👋Exciting news! UPI payments are now available in India! Sign up now →

Importance of corporate card management for Indian businesses

As your business scales, so does the complexity of managing expenses. Without clear control over how corporate cards are used, it’s easy to lose track of spending, invite misuse, or delay reconciliation. Effective corporate card management isn’t a luxury; it’s a necessity for staying compliant, empowering teams, and maintaining full visibility across your company’s financial operations.

What is corporate card management?

Managing corporate cards goes far beyond just handing out corporate cards for employees. It’s a system of controls, policies, and tools that help you track, manage, and optimize every transaction made using your company’s corporate cards.

For Indian businesses that are growing fast, staying on top of spend is non-negotiable, especially when managing distributed teams, multiple departments, and dynamic vendor relationships.

Scope of managing corporate cards

Managing corporate cards involves assigning cards to employees or teams, setting spend limits, monitoring usage in real time, and ensuring that every rupee spent is accounted for.

It covers both physical and virtual cards, allowing you to support a variety of use cases, from recurring SaaS subscriptions to travel expenses and vendor payments. Done right, it creates a tight link between spending and accountability.

Who needs corporate card oversight?

Anyone in charge of business finances. That includes your finance team, operations managers, department heads, and even team leads who manage budgets. When you empower them with tools for oversight, you reduce friction and avoid costly surprises.

Volopay’s role in streamlining corporate card management

Volopay simplifies this entire process with a platform designed for Indian businesses. From issuing cards in minutes to enforcing policies and syncing with your accounting tools, Volopay makes managing corporate cards fast, accurate, and stress-free.

Challenges Indian businesses face in managing corporate cards

Without a system in place, managing corporate cards can become a daily headache. Many Indian businesses still rely on outdated methods, which slow down processes, increase risk, and lead to poor visibility over how money is actually being spent.

Shared cards, manual expense reports, and processing delays

Using the same card for multiple employees or departments creates confusion. Manual expense reports and delayed submissions only add to the chaos, making it hard to track who spent what and why.

Reconciliation headaches and incomplete receipt records

Month-end reconciliation becomes a nightmare when receipts are missing or mismatched. Finance teams spend hours chasing down documentation, leading to delayed reporting and potential compliance issues.

Rigid spending controls from conventional banks

Most legacy banks don’t offer flexible controls on corporate cards. You’re stuck with fixed limits, limited visibility, and no way to dynamically adjust spending rules across departments or projects.

Regulatory compliance with Indian tax laws

GST compliance and documentation requirements are strict. Without proper card-level tracking and integration with your accounting systems, you risk non-compliance, penalties, and missed input tax credits.

Why growing Indian businesses need smarter corporate card management

As your business expands, so does the complexity of spending. Relying on manual processes or traditional credit cards leaves too much room for error and not enough control. Smarter corporate card management gives you the tools to keep up with growth, stay compliant, and empower your teams without compromising oversight.

Complete visibility across departments

When different departments use separate cards or submit scattered reports, it’s impossible to get a real-time picture of spending.

A centralized system lets you see exactly who’s spending what, where, and why, so nothing slips through the cracks.

Preventing overspending

Without limits or policies in place, overspending is inevitable.

Policy-backed corporate cards reduce the risk of fraud, accidental overspending, and misuse.

You can assign budgets, track anomalies, and take immediate action when needed.

Fostering employee autonomy

Giving employees access to corporate cards shouldn’t mean giving up control.

Smart card management allows you to set boundaries while keeping teams agile.

With the right tools, employees spend responsibly while you stay informed.

Real-world use cases for corporate card management

Corporate card management isn’t just for large enterprises; it benefits every department in a growing business. Whether you're scaling marketing, enabling sales teams, or managing vendor payments, having the right card infrastructure helps you stay efficient, compliant, and in control.

Team budgets and promotional initiatives

Marketing teams often run multiple campaigns at once, such as ads, events, influencer payments, and more.

Assigning cards with fixed budgets ensures teams can move fast without risking overspend.

You stay in control without bottlenecking execution, and your team has complete oversight into how campaign budgets are distributed for accurate ROI analysis.

Business travel and client engagement expenses

Sales and leadership teams often need to travel frequently for meetings.

Instead of spending their own money to host clients or book last-minute arrangements, issuing individual or team cards with usage caps gives them autonomy.

It eliminates the need for reimbursement processing, while keeping expenses aligned with company policy.

