👋Exciting news! UPI payments are now available in India! Sign up now →

Expense management cards for businesses

Managing business expenses efficiently is crucial for financial control and operational success. Traditional methods like reimbursements and petty cash often lead to inefficiencies, errors, and a lack of visibility into spending.

Modern businesses are now turning to smarter solutions to streamline their processes. One such solution gaining popularity is the use of corporate cards for businesses, especially expense management cards. These cards not only simplify tracking but also empower employees to spend responsibly within company guidelines.

In this guide, we’ll explore how expense management cards, especially prepaid cards, can help your business improve transparency, tighten financial controls, reduce administrative workload, and boost employee satisfaction.

What are expense management cards?

Expense management cards are specialized payment cards issued by businesses to employees for handling work-related expenses. These cards are tailored to monitor, control, and report expenses in real-time.

Companies can allocate budgets, set spending limits, and track transactions instantly, offering greater oversight. Expense management cards for business are designed to reduce paperwork, eliminate manual reimbursements, and minimize the risk of fraud. An employee business expense card makes it easier for staff to manage travel, client meetings, and operational purchases without using personal funds.

Overall, expense cards for employees deliver enhanced control, transparency, and efficiency in managing corporate expenses. They also integrate easily with accounting systems, making financial reporting and reconciliation faster and more accurate.

Advantages of expense management cards for businesses

Expense management cards help you manage expenses smarter, faster, and more securely. They reduce manual work, enhance visibility into spending, and lower the risk of errors or misuse. To ensure you select the best fit for your company, consider the essential factors for choosing a corporate card program.

1. Real-time expense monitoring

With expense management cards, you gain the ability to track spending instantly as transactions occur. To overcome these challenges, modern companies are adopting tools like Volopay’s expense management cards, including prepaid and purchasing options. These let you track spending in real time, giving instant visibility into employee purchases and helping prevent budget overruns.

2. Enhanced cash flow

Expense management cards help you control when and how money is spent. By monitoring expenses closely, you avoid cash shortages and financial strain. Volopay provides timely insights into spending patterns so you can adjust budgets promptly. This strengthens your business’s overall financial health.

3. Improved spending control

You can set custom limits, restrict merchant categories, and define usage policies for each card. This ensures employees spend within approved guidelines. With Volopay, enhanced control reduces overspending, improves accountability, and supports stronger financial practices across departments.

4. Streamlined reimbursements

Expense management cards eliminate the need for lengthy reimbursement processes. Instead of employees paying out of pocket, you can fund cards directly. Volopay saves time and reduces admin work by enabling direct company spending—boosting satisfaction and easing finance workflows.

5. Automated reporting

Automated reporting captures transaction details instantly, eliminating the need for manual entry. Receipts can be uploaded directly through mobile apps linked to the card. Volopay’s automation speeds up approvals, improves record-keeping, and minimizes errors—keeping your reports accurate and audit-ready.

6. Better budgeting

Expense management cards let you allocate budgets to teams, projects, or employees easily. Spending caps and tracking keep budgets on target. Using Volopay, you can monitor usage in real time and adjust allocations as needed—improving planning and efficiency over time.

7. Decreased fraud risk

Expense management cards reduce fraud opportunities with strict controls and real-time monitoring. Category restrictions and alerts catch issues early. Volopay adds extra protection with instant alerts, card freezing, and rule-based approvals—keeping your finances safe.

8. Simplified approval process

With preset rules and automated workflows, expense approvals become faster and more consistent. You can review transactions and receipts with minimal effort. Volopay lets your team handle approvals in-app, reducing delays, admin cost, and compliance risks.

9. Amplified financial transparency

Expense management cards provide detailed insights into how money is spent. Transparent reporting helps you spot inefficiencies and trends. Volopay’s real-time analytics and reporting tools improve decision-making and ensure spending aligns with business priorities.

10. Quicker account reconciliation

Each transaction is recorded and categorized instantly, making month-end reconciliation faster and more accurate. With Volopay’s accounting integrations, you can match expenses with budgets and invoices—freeing up time for strategic work.

How Volopay's expense management card simplifies business expenses

Volopay’s expense management cards provide an all-in-one solution to manage, control, and track business spending effortlessly. Businesses can automate expense approvals, control spending limits, and streamline reconciliation with real-time updates. With customizable controls and seamless integration features, Volopay ensures your company’s finances stay transparent, secure, and efficiently managed.

