👋 Exciting news! UPI payments are now available in India! Sign up now →

6 key features of virtual cards for business owners and enterprises

For personal or business uses, cards are turning into the ultimate preference. It’s convenient to use and goes with all payment modes (POS, online shopping, etc.). But they have certain limitations too. Anyone can steal your corporate card and use it.

The list of scams around it is endless. If you are a business owner who prefers both safety and security? Hear this. Virtual cards are here to solve this issue. This is very similar to physical cards, except for one or two features of virtual cards that we have discussed more in this article. Because of these features, they are slowly gaining among business owners, especially in SMEs.

Why are virtual cards taking over business payments?

It’s apparent that businesses are shifting towards digital banking products. One of their interests is the features of virtual cards. The main use case of virtual card is reimbursement.

They use cards to allow their employees to spend freely. The perks and benefits are the icings on the cake.

What are the key features of virtual cards for business?

Gain more control over the business spending

Traditional ways of expense reports leave less control to businesses. Employees spend first and submit expense reports later. Though it has to be approved, you cannot control or reduce the payments. You will have to approve reasonable reports that match your expense policies.

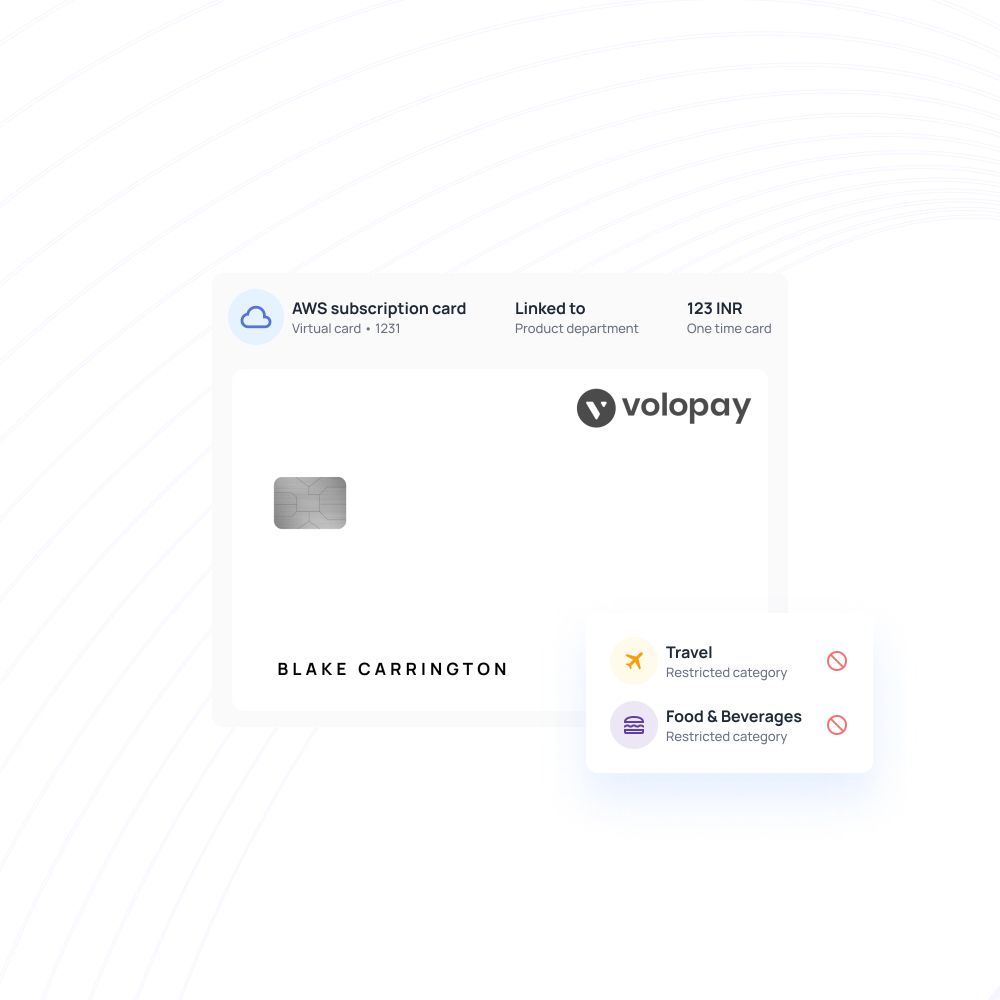

In a few years, you will spend more on reimbursements alone. You need a smart money allocation tool like virtual cards for businesses to keep tabs on this. With limits and budgets, what your employee spend will be in your control. Create cards, assign them to your employees, and add the required credits. It’s simple as that and doesn’t require approval each time for spending.

Related read: How can virtual cards facilitate recurring payments in India?

