👋 Exciting news! UPI payments are now available in India! Sign up now →

10 best prepaid travel cards in India in 2025

In today's globalized world, businesses have become increasingly international, leading to more and more employees traveling overseas for work-related purposes.

As a result, companies need to provide their employees with secure and convenient payment options during their travels. Prepaid cards have emerged as a popular payment option for business travelers, as they allow for easy and secure transactions without the need for physical cash, credit cards, or even limited-use tools like prepaid petty cash cards.

In India, there are numerous prepaid travel card options available for businesses, each with its own unique features and benefits. However, choosing the best prepaid travel card out of this lot is no easy task.

What is a prepaid travel card?

A prepaid travel card is a financial tool specifically designed for travelers. It functions like a debit card but is preloaded with a fixed amount before the journey. Users can load multiple currencies, providing flexibility for international travel.

Offering the convenience of card payments and ATM withdrawals, it eliminates the need for carrying large sums of cash.

With features such as real-time transaction monitoring and customization options, prepaid travel cards enhance financial control and security during trips, making them a preferred choice for individuals and businesses alike.

10 Best prepaid travel cards in India

1. Volopay prepaid card

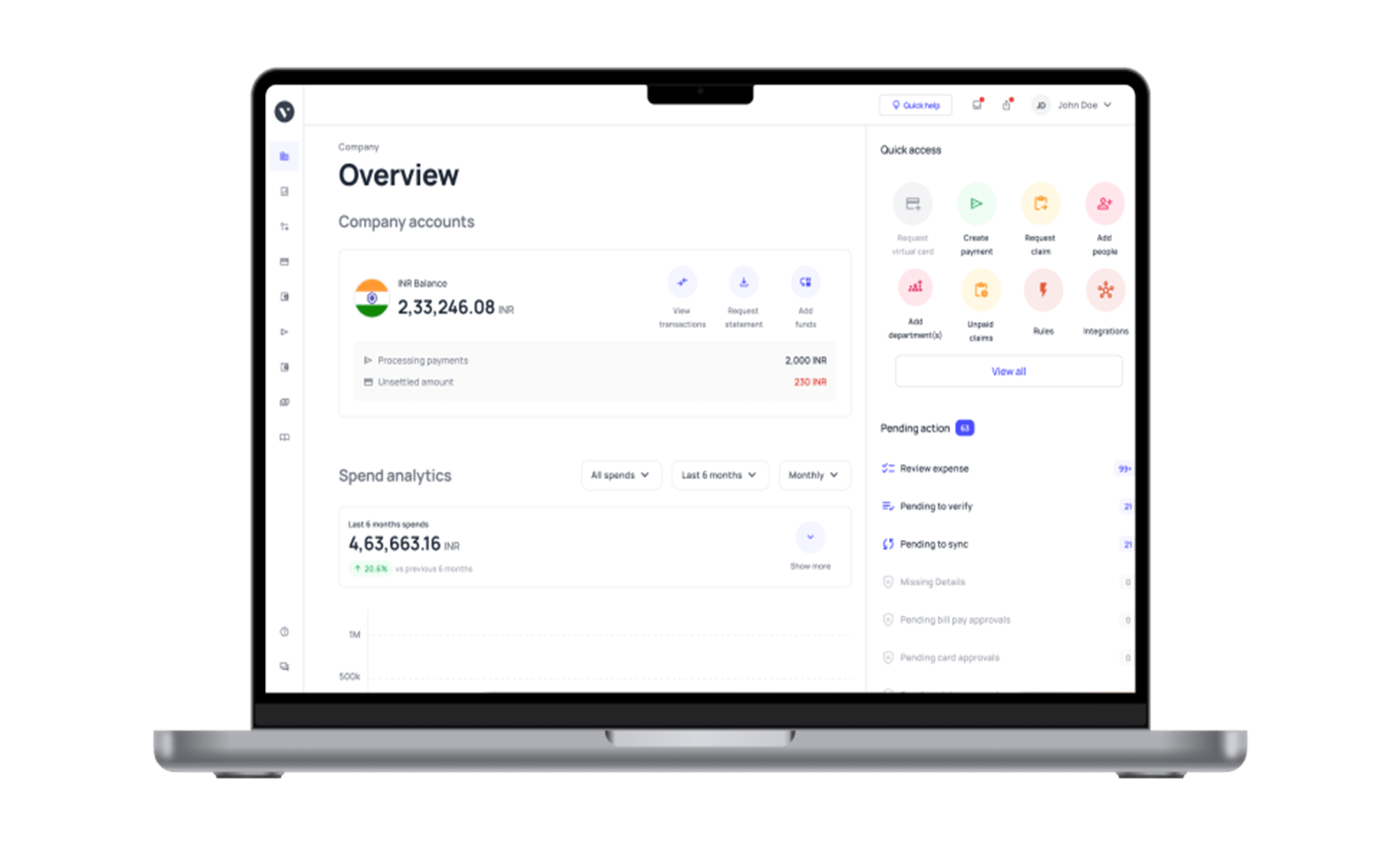

Overview

The Volopay prepaid card is designed for businesses to streamline expense management. It offers real-time tracking, automated approvals, and seamless integration with accounting systems.

With built-in spending controls, it enhances financial oversight. Companies can issue multiple cards to employees, ensuring efficient budget allocation while maintaining security and compliance in business spending.

Primary features

Volopay’s prepaid card includes automated expense tracking, real-time transaction visibility, customizable spending limits, and seamless accounting integration. It supports multi-currency transactions, eliminating forex fees.

The platform enables instant card issuance, role-based access, and mobile app functionality. These features help businesses control expenses, prevent overspending, and enhance financial transparency across teams.

Setup process and requirements

To obtain a Volopay prepaid card, businesses must sign up on the platform, verify company details, and complete Know Your Business (KYB) procedures.

After approval, administrators can issue virtual or physical cards, assign spending limits, and integrate them with accounting tools. No personal credit checks are required, ensuring quick activation.

