit card offers startups affordability. You benefit from low interest rates and minimal fees, ideal for managing cash flow. With expense tracking and employee card options, it suits Australian startups seeking cost-effective financial solutions without complex rewards.

You control spending with customizable limits and integrate transactions with accounting software. NAB’s straightforward approach ensures you focus on growth while keeping borrowing costs low, making it a practical choice for budget-conscious startups in Australia.

● Key features

You access low interest rates, expense tracking, and employee card options. NAB offers up to 55 days interest-free, integrates with accounting tools, and provides basic fraud protection for secure transactions.

● Advantages

You save with low rates and minimal fees. NAB’s interest-free period and simple expense tracking make it ideal for startups prioritizing cost control and straightforward financial management.

● Limitations

You miss out on rewards or cashback programs. Limited premium features and lower credit limits may not suit startups with high spending or those seeking advanced perks.

● How to apply

You apply online or at a NAB branch, submitting your ABN, financials, and director IDs. The process is quick, with approval often within days, ensuring fast card access.

● Setup process and requirements

You set up by registering, verifying your business, and linking accounts. Requirements include an ABN, financial records, and director IDs. NAB’s efficient process enables rapid card activation.

6. Zeller corporate cards

Zeller corporate cards streamline startup expenses with no annual fees. You issue virtual and physical cards, track spending in real-time, and integrate with accounting tools. Designed for Australian businesses, it’s perfect for startups needing simple, cost-effective expense management solutions.

You benefit from Zeller’s user-friendly platform, which offers instant card issuance and robust controls. Its focus on local businesses ensures seamless integration with Australian financial systems, helping your startup manage expenses efficiently while scaling.

● Key features

You get instant virtual cards, real-time expense tracking, and accounting integrations with Xero. Zeller offers no annual fees, customizable limits, and secure payment options for Australian startups.

● Advantages

You save with no annual fees and enjoy an easy setup. Zeller’s real-time tracking and local integrations simplify expense management, making it ideal for startups focused on efficiency.

● Limitations

You may find limited global payment options. Zeller’s features are basic compared to premium cards, and rewards are absent, which may not suit startups seeking perks.

● How to apply

You apply online via Zeller’s website, providing your ABN, financials, and director IDs. The digital process is fast, with approval and card issuance completed within days.

● Setup process and requirements

You set up by registering online, verifying your business, and linking accounts. Requirements include an ABN, director IDs, and financial records. Zeller’s process ensures quick card activation.

7. Weel corporate cards

Weel corporate cards offer startups flexible expense management. You issue virtual cards, set spending limits, and track expenses in real-time. With no annual fees and accounting integrations, it’s a cost-effective choice for Australian startups prioritizing control and efficiency.

You streamline financial tasks with Weel’s intuitive platform. Its focus on automation and customizable controls helps you manage team spending effectively, ensuring your startup stays agile and financially organized in a competitive market.

● Key features

You access unlimited virtual cards, real-time tracking, and integrations with Xero and MYOB. Weel offers customizable spending controls, automated approvals, and secure payment options for efficient expense management.

● Advantages

You benefit from no annual fees and robust integrations. Weel’s automated controls and real-time insights simplify expense tracking, making it ideal for startups seeking efficiency and control.

● Limitations

You may face limited physical card options. Weel’s rewards are minimal, and international payment support is less robust, which could challenge startups with global operations.

● How to apply

You apply online via Weel’s website, submitting your ABN, financials, and director IDs. The process is digital, with quick approval and setup for immediate card access.

● Setup process and requirements

You set up by registering online, verifying your business, and linking accounts. Requirements include an ABN, financial records, and director IDs. Weel’s process ensures fast card activation.

8. CommBank Business Low Rate credit card

CommBank’s business low rate credit card offers startups cost-effective financing. You enjoy low interest rates and up to 55 days interest-free. With expense tracking and employee card options, it’s ideal for Australian startups managing tight budgets while scaling operations.