Gain complete visibility of your expenses

Volopay’s platform gives you real-time visibility into every transaction made with the card. Businesses can instantly view who spent, how much, and where, enabling proactive financial decision-making.

Detailed dashboards provide clear insights to prevent budget overruns. With centralized data access, companies can identify spending trends across departments easily.

This comprehensive view improves budgeting, planning, and overall financial accountability. By gaining complete oversight, businesses can proactively address financial inefficiencies before they escalate.

Access detailed reports for every transaction

Each transaction made using Volopay’s card is automatically recorded and categorized. Businesses can easily access detailed reports without manual effort.

Volopay's reporting software features help generate reports that include transaction dates, amounts, vendors, and approval status. Exportable reports make audits and financial reviews much simpler.

They also help managers identify spending behaviors and adjust budgets when necessary. Having instant access to accurate reports ensures faster decision-making and better financial planning.

Tailor expense categories to fit your business needs

Volopay allows businesses to define and customize expense categories according to their operational needs. Whether it’s travel, meals, software subscriptions, or client meetings, companies can tailor categories for better reporting.

Custom categories help in aligning expenses with budgets, improving department accountability, and providing a clearer financial overview. This flexibility ensures that reporting matches the business’s structure. It also leads to cleaner, more meaningful financial analysis.

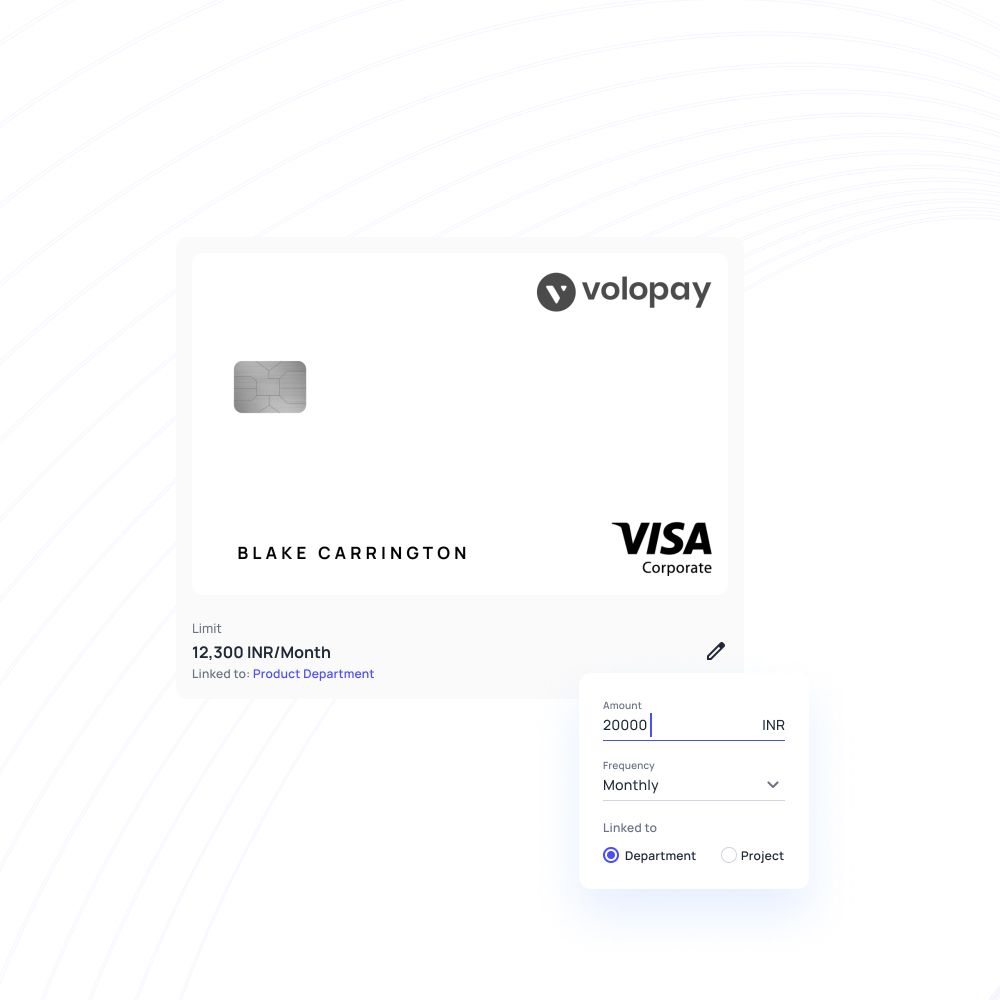

Enforce accurate and customizable spending limits

With Volopay, businesses can set strict spending limits at the employee or department level. Managers can restrict where, how much, and when the employee's business expense card can be used.

