👋Exciting news! UPI payments are now available in India! Sign up now →

Reloadable prepaid cards for business payments

Managing business expenses requires modern solutions that go beyond traditional banking methods. Reloadable prepaid cards are revolutionizing how Indian businesses handle spend control, eliminate reimbursement inefficiencies, and maintain compliance with financial regulations.

These smart payment tools are transforming corporate finance workflows across India's startups, tech hubs, and established enterprises, with platforms like Volopay leading this digital transformation in business expense management.

What are reloadable prepaid cards for business?

Meaning of reloadable prepaid cards for business use

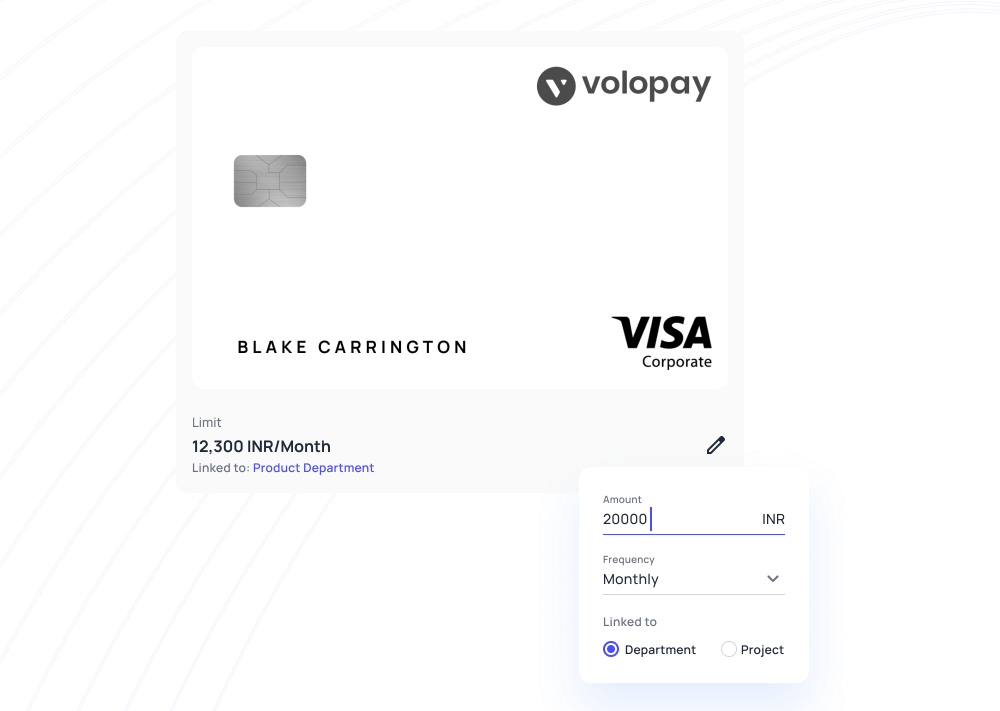

Reloadable prepaid cards for business are corporate payment solutions that allow you to load funds in advance and distribute them to employees or departments. Unlike personal prepaid cards, these business-focused tools come with advanced controls, real-time tracking, and approval workflows.

Volopay's reloadable prepaid cards are powered by intelligent automation, helping Indian businesses streamline their expense management while maintaining complete visibility over every transaction made by their team members.

How business reloadable prepaid cards work

Your finance team issues cards through a centralized dashboard, loads funds based on budget allocations, and monitors spending in real-time. The reload process is instant, allowing you to add money as needed without visiting banks or filling out lengthy forms.

Team members receive their cards with predefined spending limits, while managers get complete visibility into transactions through automated reporting. This system eliminates the traditional cycle of cash advances, expense receipts, and manual reimbursements that burden Indian businesses.

Prepaid vs. credit vs. debit cards in India

Credit cards require credit checks and often involve interest charges, making them unsuitable for controlled business spending. Debit cards directly access your bank account, creating security risks and limiting spend control. Prepaid cards, on the other hand, offer a secure, pre-funded alternative that avoids both debt and direct bank exposure.

Business reloadable prepaid cards offer the perfect middle ground—you control the funding amount, employees can't overspend beyond loaded limits, and there's no risk of debt accumulation. This makes them ideal for Indian businesses that need precise budget control while empowering their teams with convenient payment methods.

Why Indian businesses need reloadable prepaid cards

Hassles of manual reimbursements

Traditional reimbursement processes consume countless hours of your finance team's time, processing receipts, verifying expenses, and transferring funds to employee accounts.