You control spending with customizable limits and integrate with accounting tools. CommBank’s reliable support and low-cost structure make it a practical choice for startups seeking affordability and straightforward financial management in Australia’s competitive market.

● Key features

You get low interest rates, up to 55 days interest-free, and expense tracking. CommBank offers employee cards, accounting integrations, and fraud protection, ensuring secure and efficient financial management.

● Advantages

You save with low rates and interest-free periods. CommBank’s reliable support and simple expense tracking make it ideal for startups prioritizing affordability and ease of use.

● Limitations

You miss rewards or cashback programs. Lower credit limits and basic features may not suit startups with high spending or those seeking premium perks and flexibility.

● How to apply

You apply online or at a CommBank branch, providing your ABN, financials, and director IDs. The process is quick, with approval typically within days, ensuring fast card access.

● Setup process and requirements

You set up by registering, verifying your business, and linking accounts. Requirements include an ABN, financial records, and director IDs. CommBank’s process ensures rapid card activation.

9. ANZ Business Low Rate credit card

ANZ’s business low rate credit card offers startups affordability with low interest rates. You manage expenses with employee cards and basic tracking tools. Ideal for cost-conscious Australian startups, it ensures financial control without the complexity of rewards programs.

You benefit from ANZ’s straightforward approach, with up to 55 days interest-free and minimal fees. Its reliable support and simple features make it a practical choice for startups focused on keeping borrowing costs low while scaling efficiently.

● Key features

You access low interest rates, up to 55 days interest-free, and employee card options. ANZ offers basic expense tracking, accounting integrations, and fraud protection for secure startup transactions.

● Advantages

You save with low rates and interest-free periods. ANZ’s simple expense tracking and reliable support make it ideal for startups seeking cost-effective financial management without complexity.

● Limitations

You lack rewards or cashback options. ANZ’s lower credit limits and basic features may not suit startups with high spending or those needing advanced expense management tools.

● How to apply

You apply online or at an ANZ branch, submitting your ABN, financials, and director IDs. The process is efficient, with approval often within days, enabling quick card access.

● Setup process and requirements

You set up by registering, verifying your business, and linking accounts. Requirements include an ABN, financial records, and director IDs. ANZ’s process ensures fast card activation.

10. Westpac Business Choice Everyday Mastercard

Westpac’s business choice everyday mastercard offers startups flexibility with no annual fee. You manage expenses with employee cards and basic tracking tools. Ideal for Australian startups, it provides reliable support and straightforward features for efficient financial management.

You benefit from Westpac’s user-friendly platform and customizable spending controls. With no annual fee and basic integrations, it’s a cost-effective choice for startups focused on simplicity and affordability while scaling in a competitive market.

● Key features

You get no annual fee, employee card options, and basic expense tracking. Westpac offers up to 55 days interest-free, accounting integrations, and fraud protection for secure startup transactions.

● Advantages

You save with no annual fee and interest-free periods. Westpac’s reliable support and simple tracking tools make it ideal for startups prioritizing affordability and ease of use.

● Limitations

You miss rewards or cashback programs. Westpac’s basic features and lower credit limits may not suit startups with high spending or those seeking advanced financial tools.

● How to apply

You apply online or at a Westpac branch, providing your ABN, financials, and director IDs. The process is quick, with approval typically within days, ensuring fast card access.

● Setup process and requirements

You set up by registering, verifying your business, and linking accounts. Requirements include an ABN, financial records, and director IDs. Westpac’s process ensures rapid card activation.

11. Cape business credit cards

Cape business credit cards offer startups eco-friendly expense solutions. You issue virtual and physical cards, track spending in real-time, and integrate with accounting tools. With no annual fees, it’s ideal for Australian startups seeking sustainable financial management.

You benefit from Cape’s focus on sustainability and cost efficiency. Its intuitive platform and robust controls help you manage expenses effectively, making it a great choice for environmentally conscious startups scaling in Australia’s competitive market.