Limitations

Despite its advantages, the Volopay prepaid card has limitations. It cannot improve personal credit scores since it’s not a credit card. Some businesses may face restrictions on international transactions.

Certain merchant categories may be blocked, limiting flexibility. Additionally, its availability depends on regional regulations, affecting accessibility in specific markets.

Advantages

The Volopay prepaid card enhances financial control, reduces manual reimbursements, and automates approvals. Businesses gain real-time spending insights, preventing unauthorized transactions.

With seamless accounting integration, expense tracking becomes efficient. It eliminates personal fund usage, ensuring better cash flow management. The platform’s scalability makes it ideal for businesses of all sizes.

Target customers

Volopay’s prepaid card is ideal for startups, SMEs, and large enterprises managing team expenses. It benefits finance teams, department heads, and employees needing controlled spending.

Companies with frequent vendor payments, international transactions, or remote teams find it useful. Fast-growing businesses seeking automation and expense visibility also benefit from its features.

2. HDFC prepaid cards

Overview

HDFC prepaid cards provide a secure and convenient alternative to cash for individuals and businesses. These reloadable cards can be used for online and offline transactions.

They support domestic and international payments, ensuring flexibility. With predefined spending limits, they help users manage finances efficiently while reducing dependency on credit cards.

Primary features

HDFC prepaid cards offer reloadable balances, PIN-based security, and wide acceptance across merchants. Users can withdraw cash from ATMs, make online payments, and track expenses via mobile banking.

Some variants support international transactions with competitive forex rates. Its contactless payment options enhance convenience, making transactions faster and more secure for users.

Setup process and requirements

To obtain an HDFC prepaid card, individuals or businesses must submit identity proof, address proof, and a completed application form. Businesses may need additional company verification documents.

After approval, users can load funds, set spending limits, and activate the card. No credit history is required, ensuring easy accessibility for all.

Limitations

HDFC prepaid cards have usage restrictions based on variant types. Some cards are limited to domestic transactions only. Reload limits apply, restricting large payments. Cash withdrawal fees may be applicable at ATMs.

