Automated invoice processing to better manage cash flow

Do you also find yourself wondering how automated invoice processing could improve your company’s cash flow management? Let’s face it, with the pace at which technology is developing it's easy to lose track of all the things being developed in the industry. So, if you do find yourself asking this question let us assure you, you’re not alone.

As with most paper-based processes, traditional means of invoice processing is highly tedious and prone to errors. Manually entering data, cross-checking expenses, etc. only end up adding to the time, effort, and resources required by finance departments. At the same time, the pace of work our world demands is only increasing.

What is invoice management?

Invoice management is an internal business process that all companies follow. This process, simply put, is responsible for managing payments and maintaining records of the same.

The process typically involves five steps: generating the invoice, receiving it, extracting and verifying information, approving payment, and storing the invoice for future use.

Invoice management is key to tracking business expenses. It promotes consistent cash flow, simplifies accounting, saves time, and keeps your company audit-ready.

What are the problems associated with manual invoice management?

Manual invoice processing tends to demand a significant amount of time and effort. Moreover, there is always a possibility of error and delays at every stage.

Finance teams must first receive the invoice and input the information it contains into a system. Delays can begin at this stage itself, supplier invoices are often stored for a long time in recipients’ inboxes before your accounts department can get their hands on them.

Then comes the task of accurately extracting information, budget-holder confirmations and then there’s ERP system entry to be approved. At each of these stages the possibility of delays, and the need to chase individuals, is significantly high.

Another challenge is manual invoice matching, where invoices need to be manually compared against purchase orders and receipts. This process is not only time-consuming but prone to errors.

Businesses often struggle to simplify matching invoices to PO, furthur compounding inefficiencies. Additionally, invoices can be misplaced before they even reach your accounts team. Delays like this often result in the issuing and subsequent processing of duplicate invoices, neglected approval processes, and missed payment deadlines.

These are still a fraction of the direct financial obstacles presented by manual invoice processing. Procedural non-compliance and erroneous or fraudulent budget allocation are not always easy to track or gauge. Yet, these could add up to cause considerable hiccups in your accounting process.

Automated invoice approval workflows can help eliminate these inefficiencies, streamline the process, and reduce the chances of errors and delays, ultimately ensuring smoother and faster processing.

Benefits of automated invoice processing

The digital revolution in invoice management has been extraordinary. The benefits of automated invoice processing have made tasks like data extraction and invoice verification almost magical in their efficiency. With technology handling these processes, businesses can significantly reduce errors, save time, and enhance overall productivity.

Eradicate invoice processing errors

The unavoidable presence of human error when it comes to vendor invoice management has been overcome by software. Extracting and coding data is obviously a hassle. The process is especially time-consuming and prone to errors when done manually.

With the help of an OCR invoice processing software, the entire process can be automated and freed from the burden of manual entry. With machine learning software you can rest easy while a few lines of code make the entire process automated, error-free and, simply put, easy.

Save money on personnel

Automation also means a reduced need for human intervention. As a consequence, your company can defer hiring personnel unless they are an absolute necessity. Team expansion is an expensive and tedious task, this fact is universally agreed upon.

Not only do you have to allocate budgets and spend time calculating costs but there is also the hurdle of finding the right fit, which can take time. Even when hiring is needed, machine learning software helps your team manage increased workloads seamlessly, allowing you to focus on recruitment.

Increased archival control and transparency

Maintaining and managing payment records on paper can be a mammoth task for your teams. Integrating invoice management software with your accounting systems means that this entire process can be automated without the fear of erroneous entries.

This means that, with automated systems, whenever you need access to a particular invoice all you need to do is click a few buttons. Not only do these systems eradicate the fear of not being able to locate data but it also saves physical space, time, and effort.

Higher quality data and analytical insights

Automating invoice processing not only means lower error rates with regard to data entry, but it also ensures better quality data is readily available. This software is capable of efficiently managing and building massive databases which, if done manually, would have been highly time-consuming and prone to errors.

With such accurate and structured data at hand, your finance departments can make far better, more informed decisions regarding payments, cash flow, and revenue forecasting.

Increased time & money savings

One of the biggest advantages that such software brings is the time and, consequently, money that is saved. Less time spent doing mundane manual entry tasks means your team has more time to spend on other, more important, tasks.

Manual invoice management can take approximately 20 to 21 days. On the other hand, outsourcing tasks such as vendor invoice management to software can cut that time down to just 3 to 4 days, significantly improving efficiency and freeing up valuable resources.

Go paperless

Being climate-conscious is increasingly essential for businesses across all industries as the demand for sustainability grows. With vendor invoice management automation, companies can reduce the amount of paper they use, helping to conserve valuable resources.

This shift not only supports environmental sustainability but also optimizes your internal processes, making them more efficient, faster, and cost-effective. The result is a streamlined, eco-friendly approach that benefits both your business and the planet.

Why choose Volopay?

Now that you know how invoice management software works, the next step is choosing the right provider. In this context, Volopay's invoice management software stands out as one of the best available solutions for streamlining your expense management.