● Key features

You access virtual and physical cards, real-time tracking, and Xero integrations. Cape offers no annual fees, customizable limits, and eco-friendly options, ensuring sustainable and efficient expense management.

● Advantages

You save with no annual fees and enjoy eco-friendly features. Cape’s real-time tracking and integrations simplify expense management, making it ideal for startups prioritizing sustainability and efficiency.

● Limitations

You may find limited global payment options. Cape’s rewards are minimal, and features are less robust than premium cards, which may not suit high-spending startups.

● How to apply

You apply online via Cape’s website, submitting your ABN, financials, and director IDs. The digital process is fast, with approval and card issuance completed within days.

● Setup process and requirements

You set up by registering online, verifying your business, and linking accounts. Requirements include an ABN, director IDs, and financial records. Cape’s process ensures quick card activation.

Importance of business credit cards for startups in Australia

Business credit cards for startups are vital for managing finances effectively. They streamline operations, improve cash flow, and build credit, letting you focus on growth. These cards offer tailored features, ensuring your startup thrives in a competitive market while maintaining financial control.

1. Separating personal and business finances

You keep personal and business expenses distinct with startup business credit cards. This separation simplifies tax reporting, reduces liability, and ensures compliance, protecting your personal finances while maintaining clear records for your Australian startup’s financial health.

2. Supporting healthy cash flow

You bridge cash flow gaps with credit cards for startups. They cover expenses during delayed client payments, ensuring smooth operations. Flexible credit limits and interest-free periods help you manage daily costs without disrupting your startup’s growth.

Read our article on cash flow management to know the effective ways to manage and improve your business cashflow in detail.

3. Easy access to short-term credit

You access quick credit with business credit cards for startups. Fund equipment, marketing, or travel without draining cash reserves. Many providers offer lenient approval criteria, making it easier for startups to secure financing for immediate needs.

4. Building a strong business credit profile

You build a robust credit history using startup business credit cards. Responsible usage strengthens your startup’s credit score, improving future financing options. In Australia, this credibility is crucial for securing loans or partnerships as your business grows.

Related read: Tips to improve your business credit score

5. Unlocking rewards and extra perks

You maximize savings with the best startup business credit cards. Cashback, travel points, or vendor discounts enhance purchasing power. Tailored perks like insurance or lounge access benefit startups, making every dollar spent work harder for your business.

Factors to consider before choosing a startup credit card

Selecting the best startup business credit cards in Australia requires careful evaluation. You need a card that aligns with your startup’s financial goals, offering flexibility, rewards, and cost efficiency. Consider these factors to ensure your choice supports growth and simplifies management.

Assess overall cost of ownership

You evaluate fees, interest rates, and hidden costs. Low-rate cards save money, while premium cards have higher fees but offer rewards. Choose based on your startup’s budget.

Evaluate flexibility of credit limits

You need flexible credit limits to match your startup’s spending. Cards like Volopay offer adjustable limits, ensuring you cover operational costs without overextending, vital for Australian startups scaling rapidly.

Match rewards with business spending habits

You choose cards with rewards that align with your expenses. Ensure rewards match your startup’s spending patterns, like marketing or office supplies, for maximum value. That way, you can earn perks while making purchases.

Check for digital and accounting integrations

You prioritize cards with integrations like Xero or QuickBooks. Providers like Volopay streamline bookkeeping, saving time. Seamless digital tools are essential for startups managing complex financial workflows efficiently.

Review customer service and support quality

You rely on responsive support for urgent issues. Strong support ensures your startup resolves financial hiccups quickly. Take a look at the customer service provisions for each card provider, as well as reviews online for their turnaround time.

Eligibility criteria for startup business credit cards

Securing startup business credit cards requires meeting specific criteria. Providers assess your business’s legitimacy and financial health to approve applications. Understanding these requirements helps you prepare and access the right card for your startup’s needs.

1. Proof of business registration (ABN/ACN)

You provide a valid ABN or ACN to verify your business. Australian providers like Volopay require this to confirm your startup’s legal status, ensuring compliance with local regulations.