Additionally, unlike credit cards, they do not offer rewards, cashback, or credit-building benefits for users.

Advantages

HDFC prepaid cards provide controlled spending, ensuring financial discipline. They eliminate debt risks by using preloaded funds. Users benefit from security features like chip-based protection and PIN authentication.

Businesses can distribute them for employee expenses, reducing reimbursement hassles. Their wide acceptance makes them suitable for personal and corporate financial management.

Target customers

HDFC prepaid cards cater to individuals, corporate employees, and travelers. Students use them for controlled expenses, while businesses distribute them for salary disbursements and employee benefits.

Frequent travelers benefit from forex prepaid cards. Companies managing petty cash or vendor payments also find these cards useful for secure and trackable transactions.

3. Axis Bank

Overview

Axis Bank offers two types of prepaid travel cards: the Multi-Currency Forex Card and the Travel Currency Card. The Multi-Currency Forex Card supports up to 16 currencies, making it ideal for travelers visiting multiple countries.

The Travel Currency Card is designed for those who frequently visit a single country and need a specific currency.

Primary features

The Multi-Currency Forex Card allows users to load multiple currencies and switch between them easily. The Travel Currency Card supports a single currency for specific destinations.

Both cards provide chip-and-PIN security, ATM withdrawals, and contactless payments. Users benefit from real-time exchange rates, fraud protection, and easy fund reloading.

Setup process and requirements

Applicants must provide identity proof, address proof, and travel documents. The cards can be obtained online or at Axis Bank branches. Businesses need company registration details for corporate-issued cards.

Applications can be completed online or at Axis Bank branches. Once approved, users can load funds and activate the card through mobile banking.

Limitations

The Multi-Currency Forex Card may have limited currency support for certain countries. Exchange rates fluctuate, affecting balances. The Travel Currency Card is restricted to one currency, limiting flexibility.

ATM withdrawals may incur fees. Reloading delays can occur during non-banking hours. Some merchants may not accept prepaid forex cards.

Advantages

Both cards offer secure, cashless transactions, reducing foreign exchange risks. The Multi-Currency Forex Card is convenient for multi-destination travelers, while the Travel Currency Card ensures cost-effective spending in a single country.

Users enjoy lower forex markups, easy mobile tracking, and emergency card replacement services during international travel.

Target customers

The Multi-Currency Forex Card is ideal for business travelers, tourists, and students visiting multiple countries. The Travel Currency Card suits individuals frequently traveling to a specific country.

Corporate employees, international students, and families vacationing abroad benefit from these prepaid travel cards for secure and hassle-free foreign currency transactions.

4. SBI business debit card

Overview

The SBI business debit card is designed for corporate customers to facilitate secure and convenient transactions. It allows businesses to manage daily expenses efficiently while offering cashless payment options.

The card provides seamless access to funds, online purchases, and ATM withdrawals, ensuring better financial management for small and large enterprises.

Primary features

The SBI business debit card offers high transaction limits, secure PIN-based payments, and global acceptance. It supports online and in-store purchases, ATM withdrawals, and contactless payments.

Businesses benefit from real-time expense tracking, fraud protection, and SMS alerts. The card integrates with corporate accounts, simplifying financial transactions for business operations.

Setup process and requirements

To obtain an SBI business debit card, companies must have a corporate account with SBI. Business registration documents, identity proof, and KYC compliance are mandatory.

After approval, account holders receive the card, which must be activated through an ATM or online banking. Spending limits and user access controls can be configured.

Limitations

The SBI business debit card has spending limits that may not suit large enterprises. It lacks reward programs or cashback benefits. International transactions may incur additional charges.

ATM withdrawal limits can restrict cash availability. Certain merchant categories may have restrictions, limiting usage flexibility for businesses with diverse financial needs.

Advantages

The SBI business debit card enables secure and convenient business transactions. It eliminates cash-handling risks, ensuring better financial management. Instant fund access improves liquidity.

The card’s integration with SBI accounts allows seamless tracking. Real-time transaction alerts enhance security, while wide acceptance makes it suitable for online and offline payments.