These controls ensure that spending aligns with company policies, minimizing unauthorized expenses and promoting responsible employee financial behavior. Spending rules can be modified instantly if needed. This keeps employee usage flexible yet within defined company policies.

Reconcile expenses quickly and efficiently

Forget lengthy reconciliation processes. Volopay captures transaction details instantly, matching receipts and categorizing expenses automatically. Finance teams can reconcile accounts in just a few clicks.

This automation significantly reduces errors and financial discrepancies. It also frees up valuable time that finance teams can dedicate to strategic analysis and forecasting. With faster reconciliation, companies can maintain real-time financial accuracy across all departments.

Enjoy 24/7 access to dedicated support

Volopay offers round-the-clock customer support to assist with any issues regarding card usage, platform access, or expense tracking. Whether you need technical help or have questions about expense cards for employees, our team is always available.

24/7 support ensures seamless financial operations without delays or disruptions. Assistance is available through multiple channels, including chat, phone, and email. This guarantees that users always get quick and effective resolutions.

Set up role-based access for better user control

Volopay enables businesses to assign user roles based on job responsibilities. Admins can control who can create, approve, or view expenses.

This role-based access system enhances security and accountability, ensuring that sensitive financial data remains protected while empowering teams to manage their expense-related tasks efficiently and independently.

Role configurations can be updated instantly if there are organizational changes. This ensures that access remains accurate and compliant at all times.

Utilize advanced security protocols for peace of mind

Security is a top priority at Volopay. Every transaction is protected by advanced encryption, fraud detection algorithms, and real-time alerts. Businesses can block cards instantly if suspicious activity is detected.

Multi-factor authentication and spending controls provide added protection. These features work together to keep sensitive company and employee data safe. Additionally, continuous monitoring tools help identify and prevent potential threats before they impact operations.

Automatically direct transaction requests to approvers

Volopay’s smart approval workflow system automatically sends transaction requests to designated approvers based on pre-set rules. This automation speeds up the approval process, reduces bottlenecks, and ensures compliance with internal policies.

Managers can approve or decline requests instantly, making expense management faster, more transparent, and highly efficient. Notifications and reminders ensure that approval delays are minimized. This keeps business operations running smoothly and improves employee satisfaction.

How to set up Volopay’s expense management cards

Choose your card

Start by selecting the type of Volopay card that best fits your company’s spending needs, whether virtual or physical. Virtual cards work well for online subscriptions and vendor payments, while physical cards are perfect for travel or in-person expenses.

Businesses can also choose between single-use and recurring-use cards based on specific requirements. Each card type comes with features designed for maximum control and security. Picking the right card is key to managing expenses efficiently.

Set policies and limits

Next, establish clear policies and spending limits for each card to align with your company’s financial guidelines. Set daily, weekly, or monthly caps to control overspending and define usage restrictions for specific merchants or categories.

You can customize limits based on departments, projects, or employee roles. This ensures every transaction is compliant with internal policies. Defining strong limits helps maintain financial discipline across the organization.

Configure approvals

Create automated workflows to route expense requests and transactions to the appropriate approvers within your organization. Define who can approve, reject, or escalate spending requests based on department, hierarchy, or project.

Volopay’s system enables multi-level approvals to ensure thorough oversight. Configured workflows not only speed up approvals but also maintain policy compliance. Having structured workflows ensures quicker expense clearance and better accountability.

Integrate with accounting

Connect Volopay to your existing accounting software to sync expense data seamlessly and eliminate manual data entry. Popular platforms like QuickBooks, Xero, and NetSuite are fully supported.

Integration allows businesses to automate reconciliation, streamline financial reporting, and maintain accurate records. It also improves tax compliance by ensuring every transaction is properly categorized. A smooth integration keeps your financial data up-to-date and reliable.

Enable tracking and reports

Enable real-time expense tracking to monitor spending across teams, projects, and locations. Customize dashboards to generate reports on specific metrics like category spend, department budgets, or vendor payments.

Automated reporting saves time and enhances financial visibility. Businesses can also schedule regular expense summaries for leadership reviews. Better tracking ensures that no expense goes unnoticed or unmanaged. This comprehensive oversight allows businesses to adjust strategies and optimize resource allocation effectively.

