👋Exciting news! UPI payments are now available in India! Sign up now →

Prepaid travel cards for effortless global spending

Indian companies are increasingly recognizing the limitations of traditional corporate travel expense management. You've likely experienced the frustration of manual reimbursement processes, where employees submit receipts weeks after business trips, creating administrative bottlenecks and delayed expense reporting.

Currency exchange inefficiencies further complicate international travel, with fluctuating forex rates impacting your budget predictability. Compliance issues arise when tracking expenses across multiple departments and locations becomes cumbersome.

Enter the prepaid travel card, a modern financial solution designed to streamline your corporate travel expenses. These innovative payment tools offer real-time expense tracking, eliminate the need for cash advances, and provide enhanced financial control for your business operations.

What is a prepaid travel card?

A prepaid travel card is a secure, reloadable payment instrument specifically designed for Indian businesses managing domestic and international travel expenses. Your business prepaid travel card serves as a comprehensive expense management tool, enabling centralized control over travel budgets while providing employees with convenient payment options.

Whether you're sending team members to domestic conferences or international client meetings, these cards eliminate the complexities associated with foreign exchange transactions and cash handling.

How prepaid travel cards work

The prepaid travel card operates on a simple load-and-use model that doesn't require credit approval or extensive documentation. You load funds onto the card before your employee travels, establishing a predetermined spending limit that aligns with your approved travel budget.

This pre-funding approach eliminates the risk of overspending and provides immediate visibility into available balances.

Designed for international and domestic travel

Prepaid cards for travel are specifically engineered to handle the complexities of both international and domestic business travel. These cards support multiple currencies and are accepted at millions of merchant locations worldwide, ensuring your employees can make payments seamlessly regardless of their destination.

The international compatibility extends to ATM withdrawals, hotel bookings, restaurant payments, and transportation services.

Why Indian businesses should use prepaid travel cards for work trips

Simplified budget allocation

Your prepaid travel card for business eliminates budgeting uncertainties by allowing you to assign specific spending limits per employee or trip before travel begins. This proactive approach ensures that every business trip operates within predetermined financial parameters, removing ambiguity from expense management.

You can customize spending limits based on destination, trip duration, and employee seniority, creating a transparent framework that both finance teams and travelers understand clearly.

No more employee reimbursements

Prepaid cards for travel eliminate the traditional reimbursement cycle that burdens both employees and finance departments. Your employees no longer need to use personal funds for business expenses, removing the financial strain of waiting weeks for reimbursement processing.

This immediate access to company funds improves employee satisfaction while reducing administrative overhead for your finance team.