Target customers

SBI’s business debit card is ideal for SMEs, startups, and corporations managing daily business expenses. Entrepreneurs use it for supplier payments and operational costs. Large enterprises benefit from streamlined financial management.

Businesses seeking secure, cashless transactions and better control over expenses find this card valuable for financial operations and budgeting.

5. YES Bank prepaid cards

Overview

YES Bank prepaid cards provide a convenient alternative to cash for individuals and businesses. These reloadable cards support online and offline transactions, ensuring controlled spending.

Available in multiple variants, they cater to corporate and personal financial needs. With robust security features, they offer a seamless payment experience across various merchants.

Primary features

YES Bank prepaid cards come with customizable spending limits, PIN-based security, and online tracking. They support domestic and international transactions with competitive forex rates.

Its users benefit from instant reloading options, contactless payments, and ATM withdrawals. Businesses can issue multiple cards for employees, enhancing financial control and expense management efficiency.

Setup process and requirements

To get a YES Bank prepaid card, individuals must submit KYC documents, including identity and address proof. Businesses need company registration details.

After approval, funds can be loaded, and the card is activated through online banking or an ATM. Users can manage transactions, set limits, and monitor expenses through mobile apps.

Limitations

YES Bank prepaid cards have limited credit-building benefits, as they do not contribute to credit scores. Some cards may have restrictions on international usage.

Reload limits apply, restricting large transactions. ATM withdrawals may incur additional charges. Certain merchant categories may be blocked, limiting flexibility for specific business and personal expenses.

Advantages

YES Bank prepaid cards enhance financial discipline by allowing controlled spending. They provide security with PIN protection and fraud monitoring.

Businesses can distribute cards for employee expenses, reducing reimbursement hassles. Users benefit from quick reloading, easy tracking, and global acceptance, making them suitable for personal and corporate financial management.

Target customers

YES Bank prepaid cards cater to individuals, businesses, and travelers. Companies use them for employee expenses and vendor payments. Students benefit from controlled budgeting.

Frequent travelers utilize forex prepaid cards for international transactions. Organizations managing petty cash and corporate disbursements find these cards useful for secure and trackable payments.

6. IndusInd Bank multi-currency forex card

Overview

The IndusInd Bank multi-currency forex card is designed for international travelers, allowing them to load and manage multiple currencies on a single card.

It offers seamless transactions across global merchants and ATMs, reducing currency conversion hassles. With real-time tracking and security features, it ensures a smooth and secure travel experience.

Primary features

This forex card supports multiple currencies, eliminating frequent conversion charges. It provides chip and PIN security, contactless payments, and ATM access worldwide.

Users benefit from instant currency reloading, real-time balance tracking, and emergency card replacement. The card also offers travel insurance, fraud protection, and exclusive discounts at partner merchants.

Setup process and requirements

Customers must provide valid identity proof, address proof, and travel-related documents to apply. The card can be obtained from IndusInd Bank branches or through online applications.

After verification, users load desired currencies and activate the card. Transactions can be managed via mobile banking, ensuring flexibility and ease of use.

Limitations

The card is restricted to specific currencies and may not support all international destinations. ATM withdrawals may incur additional fees. Exchange rate fluctuations can impact balances.

Reloading delays might occur during non-banking hours. Some merchants may not accept forex cards, requiring alternative payment methods for seamless transactions while traveling.

Advantages

The IndusInd forex card reduces conversion charges, providing cost-effective international payments. It offers robust security features, including fraud protection and PIN-based transactions.

Travelers benefit from real-time balance updates and easy currency management. The card’s wide acceptance ensures convenience, while insurance coverage enhances financial security during international trips.

Target customers

The card is ideal for frequent travelers, students studying abroad, and corporate professionals attending international meetings. Tourists benefit from hassle-free foreign currency management.

Businesses use it to cover employee travel expenses. Anyone needing a secure, prepaid travel solution with multi-currency support finds this card valuable for global transactions.

7. ICICI Bank

Overview

ICICI Bank offers two prepaid multi-currency travel cards for business purposes: the Multi Wallet Card and the Reimbursement Card.

