7 Effective ways to reduce business expenses

Every business needs to make expenses in order to make money. After all, most business operations rely on certain expenses being made to gain different facilities and resources.

However, it’s not uncommon that businesses begin to spend more than they think they will. It could lead to your spending getting out of control, which will ultimately lead to poor financial health if you don’t reduce business expenses.

This is why expense management is key to any business. You want to make sure that you’re always on top of your spending and pushing down costs whenever you can. Here are some ways to cut costs in business effectively.

What are business expenses?

Business expenses are incurred when you spend money for business purposes. One way of putting it simply is that they’re expenses that you need to make to ensure that your business operations run smoothly.

This can include both fixed and variable expenses for the day-to-day operation of your business, starting from employee compensation to production costs.

When you run your business, you’ll likely find you’re making a lot more expenses than you thought you would, especially when unexpected situations arise.

You’ll want to try cutting costs in business, while still maintaining your regular operations without compromising quality.

What is the importance of managing business expenses effectively?

1. Improved cash flow

Poorly managed business expenses will result in your cash flow taking a hit. You might need to make expenses before you have the income that you need or you could simply have too many expenses.

Having proper expense management will allow you to consider your cash inflow before making expenses, ultimately leading to an improved cash flow.

Unlock the secrets to increase cash flow in your business with our comprehensive article. Know the proven techniques to increase revenue, minimize costs, and streamline finances.

2. Increased profitability

No matter how much revenue you make, it’ll be difficult to increase your profits if you’re not managing your expenses. You don’t want to spend every dollar that you made. Instead, you want to try to reduce business expenses.

Only make expenses that you know are necessary for your business. This way, you won’t be spending all your revenue.

3. Competitive advantage

All your competitors will want the same thing, which is to be the market leader and generate the most profits.

While it’s tough to stay on top of your competitors, you can be one step closer if you reduce business expenses. By cutting costs in business, you’ll maintain that you can stay in business longer.

4. Financial stability

It’s important that you have enough reserve cash should unprecedented situations or emergencies happen. The last thing you want is to constantly be almost running out of money.

Instead, you want to find ways to reduce business expenses to give yourself a buffer. Managing your expenses effectively will allow you to have better financial stability.

5. Flexibility and agility

Different situations—both internal and external—will crop up from time to time, requiring you to quickly adapt to the current circumstances.

The good news is that you’ll have a much easier time doing that if you’re already managing your business expenses effectively.

You’ll be able to pinpoint which expenses can be reduced and which you need to make more of.

6. Investment in growth

For your business to scale, you need to invest in it. For example, you might be thinking of opening up a new business location when you have enough capital on hand.

By pinpointing unnecessary expenses, you can reduce business expenses wisely and choose to invest that money in your growth instead.

7. Sustainable operations

Managing your expenses is key to being able to stay on the market for a long time. It’s important that you do your forecasts and plan ahead with your expenses. It ensures that your business is sustainable and that you’ll be able to make all necessary expenses.

Coming up with business cost cutting ideas will also help you stay afloat.