Employees often wait weeks for reimbursements, leading to dissatisfaction and cash flow issues.

This approach creates bottlenecks that slow down business operations and frustrate both finance teams and employees who advance their personal money for business expenses.

Lack of real-time visibility into spending

Conventional corporate cards provide expense reports only after transactions are completed, leaving finance teams blind to spending patterns and budget utilization.

You discover overspending or policy violations only during monthly reconciliation, when it's too late to take corrective action.

This delayed visibility makes it impossible to implement proactive spend management or make informed budget decisions for your growing business operations.

Overspending and fraud risks

Without proper controls, employees might exceed budgets or make unauthorized purchases that violate company policies.

Traditional expense methods rely on trust and post-transaction verification, creating opportunities for expense fraud or unintentional policy violations.

Reloadable prepaid cards eliminate these risks by enforcing spend limits automatically and providing real-time transaction alerts to prevent unauthorized or excessive spending.

Smart features of Volopay’s reloadable prepaid cards

Real-time visibility and spend controls

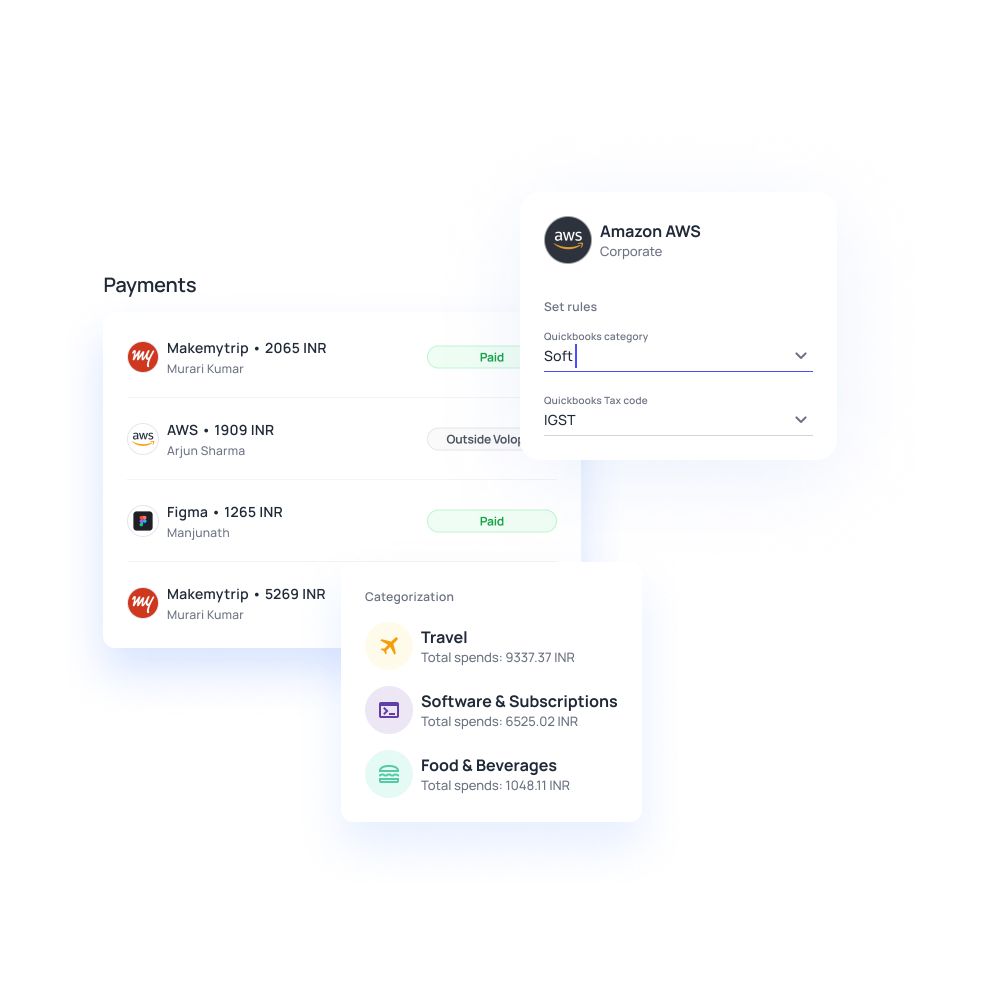

Volopay's dashboard provides real-time visibility into every transaction, showing you exactly where and when your team spends money. Smart controls let you set spending limits by merchant category, transaction amount, or time periods, while automated approval workflows ensure policy compliance.