2. Credit standing of business owners

You submit personal credit details, as providers assess directors’ creditworthiness. A strong credit score boosts approval chances for business credit cards for startups in Australia.

3. Revenue, turnover, or cash flow evidence

You present financial statements or bank records. Providers may require proof of revenue or cash flow to evaluate your Australian startup’s ability to manage credit responsibly.

4. Identity verification for directors

You provide ID documents for directors, such as passports or driver’s licenses. Australian regulations mandate this for cards to ensure compliance and prevent fraud during applications.

5. GST or tax compliance records

You submit GST registration or tax records. Providers require these to confirm your Australian startup’s compliance with ATO regulations, ensuring eligibility for credit cards for startups.

How to apply for a business credit card in Australia

Applying for the best startup business credit cards in Australia is straightforward if you’re prepared. The process involves research, documentation, and verification, ensuring your startup accesses the right financial tools to support growth and manage expenses effectively.

1. Research and shortlist suitable providers

Explore all your options and research several providers, comparing features, fees, and rewards. Focus on cards matching your startup’s needs, such as low rates or robust expense tracking, for optimal fit.

2. Prepare the necessary business documents

You gather your ABN, financial statements, and director IDs. Having these ready streamlines applications for startup business credit cards, ensuring providers process your request quickly.

3. Submit the online or bank application

You apply online via provider websites or at the branches of banks. Submit the required documents for business credit cards for startups, ensuring accuracy to avoid delays.

4. Undergo credit and risk evaluation

You wait as providers assess your creditworthiness and business risk. Once your bank or provider is done assessing your profile and conducting all the required checks, approval is often granted within days for eligible startups.

5. Receive approval and set card controls

You receive approval and configure card settings like spending limits. For cards like Volopay, you set controls via digital dashboards, ensuring your startup’s financial security as well as compliance with company policies.

Tips for managing business credit cards responsibly

Establish clear spending categories and limits

Managing startup business credit cards responsibly ensures financial health. You maintain control, avoid debt, and optimize benefits by implementing smart strategies.

You set specific categories like travel or supplies with defined limits. Cards like Volopay let you customize controls, ensuring your startup’s spending aligns with budgets and goals.

Implement multi-level approval workflows

You create approval processes for large expenses. Control tools allow multi-level approvals, ensuring oversight and preventing unauthorized spending, keeping your startup’s finances secure and transparent.

Leverage real-time alerts and dashboards

You monitor spending with real-time alerts, which are built into the cards. Dashboards provide instant insights, helping you track expenses and detect issues quickly for your Australian startup’s financial control.

Integrate card data with accounting software

You connect cards like Volopay to Xero, MYOB, or QuickBooks. This integration automates bookkeeping, saving time and ensuring accurate financial records for your startup’s compliance and efficiency.

Review statements and audit regularly

You check monthly statements for errors or fraud. Regular audits with cards ensure accuracy, helping your startup maintain financial discipline and avoid costly oversights.

Rotate and restrict employee access

You limit employee card access and rotate credentials periodically. Card providers will allow you to freeze or revoke cards, ensuring your startup’s funds remain secure from misuse.

Regulatory and compliance aspects in Australia to consider

Using business credit cards for startups in Australia requires compliance with local regulations. You ensure legal and financial adherence to protect your startup and maintain trust with providers and authorities in a regulated market.

1. Know your credit reporting obligations

You report credit usage accurately to agencies like Equifax. Australian providers require compliance to maintain your startup’s credit profile, ensuring transparency in financial dealings.

2. Understand ASIC and consumer credit rules

You comply with ASIC’s regulations for credit cards for startups. These rules govern credit issuance and usage, ensuring your Australian startup avoids penalties and operates within legal boundaries.

3. Ensure GST and tax record compliance

You maintain accurate GST and tax records. Cards require ATO compliance, ensuring your Australian startup’s transactions align with tax obligations for seamless financial reporting.