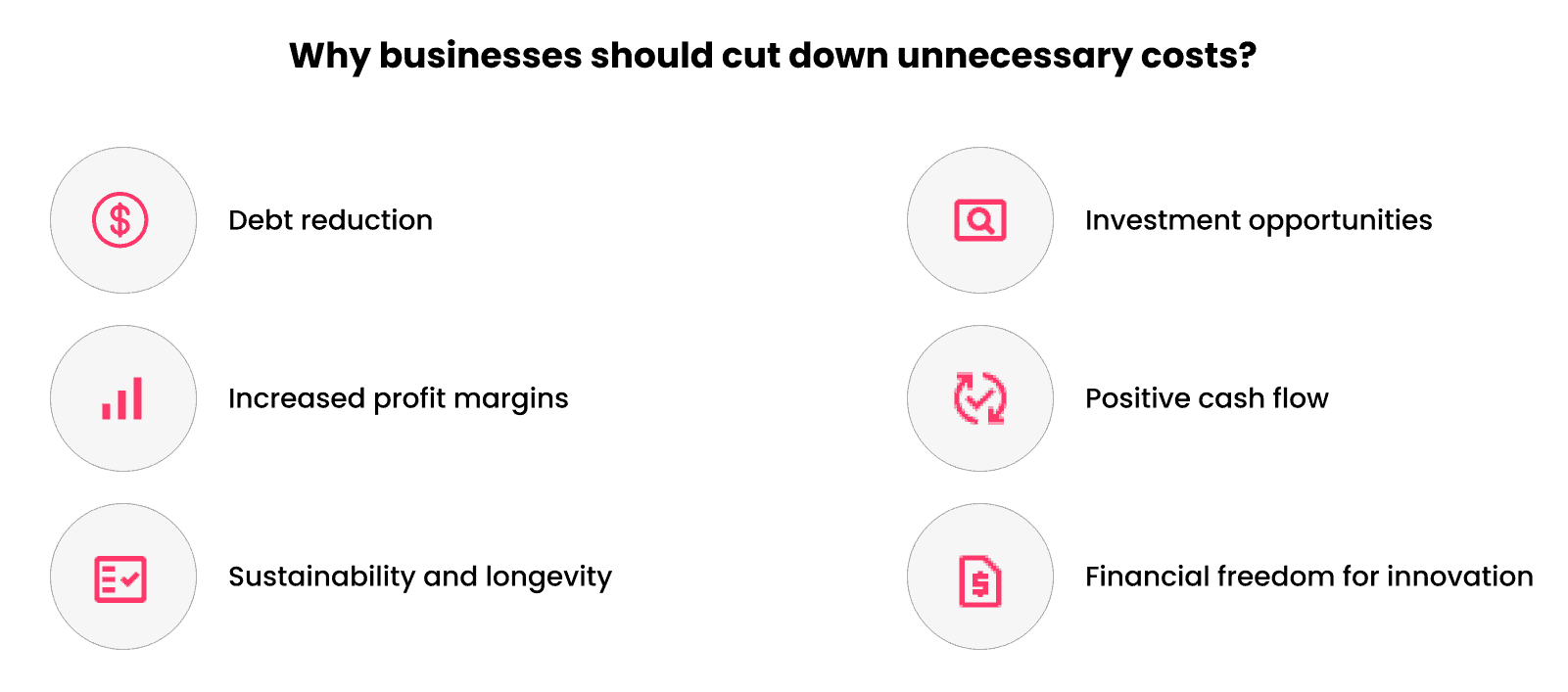

How reducing expenses can improve profitability and financial stability?

Managing your expenses well will help you reduce business expenses. In doing so, you’ll end up having better financial stability.

Here are some reasons why you should find ways to cut costs in business.

Debt reduction

For many businesses, expenses are associated with debt. Whether that’s getting a loan or using a corporate credit card to pay off your monthly expenses, you may not realize how much you have in debt until you have to make your repayment.

By cutting costs in business, however, your debt will be much more manageable.

Investment opportunities

While you never want too much cash sitting around, that doesn’t mean that you should be recklessly spending your money. The smart thing to do is to invest your cash in growth opportunities.

When you reduce business expenses, you’ll have more in savings, which means you’ll have more to invest back into your business.

Increased profit margins

Businesses want at least a healthy profit margin. While it’s not easy to balance out what is an acceptable price for your product with your ideal profit margin, you’ll have an easier time when you can find ways to cut costs in business.

You can even stay at the same pricing but with an improved profit margin.

Positive cash flow

Having a positive cash flow means that you have more cash inflow than outflow. Naturally, when you reduce business expenses, achieving this will be much easier. It’s important that you properly consider what expenses aren’t meaningful and necessary.

Once you start cutting back on them, you can still maintain a similar level of cash inflow while minimizing outflow.

Competitive advantage

You won’t be the only business trying to find ways to reduce business expenses. Failing to do so will result in you being left behind by your competitors.

You want to reduce business expenses as best as you can to pull ahead and gain a competitive advantage by increasing your profit margin or investing more in your business.

Sustainability and longevity

You may have a lot of money to burn now, but doing that without reservation is going to negatively impact your business in the long run.

It’s why managing business expenses is so important. For recurring expenses especially, you need to think about whether you’ll have the money to pay them off at all times during the year.

Financial freedom for innovation

You may want to eventually develop new products or make improvements to your existing ones, which will require additional funds.