Real-time SMS and email alerts keep you informed about spending patterns, budget utilization, and any transactions that require your attention for immediate action.

Easy reload and issuance

Adding funds to your cards takes just a few clicks through Volopay's platform, with instant limit allocation. New card issuance happens within minutes, not days, allowing you to onboard new employees or create project-specific cards immediately.

This flexibility means you can respond quickly to changing business needs, whether it's a last-minute business trip or an urgent vendor payment that requires immediate attention.

Card limits, spend category controls, and expiry settings

Configure spending caps for different employee levels, restrict transactions to specific merchant categories like fuel or restaurants, and set automatic expiry dates for temporary projects.

These granular controls ensure that your marketing team can't use their cards for office supplies, while your travel cards work only for transportation and accommodation expenses. This level of control eliminates the guesswork from expense management and prevents policy violations automatically.

Issuance of virtual and physical cards

Issue virtual cards instantly for online subscriptions, SaaS payments, and digital marketing expenses, while physical cards handle in-person transactions like client meetings and business travel.

Volopay's virtual cards are perfect for recurring vendor payments and subscription management, while physical cards provide the flexibility your team needs for day-to-day business operations across different locations and transaction types.

Volopay: More than just cards—a complete finance stack

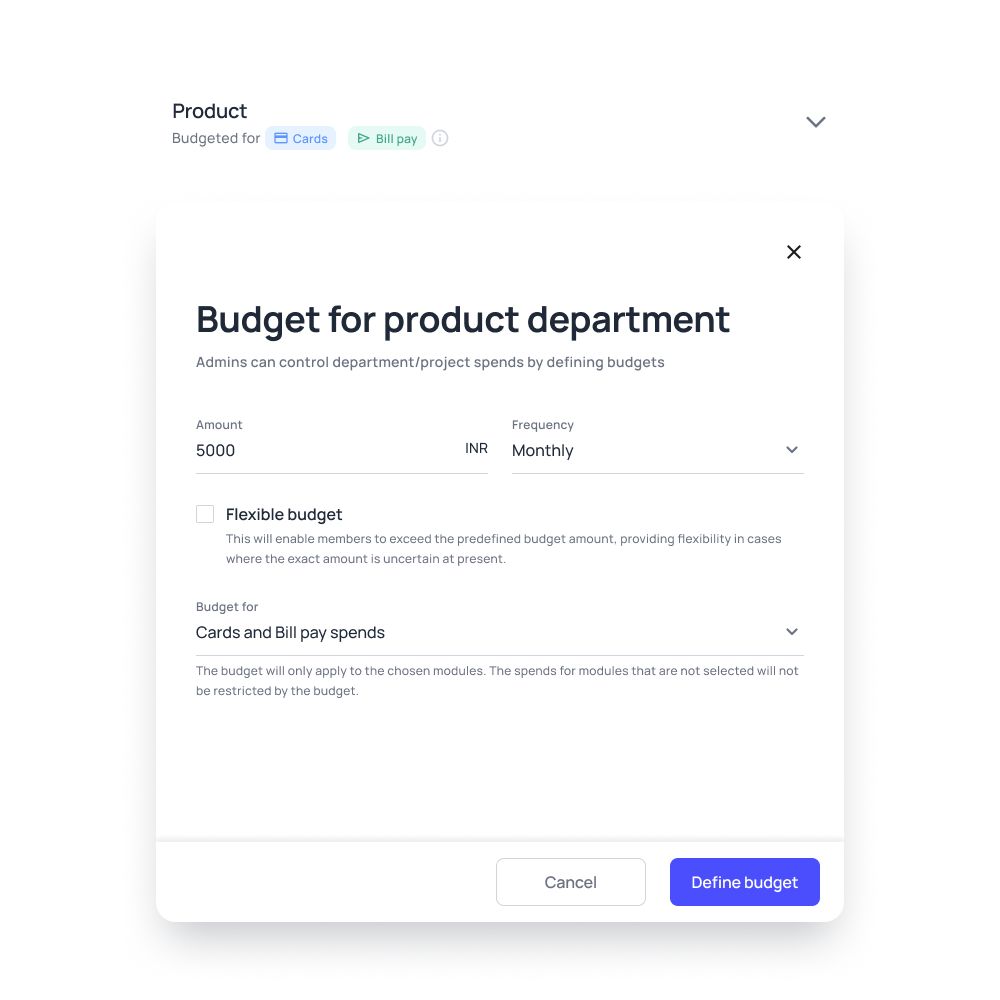

Volopay unifies card management and expense reporting across all your departments, branch offices, and subsidiary companies through a single dashboard.