Vendor payments and SaaS tools

Recurring charges for tools and subscriptions can be hard to track. Virtual cards let you assign one card per vendor, making it easier to monitor.

Your teams have the ability to cancel unused services and also prevent double billing by spotting recurring subscriptions to the same service.

Additionally, it allows for an easy and efficient way to keep track of how much your company is spending on its teck stack.

Petty cash and remote team spending

Instead of reimbursing petty cash or transfers to remote employees, issue reloadable cards.

It’s faster and easier to reconcile, especially when paired with automated receipt capture.

Remote teams are empowered with greater autonomy, without compromising on policy compliance or budgetary restrictions, and petty cash can be tracked digitally instead of chasing paper trails.

Features to look for in a modern corporate card platform

Not all corporate card platforms are built the same. To truly manage spend across a growing business, you need more than just card issuance; you need built-in control, visibility, and integration. Here’s what to look for in a solution that supports your scale.

Instant card issuance

The ability to issue cards instantly, virtual or physical, makes a huge difference when teams need to move fast.

Whether it’s onboarding a new employee or launching a campaign, instant issuance keeps things moving without waiting on a bank’s timeline, because modern businesses need immediate access to payment solutions.

Rapid deployment eliminates waiting periods that disrupt operations, allowing teams to make purchases, book travel, and handle vendor payments without administrative delays affecting business momentum.

Role based spend limits

Your finance team should be able to assign specific limits based on role, department, or even individual projects. This ensures that budget controls are baked into the system, not added as an afterthought.

Granular spending controls prevent budget overruns and unauthorized expenses. Advanced platforms allow finance teams to set specific limits based on employee roles, departments, or individual projects.

Marketing managers receive different allowances than procurement officers, while temporary project budgets can be assigned and automatically expire, ensuring financial discipline across organizational levels.

Global payment support

Indian businesses operating globally require seamless international transaction capabilities. Modern corporate cards support multiple currencies with competitive exchange rates, reducing foreign transaction fees.

This functionality enables smooth vendor payments abroad, international travel expenses, and cross-border business operations without relying on traditional banking channels that often involve delays and higher costs.

Real-time spend alerts

Immediate transaction visibility transforms financial oversight. Real-time notifications alert finance teams to unusual spending patterns, policy violations, or approaching budget limits.

This instant awareness prevents fraudulent activities, enables quick expense corrections, and maintains budget compliance. Finance managers can intervene immediately rather than discovering issues during monthly reconciliation cycles.