The Multi Wallet Card allows users to load up to 15 currencies, making it ideal for frequent travelers. The Reimbursement Card simplifies expense management by directly linking expenses for

easy reimbursement.

Primary features

The Multi Wallet Card supports up to 15 different currencies, offering a flexible solution for international travelers. The Reimbursement Card enables employees to directly submit expenses, simplifying the reimbursement process.

Both cards are equipped with secure PIN-based transactions, real-time balance tracking, and mobile alerts for enhanced spending control.

Setup process and requirements

To apply, individuals must provide identity and address proof, with KYC verification. Businesses require company registration details for corporate cards.

Applications can be completed online or at ICICI Bank branches. After approval, users load funds based on currency exchange rates and activate the card through mobile banking for secure management.

Limitations

The Multi Wallet Card has limitations on currency support for certain regions. ATM withdrawals may incur charges. The Reimbursement Card requires businesses to set up a proper expense submission process.

Both cards may face delays in reloading during non-banking hours, and international transaction fees may apply based on usage.

Advantages

Both cards offer enhanced convenience for businesses and travelers. The Multi Wallet Card supports multiple currencies, reducing the need to carry cash.

The Reimbursement Card streamlines expense reporting and reimbursement. With secure transaction features, fraud protection, and global acceptance, ICICI Bank prepaid cards provide a flexible, cost-effective solution for businesses.

Target customers

The Multi Wallet Card is ideal for business travelers who visit multiple countries and need flexible currency management. The Reimbursement Card targets businesses looking to streamline employee expense submissions and reimbursements.

Both cards are suitable for corporate clients, frequent travelers, and organizations seeking efficient expense management and cost control solutions.

8. Bank of Baroda travel card

Overview

The Bank of Baroda travel card is a prepaid foreign currency card designed for international travelers. It enables cashless transactions across multiple countries, eliminating the need for carrying cash.

With strong security features and competitive exchange rates, this card ensures convenient and cost-effective spending for business and leisure travelers.

Primary features

Their travel card supports multiple foreign currencies, reducing exchange costs. It offers chip and PIN security, worldwide ATM access, and contactless payments.

Users benefit from instant reloading, real-time expense tracking, and fraud protection. The card includes emergency assistance, insurance coverage, and exclusive discounts for travelers at partner merchants.

Setup process and requirements

Customers need valid identity proof, address proof, and travel-related documents to apply. The card can be obtained at Bank of Baroda branches or online.

After verification, users need to load the required currency and activate the card. Mobile banking access allows balance checks, transaction history tracking, and secure fund management.

Limitations

The card is limited to specific currencies and regions. ATM withdrawals may incur additional fees. Exchange rate fluctuations impact spending.

Reloading is subject to banking hours, causing potential delays. Some merchants do not accept prepaid travel cards, requiring alternative payment options for seamless international transactions during travel.

Advantages

The Bank of Baroda travel card simplifies international transactions by offering multi-currency support. It reduces forex conversion fees, ensuring cost-effective spending.

Security features protect against fraud, while real-time tracking enhances financial control. Wide merchant acceptance and emergency assistance services make it a reliable choice for global travelers.

Target customers

The card is ideal for frequent travelers, corporate professionals, and students studying abroad. Tourists benefit from easy foreign currency access.

Businesses use it to manage employee travel expenses. It is a preferred option for individuals seeking a secure, prepaid travel solution with cost-effective international transaction capabilities and global acceptance.

9. RuPay prepaid cards

Overview

RuPay prepaid cards offer a convenient and secure payment solution for individuals and businesses. These reloadable cards support online and offline transactions, ATM withdrawals, and contactless payments.

They provide an alternative to cash, ensuring controlled spending. Widely accepted across India, RuPay prepaid cards cater to various financial needs and lifestyles.

Primary features

RuPay prepaid cards enable secure PIN-based transactions, online payments, and ATM withdrawals. They offer contactless payment support, instant reloading, and real-time expense tracking.