Whether you're managing a Mumbai head office and Delhi branch, or coordinating between different business units, you get consolidated reporting and centralized policy enforcement.

This unified approach eliminates the complexity of managing multiple expense systems and provides complete financial visibility across your entire organization.

Advanced businesses can leverage Volopay's APIs to integrate with existing ERP systems, automate approval workflows, and create custom expense rules that match your unique business processes.

These integrations allow your finance team to build sophisticated automation that grows with your business needs.

Whether you need integration with Tally, NetSuite, QuickBooks, or custom accounting software, Volopay's flexible platform adapts and integrates seamlessly with your existing technology stack.

As your business expands from a small team to hundreds of employees, Volopay's platform scales seamlessly with customizable user roles, department-wise budget allocations, and hierarchical approval structures.

You can create different permission levels for managers, finance heads, and C-level executives while maintaining granular control over spending policies.

This scalability ensures that your expense management system grows with your business without requiring any platform changes or data migration.

Ensure expense compliance with Volopay's reloadable prepaid cards

Auto-enforce spending policies

Built-in policy enforcement prevents employees from making off-policy purchases automatically, eliminating the need for manual policy monitoring and correction. Your predefined rules work 24/7 to ensure compliance with company spending guidelines, vendor restrictions, and budget limitations.

This proactive approach to policy enforcement reduces the administrative burden on your finance team while ensuring that every transaction aligns with your established business policies and procedures.

Maintain digital records and receipts

Every transaction automatically generates digital records that integrate with your accounting systems, ensuring GST compliance and creating audit-ready documentation. Employees can upload receipts directly through the mobile app, while the system maintains tamper-proof transaction histories.

This digital approach eliminates the risk of lost receipts and ensures that your business always has the documentation needed for tax compliance and financial auditing requirements.

Grant role-based access to teams

Implement hierarchical access controls that give managers oversight of their teams' spending while restricting access to sensitive financial data. Finance heads get complete visibility across all departments, while team leads see only their assigned budgets and team members.

This role-based approach ensures that the right people have access to the right information without compromising financial security or creating unnecessary administrative complexity in your organization.

Volopay’s reloadable prepaid cards: Use cases for Indian businesses

Outstation travel and allowances

Eliminate the hassle of ATM withdrawals and cash advances for employees traveling to client locations across India. Load your prepaid cards with predetermined amounts for transportation, accommodation, and meal expenses, while maintaining complete visibility into spending patterns.

This approach reduces cash handling risks, provides better exchange rates for interstate travel, and ensures that your traveling employees have immediate access to funds without personal financial strain.

