👋Exciting news! UPI payments are now available in India! Sign up now →

Volopay: A modern alternative to company prepaid credit cards

If you're looking for a better way to manage company expenses, Volopay prepaid cards are a smarter choice than traditional company prepaid credit cards. You get instant control over spending, real-time tracking, and custom limits for each employee without the hassle of dealing with credit or delayed reimbursements.

What is a prepaid card?

A prepaid card is a payment method that you load with funds in advance, letting your team spend only what’s available.

Unlike credit cards, there's no borrowing involved—just simple, controlled spending that helps you manage budgets, avoid debt, and keep your business finances streamlined.

Difference between prepaid cards and prepaid credit cards in India

Prepaid cards differ from credit-based options by eliminating the risk of debt. You preload funds onto the card, so your team can only spend what’s available.

Unlike prepaid credit cards, prepaid cards offer tighter control over expenses, real-time visibility, and simplified reconciliation, making it easier to track spending and stay within budget at all times.

You no longer need to worry about overspending or interest charges that affect your bottom line.

Why choose Volopay prepaid cards?

With Volopay prepaid cards, you can issue cards instantly, set custom spending rules, and monitor every transaction live. You stay in control without relying on credit. It’s a secure, scalable, and modern solution tailored for fast-moving Indian businesses looking to streamline expense management. Plus, it seamlessly integrates with your accounting systems to automate and simplify financial workflows.

Instant fund loading for cards

With Volopay's corporate cards, you can instantly load funds onto prepaid cards using an intuitive online dashboard. This ensures your team always has access to approved budgets without delays. It’s a faster, more reliable alternative to traditional company prepaid credit cards, helping you maintain uninterrupted business operations.