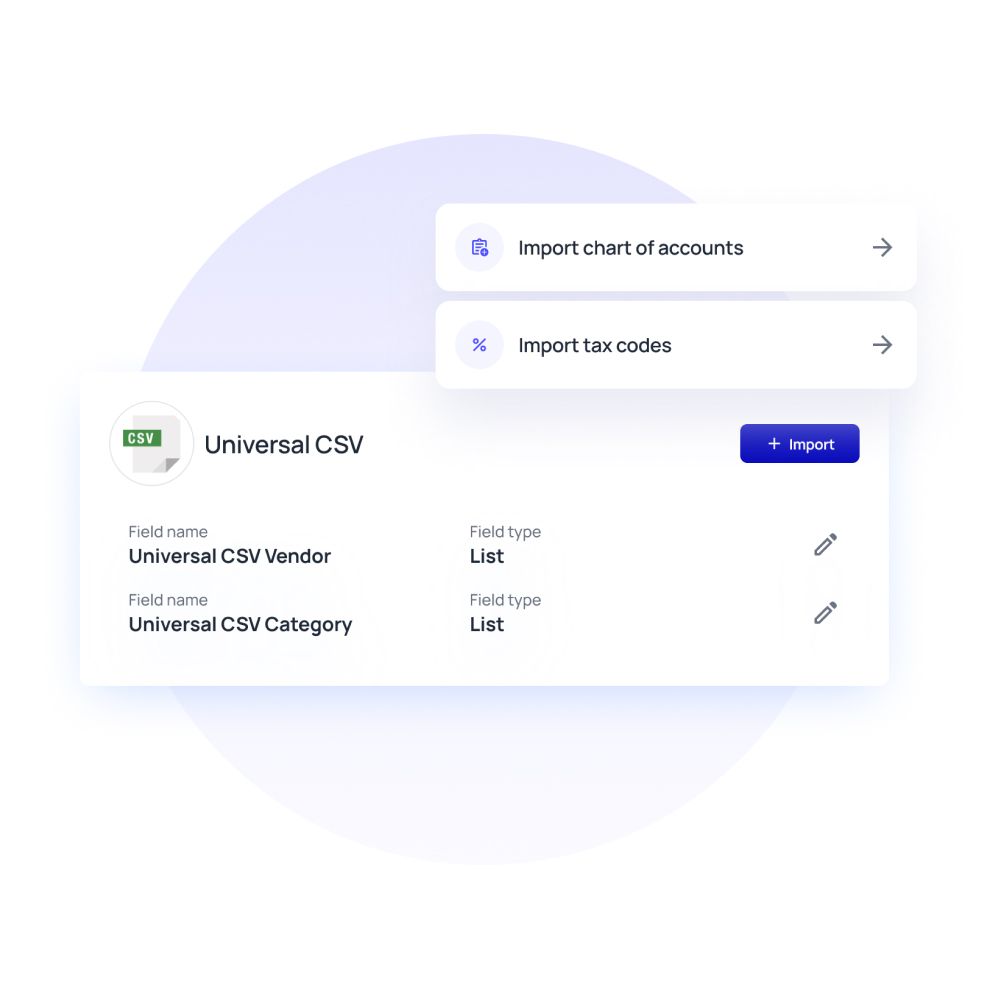

ERP/accounting integration

Automated data synchronization eliminates manual expense entry and reduces accounting errors. Leading corporate card platforms integrate directly with popular ERP systems and accounting software, including QuickBooks and Tally.

This connectivity ensures transaction data flows automatically into financial systems, streamlining reconciliation processes and maintaining accurate, up-to-date financial records.

How Volopay streamlines corporate card management

Volopay is built to simplify how you manage corporate cards, without the delays, guesswork, or manual effort. Whether you're scaling rapidly or managing a lean finance team, Volopay gives you the tools to control spending, reduce errors, and stay compliant, all from a single platform.