Some variants provide cashback and rewards. The cards come with fraud protection, ensuring secure transactions. Businesses can issue multiple cards to employees for controlled corporate spending.

Setup process and requirements

Individuals need identity proof, address proof, and KYC verification to apply. Businesses must provide company registration details.

Applications can be completed online or at issuing banks. After verification, funds can be loaded onto the card. Users activate the card through mobile banking or ATMs and set transaction limits for security.

Limitations

RuPay prepaid cards may have limited international acceptance compared to global networks. Reloading is subject to banking hours, causing delays.

Some cards have daily transaction limits. ATM withdrawals may incur additional fees. Certain merchant restrictions apply, limiting usability. Unlike credit cards, they do not build credit history or offer loans.

Advantages

RuPay prepaid cards provide a secure, cashless payment method with controlled spending. They are widely accepted across India, ensuring convenience.

Instant reloading and real-time tracking enhance financial management. Businesses benefit from streamlined employee expense control. The cards offer affordability with lower fees, making them ideal for budget-conscious users.

Target customers

These cards are ideal for individuals seeking a prepaid payment solution, businesses managing employee expenses, and students requiring controlled spending.

Government schemes use them for subsidy distribution. Travelers benefit from secure transactions. Customers preferring a domestic payment network with low fees and broad acceptance find RuPay prepaid cards advantageous.

10. Happay World travel card

Overview

The Happay World Travel Card is a prepaid forex card designed for corporate and frequent travelers. It supports multiple currencies, eliminating conversion hassles.

The card ensures seamless transactions across global merchants and ATMs. With advanced expense management tools, it enables businesses to control and monitor employee travel spending efficiently.

Primary features

The card supports multiple foreign currencies, real-time expense tracking, and automated reconciliation. It offers contactless payments, PIN security, and 24/7 customer support.

Businesses can issue and control multiple cards for employees. Integrated with mobile and web platforms, it simplifies forex transactions, ensuring transparency, security, and streamlined financial management.

Setup process and requirements

Businesses must register with Happay and provide company details, KYC documents, and employee data. Individuals need valid identification and travel proof.

After approval, users load funds and activate the card through mobile banking. Spending limits, currency preferences, and security settings can be customized, ensuring efficient financial control during international travel.

Limitations

The card is primarily for corporate users, limiting availability for individuals. ATM withdrawals may attract additional fees. Exchange rate fluctuations can affect balances.

Reloading delays may occur during non-banking hours. Some merchants may not accept prepaid forex cards, requiring alternative payment methods for seamless transactions in specific locations.

Advantages

The Happay World Travel Card offers controlled forex spending, reducing conversion costs. Businesses benefit from automated expense tracking, ensuring compliance and transparency.

Enhanced security features protect against fraud. The card’s global acceptance and integration with financial systems streamline corporate travel management, making international transactions easier and more cost-effective.

Target customers

This card is ideal for corporate employees traveling internationally, businesses managing travel expenses, and frequent travelers needing a multi-currency payment solution.

Organizations seeking streamlined financial management for employee expenses benefit from its features. It also suits professionals attending global conferences and expatriates requiring secure, controlled foreign currency transactions.

Streamline your travel expense management

How to apply for a corporate prepaid travel card?

1. Research and compare

Before diving into the application process, thorough research and comparison of different corporate prepaid travel card providers are essential.

Consider factors such as fees, exchange rates, global acceptance, and additional features like expense tracking and reporting. This step lays the foundation for choosing a card that aligns with the company's specific needs and financial objectives.

2. Contact the provider

Once a suitable provider is identified, the next step involves reaching out to them. This initial contact allows for a detailed discussion of the features, terms, and conditions of the corporate prepaid travel card program.

It also provides an opportunity to clarify any queries and gain a comprehensive understanding of the application process.

3. Gather the required documents

To streamline the application process, gather all the necessary documents. Typically, this includes corporate identification documents, proof of business registration, and details of authorized signatories.

Ensuring that all required paperwork is in order accelerates the subsequent stages of the application.

4. Complete the application form

Most of the best prepaid travel card providers offer an online application form for corporate prepaid travel cards. The form typically requires information about the company, its employees, and the desired features of the cards.