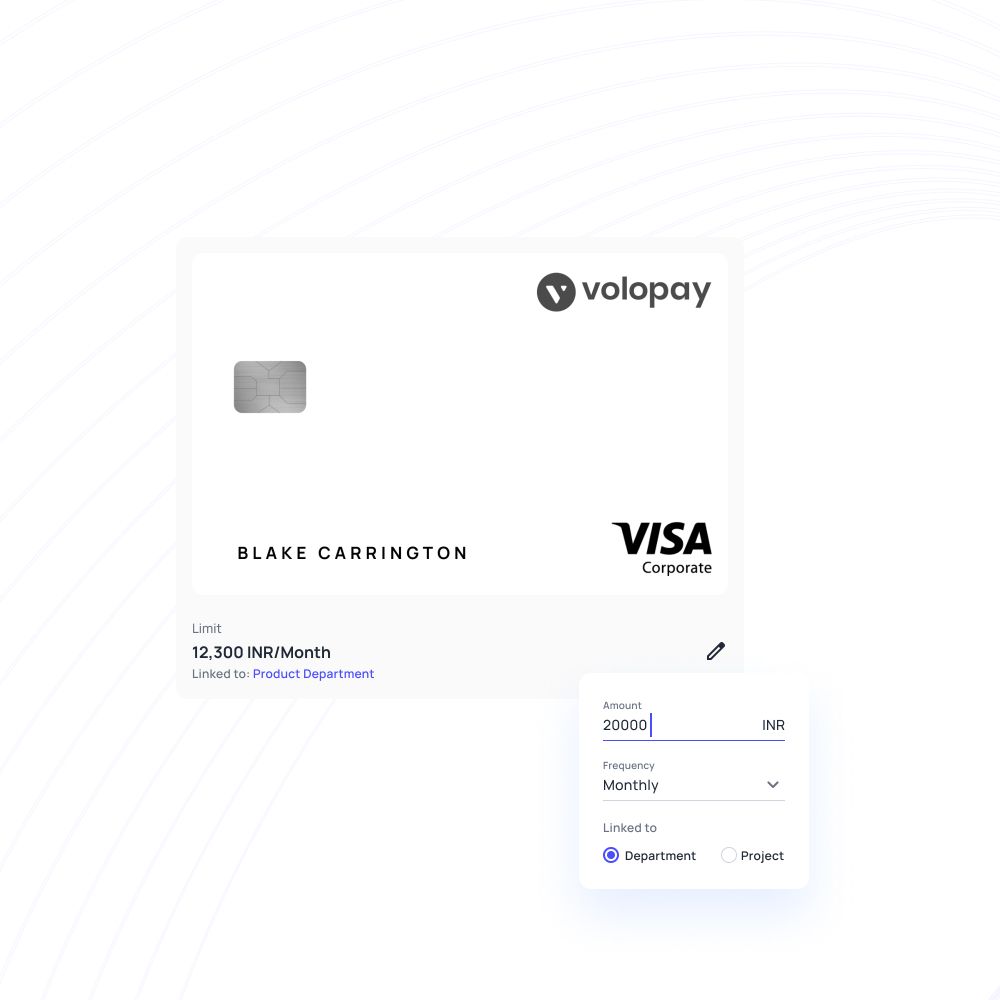

Customized spending limits

Volopay allows you to set precise spending limits on each card, tailored to individual roles or departments. You can even restrict usage to specific merchants or categories, minimizing the risk of overspending. These customizable controls give you tighter management over employee expenses across your organization.

Real-time transaction monitoring

Every time a transaction occurs, it’s automatically recorded in Volopay’s ledger for full transparency. You can track all spending activities live and get immediate insights into where company money is going. This real-time visibility helps you detect irregularities early and maintain financial accountability.

Simplified accounting system integration

Volopay connects effortlessly with accounting platforms like Xero and NetSuite. All transactions are synced automatically, reducing manual data entry and saving you hours of reconciliation work. This seamless integration streamlines your financial processes and keeps your books accurate and up to date.

Unlimited virtual cards for online expenses

Volopay lets you create unlimited virtual prepaid cards to streamline online spending for your business. Use them for managing SaaS subscriptions, paying vendors, or making secure online purchases. Each card can be assigned to a specific purpose or user, ensuring better control and enhanced security.

Automated reimbursement processing

Employees can easily submit reimbursement requests through Volopay’s mobile app. Built-in OCR technology captures and processes receipt details instantly, reducing manual input. This speeds up approval workflows, ensures accuracy, and helps finance teams close reimbursement cycles faster without back-and-forth emails or paperwork.

Industry-leading security protections

Volopay is certified with ISO and PCI DSS standards, ensuring your financial data is protected at all times. In case of suspicious activity or card misuse, you can instantly freeze or deactivate any card. These built-in protections help you prevent fraud before it impacts your business.

Multi-tier approval workflows

Volopay supports up to five levels of customizable multi level approvals, allowing you to set pre-defined rules for each expense category or department. This structured process ensures that all spending requests go through the right checks, helping you maintain control and compliance without slowing down operations.

Mobile app for on-the-go management

With Volopay’s mobile app, you and your team can manage expenses from anywhere. Employees can upload receipts, request approvals, and track transactions in real time. While managers can approve or decline expenses and monitor spending on the move, making business expense control truly effortless.

Diverse applications for every team

Corporate travel expense management

Volopay prepaid cards simplify travel expense tracking for your team on the go.

Employees can use their assigned cards for flights, lodging, meals, and transport, without using personal funds.

All expenses are live recorded, ensuring better visibility and control over corporate travel budgets.

Subscription payment handling

You can assign virtual cards to manage recurring payments for tools like Slack, Zoom, or Adobe.

This avoids failed payments and makes cancellations or updates easy without impacting other services.

Separate cards for each subscription also help you identify unused or duplicate tools quickly.

Procurement and vendor transactions

Your procurement or finance team can use prepaid cards for purchasing inventory, office supplies, or raw materials.

Assign vendor-specific cards with fixed budgets to maintain tighter control.

It eliminates the need for lengthy reimbursement cycles or manual vendor payments via traditional banking methods.