Expense management

With our expense management platform, companies can make domestic and international invoice payments. Additionally, you can benefit from Magic Scan invoice processing, which allows for quick and accurate extraction of invoice data to streamline your workflow.

Bill Pay

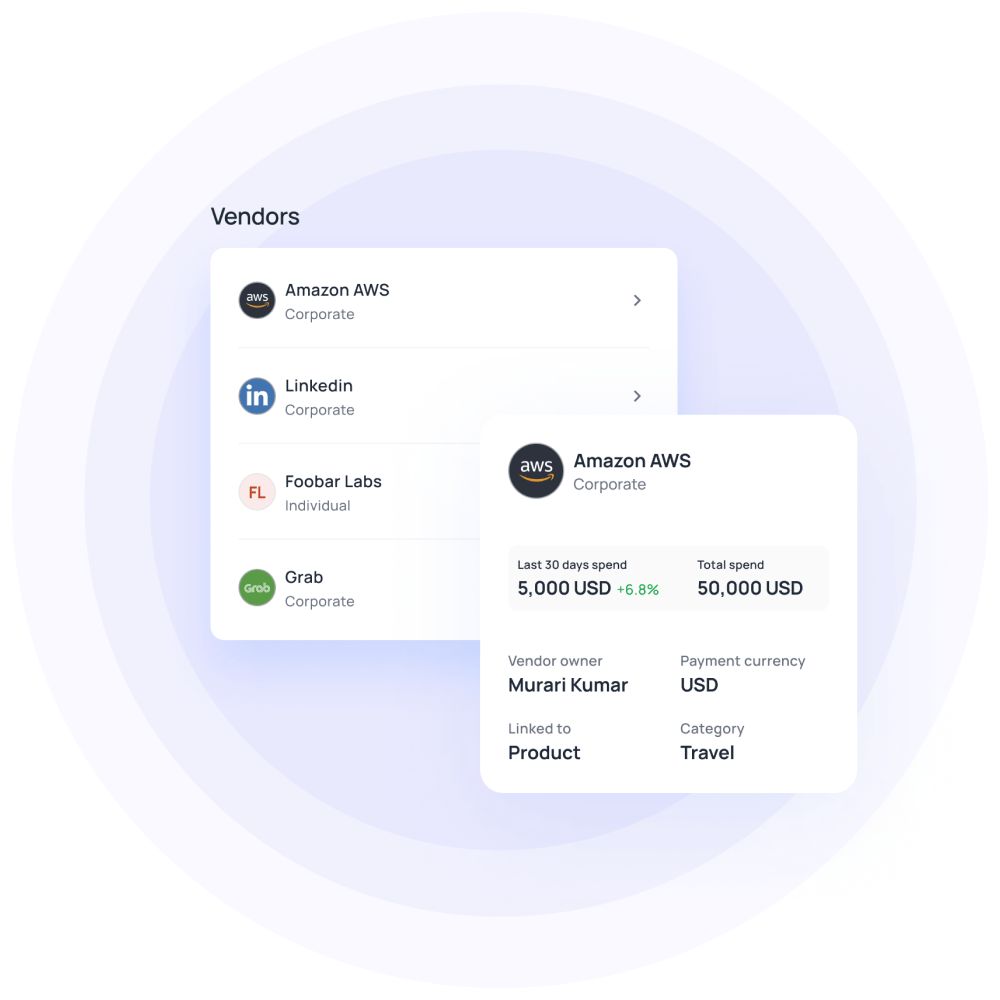

With Bill Pay you can pay vendors around the world, set up custom payment approvals and personalized spend parameters that work for your business.

Centralized dashboard

Volopay is an all-in-one solution for managing expenses, finances, reimbursements, and more. It eliminates the need for multiple software, bringing everything into one seamless platform, including a consolidated dashboard to manage all your multi-entity finances.

Accounting software integration

Syncing with accounting applications like Xero, MYOB, Deskera, Quickbooks, and Netsuite has never been this easier. Once you make the payment through Volopay, it automatically syncs and updates this into your overall financial records.

FAQs

Yes. At Volopay we take the security of your invoice management processes and information very seriously. Our software is protected by multiple layers of security protocols and follows regular rigorous checks to ensure complete security.

Yes. Volopay’s invoice management software is fitted with parameters that ensure duplicate invoices are not created when processing the same.

Volopay enables you to make payments earlier than the due dates. You can select particular payments and set them up to be paid early to your vendor and then avail discounts and cashbacks on the platform itself.

The average time taken for invoice processing is approximately 2 to 3 days. With Volopay, this time is cut down drastically. Transactions happen in real-time and take only moments to complete processing on our platform.

Trusted by finance teams at startups to enterprises.

Want to get started with Volopay's invoice management software?

Related pages

Learn how to avoid duplicate invoice payments with these common causes and practical steps to streamline your accounts payable process.

Discover how automating supplier invoice processing boosts accuracy, reduces errors, and accelerates payments, in our complete guide.

Check out our guide to batch payment processing to learn when to use it, its benefits, and key considerations for streamlining accounts payable.