When you cut back on business expenses, it’ll be easier to achieve that financial freedom so you can use your money to innovate. As a result, you’ll be able to offer better products for your customers.

7 ways to reduce business expenses

With the many benefits that you could be getting by cutting costs in business, it’s a no-brainer that you’ll want to do exactly that.

However, this will take multiple steps and strategies, requiring you to find different ways to reduce business expenses. Here are some of the most effective ways to do so.

1. Conduct a comprehensive expense audit

Before you can effectively reduce your business expenses, you’ll need to see where you’re at right now. A thorough evaluation of your current processes and expenses is your best bet when you’re trying to cut costs.

Go through all the expense data available to you. It’s recommended that you conduct an expense audit to be sure that you have a holistic and comprehensive perspective of what your expenses look like.

In doing so, you’ll also have an easier time figuring out where you want the business to go in the future.

2. Create a budget

While auditing is great to lay out the bare bones of your business cost cutting ideas, you’ll still need to devise an action plan, as planning is key to being able to reduce business expenses. The best way to plan is to create a budget for you to adhere to.

When you have a budget, you’ll have a benchmark to measure your costs. This forces you and your employees to prioritize to stay within the given limit, effectively reducing your costs. Keep in mind that the best budgets are always consistently evaluated.

Related read: How to create a startup budget in 7 simple steps?

3. Reduce overhead costs

Reducing overhead costs seems like the obvious answer to cutting costs in business. But the truth is that most businesses don’t know where to start.

Once you get your audit results and create a budget, you should have an easier time pinpointing where you can cut back on expenses.

If you have too much inventory in stock, for example, consider slowing down production and focusing on turning your inventory into revenue.

You could also centralize and combine some processes, effectively reducing their costs. One way would be to save on storage space by digitizing.

4. Cut non-essential expenses

It goes without saying that you should not be spending on any non-essential expenses.

However, not only is it tough to determine what expenses are unnecessary, but it’s also sometimes difficult to keep track of all your expenses and cut non-essential ones accordingly.

Sometimes it’s already too late and your subscription fee has already been auto debited. Try to not automatically renew every single service you use and evaluate them regularly. You might find that you no longer need a particular subscription.

Consider using a centralized expense management software to make reviews easier.

5. Review and optimize marketing strategies

It’s easy to want to rely on paid marketing strategies. It makes sense to pay money, get your ads more visible, and attract leads that way. It’s less of a hassle when you’re paying money to get yourself more visible.

But investing more time in your marketing strategies can actually help you cut back on advertising costs. Take a look at what resources you already have and use that. Start thinking of optimizing your search engine or social media opportunities.

Businesses that effectively tell their brand stories and put faces to names are often more likely to gain traction, too.

6. Consider outsourcing

If you’re thinking that outsourcing is a more expensive alternative than doing things in-house, you won’t be the only one. It’s a common misconception that paying someone else to do your work will cost you more.

However, it’s important to consider that when you outsource, you’re paying experts who know the job inside and out. These are some ways to reduce business expenses by cutting back on hiring and training costs.

It takes less time and can ultimately be more productive for your business. Not to mention that many service providers are also willing to negotiate good deals.

7. Implement technology solutions

In a modern age where digitizing your processes is becoming increasingly common, you should also consider implementing technology solutions for your business.

Many technology and software providers can help you automate and digitize different aspects of your business. Video communication tools, for example, can minimize business trip expenses by facilitating virtual conferencing.

An expense management tool can also help you automate your finance-related tasks. You’ll be spending less time and money on managing your expenses while also improving the way you’re cutting costs in business.

Importance of regularly reviewing and optimizing expenses

Cutting costs in business is not just about finding ways to reduce business expenses. Every cost that you cut needs to be thoroughly analyzed and considered.

It’s about managing your expenses and optimizing as best as you can. Here are why you want to make sure that you’re always optimizing and not just trying to thoughtless reduce business expenses.

Identify opportunities

When you have a lot of business expenses, it can be difficult to pinpoint which ones are necessary and which aren’t.

An expense management tool will be able to help you do this more efficiently, allowing you to get a visualization of your data within minutes. This way, you can quickly identify where you might be able to cut costs.