Assign user roles

Set permissions for different team members based on their roles, such as admin, finance manager, department head, or employee. Role-based access ensures that only authorized personnel can issue cards, approve transactions, or modify budgets.

This segregation of duties improves security and accountability. Role assignments can be adjusted anytime as teams grow or reorganize. Properly assigned roles reduce the chances of misuse or error.

Issue cards to employees

Distribute corporate cards to employees based on their responsibilities and spending needs. Cards can be issued individually or in bulk with specific policy settings already applied.

Providing employees with company-approved cards improves spending transparency and eliminates the need for out-of-pocket reimbursements. Each issued card is immediately tracked within the Volopay system. Quick card distribution ensures smooth onboarding for all new users.

Start spending

Once setup is complete, employees can begin using their cards for approved business expenses. Transactions are monitored in real-time, ensuring adherence to spending limits and company policies.

Receipts can be uploaded instantly to keep documentation accurate and audit-ready. Payments can be made securely online, in-store, or internationally.

Starting payments immediately enables teams to operate without any unnecessary financial delays. This seamless payment process helps businesses maintain operational efficiency and financial control.

Core features of Volopay’s expense management card

Volopay’s expense management cards provide businesses with a range of key features designed to enhance spending control, improve visibility, and streamline financial operations.

These cards help businesses manage their expenses efficiently while providing employees with convenient, secure, and flexible payment options. Volopay’s corporate cards are equipped with several user-friendly tools that support business growth and enable smooth financial expense management.

1. Direct deposit support

Volopay’s expense management cards support direct deposit, making it easier for businesses to fund cards instantly.

Employees receive funds directly onto their cards, allowing them to access payments quickly. This feature reduces the hassle of traditional payment methods like checks.

Direct deposit enhances overall efficiency and guarantees timely access to funds, keeping business operations flowing smoothly. It also ensures employees have immediate access to the funds they need.

2. Easy and convenient access

Volopay’s cards are highly accessible, offering businesses and employees quick and easy access to their funds anytime. With no complicated setup process, employees can begin using their cards almost immediately after issuance.

Whether employees are on-site or working remotely, they can access the funds they need at their convenience. This seamless access improves productivity by ensuring that financial resources are always available when needed. Businesses can also manage funds remotely without relying on physical locations.

3. Mobile-friendly functionality

With Volopay’s mobile app, users can manage their expense cards from anywhere at any time. The app offers complete control over expenses, allowing employees and finance teams to track spending, upload receipts, and check balances on the go.

The mobile app is user-friendly and designed to provide a hassle-free experience for managing business finances. Employees can also make payments, receive instant notifications, and review transaction history—all through their phones. This flexibility ensures that businesses remain agile and responsive.

4. Cost-effective pricing

Volopay’s expense management cards offer highly competitive pricing, ensuring that businesses can benefit from premium features without breaking the bank. There are no hidden fees, and businesses can choose a pricing structure that fits their budget and usage needs.

This value proposition is designed to help companies save money while optimizing their expense management. Volopay’s transparent pricing allows businesses to plan their finances effectively, ensuring no unexpected costs arise.

5. Unlimited card reloads

Volopay’s expense management cards come with the flexibility of unlimited reloads, ensuring businesses can continue to fund their cards as needed. This feature is ideal for companies with fluctuating expense demands.

It eliminates the need to issue new cards or worry about running out of funds. Unlimited reloads allow businesses to maintain full control over spending, even as financial requirements change throughout the year. This capability ensures that funds are always available when employees need them.

6. 24/7 customer assistance

Volopay offers round-the-clock customer support to help businesses resolve any issues quickly and efficiently. Whether it’s a question about a transaction, card functionality, or account issues, support is available via chat, email, or phone.

Having access to customer support at all times ensures that any problems can be addressed immediately, minimizing disruptions to business operations. The dedicated support team is knowledgeable and ready to assist with any inquiries or concerns.

7. Worldwide acceptance

Volopay’s expense management cards are accepted globally, making them an ideal choice for businesses with international operations. Whether traveling for work or conducting business with overseas vendors, employees can use their cards without concerns about geographical limitations.

This global acceptance ensures that employees can make payments, both online and offline, without interruptions. Businesses can easily handle international payments, making Volopay’s cards highly versatile for companies with a global reach.