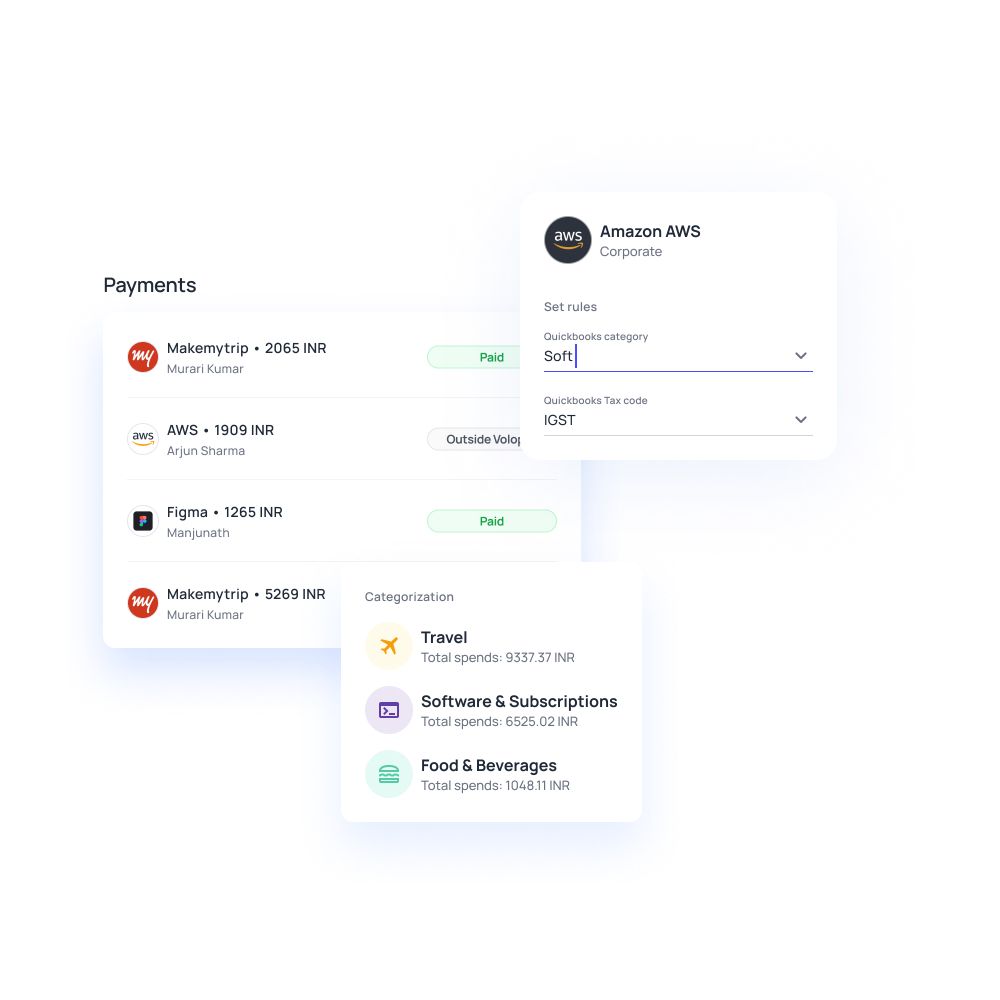

Real-time visibility into travel spends

Your business prepaid travel card provides instant transaction updates and spending alerts throughout the trip. You receive real-time notifications when employees make purchases, enabling immediate oversight of travel expenses.

This transparency allows you to monitor spending patterns, identify potential issues early, and maintain complete visibility into your company's travel budget utilization.

Save on forex conversion charges

Prepaid travel cards support overseas payments without hidden international transaction fees that typically plague traditional payment methods.

You benefit from competitive exchange rates and transparent fee structures, significantly reducing the overall cost of international business travel while maintaining predictable expense forecasting.

Enforce travel policies automatically

Your prepaid travel card automatically enforces company travel policies through built-in restrictions and spending controls.

You can block specific merchant categories, set daily spending limits, and restrict ATM withdrawals, ensuring compliant spending without requiring manual approvals or constant monitoring.

For a deeper dive into how prepaid cards benefit employee travel, refer to our article on 10 benefits of prepaid cards for employee travel expenses.

Real-world use-cases: How Indian businesses benefit from Volopay’s prepaid cards for travel

Your growing startup can efficiently manage expenses when employees travel for business conferences, client meetings, or international relocations.

Prepaid travel cards eliminate the complexity of advance payments and reimbursements, allowing your remote team members to focus on business objectives rather than expense management.

Whether your developers are attending tech conferences or your sales team is meeting clients, prepaid cards for travel provide seamless payment solutions.

Your sales representatives and field service technicians require flexible spending access while traveling across territories.

A business prepaid travel card enables real-time expense management for hotel bookings, client entertainment, and transportation costs.

Your field teams can operate independently with predetermined budgets, ensuring they maintain professional standards while adhering to company spending policies.

Your multi-location business can assign prepaid travel cards with region-specific budgets to teams operating across different states.

This approach allows your Mumbai team to have different spending limits compared to your Delhi operations, reflecting local cost variations and operational requirements.

Each regional team receives tailored financial access aligned with their specific market conditions.