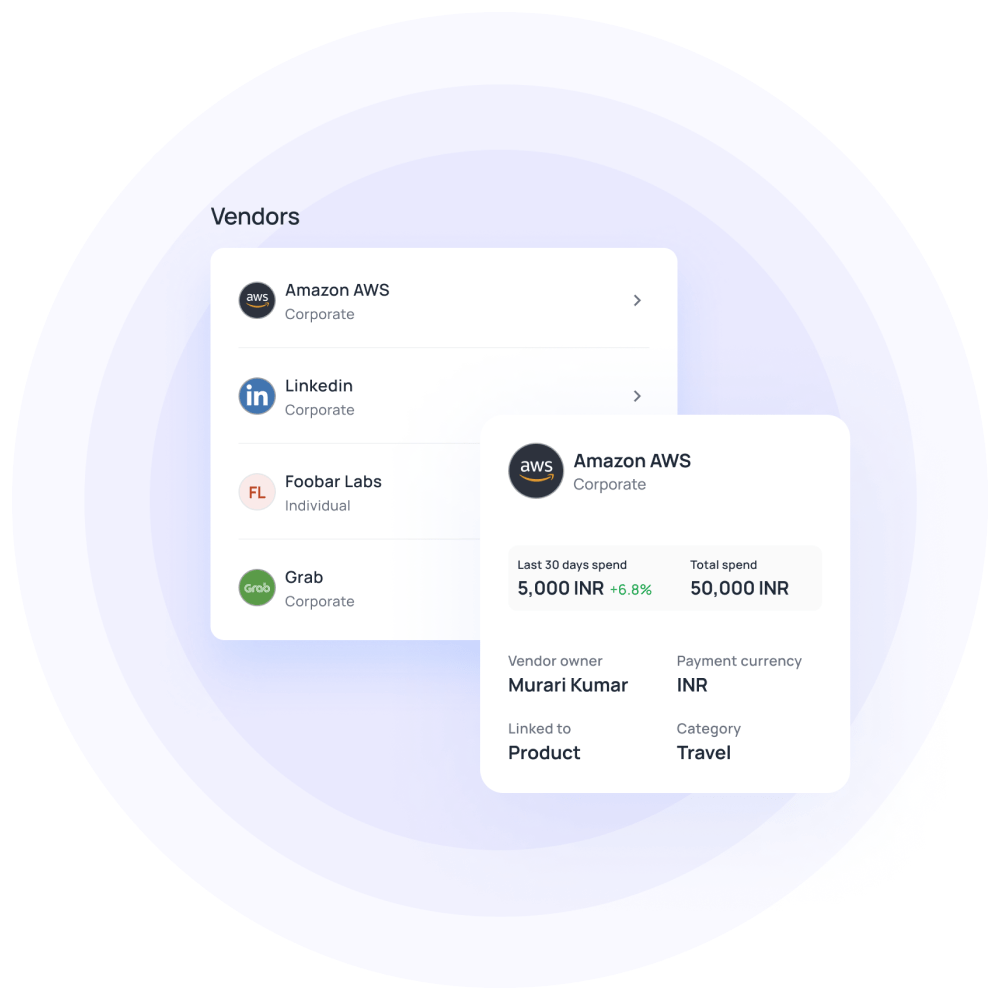

SaaS subscriptions and vendor payments

Stop sharing a single corporate card across multiple team members for software subscriptions, online tools, and digital marketing expenses.

Issue dedicated virtual cards for different departments or specific vendors, maintaining clear spending boundaries and preventing payment conflicts. This segregation helps you track software costs accurately, prevents payment failures due to card sharing, and maintains security by limiting card exposure across your organization.

Project-based budgets and client spends

Create dedicated cards for specific projects, campaigns, or client retainers with preset budgets that automatically track spending against allocated amounts.

Marketing teams can manage campaign expenses separately from operational costs, while project managers get real-time visibility into project profitability. This approach enables accurate project accounting, prevents budget overruns, and provides clients with transparent expense reporting when required for billing or reimbursement purposes.

Financial benefits of switching to reloadable prepaid cards

Unlike corporate credit cards that accumulate interest charges and late payment fees, reloadable prepaid cards use your own funds, eliminating debt-related costs entirely.

This pay-as-you-go approach helps maintain a healthy cash flow management for your business while avoiding the financial pitfalls associated with credit-based payment systems.

Your business saves money on interest payments and avoids the administrative complexity of managing credit limits and payment schedules.

Automated transaction categorization and real-time expense visibility and reporting eliminate the manual work of matching receipts with bank statements and updating Excel spreadsheets.

Your finance team can focus on strategic financial planning instead of administrative tasks, while automated integration reduces data entry errors.

This efficiency gain translates to significant cost savings for the business through reduced administrative overhead and faster monthly closing processes.

Consolidate all business expenses—from employee spending to vendor payments—into a single dashboard that provides comprehensive financial insights.

Track every rupee spent across different departments, projects, and expense categories without juggling multiple systems or reports.

This unified visibility enables better budget planning, identifies cost optimization opportunities, and provides the financial transparency needed for informed business decision-making and investor reporting.

Which Indian businesses should use reloadable prepaid cards?

1. Startups and tech firms

Fast-growing startups need agile payment solutions that can adapt to changing team sizes, rapid scaling, and diverse expense requirements. Business reloadable prepaid cards provide the flexibility to issue cards instantly for new hires, manage varying project budgets, and maintain financial control during periods of rapid growth.

Tech companies especially benefit from seamless integration with digital tools and the ability to manage SaaS subscriptions efficiently.

2. Growth-stage SMBs

As your business expands beyond a handful of employees, manual expense management becomes increasingly complex and time-consuming. Growth-stage companies need sophisticated financial controls that can handle multiple departments, varied spending requirements, and increased transaction volumes.

Reloadable prepaid cards for business provide the scalability and control needed to manage this complexity while maintaining the agility that drives business growth and competitive advantage.