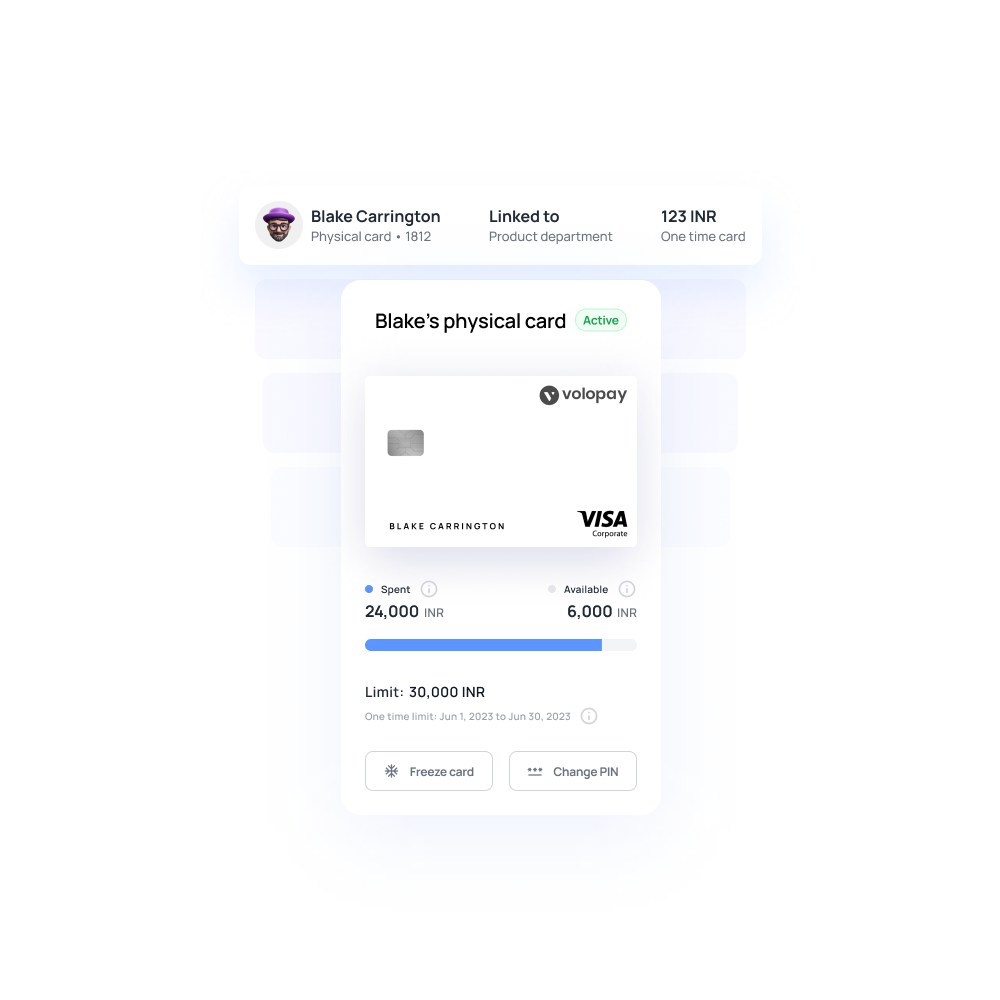

Detailed controls for each employee or team

With Volopay, you can assign individual cards to employees or teams and define precise spending rules. No more one-size-fits-all spending permissions.

Administrators can set specific spend limits based on roles, project requirements, or departmental budgets.

When situations change, cards can be instantly frozen or paused without affecting other team members, providing precise control over corporate spending while maintaining operational flexibility.

Automated expense categorization

Manual expense sorting becomes obsolete with Volopay's intelligent categorization system. Transactions automatically map to appropriate general ledger codes based on merchant categories and predefined rules.

This automation significantly reduces accounting errors while eliminating hours of manual labor typically required for expense processing, allowing finance teams to focus on strategic analysis rather than data entry.

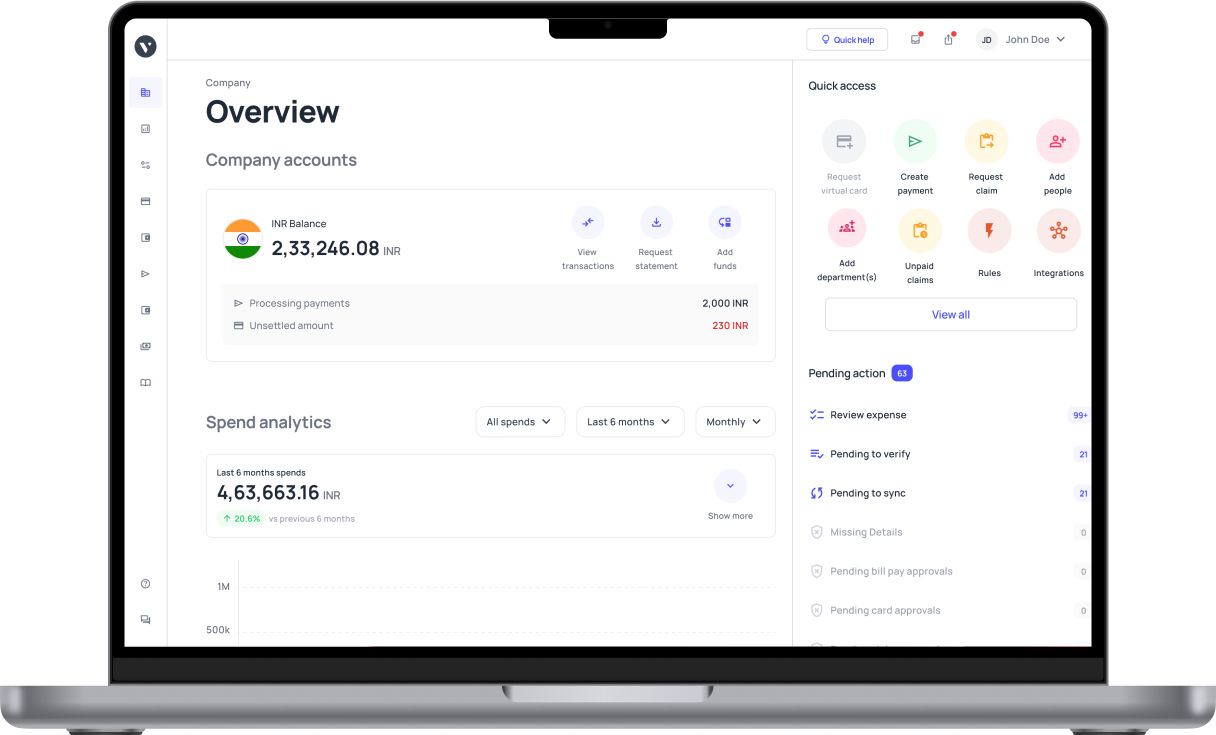

Real-time budget and spend insights

CFOs and finance administrators gain real-time visibility into company spending through comprehensive live dashboards.