Your marketing professionals can track exhibition expenses, promotional material costs, and networking event spending in real-time during domestic and international trade shows.

Prepaid travel cards provide immediate visibility into marketing budgets, enabling better resource allocation and preventing overspending during critical business events.

Your prepaid travel card for business allows you to provide limited financial access.

To vendors, consultants, and temporary contractors without exposing your primary bank accounts, maintaining security while enabling operational flexibility.

Upgrade your travel spend with smart prepaid cards

What makes Volopay the ideal solution for Indian businesses?

Volopay emerges as the strategic travel expense with prepaid cards solution specifically designed for India-based companies navigating the complexities of global and domestic business travel.

Understanding the unique challenges faced by Indian businesses, Volopay combines international payment capabilities with local market expertise, creating a comprehensive platform that addresses your specific operational requirements.

Your business gains access to enterprise-grade expense management tools while maintaining the flexibility needed for dynamic travel scenarios.

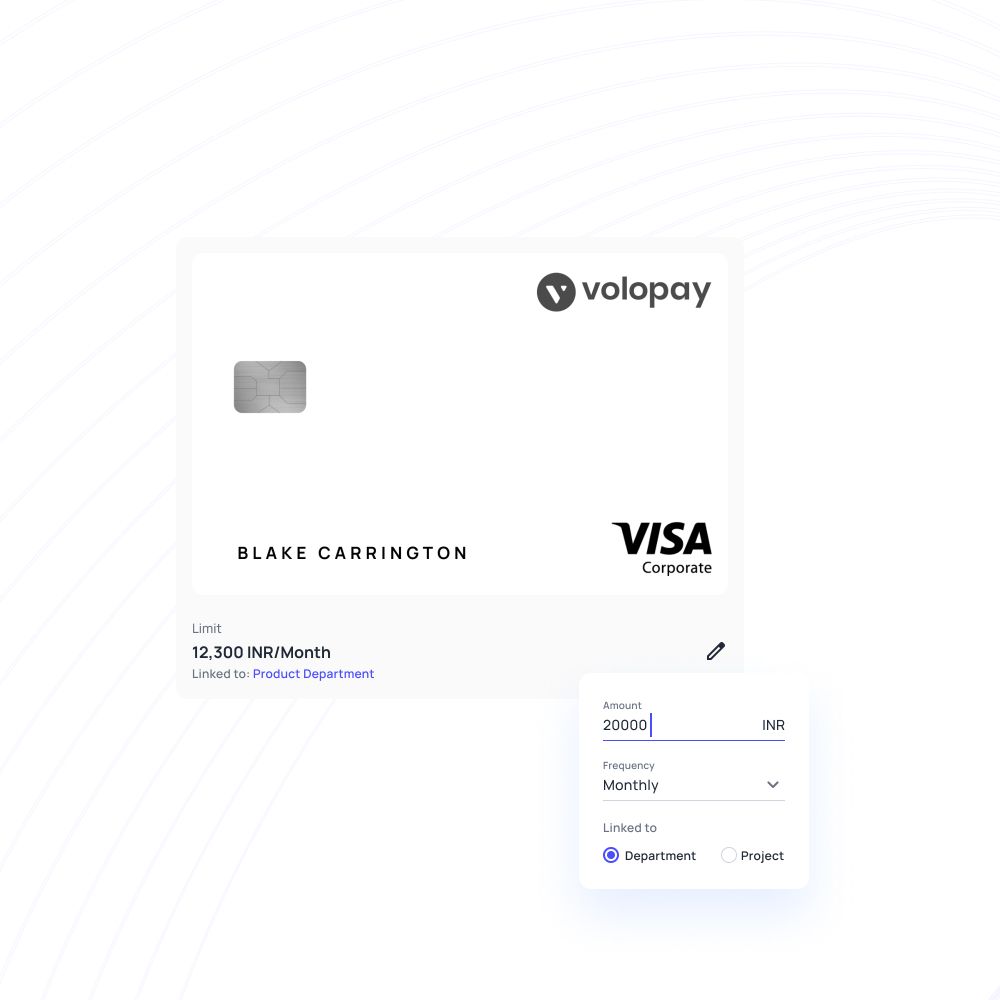

Central dashboard to manage all cards

Your finance team can efficiently track, manage, and update multiple employee prepaid cards for travel through Volopay's unified interface. This centralized approach eliminates the complexity of managing individual card accounts, providing comprehensive visibility into all travel-related expenses across your organization.