Manage budgets across teams efficiently

Create departments to keep an eye on departmental budgets. You can monitor employees’ expenses. But keeping tabs on how much they spend is difficult to do for a big team. You can rather excise budget on how much a department spends. Departmental-level control is much better than employee-level control. Virtual cards allow you to create departments and map employees to them.

When an employee spends, the expense is directly tagged to their department’s budget. Departmental managers can decide who gets the card to spend. They can approve if any card needs more than the assigned credit. That’s how you can manage budgets and control expenses at departmental levels. It’s also applicable to other card payments like SaaS subscriptions, petty expenses, and the like.

Monitor and manage your subscriptions

SaaS applications are dominating the market. They simplify our work and are accessible from anywhere. They have fixed payment plans that you pay every month. Most teams have credit cards from which they auto-pay every month. But you will have less control as money automatically goes out each month. You also don’t get centralized payment management. Your team can’t instantly find how much they pay a particular vendor.

Besides, if your card is temporarily down, no SaaS payment will go through. Fix this by shifting to flexible corporate cards of Volopay. You can have one card exclusively for each vendor. Auto-schedule their payments for a fixed time and date. Don’t want to continue your subscription? Block or freeze your card. One card being frozen will not affect your other payment cards.

Insights into the activities of spend owners

Virtual cards for business are most suitable for booking flight tickets, hotel rooms, travel card recharges, etc. You give your employees credits to spend on their own. Nevertheless, you also can see where they spend it. Through the Volopay dashboard, you can monitor each card’s spending.

Also, you can break down the expenses and analyze what costs more. These insights can be very useful in setting budgets for the concurrent year. If costs are higher due to inflation, you have factual data to prove and modify your travel policies/budgets.

Serves as an all-in-one employee expense management tool

Other than travel, employees have other reimbursable expenses too. Modern workplaces attract talent by offering these perks. They can be team lunches, coffee, course fees for upskilling, holiday gifts, and home office furniture. Cards can be the best way to distribute the required funds. You decide the budget, add the credit, and the employee spends that and attaches receipts.

Your virtual card portal will be a centralized platform to manage all employee expenses. It’s much easier to generate financial reports this way. You can have an entire report dedicated to employee expenses alone. You can glimpse overspending areas and departments and take necessary action. Accurate and easy-to-collect financial data is important for making budgeting decisions.

Reduce risk and minimize damage from fraud

Credit card theft can happen within the blink of an eye. Your card details are sensitive and must be protected. But physical cards are prone to damage and theft. It takes additional time to contact the bank and block it. When a card is exposed, it also puts your vendor information at risk. This cannot happen to a virtual card.

Each card is independent and is not related to other cards. If card details get stolen, you can safely isolate that from the network. Block, delete, and freeze — these are options to regulate the card. Each card has unique details, which protect your payment information and capabilities from theft and attack.

Suggested read: How to apply for a virtual credit card for your business?

Experience the benefits of virtual cards of Volopay!

Virtual cards are a resourceful feature for any accounting team. They have the trust of growing teams who want to streamline their online payments. Volopay offers corporate cards at competitive rates. It also has a payment suite with tools to automate your expense management.

Here is why you should consider the features of virtual cards by Volopay.

Budgets

Make budgets and turn them into inputs while you spend on Volopay. Get alerted when you overspend and act on it.

Organized expense management

Have a single application from where you can access all vendors. Monitor them in real-time and start spending less.

Monthly credits

Low on funds? Request credits and use them to make payments. Pay them at the end of each month. Volopay offers no-collateral credits with flexible repayment options.

Synching employee expenses with other accounting platforms

Volopay integrates with many accounting software in the market. Connecting and tapping into your payment data is simpler.

Multi-currency wallets

Maintain business accounts. Load and spend money in foreign currencies and pay international vendors. Slash the higher conversion fees that fintech platforms charge.

Easy to create, use, and discard functionality

You can create a card within minutes, assign it, and add credits. Impromptu business travel? No worries, as you can get access to funds right away.

Better operability for finance teams

Monitor from the dashboard and see how credits are utilized. Run financial reports much faster with data at your fingertips.

Automation of subscription payments

Volopay cards will help you schedule monthly payments. You won’t lose your subscription and can stop it anytime you wish.

FAQs on virtual cards

A virtual debit card is the digital version of a debit card that be used to make online expenses. They work exactly like a normal debit card, except that they can only be used for online expenses.

A virtual credit card is the intangible digital version of a credit card. They are used for online expenses as they are safer and secure from potential online theft.

You must choose a card provider that has the payment infrastructure to let its users use their virtual debit cards for international payments. Volopay is one such provider who offers virtual international debit cards to businesses.