8. Advanced security features

Security is a priority with Volopay’s expense management cards. The cards are equipped with encryption technology, fraud detection systems, and real-time alerts to keep transactions safe.

Businesses can also freeze or block cards instantly if suspicious activity is detected. Multi-factor authentication further protects sensitive financial data.

Volopay’s security measures are designed to safeguard both businesses and employees, ensuring peace of mind when managing expenses. This robust security framework mitigates risks and enhances trust in the system.

9. Seamless payroll integration

Volopay’s expense management cards integrate seamlessly with payroll systems, simplifying the payment and reimbursement process for businesses. This integration allows businesses to pay employees directly through the expense card, reducing the need for separate payroll processes.

It also eliminates the complexities of manual reimbursements and ensures employees receive timely payments. Integrating payroll and expense management creates a unified approach to financial administration. This feature streamlines payroll operations and supports a more efficient financial workflow.

How does Volopay’s expense management card work?

Volopay’s expense management card simplifies business spending by streamlining payment processes and ensuring real-time tracking of all expenses.

By providing instant payment capabilities, receipt management, and automated approval workflows, businesses can enhance efficiency while maintaining full control over expenses. The system helps businesses track and manage payments seamlessly, from the point of transaction to reconciliation and reporting.

Payment is initiated

When an employee makes a payment using the Volopay expense management card, the transaction is instantly recorded in the system.

The card is accepted globally, allowing employees to make purchases online or in person without any issues. This ensures businesses can manage payments efficiently and in real-time.

The platform updates automatically, giving businesses an immediate overview of all transactions. This process reduces admin work and allows businesses to focus on growth.

Receipts are uploaded

After a payment is made, employees upload receipts directly through the Volopay platform. This step ensures that businesses keep accurate records for each transaction.

The system supports multiple file formats, making the receipt upload process easy and efficient.

Employees can take a photo of receipts using their mobile devices and attach them directly to the transaction. This feature ensures that receipts are stored in one centralized location for future reference and audits.

Receipts are then matched and verified

Once a receipt is uploaded, the system automatically matches it with the corresponding payment made through the Volopay card. This validation process ensures that the details align, such as the amount spent, the date, and the vendor.

The system checks for discrepancies, eliminating the need for manual matching, which significantly reduces errors. Accurate matching ensures complete compliance with company policies, enhancing transparency and accountability in expense management.

Request is routed to the designated approver

Once receipts are matched and validated, the request for approval is routed to the appropriate manager or approver based on pre-configured workflows. Volopay’s platform allows businesses to set up custom approval hierarchies that align with their internal policies.

Approvers receive instant notifications, ensuring that requests are handled promptly. This automated process eliminates delays and ensures that the right individuals are reviewing and approving the expenses in real-time, streamlining the approval workflow.

Approval or rejection is completed

The approver reviews the request, which includes transaction details, receipts, and any additional notes. They can either approve or reject the request based on company policies.

If approved, the transaction is processed, and the funds are allocated accordingly. If rejected, the employee is notified with an explanation for the decision.

This simple yet effective approval process ensures complete compliance and proper management of business expenses while allowing for quick resolution of issues.

Transaction is logged in the accounting system

Once the request is approved, the transaction is automatically recorded in the business’s accounting software.

Volopay seamlessly integrates with popular accounting platforms, ensuring that all financial data is updated in real-time. This integration eliminates manual data entry and reduces the risk of errors.

The system records key details such as transaction amounts, vendors, and payment methods, creating a complete financial record. This streamlined process ensures accurate financial reporting.

Each transaction synced and reconciled

After the transaction is recorded, the finance team can easily reconcile the expenses.

Volopay’s platform simplifies reconciliation by automatically matching bank statements with recorded transactions. This minimizes discrepancies and ensures that all expenses are accounted for correctly.

The system flags any mismatches, allowing for quick resolution. Automated reconciliation reduces manual effort and accelerates the financial closing process, enhancing efficiency, accuracy, and overall visibility in financial tracking, monitoring, reporting and operations.

Comprehensive report is generated for analysis

Once reconciliation is complete, Volopay generates a detailed report that summarizes the entire transaction history. These reports provide insights into spending patterns, departmental expenses, and budget adherence.

Businesses can customize these reports to focus on specific metrics, such as spending by category or employee. The detailed reports help businesses analyze financial performance and make data-driven decisions.

With automated reporting, businesses can review expenses regularly, ensuring effective financial planning and control.