Real-time data displays current budget utilization, spending trends, and departmental breakdowns.

These dynamic insights enable proactive budget management, helping executives identify potential overruns before they occur and make informed decisions based on current financial data rather than outdated reports.

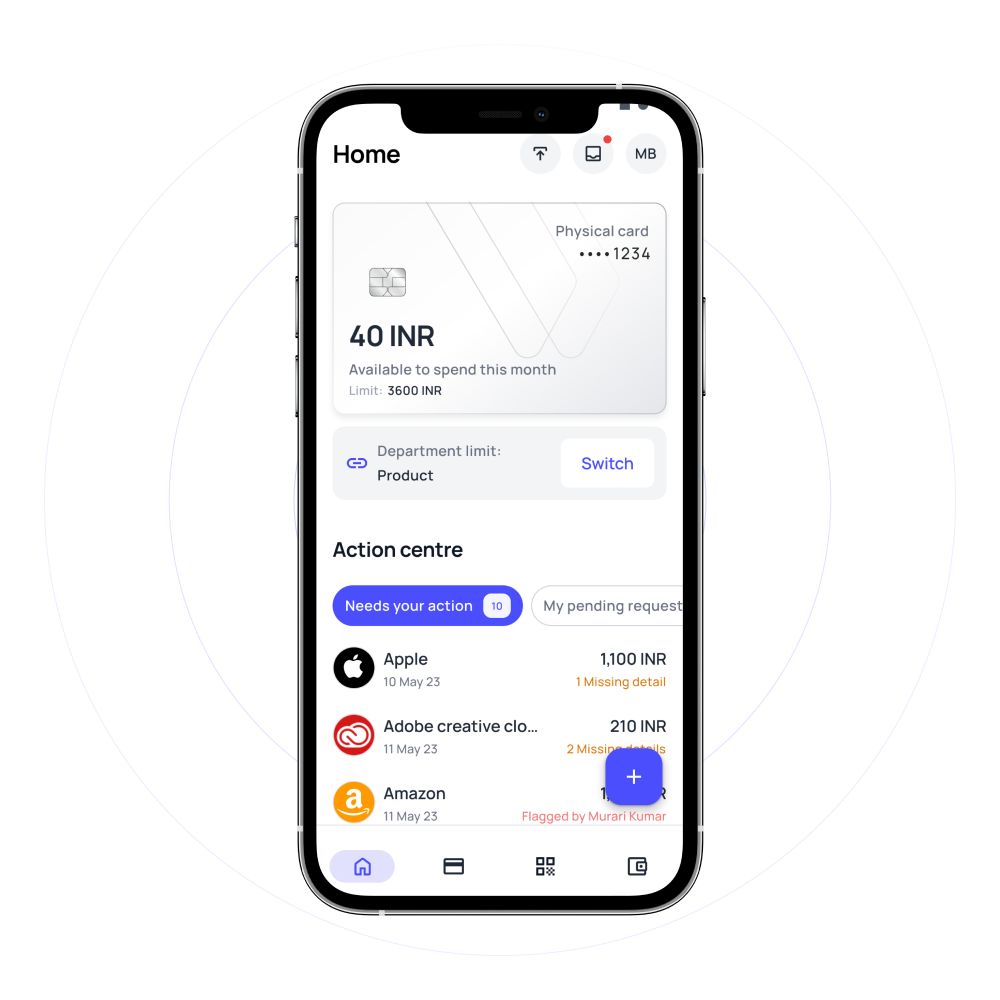

Accessible via mobile app and web

Volopay's platform ensures seamless access across all devices and locations. Employees can submit expenses, upload receipts, and check spending limits through Volopay's user-friendly mobile app, while administrators manage cards and approve transactions via web interfaces.

This flexibility supports remote work environments and business travel, enabling expense management regardless of geographical location or device preference.

UPI-enabled corporate cards that scale with you

Volopay's UPI-enabled corporate cards adapt to business growth without infrastructure limitations. As companies expand teams or enter new markets, additional cards can be issued instantly.

The UPI integration and physical card support enable seamless domestic transactions with local vendors and suppliers. Virtual cards further extend flexibility for secure online and remote payments. The platform’s architecture ensures unlimited scaling without compromising performance.

Best practices for managing corporate cards efficiently

Having corporate cards is one thing; managing them well is another. Following a few best practices can help you get the most out of your system while avoiding compliance risks and overspending.