You can monitor spending patterns, adjust limits, and generate reports from a single dashboard.

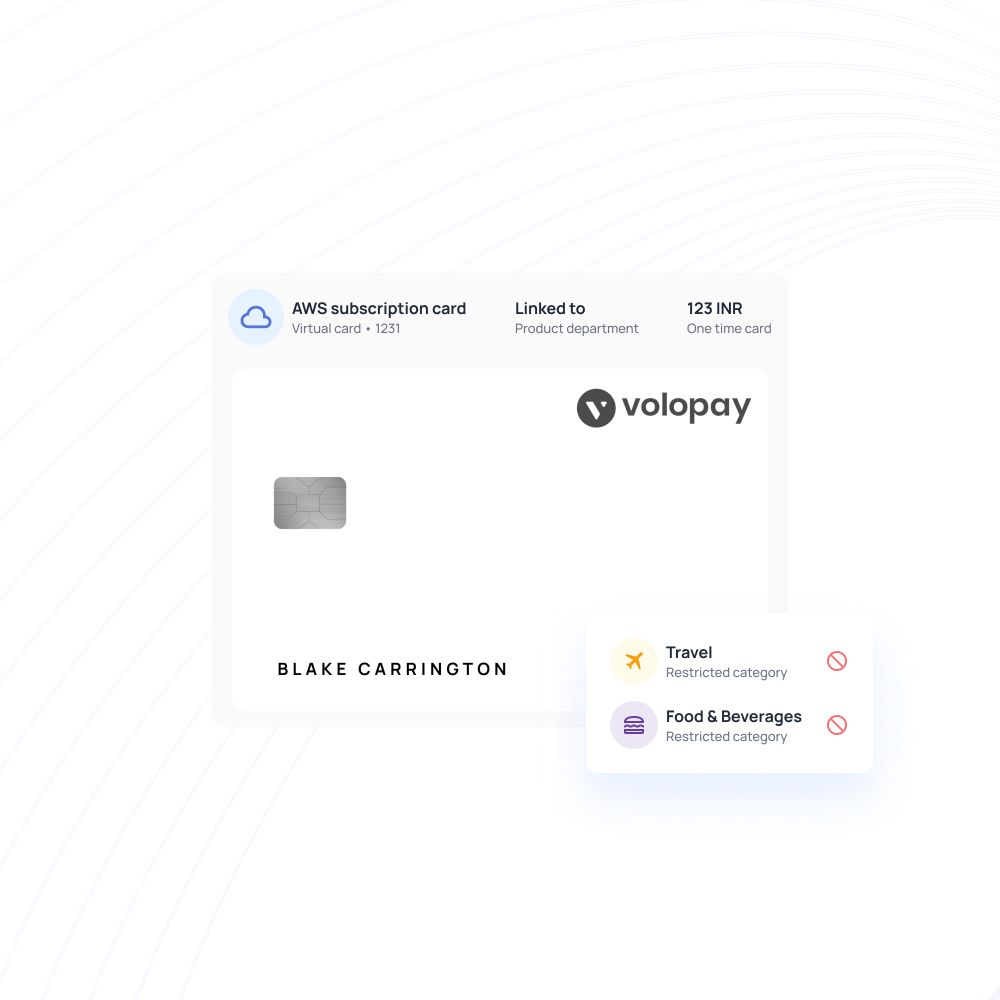

Advanced control settings

Volopay's business prepaid card allows you to create sophisticated spending rules based on location, vendor categories, or specific expense types.