Completing this form accurately and comprehensively ensures a smooth transition to the next phase of the application process.

5. Verification process

Once the application is submitted, the provider initiates a verification process. This step involves validating the information provided, checking the authenticity of the documents, and ensuring compliance with regulatory requirements.

The thoroughness of this verification process contributes to the security and reliability of the corporate prepaid travel card program.

6. Add funds to the card

After successful verification, it's time to load funds onto the corporate prepaid travel cards. The company decides the initial load amount for each card, taking into account anticipated expenses.

The flexibility to add funds as needed allows for dynamic budget management during corporate travels.

7. Customize card features

Many providers offer customization options for corporate prepaid travel cards. This includes setting spending limits, defining transaction categories, and tailoring features to align with company policies.

Taking advantage of these customization options ensures that the cards are optimized to meet the specific needs and financial controls of the organization.

8. Activate the cards

Once funds are loaded and features are customized, the corporate prepaid travel cards need to be activated. This step may involve individual card activation by the employees or a centralized activation process facilitated by the company's administrator.

Activation marks the readiness of the cards for use during business travels.

9. Distribute the cards

With the cards activated, the next step is distribution to the intended users within the organization.

Clear communication about the distribution process, along with any guidelines for card usage, enhances employee understanding and encourages responsible spending behavior.

10. Training and support

To maximize the benefits of the corporate prepaid travel card program, providing training and ongoing support is crucial. Conduct training sessions to educate employees on how to use the cards, access transaction details, and adhere to company policies.

Additionally, having a dedicated support system ensures quick resolution of any issues or concerns that may arise during the usage of the cards.

11. Regular monitoring

The final step in the application process is establishing a system for regular monitoring of card activities. Implementing tools for real-time expense tracking, generating detailed reports, and conducting periodic audits contribute to efficient financial management.

Regular monitoring also allows the company to identify any discrepancies or potential misuse promptly.

How do Volopay prepaid cards help your organization?

1. Streamlined expense management

Volopay prepaid cards offer a user-friendly tool that allows employers to maintain constant control and monitor employee spending in real time. This feature helps businesses keep track of expenses and manage their budgets more efficiently.

2. Enhanced security

Volopay prepaid cards come with highly secure, bank-grade security features, including two-factor authentication, approval workflows, and real-time transaction alerts.

This feature ensures that only authorized employees can use the card and that businesses are protected against fraudulent transactions.

3. Convenience

Volopay prepaid cards can be accessed easily and used for all sorts of online and store payments, making it a convenient payment option for businesses.

In fact, you can issue unlimited virtual Volopay cards at no added cost and use them for various purposes.

4. Better record keeping

Transactions made with Volopay prepaid cards are recorded instantly. Detailed transaction records are made available that can be easily downloaded and reconciled with accounting systems.

This feature ensures that businesses can keep accurate records of their expenses and reduces the risk of errors.

5. Better spend control

Volopay prepaid cards come with a predetermined spending limit feature that aids in preventing overspending and keeping expenses within the set budget.

Additionally, the card only needs to be loaded with the required amount, reducing the risk of overspending or unauthorized expenses.

6. No debt accumulation

Unlike credit cards, Volopay prepaid cards do not amass debt. This characteristic feature ensures that businesses do not have to be concerned about interest charges, late fees, or other similar expenses.

7. Better rewards

Volopay prepaid cards provide attractive rewards, such as partnership benefits, travel insurance, and much more. This aspect is particularly beneficial for global travelers who can enjoy these perks while on the move.

8. No need for credit check

Volopay prepaid cards do not require a mandatory credit check. This makes them an accessible payment option for businesses that may not have a particularly healthy credit history.

9. Unlimited virtual prepaid cards

With Volopay you can issue an unlimited number of virtual prepaid cards at no additional charges whatsoever. These cards can be used for a large variety of purposes including subscription management cards, gift cards, travel cards, burner cards, vendor payment cards and so much more. This makes Volopay one of the best prepaid travel card providers in India.