Volopay: The must-have expense management card for every business

1. Startups

● User-friendly interface for smooth employee onboarding

Volopay’s user-friendly interface makes it easy for startup employees to get on board quickly. Its intuitive design reduces training time and enhances productivity right from the start.

Employees can manage their expenses effortlessly, fostering smooth adoption across the team. This simplicity ensures a hassle-free experience, even for those unfamiliar with expense management tools.

● Fast and hassle-free setup

Setting up Volopay for your startup is fast and efficient. Businesses can get their expense management system up and running within minutes, ensuring minimal disruption to daily operations. This streamlined process saves valuable time and resources, enabling teams to focus on growth.

● Reduced administrative burden

Volopay’s automated features reduce administrative tasks significantly. With features like receipt scanning, real-time tracking, and instant approvals, your team spends less time on manual work.

The platform’s easy configuration minimizes paperwork, leaving more time for strategic decision-making. This efficiency allows teams to focus on growing the business instead of managing tedious processes.

2. Small-sized businesses

● Enhanced visibility over employee spending

Volopay provides small businesses with real-time visibility into all employee expenses. By tracking every transaction, business owners can quickly identify trends and discrepancies, ensuring that budgets are followed. This transparency helps avoid overspending, improves budgeting accuracy, and promotes more disciplined financial management.

● Scalability potential for growing needs

As small businesses grow, Volopay scales alongside them. The system allows easy adjustments to accommodate increasing transactions and new team members.

With flexible features and tools, your business can keep pace with its growth without worrying about outgrowing the platform.

● Automation adaptability for increasing spending

Volopay adapts to rising expenses through automation, such as auto-categorizing transactions and generating reports.

As spending increases, the platform’s automation ensures that financial processes remain efficient and accurate, helping businesses handle larger volumes of expenses without adding complexity or overhead.

3. Medium-to-large sized businesses

● Advanced analytics and reporting features

For medium to large businesses, Volopay offers powerful analytics tools to generate comprehensive financial reports.

These reports give deep insights into spending patterns, allowing businesses to optimize budgeting and forecast future expenses more effectively. Advanced analytics help businesses make data-driven decisions for better financial control.

● Customizable, multi-level workflows for diverse teams

Volopay offers customizable approval workflows that cater to various departments and team structures. Businesses can set different approval hierarchies and spending limits to match their organizational needs. This flexibility ensures that each team has the appropriate checks and balances, streamlining the approval process.

● Global acceptance during worldwide outreach scaling

Volopay’s global acceptance allows medium-to-large businesses to scale internationally without worrying about currency or transaction restrictions.

Whether conducting business domestically or abroad, the platform ensures seamless payments across borders, supporting businesses as they expand their reach globally with no limitations.

FAQs

Volopay provides 24/7 customer support via chat, email, and phone. The support team is readily available to assist with any technical or operational issues you may encounter.

Volopay offers multi-factor authentication, encryption, real-time transaction alerts, and fraud detection tools. These measures help protect your business and prevent unauthorized access to your financial data and transactions.

Yes, Volopay offers comprehensive analytics and reporting tools that track and categorize expenses in real-time. This feature provides businesses with insights into spending patterns and helps improve budget management.

Volopay adheres to all Indian financial and tax regulations, including GST compliance. It ensures that all transactions are recorded and reported correctly to meet local statutory and audit requirements.

Volopay cards can manage various business expenses, such as travel, office supplies, subscriptions, vendor payments, and employee reimbursements. It simplifies tracking and controlling all types of operational costs.

Volopay helps prevent fraud with features like real-time transaction alerts, spending limits, and the ability to freeze or block cards instantly. These features ensure that only authorized transactions are processed.

If an employee loses their Volopay card, it can be immediately deactivated through the Volopay platform. You can then order a replacement card while ensuring no fraudulent transactions occur.

Volopay allows businesses to set up custom alerts for specific transaction thresholds, approval requests, and expense category limits. This helps businesses stay on top of spending in real-time.

Yes, Volopay allows businesses to track budgeted versus actual spending. The platform provides detailed reports, enabling users to monitor expenses closely and ensure they stay within set financial limits.

When using Volopay cards internationally, consider foreign transaction fees, exchange rates, and global acceptance. Volopay ensures smooth cross-border payments without hidden charges, making international usage hassle-free.

Volopay ensures compliance by providing automated approval workflows, real-time tracking, and customizable policies. This reduces the need for micromanagement, allowing employees to spend within set parameters while staying compliant.