Set clear ownership and spending rules

Establishing transparent card policies prevents unauthorized spending and defines accountability structures. Specify eligible expenses, spending limits, and consequences for policy violations.

Assign clear ownership to individual employees or team leads who become responsible for card usage. Volopay's policy engine enforces these rules automatically, blocking transactions that violate predetermined guidelines and maintaining spending discipline.

Implement pre-approvals with layered workflows

Multi-tiered approval processes ensure spending compliance before transactions occur. Configure workflows requiring manager approval for purchases exceeding specific thresholds or unusual merchant categories.

Volopay's approval system routes requests automatically based on predetermined rules, creating audit trails while preventing unauthorized expenses. This proactive approach builds compliance into daily operations rather than addressing violations after they happen.

Consolidate reports and leverage spend insights

Consolidated reporting reveals spending patterns that individual transaction reviews miss. Monthly analysis identifies cost optimization opportunities, vendor negotiation leverage, and budget reallocation needs.

Volopay's analytics dashboard aggregates data across all cards, highlighting departmental trends and anomalies. Finance teams can optimize procurement strategies and identify potential savings through comprehensive spend visibility and pattern recognition.

How Volopay compares to traditional corporate card issuers

Traditional banks require weeks to process corporate card applications, involving extensive documentation and credit reviews.

Volopay delivers virtual cards within minutes and physical cards within days.

This speed proves essential for scaling teams who need immediate payment solutions for new hires, project launches, or unexpected business opportunities that cannot wait for lengthy bank procedures.

Banks offer basic corporate cards that require expensive third-party expense management software to achieve proper control.

Volopay integrates spending limits, approval workflows, expense categorization, and reporting directly into the platform.

Finance teams avoid juggling multiple vendors, complex integrations, and subscription costs while maintaining complete financial oversight through one unified system.

Traditional issuers typically serve single markets, forcing companies to manage multiple relationships across different countries.

Volopay enables multi-entity, multi-currency control from one dashboard.

International businesses can issue cards for teams in various locations, manage different subsidiaries, and handle cross-border transactions without maintaining separate banking relationships.

How to set up a corporate card management system

Select a platform based on your needs

A well-structured corporate card system helps you scale without losing control. Evaluate potential platforms by examining their control features, spending limits, and reporting capabilities.

Look for solutions that offer real-time transaction monitoring, customizable approval workflows, and multi-level spending controls. Consider your company's size, industry requirements, and growth projections when making this decision.

Platforms should provide mobile access for employees and comprehensive admin dashboards for finance teams. Assess integration capabilities with your existing financial systems before committing to any provider.

Onboard employees and set card rules

Establish clear spending policies before distributing cards to team members. Define spending limits by department, role, and transaction type. Create specific guidelines for acceptable purchases, receipt submission requirements, and approval processes.

Train employees on proper card usage through structured sessions that cover policy details, mobile app functionality, and expense reporting procedures. Document all policies in an accessible employee handbook and require an acknowledgment of terms before card activation.

Integrate with your expense tools and ERP

Connect your card management platform with existing accounting software, expense management tools, and enterprise resource planning systems. Volopay simplifies this process with plug-and-play integrations that automatically sync transaction data, reducing manual data entry and potential errors.

Configure automated workflows that route expenses to appropriate approvers based on amount, category, or department. Test all integrations thoroughly before full deployment to ensure data flows correctly between systems.

Monitor usage and optimize over time

Track spending patterns, policy compliance, and system performance through regular reporting and analysis. Use Volopay analytics to identify spending trends, detect unusual transactions, and measure policy adherence across departments.

Schedule monthly reviews with department heads to discuss spending patterns and adjust limits as needed. Collect employee feedback on system usability and policy effectiveness to inform future improvements and training updates.

FAQs on corporate card management

Use a centralized platform like Volopay to assign, monitor, and control cards by team, project, or individual. This ensures transparency and accountability without micromanagement.

Yes. Volopay supports GST-compliant payments and provides documentation that aligns with Indian tax laws, helping you claim input tax credit and stay audit-ready.

Corporate card management focuses on issuing and controlling company cards. Expense management covers the full lifecycle of a business expense, including reimbursements, approvals, and accounting. Volopay does both on one platform.

Absolutely. Volopay lets you create vendor-specific virtual cards to track and control recurring charges, reduce fraud risk, and cancel unused services easily.

Every transaction is automatically categorized, matched with receipts, and synced with your accounting software. This eliminates manual reconciliation and reduces month-end workload.