👋 Exciting news! UPI payments are now available in India! Sign up now →

How can virtual cards facilitate recurring payments in India?

In October 2021, when the Reserve Bank of India (RBI) mandated changes on recurring transactions, it made a massive impact on the Indian population that had to switch back to the tedious task of manual payment. While RBI’s intention behind this move was to protect people from frauds and long-forgotten subscriptions that were unknowingly paying for, it had quite a different impact on businesses.

In the corporate world where time is money, automation is not a desire, it’s a necessity. Businesses rely on automated payments for their SaaS tools, vendor payouts, routine office purchases, and much more. While the manual payment of business expenses is still ongoing trouble for most business owners, it doesn’t have to be an issue for you.

What are recurring payments?

Recurring credit card billing or recurring payment is an expense model where customers have to authorize a vendor to initiate payment via auto deduction from the bank account in exchange for goods and services provided to them on a long-term basis. Recurring charges can be of two types:

Fixed recurring merchant transaction

With this type of payment, the merchant is authorized by the customer to auto-debit payment at a fixed interval of time. For a normal consumer, this could include an OTT media service subscription payment, gym membership, etc. For a business, recurring payments on debit card subscriptions are the biggest player in fixed merchant transactions.

Variable recurring merchant transaction

The amount charged for these payments is irregular, and the cost is subject to change based on the quantity ordered or a change in the customer’s consumption pattern of a good or service. For a normal consumer, this includes electricity and other utility charges. For a business, it could also include the purchase of raw materials that varies based on business performance

Manage your recurring payments with corporate cards

Challenges with credit card recurring payments

There are some legitimate issues in the auto-debit payment model which spurred RBI guidelines payment gateway into action and put a compliance norm on recurring transactions. Let’s see what they are:

Recurring payments tend to cost more

Automating your expenses doesn’t come cheap, and the same is true with recurring transactions. Recurring payments, RBI said, are riddled with recurring fees levied by issuing banks that will ultimately be borne by the customer, significantly bumping up the amount you have to pay. Fortunately, Volopay has an innovative solution that reduces your expense burden, but more on that later.

Higher payment failures

The worst expense notification you could receive is “Auto debit Payment Failed”, followed by a bank notification that says “Account Debited INR XXX”. Payment failures are an increasingly common nuisance with a non-compliant recurring transaction. This leaves the consumer in a whirlwind of contacting bank authorities to get their money back, on top of becoming a defaulter and paying late fees through no fault of their own.

Customer exploitation

The ugly truth of recurring payments which pushed the RBI to enforce mandates on the auto-debit feature is the way merchants rely on customers’ forgetfulness to keep making money on these payments. Since these payments will continue getting processed until the customer intervenes and halts the process, some businesses do not inform their customers of the auto-debit feature even when they are fully aware of the fact that the customer has stopped using their product or service. It could be in the case of gym memberships where the owner is aware that the customer doesn’t avail of their services, or in the case of SaaS tools where companies can see that the customer’s account has gone dormant.

Credit card fraud

One of the main reasons for RBI’s stringent mandate was to reduce instances of automatic payments debit card fraud due to card information being stored in the merchant database. This means that whenever you are paying for Facebook Ads or Google Ads, you are also giving away your business account’s sensitive information which can be misused in case of hacking activity.

What is the process for registration of card details for e-mandate-based recurring transactions?

A credit/debit cardholder who is going for an e-mandate facility on a card will be required to go through a registration process that is one-time, with authentication validation by the issuer as an additional factor.

In addition to the normal process required by the issuer, an e-mandate on a card for transactions that are recurring shall be registered only once AFA validation is successful.

Only after all requisite information is obtained by the issuer shall the registration be completed. This includes the e-mandate’s validity period among other requirements. If required, the facility for validity period modification of the e-mandate shall also be provided.

During the process of registration for virtual credit card recurring payments, the cardholder shall be given the choice to provide the e-mandate for either a variable value of the recurring transaction or for a fixed value of the recurring transaction that has been pre-specified. AFA validation will be required for any modification in the existing e-mandate.

As a customer facilitation and risk mitigant measure, the issuer will be required to send the cardholder a pre-transaction notification. This must be done a minimum of 24 hours before the actual charge/debit to the card.