3. Large firms with distributed teams

Enterprises with remote offices, field sales teams, or freelance contributors need centralized expense management that works across geographical boundaries. Large organizations benefit from hierarchical controls, department-wise budget management, and consolidated reporting that provides visibility across all business units.

The ability to issue and manage hundreds of cards from a single platform makes these solutions ideal for complex organizational structures.

To dive deeper into how reloadable prepaid cards can meet the specific needs of your business—whether you're a growing startup, a mid-sized company scaling operations, or a large enterprise managing distributed teams—check out our in-depth blog on the Best prepaid cards in India. It breaks down key features, use cases, and comparisons to help you make an informed decision.

Why choose Volopay's reloadable prepaid cards?

One-stop solution for business spend management

Volopay combines expense management, bill payments, corporate cards, and accounting integrations into a unified platform that eliminates the need for multiple financial tools.

This comprehensive approach reduces vendor management complexity, provides better integration between financial systems, and offers superior customer support compared to managing relationships with multiple service providers for different aspects of your business's financial operations.

Dedicated customer support and onboarding

Indian businesses receive localized customer support that understands regional business practices, regulatory requirements, and market-specific challenges. Volopay's onboarding team helps you configure policies, train your staff, and optimize workflows for maximum efficiency.

This personalized approach ensures that your transition to modern expense management is smooth, successful, and tailored to your specific business requirements and operational preferences.

Built to scale with your business

Whether you're managing fifty employees or five hundred, Volopay's infrastructure scales seamlessly without requiring platform changes or data migration. Advanced features like custom workflows, API integrations, and enterprise-grade security controls become available as your business grows.

This scalability means you invest in a long-term solution that adapts to your evolving needs rather than requiring expensive platform changes as your business expands.

Flexible controls for different roles and budgets

Create sophisticated permission structures that reflect your organizational hierarchy, with different spending limits and approval requirements for various employee levels. Marketing managers might have higher limits for campaign expenses, while junior staff have restricted spending authority.

This flexibility ensures that your expense management system reflects your business structure and operational requirements while maintaining appropriate financial controls and accountability.

Secure platform with fraud safeguards

Advanced security features, including real-time transaction monitoring, automated fraud detection, and secure card tokenization, protect your business from financial losses and unauthorized transactions.

Multi-factor authentication, encrypted data transmission, and compliance with international security standards ensure that your financial data remains protected. These security measures provide peace of mind while enabling your team to transact confidently across various vendors and platforms.

Get started with Volopay’s reloadable prepaid cards

Create your Volopay account in minutes

Getting started requires no lengthy paperwork or bank visits—simply register online with your business details and basic documentation. The streamlined onboarding process means you can have your account set up and ready for card issuance within the same day.

This quick setup eliminates the traditional delays associated with corporate banking and allows you to modernize your expense management immediately without disrupting ongoing business operations.

Configure your team's roles and card limits

Customize spending policies, approval workflows, and card limits based on your organizational structure and budget requirements from day one. Set up department-wise budgets, configure merchant category restrictions, and establish approval hierarchies that match your business processes.

This initial configuration ensures that your expense management system works exactly as needed, with policies and controls that reflect your business requirements and operational preferences.

Simplify business expenses from here on

Once configured, Volopay handles the complexity of expense management automatically, from policy enforcement to accounting integration and reporting. Your team focuses on business growth while the platform manages financial compliance, transaction monitoring, and administrative tasks.

This automation transforms expense management from a time-consuming administrative burden into a strategic advantage that supports your business objectives and growth plans.

FAQs about reloadable prepaid cards

Reloadable prepaid cards use your own funds loaded in advance, eliminating debt risk and interest charges. Unlike credit cards, they provide instant spending control through preset limits and prevent overspending beyond loaded amounts, making budget management more predictable and secure.

Yes, you can issue unlimited cards to different employees with customized spending limits, merchant restrictions, and expiry dates. Each card operates independently while providing centralized visibility and control through your admin dashboard for comprehensive expense management.

Adding funds is instant through bank transfers or UPI payments via the Volopay dashboard. Simply select the card, enter the amount, and funds are available immediately. Automated reload options ensure cards never run out of funds during critical business operations.

Yes, Volopay cards work globally with international security standards and real-time fraud monitoring. You can enable or disable international transactions based on business needs while maintaining complete visibility over foreign exchange rates and international spending patterns.

You have complete control over merchant categories, transaction amounts, and usage locations. Set cards to work only at fuel stations, restaurants, or specific vendor types while blocking unauthorized merchant categories to ensure spending aligns with business policies.