4. Comply with anti-money laundering (AML) standards

You adhere to AML regulations, verifying transactions and identities. Providers enforce AML checks, ensuring your Australian startup’s startup business credit cards usage is lawful and secure.

5. Protect data under Australia’s Privacy Act

You safeguard cardholder data under the Privacy Act. Card providers will emphasize secure data handling, ensuring your Australian startup protects sensitive information and complies with privacy laws.

Alternatives to business credit cards for startups

If the best startup business credit cards don’t suit your needs, alternatives exist. You explore options like loans or virtual cards to manage expenses, ensuring your Australian startup maintains financial flexibility and supports growth effectively.

Corporate cards

You use corporate cards like Volopay for customizable controls and integrations. We offer real-time tracking and multi-currency support, ideal for Australian startups managing team expenses without traditional credit card debt.

Prepaid expense cards

You opt for prepaid cards to control spending without credit. Load funds and set limits, ensuring your Australian startup avoids overspending while maintaining flexibility for operational expenses like supplies.

Virtual cards

You can also issue virtual cards for secure online payments. Providers like Volopay offer unlimited virtual cards, perfect for Australian startups managing subscriptions or vendor payments with enhanced security.

Business loans and lines of credit

You access loans or credit lines for larger funding needs. Unlike credit cards for startups, these provide higher limits, supporting Australian startups with significant investments or long-term growth plans.

Invoice financing

You leverage invoice financing to unlock cash from unpaid invoices. This alternative supports cash flow for Australian startups, covering expenses without relying on startup business credit cards for credit.

Volopay corporate cards: Powering startup growth and efficiency

Volopay corporate cards are among the best, offering unmatched control and efficiency. You streamline expenses, access custom controls, and integrate with accounting tools, empowering your startup to scale rapidly while maintaining financial discipline in a competitive market.

Instant virtual and physical card issuance

You issue virtual and physical Volopay cards instantly. This speed ensures your Australian startup covers urgent expenses, from marketing to travel, without delays, keeping operations smooth and agile.

Customizable spend controls and limits

You set tailored spending limits with Volopay. Assign cards to employees or departments, ensuring your startup controls budgets effectively while preventing overspending with real-time adjustments.

Real-time expense tracking and reporting

You monitor spending instantly with Volopay’s dashboard. Detailed reports simplify financial oversight, helping your startup track expenses, identify trends, and maintain control without manual processes.

Seamless integration with accounting software

You connect Volopay to Xero, QuickBooks, MYOB, or NetSuite. This integration automates bookkeeping, saving time and ensuring accurate financial records for your Australian startup’s compliance and efficiency.

Multi-currency and international payments

You handle global transactions with Volopay’s multi-currency support. Low FX fees and competitive exchange rates make it ideal for Australian startups with international suppliers or clients.

Automated approval workflows

You streamline approvals with Volopay’s automated workflows. Set multi-level checks for large expenses, ensuring your startup maintains financial oversight while speeding up decision-making processes.

Centralized dashboard for team management

You manage all cards via Volopay’s centralized dashboard. Track team spending, adjust limits, and freeze cards instantly, giving your startup complete control over financial operations.

Advanced security and fraud protection

You protect funds with Volopay’s advanced security. Features like card freezing and fraud detection ensure your startup’s transactions remain safe, minimizing risks in a digital economy.

FAQs

You use startup business credit cards for international payments, benefiting from multi-currency support and low FX fees for seamless global transactions.

You manage SaaS subscriptions with business credit cards for startups, using virtual cards for secure, recurring payments with customizable limits and tracking.

You get advanced controls, integrations, and no credit burden with Volopay, unlike traditional credit cards for startups, offering flexibility and efficiency for Australian startups’ expense management.

You issue unlimited Volopay cards to employees, with customizable limits and controls, empowering your Australian startup to manage team spending securely and efficiently.

You trust Volopay’s compliance with ASIC, AML, and Privacy Act regulations, ensuring your Australian startup’s cards meet legal standards for secure usage.