The cardholder will be provided the option to choose a channel among options available (SMS, email, etc.) for receiving the pre-transaction notification from the issuer while registering the e-mandate on the card. The facility is also there if you choose to change this mode of notification at a later stage.

Impact of new rules implemented by RBI on recurring transactions

Knowing these challenges now, it makes sense why the RBI has imposed restrictions on the auto-debit feature to safeguard the general population from forgotten yet still active recurring transactions. But what are these restrictions? Let’s find out.

The Reserve Bank of India (RBI) mandated changes in the auto-debit payment rules on October 1st, 2021. Post these changes, any previous instructions regarding transaction payments will not be honored. Under these new mandates, all recurring payments now need to be validated with additional authentication. On top of this, payments exceeding INR 5,000/- must be validated by a one-time password (OTP) each time a customer makes a transaction. The auto-debit new rules apply to all debit and credit transactions, on both domestic and international payment platforms.

What does this mean for banks, merchants, and users alike? Chaos.

Banks and merchants are undergoing extreme recurring payments RBI e-mandate recalibrations. Banks have to furnish a list of merchants that have enabled additional factor authentication on recurring transactions. Only those transactions are allowed that are made out for merchants who have integrated with this new infrastructure. Any non-compliance with the RBI e-mandate circular will be dealt with with serious consequences.

For users, these new rules are a surefire way to waste precious time while making payments. Users have to undergo a time-consuming registration process to issue e-mandate on cards, and key in the validity period and maximum amount of the instruction. The issuing bank sends a debit notification with the amount and merchant name 24 hours before each payment.

The notification includes a link that leads to a page where users can modify, view, or cancel the payment or mandate. If no action is taken, the transaction will be declined. What’s worse, if you do not receive any communication from the bank about the changes, then the user has to make direct payments to the vendor using merchant apps, websites, or the bank’s net-banking facility to avoid any late fees.

This has seriously impacted a large number of card users, especially business owners who earlier benefited immensely from the auto-debit feature and are now forced to validate every single recurring transaction above INR 5,000/-.

Get the best virtual cards for your Indian business today

Impact of new recurring payments rules on businesses

The auto-debit new rules have spelled disaster for business owners, especially those whose companies revolve around a subscription-based model. Users are forced to choose between updating their payment method according to the new rules or authenticating their recurring transactions every single time. For some, the choice is still an illusion - multiple industries have been hit with mandates registrations that they aren’t capable yet facilitating entirely.

The worst hit will be those business owners who rely on recurring payments for small businesses. Small business merchants who do not have direct connectivity to banks may find it especially difficult to route mandates. And when recurring payments which are preferred for the very reason that they are automated require manual authentication, then even customers are more likely to discontinue using small business services.

With the current state of credit card recurring payments, RBI and its new mandate have disheartened many businesses. But it doesn’t have to be this way. Virtual credit cards for subscriptions keep your debit and credit cards, and your bank account details safe by creating a temporary 16 digit number card that can be used just like a regular credit card.

How virtual cards can help manage recurring payments?

Compared to physical debit and credit cards, virtual cards offer a host of benefits that make them the best choice for recurring transactions. Virtual cards are flexible and can be set up for one-time use or recurring transactions, whichever you prefer. You can set instant virtual credit card recurring payments for varied purposes, from SaaS subscriptions to vendor payouts to routine office expenses. With their recurring features, you can set automatic payment disbursements and enjoy!

An online virtual credit card comes with unique features such as blocking specific to not allow your employees from making unnecessary payments, the card is now dedicated for specific transactions only. While virtual cards are a highly secure payment method, if you are exposed to fraud, you can simply deactivate the card or block it all together without it ever affecting your company’s cash flow. Worried about paying on time? Now you don’t have to. Modern virtual cards come with a payment reminders feature, that helps you avoid any late fees that may come your way!

Not all virtual cards are made just the same. If you want to enjoy the best and most seamless virtual card experience, choose Volopay.