Maintain financial control

You don’t want your expenses to get out of hand, as it could lead to poor financial health. Regular reviews of your expenses allow you to maintain control over how much money you’re spending.

You also get to see exactly how your money is being used, which helps you ensure that all expenses made are within company policies.

Adapt to changing business needs

As your business grows and the market trends shift, it’s important that you’re capable of adapting. If you’re already monitoring and optimizing your expenses regularly, this won’t prove to be difficult.

Not only are you continuously adapting by making changes along the way, but you also have access to historical data, allowing you to easily create forecasts.

Stay ahead of industry trends

You want to stay ahead of your competitors when it comes to industry trends. What this means is that when you see something coming, you want to be fully prepared to respond.

Monitoring and cutting costs in business allows you to see what’s coming based on previous data and also ensures that you have the funds ready for a response.

Avoid financial risks

While you can’t entirely get rid of risks, you can minimize them by controlling your spending. Reviewing your expenses and cutting costs in business do exactly that.

You won’t have to worry about having to pay more than you earn when you’re monitoring expenses. On top of that, finding ways to cut costs in business will also make sure you can deal with risks.

Enhance profitability

Implementing a culture of regular reviews and evaluations is often key to improving any aspect of your business. With business expenses, you’ll see what business cost cutting ideas you can come up with when you do your evaluations.

Cutting costs in business that are unnecessary and don’t impact your daily operations will also inevitably increase your business profitability.

Improve financial forecasting

It goes without saying that the more you pay attention to your financial data, the better you will get at forecasting. This is also applicable to your business expenses.

When you’re consistently engaging with, reviewing, and fine-tuning your expenses, you’ll get a better understanding of your business needs. Your financial forecasts are bound to be more accurate when you have this knowledge.

Compliance and transparency

When expenses are poorly managed, you’ll end up with little to no transparency. On the other hand, making sure that your expenses are thoroughly reviewed will give you more visibility and control over what your employees are spending your money on.

Employees are often more likely to comply with your policies and be more transparent when they know their expenses are being monitored.

Volopay - The all-in-one solution for businesses to manage their expenses efficiently!

There is no one correct way to reduce business expenses. Instead, it’s recommended for businesses to use a number of different strategies and business cost cutting ideas to save up on costs.

Opting to make the switch from manual administrative processes to implementing technology solutions, for example, can help you save on labor costs in the long run.

Similarly, doing regular reviews on your monthly expenses will also make pinpointing and reducing unnecessary expenses much easier.

The good news is that Volopay can be just the solution for you. Kill two birds in one stone by automating your expense management process.

Automation will help you cut down administrative costs, allowing you to do expense reporting, tracking, and reimbursement faster.

With features like receipt scanning and automated approval workflows, employees won’t have to work overtime on otherwise manual tasks!

Volopay also helps you ensure you’re getting better visibility and accuracy on your business expenses.

Get a visualization of your expense data through your Volopay dashboard, allowing you to easily see which expense categories are your most prominent ones and what expenses you can cut back on.

With an all-in-one approach to expense management, Volopay is the perfect tool to help you reduce business expenses effectively.

FAQ's

The best way a business can reduce expenses without compromising the running of its daily operations is by identifying which expenses are unnecessary and can simply be cut. Taking away these expenses should ideally have no lasting impact on your day-to-day processes.

There are several steps and strategies involved to help you reduce business expenses. One thing that you should do is invest in an expense management system, which can help you cut back on costs while also helping you identify what expenses you need to cut.

Creating budgets and implementing them is also easier when you have an expense management system.

You’ll only be able to reduce costs if you keep a close eye on your existing expenses. Identify which expenses aren’t bringing you returns and can be cut. Make sure you have a budget for your business expenses to keep costs down and improve your profitability.

By reducing costs, businesses can enjoy higher profitability and better cash flow. In especially competitive markets, this is extremely important as it ensures that your business can keep up with competitors and changing market trends, allowing you to stay in business for a long time.

Both increasing revenue and decreasing expenses require proper planning and strategizing. You’ll want to review your expenses and determine which have high returns and which don’t. From there, you’ll be able to figure out which expenses you can cut back on. Focus instead on what is working for your business to increase revenue.