You can restrict ATM withdrawals in certain regions, block entertainment expenses, or limit daily spending amounts, ensuring your travel policies are automatically enforced without manual intervention.

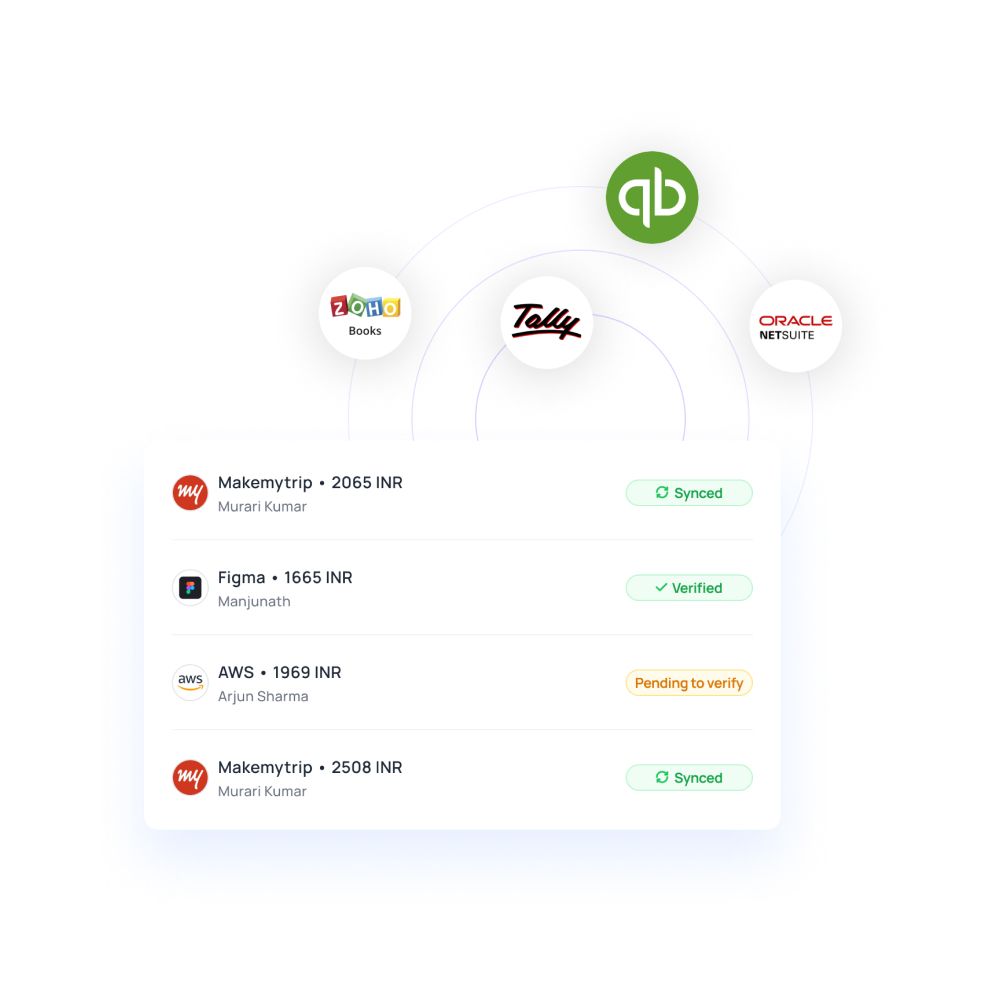

Accounting integrations for Indian ERP tools

Your prepaid travel card transactions seamlessly sync with popular accounting software, including Tally, Zoho Books, and QuickBooks.

This integration eliminates manual data entry, reduces accounting errors, and ensures your financial records remain accurate and up to date.

Instant card issuance

Volopay enables you to create and assign prepaid cards for travel to team members instantly, even during last-minute travel requirements.