Related read - Simplify recurring payments in India for businesses

Manage recurring payments with Volopay

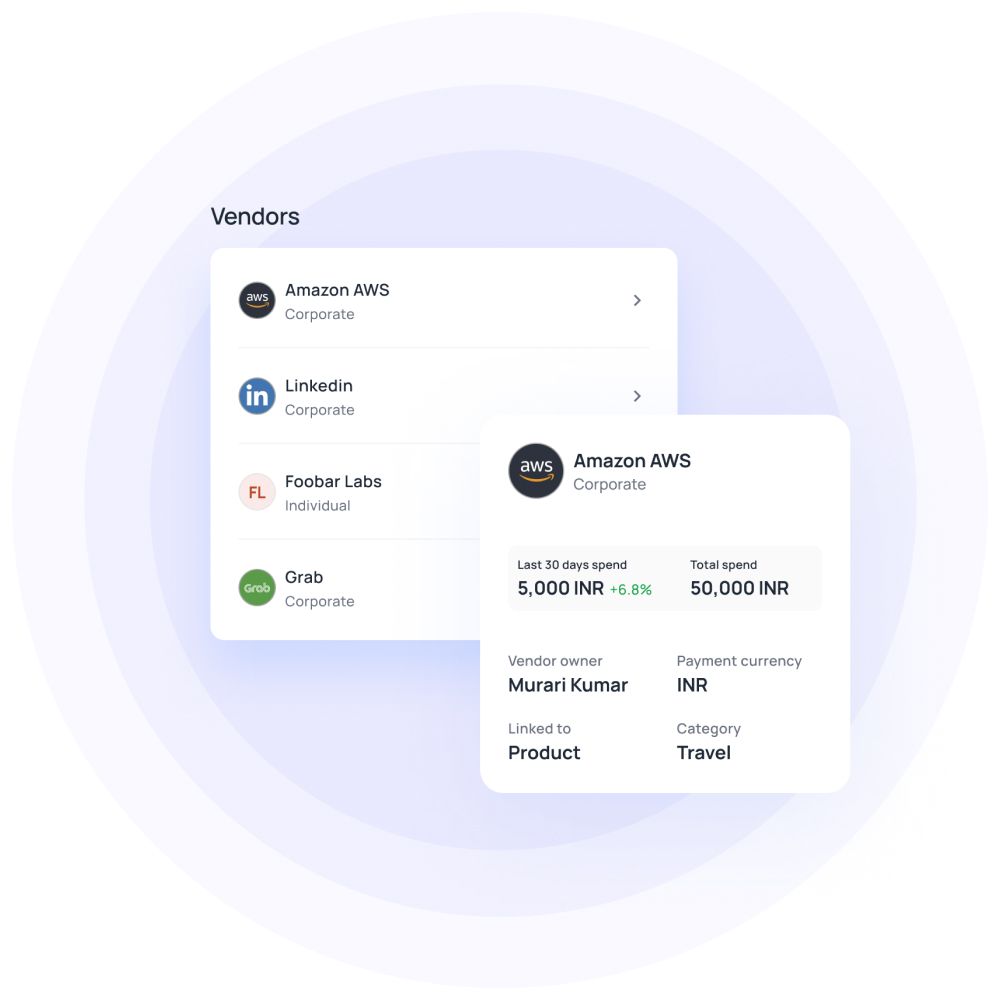

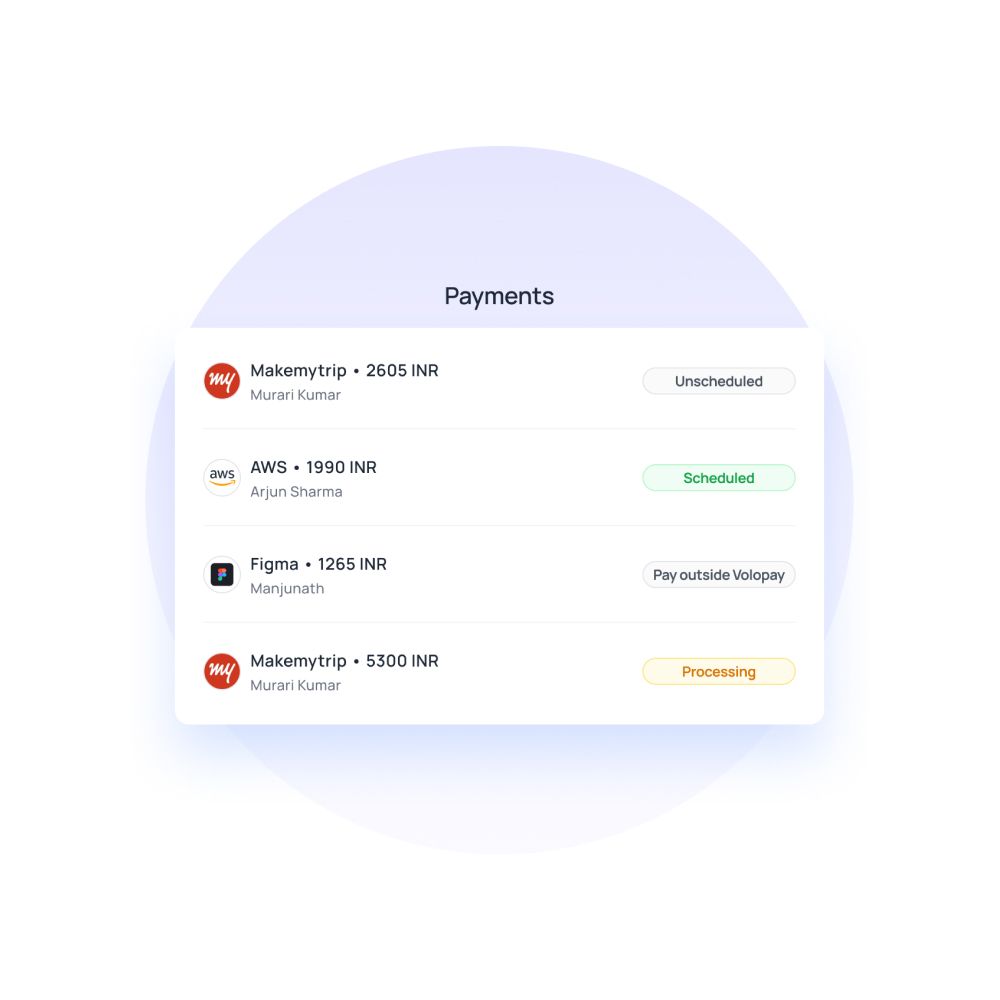

With Volopay’s unlimited virtual cards, you can set virtual card recurring payments to all your vendors without worrying about authenticating every single payment again and again! Create a dedicated virtual card for each vendor (AWS, Facebook, Google, etc), set it to autopay, and never worry about underpayment or overpayment ever again.

The best part? Since virtual cards are temporary cards that directly pull funds from the card balance with only the amount required for making recurring payments, you do not have to worry about fraud or illegal activities. Your business bank account is not directly involved in the payment and therefore remains untouched in case of fraudulent activities, keeping all your company money safe!

While other issuing banks and payment gateways charge you exorbitant payment fees, Volopay charges you INR 0 payment fees for all domestic and international recurring payments!

In addition to these powerful virtual cards, Volopay offers a robust subscription management software that seamlessly integrates with your payment process. This means you can easily manage all your subscriptions in one place—track billing cycles, update payment details, and monitor expenditures—enhancing your overall financial management.

FAQs

All recurring transactions which do not comply with RBI e-mandate framework will be declined. Existing recurring mandates will also get declined if the merchant is unable to provide transaction details according to the required format by RBI. Overseas recurring transactions will also get declined under the same conditions.

RBI has been mandated to set up eMandates in order to make recurring payments in India. This is affecting the subscription-based model payments that SaaS products have. Users of these products can no longer set up automatic payments that go out every month. Instead, they will receive a notification from which the payment should be initiated.

Recurring payments are payments that go out automatically at a fixed amount and time. If you have a product that has a fixed monthly price, you can set up recurring payments to pay that. Ex. Netflix, Hubspot, Google workspace, etc. You will choose a plan and make the initial payment. Later, you will be redirected to set automated monthly payments on specific data and time.

For businesses, recurring payments are a must to use applications and subscriptions continuously. They can get virtual cards to automate recurring payments and pay without interruptions. The flexible nature of virtual cards makes them the most convenient for fixed and variable recurring payments.

Virtual cards are very effective with recurring payments and have high success rates. They can be used to schedule your recurring payments for different app subscriptions. Your merchant will be authorized to receive payments from virtual cards without your intervention. If you want to cancel it, you can simply block or freeze the card.

Volopay offers two types of corporate cards in India. They are INR and USD cards. Depending on the currency you want to load in and spend, you can choose one among them. INR cards are for local spending where you spend in rupees. USD cards are for international payments in dollars. You can load in USD and spend in USD, cutting down conversion fees.

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started now