Miscellaneous business purchases

For ad hoc or departmental needs—like event supplies or team lunches—Volopay prepaid cards offer complete flexibility without sacrificing accountability.

You can issue one-time-use cards or set low limits to manage small purchases efficiently.

Each transaction is tagged automatically, making reporting and reconciliation seamless.

Effortless budget allocation with Volopay

Departmental budget setup

Volopay allows your finance team to assign prepaid card budgets to specific departments like HR, marketing, or operations.

Each team receives only what they need, which improves accountability and reduces wasteful spending. This setup ensures every department stays within its limits while simplifying budget tracking across the organization.

Project-based funding

You can allocate prepaid card budgets to individual projects, such as product launches or digital marketing campaigns.

This makes it easier to track spending per initiative without mixing up costs. With project-based cards, you maintain clear visibility on how much each campaign consumes, ensuring better planning and cost control.

Flexible budget adjustments

As business priorities shift, Volopay lets you adjust card budgets instantly through a central dashboard.

Whether scaling up a project or reducing department spend, changes happen in real time. This flexibility allows your finance team to stay agile and responsive to evolving financial goals or market demands.

Automated budget alerts

Volopay sends instant alerts when spending nears or exceeds set limits, helping you avoid budget overruns.

These automated notifications keep your team informed and accountable at all times. With early warnings in place, you maintain tighter financial control and ensure that budget discipline is consistently enforced.

Choose the best prepaid card for smarter spending

Tailored solutions for every role

1. Finance leaders

Volopay gives finance leaders full visibility and control over company spending through real-time dashboards, approval workflows, and customizable budgets. You can reduce manual work, eliminate overspending, and implement policy compliance easily. It’s a strategic tool to streamline expense processes while aligning spending with your financial goals.

2. Tech managers

Tech managers can use Volopay to allocate funds for software subscriptions, cloud services, and equipment purchases. Virtual cards make it easy to manage recurring payments securely and avoid service disruptions. With spend tracking and category-level controls, you can ensure tech budgets are used effectively without surprises.

3. Accounting teams

Accounting teams benefit from Volopay’s automated expense syncing with platforms. Every transaction is recorded with receipts and tags, simplifying reconciliation. You can close books faster, avoid manual errors, and maintain compliance—all while gaining more time to focus on higher-value financial reporting tasks.

4. Marketing directors

Marketing directors can manage campaign spending with prepaid cards dedicated to specific vendors, tools, or platforms. Whether it’s ad spend or event costs, you get clear visibility into every rupee spent. This helps you optimize budgets, cut redundant tools, and prove ROI across multiple marketing initiatives.

Empowering businesses of all sizes

As a startup, you need full visibility into your spending to make the most of limited funds.

Volopay prepaid cards help you track every transaction in real time, control budgets, and avoid overspending.

It’s a simple, scalable solution to manage cash flow while you focus on growth.

For small and medium-sized businesses, Volopay simplifies expense management with easy approval workflows and direct integrations with accounting platforms.

You save time on manual work, reduce financial errors, and ensure your growing team follows clear spending policies—all while scaling your operations efficiently.

Large enterprises benefit from Volopay’s powerful analytics, multi-level approvals, and automated and customizable multi-level workflows.

Real-time visibility and policy enforcement help maintain control over high-volume spending without slowing down business operations or decision-making.

Trusted by industry leaders

Customer success stories

EdgeRed streamlined its financial operations using Volopay’s prepaid cards and expense automation tools. The platform helped them reduce manual effort, gain real-time visibility, and maintain tight budget control across teams.

Read the full case study to see how EdgeRed scaled smarter with Volopay.

Awards and certifications

Volopay is ISO-certified and PCI DSS-compliant, ensuring top-tier data security and operational reliability. On G2, the platform maintains a strong rating of 4.3/5 based on verified user reviews.

These industry recognitions reflect our commitment to delivering secure, user-friendly, and high-performing financial solutions for businesses of all sizes.

Bring Volopay to your business

Get started now