This flexibility ensures your employees always have access to company funds when business opportunities arise.

Start streamlining your business travel costs

Secure and compliant travel spending for Indian businesses

Built-in spend limits and merchant controls

Your prepaid cards for travel feature comprehensive security controls that prevent unauthorized transactions through pre-configured spending rules. You can establish daily, weekly, or monthly spending limits on each card while blocking specific merchant categories that fall outside your travel policy.

These automated controls ensure your employees cannot exceed approved budgets or make non-compliant purchases.

Real-time tracking for GST-compliant records

Your business prepaid travel card automatically captures transaction details, including date, vendor information, and amounts, creating clean audit trails that meet GST compliance requirements.

Every purchase generates detailed records that simplify tax filing processes and support input tax credit claims, ensuring your travel expenses contribute to overall tax efficiency.

Auto-capture of receipts and invoices

Volopay's prepaid travel card system enables automatic receipt capture through mobile app uploads or email forwarding, ensuring every transaction has supporting documentation.

This feature streamlines input tax credit claims while maintaining complete expense documentation for audit purposes.

Secure infrastructure with data compliance

Your prepaid travel card for business operates on a PCI DSS-compliant infrastructure specifically designed for Indian regulatory requirements.

All transaction data remains secure while meeting local data protection standards, ensuring your financial information stays protected throughout the payment process.

Centralized logs for audit and reporting

Your finance team can generate comprehensive downloadable reports that simplify monthly closures and statutory filings.

streamlining compliance processes while maintaining complete expense visibility across all travel activities.

Get started with Volopay prepaid cards for travel

Starting your journey with Volopay's prepaid travel card solution is straightforward and designed specifically for Indian businesses seeking efficient expense management.

The streamlined onboarding process ensures your team can begin using prepaid cards for travel within minimal setup time, allowing you to focus on core business activities while maintaining financial control.

Create your Volopay account

Your business can sign up for Volopay online by providing basic KYC documentation, including company registration details, GST certificates, and authorized signatory information. The digital onboarding process eliminates lengthy paperwork while ensuring regulatory compliance.

You complete the verification process entirely online, making account setup convenient for busy finance teams.

Load funds securely

Your prepaid travel card funding happens through secure INR transfers from your company's current account directly to your Volopay wallet.

This straightforward funding mechanism ensures you maintain complete control over available balances while providing immediate access to loaded funds for card usage.

Generate virtual or physical cards

Volopay enables instant creation of both physical and Volopay's virtual cards for travel based on your specific requirements. Virtual cards provide immediate access for online bookings and digital transactions, while physical cards support in-person payments and ATM withdrawals during travel.

Set rules and monitor spend

Your business prepaid travel card comes with comprehensive control settings that allow you to apply spending restrictions, merchant category blocks, and daily limits.

Real-time spending insights provide visibility into employee expenses across teams, ensuring your travel budgets remain optimized and compliant with company policies.

Bring Volopay to your business

Get started now

FAQs about prepaid cards for travel

Your prepaid travel card operates on pre-loaded funds without requiring a bank account linkage, while debit cards directly access your company's bank balance.Prepaid cards for travel offer better expense control since you can't exceed the loaded amount, making budget management more predictable.

Yes, you can instantly reload your business prepaid travel card remotely through Volopay's dashboard while employees are traveling. This flexibility ensures your team never runs out of funds during critical business trips.

Your prepaid travel card features advanced security protocols, including real-time fraud monitoring, transaction alerts, and the ability to instantly freeze cards if suspicious activity occurs. International transactions are protected by global payment network security standards.

Virtual prepaid cards for travel are issued instantly upon account setup, while physical cards typically arrive within 3-5 business days across major Indian cities.

You can block or freeze a card via the Volopay mobile app or web dashboard, which takes effect instantly. Additionally, you can contact Volopay's customer support immediately to freeze the card and request a replacement. Emergency card replacement services ensure your employees can continue business activities without interruption.